JASFX 2025 Review: Everything You Need to Know

Summary

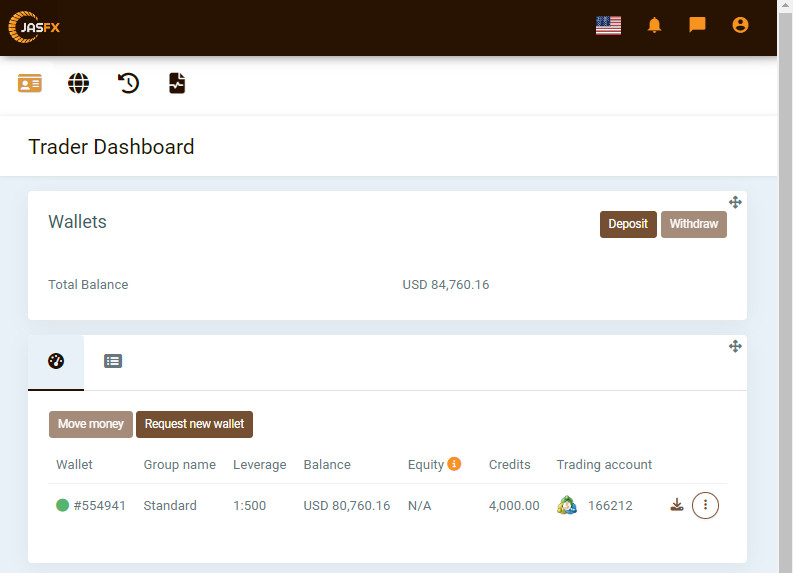

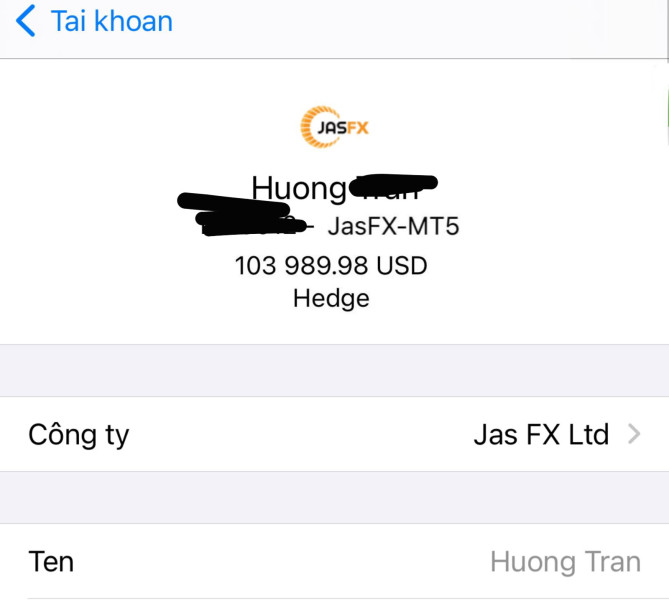

This jasfx review shows concerning issues about a new forex broker that traders should consider carefully. JASFX started in 2022 and operates from places with weak rules, including Comoros and St. Vincent and the Grenadines. The broker offers multiple types of assets like forex, commodities, indices, and metals with leverage up to 1:500, but many users complain about withdrawal problems and bad customer service on review sites.

The broker wants traders who seek high-leverage chances. However, potential clients should be very careful when dealing with this company. Many fraud recovery websites and trading forums have pointed out big problems with getting money out and support teams that don't respond to users.

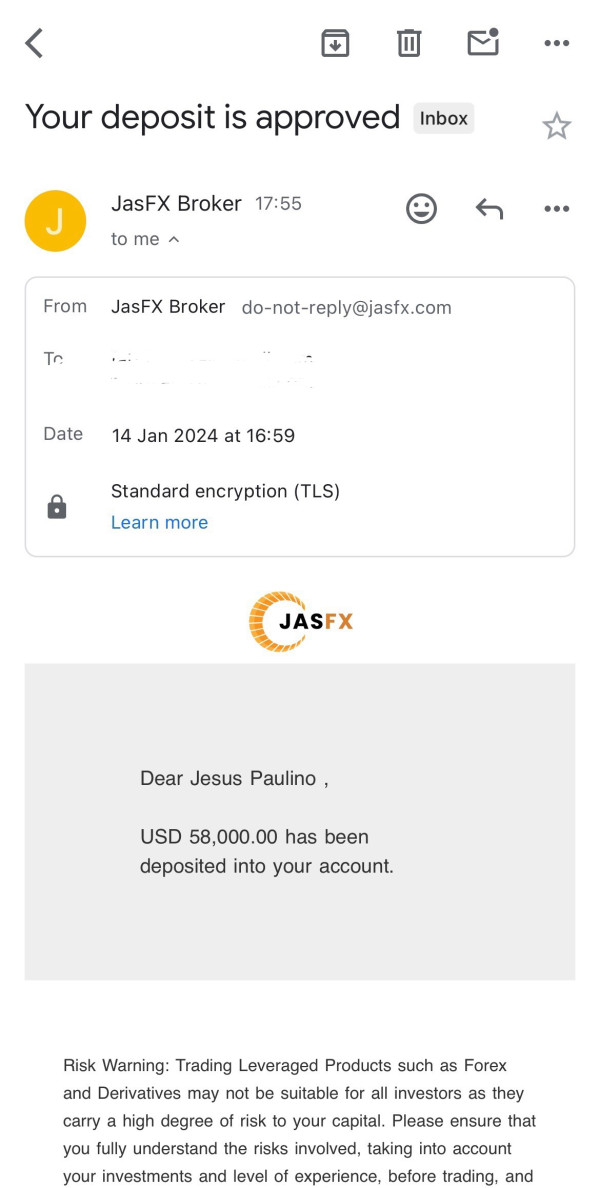

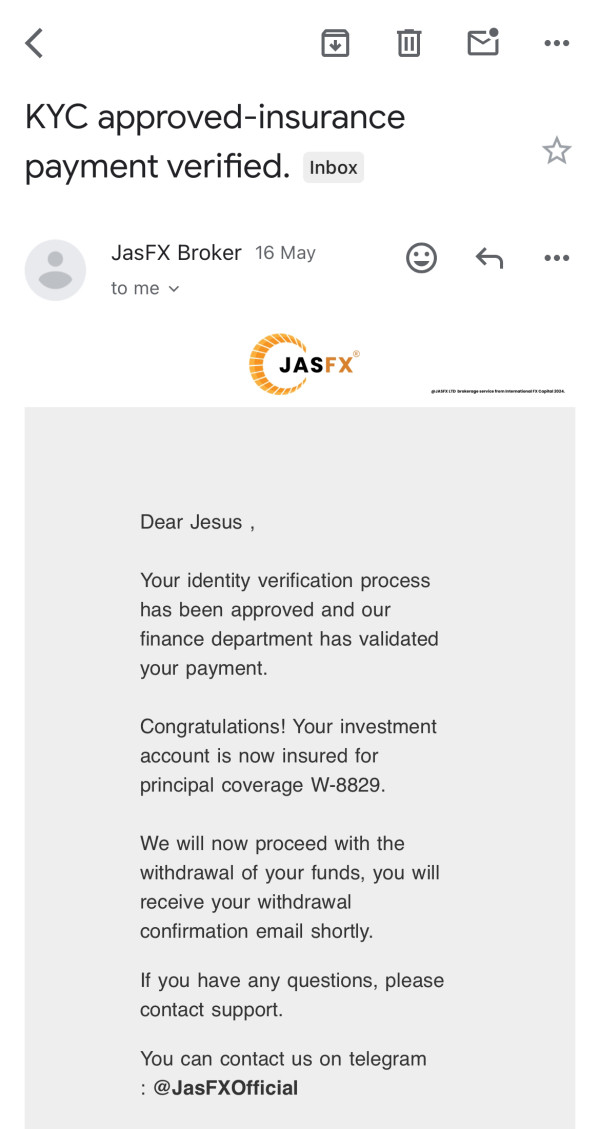

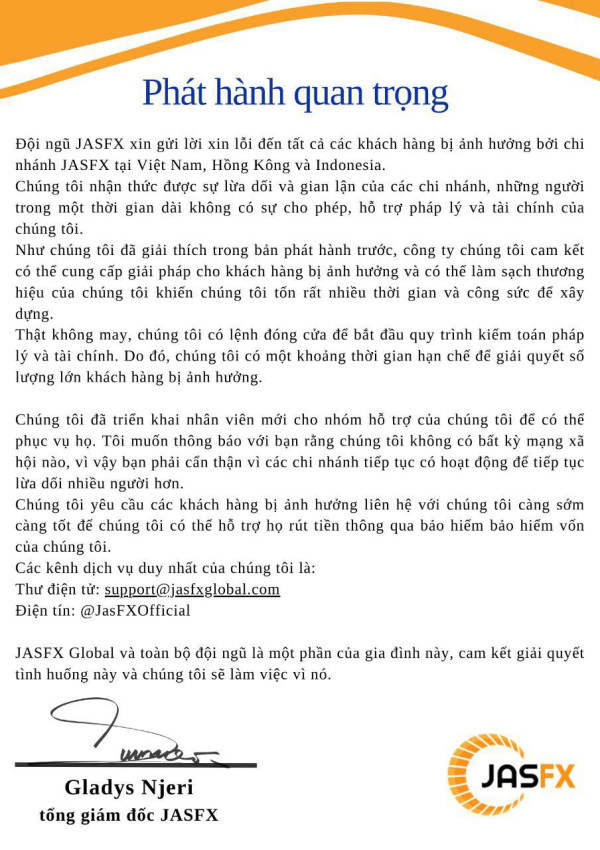

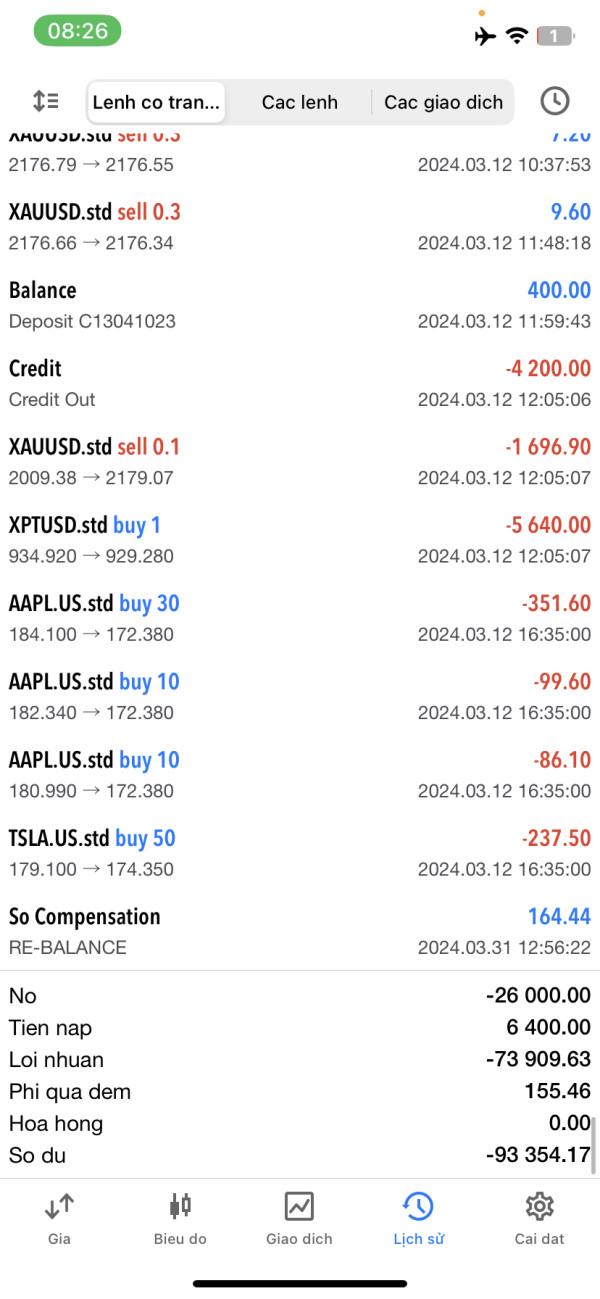

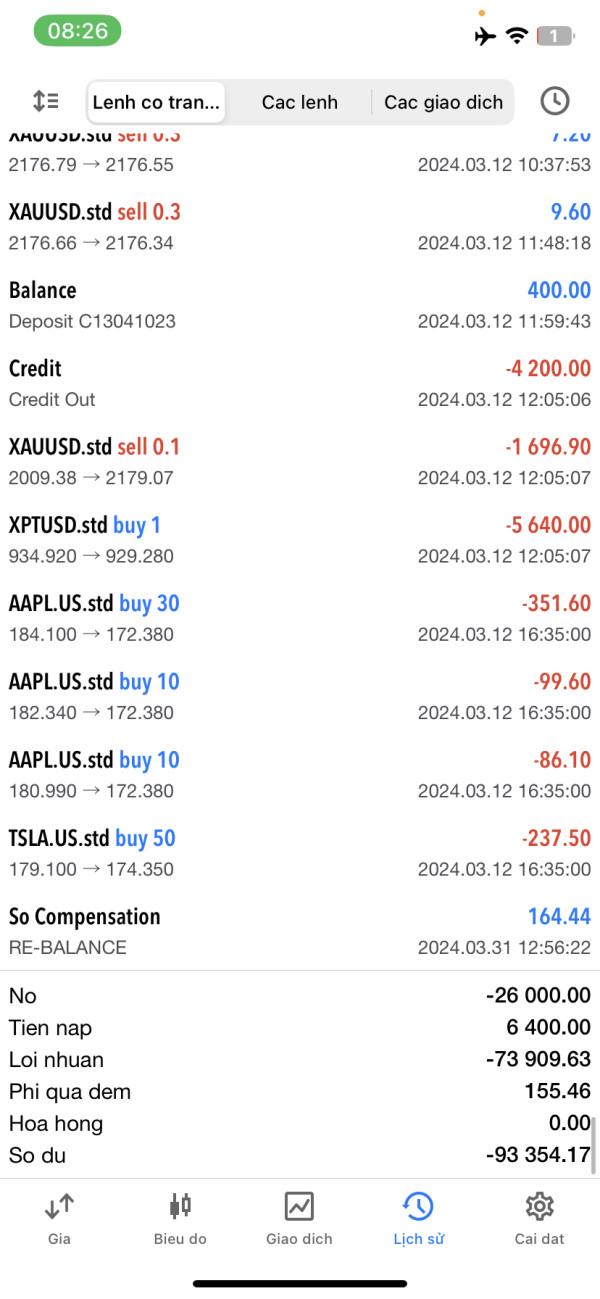

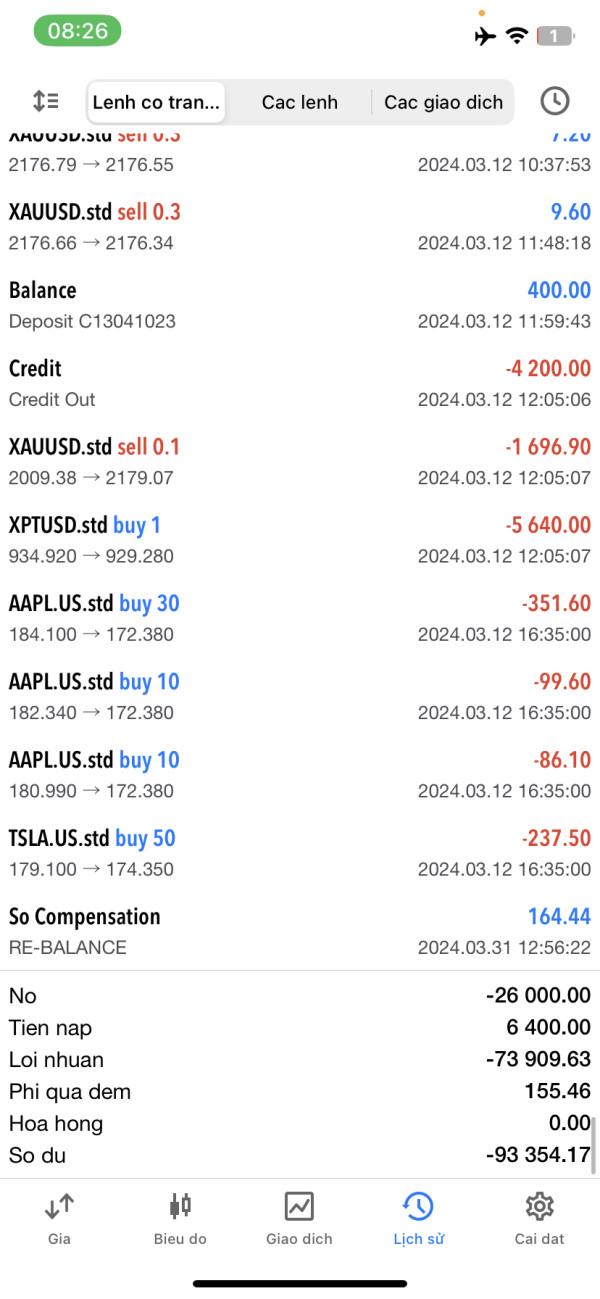

According to fraudrecoveryexperts.com reports from December 2023, users have had major trouble getting their funds back. Some people say their experiences were like fraud. The broker offers what looks like good trading conditions on paper, but the mostly negative feedback from real users shows that JASFX doesn't meet basic industry standards for being reliable and trustworthy.

The broker's registration under SVG FSA doesn't regulate forex trading activities, which makes concerns about protecting client funds even worse.

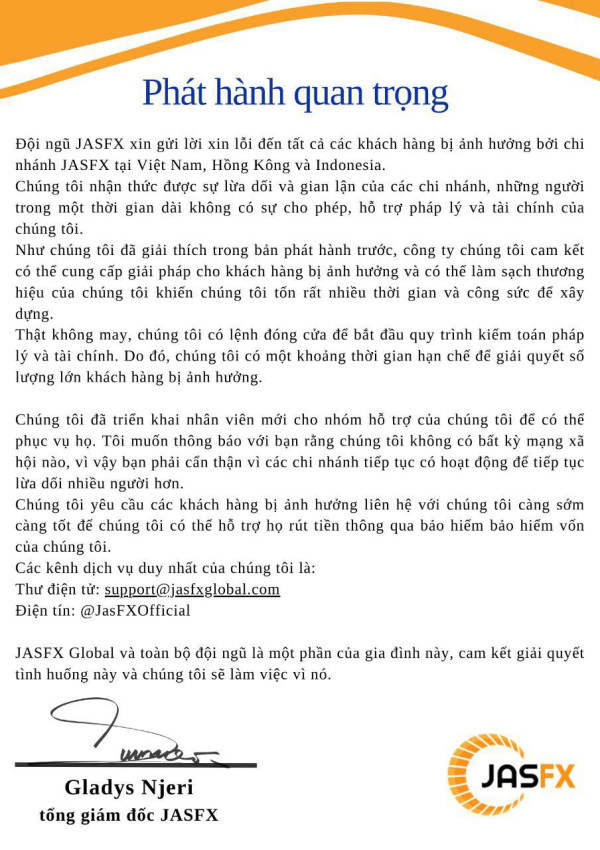

Important Notice

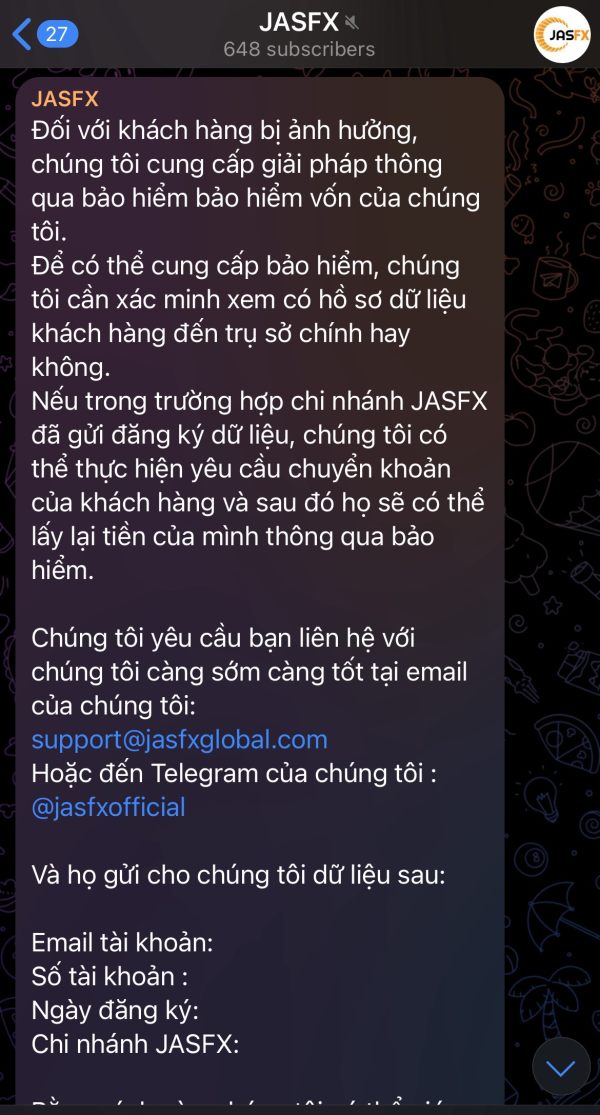

Regional Entity Differences: JASFX operates through registrations in multiple jurisdictions including Comoros and St. Vincent and the Grenadines. The SVG FSA registration doesn't provide oversight for forex trading activities, which means clients may not have standard protections that licensed forex brokers usually provide.

Review Methodology: This evaluation uses analysis of public information, user feedback from multiple review platforms, regulatory databases, and reports from fraud monitoring websites. All assessments show documented user experiences and company information that can be verified as of early 2025.

Rating Framework

Broker Overview

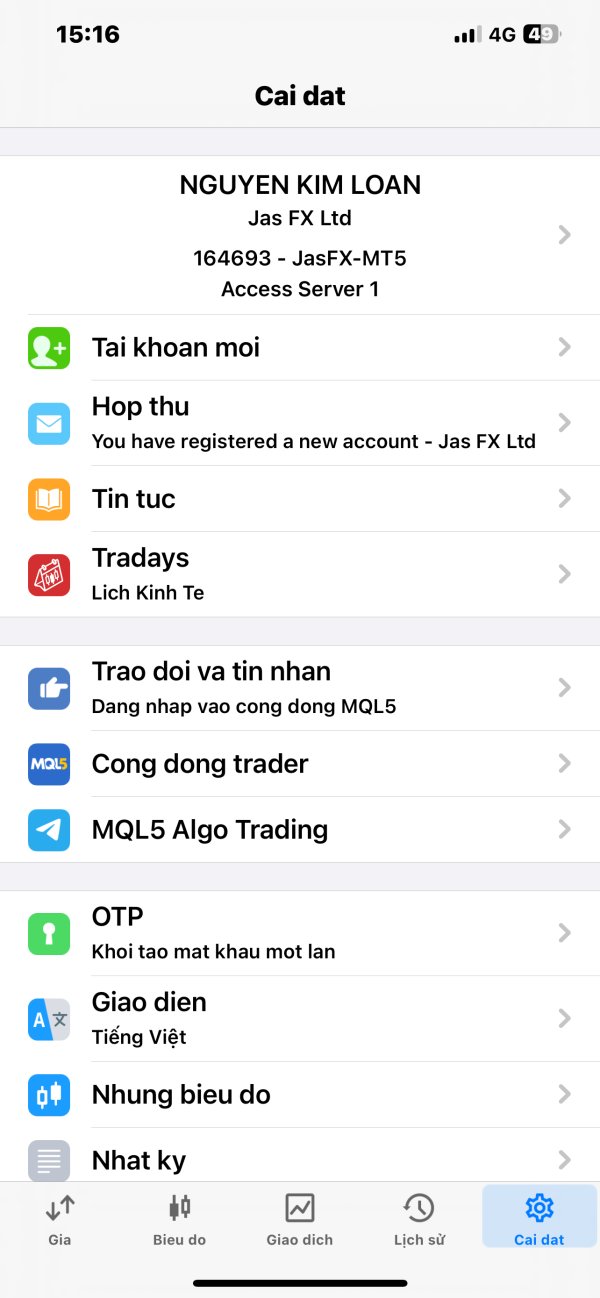

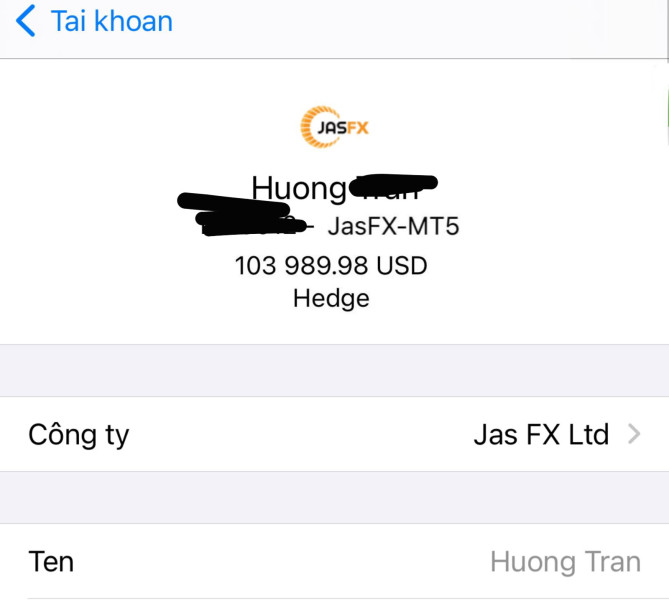

JASFX entered the forex brokerage market in 2022. The company positions itself as a multi-asset trading provider based in St. Vincent and the Grenadines. According to WikiBit's broker database, the company operates under registration with SVG FSA, though this registration specifically excludes forex trading regulation.

The broker's business model focuses on providing leveraged trading opportunities across various financial instruments. It targets traders seeking high-risk, high-reward trading scenarios. The company's relatively recent establishment in a highly competitive market has been overshadowed by concerning user reports and negative reviews.

Despite marketing efforts emphasizing trading opportunities and competitive conditions, JASFX has struggled to establish credibility within the trading community. According to personal-reviews.com analysis from March 2022, early warning signs about the broker's practices were already emerging shortly after its launch. JASFX advertises trading in forex pairs, commodities, indices, and precious metals, with maximum leverage reaching 1:500.

However, specific details about trading platforms, execution models, and technological infrastructure remain notably absent from available documentation. This jasfx review finds that the broker's lack of transparency regarding operational details raises additional concerns about its legitimacy and professional standards.

Regulatory Status: JASFX holds registration in Comoros and St. Vincent and the Grenadines under SVG FSA. It's critical to note that SVG FSA explicitly does not regulate forex trading activities, leaving clients without standard regulatory protections.

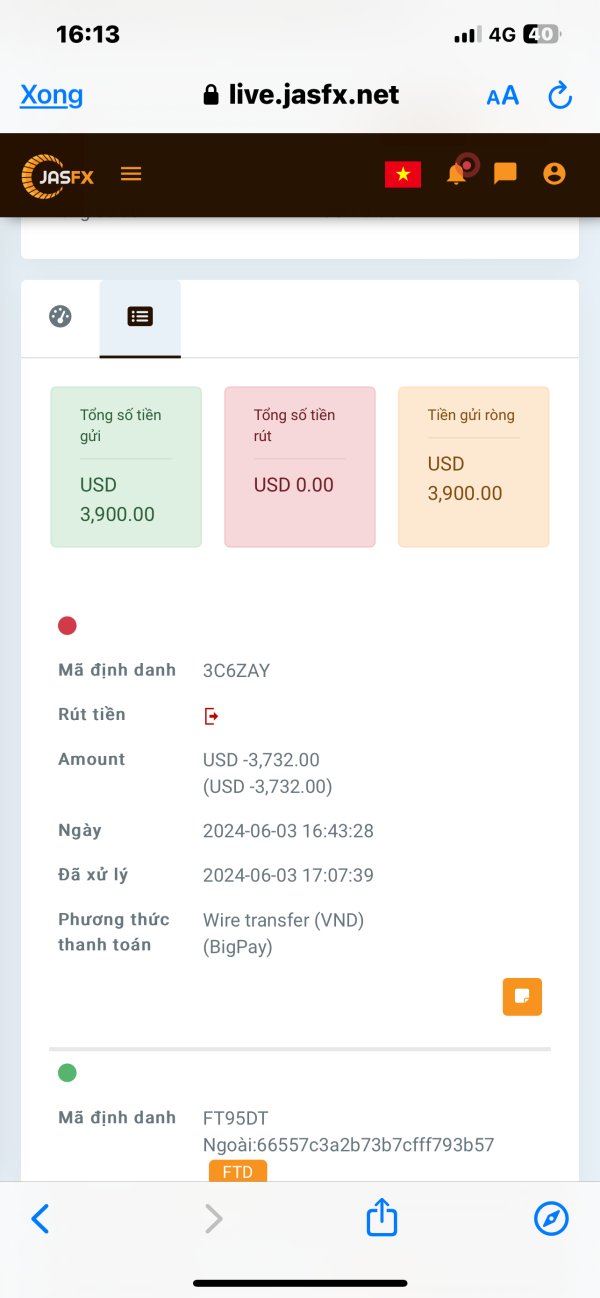

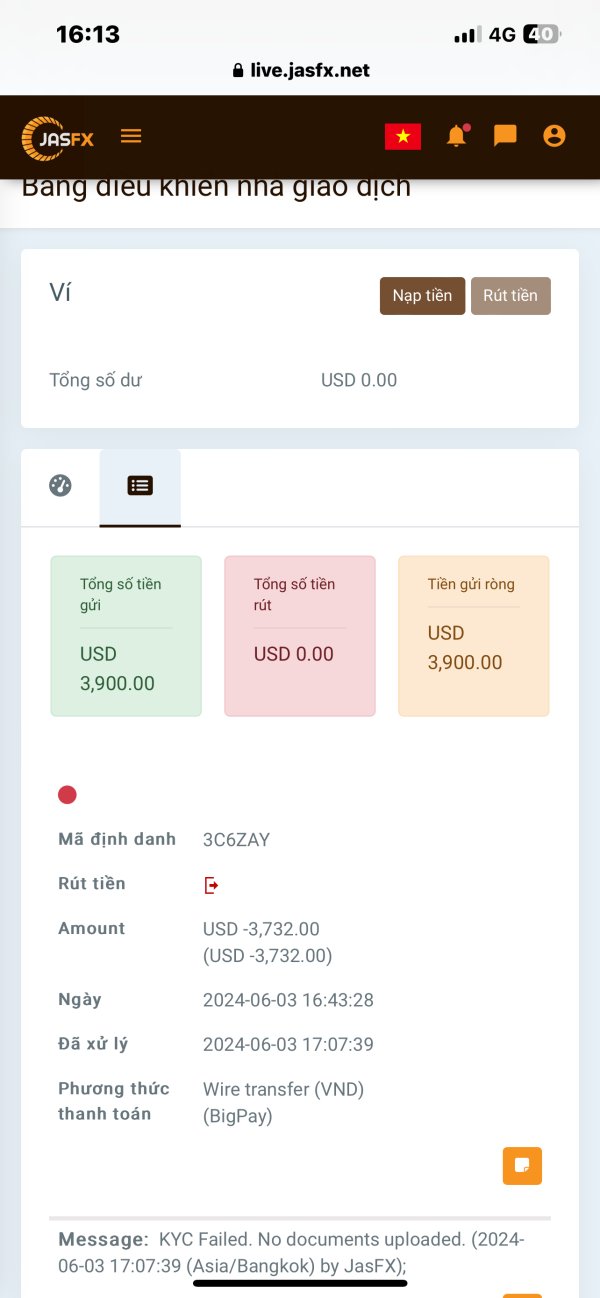

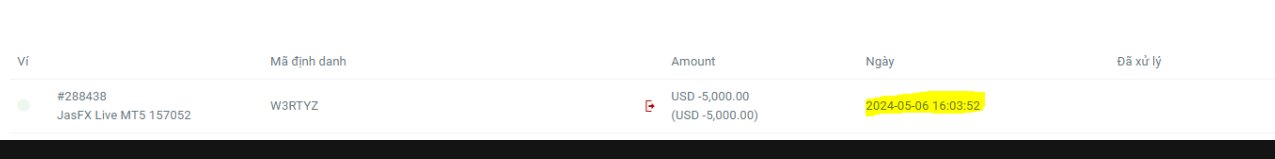

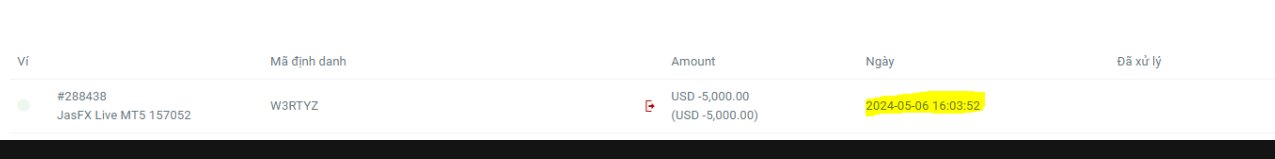

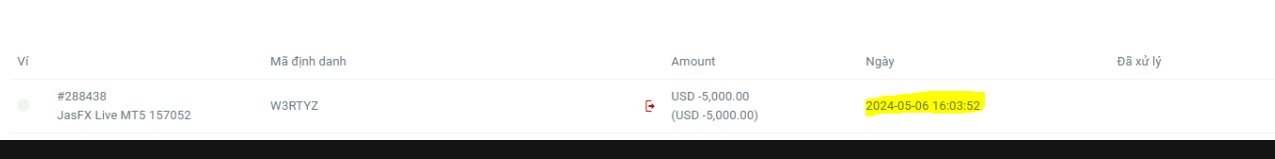

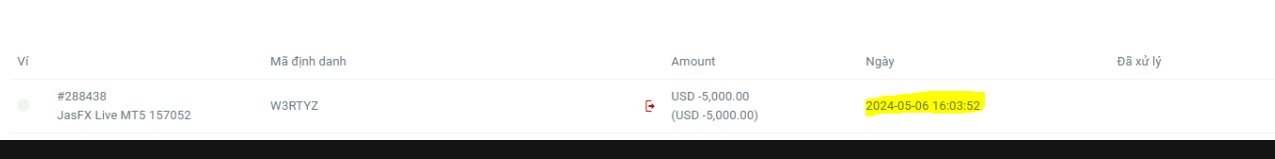

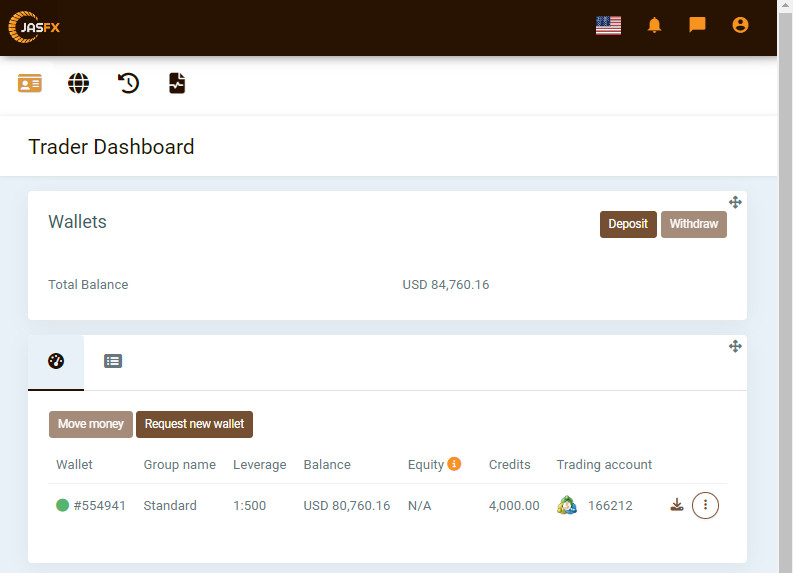

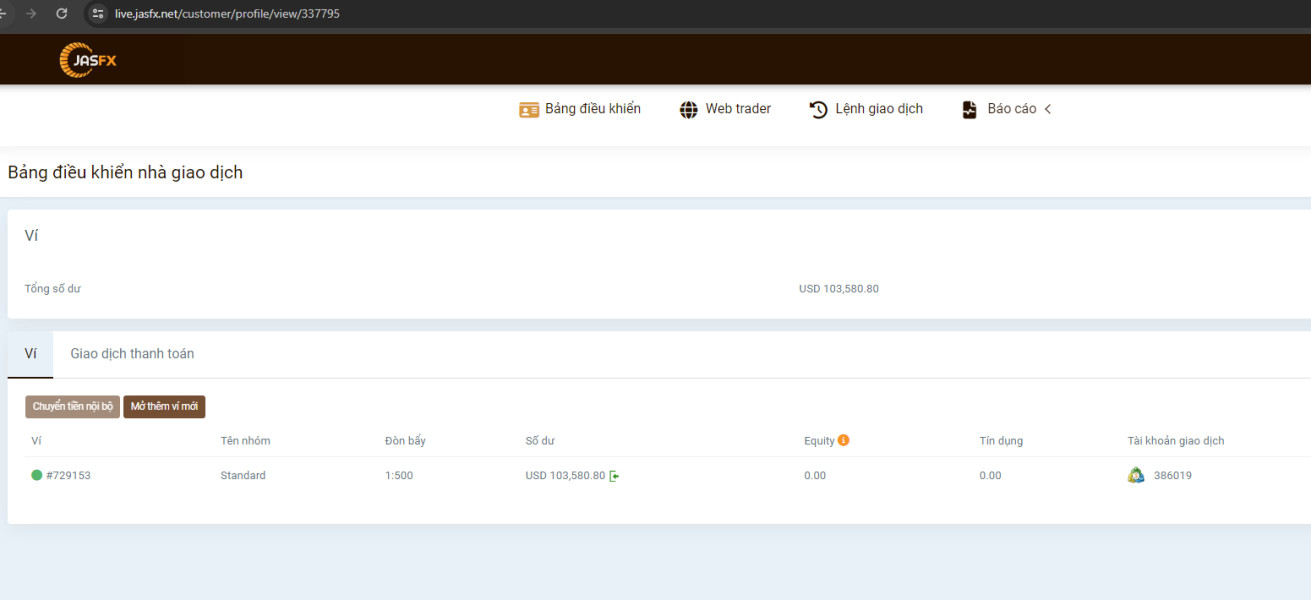

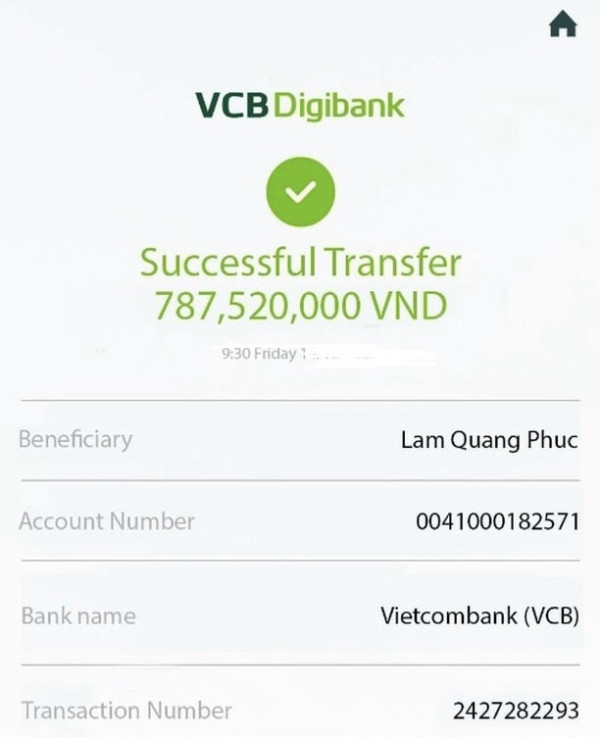

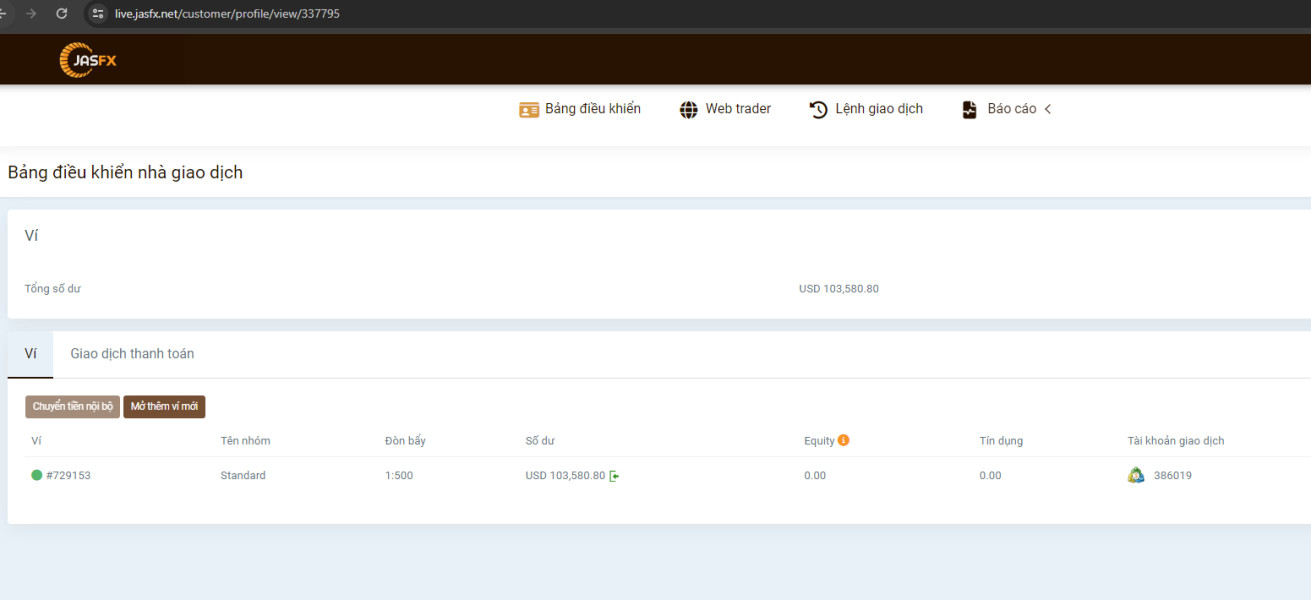

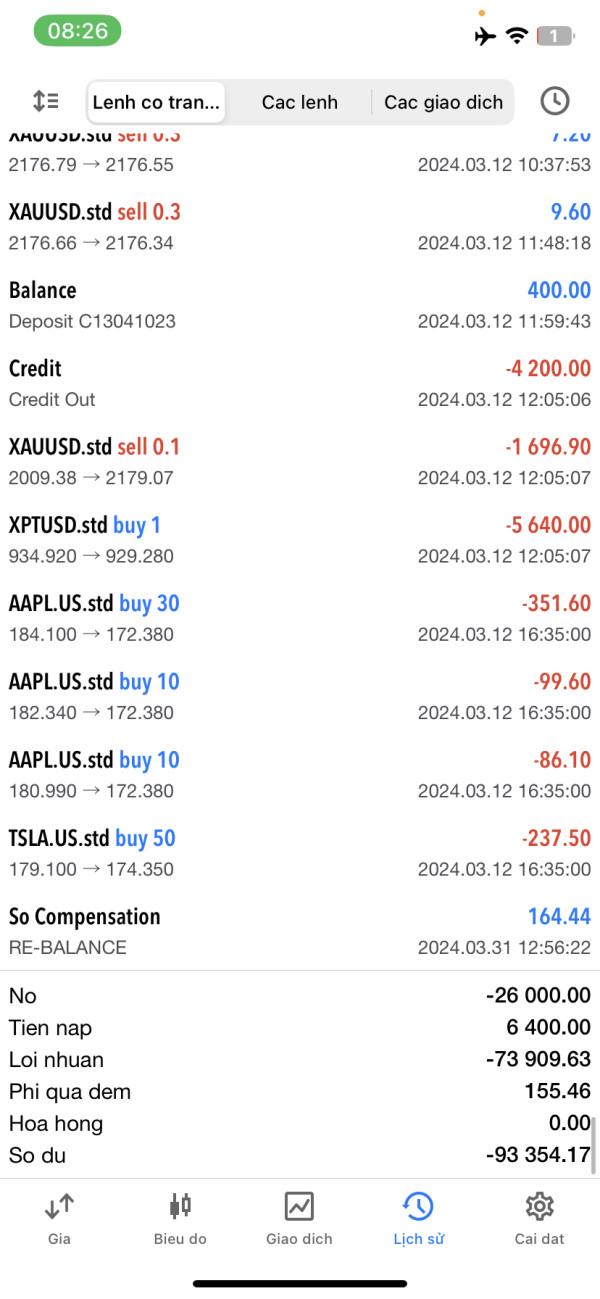

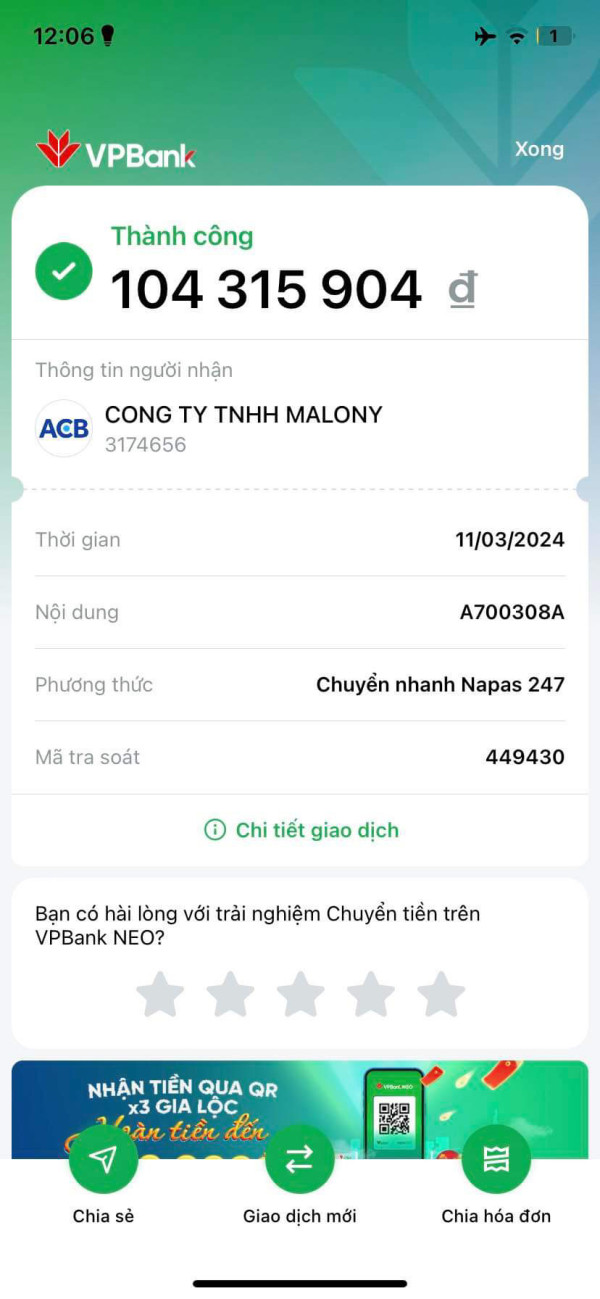

Deposit and Withdrawal: Specific deposit and withdrawal methods are not clearly detailed in available documentation. User reports from invest-reviews.com indicate significant difficulties with fund withdrawals, with some clients unable to access their deposits entirely. The broker requires a minimum deposit of USD 500, which is relatively high compared to industry standards and may limit accessibility for novice traders.

Bonuses and Promotions: Available documentation does not provide specific information about bonus structures or promotional offers. This suggests either absence of such programs or lack of transparency in marketing materials. JASFX advertises access to forex currency pairs, commodities, stock indices, and precious metals, though specific instrument counts and availability details remain unspecified.

Cost Structure: Detailed information about spreads, commissions, and additional fees is not readily available in public documentation. This makes cost comparison with other brokers impossible. Maximum leverage is advertised at 1:500, which exceeds regulatory limits in many jurisdictions and may indicate targeting of unregulated markets.

Platform Options: Specific trading platform information is not detailed in available materials. This raises questions about technological capabilities and user interface quality. Specific country restrictions are not clearly outlined in available documentation, and available documentation does not specify supported languages for customer service.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

JASFX's account conditions present several concerning aspects that contribute to its low rating in this category. The broker's minimum deposit requirement of USD 500 significantly exceeds industry standards for entry-level accounts. According to forexpeacearmy.com discussions, this high threshold combined with limited account type information suggests either poor market positioning or intentional barriers to entry.

The lack of detailed information about different account tiers, Islamic account availability, or special features indicates either underdeveloped service offerings or deliberate opacity. Most reputable brokers provide comprehensive account comparison charts and clear feature breakdowns, which appear absent from JASFX's available materials. User feedback suggests that even meeting the minimum deposit requirement doesn't guarantee smooth account operation, with several reports indicating difficulties accessing account features post-deposit.

The account opening process details remain unclear, with no specific information about required documentation, verification timelines, or approval procedures. This jasfx review finds that such fundamental gaps in account condition transparency raise serious questions about the broker's operational readiness and client service capabilities.

The tools and resources category reveals significant deficiencies in JASFX's service offerings. Available documentation provides no specific information about trading platforms, analytical tools, or research resources that would typically be essential for informed trading decisions. According to various review platforms, the absence of detailed platform specifications suggests either reliance on generic white-label solutions or inadequate technological infrastructure.

Educational resources, market analysis, and research capabilities appear to be either non-existent or poorly marketed. This leaves potential clients without clarity about learning and development support. Most established brokers provide extensive educational libraries, webinars, and market commentary, which seem notably absent from JASFX's offering portfolio.

Automated trading support, expert advisors compatibility, and advanced charting capabilities remain unspecified in available materials. User feedback indicates that those who have accessed the platform found limited analytical tools and basic functionality that falls short of modern trading requirements. The lack of mobile trading information further suggests potential limitations in platform accessibility and user experience.

Customer Service and Support Analysis (Score: 2/10)

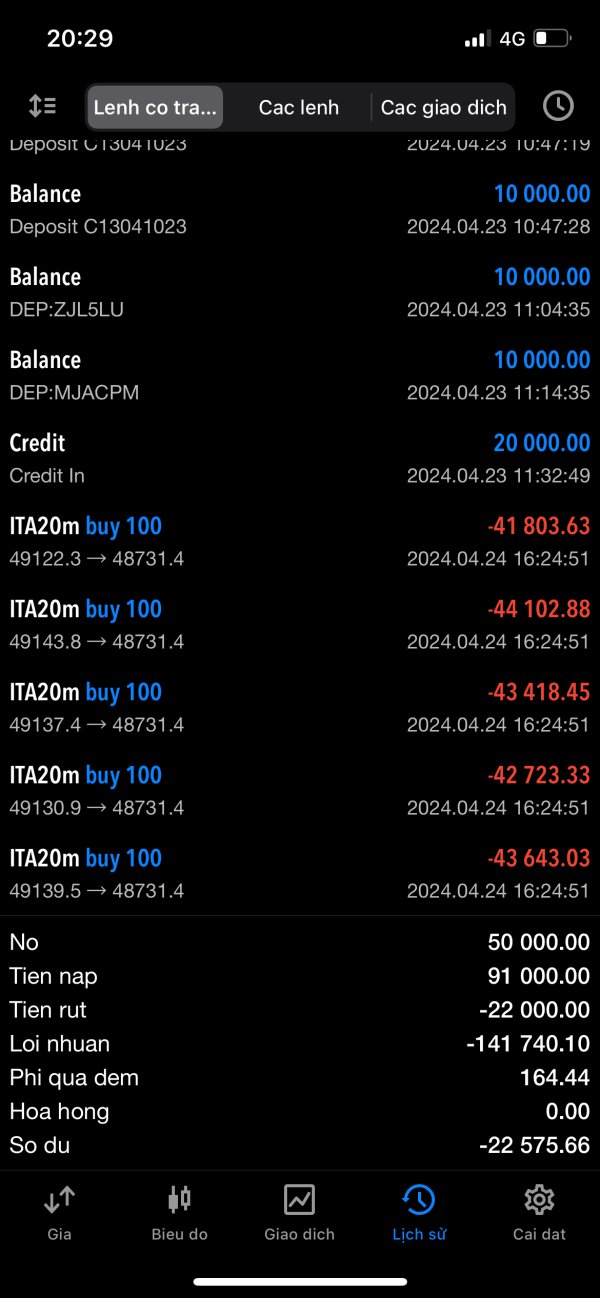

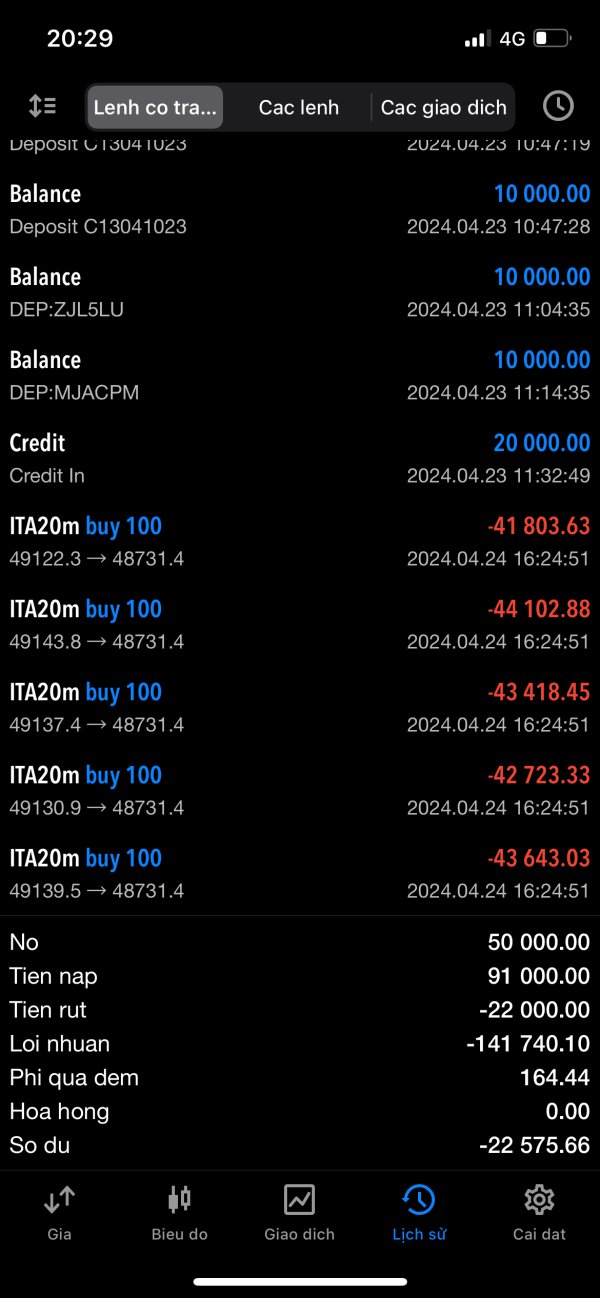

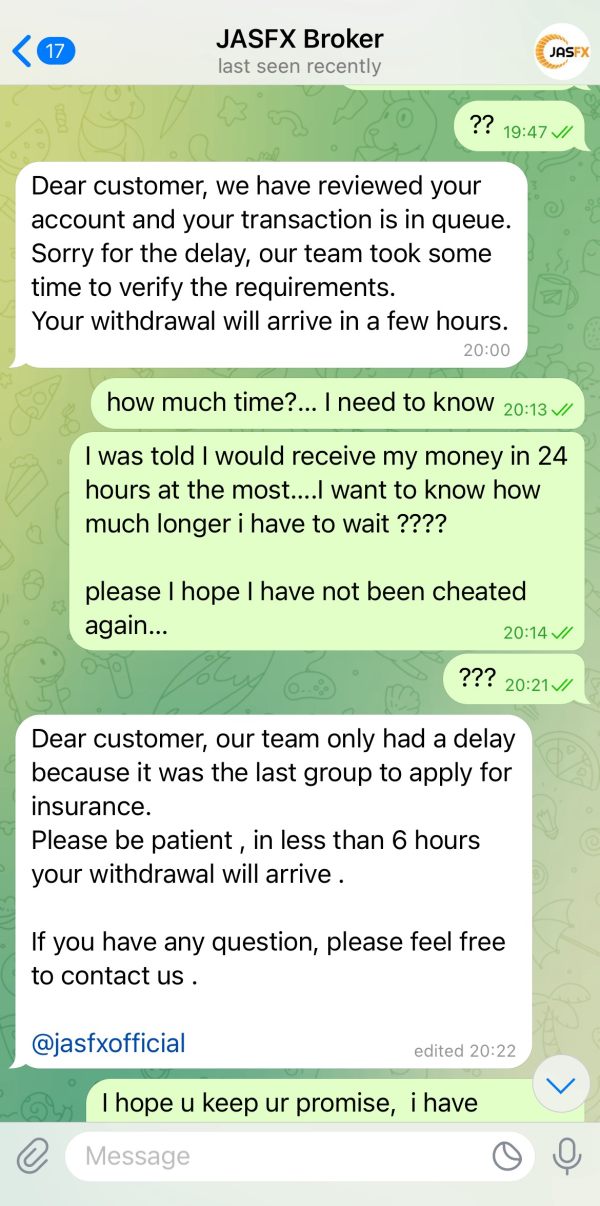

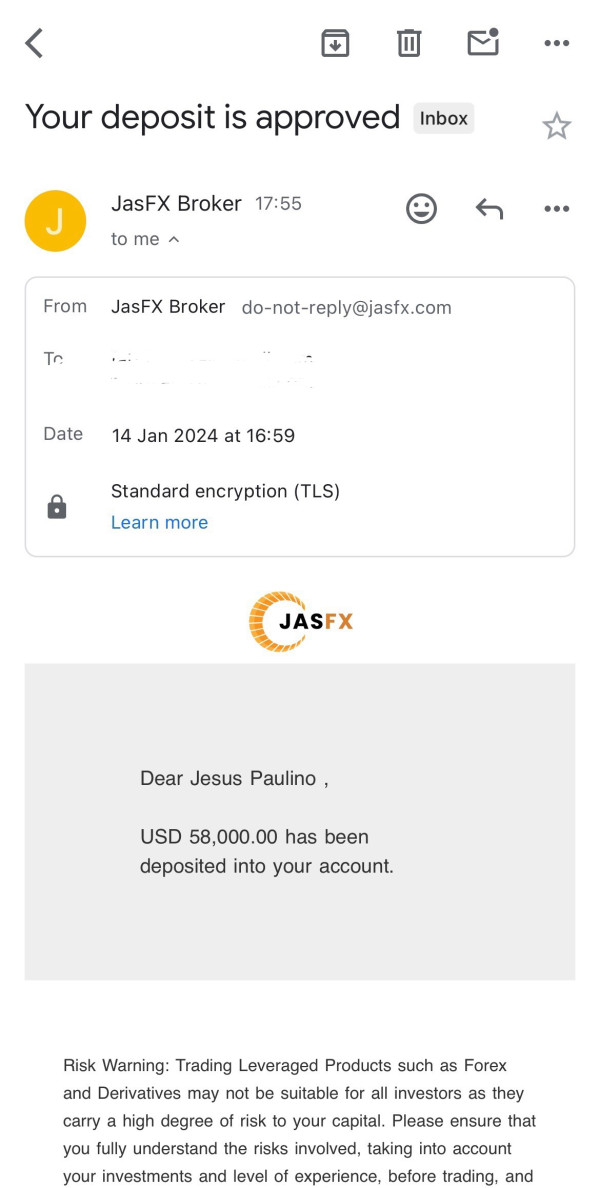

Customer service represents JASFX's most critically problematic area. There are widespread user complaints about unresponsive support and inadequate problem resolution. According to fraudrecoveryexperts.com reports from December 2023, multiple users have experienced complete communication breakdowns when attempting to resolve withdrawal issues or account problems.

Response times appear to be extremely poor, with users reporting days or weeks without replies to urgent inquiries. The quality of support, when available, has been characterized as unhelpful and evasive, particularly regarding fund withdrawal requests. Several users have described support interactions as deliberately obstructive, suggesting systematic issues rather than isolated incidents.

Language support options and available communication channels are not clearly specified. This indicates either limited international service capabilities or poor communication infrastructure. The absence of live chat, comprehensive FAQ sections, or detailed contact information further compounds accessibility concerns for users requiring assistance.

Trading Experience Analysis (Score: 3/10)

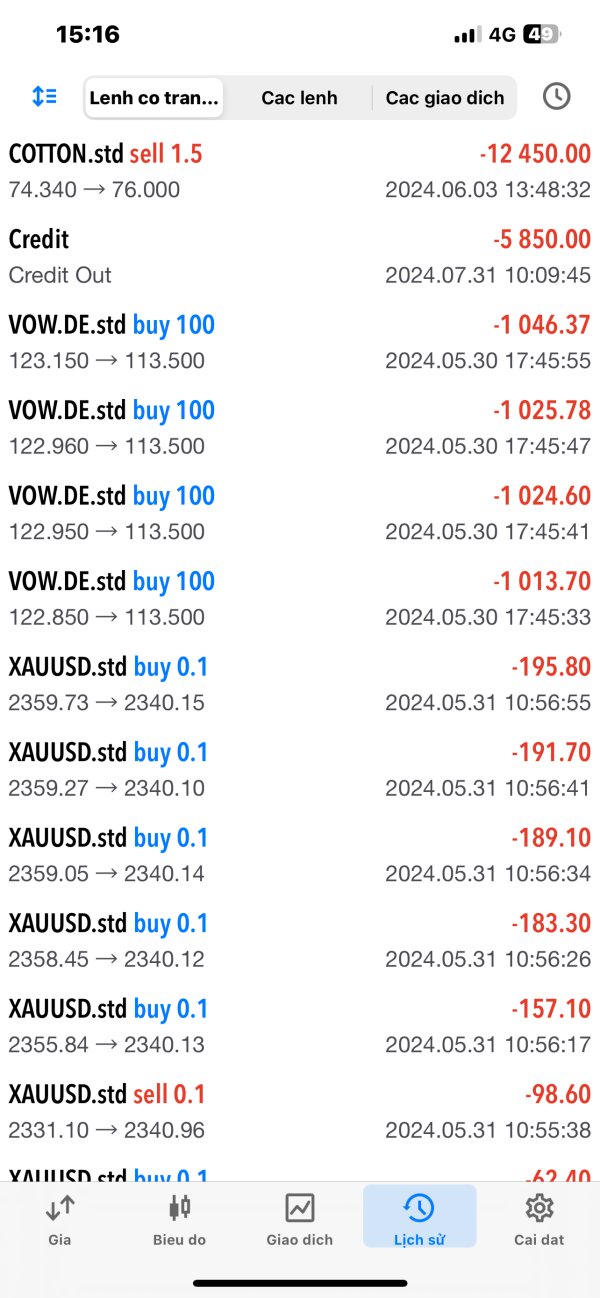

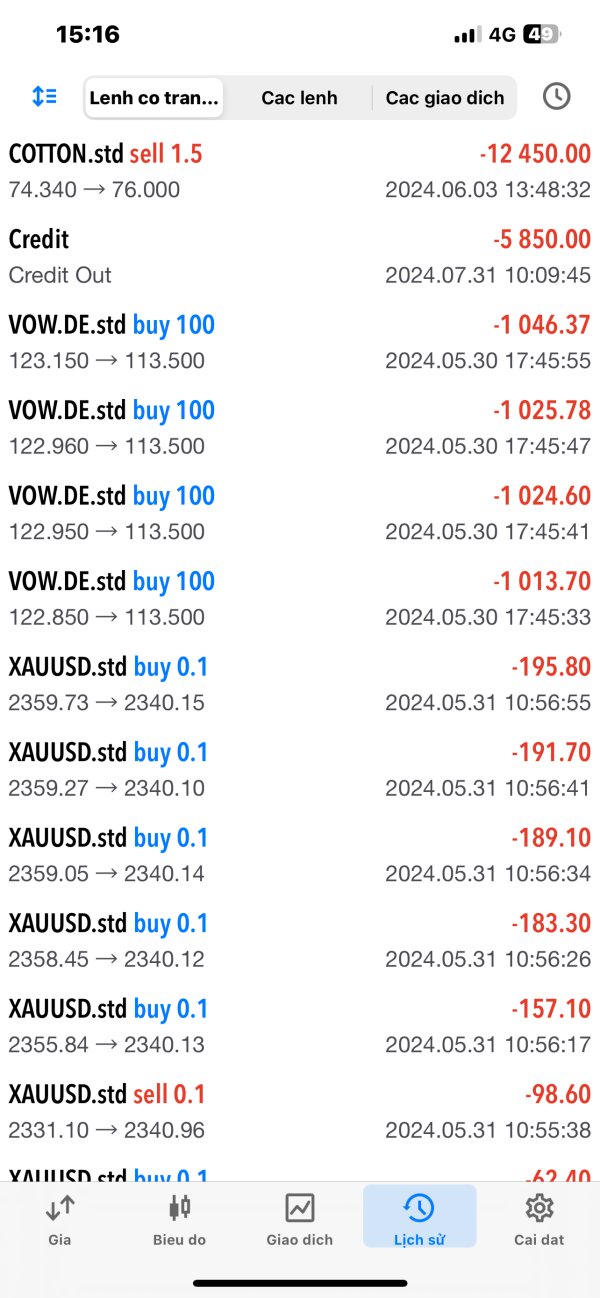

User reports regarding trading experience with JASFX indicate significant performance and reliability issues. According to invest-reviews.com feedback, platform stability problems and execution quality concerns have been consistently reported by users who managed to access trading services. Slippage and requote issues appear to be common, suggesting either poor liquidity provision or unfavorable execution practices.

Platform functionality limitations have been highlighted in user reviews, with reports of basic interface design and limited advanced trading features. Mobile trading experience information remains unavailable, potentially indicating absence of dedicated mobile applications or responsive web platforms. Order execution speed and reliability appear problematic based on available user feedback.

The trading environment seems to suffer from inadequate liquidity and potentially unfavorable market conditions. Users report difficulties in executing trades at expected prices. This jasfx review notes that such fundamental execution problems significantly impact the overall trading experience and raise questions about the broker's market access and operational capabilities.

Trust and Safety Analysis (Score: 1/10)

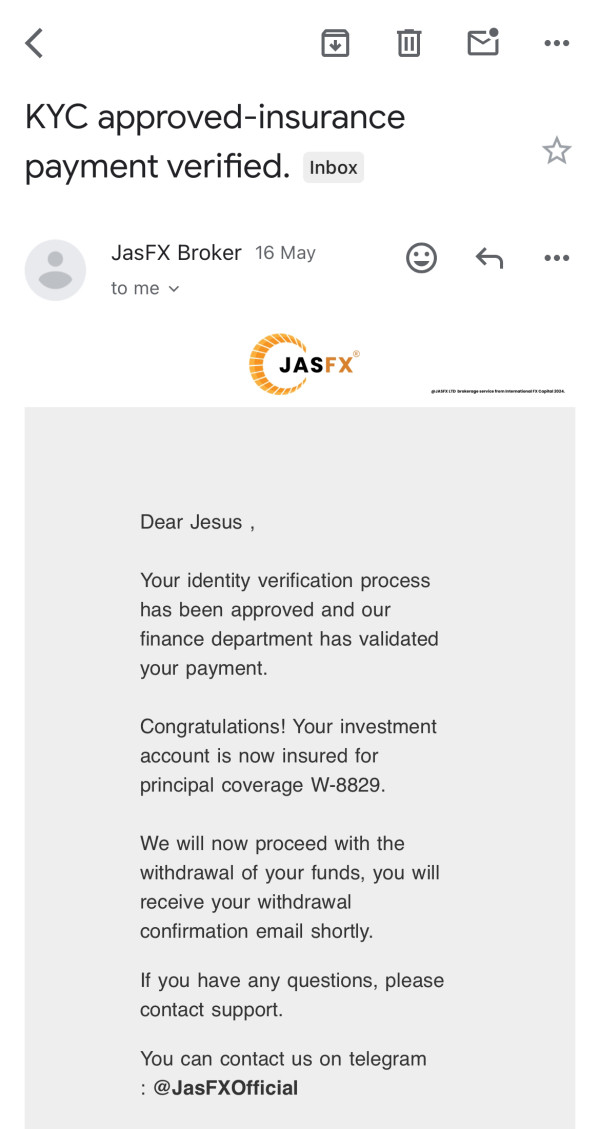

Trust and safety concerns represent the most serious issues with JASFX, earning the lowest possible rating due to multiple fraud allegations and regulatory inadequacies. The broker's registration under SVG FSA, which explicitly does not regulate forex trading, means clients lack fundamental regulatory protections typically expected from legitimate forex brokers. Fund safety measures and segregation protocols are not detailed in available documentation, raising concerns about client money protection.

Multiple fraud recovery websites have specifically highlighted JASFX as problematic, with documented cases of users unable to withdraw deposits or profits. The company's transparency regarding operational procedures, management team, and business practices appears severely limited. Industry reputation has been significantly damaged by negative user experiences and fraud allegations.

Third-party evaluation sites consistently rate JASFX unfavorably, with warnings about potential scam activities. The broker's handling of negative incidents appears inadequate, with little evidence of proper dispute resolution or customer protection measures.

User Experience Analysis (Score: 2/10)

Overall user satisfaction with JASFX appears extremely low based on available feedback across multiple review platforms. Users consistently report negative experiences ranging from technical difficulties to complete inability to access funds. The registration and verification process details remain unclear, potentially indicating either poor onboarding procedures or deliberately complex requirements.

Interface design and platform usability information is limited, though user feedback suggests basic functionality and poor user experience design. Fund operation experiences, particularly withdrawals, represent the most significant user complaints, with multiple reports of complete inability to access deposited funds. Common user complaints center on withdrawal difficulties, unresponsive customer service, and potential fraudulent activities.

The user demographic appears to include traders seeking high-leverage opportunities who subsequently encountered significant problems with basic broker services. Improvement recommendations would require fundamental operational changes including proper regulatory compliance, transparent fund handling, and responsive customer support systems.

Conclusion

This comprehensive jasfx review concludes that JASFX presents significant risks that make it unsuitable for recommendation to any category of trader. The broker's combination of regulatory inadequacy, widespread user complaints, and documented withdrawal difficulties creates an unacceptable risk profile for potential clients.

While the advertised high leverage of 1:500 might initially attract traders seeking aggressive trading opportunities, the overwhelming evidence of operational problems and potential fraudulent activities far outweighs any perceived benefits. The lack of proper regulatory oversight, combined with consistent negative user experiences, suggests that JASFX fails to meet basic industry standards for safety and reliability. Traders are strongly advised to consider well-regulated, established brokers with proven track records of client fund safety and responsive customer service.

The risks associated with JASFX appear to significantly exceed any potential trading advantages, making it an unsuitable choice for both novice and experienced traders seeking legitimate forex trading opportunities.