Kes Market 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive kes market review examines a broker that focuses on Kenyan Shilling trading services in the forex market. Kes Market positions itself as a specialized forex broker with emphasis on regional currency analysis and market fundamentals, specifically targeting the USD/KES currency pair and related market segments.

The broker's main feature is its specialized market analysis team that conducts daily analyses of regional pipeline flows and supply/demand fundamentals across major market areas in North America. Current market data shows a bearish outlook for the USD/KES market. This suggests the broker provides real-time sentiment analysis and technical insights for traders interested in this specific currency pair.

However, this kes market review must note significant limitations in available information. Critical details about regulatory oversight, trading conditions, platform specifications, and user feedback remain unavailable in accessible sources. This lack of transparency raises questions about the broker's operational scope and regulatory compliance status. It makes providing a definitive assessment of its services and reliability for potential clients challenging.

Important Notice

Due to the limited availability of comprehensive information about Kes Market, this review is based on fragmented data sources and publicly available content. Potential traders should be aware that regulatory information, detailed trading conditions, and verified user experiences are not readily accessible through standard industry channels.

The evaluation methodology employed in this assessment relies heavily on available market data and technical analysis information, but lacks substantial user feedback and detailed operational data that would typically support a comprehensive broker review. Traders considering this broker should conduct additional due diligence. They should seek direct communication with the company to obtain missing critical information.

Rating Framework

Broker Overview

Kes Market presents itself as a specialized forex broker with a particular focus on Kenyan Shilling trading services and related market analysis. The company appears to have developed expertise in regional currency markets. It emphasizes providing daily market analysis and technical insights for traders interested in African currency pairs, particularly the USD/KES exchange rate.

The broker's operational model centers around providing specialized market analysis through its dedicated KES Market Analysis team. This team reportedly conducts comprehensive daily analyses of regional pipeline flows. It examines supply and demand fundamentals across major market areas in North America, suggesting a focus on macroeconomic factors that influence currency movements between the US Dollar and Kenyan Shilling.

According to available market data, the broker provides sentiment analysis indicating current bearish conditions in the USD/KES market. This suggests that Kes Market offers technical analysis services alongside its trading platform. The broker potentially targets traders who require specialized insights into emerging market currencies and their relationships with major global currencies.

However, this kes market review must emphasize that fundamental information about the company's establishment date, corporate background, regulatory status, and detailed service offerings remains unavailable through standard industry information channels. The lack of readily accessible corporate information raises questions about transparency and regulatory compliance. Potential clients should carefully consider these concerns.

Regulatory Status

Specific regulatory information for Kes Market is not readily available through standard industry databases or official regulatory websites. The absence of clear regulatory oversight details represents a significant concern for potential traders seeking properly licensed and regulated forex brokers.

Deposit and Withdrawal Methods

Information regarding accepted payment methods, processing times, and any associated fees for deposits and withdrawals is not available in accessible sources. This lack of transparency regarding financial transactions is a notable limitation.

Minimum Deposit Requirements

Specific minimum deposit amounts and account tier structures have not been disclosed in available materials. This makes it impossible to assess the broker's accessibility for different trader categories.

Details about welcome bonuses, trading incentives, or promotional programs are not mentioned in available sources. This suggests either the absence of such offerings or limited marketing transparency.

Available Trading Assets

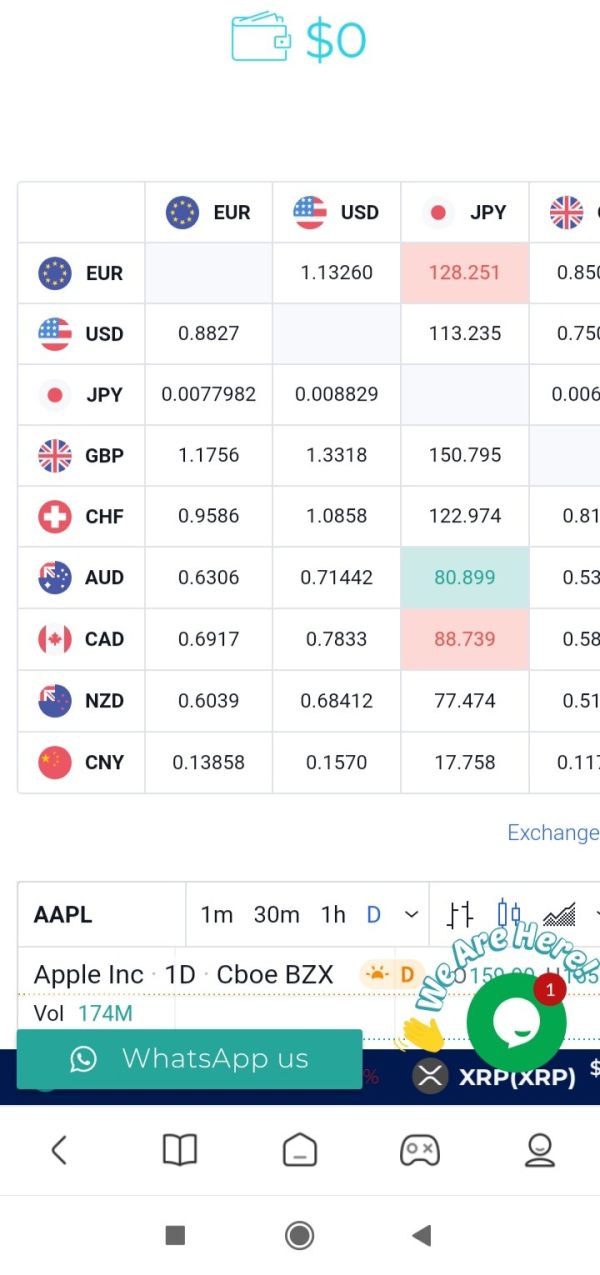

The primary focus appears to be on forex trading, with particular emphasis on Kenyan Shilling pairs. The USD/KES currency pair is specifically mentioned in available market analysis content. This indicates it as a core offering.

Cost Structure

Critical information about spreads, commissions, overnight fees, and other trading costs is not available in accessible sources. This represents a significant information gap for traders evaluating the broker's competitiveness.

Leverage Options

Specific leverage ratios offered to different account types and jurisdictions are not disclosed in available materials. This limits assessment of the broker's risk management approach.

Details about available trading platforms, including mobile applications and web-based interfaces, are not readily accessible through standard information channels.

This kes market review highlights the substantial information gaps that exist regarding fundamental broker details that traders typically require for informed decision-making.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Kes Market's account conditions faces significant challenges due to the absence of detailed information about account types, minimum deposit requirements, and account-specific features. Standard industry practice involves offering multiple account tiers designed to accommodate different trader profiles, from beginners to professional traders. However, no such information is readily available for this broker.

Without access to specific account opening procedures, verification requirements, or documentation needed for different account types, it becomes impossible to assess the accessibility and user-friendliness of the broker's onboarding process. Additionally, the absence of information about special account features, such as Islamic accounts for Muslim traders or professional accounts for qualified investors, limits the ability to evaluate the broker's inclusivity and regulatory compliance.

The lack of transparency regarding account conditions raises concerns about the broker's operational standards and commitment to providing clear information to potential clients. Industry best practices typically involve comprehensive disclosure of all account-related terms and conditions. This makes this information gap particularly noteworthy.

This kes market review cannot provide a meaningful assessment of account conditions without access to fundamental details that would typically be readily available from regulated forex brokers operating in transparent markets.

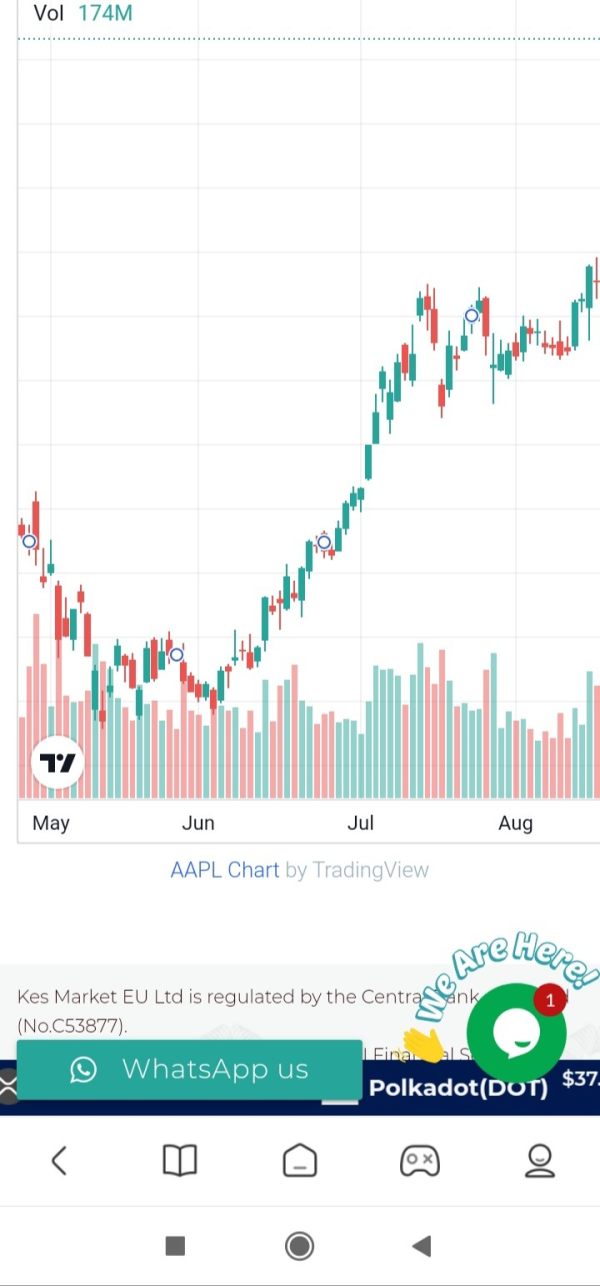

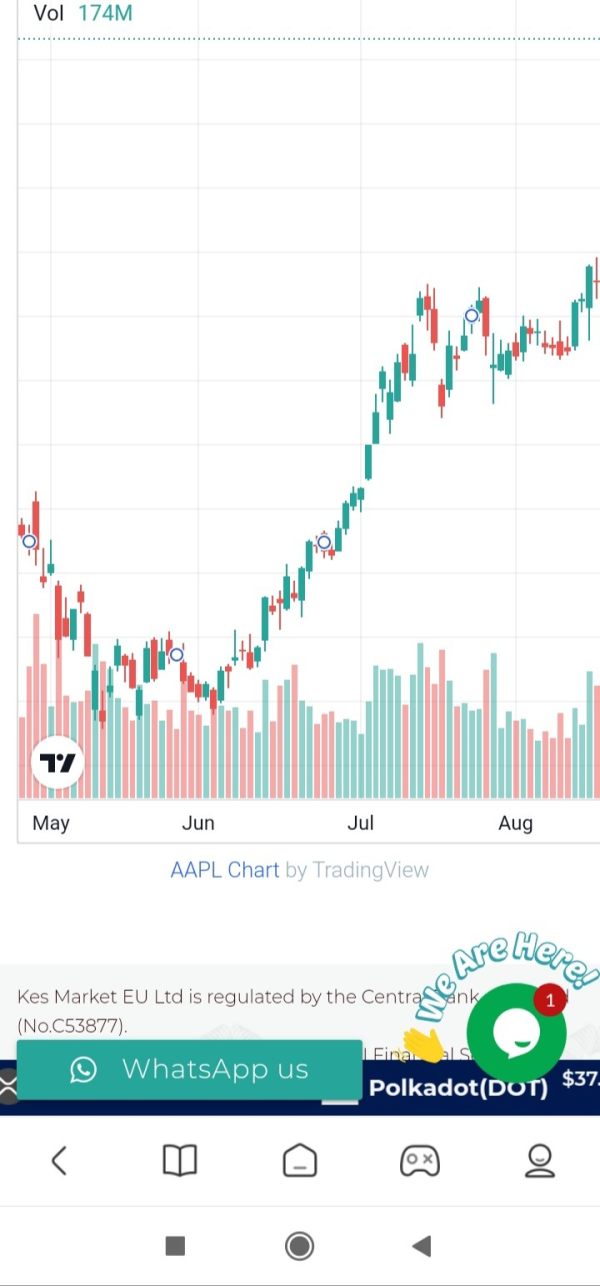

Assessment of Kes Market's trading tools and educational resources is severely limited by the lack of accessible information about the broker's platform capabilities and client support materials. While the broker appears to offer market analysis services, specifically mentioning daily analyses conducted by their KES Market Analysis team, the scope and quality of these analytical tools remain unclear.

The mention of regional pipeline flows analysis and supply/demand fundamentals suggests some level of fundamental analysis capability. However, without detailed information about chart analysis tools, technical indicators, automated trading support, or third-party plugin compatibility, it's impossible to evaluate the comprehensive trading environment offered to clients.

Educational resources, which are crucial for trader development and represent a key differentiator among forex brokers, are not mentioned in available sources. The absence of information about webinars, trading guides, market commentary, or educational video content suggests either limited educational support or poor transparency regarding available learning materials.

Research capabilities beyond the mentioned market analysis team remain unknown, including access to economic calendars, real-time news feeds, or professional research reports that traders typically expect from comprehensive forex brokers.

Customer Service and Support Analysis

The evaluation of Kes Market's customer service capabilities is significantly hampered by the complete absence of information regarding support channels, response times, and service quality metrics. Standard industry practice involves providing multiple communication channels including live chat, email support, and telephone assistance. However, no such details are available for this broker.

Critical customer service elements such as support availability hours, multilingual support options, and regional support teams cannot be assessed due to information unavailability. The absence of this fundamental information raises concerns about the broker's commitment to client support and operational transparency.

Without access to user feedback, complaint resolution procedures, or service level agreements, it becomes impossible to evaluate the quality and reliability of customer support services. Industry-leading brokers typically provide comprehensive support documentation and clear escalation procedures. This makes the absence of such information particularly notable.

The lack of readily available customer service information suggests potential challenges for traders who may require assistance with account management, technical issues, or trading-related inquiries, representing a significant limitation in the broker's service transparency.

Trading Experience Analysis

Evaluating the trading experience offered by Kes Market proves challenging due to the absence of detailed platform information, execution quality data, and user experience feedback. While the broker appears to focus on KES-related trading services, specific details about platform stability, order execution speed, and trading environment quality are not readily available.

Critical trading experience factors such as platform uptime statistics, average execution speeds, slippage rates, and requote frequency cannot be assessed without access to performance data or user testimonials. The stability and reliability of trading platforms, particularly during high-volatility market conditions, represent crucial factors for trader satisfaction. These remain unmeasurable with available information.

Mobile trading capabilities, which have become essential for modern forex trading, are not documented in accessible sources. The absence of information about mobile app features, cross-platform synchronization, or mobile-specific trading tools limits the ability to assess the broker's adaptation to contemporary trading needs.

Without verified user experiences or third-party performance reviews, this kes market review cannot provide meaningful insights into the practical trading experience that clients might expect from this broker's services.

Trust and Security Analysis

The assessment of Kes Market's trustworthiness and security measures faces substantial limitations due to the absence of regulatory information and transparency regarding operational safeguards. Regulatory oversight represents the foundation of broker trustworthiness in the forex industry. Yet no specific regulatory affiliations or license numbers are readily available for verification.

Client fund protection measures, including segregated account policies, deposit insurance coverage, and negative balance protection, cannot be evaluated without access to regulatory disclosures or company policy documentation. These security measures are fundamental to trader protection. They represent critical factors in broker selection decisions.

Corporate transparency elements such as company registration details, beneficial ownership information, and audited financial statements are not readily accessible through standard information channels. The absence of such transparency raises questions about the broker's commitment to regulatory compliance and operational accountability.

Without access to regulatory warnings, enforcement actions, or industry reputation data, it becomes impossible to assess the broker's standing within the forex industry or identify any potential red flags that might concern prospective clients.

User Experience Analysis

The evaluation of overall user experience with Kes Market is severely constrained by the absence of verified user feedback, satisfaction surveys, and comprehensive user journey documentation. User experience encompasses multiple touchpoints from initial registration through ongoing trading activities. None of these can be adequately assessed with available information.

Interface design quality, navigation intuitiveness, and overall platform usability cannot be evaluated without access to platform demonstrations or user interface screenshots. Modern forex trading relies heavily on user-friendly design and efficient workflow management. This makes this information gap particularly significant.

Registration and account verification processes, which significantly impact first impressions and user satisfaction, are not documented in accessible sources. The efficiency and user-friendliness of these onboarding procedures often determine client retention rates and overall satisfaction levels.

Common user complaints, feature requests, and satisfaction metrics that would typically inform user experience assessments are not available through standard review platforms or industry feedback channels, limiting the ability to provide meaningful insights into actual user experiences with this broker.

Conclusion

This comprehensive kes market review reveals significant limitations in available information about Kes Market as a forex broker. While the company appears to offer specialized services related to Kenyan Shilling trading and provides market analysis through its dedicated team, the absence of fundamental details about regulatory status, trading conditions, and user experiences makes it difficult to provide a definitive assessment.

The broker may appeal to traders specifically interested in KES currency pairs and those seeking specialized analysis of African emerging market currencies. However, the lack of transparency regarding regulatory oversight, platform capabilities, and operational details represents substantial concerns for potential clients seeking reliable and well-documented forex trading services.

Prospective traders should exercise considerable caution and conduct extensive due diligence before considering this broker, particularly given the absence of readily available regulatory information and verified user feedback that would typically support informed decision-making in forex broker selection.