gtja 2025 Review: Everything You Need to Know

1. Summary

This gtja review looks at GTJA as a financial services company with a strong reputation in China's markets. GTJA started in 1999 and has become a major player in securities and forex trading over the years. The firm ranked in the top three for operating revenue from 2007 to 2015, which shows its strong position in the market. GTJA is known for its long history, integrated financial services, and fast customer support that works well for investors. These features make GTJA a good choice for people who want both forex and securities trading on one platform. This review uses public information and user feedback to give you an honest look at what the broker does well and where it could improve.

2. Notice and Considerations

GTJA operates under Chinese market rules with CFFEX watching over it. The rules here might be different from other regions because of how the company works across different areas. We built this review using public data and user feedback to give you an objective look at what GTJA offers. Keep in mind that some details about trading conditions, minimum deposits, and fees are not available to the public. Our review focuses on customer service quality, market presence, and how well the company operates rather than specific account details.

3. Scoring Framework

4. Broker Overview

GTJA started in 1999 and has built a strong reputation in China's financial world. The company is one of the top securities firms that successfully combines different financial services from stock trading to forex operations. From 2007 to 2015, GTJA was consistently one of the top three companies for revenue, which shows its strong market performance and stability. The firm's long history creates significant trust with clients and shows its lasting success in the industry. GTJA focuses on offering many different financial products for investors who want all-in-one solutions. This approach has helped GTJA attract different types of investors, especially those interested in both securities and foreign exchange markets.

The available information about GTJA's trading platform is limited, but the firm offers both securities and forex trading under one service umbrella. CFFEX oversight gives the firm credibility in the domestic market and shows it follows proper regulations. However, there are no clear details about platform technology, how orders are executed, or what multi-asset trading features are available. Investors who want a combined solution for stock trading and forex might like what GTJA offers. This gtja review shows that while the broker has a solid reputation for regional performance and customer service, it needs to be more open about specific trading conditions and technology tools.

Regulatory Region :

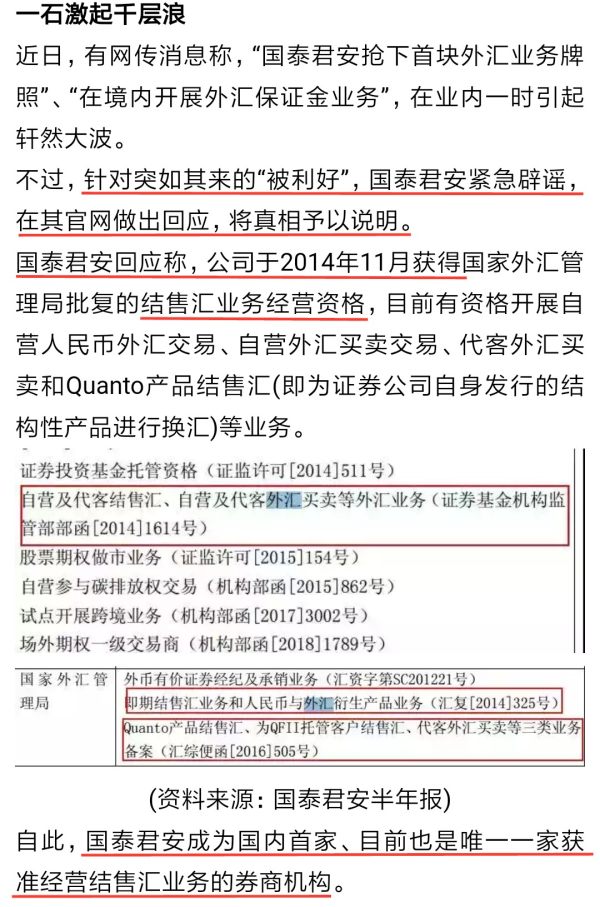

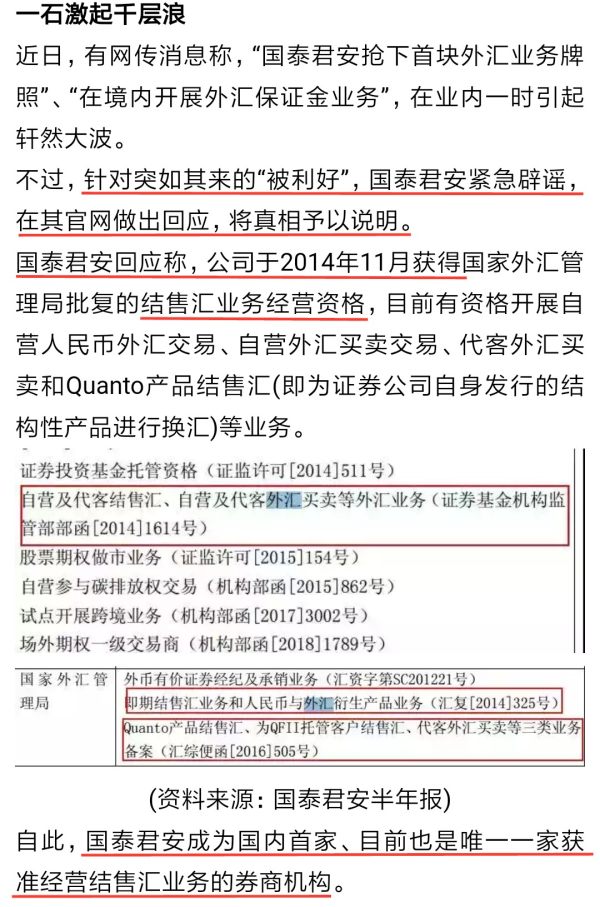

GTJA operates under the China Financial Futures Exchange oversight. This regulatory connection ensures the company follows market rules and meets standards set by Chinese financial authorities. However, specific regulatory numbers and identifiers are not available in the public information we reviewed.

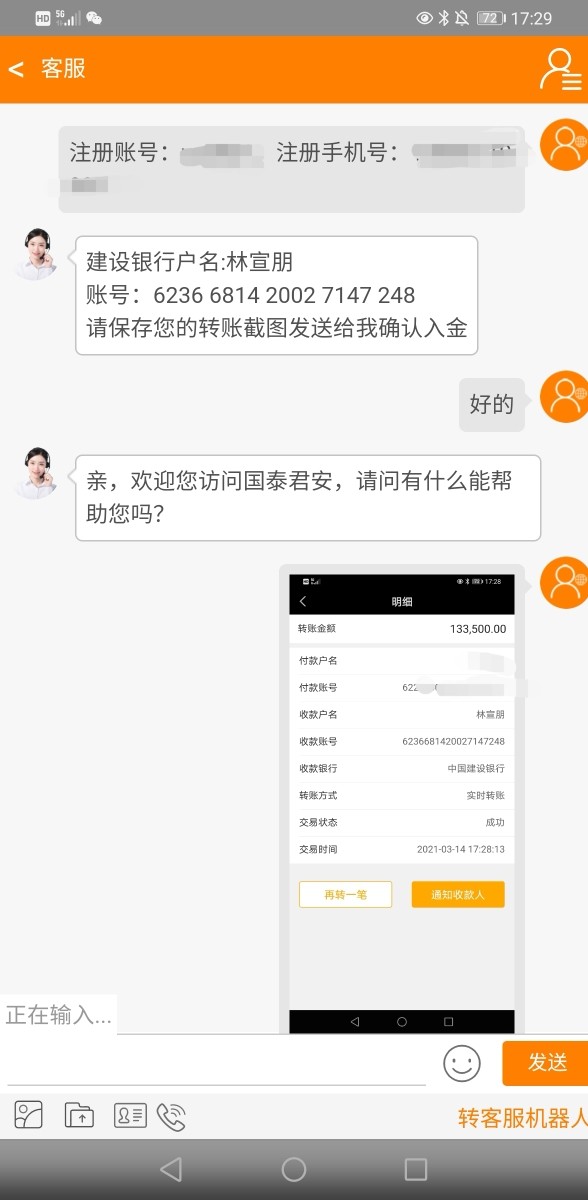

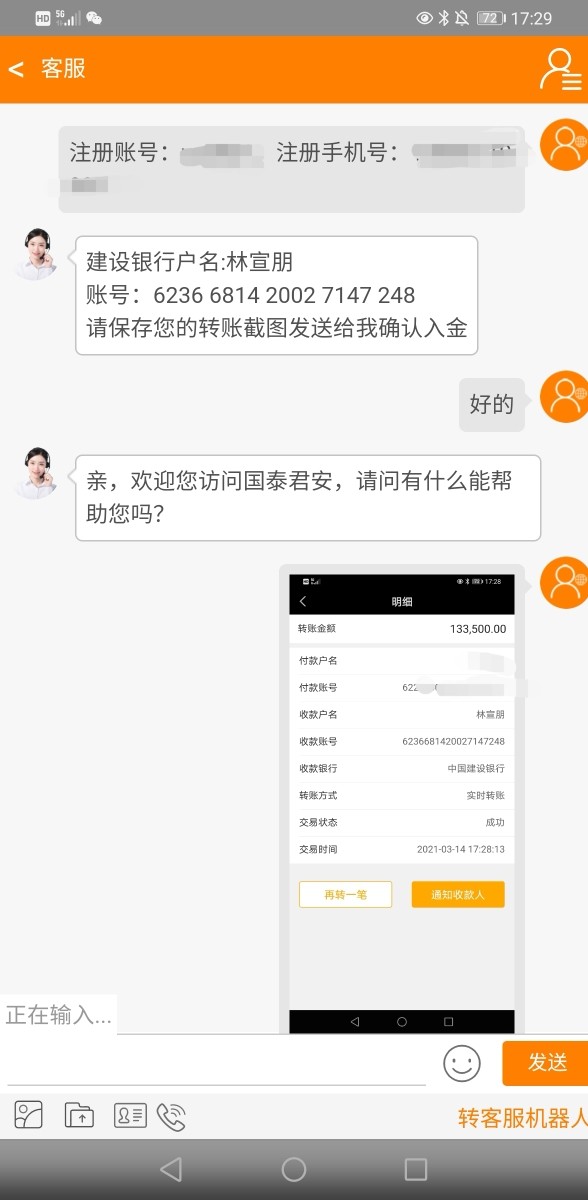

Deposit and Withdrawal Methods :

The specific deposit and withdrawal methods that GTJA offers are not clearly described in available materials. GTJA probably supports standard payment options, but we don't have details about specific channels, fees, or how long transactions take. This information is not included in current documentation.

Minimum Deposit Requirement :

The minimum deposit needed to open an account with GTJA is not detailed in the information we reviewed. This makes it hard for potential investors to know how much money they need to start trading.

Bonus and Promotions :

There is no specific information about bonus offers or promotional deals provided by GTJA. Investors who want incentive-based accounts will need to ask the broker directly since current reviews don't show any ongoing or past promotional campaigns.

Tradable Assets :

GTJA gives access to multiple asset classes, mainly focusing on securities and foreign exchange trading. Investors can engage in different markets under one platform, which offers good variety for traders. While the range of available instruments seems comprehensive, the details about specific assets within these classes are not fully listed in the information we gathered.

Cost Structure :

A clear description of GTJA's cost structure, including spreads, commissions, and other fees, is missing from available public information. This gap creates uncertainty for traders who need precise cost breakdowns to compare against other brokers in the industry. The missing information affects how transparent the broker's pricing model appears to potential clients. This means people have to rely on direct questions to the broker or feedback from other traders to understand costs. The absence of detailed cost information is one of the main concerns we found in this review.

Leverage Ratios :

Information about the maximum leverage ratios that GTJA offers is not available in current reviews. Potential clients don't have access to detailed leverage terms, which is important for managing risk in forex and securities trading.

Platform Options :

The detailed specifications of trading platforms available through GTJA are not provided in the materials we reviewed. While the broker handles securities and forex trading, there is a clear lack of information about platform technology, user interface, and supported devices. This leaves prospective users with questions they need to ask directly.

Regional Restrictions :

No clear information about regional restrictions on account registration or trading activity is available. Investors should assume that regional limits may apply based on local Chinese financial rules and cross-border compliance policies.

Customer Support Languages :

The specific languages supported by GTJA's customer service are not detailed in current available information. However, service responsiveness is acknowledged by users.

6. Detailed Scoring Analysis

6.1 Account Conditions Analysis

When we look at GTJA's account conditions, the available information doesn't give us complete details about account types or special features like Islamic accounts. The minimum deposit requirement is not specified, which can be important for new traders who want to know upfront costs. The lack of clear information on commission structures and leverage ratios led to an average score of 5/10 in this category. This score reflects the uncertainty that comes with opening an account when detailed financial commitments are not revealed to potential clients. The account opening process is also not fully explained, which leaves questions about how simple the procedure is and what documents you need. Compared to other brokers that provide transparent and well-documented account setup information, GTJA's lack of clarity on these key points results in a middle-range performance rating. Despite this issue, the strong reputation that comes from decades in the market helps reduce some concerns about the company's reliability. Users who want a more detailed breakdown of account conditions should contact the broker directly to get the information they need.

GTJA's trading tools and resources are less competitive compared to industry standards based on our review. The available material shows no detailed descriptions of proprietary trading platforms, automated trading facilities, or comprehensive research and educational materials. This shortfall in providing analytical tools and resources puts GTJA at a disadvantage compared to other brokers who often highlight innovative trading applications and research support as key features. There is no clarity around available charting software, technical analysis tools, or algorithmic trading capabilities, which further shows this limitation. Additionally, there is no mention of educational content or webinars that could help retail traders improve their market knowledge and skills. While the platform may support basic trading needs in securities and forex, the absence of advanced tools limits value for those seeking an integrated research and education experience. This gap in tools and resources is significant and means potential investors should carefully evaluate their personal trading requirements before committing to the service. The 4/10 score reflects these limitations in what modern traders typically expect from a full-service broker.

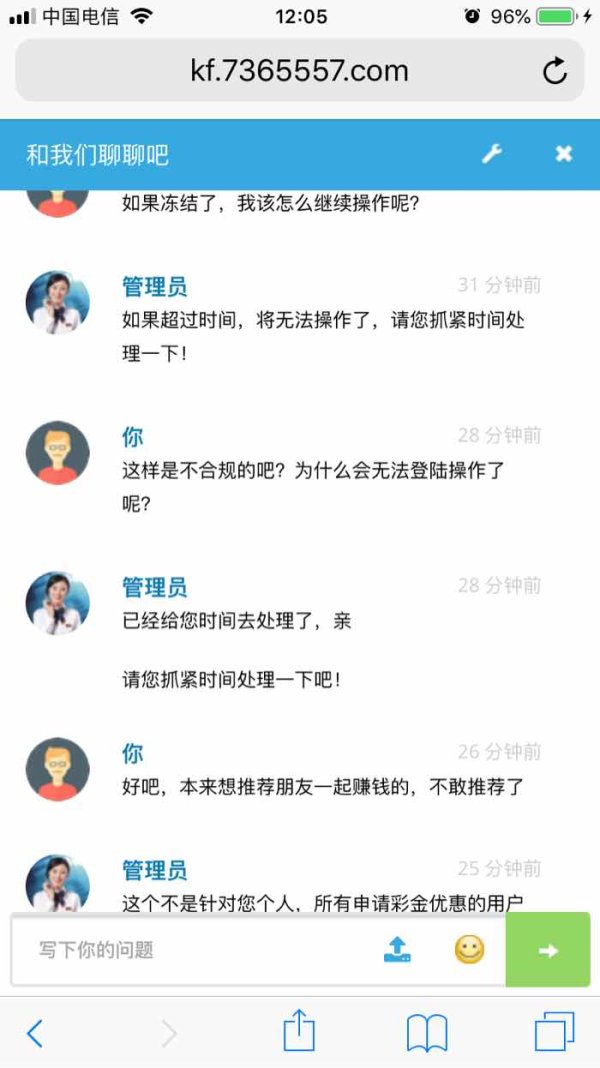

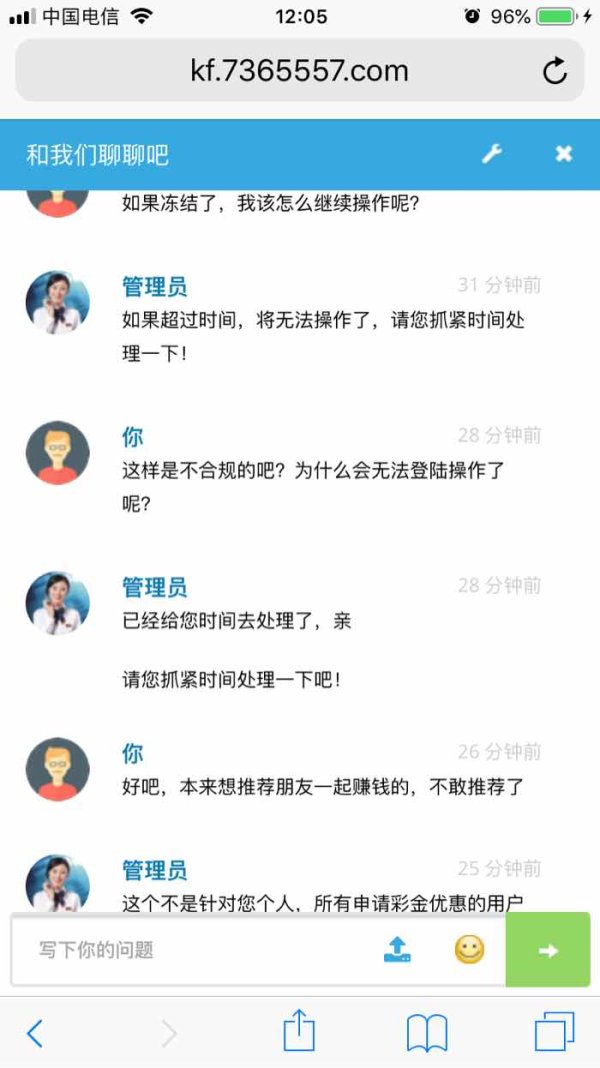

6.3 Customer Service and Support Analysis

GTJA excels in customer service and support, consistently showing high standards of responsiveness to client needs. User feedback emphasizes that questions and issues are generally addressed quickly, which is crucial for maintaining customer satisfaction in the fast-moving world of trading. The variety of communication channels—although not described in detail—suggests a system designed for efficient resolution of client problems. When users reported needing immediate help, the quick response time increased trust in the broker's commitment to service quality. However, detailed information about multi-language support or extended service hours is not provided in available materials. Despite this gap, the overall impression remains positive as the customer service framework appears strong enough to handle both routine questions and more complex technical problems. The swift customer support has contributed significantly to the 8/10 rating in this area, showing that even without complete details, service quality stands out as a competitive advantage for GTJA. This strong performance in customer service helps offset some of the concerns about missing information in other areas of the broker's operations.

6.4 Trading Experience Analysis

The trading experience provided by GTJA shows average performance, mainly because of missing information in key operational areas. The platform's stability, order execution quality, and overall speed are vaguely described, leaving potential users with unanswered questions about the technology foundation. Although GTJA is recognized for its legacy in securities and forex trading, important elements like platform functionality, mobile trading interface, and real-time data processing are not clearly defined in reviews. This lack of clarity affects overall user confidence since traders typically prefer platforms that offer reliable, easy-to-use, and technologically advanced interfaces. The absence of specifics on order execution speed and reliability during volatile market conditions also contributes to the moderate score of 5/10. While the firm's history and reputation suggest a dependable trading environment, the lack of detailed information prevents it from competing with other brokers who provide thorough technical disclosures. Traders who prioritize platform performance and technology features may find this lack of transparency concerning when making their broker selection decision.

6.5 Trust Analysis

Trust is a key factor for any financial service provider, and GTJA benefits from a well-established reputation built over decades of operation. Regulated by CFFEX, GTJA follows the regulatory standards expected in the Chinese financial market, which adds credibility to its operations. The firm's historical performance—especially its period of ranking among the top three in operating revenue from 2007 to 2015—further strengthens its market reliability and shows consistent business success. However, the absence of specific regulatory identifiers and transparent disclosures about fund protection measures creates some uncertainty for potential clients. Investors cannot fully determine how robust GTJA's risk management practices are from publicly available data, which is a limitation. While the broker's legacy and market position suggest a trustworthy profile, the limited insight into how negative events are resolved and comprehensive safety protocols prompts a cautious approach. GTJA's trust rating of 6/10 reflects a balance between a respected industry reputation and the need for more detailed disclosures on risk management and compliance measures. This score shows that while the company has earned trust through performance, more transparency would strengthen investor confidence.

6.6 User Experience Analysis

The overall user experience with GTJA, while supported by a reliable market presence, remains difficult to fully assess due to insufficient details about interface design, registration processes, and daily usability. There is little available documentation about how easy the trading interface is to use or whether the platform design works well for both new and experienced traders. The registration and verification steps, which are essential for smooth onboarding, are not explained in current reports, leaving potential users uncertain about the process. Additionally, investor feedback does not provide a clear picture of how easy it is to deposit and manage funds through the platform. While the firm's commitment to customer service offers some balance to these concerns, the absence of specific insights into user interface design, functionality, and regular software updates limits the ability to give a rating above average. The user experience receives a score of 5/10, reflecting potential areas for improvement in designing a more accessible and engaging trading environment for clients. This score suggests that while basic functionality may be adequate, there is room for enhancement in the overall user experience design and implementation.

7. Conclusion

GTJA stands as a reputable integrated financial services provider, particularly noted for its long history in securities and forex trading in China. With strong customer service and a solid market position under CFFEX supervision, the firm appeals to investors seeking comprehensive trading solutions that combine multiple asset classes. However, many operational details—including minimum deposits, platform technology, and cost structures—remain insufficiently described, which highlights room for improvement in transparency. Overall, this gtja review suggests that while GTJA excels in customer support and market reputation, prospective users should ask more questions about specific trading conditions to ensure the broker meets their investment needs. The company's strong foundation and regulatory oversight provide a good base, but more detailed information would help investors make better-informed decisions.