IQTrade 2025 Review: Everything You Need to Know

Executive Summary

This iqtrade review gives you a complete look at IQTrade. IQTrade is a new forex broker that has caught attention in the trading world, even though it works without any rules watching over it. The company started in 2022 and is registered in Greece. It lets traders use high leverage up to 1:500 and trade many different things like forex, futures, Bitcoin, gold, crude oil, and stocks.

The broker stands out because it offers MT5 trading platform, web trading, and mobile apps. It provides 24/7 trading services so traders from all time zones can trade anytime. IQTrade says it won several industry awards in 2021, but we need to check if these awards are real.

This platform mainly targets active traders who want high-risk, high-reward chances. It especially appeals to those who like leveraged trading and want to trade on mobile devices. The broker appeals to users who care more about trading flexibility and many different assets than regulatory protection. But potential users should think carefully about the risks of trading with an unregulated broker before they invest.

Important Notice

Regional Entity Differences: IQTrade works as an unregulated broker registered in Greece. People thinking about using it must understand that trading with an unregulated company has risks. These risks include limited help for solving disputes and no investor protection that regulated brokers usually provide. Users should carefully think about these risks compared to how much risk they can handle and their investment goals.

Review Methodology: This review uses information available to the public, user feedback from review websites, and official broker messages. Since there is limited regulatory oversight, some information might change without warning.

Rating Framework

Broker Overview

IQTrade started in the forex market in 2022 as a Greece-registered trading platform. The company positions itself as a provider of many different trading products across multiple types of assets. IQTrade has focused on building partnerships with international banks and electronic wallet providers to help global trading operations work better. Even though the company is new, IQTrade has tried to build trust through claimed industry awards and services focused on users.

The broker uses a business model that focuses on easy access and variety. It offers traders exposure to traditional forex pairs along with alternative investments like cryptocurrencies and commodities. IQTrade's approach targets traders who want complete market access through one platform, but this comes with the downside of working outside established regulatory systems.

The platform supports MT5, web-based, and mobile trading interfaces. This accommodates different trading preferences and technical needs. Available assets include futures contracts, Bitcoin and other cryptocurrencies, precious metals like gold, energy commodities including crude oil, and various stock instruments. However, as an unregulated broker, IQTrade operates without oversight from major financial regulatory authorities. Potential users must think about this when making their decision.

Regulatory Status: IQTrade operates as an unregulated broker registered in Greece. This means it lacks oversight from established financial regulatory authorities such as the FCA, ASIC, or CySEC. This status greatly affects the level of protection available to traders.

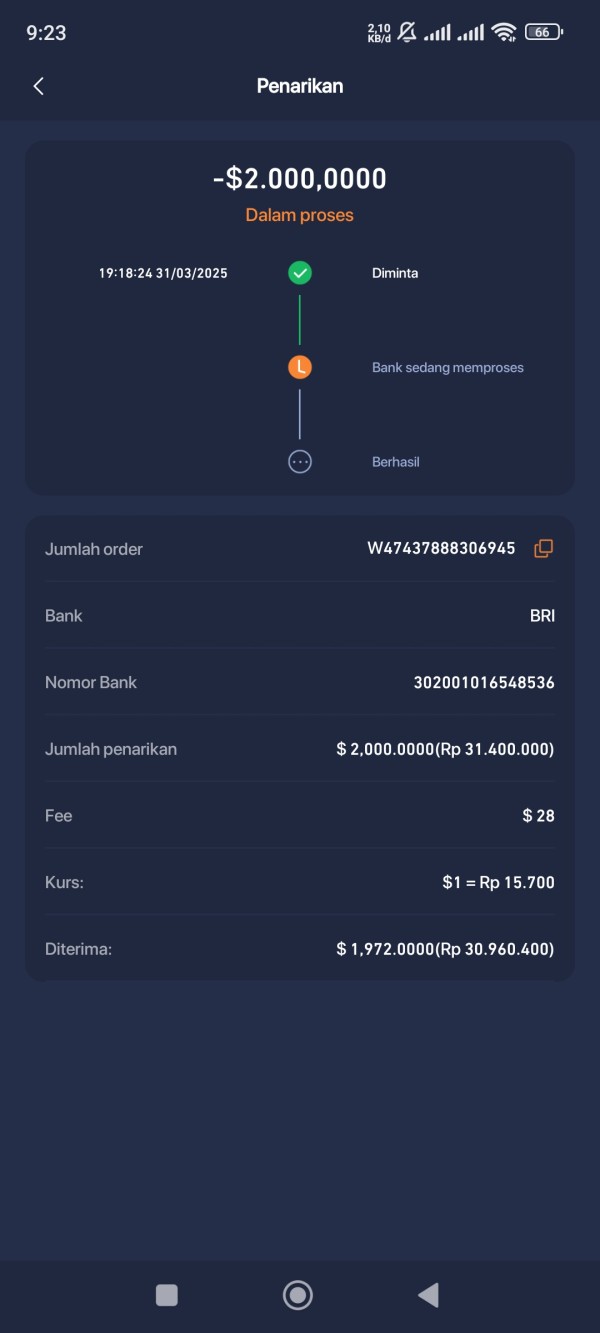

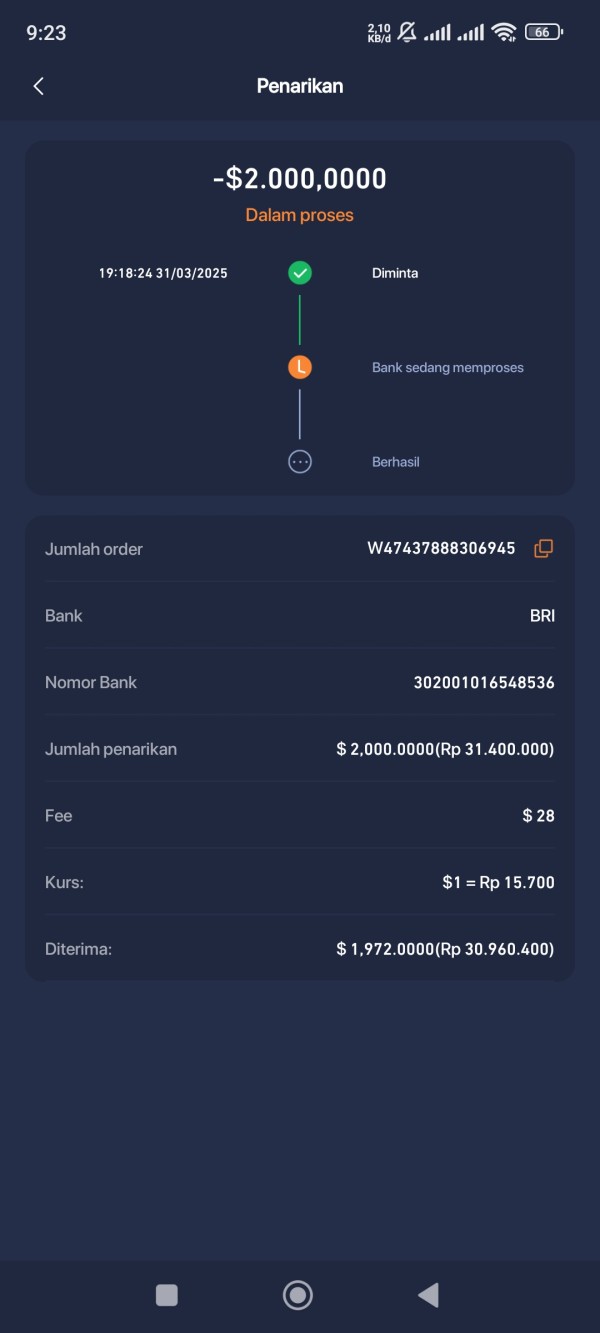

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods was not detailed in available materials. The broker mentions cooperation with well-known banks and electronic wallet providers.

Minimum Deposit Requirements: The platform requires a minimum deposit of $100. This makes it accessible to retail traders with modest starting capital.

Bonuses and Promotions: Available materials do not specify current bonus or promotional offerings. Users should ask directly about any incentive programs.

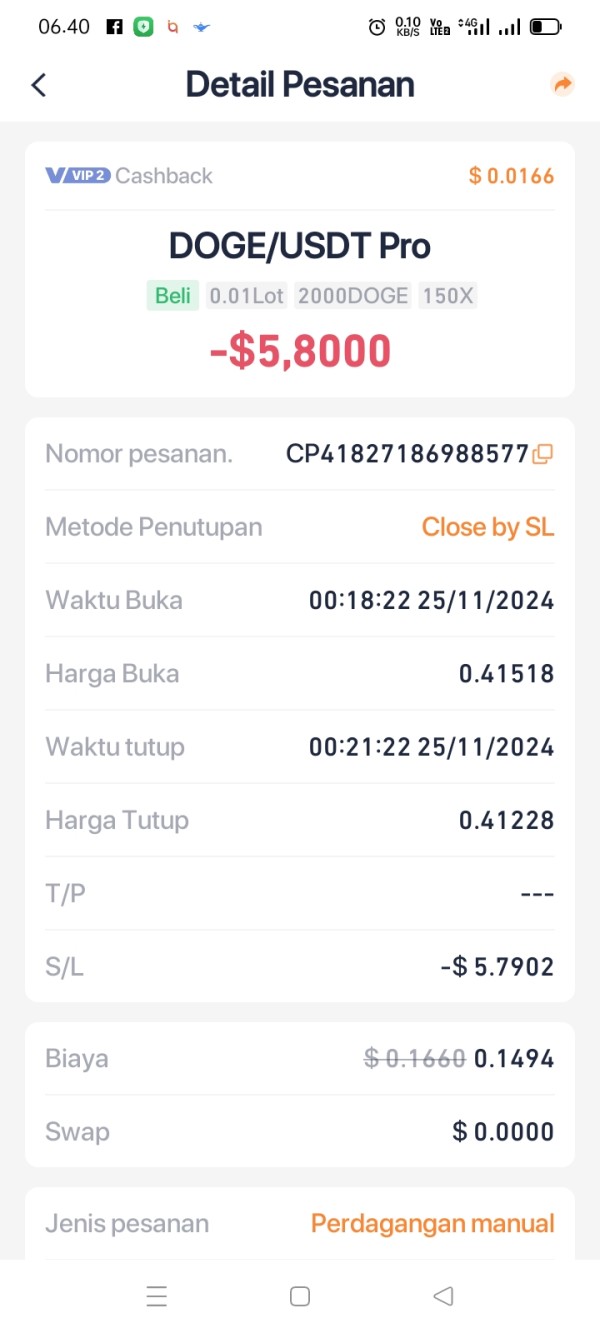

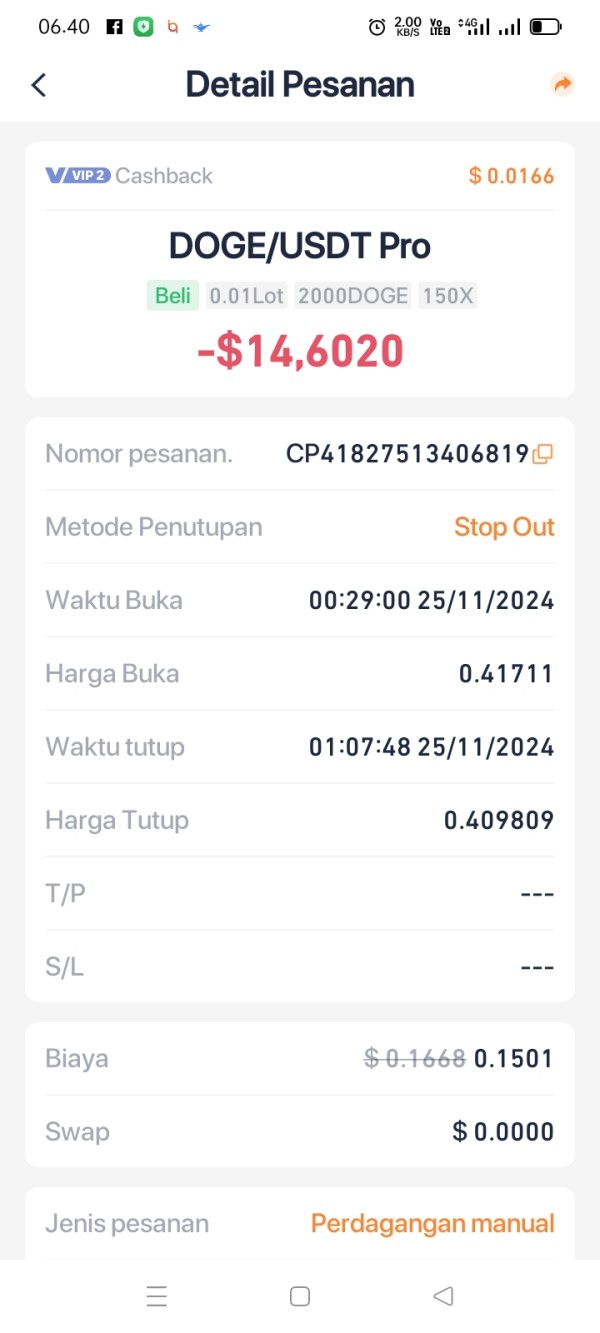

Tradeable Assets: The broker provides access to multiple asset classes including futures contracts, Bitcoin, gold, crude oil, and stocks. This offers diversified trading opportunities across different markets.

Cost Structure: Trading spreads begin at 1.5 pips. Comprehensive commission structures and additional fees were not detailed in available information.

Leverage Ratios: IQTrade offers leverage up to 1:500. This represents significant amplification potential but also correspondingly high risk exposure.

Platform Options: The broker supports MT5, web-based trading, and mobile applications. This provides flexibility across different devices and trading preferences.

Geographic Restrictions: Specific regional restrictions were not detailed in available materials.

Customer Service Languages: Available support languages were not specified in accessible information.

This iqtrade review continues with detailed analysis of each rating dimension to provide comprehensive insight into the broker's offerings.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

IQTrade's account structure presents a mixed picture for potential traders. The $100 minimum deposit requirement positions the broker competitively within the retail forex market. This makes it accessible to traders with limited initial capital. However, the absence of mentioned demo accounts represents a significant limitation. This is particularly true for new traders who typically benefit from risk-free practice environments before committing real funds.

The lack of detailed information about different account tiers or special features suggests either a simplified account structure or insufficient transparency in marketing materials. Most established brokers offer multiple account types with varying features, spreads, and minimum requirements to accommodate different trader profiles. The apparent absence of Islamic accounts or other specialized offerings may limit appeal to certain trader demographics.

Account opening procedures and verification requirements were not detailed in available materials. This makes it difficult to assess the onboarding experience. The combination of low minimum deposits with limited account variety and unclear demo access contributes to a moderate rating in this category. This iqtrade review finds that while the entry barrier is low, the overall account conditions lack the comprehensive features typically expected from full-service brokers.

IQTrade demonstrates strength in platform diversity by offering MT5, web-based, and mobile trading solutions. The MT5 platform provides robust technical analysis capabilities, automated trading support, and comprehensive charting tools that appeal to serious traders. The availability of web and mobile platforms ensures accessibility across different devices and trading scenarios.

The broker's asset variety spanning forex, cryptocurrencies, commodities, and stocks provides traders with diversification opportunities within a single platform. This multi-asset approach allows for portfolio diversification and cross-market trading strategies that many traders value.

However, available materials do not detail additional research resources, market analysis, educational content, or advanced trading tools beyond basic platform functionality. Many competitive brokers provide daily market commentary, economic calendars, sentiment indicators, and educational resources that enhance the trading experience. The absence of mentioned research capabilities and educational support limits the comprehensive value proposition. Though the solid platform foundation earns a respectable rating in this category.

Customer Service and Support Analysis (6/10)

Customer service evaluation for IQTrade faces limitations due to sparse available information about support channels, response times, and service quality. The mention of 24/7 trading availability suggests round-the-clock market access. Though this doesn't necessarily translate to continuous customer support availability.

Available materials do not specify whether support is provided through live chat, email, phone, or other communication channels. Response time expectations, multilingual support capabilities, and staff expertise levels remain unclear from accessible information. These factors are crucial for trader satisfaction, particularly during market volatility or technical issues.

The absence of detailed customer service information in promotional materials may indicate either underdeveloped support infrastructure or inadequate communication about available services. Effective customer support is essential for forex brokers, especially those operating without regulatory oversight. Traders rely heavily on direct broker communication for issue resolution. The moderate rating reflects uncertainty about service quality rather than confirmed deficiencies.

Trading Experience Analysis (6/10)

IQTrade's trading environment offers several positive elements alongside areas of concern. The 24/7 trading availability accommodates different time zones and trading schedules. This appeals to active traders and those in various geographic locations. The MT5 platform provides a professional trading environment with advanced order types, technical indicators, and automated trading capabilities.

Spreads starting at 1.5 pips fall within reasonable ranges for retail forex trading. Though competitive analysis requires more comprehensive fee disclosure. The high leverage availability up to 1:500 provides significant position amplification potential. This appeals to traders seeking maximum capital efficiency, though this also substantially increases risk exposure.

However, crucial trading experience factors remain unclear, including execution speed, slippage rates, requote frequency, and server stability during high volatility periods. Platform performance during major news events and market opening hours significantly impacts trading outcomes but lacks detailed documentation. The absence of comprehensive performance data and limited user feedback about execution quality contributes to a moderate rating. This iqtrade review notes that while basic trading infrastructure appears adequate, transparency about execution quality needs improvement.

Trust and Safety Analysis (4/10)

The trust and safety evaluation reveals significant concerns primarily stemming from IQTrade's unregulated status. Operating without oversight from established financial regulatory authorities eliminates many standard protections that traders typically rely upon. These include segregated client funds, compensation schemes, and regulatory dispute resolution mechanisms.

The broker's registration in Greece without specific regulatory authorization means that standard investor protections are not guaranteed. This includes uncertainty about fund segregation practices, operational transparency requirements, and financial reporting standards that regulated brokers must maintain.

While IQTrade claims multiple industry awards from 2021, the specific nature and verification of these accolades require additional substantiation. Industry recognition can indicate quality service, but without regulatory backing, such claims carry less weight in establishing trustworthiness.

The absence of detailed information about fund security measures, operational transparency, and financial stability reporting further impacts confidence levels. For traders prioritizing security and regulatory protection, the unregulated status represents a fundamental limitation. This significantly affects the trust rating in this evaluation.

User Experience Analysis (7/10)

Available user feedback suggests generally positive experiences, with ReviewMeta indicating an average adjusted rating of 4.35 out of 5. This suggests that users who engage with the platform often find satisfactory service levels. Though the sample size and representativeness of reviews require consideration.

The multi-platform approach supporting MT5, web, and mobile trading provides flexibility for different trading styles and preferences. Modern interface design and cross-device compatibility appeal to contemporary traders who expect seamless transitions between desktop and mobile environments.

However, comprehensive user experience assessment faces limitations due to sparse detailed feedback about specific platform features, customer service interactions, and operational reliability. User testimonials and detailed experience reports would provide valuable insights into day-to-day platform performance and user satisfaction drivers.

The positive rating trend suggests that IQTrade delivers satisfactory service to its user base. Though the limited scope of available feedback prevents more definitive assessment. The platform appears to meet basic user expectations while potentially offering room for enhanced features and service improvements.

Conclusion

This iqtrade review reveals a broker with both appealing features and significant limitations. IQTrade offers competitive elements including high leverage ratios, diverse asset access, and multi-platform trading capabilities that attract active traders seeking flexible trading environments. The relatively low minimum deposit and claimed industry recognition suggest efforts to serve retail traders effectively.

However, the unregulated status represents a fundamental concern that potential users must carefully consider. The absence of regulatory oversight eliminates standard protections and recourse mechanisms that many traders consider essential. Combined with limited transparency about operational details, customer service capabilities, and fee structures, the overall proposition requires careful risk assessment.

IQTrade appears most suitable for experienced traders who prioritize trading flexibility and high leverage access over regulatory protection. This particularly applies to those comfortable with mobile and web-based trading platforms. New traders or those seeking comprehensive educational resources and regulatory security may find better alternatives among established, regulated brokers.

The moderate overall rating reflects a platform with functional capabilities but significant limitations in transparency and regulatory protection. These limitations impact its suitability for risk-averse traders.