FIBI 2025 Review: Everything You Need to Know

Executive Summary

FIBI stands out as a modern financial services provider. The company has embraced artificial intelligence to enhance the investment experience for contemporary traders and investors. This comprehensive fibi review reveals a company that positions itself at the intersection of traditional financial services and cutting-edge technology. FIBI offers AI-powered investment assistance alongside conventional trading services.

The broker's most notable feature is its AI Investment Assistant. This tool is designed specifically for modern investors who seek data-driven insights and automated support in their trading decisions. FIBI appears to focus heavily on empowering GCC investors with localized analytics and integrated solutions that cater to regional market dynamics. User feedback indicates positive reception. Testimonials highlight satisfaction with the platform's offerings.

This review targets professional investors and those seeking high-quality educational resources and technological innovation in their trading experience. FIBI's emphasis on AI integration and localized market expertise makes it particularly appealing to tech-savvy traders who value advanced analytical tools and regional market knowledge.

Important Notice

This evaluation is based on available public information, user feedback, and company materials accessible through various sources. The assessment methodology incorporates analysis of the broker's technological offerings, market positioning, and available user testimonials to provide a comprehensive overview of FIBI's services.

Given the evolving nature of AI-powered financial services and regulatory environments, potential users should verify current terms, conditions, and regulatory status directly with FIBI before making any investment decisions.

Rating Framework

Broker Overview

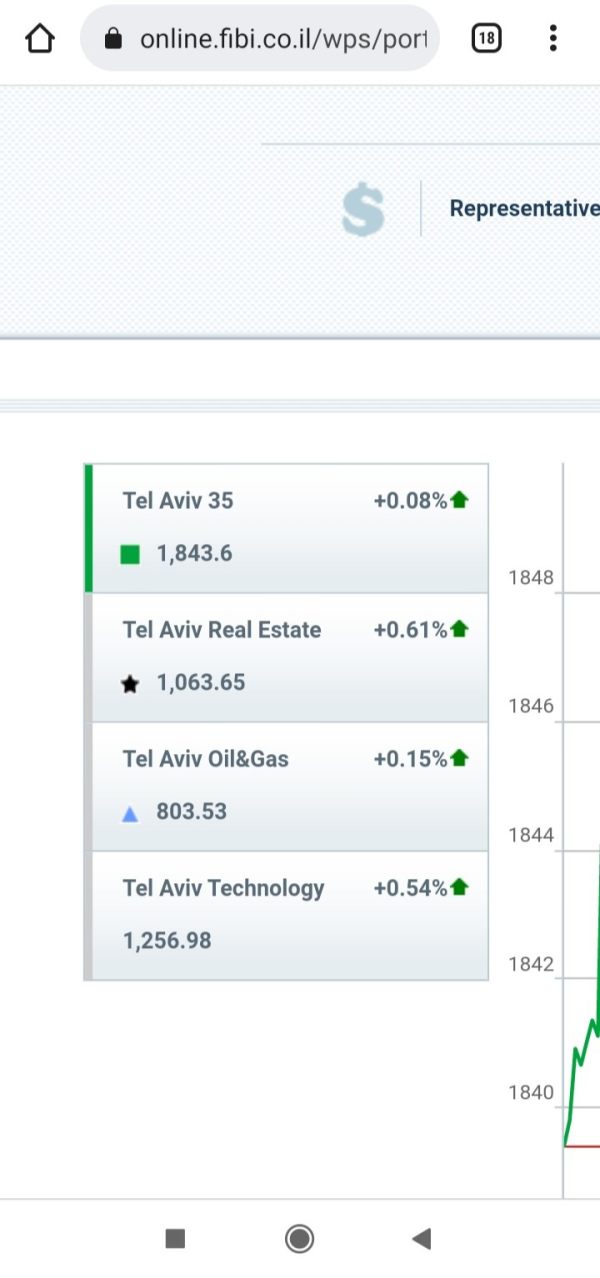

FIBI represents a new generation of financial services providers. The company integrates artificial intelligence with traditional investment services. FIBI has positioned itself as a technology-forward broker, developing sophisticated AI tools specifically designed to assist modern investors in making smarter financial decisions. The company's approach emphasizes the integration of localized market analytics, particularly focusing on GCC markets. This demonstrates their commitment to regional expertise and specialized market knowledge.

The broker's business model centers around providing comprehensive financial services enhanced by AI capabilities. Their AI Investment Assistant represents a significant technological advancement in the retail trading space. The assistant offers automated support and intelligent insights to help investors navigate complex market conditions. This technological focus suggests FIBI is targeting sophisticated investors who appreciate data-driven approaches to trading and investment decisions.

Based on available information, FIBI operates as a comprehensive financial services provider offering various investment products and services. The company appears to maintain a strong emphasis on educational resources and investor empowerment, particularly through their AI-enhanced tools and localized market analysis capabilities. Their focus on GCC markets indicates specialized regional expertise that could benefit investors interested in these specific markets.

Regulatory Status: Specific regulatory information was not detailed in available materials. Users must verify this directly with the broker.

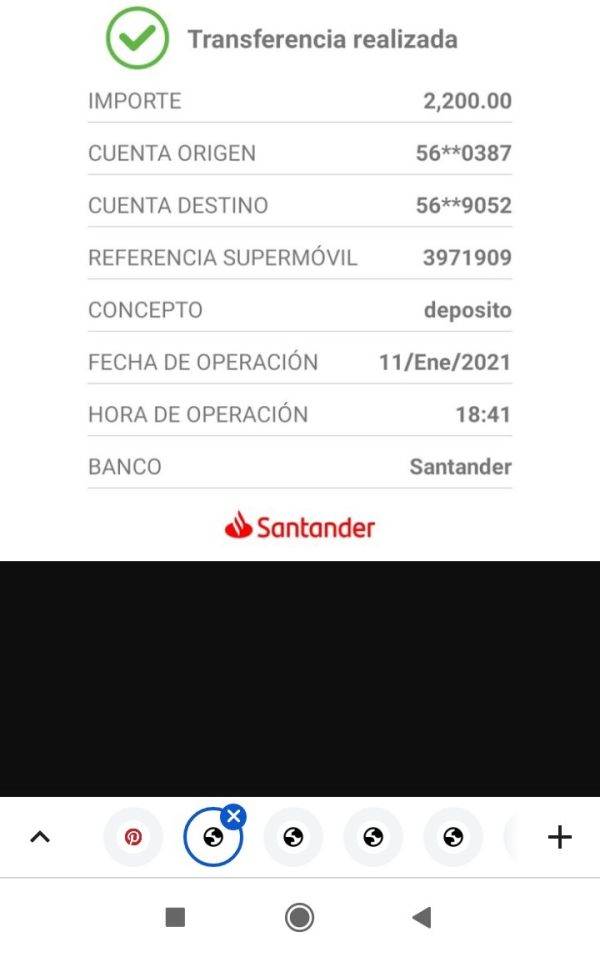

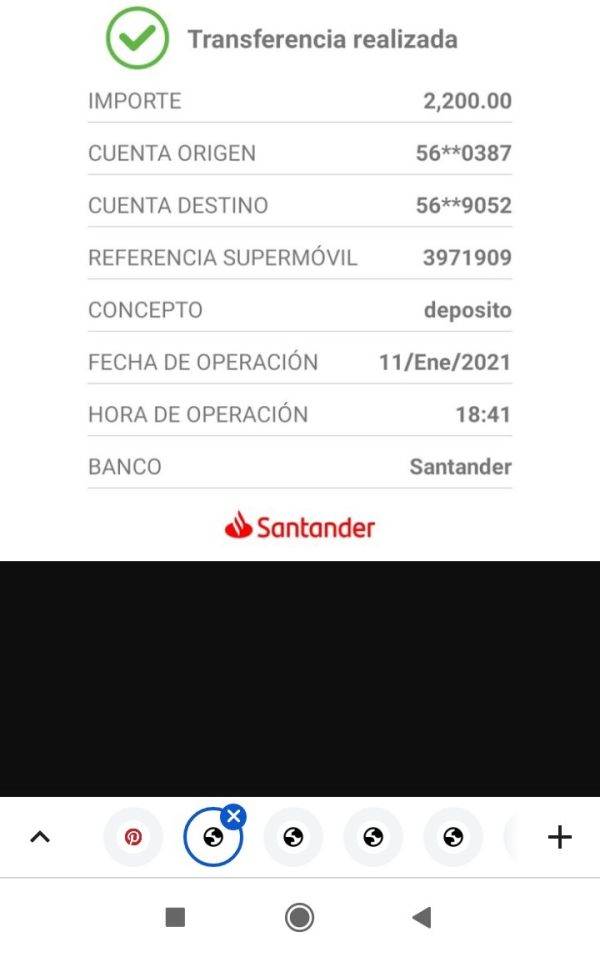

Deposit and Withdrawal Methods: Detailed information about payment methods and processing times was not specified in accessible sources.

Minimum Deposit Requirements: Specific minimum deposit amounts were not disclosed in the reviewed materials.

Bonuses and Promotions: Information regarding promotional offers or bonus structures was not available in the examined sources.

Tradeable Assets: While specific asset classes were not detailed, the broker's focus on comprehensive financial services suggests availability of various investment instruments. These likely include traditional and modern financial products.

Cost Structure: Detailed pricing information, including spreads, commissions, and fees, was not specified in available materials. Users would need to inquire directly with the broker.

Leverage Ratios: Specific leverage offerings were not mentioned in the accessible information.

Platform Options: The primary focus appears to be on their proprietary AI-enhanced platform. Specific technical details about additional platform options were not provided.

Geographic Restrictions: While there's clear focus on GCC markets, specific geographic limitations were not detailed in available materials.

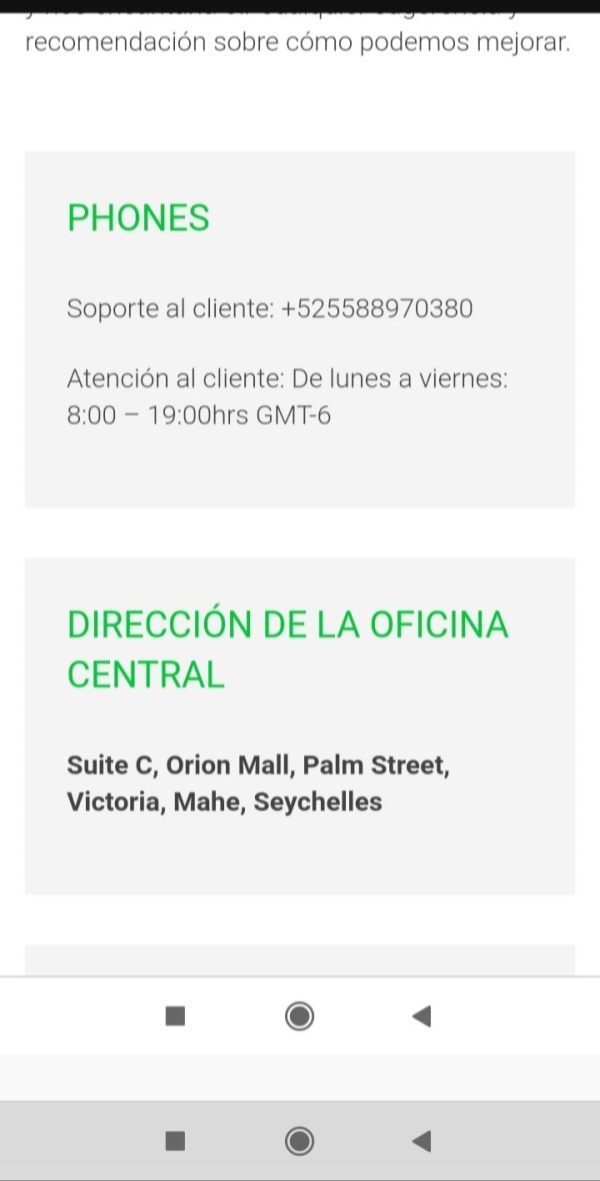

Customer Support Languages: Specific language support information was not provided in the reviewed sources.

This fibi review highlights the need for potential users to contact the broker directly for comprehensive details about trading conditions and specific service parameters.

Detailed Rating Analysis

Account Conditions Analysis

FIBI's account structure details remain limited in publicly available information. This impacts the ability to fully assess their account offerings. The broker appears to focus more on their technological capabilities and AI integration rather than promoting traditional account tier structures that many brokers emphasize. This approach suggests they may offer a more streamlined account experience. Specific details about minimum deposits, account types, and special features require direct inquiry.

The lack of detailed account information in marketing materials could indicate either a simplified account structure or a consultative approach. Account conditions may be tailored to individual client needs. For professional investors and those interested in AI-enhanced trading tools, this approach might be appealing as it suggests personalized service rather than rigid account categories.

However, the absence of transparent account condition information in this fibi review represents a significant limitation for potential users. Many prefer to compare specific terms before engaging with a broker. Prospective clients would need to contact FIBI directly to understand their account offerings, minimum requirements, and any special account features that might be available.

FIBI excels in the tools and resources category. The company's success stems primarily from their innovative AI Investment Assistant, which represents a significant technological advancement in retail trading services. The AI assistant is specifically designed for modern investors and appears to offer sophisticated analytical capabilities that can help users make more informed investment decisions. This technological focus demonstrates FIBI's commitment to providing cutting-edge tools that differentiate them from traditional brokers.

The company's emphasis on "Empowering GCC Investors with Smarter Decisions" through integrated, localized analytics suggests they provide specialized research and market analysis tools. These tools are tailored to regional markets. This localized approach to market analysis could be particularly valuable for investors interested in GCC markets, offering insights that might not be available through more generalized global platforms.

FIBI's development process for AI in finance indicates substantial investment in technological infrastructure and research. This commitment to AI development suggests ongoing improvements and updates to their analytical tools. These improvements could provide long-term value for users who appreciate evolving technological capabilities in their trading environment.

Customer Service and Support Analysis

Customer service information for FIBI remains limited in publicly available sources. User testimonials such as "Love it" suggest positive experiences with the broker's support and overall service quality. The positive user feedback indicates that existing clients are satisfied with their interactions. Specific details about support channels, response times, and service availability are not detailed in accessible materials.

The broker's focus on AI integration and modern technology suggests they may employ advanced customer service tools. These could include automated support systems or AI-enhanced customer service capabilities. However, without specific information about support channels such as live chat, phone support, email response times, or support hours, it's difficult to comprehensively assess their customer service capabilities.

For a technology-focused broker like FIBI, customer support quality becomes particularly important. Users may require assistance with advanced features and AI tools. The limited availability of detailed customer service information represents an area where potential users would need to conduct direct inquiries to understand the level and quality of support they can expect.

Trading Experience Analysis

FIBI's trading experience appears to be enhanced by their AI Investment Assistant and focus on modern technological solutions. This suggests a potentially superior trading environment for users who value technological innovation. The integration of AI tools into the trading experience could provide users with enhanced decision-making support, automated analysis, and intelligent market insights that traditional platforms might not offer.

The company's emphasis on "training AI for finance" and their development process indicates significant investment in creating a sophisticated trading environment. This technological foundation suggests that users might experience more advanced analytical capabilities. These could include predictive analytics, automated market scanning, and intelligent trade suggestions based on AI analysis.

However, specific details about platform stability, execution speeds, order types, and mobile trading capabilities were not detailed in available materials. For this fibi review, the assessment of trading experience relies primarily on the technological capabilities they emphasize. This differs from concrete performance metrics or user experience details that would typically inform such evaluations.

Trust and Reliability Analysis

FIBI's trust and reliability assessment is challenging due to limited publicly available information. Details about regulatory status, company history, and specific compliance measures are not readily available. While the company appears to maintain a professional presence and focuses on sophisticated AI technology development, the lack of detailed regulatory information in accessible materials raises questions about transparency in this critical area.

The positive user feedback, including testimonials expressing satisfaction with the service, provides some indication of user trust and positive experiences. However, without specific information about regulatory licenses, segregation of client funds, investor protection measures, or company financial stability, it's difficult to provide a comprehensive trust assessment.

For potential users conducting due diligence, the limited availability of regulatory and compliance information represents a significant consideration. Professional investors typically require detailed information about broker licensing, regulatory oversight, and fund protection measures before committing to a trading relationship. This makes transparency an area where FIBI would need to provide more information.

User Experience Analysis

User experience appears to be a strong focus for FIBI. Available testimonials indicate high satisfaction levels among existing users. The "Love it" feedback suggests that users appreciate the overall experience provided by the platform. Specific details about interface design, ease of use, and platform navigation were not detailed in available materials.

FIBI's emphasis on AI integration and modern investor tools suggests they prioritize user experience through technological innovation rather than traditional platform features. This approach likely appeals to tech-savvy investors who appreciate intelligent automation and advanced analytical capabilities integrated into their trading experience. It may be less suitable for users who prefer simpler, more traditional platform designs.

The broker's focus on empowering investors with "smarter decisions" through integrated analytics suggests a user experience designed around providing actionable insights. The platform supports informed decision-making. This educational and analytical approach to user experience could be particularly appealing to professional investors and those seeking to improve their investment knowledge and capabilities through advanced tools and resources.

Conclusion

FIBI emerges as a technology-forward broker that prioritizes AI integration and modern investment tools over traditional broker marketing approaches. While user satisfaction appears high based on available testimonials, the limited transparency regarding regulatory status, account conditions, and specific trading terms represents a significant consideration for potential users.

The broker appears most suitable for professional investors and technology-oriented traders who value AI-enhanced tools. These users must be comfortable with a consultative approach to account setup and service delivery. FIBI's focus on GCC markets and localized analytics makes it particularly relevant for investors interested in these regional markets.

The main advantages include innovative AI technology and positive user feedback. The primary limitations center around limited publicly available information about regulatory compliance and specific trading conditions. Prospective users should conduct thorough due diligence and direct consultation with FIBI before making any commitment.