Is JUNCHENG TRADE LIMITED safe?

Business

License

Is Juncheng Trade Safe or a Scam?

Introduction

In the ever-evolving landscape of the foreign exchange market, Juncheng Trade has emerged as a player offering various trading services. Based in Hong Kong, this forex broker operates with the promise of providing access to a wide range of tradable assets, including forex, commodities, and contracts for difference (CFDs). However, the question remains: Is Juncheng Trade safe or a scam? As traders navigate this complex environment, it is crucial to evaluate the legitimacy and reliability of brokers before committing funds. This article aims to provide a comprehensive analysis of Juncheng Trade, examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The findings are based on extensive research, including reviews from reputable financial websites, user feedback, and regulatory databases.

Regulation and Legitimacy

A key factor in assessing the safety of any forex broker is its regulatory status. Regulation serves as a protective measure for traders, ensuring that brokers adhere to specific standards and practices designed to safeguard client funds. Juncheng Trade is currently unregulated, which raises significant concerns regarding its legitimacy. The absence of oversight from recognized regulatory bodies means that traders may not have the same level of protection as they would with a regulated broker.

Regulatory Information

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of a regulatory license implies that Juncheng Trade has not undergone the scrutiny required to operate legally in many jurisdictions. This unregulated status can expose traders to various risks, including potential fraud and malpractice. While some argue that unregulated brokers can offer competitive trading conditions, the absence of oversight can also lead to issues such as difficulty in fund withdrawals and a lack of transparency.

Company Background Investigation

Understanding the companys history and ownership structure is essential for assessing its reliability. Juncheng Trade was established in Hong Kong and has been operating for approximately 2 to 5 years. The company claims to offer a variety of trading services, yet there is limited information available regarding its ownership and management team. This lack of transparency can be a red flag for potential investors.

The management teams background and professional experience are crucial indicators of a broker's reliability. However, Juncheng Trade does not provide sufficient information about its executives or their qualifications. This lack of clarity can hinder traders from making informed decisions and raises questions about the company's commitment to ethical business practices.

Trading Conditions Analysis

An essential aspect of any forex broker is its trading conditions, including fees and commissions. Juncheng Trade advertises low spreads and a commission-free trading model, which may seem attractive to potential clients. However, it is vital to scrutinize these claims and compare them to industry averages.

Core Trading Costs

| Fee Type | Juncheng Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Low | 1-3 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | N/A | Varies |

While the promise of low trading costs is appealing, traders should be cautious of hidden fees or unfavorable conditions that might arise during trading. Additionally, the lack of clarity regarding overnight interest rates could suggest that the broker may impose unexpected charges, further complicating the trading experience.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. Juncheng Trades unregulated status raises significant questions about its fund safety measures. Without regulatory oversight, there is no guarantee that client funds are held in segregated accounts or protected against insolvency.

Moreover, the absence of investor protection schemes means that traders may have limited recourse if the broker were to become insolvent or engage in fraudulent activities. Historically, unregulated brokers have faced numerous allegations of mishandling client funds, which can lead to devastating financial losses for traders.

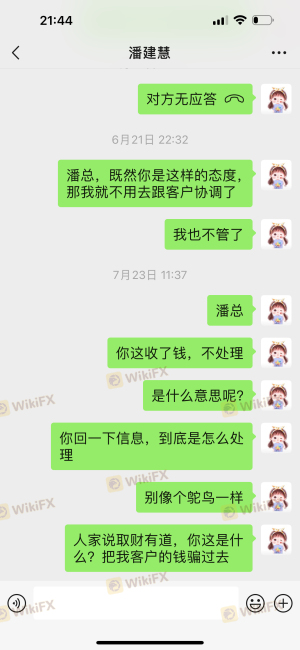

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding a broker's reputation in the market. Reviews of Juncheng Trade reveal a mixed bag of experiences, with several users expressing concerns about withdrawal difficulties and a lack of responsive customer support.

Common Complaint Types

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Moderate |

| Customer Support Delay | High | Poor |

Among the complaints, withdrawal issues seem to be the most severe, with many users reporting difficulties in accessing their funds. This raises a significant red flag regarding the broker's operational integrity. A notable case involved a trader who faced multiple delays in processing a withdrawal request, ultimately leading to frustration and financial loss.

Platform and Trade Execution

The trading platform is another critical aspect that can affect a trader's experience. Juncheng Trade utilizes the popular MetaTrader 4 (MT4) platform, known for its robust features and user-friendly interface. However, the performance and reliability of the platform are equally important.

Traders have reported mixed experiences with order execution quality, with some experiencing slippage and rejected orders during volatile market conditions. Such issues can lead to significant financial implications, particularly for those employing high-frequency trading strategies.

Risk Assessment

When evaluating the overall risk of trading with Juncheng Trade, several factors come into play. The unregulated status, coupled with customer complaints and concerns about fund safety, indicates a higher level of risk for potential investors.

Risk Scorecard

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Fund Safety Risk | High | No segregation or protection measures |

| Customer Service Risk | Medium | Reports of poor response and support |

To mitigate these risks, potential traders should conduct thorough research and consider starting with a small investment. Additionally, seeking out regulated alternatives may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, is Juncheng Trade safe or a scam? The evidence suggests that potential traders should exercise caution. The unregulated status, lack of transparency, and numerous customer complaints indicate that the broker may not be a reliable choice for trading. While the promise of low fees and a user-friendly platform may be enticing, the risks associated with trading with Juncheng Trade outweigh the potential benefits.

For traders seeking safer alternatives, consider brokers that are regulated by reputable authorities such as the FCA or ASIC. These brokers typically offer better protection for client funds and a more transparent trading environment. Ultimately, conducting thorough due diligence and being aware of the red flags can help traders make informed decisions and protect their investments in the forex market.

Is JUNCHENG TRADE LIMITED a scam, or is it legit?

The latest exposure and evaluation content of JUNCHENG TRADE LIMITED brokers.

JUNCHENG TRADE LIMITED Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JUNCHENG TRADE LIMITED latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.