GPM Broker 2025 Review: Everything You Need to Know

Executive Summary

This gpm broker review looks at a Spanish financial services company that started in 2019. GPM Broker works mainly as an asset management company, offering model investment portfolios and investment funds to clients who want professional portfolio management services. Based on available information and user feedback analysis, GPM Broker receives a neutral overall assessment, with mixed user experiences ranging from positive testimonials to concerning exposure reports.

The broker operates under Spanish law. It claims regulatory oversight from CNMV, though specific licensing details remain unclear. GPM Broker's service offering includes CFDs, stocks, bonds, and derivatives trading, primarily targeting Spanish-speaking investors interested in managed investment solutions. However, significant concerns exist regarding regulatory transparency and fund safety, which potential clients should carefully consider before engaging with this provider.

User feedback shows a split experience base. Some clients report good service while others have raised red flags about the company's operations. The platform's limited language support and slow website performance further restrict its appeal to international markets.

Important Disclaimers

Regional Entity Differences: GPM Broker operates mainly from Spain under local regulatory framework. Services, terms, and regulatory protections may differ significantly from brokers operating in other jurisdictions such as the UK, Cyprus, or Australia. Potential clients should verify the specific regulatory status applicable to their region before proceeding.

Review Methodology: This evaluation is based on publicly available information, user feedback from various review platforms, and company disclosures. The assessment does not include direct trading experience or real-money testing of the platform's services.

Overall Rating Framework

Broker Overview

GPM Broker started its operations in 2019. The company focuses mainly on providing structured investment solutions through model portfolios and managed funds, differentiating itself from traditional retail forex brokers by emphasizing professional asset management services. According to available information, GPM Broker targets investors seeking hands-off investment approaches with professional portfolio construction and ongoing management.

The broker's business model centers around offering pre-built investment portfolios and fund management services. This approach appeals to investors who prefer professional management over self-directed trading activities. However, the company's operational transparency remains limited, with minimal public disclosure about its internal processes, fund management strategies, or detailed service offerings.

GPM Broker operates under Spanish regulatory framework. The company offers access to various financial instruments including CFDs, stocks, bonds, and derivatives, though specific details about trading conditions, spreads, and execution quality remain undisclosed in available materials. This gpm broker review notes that the firm's limited transparency poses challenges for comprehensive evaluation.

Regulatory Status: GPM Broker claims regulation under CNMV. Specific license numbers and regulatory details are not clearly disclosed in available public information. This lack of transparency raises questions about the depth of regulatory oversight.

Deposit and Withdrawal Methods: Specific information about funding methods, processing times, and fees is not detailed in available sources. This limits clients' ability to assess the convenience and cost-effectiveness of money management procedures.

Minimum Deposit Requirements: Available materials do not specify minimum deposit thresholds for different account types or services. This makes it difficult for potential clients to understand entry requirements.

Promotional Offers: No specific information about bonuses, promotional campaigns, or new client incentives is mentioned in available sources. This suggests either absence of such programs or limited marketing disclosure.

Tradeable Assets: The broker provides access to CFDs, stocks, bonds, and derivatives across various markets. However, specific details about available instruments, market coverage, and asset universe remain undisclosed in public materials.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is not available in reviewed sources. This significantly hampers cost comparison with alternative providers. This lack of fee transparency represents a major concern for potential clients.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available information. This limits understanding of risk parameters and capital efficiency options.

Platform Technology: Detailed information about trading platforms, software capabilities, and technological infrastructure is not provided in available sources.

Geographic Restrictions: Specific information about service availability across different countries and jurisdictions is not clearly outlined in reviewed materials.

Customer Service Languages: According to available information, GPM Broker provides support mainly in Spanish. The website is available only in Spanish language, limiting accessibility for international clients.

This gpm broker review emphasizes that the significant information gaps represent a substantial concern for transparency and client decision-making processes.

Account Conditions Analysis

GPM Broker's account structure and conditions remain largely unclear based on available information sources. The lack of detailed disclosure about account types, minimum funding requirements, and specific terms represents a significant transparency deficit that potential clients should carefully consider. Without clear information about entry requirements, fee structures, or account benefits, investors cannot make informed comparisons with alternative providers.

User feedback suggests that account opening processes exist. This is evidenced by both positive and neutral reviews from actual clients. However, the absence of detailed publicly available information about account tiers, special features, or differentiated service levels raises questions about the broker's commitment to transparency. Professional asset management services typically require substantial minimum investments, but GPM Broker has not disclosed these thresholds publicly.

The company's focus on asset management rather than active trading suggests that account structures may differ from traditional forex brokers. This potentially involves managed account arrangements or investment fund subscriptions. However, without specific documentation, potential clients cannot assess whether these arrangements align with their investment objectives and risk tolerance levels.

Account funding and withdrawal procedures remain undocumented in available sources. This creates uncertainty about liquidity access and operational convenience. The absence of information about account protection measures, segregation policies, or insurance coverage further compounds transparency concerns. This gpm broker review notes that such information gaps are unusual for legitimate financial service providers and warrant careful consideration by potential clients.

Available information provides minimal insight into GPM Broker's trading tools, analytical resources, or educational offerings. The absence of detailed platform specifications, research capabilities, or client support tools represents a significant information gap that limits comprehensive evaluation of the broker's technological capabilities and client service infrastructure.

Traditional asset management firms typically provide clients with portfolio analysis tools, performance reporting systems, and market research resources. However, GPM Broker has not publicly disclosed the availability or quality of such resources, making it difficult for potential clients to assess the value proposition beyond basic investment management services.

Educational resources, market analysis, and investment research are crucial components of professional asset management services. The lack of information about these offerings suggests either limited resource availability or poor communication of existing capabilities. Professional investors typically expect access to detailed market insights, portfolio analytics, and ongoing educational support.

Automated trading support, algorithmic solutions, and advanced order management systems are increasingly important in modern investment management. Available sources do not indicate whether GPM Broker provides such technological capabilities, potentially limiting its competitiveness in the evolving financial services landscape.

User feedback does not specifically address tool quality or resource availability. This suggests that clients may not have extensive access to sophisticated analytical capabilities or that such features are not prominently featured in the service offering.

Customer Service and Support Analysis

Customer service quality at GPM Broker presents a mixed picture based on available user feedback and operational information. User reviews indicate varied experiences with support quality, ranging from satisfactory interactions to concerns about responsiveness and problem resolution effectiveness. The diversity in client feedback suggests inconsistent service delivery or varying client expectations and needs.

Language support limitations represent a significant constraint for international clients. GPM Broker appears to operate mainly in Spanish. This linguistic limitation restricts the broker's ability to serve diverse international markets effectively and may contribute to communication challenges for non-Spanish speaking clients seeking support services.

Response times and service availability hours are not clearly specified in available information. This makes it difficult for potential clients to assess whether support infrastructure meets their operational requirements. Professional asset management clients typically expect prompt responses to inquiries and reliable access to account information and support services.

The quality of technical support, account management assistance, and problem resolution processes cannot be comprehensively evaluated based on available information. User feedback suggests that some clients have received adequate support, while others may have encountered difficulties, indicating potential inconsistencies in service delivery standards.

Communication channels, escalation procedures, and specialized support for different client segments are not clearly documented in available sources. This lack of detailed service information makes it challenging for potential clients to understand what level of support they can expect and how complex issues would be addressed.

Trading Experience Analysis

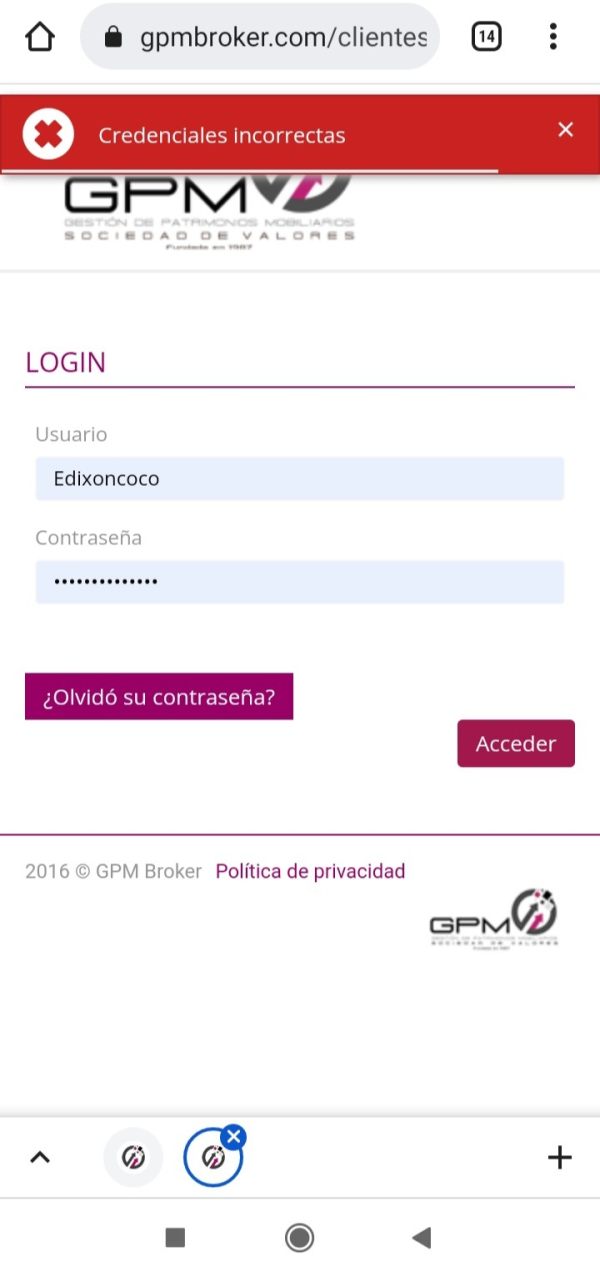

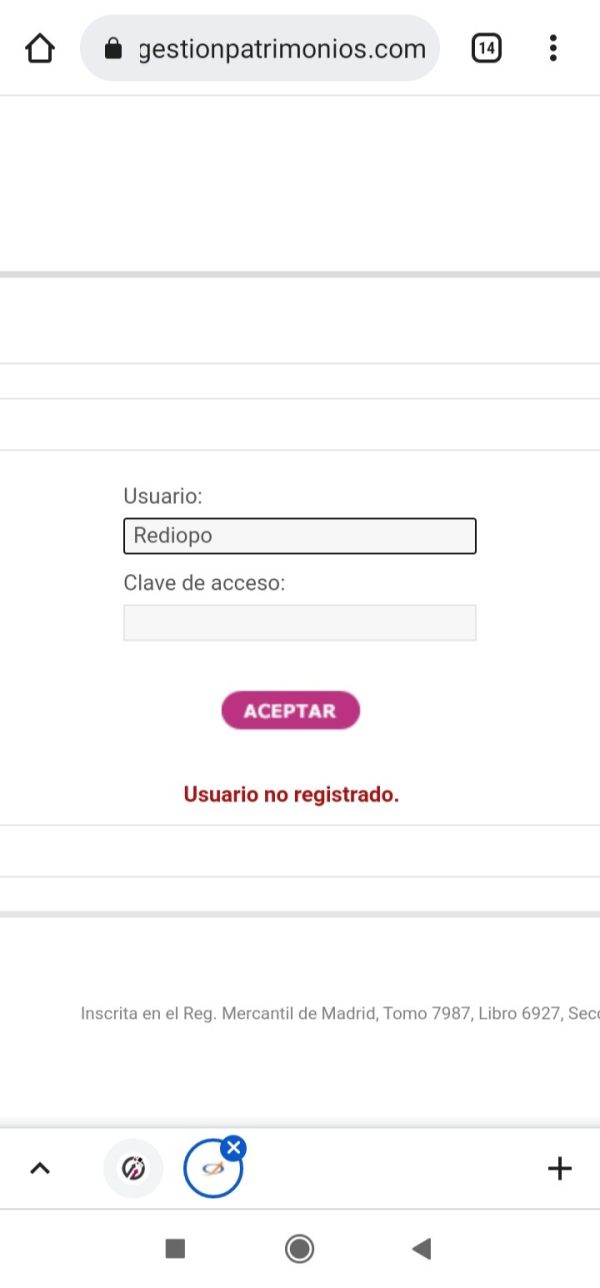

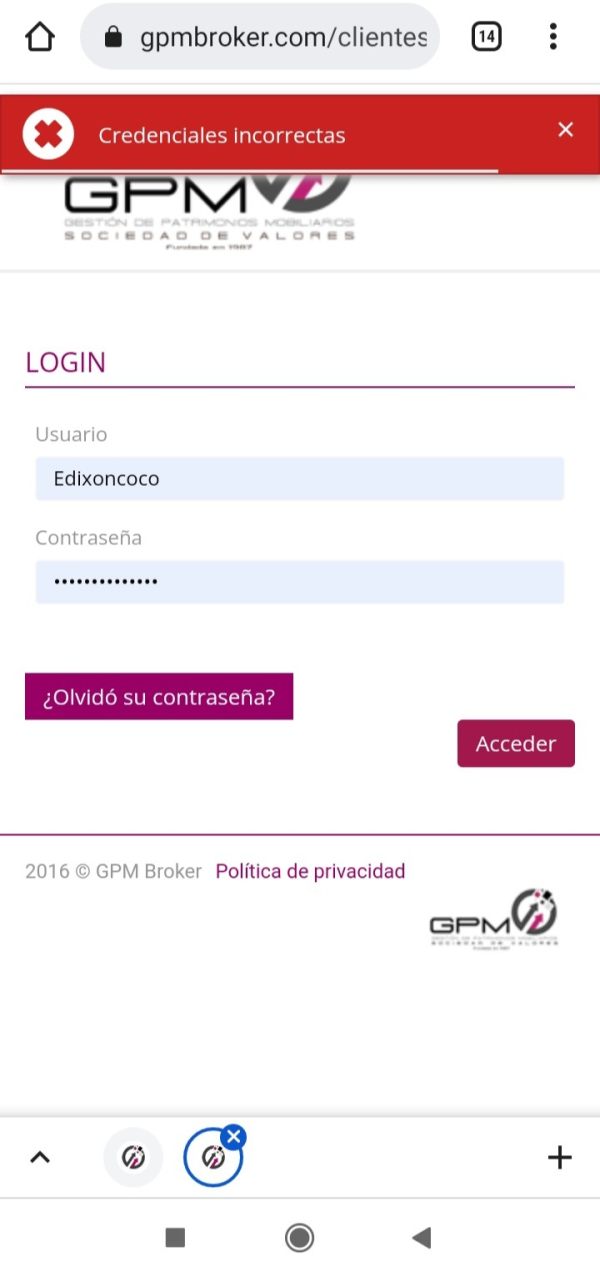

Trading experience evaluation for GPM Broker is significantly hampered by limited technical information and mixed user feedback regarding platform performance and operational efficiency. Available sources indicate that the company's website experiences slow loading times, which may reflect broader technical infrastructure challenges that could impact client experience and service reliability.

Platform stability and execution quality are critical factors for any financial services provider. Yet specific performance metrics, uptime statistics, and execution speed data are not available in reviewed sources. The reported website performance issues raise concerns about the overall technological infrastructure supporting client services and investment management operations.

Order execution quality, slippage rates, and fill accuracy are essential considerations for investment services. But detailed information about these operational aspects is not disclosed in available materials. Professional asset management services require reliable execution capabilities to implement investment strategies effectively and protect client interests.

Mobile platform availability and functionality are increasingly important for modern investment management. They allow clients to monitor portfolios and communicate with managers efficiently. However, specific information about mobile access capabilities and app functionality is not provided in available sources.

The user experience appears split based on available feedback. Some clients report satisfactory experiences while others have raised concerns through exposure reports. This difference in client experiences suggests potential inconsistencies in service delivery or varying client expectations and requirements. This gpm broker review emphasizes the importance of understanding these experience variations before committing to services.

Trust and Safety Analysis

Trust and safety considerations represent perhaps the most critical concerns regarding GPM Broker based on available information and user feedback. The broker's regulatory status under CNMV appears uncertain, with specific license numbers and detailed regulatory compliance information not clearly disclosed in public materials. This regulatory ambiguity creates significant concerns about client protection and operational oversight.

Fund safety measures, client money segregation policies, and insurance coverage details are not adequately documented in available sources. Professional asset management requires robust client protection mechanisms, including segregated accounts, insurance coverage, and clear redemption procedures. The absence of detailed information about these protective measures raises substantial concerns about client fund security.

Company transparency regarding financial health, operational procedures, and management structure is limited based on available information. Legitimate financial service providers typically maintain high disclosure standards, including regular financial reporting, management team information, and clear operational procedures. GPM Broker's limited transparency in these areas represents a significant red flag for potential clients.

Industry reputation and third-party validation are crucial indicators of trustworthiness in financial services. Available sources do not indicate significant industry recognition, awards, or positive third-party assessments that would support confidence in the broker's operations and reliability.

The existence of exposure reports alongside positive reviews creates a concerning pattern that suggests potential operational issues or client disputes. The presence of such mixed feedback, particularly exposure reports, indicates that some clients have experienced significant problems that warrant careful consideration by potential investors.

Regulatory gray-area operations, as suggested by available information, pose substantial risks to investor fund safety and legal protection. Clients considering GPM Broker's services should thoroughly investigate regulatory status and protection mechanisms before committing funds to any investment programs or managed accounts.

User Experience Analysis

User experience with GPM Broker presents a complex picture characterized by significantly divided feedback and varying levels of client satisfaction. Available user reviews demonstrate a split experience base, with some clients providing positive testimonials while others have submitted exposure reports indicating serious concerns about the broker's operations and service delivery.

The positive user feedback suggests that some clients have found GPM Broker's asset management services satisfactory. This indicates that the company may deliver adequate service for certain client segments or under specific circumstances. These positive experiences provide some evidence that the broker can execute its stated service offerings effectively for at least some portion of its client base.

However, the presence of exposure reports raises serious concerns about operational consistency and client protection. Exposure reports typically indicate significant problems with fund safety, withdrawal processing, or service delivery that have prompted clients to seek external assistance or warn other potential investors. The existence of such reports alongside positive reviews suggests either inconsistent service quality or potential issues with specific service aspects.

Website performance issues, including slow loading times and Spanish-only language support, limit accessibility and user convenience for international clients. These technical and linguistic barriers may contribute to user frustration and limit the broker's ability to serve diverse client needs effectively.

The target user profile appears to focus on Spanish-speaking investors seeking asset management services rather than active traders requiring sophisticated platforms and tools. However, the mixed feedback suggests that even within this target demographic, client satisfaction varies significantly, indicating potential service delivery inconsistencies or mismatched client expectations.

Registration and verification processes, account management procedures, and ongoing client communication quality are not well-documented in available sources. This makes it difficult to assess the complete user journey and identify specific areas of strength or weakness in the client experience.

Conclusion

This comprehensive gpm broker review reveals a financial services provider operating in a challenging transparency environment with significant information gaps and mixed client feedback. While GPM Broker offers asset management services and has generated some positive client testimonials, substantial concerns exist regarding regulatory clarity, operational transparency, and consistent service delivery.

GPM Broker may be suitable for Spanish-speaking investors specifically seeking asset management services and comfortable with limited transparency and regulatory uncertainty. However, the significant information gaps, exposure reports, and regulatory ambiguities make this provider unsuitable for investors prioritizing fund safety, operational transparency, and robust client protection mechanisms.

The primary advantages include specialized asset management focus and some positive client experiences. The significant disadvantages encompass regulatory uncertainty, limited transparency, technical performance issues, and concerning exposure reports. Potential clients should conduct thorough due diligence and consider alternative providers with clearer regulatory status and more comprehensive transparency before committing funds to GPM Broker's services.