ROYAL EXCHANGE Review 1

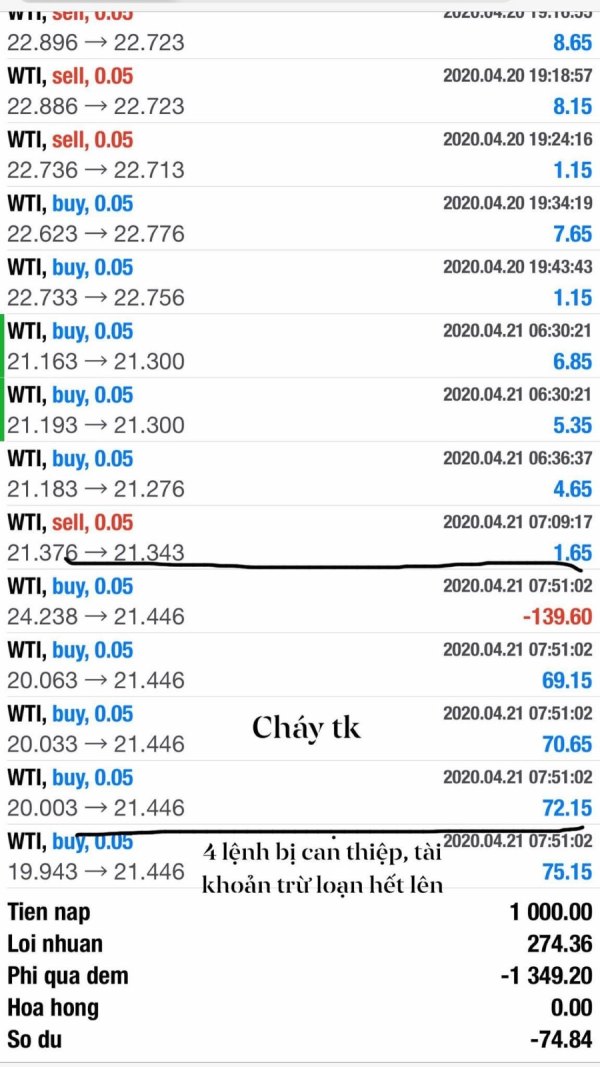

ROYAL EXCHANGE is a fraud, providing inadequate solutions fro investors.

ROYAL EXCHANGE Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

ROYAL EXCHANGE is a fraud, providing inadequate solutions fro investors.

This royal exchange review looks at a unique place in London's financial district. The Royal Exchange has changed a lot since people first built it. The Royal Exchange started in 1571, and workers finished the current building in 1844. It shows how a traditional financial institution became a modern shopping center and trading venue. The Ardent Companies have owned this historic venue since 2022. Lloyd's of London called this place home for nearly 150 years before it changed to what it is today.

The Royal Exchange attracts people who like London's rich financial history. It also draws those who want a unique trading environment in a culturally important setting. The central location in the City of London and beautiful old architecture bring in local users and international visitors. These people want to experience trading in a historically important venue. However, people should know that detailed information about specific trading conditions, rules, and modern financial services is hard to find in public documents.

This review stays neutral because we lack complete information about current trading services, rule following, and specific account conditions. We do highlight how important this institution is historically and how it operates now.

Regional Entity Differences: The Royal Exchange has changed a lot from its start as a financial institution to how it works now as a shopping center and trading venue. This change may really affect what users expect, especially those looking for traditional brokerage services. The current entity works under different rules than the historical financial institutions that used to be in the same location.

Review Methodology: This evaluation uses information that anyone can find and documented historical records. We have limited access to detailed trading conditions and regulatory information, so this assessment focuses on facts we can verify about the institution's current status and historical context rather than a complete service analysis.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific account condition information not detailed in available materials |

| Tools and Resources | N/A | Trading tools and resources information not specified in available materials |

| Customer Service | N/A | Customer service details not mentioned in available materials |

| Trading Experience | N/A | Trading experience specifics not detailed in available materials |

| Trust and Reliability | N/A | Trust metrics not specified in available materials |

| User Experience | N/A | User experience details not mentioned in available materials |

Historical Foundation and Corporate Structure

The Royal Exchange is one of London's most historically important financial venues. People originally established it on January 23, 1571. Sir William Tite designed the current architectural structure, and workers completed it on October 28, 1844. This created the foundation for what would become a landmark in the City of London. The Ardent Companies have owned the property since 2022, which marks a new chapter in its operational history.

The institution changed from a traditional financial exchange to a modern shopping center and trading venue. This change reflects broader shifts in London's financial district. This evolution shows how the place can adapt to contemporary market demands while keeping the historical importance that has made the Royal Exchange a recognizable landmark for over four centuries.

Current Business Model and Operations

Today's Royal Exchange operates under a hybrid model. It combines retail shopping facilities with trading center capabilities. This royal exchange review notes that the venue has successfully changed from its original role as a purely financial institution to a multifaceted commercial space that serves diverse user needs. The current operational structure is very different from traditional brokerage models. Instead, it focuses on providing a unique environment that blends historical importance with modern commercial functionality.

The venue's location in the heart of the City of London continues to attract users interested in financial activities. However, the specific nature of services offered requires careful consideration by potential users seeking traditional brokerage capabilities.

Regulatory Framework: Available materials do not specify current regulatory oversight or compliance frameworks governing the Royal Exchange's operations. Potential users should independently verify regulatory status and compliance requirements.

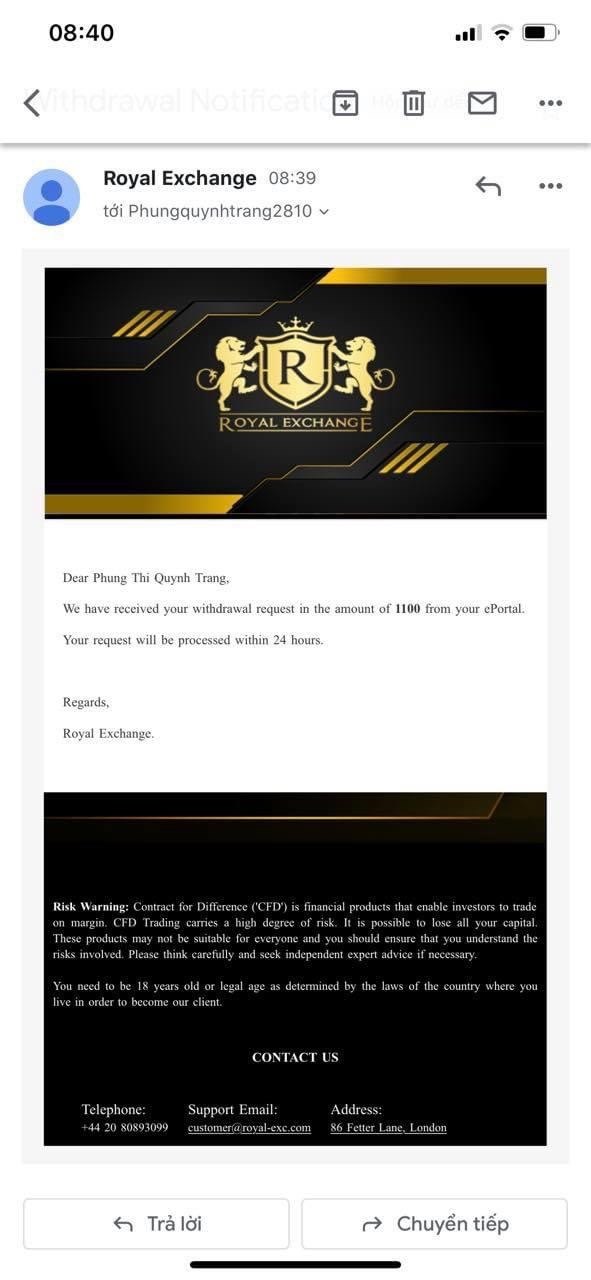

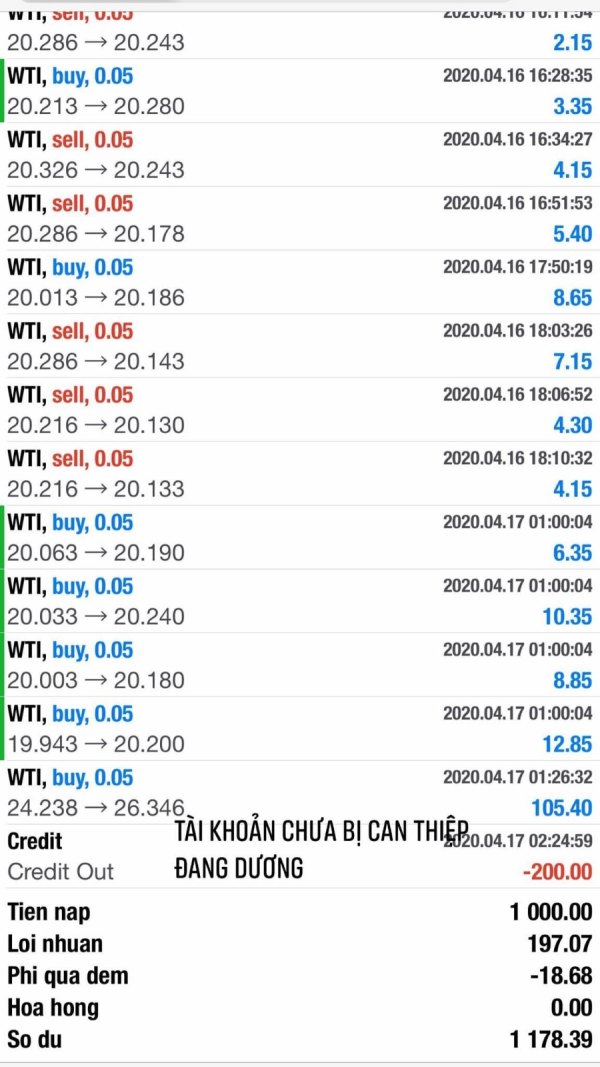

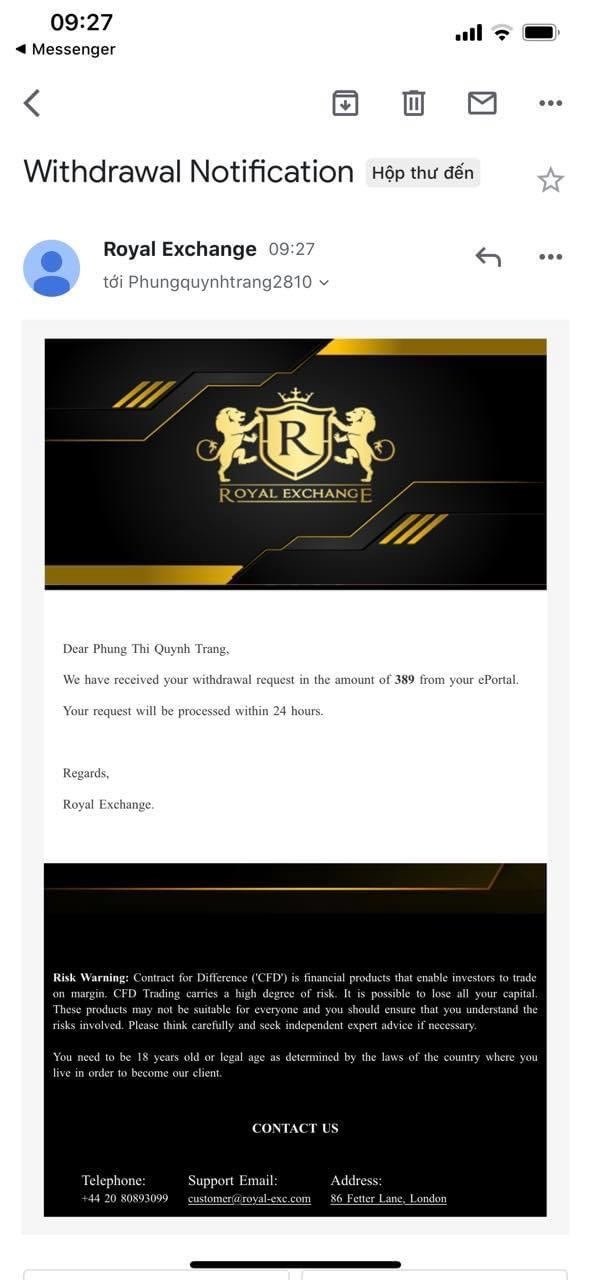

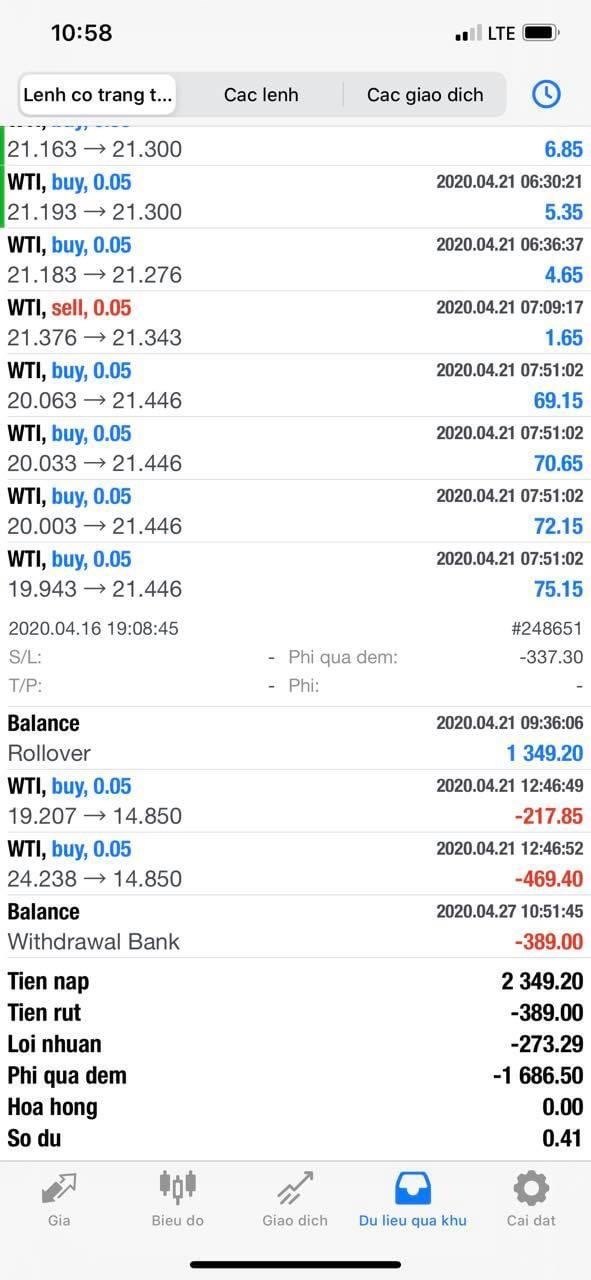

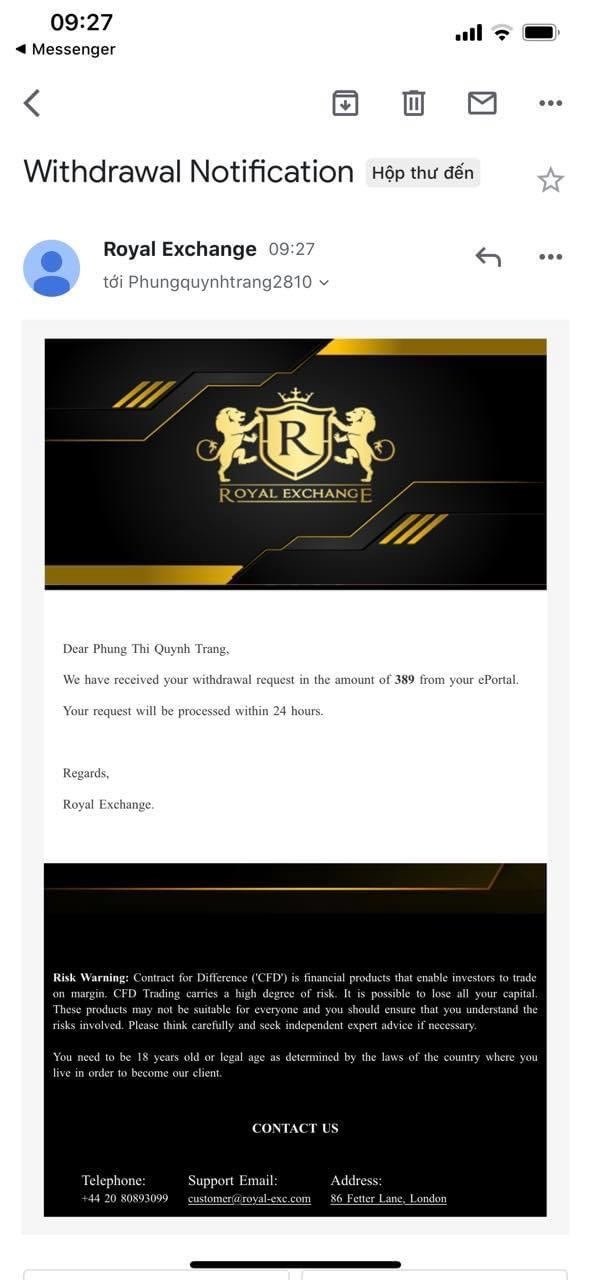

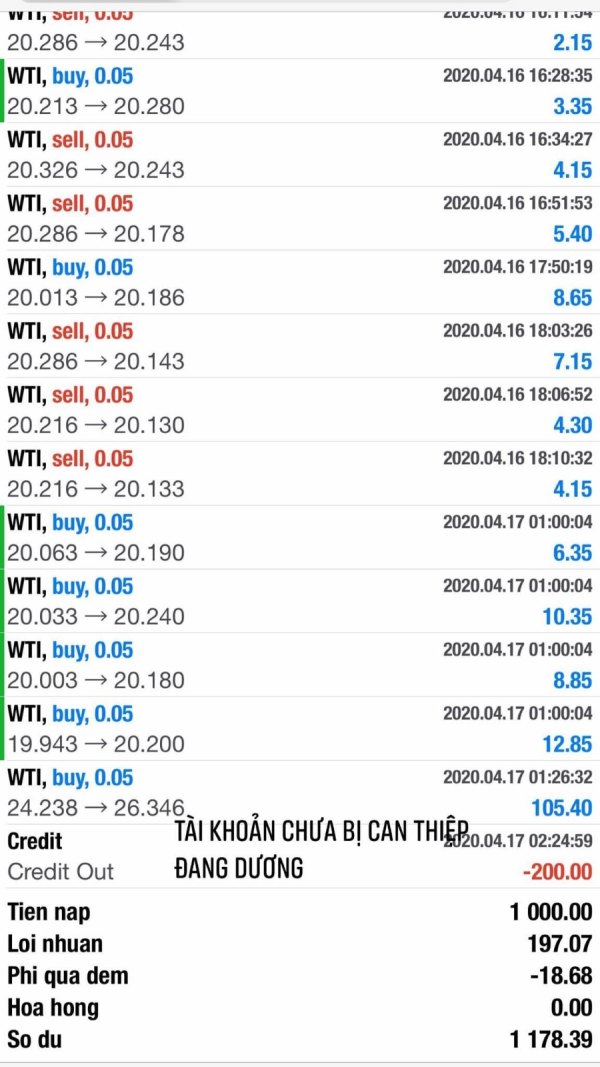

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal mechanisms is not detailed in available documentation. Users requiring this information should contact the venue directly.

Minimum Deposit Requirements: Minimum deposit thresholds are not specified in publicly available materials reviewed for this royal exchange review.

Promotional Offerings: Details about bonuses, promotions, or special offers are not mentioned in available documentation.

Tradeable Assets: The range of tradeable assets and financial instruments available through the Royal Exchange is not specified in current available materials.

Cost Structure: Comprehensive fee schedules, commission rates, and cost breakdowns are not detailed in publicly available information sources.

Leverage Options: Leverage ratios and margin requirements are not specified in available documentation.

Platform Selection: Information about specific trading platforms or technology infrastructure is not detailed in reviewed materials.

Geographic Restrictions: Regional limitations or geographic restrictions are not mentioned in available sources.

Customer Service Languages: Supported languages for customer service are not specified in available materials.

The evaluation of account conditions for the Royal Exchange faces big limitations because we don't have enough publicly available information. Traditional metrics used to assess brokerage account conditions include account types, minimum balance requirements, and specific terms of service, but these are not detailed in current documentation. This royal exchange review cannot provide definitive scoring for account conditions without access to comprehensive service agreements or detailed operational parameters.

The historical importance of the venue suggests potential for premium account experiences. This is especially true given its prestigious location and architectural heritage. However, we don't have specific information about account opening procedures, verification requirements, or ongoing account maintenance terms. This means prospective users cannot make informed comparisons with traditional brokerage offerings.

The transformation from a traditional financial institution to a shopping center and trading venue may indicate non-traditional account structures. These structures differ from standard brokerage models. Users seeking conventional account features should verify current offerings directly with the venue operators.

Assessment of trading tools and resources available through the Royal Exchange is limited by the lack of publicly available information. Standard brokerage evaluation criteria include charting software, analytical tools, research resources, and automated trading capabilities, but we cannot properly evaluate these based on current documentation.

The venue's historical connection to Lloyd's of London for nearly 150 years suggests potential access to sophisticated financial resources and industry connections. However, specific details about current technological infrastructure, research capabilities, or educational resources are not documented in available materials.

The unique positioning as both a shopping center and trading venue may indicate innovative approaches to resource provision. These approaches differ from traditional brokerage models. Prospective users interested in specific tools or resources should conduct direct inquiries to understand current capabilities and offerings.

Customer service evaluation for the Royal Exchange cannot be comprehensively assessed because we lack sufficient information about support channels, response times, and service quality metrics. Traditional customer service assessment criteria include availability hours, communication channels, and multilingual support, but these are not detailed in available documentation.

The venue's prestigious location in the City of London and historical importance may suggest high-quality service standards. However, specific service level agreements or customer support protocols are not publicly documented. The transition from traditional financial institution to modern commercial venue may have resulted in customer service models that differ from standard brokerage expectations.

Users requiring specific customer service features or support levels should directly verify current service capabilities and availability with venue operators before making commitments.

The trading experience at the Royal Exchange cannot be thoroughly evaluated based on available information. Key performance indicators such as platform stability, execution speed, order processing capabilities, and mobile accessibility are not detailed in current documentation.

The venue's transformation from a traditional exchange to a shopping center and trading venue suggests a unique trading environment. This environment may differ significantly from conventional online brokerage platforms. This royal exchange review notes that the physical presence in London's financial district could provide distinctive advantages for certain types of trading activities.

However, we don't have specific information about trading infrastructure, technology capabilities, or execution quality metrics. This means prospective users cannot make informed assessments about the trading experience quality compared to established brokerage alternatives.

Trust and reliability assessment for the Royal Exchange faces challenges because we have limited information about regulatory oversight, financial safeguards, and operational transparency. Standard trust indicators used in brokerage evaluation include regulatory compliance, fund segregation, and insurance coverage, but these are not detailed in available materials.

The institution's historical importance and longevity since 1571 provide some indication of stability and permanence. The ownership by The Ardent Companies since 2022 represents recent changes that may affect operational reliability. However, specific details about this ownership transition are not comprehensively documented.

We don't have access to regulatory filings, financial statements, or detailed operational disclosures, so this review cannot provide definitive trust assessments. Prospective users should independently verify regulatory status, financial protections, and operational safeguards before engaging with services.

User experience evaluation for the Royal Exchange is limited by insufficient information about interface design, accessibility features, and overall user satisfaction metrics. The venue's unique positioning as both a shopping center and trading venue may create distinctive user experiences that differ from traditional online brokerage platforms.

The historical architecture and central London location could contribute to a premium user experience for those who value physical presence and cultural importance in their trading environment. However, specific details about user interface design, navigation ease, and accessibility features are not documented in available materials.

Modern user experience expectations include mobile optimization, intuitive design, and seamless functionality, but we cannot assess these without direct access to current systems and user feedback. Prospective users should personally evaluate the user experience before making commitments.

This royal exchange review reveals a unique entity that has successfully transformed from its historical origins as a financial institution to its current operation as a shopping center and trading venue. The Royal Exchange's rich history dating back to 1571 and prestigious location in the City of London provide compelling context. However, the lack of detailed information about current trading services, regulatory compliance, and operational specifics necessitates a neutral overall assessment.

The venue may appeal particularly to users who value historical importance and unique trading environments. This is especially true for those interested in London's financial heritage. However, prospective users seeking comprehensive brokerage services should carefully verify current capabilities, regulatory status, and service offerings directly with venue operators.

The main advantages include the institution's remarkable longevity and prestigious location. The primary limitation remains the insufficient publicly available information about modern trading services and regulatory frameworks.

FX Broker Capital Trading Markets Review