Scotia iTRADE Review 2

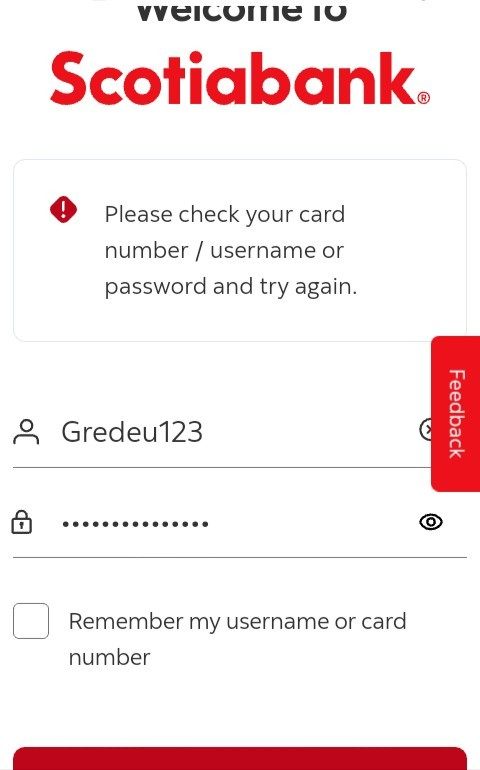

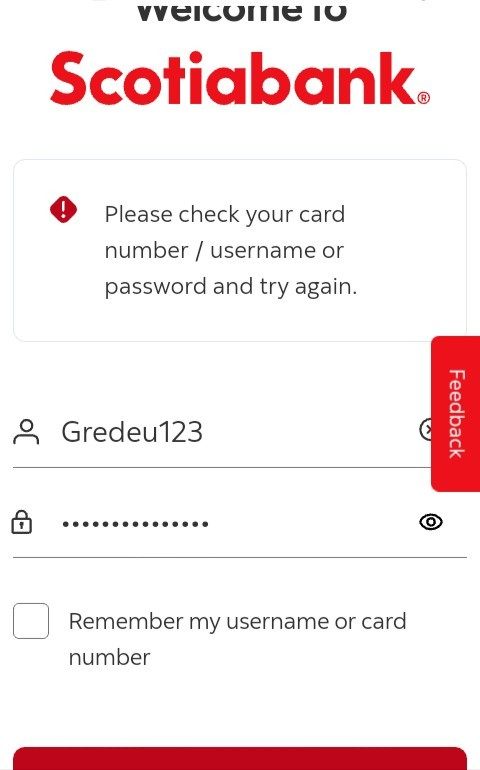

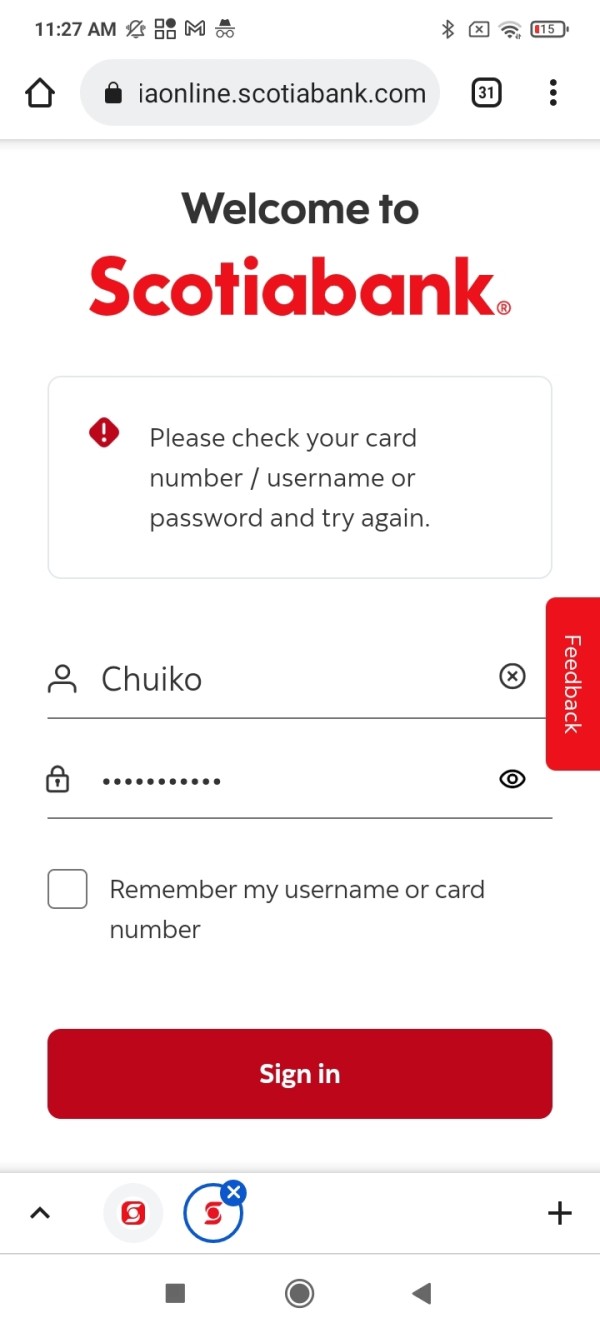

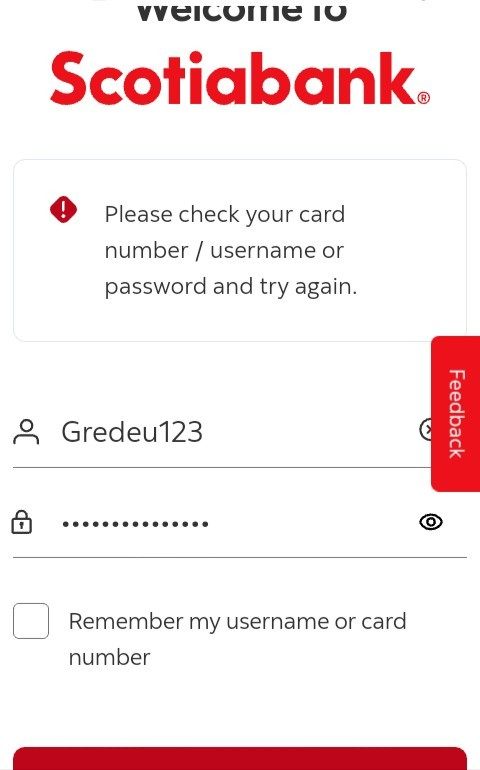

I deposited 80,000 pesos and was blocked by the webpage. They said my account information was wrong. What can I do?

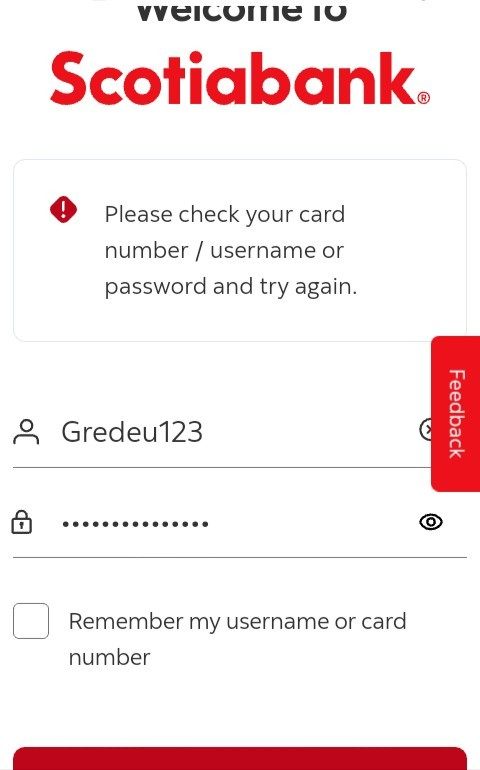

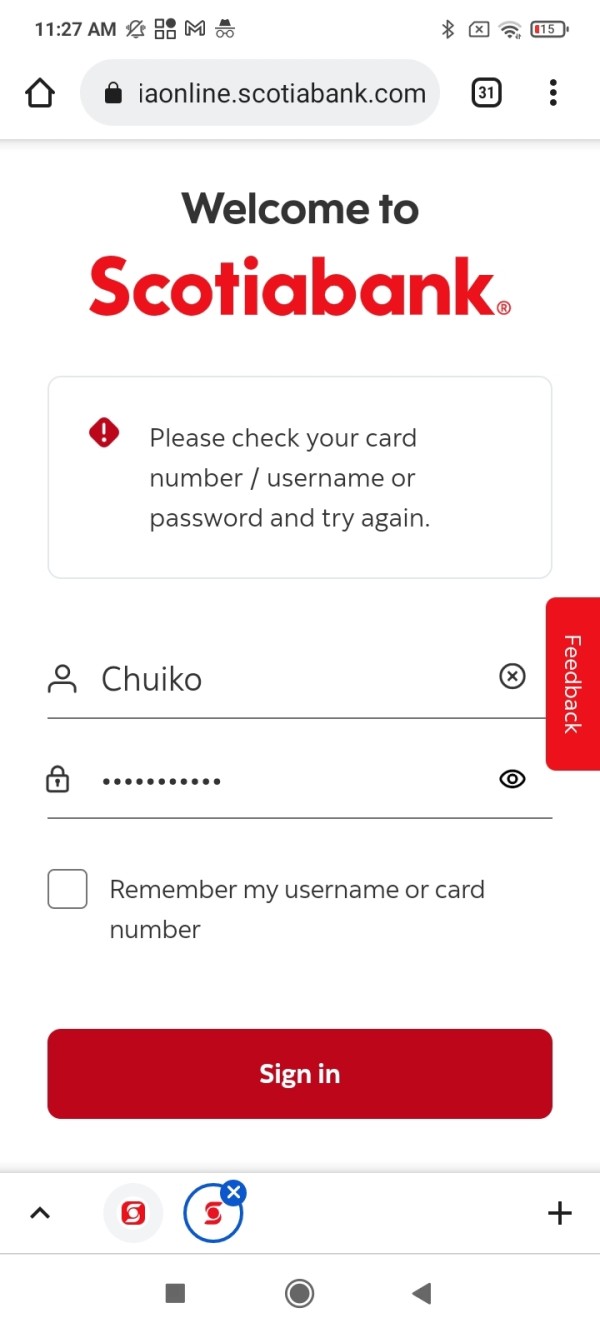

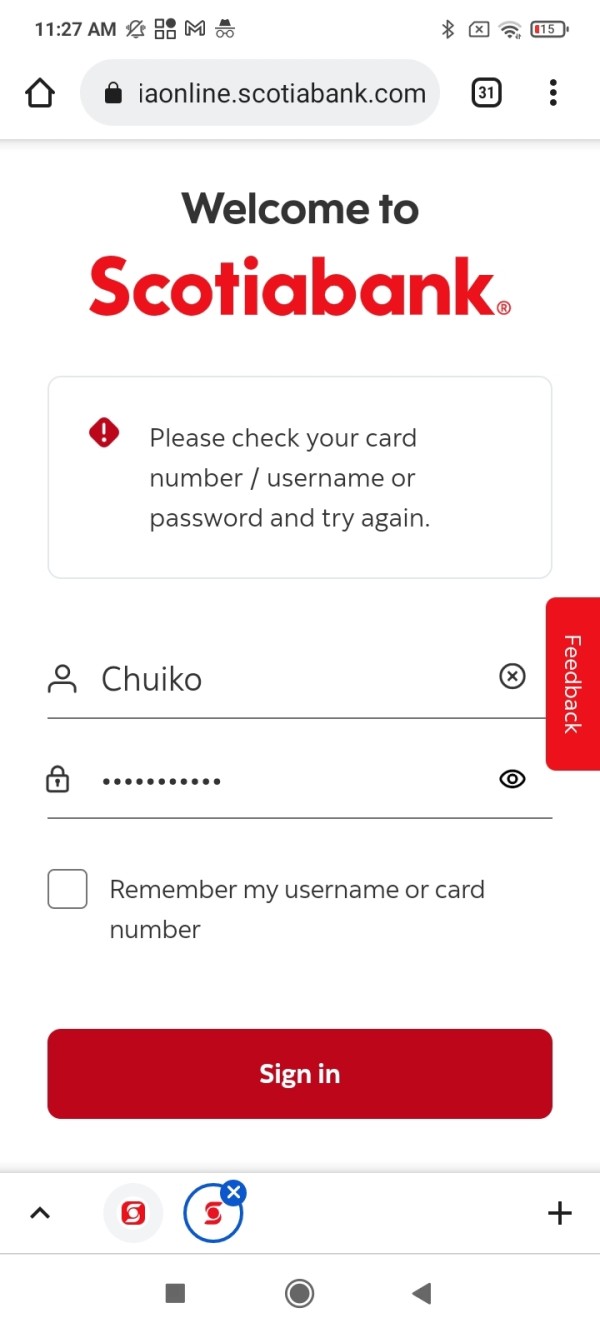

I deposited 180,000 pesos but they blocked me. Please help.

Scotia iTRADE Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

I deposited 80,000 pesos and was blocked by the webpage. They said my account information was wrong. What can I do?

I deposited 180,000 pesos but they blocked me. Please help.

Scotia iTRADE is a top-rated online discount brokerage that offers low-cost commissions for direct investing and online trading. This Scotia Itrade review shows a mixed picture of how the platform performed in 2025, though the results vary significantly across different user experiences. The broker provides innovative technologies that work well for various investor levels. User feedback shows major concerns about fees, platform availability, and customer service quality, creating challenges for many traders.

The platform attracts users with promotional offers of up to $5,000 cash and 500 free trades for new account funding from other institutions. It also features a user-friendly mobile application that simplifies trading tasks. Scotia iTRADE targets individual investors who want direct investment opportunities and online trading capabilities through their comprehensive digital platform, serving a broad range of financial goals.

The service markets itself as a discount brokerage, but user experiences tell a different story. Complaints about high fees and platform reliability issues affect the overall trading experience significantly. The service works best for investors who value banking convenience and can handle potential customer service challenges without major frustration.

This review comes from comprehensive analysis of user feedback, platform features, and publicly available information about Scotia iTRADE's services. Our evaluation method uses multiple data sources including user reviews, fee schedules, and platform functionality assessments to provide an objective analysis of what the brokerage offers to its clients.

Information presented reflects the current state of Scotia iTRADE's services as of 2025. Specific regulatory details and certain operational aspects may vary over time. Readers should verify current terms and conditions directly with Scotia iTRADE before making investment decisions, as policies and features can change without notice.

| Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 4/10 | Below Average |

| Tools and Resources | 6/10 | Average |

| Customer Service | 3/10 | Poor |

| Trading Experience | 5/10 | Average |

| Trust and Security | 4/10 | Below Average |

| User Experience | 4/10 | Below Average |

Scotia iTRADE operates as Scotiabank's online discount brokerage division. The platform provides digital investment services to Canadian investors who want modern trading capabilities. The platform combines traditional banking convenience with modern trading technologies, positioning itself as a comprehensive solution for both novice and experienced investors seeking direct market access through reliable digital channels.

The brokerage centers its business model on offering reduced-commission trading while maintaining integration with Scotiabank's broader financial ecosystem. This approach allows clients to manage investments alongside their banking relationships. The result creates a unified financial management experience that many users find convenient for their daily financial activities.

Scotia iTRADE's platform uses proprietary trading technology designed to serve various investment styles and experience levels. The service includes multiple account types and investment options, though specific asset classes and detailed platform capabilities require further investigation based on individual investor needs and preferences. The broker's integration with Scotiabank's infrastructure provides additional banking conveniences that distinguish it from standalone brokerage services in the competitive Canadian market.

Regulatory Status: Specific regulatory information was not detailed in available materials. As part of Scotiabank, the platform operates under Canadian financial regulations that govern major banking institutions.

Deposit and Withdrawal Methods: Information about specific funding methods was not comprehensively detailed in source materials.

Minimum Deposit Requirements: Exact minimum deposit amounts were not specified in available documentation.

Promotional Offers: Scotia iTRADE provides attractive incentives including up to $5,000 cash and 500 free trades for clients funding new or existing accounts from other financial institutions. These promotions represent significant value for investors transferring substantial assets from competing platforms.

Available Assets: Specific asset classes were not comprehensively listed in available documentation. The platform supports direct investing and online trading across various investment vehicles that meet most investor needs.

Cost Structure: Users report concerns about high fees, though detailed commission schedules indicate competitive pricing for certain transaction types. Extended-hours trading incurs additional ECN fees. Some mutual funds carry quarterly maintenance charges that can add up over time.

Leverage Options: Specific leverage ratios were not detailed in the Scotia Itrade review materials examined.

Platform Options: The primary trading interface is the Scotia iTRADE online platform. It includes mobile applications designed for convenient trading access on smartphones and tablets.

Geographic Restrictions: Service availability appears focused on Canadian markets. Specific international restrictions were not detailed in available materials.

Customer Service Languages: Language support options were not specifically outlined in available materials.

Scotia iTRADE offers multiple account options designed to accommodate different investor profiles and objectives. The account conditions receive a below-average rating due to user concerns about fee structures and limited transparency regarding specific requirements that potential clients need to understand before opening accounts. While the platform markets itself as a discount brokerage, user feedback suggests that actual costs may exceed expectations. This issue particularly affects smaller investors or those with lower trading volumes who expected more competitive pricing.

The account opening process appears straightforward and leverages Scotiabank's existing customer infrastructure for streamlined onboarding. However, detailed information about minimum balance requirements, account maintenance fees, and specific features of different account types remains unclear from available sources, creating confusion for potential users. This lack of transparency impacts the overall assessment of account conditions significantly.

The promotional offers include substantial cash bonuses and free trades that provide significant value for qualifying investors. However, these benefits may not offset ongoing fee concerns for all user types who plan to trade regularly. The Scotia Itrade review indicates that while initial incentives are attractive, long-term cost considerations require careful evaluation by potential clients before making commitments.

Scotia iTRADE provides a moderate selection of trading tools and resources through its online platform and mobile application. The platform receives an average rating in this category due to adequate basic functionality combined with limited advanced features that more sophisticated traders typically expect from modern brokerage platforms. The mobile application earns praise for user-friendliness and provides convenient access to essential trading functions and account management capabilities.

The online trading platform offers standard features expected from modern brokerage services. Specific analytical tools and research capabilities were not comprehensively detailed in available materials, which creates uncertainty about the platform's full capabilities. This limitation affects the platform's appeal to more sophisticated traders who require advanced charting, technical analysis, or comprehensive market research resources for their investment strategies.

Educational resources and research materials appear limited based on available information. This represents a significant gap for investors seeking learning opportunities or in-depth market analysis to improve their trading skills. The platform's focus appears more oriented toward execution rather than education or research support, which may limit its value for developing traders who need guidance.

Customer service represents a significant weakness for Scotia iTRADE and earns a poor rating based on user feedback indicating slow response times and unsatisfactory support quality. Multiple user reports highlight difficulties reaching customer service representatives and inadequate resolution of account-related issues that require professional assistance. The lack of detailed information about customer service channels, availability hours, and support options further compounds these concerns for users who need reliable help.

While the platform presumably offers multiple contact methods through Scotiabank's infrastructure, user experiences suggest that support quality does not meet expectations for a major financial institution's brokerage division. Response time issues appear particularly problematic, with users reporting extended delays in receiving assistance for both technical and account-related inquiries that should be resolved quickly. This poor customer service performance significantly impacts the overall user experience and represents a major deterrent for potential clients who prioritize reliable support access.

The trading experience on Scotia iTRADE receives an average rating that reflects mixed user feedback about platform performance and functionality. While the mobile application earns positive reviews for user-friendliness, broader platform availability issues create concerns about reliability during critical trading periods when users need immediate access. Platform stability appears inconsistent based on user reports, with some experiencing difficulties accessing trading functions when needed most.

These availability issues represent serious concerns for active traders who require reliable platform access. The problems become particularly troublesome during volatile market conditions or time-sensitive trading opportunities when delays can cost money. Order execution quality and specific performance metrics were not comprehensively detailed in available materials, making it difficult to assess the platform's competitive position regarding trade execution speed and pricing accuracy.

The Scotia Itrade review suggests that while basic trading functionality exists, the overall experience may not meet the standards expected from a leading financial institution's brokerage platform. Users expect consistent performance and reliable access from established financial institutions.

Trust and security considerations for Scotia iTRADE receive a below-average rating due to limited transparent information about regulatory oversight and security measures. While the platform operates under Scotiabank's umbrella and provides some institutional credibility, specific regulatory details and security protocols were not comprehensively outlined in available materials for user review. The absence of detailed regulatory information creates uncertainty about investor protection measures and compliance standards that users need to understand.

This lack of transparency affects user confidence, particularly for investors prioritizing regulatory oversight and fund security when selecting brokerage services for their portfolios. User feedback indicates concerns about overall platform reliability and institutional responsiveness, which impacts trust levels among current and potential clients. While Scotiabank's established reputation provides some reassurance, the specific performance issues and customer service problems reported by users create legitimate concerns about the platform's commitment to client satisfaction and service quality.

Overall user experience with Scotia iTRADE receives a below-average rating that stems primarily from concerns about fees, platform reliability, and customer service quality. While individual components like the mobile application receive positive feedback, the cumulative user experience falls short of expectations for a major bank's brokerage platform in today's competitive market. The platform appears most suitable for investors who prioritize banking integration and are willing to accept potential service limitations in exchange for consolidated financial management convenience.

However, users seeking premium brokerage experiences or comprehensive trading resources may find the platform lacking compared to specialized competitors. Common user complaints center on high fees relative to discount brokerage expectations, platform availability issues during important trading periods, and inadequate customer service responsiveness when problems arise. These concerns significantly impact user satisfaction and limit the platform's appeal to demanding traders or investors requiring reliable, comprehensive service for their investment activities.

Scotia iTRADE presents a mixed proposition for Canadian investors in 2025. The platform offers attractive promotional incentives and benefits from Scotiabank's institutional backing, providing some advantages for users who value integrated banking services. However, significant concerns about fees, customer service, and platform reliability limit its overall appeal to serious traders and investors. The service appears most suitable for investors prioritizing banking convenience over premium brokerage features, though potential users should carefully evaluate ongoing costs and service limitations before committing to the platform for their investment needs.

FX Broker Capital Trading Markets Review