Is IQ trade safe?

Pros

Cons

Is IQTrade Safe or Scam?

Introduction

IQTrade positions itself as a modern trading platform catering to various financial instruments, including forex, commodities, and cryptocurrencies. As the forex market continues to grow, the number of brokers has surged, making it essential for traders to exercise caution when selecting a trading partner. The landscape is fraught with potential scams and unreliable entities that can jeopardize investors' funds. Therefore, assessing the trustworthiness of a broker like IQTrade is crucial. This article employs a comprehensive evaluation framework, relying on regulatory status, company background, trading conditions, customer safety, user experience, and risk assessment to determine whether IQTrade is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a broker is a key indicator of its legitimacy. A well-regulated broker is typically subject to stringent oversight, ensuring a higher level of protection for clients. In the case of IQTrade, it appears that the broker operates without any significant regulatory oversight from recognized financial authorities.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation from top-tier authorities such as the FCA (UK), ASIC (Australia), or SEC (USA) raises serious concerns about the safety of funds deposited with IQTrade. The lack of regulatory oversight means that clients have limited recourse in the event of disputes or financial malpractice. Furthermore, the absence of a clear regulatory framework may expose traders to various risks, including unfair trading practices and potential fraud. Therefore, when considering whether IQTrade is safe, the lack of regulation is a significant red flag.

Company Background Investigation

Understanding the company behind a trading platform is vital for assessing its reliability. Unfortunately, IQTrade lacks transparency regarding its ownership structure and management team. There is little publicly available information about the companys history, which raises questions about its legitimacy.

Moreover, the absence of identifiable management or a clear operational history is concerning. A reputable broker typically provides detailed information about its founders and key personnel, including their qualifications and experience in the financial industry. The lack of such information may suggest that IQTrade is attempting to obscure its true nature, making it difficult for potential clients to gauge its trustworthiness.

The overall opacity surrounding IQTrade further complicates the evaluation of whether IQTrade is safe for trading activities. Without transparency, traders may find themselves vulnerable to potential scams or unethical practices.

Trading Conditions Analysis

When evaluating a broker, it is essential to analyze the trading conditions offered. IQTrade claims to provide competitive spreads and low fees, but the specifics of their fee structure remain ambiguous.

| Fee Type | IQTrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0-1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5%-2.0% |

The lack of clarity regarding commissions and overnight interest is concerning. Traders should be cautious of brokers that do not clearly disclose their fee structures, as this can lead to unexpected costs that diminish profitability. Furthermore, any broker that employs hidden fees or complex withdrawal policies can create a challenging trading environment, leading traders to question whether IQTrade is safe.

Client Funds Safety

The safety of client funds is paramount when choosing a trading platform. IQTrade's policies regarding fund security are unclear, which is a significant concern. A reputable broker should ideally maintain client funds in segregated accounts to protect them from operational risks. Additionally, measures like negative balance protection are essential to ensure that clients do not lose more than their initial investment.

However, without clear information on IQTrade's fund safety protocols, traders may find themselves at risk. The absence of investor protection schemes or compensation funds further exacerbates the situation. Historical issues related to fund security, if any, are also crucial to consider. Unfortunately, the lack of transparency makes it difficult to ascertain whether IQTrade is safe for clients' investments.

Customer Experience and Complaints

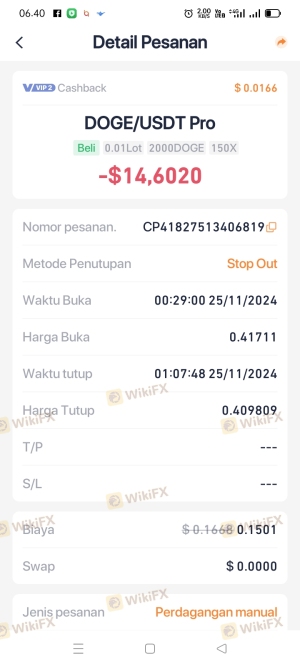

Customer feedback can provide valuable insights into a broker's reliability and service quality. Reviews of IQTrade reveal a mixed bag of experiences, with several users reporting issues related to withdrawals and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Support | Medium | Fair |

| Misleading Promotions | High | Poor |

Common complaints include difficulties in withdrawing funds, which is a significant red flag for any broker. If a broker makes it challenging for clients to access their funds, it can indicate potential fraud or mismanagement. Additionally, the quality of customer service provided by IQTrade has been criticized, with many users expressing frustration over unresponsive support channels.

These issues raise substantial concerns regarding whether IQTrade is safe, as a broker that cannot adequately support its clients is unlikely to be trustworthy.

Platform and Trade Execution

The performance of a trading platform is critical for effective trading. IQTrade's platform has been described as user-friendly, but there are concerns regarding its execution quality. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

Moreover, any signs of platform manipulation or unethical practices should be carefully scrutinized. A broker that fails to execute trades as expected can lead to substantial financial losses, prompting traders to question the integrity of the platform.

Risk Assessment

Using IQTrade involves several risks that potential traders should be aware of. The lack of regulation, transparency issues, and customer complaints contribute to a risk-laden environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized authorities |

| Transparency Risk | High | Lack of company information and history |

| Fund Safety Risk | High | Unclear policies on fund security |

To mitigate these risks, traders should conduct thorough research before engaging with IQTrade. It is advisable to start with smaller investments and to be wary of any broker that does not offer clear and transparent trading conditions.

Conclusion and Recommendations

In conclusion, the investigation into IQTrade raises several concerns regarding its safety and reliability. The absence of regulation, lack of transparency, ambiguous trading conditions, and negative customer feedback all suggest that traders should exercise caution. While some users have reported positive experiences, the overwhelming evidence points towards significant risks associated with trading on this platform.

For traders seeking a reliable broker, it may be prudent to consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers such as eToro, IG, or OANDA are examples of platforms that offer comprehensive regulatory oversight and transparent trading conditions. Ultimately, when assessing whether IQTrade is safe, the potential risks and lack of clarity may outweigh any perceived benefits.

Is IQ trade a scam, or is it legit?

The latest exposure and evaluation content of IQ trade brokers.

IQ trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IQ trade latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.