JUNCHENG TRADE 2025 Review: Everything You Need to Know

Executive Summary

JUNCHENG TRADE is an unregulated forex broker that has been operating since 2019. It is headquartered in Hong Kong. This juncheng trade review reveals a trading platform that offers multiple financial instruments including forex, commodities, indices, and CFDs through the popular MT4 trading platform. The broker provides leverage up to 1:100. This makes it potentially attractive to traders seeking higher leverage opportunities.

However, the lack of regulatory oversight presents significant concerns for potential clients. JUNCHENG TRADE primarily targets forex and CFD traders who prioritize high leverage trading and prefer the MT4 platform environment. While the broker offers access to various asset classes, the absence of transparent information regarding account conditions, customer support channels, and safety measures raises questions. These concerns affect its overall reliability and trustworthiness in the competitive forex market landscape.

Important Disclaimers

Due to JUNCHENG TRADE's unregulated status, investors across different regions may face potential legal and financial security risks when engaging with this broker. The regulatory environment varies significantly between jurisdictions. The absence of proper oversight could expose traders to substantial risks including potential fund security issues and limited recourse options.

This review is based on publicly available information and user feedback where accessible. The evaluation does not include first-hand trading experience data. Potential clients should conduct their own due diligence before making any investment decisions with this broker.

Rating Framework

Broker Overview

JUNCHENG TRADE LIMITED was established in 2019 as a Hong Kong-based forex broker. It positions itself in the competitive online trading market. The company operates as an unregulated financial services provider, offering access to various financial markets through its trading platform. Despite its relatively recent establishment, the broker has attempted to carve out a niche in the forex trading space by providing leverage options and multi-asset trading capabilities.

The broker's business model centers around providing retail traders with access to foreign exchange markets, commodities, indices, and CFDs. However, the lack of regulatory oversight raises significant questions about the company's compliance framework and client protection measures. The absence of clear regulatory backing may appeal to some traders seeking fewer restrictions, but it simultaneously exposes clients to heightened risks typically mitigated by regulated brokers.

JUNCHENG TRADE operates primarily through the MT4 trading platform. This platform is widely recognized in the industry for its reliability and comprehensive trading tools. The broker supports trading across multiple asset classes including major and minor currency pairs, precious metals, energy commodities, and stock indices. This juncheng trade review indicates that while the broker offers diverse trading opportunities, the lack of detailed information about its operational structure and client protection measures remains a significant concern for potential investors.

Regulatory Status: According to available information, JUNCHENG TRADE operates without specific regulatory oversight from major financial authorities. This unregulated status means the broker does not fall under the supervision of organizations like the FCA, ASIC, or CySEC. These organizations typically provide investor protection frameworks.

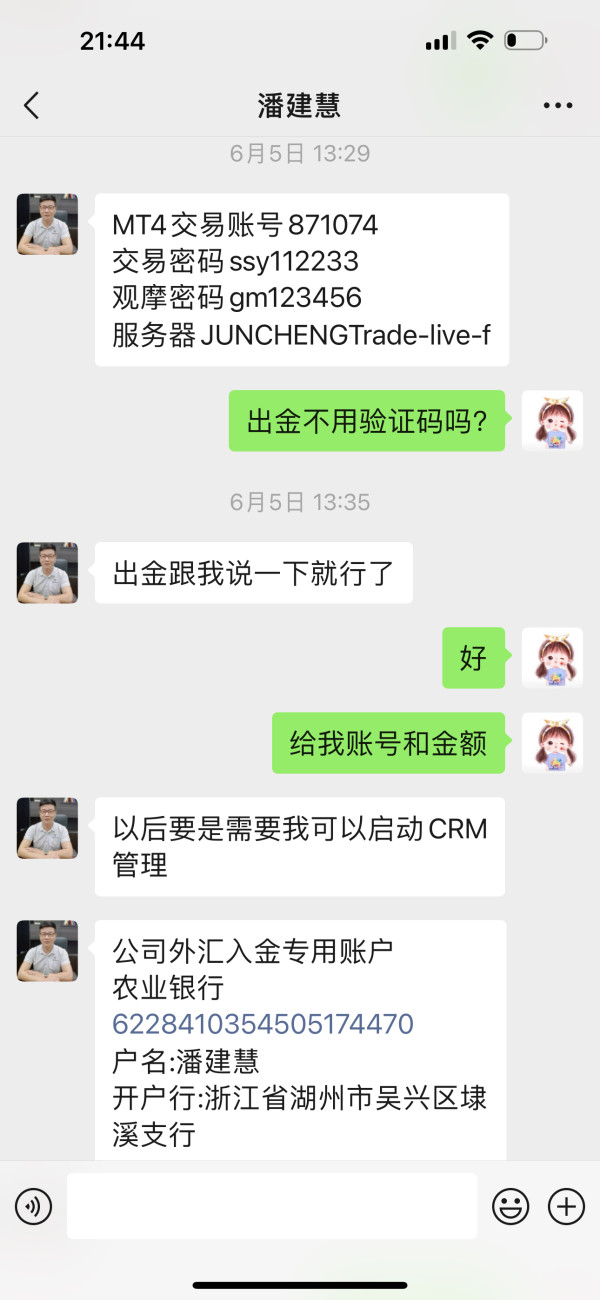

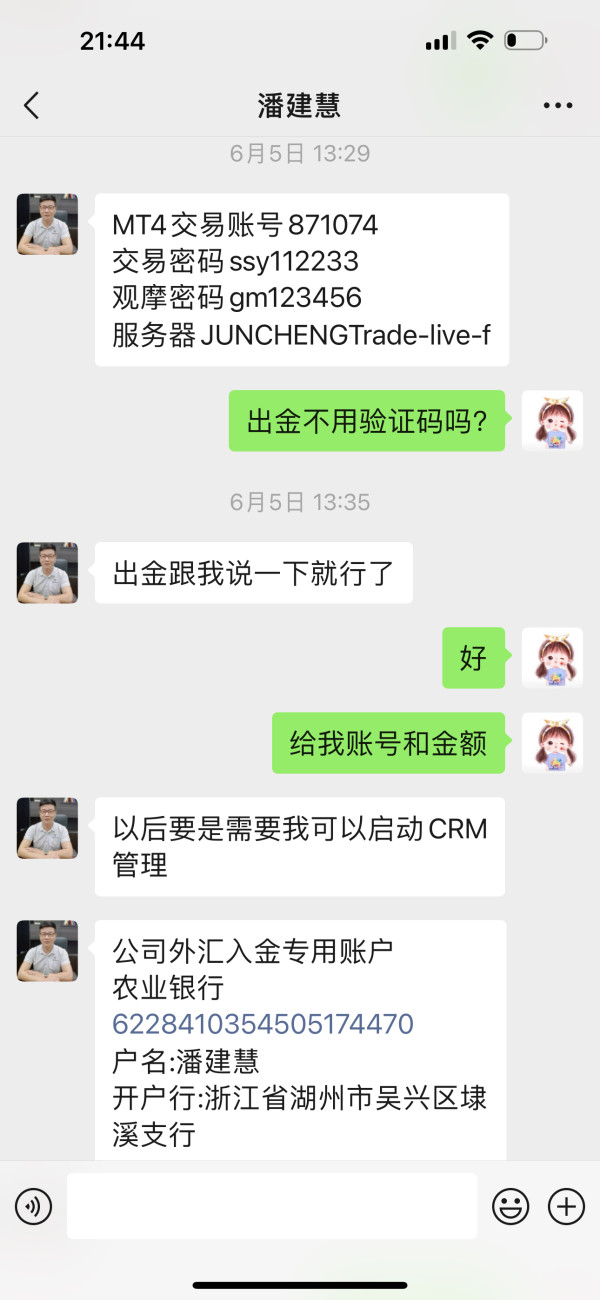

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available sources. This lack of transparency regarding payment processing options may concern potential clients who require clear understanding of funding procedures.

Minimum Deposit Requirements: The minimum deposit requirements are not specifically mentioned in available documentation. This makes it difficult for potential clients to assess accessibility and entry barriers.

Bonuses and Promotions: Available information does not detail specific bonus structures or promotional offerings. These may be available to new or existing clients.

Trading Assets: JUNCHENG TRADE supports trading across multiple asset categories including foreign exchange pairs, commodities such as precious metals and energy products, major stock indices, and contracts for difference across various markets. The broker provides access to a wide range of financial instruments.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not readily available in public sources. This makes cost comparison with other brokers challenging for potential clients.

Leverage Options: The broker offers leverage up to 1:100, though some sources suggest variations in leverage ratios. This level of leverage can amplify both profits and losses significantly.

Trading Platforms: JUNCHENG TRADE provides access to the MetaTrader 4 platform. This platform offers comprehensive charting tools, technical indicators, and automated trading capabilities.

Geographic Restrictions: Specific information about geographic restrictions or service availability in different regions is not detailed in available sources. This creates uncertainty for international traders.

Customer Support Languages: Available documentation does not specify which languages are supported by the customer service team. This juncheng trade review highlights the significant information gaps that potential clients may encounter when evaluating this broker.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions offered by JUNCHENG TRADE present several areas of concern for potential clients. The broker does not provide clear information about different account types. This makes it difficult for traders to understand what options are available based on their trading style and capital requirements. The absence of detailed minimum deposit requirements creates uncertainty for new traders trying to assess whether the broker is accessible for their budget level.

Account opening procedures are not clearly outlined in available documentation. This could lead to confusion during the registration process. The lack of information about special account features, such as Islamic accounts for Muslim traders or demo accounts for practice trading, further limits the broker's appeal to diverse trading communities. Additionally, without clear details about account maintenance fees, inactivity charges, or other potential costs, traders cannot make informed decisions about the long-term viability of maintaining accounts with this broker.

The unclear account structure and limited transparency regarding account conditions significantly impact the overall user experience. Professional traders typically require detailed information about account specifications, including spread types, execution models, and available leverage options for different account tiers. The absence of such information in this juncheng trade review suggests that potential clients may need to contact the broker directly to obtain basic account information. This is not ideal in today's competitive trading environment.

JUNCHENG TRADE's tools and resources offering centers primarily around the MT4 trading platform. This provides a solid foundation for technical analysis and trade execution. The MT4 platform includes standard features such as multiple chart types, technical indicators, and the ability to use Expert Advisors for automated trading strategies. This platform choice demonstrates the broker's understanding of trader preferences, as MT4 remains one of the most popular trading platforms globally.

However, the broker appears to lack comprehensive market analysis and research resources that many traders rely on for making informed trading decisions. Educational materials, market commentary, economic calendars, and trading guides are not prominently featured in available information about the broker's offerings. This absence of educational support may particularly disadvantage novice traders who require guidance and market insights to develop their trading skills effectively.

The limited information about additional trading tools, such as proprietary indicators, market sentiment tools, or advanced charting packages, suggests that traders must rely primarily on the standard MT4 features. While MT4 is comprehensive, competitive brokers typically supplement platform offerings with additional research tools, daily market analysis, and educational webinars to enhance the overall trading experience.

Customer Service and Support Analysis (3/10)

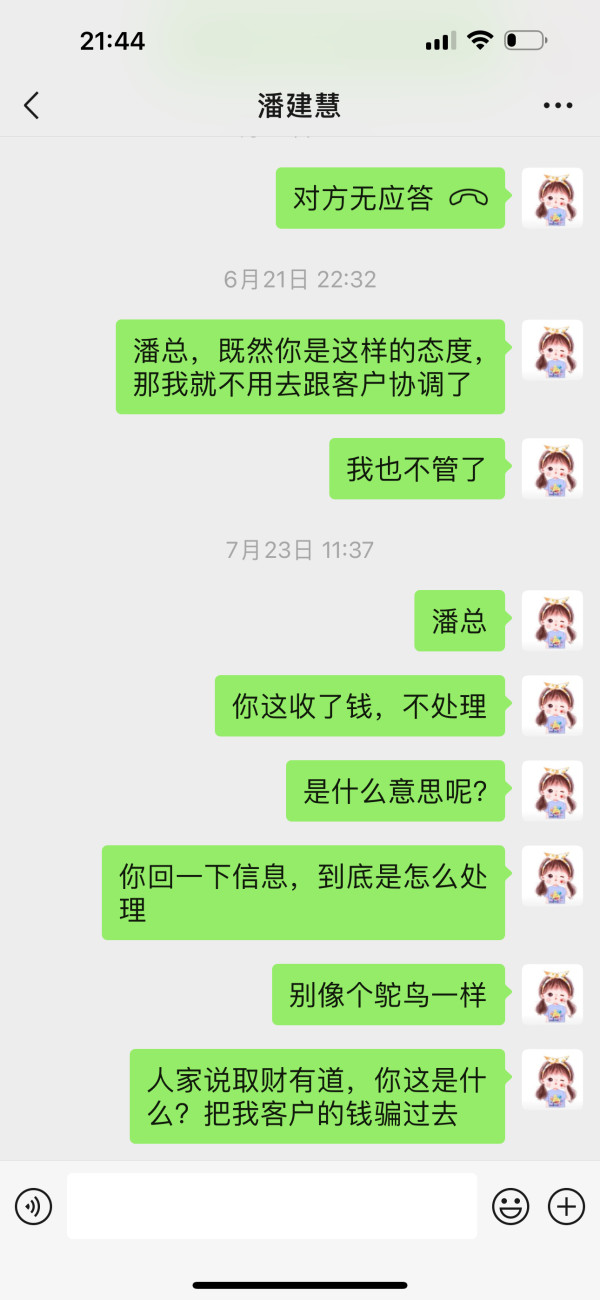

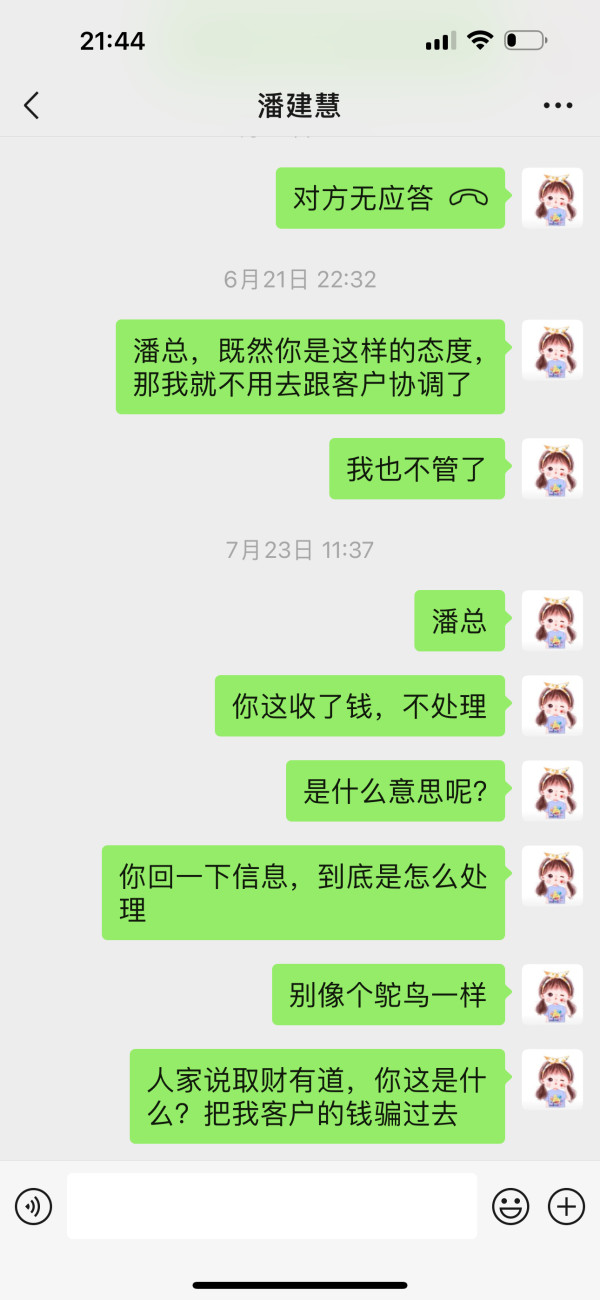

Customer service information for JUNCHENG TRADE is notably absent from available sources. This represents a significant concern for potential clients. The lack of clearly defined customer support channels means traders cannot easily determine how to contact the broker for assistance with account issues, technical problems, or general inquiries. This absence of transparent communication channels is particularly problematic in forex trading, where timely support can be crucial during volatile market conditions.

Response time expectations, service quality standards, and availability hours are not specified in available documentation. Professional traders typically require access to responsive customer support, especially when dealing with time-sensitive trading matters or technical platform issues. The absence of such information suggests that customer service may not be a priority for this broker, or that support infrastructure may be underdeveloped.

Multilingual support capabilities are also unclear. This could limit the broker's accessibility to international clients. In today's global trading environment, brokers typically provide support in multiple languages to serve diverse client bases effectively. The lack of information about supported languages and regional support availability further compounds concerns about the broker's customer service capabilities.

Trading Experience Analysis (5/10)

The trading experience with JUNCHENG TRADE centers around the MT4 platform. This provides a familiar environment for experienced forex traders. MT4's robust charting capabilities, technical analysis tools, and support for automated trading strategies offer a solid foundation for various trading approaches. The platform's reliability and widespread adoption in the industry represent positive aspects of the trading experience.

However, crucial details about execution quality, including information about slippage rates, requotes frequency, and order processing speed, are not available in public sources. These factors significantly impact the actual trading experience and can affect profitability, particularly for scalping strategies or during high-volatility periods. The absence of such performance metrics makes it difficult for traders to assess whether the broker can meet their execution requirements.

Platform stability and uptime statistics are also not documented. This leaves questions about the reliability of the trading infrastructure. Mobile trading capabilities, while likely available through MT4 mobile applications, are not specifically detailed in terms of functionality or user experience. The lack of comprehensive information about the trading environment, including details about liquidity providers and spread competitiveness, limits traders' ability to evaluate the overall trading experience quality.

This juncheng trade review indicates that while the MT4 platform provides basic trading functionality, the absence of detailed performance metrics and execution quality information presents significant evaluation challenges for potential clients.

Trust and Safety Analysis (2/10)

The trust and safety profile of JUNCHENG TRADE presents significant concerns due to its unregulated status. Operating without oversight from established financial regulatory authorities means the broker lacks the standard investor protection frameworks that regulated brokers must maintain. This absence of regulatory supervision eliminates important safeguards such as segregated client funds, compensation schemes, and regular compliance audits that protect trader interests.

Client fund protection measures are not detailed in available information. This raises questions about how trader deposits are safeguarded and whether funds are held in segregated accounts separate from company operational funds. The lack of transparency regarding financial reporting, audited statements, or third-party fund custody arrangements further compounds safety concerns for potential clients considering significant deposits.

Company transparency regarding management structure, ownership details, and operational procedures is limited in available sources. Established brokers typically provide comprehensive information about their corporate structure, key personnel, and business operations to build client confidence. The absence of such transparency makes it difficult for traders to assess the broker's stability and long-term viability in the competitive forex market.

User Experience Analysis (4/10)

User experience evaluation for JUNCHENG TRADE is challenging due to limited available feedback and the absence of comprehensive user satisfaction data. The reported user rating of zero suggests either a lack of substantial user base or limited engagement in providing feedback about the broker's services. This absence of user testimonials and reviews makes it difficult to assess real-world experiences with the platform.

Interface design and usability information, beyond the standard MT4 platform features, is not detailed in available sources. While MT4 provides a familiar interface for experienced traders, the broker's website usability, account management portal functionality, and overall digital experience remain unclear. Modern traders typically expect intuitive, responsive web platforms that complement their trading software experience.

Registration and account verification processes are not clearly outlined. This potentially creates friction for new clients attempting to open trading accounts. Efficient onboarding procedures are crucial for positive first impressions and user retention. The lack of detailed information about funding procedures, withdrawal processing times, and account management capabilities further limits the ability to assess the overall user experience quality.

Conclusion

JUNCHENG TRADE presents itself as a Hong Kong-based forex broker offering MT4 trading access with leverage up to 1:100 across multiple asset classes. However, this juncheng trade review reveals significant concerns regarding the broker's unregulated status, limited transparency, and absence of detailed information about crucial trading conditions and client protection measures.

The broker may appeal to experienced traders seeking high leverage opportunities and familiar with MT4 platform functionality. But the lack of regulatory oversight and comprehensive client support infrastructure makes it unsuitable for most retail traders. The absence of clear information about costs, customer service, and safety measures represents substantial drawbacks in today's competitive forex market.

Potential clients should carefully consider the risks associated with unregulated brokers. They may find better value and security with established, regulated alternatives that provide comprehensive trader protection and transparent operating conditions.