Gavin 2025 Review: Everything You Need to Know

Executive Summary

This gavin review shows a detailed analysis of what seems to be a real estate-focused brokerage service rather than a traditional forex broker. Based on available information, Gavin represents a collection of experienced real estate professionals, most notably Gavin Ernstone, who brings nearly 30 years of real estate experience from London to Las Vegas, and Gavin Wisser, operating through HomeStar Brokers in Salem, Oregon. The evaluation reveals a neutral stance due to limited comprehensive information about forex trading services, though the strong real estate background of key figures suggests potential value for investors seeking diversified investment opportunities. The primary user base appears to be potential real estate investors or clients looking for alternative investment avenues beyond traditional forex trading. While the extensive real estate expertise provides credibility, the lack of transparent information about forex-specific services, regulatory compliance, and trading platforms presents challenges for potential forex traders seeking detailed operational insights.

Important Notice

Due to limited available information specifically related to forex trading services, this review cannot confirm regulatory differences across various regions or jurisdictions. The assessment is based on publicly available information about the key personnel and their real estate backgrounds. Potential clients should conduct independent verification of any forex-related services, regulatory compliance, and operational details before making investment decisions. This evaluation methodology relies on available company background information and market presence rather than comprehensive trading platform analysis.

Rating Framework

Broker Overview

Gavin represents a unique entity in the financial services landscape. The company is primarily distinguished by the extensive real estate expertise of its key personnel. Gavin Ernstone, the broker and owner of Simply Vegas Real Estate, brings nearly three decades of real estate experience, having begun his career in London, England, at just 17 years old before establishing himself as a leading luxury agent across the Las Vegas Valley. His background demonstrates a deep understanding of high-value transactions and client relationship management. These skills are transferable to various financial service sectors. The organization also includes Gavin Wisser, who operates as a Salem, Oregon real estate broker through HomeStar Brokers, known for attention to detail, strong ethics, and thorough transaction management.

The business model appears to focus on providing comprehensive real estate services while potentially offering diversified investment opportunities. However, specific information about forex trading platforms, traditional brokerage services, or financial trading infrastructure is not detailed in available source materials. The company's approach emphasizes high-quality service delivery, professional staging recommendations, targeted online advertising, and seamless client experiences. This suggests a client-centric operational philosophy that could extend to other financial services.

Regulatory Jurisdiction: Specific regulatory information for forex trading services is not mentioned in available source materials. This requires independent verification.

Deposit and Withdrawal Methods: Payment processing methods and financial transaction procedures are not detailed in the current information set.

Minimum Deposit Requirements: Minimum investment or deposit thresholds are not specified in available documentation.

Bonus and Promotions: Promotional offers or bonus structures are not mentioned in the source materials.

Tradeable Assets: While real estate investment opportunities are evident, specific tradeable financial instruments or asset classes are not detailed.

Cost Structure: Fee schedules, commission rates, and pricing models for potential forex services are not outlined in available information. However, the real estate background suggests experience with transaction-based fee structures.

Leverage Ratios: Leverage options for trading are not specified in current documentation.

Platform Options: Trading platform specifications and technology infrastructure details are not provided in source materials.

Geographic Restrictions: Service availability limitations are not clearly defined in available information.

Customer Support Languages: Multi-language support capabilities are not specified in current materials.

This gavin review highlights the significant information gaps that potential clients should address through direct communication with the service provider.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions for Gavin's services remain largely undefined in available documentation. This makes comprehensive evaluation challenging. While the real estate background of key personnel suggests experience with high-value client accounts and sophisticated transaction management, specific details about forex trading account types, minimum balance requirements, or account tier structures are not provided. Gavin Ernstone's extensive experience with luxury real estate clients in Las Vegas indicates familiarity with premium service delivery and personalized account management approaches. However, without detailed information about account opening procedures, verification requirements, or special account features such as Islamic trading accounts, potential clients cannot make informed decisions about account suitability. The emphasis on attention to detail and thorough transaction management in the real estate context suggests potential for well-structured account conditions. However, this gavin review cannot provide specific assessments without concrete operational details.

The tools and resources available through Gavin's services are not comprehensively detailed in available source materials. However, the real estate background suggests familiarity with professional-grade analytical tools and market research capabilities. Gavin Ernstone's track record with high-quality listing presentations, targeted advertising, and market analysis in the luxury Las Vegas real estate sector indicates potential access to sophisticated analytical resources. The mention of professional staging recommendations and comprehensive market knowledge suggests an understanding of presentation tools and market intelligence gathering. However, specific information about trading platforms, technical analysis tools, automated trading capabilities, or educational resources for forex trading is not available. The real estate focus implies strong client communication tools and transaction management systems. Without detailed specifications about trading-specific resources, research capabilities, or educational support materials, this evaluation cannot provide definitive assessments of the tools and resources quality for forex trading purposes.

Customer Service and Support Analysis

Customer service capabilities appear to be a strength based on the real estate background. Gavin Wisser is specifically noted for attention to detail, strong ethics, and thorough transaction management that ensures seamless and stress-free client experiences. The luxury real estate focus of Gavin Ernstone suggests experience with high-touch customer service models and personalized attention that premium clients expect. However, specific information about customer service channels, response times, availability hours, or multi-language support for forex trading services is not detailed in available materials. The real estate background implies strong relationship management skills and problem-solving capabilities, as property transactions require extensive client communication and issue resolution. Without concrete details about customer support infrastructure, response time metrics, or service quality measurements specific to trading environments, this assessment relies primarily on the demonstrated customer service excellence in the real estate sector as an indicator of potential service quality.

Trading Experience Analysis

The trading experience evaluation is significantly limited by the absence of specific information about trading platforms, execution quality, or technical performance metrics in available source materials. While the real estate background demonstrates transaction management expertise and high-value deal execution capabilities, these skills may not directly translate to forex trading platform proficiency. Gavin Ernstone's nearly 30 years of real estate transaction experience suggests understanding of market timing, negotiation, and execution under pressure. These skills are relevant to trading environments. However, without details about trading platform stability, order execution speeds, mobile trading capabilities, or trading environment infrastructure, this gavin review cannot provide meaningful assessment of the actual trading experience quality. The emphasis on seamless client experiences in real estate suggests attention to operational efficiency. However, specific technical performance data, platform functionality details, or trading execution quality metrics are not available for evaluation.

Trust Score Analysis

The trust assessment reveals mixed indicators due to limited transparency about regulatory compliance and operational details specific to forex services. The extensive real estate backgrounds of key personnel provide some credibility foundation, with Gavin Ernstone's 30-year track record and Gavin Wisser's emphasis on strong ethics suggesting commitment to professional standards. However, critical trust factors such as regulatory licensing for forex services, client fund protection measures, segregated account policies, or financial services compliance are not detailed in available information. The real estate industry experience indicates familiarity with regulatory requirements and professional standards. Without specific information about forex regulatory oversight, third-party audits, or industry certifications, the trust evaluation remains incomplete. The lack of transparent operational information and specific regulatory details presents challenges for clients seeking to verify credibility and safety measures for potential forex trading services.

User Experience Analysis

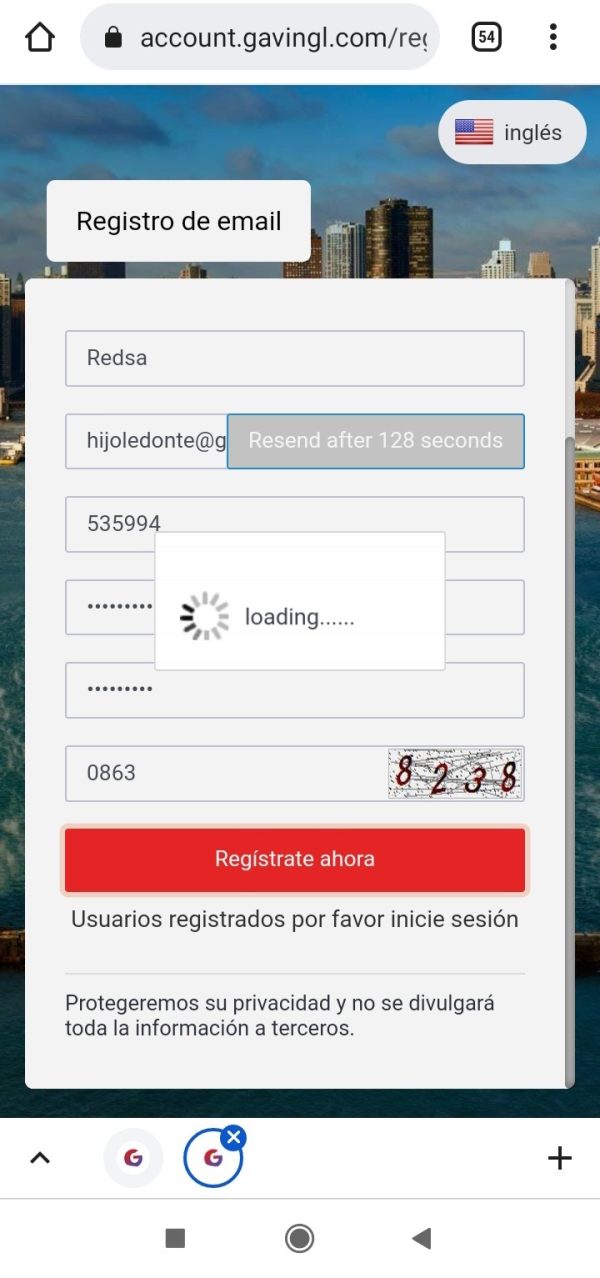

User experience evaluation is constrained by the absence of specific user feedback or interface details for forex trading services. The real estate background suggests focus on client satisfaction and streamlined processes, with Gavin Wisser noted for providing stress-free experiences and Gavin Ernstone recognized for unmatched personal service levels. These indicators suggest potential for positive user experiences, though specific details about platform usability, registration processes, or account management interfaces are not available. The emphasis on high-quality service delivery and attention to detail in real estate contexts implies understanding of user experience principles. Without concrete information about trading platform interfaces, mobile application functionality, or user feedback from forex trading clients, this assessment relies on extrapolation from real estate service quality. The professional approach to client relationships demonstrated in real estate suggests potential for well-designed user experiences. However, comprehensive evaluation requires specific information about trading platform usability and client satisfaction metrics.

Conclusion

This gavin review concludes with a neutral assessment due to significant information limitations regarding forex trading services and operational details. While the extensive real estate expertise of key personnel, particularly Gavin Ernstone's 30-year track record and Gavin Wisser's emphasis on ethical practices, provides some credibility foundation, the lack of transparent information about forex-specific services, regulatory compliance, and trading infrastructure prevents definitive evaluation. The service appears most suitable for potential real estate investors or clients seeking diversified investment opportunities beyond traditional forex trading. The primary advantages include the proven experience and professional standards demonstrated in real estate contexts, while the main disadvantage is the absence of comprehensive information about forex trading capabilities and regulatory compliance.