EZE Review 1

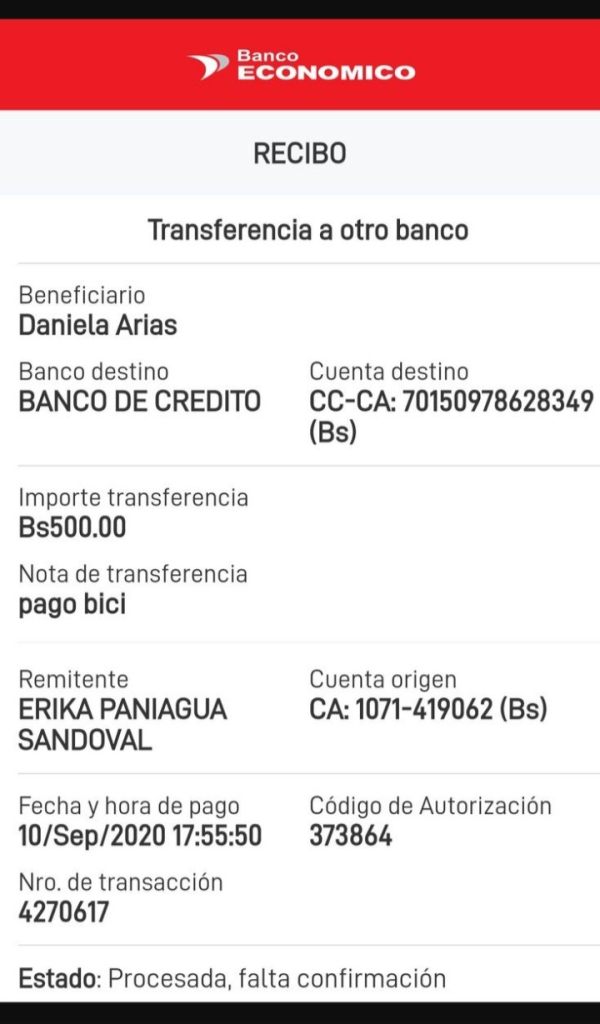

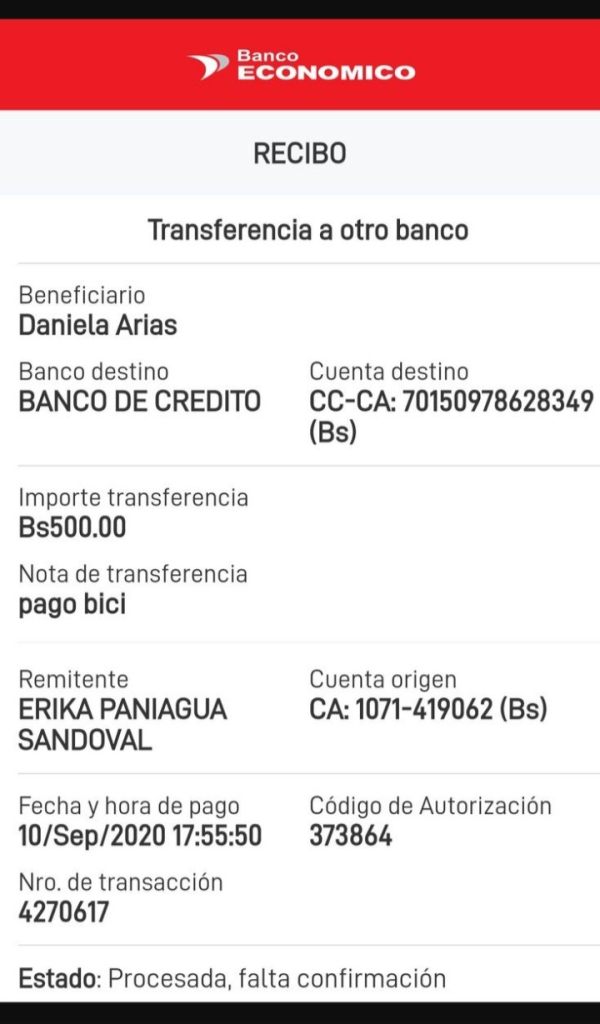

They rejected my withdrawal and lied to me. Help. They called me and asked for more money. I deposited $500. They sent me negative message.

EZE Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

They rejected my withdrawal and lied to me. Help. They called me and asked for more money. I deposited $500. They sent me negative message.

This complete eze review looks at a trading technology company that has gotten attention in the financial services world. Based on worker feedback and platform analysis that we could find, Eze Software keeps an overall rating of 3.7 out of 5, with 76% of workers saying they would recommend the company to others. This good feeling shows that Eze is an important player in the trading technology space.

The company's main product, Eze EMS, is an Execution Management System that stands out as a fast, multi-broker platform. It gives users central access to liquidity across global equity, futures, and options markets. This advanced trading setup makes Eze a solution that works best for professional traders and big investors who need strong execution abilities and wide market access.

The platform focuses on multi-asset trading and fast execution, which suggests that Eze targets smart market users who care most about performance and reliability. However, detailed information about specific trading conditions and rules stays limited in sources that everyone can see.

Readers should know that this eze review uses limited information that everyone can see, and specific rule details were not mentioned in sources we could access. This may mean that trading conditions and rule oversight change across different areas where Eze works.

Our review method includes user feedback analysis, platform function assessment, and industry standard comparisons. However, the lack of complete rule information in source materials suggests that future users should do extra research about licensing and rule compliance in their specific regions before using Eze's services.

| Criterion | Score | Basis |

|---|---|---|

| Account Conditions | N/A | Information not available in source materials |

| Tools and Resources | 8/10 | High-speed EMS platform with comprehensive market access |

| Customer Service | N/A | Specific customer service details not mentioned |

| Trading Experience | N/A | User trading experience data not available |

| Trust and Reliability | N/A | Regulatory information not specified in sources |

| User Experience | 7/10 | Based on 3.7/5 Glassdoor rating from employee feedback |

Eze Software works as a technology provider that specializes in execution management systems for financial markets. While specific founding details were not mentioned in available sources, the company has made itself known as a provider of high-speed, multi-broker execution management solutions. Their main business model centers around giving central liquidity access across global equity, futures, and options markets through their advanced EMS platform.

The company's approach focuses on serving big clients and professional traders who need advanced execution abilities. Their Eze EMS platform represents a complete solution designed to handle complex trading needs across multiple asset classes and markets at the same time.

From a platform view, Eze EMS serves as the company's main offering, working as an Execution Management System that emphasizes speed and multi-market connectivity. The platform supports trading across equities, options, and futures markets, giving users access to diverse asset classes through a single interface. However, specific rule oversight details and licensing information were not detailed in available source materials, which future users should investigate on their own.

Regulatory Jurisdictions: Specific rule information was not mentioned in available source materials, requiring additional investigation for compliance verification.

Deposit and Withdrawal Methods: Payment processing options and procedures were not specified in accessible documentation.

Minimum Deposit Requirements: Entry-level funding requirements were not detailed in available sources.

Bonus and Promotional Offers: No information about promotional incentives was found in source materials.

Tradeable Assets: The platform supports trading across equities, options, and futures markets, providing multi-asset class functionality through the Eze EMS platform.

Cost Structure: Specific information about spreads, commissions, and fee schedules was not available in reviewed sources, requiring direct inquiry with the provider.

Leverage Ratios: Leverage specifications were not mentioned in accessible materials.

Platform Options: Eze EMS serves as the primary trading platform offering.

Geographic Restrictions: Regional availability limitations were not specified in source documentation.

Customer Support Languages: Language support options were not detailed in available materials.

This eze review highlights the need for additional information gathering directly from the provider about specific trading terms and conditions.

The evaluation of Eze's account conditions faces big limitations because there is not enough information that everyone can see. Source materials did not provide details about account type varieties, their distinctive features, or the specific benefits that come with different account levels. This information gap makes it hard to assess how complete and competitive Eze's account offerings are.

Minimum deposit requirements, which typically serve as a key difference among trading platforms, were not specified in available documentation. Similarly, the account opening process, including verification procedures, documentation requirements, and timeline expectations, remains unclear from sources that everyone can access.

Special account features, such as Islamic accounts for Sharia-compliant trading or demo accounts for testing purposes, were not mentioned in the reviewed materials. The absence of this information in our eze review suggests that future clients should directly contact Eze for complete account condition details.

Without specific user feedback about account conditions or comparative analysis with other execution management providers, it becomes difficult to provide a meaningful assessment of how Eze's account structure measures against industry standards. This represents a significant information gap that potential users should address through direct communication with the provider.

Eze shows considerable strength in its tools and resources offering, mainly through the Eze EMS platform. This high-speed, multi-broker execution management system represents an advanced technological solution designed for professional trading environments. The platform's ability to provide central liquidity access across global equity, futures, and options markets indicates a strong infrastructure capable of supporting complex trading strategies.

The execution management system's emphasis on speed suggests that Eze has invested significantly in technological infrastructure to meet the demanding requirements of big traders and professional market participants. The multi-broker connectivity feature allows users to access diverse liquidity sources through a single platform, potentially improving execution quality and reducing operational complexity.

However, specific details about research and analysis resources were not mentioned in available sources. Educational resources, market analysis tools, and fundamental research capabilities remain unclear from information that everyone can access. Additionally, automated trading support, algorithmic trading capabilities, and API access details were not specified in the reviewed materials.

The absence of complete user feedback about tool effectiveness and resource quality in this eze review indicates that while the platform appears technologically advanced, real-world user experience data would provide valuable additional insight into the practical effectiveness of these tools.

Customer service evaluation for Eze faces significant constraints because there is limited information that everyone can see. Source materials did not specify the customer service channels available to users, such as phone support, live chat, email assistance, or help desk ticketing systems. This information gap makes it difficult to assess the accessibility and convenience of support options.

Response time expectations, service level agreements, and support quality metrics were not mentioned in available documentation. The absence of specific user feedback about customer service experiences prevents meaningful analysis of support effectiveness and problem resolution capabilities.

Multilingual support availability, which is particularly important for a platform serving global markets, was not detailed in source materials. Similarly, customer service operating hours, timezone coverage, and emergency support procedures remain unclear from information that everyone can access.

Without documented case studies of problem resolution or user testimonials about support experiences, this eze review cannot provide substantive evaluation of customer service quality. The lack of transparent customer service information suggests that future users should investigate support capabilities directly with the provider before committing to the platform.

Evaluating the trading experience with Eze presents challenges because there is limited user feedback and performance data in available sources. While the Eze EMS platform emphasizes high-speed execution and multi-market connectivity, specific user experiences about platform stability, execution speed, and overall performance were not detailed in accessible materials.

Platform functionality completeness, including order types, risk management tools, and portfolio management capabilities, requires further investigation beyond what is available in current source materials. The multi-asset trading capability across equities, options, and futures suggests complete market access, but user interface design, navigation efficiency, and feature accessibility remain unclear.

Mobile trading experience, which has become increasingly important for modern traders, was not addressed in available documentation. The absence of mobile platform specifications or user feedback about mobile functionality represents a significant information gap in this eze review.

Trading environment factors such as market data quality, charting capabilities, and analytical tools integration were not specified in source materials. Without concrete user testimonials or performance benchmarks, it becomes difficult to assess how the platform performs under various market conditions or during periods of high volatility.

Trust and reliability assessment for Eze encounters substantial limitations because specific regulatory information is absent in available source materials. Regulatory licensing, compliance frameworks, and oversight mechanisms were not detailed in accessible documentation, making it challenging to evaluate the platform's regulatory standing and compliance posture.

Fund safety measures, including segregated account policies, client money protection schemes, and insurance coverage, were not specified in reviewed sources. These elements typically serve as crucial indicators of broker reliability and client fund security, but their absence in available information creates uncertainty about asset protection measures.

Company transparency about ownership structure, financial reporting, and corporate governance practices was not addressed in source materials. Industry reputation indicators, such as awards, recognitions, or third-party certifications, were not mentioned in accessible documentation.

The handling of negative events, customer complaints, or regulatory issues was not documented in available sources. Without specific regulatory verification data, third-party industry assessments, or complete user trust feedback, this eze review cannot provide definitive evaluation of the platform's trustworthiness and reliability standards.

User experience evaluation for Eze draws mainly from employee feedback, with the company maintaining a 3.7 out of 5 rating on Glassdoor based on employee reviews. This rating suggests moderate satisfaction levels among those working within the organization, though it doesn't directly reflect client user experience.

Interface design quality, navigation intuitiveness, and overall platform usability were not specifically addressed in available source materials. The registration and verification process complexity, timeline requirements, and user onboarding experience remain unclear from information that everyone can access.

Fund operation experiences, including deposit processing times, withdrawal procedures, and transaction management, were not detailed in reviewed sources. Common user complaints, frequently encountered issues, or typical support requests were not documented in available materials.

User demographic analysis and trader type suitability assessments were not provided in source documentation. Without complete user feedback compilation or detailed user satisfaction surveys, this eze review cannot offer thorough evaluation of the actual client experience with the platform.

This eze review reveals that Eze operates as a technology-focused execution management provider with apparent strengths in platform speed and multi-market connectivity. The company's 3.7/5 employee rating suggests reasonable organizational satisfaction, though complete client feedback remains limited in sources that everyone can see.

Eze appears most suitable for professional traders and big investors seeking high-speed execution management systems with multi-broker connectivity. The Eze EMS platform's emphasis on central liquidity access across global equity, futures, and options markets positions it as a solution for sophisticated trading operations.

The primary advantages include the high-speed Eze EMS platform and complete market access capabilities. However, significant information gaps exist about regulatory oversight, specific account conditions, customer service quality, and detailed trading terms. Future users should conduct thorough due diligence and direct communication with Eze to obtain complete information before making platform decisions.

FX Broker Capital Trading Markets Review