GF Markets 2025 Review: Everything You Need to Know

Summary

GF Markets is an unregistered forex broker that started in 2019. It mainly operates from Saint Vincent and the Grenadines, though some information points to headquarters in Saint Lucia. This gf markets review shows major trust problems among users about whether the broker is real and properly regulated.

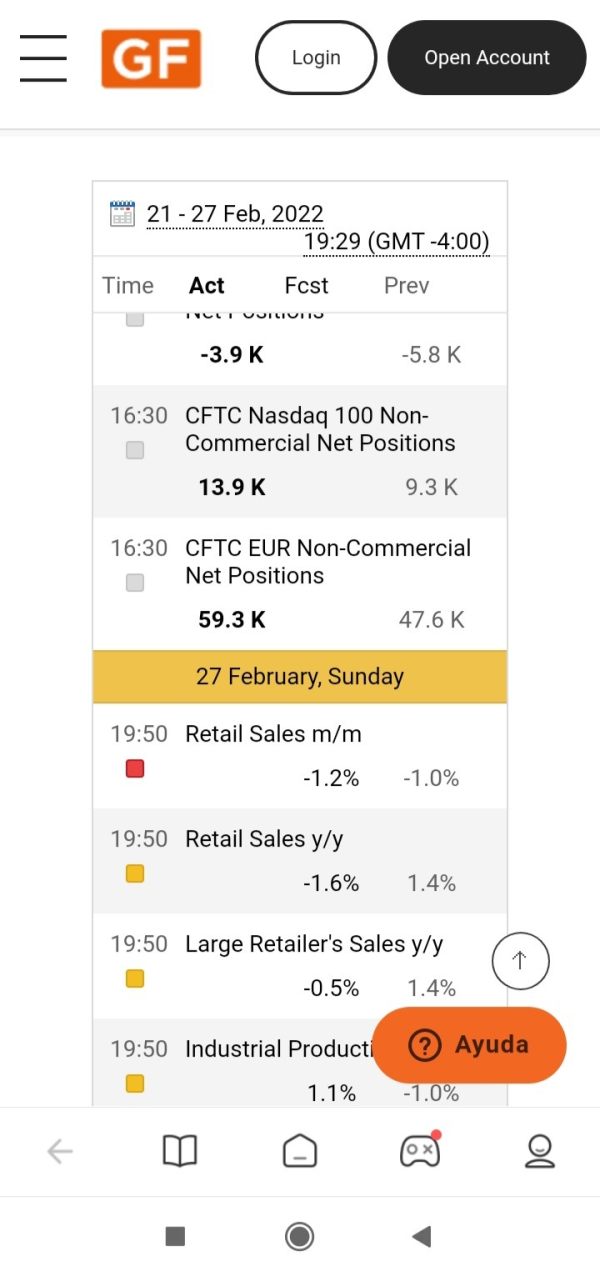

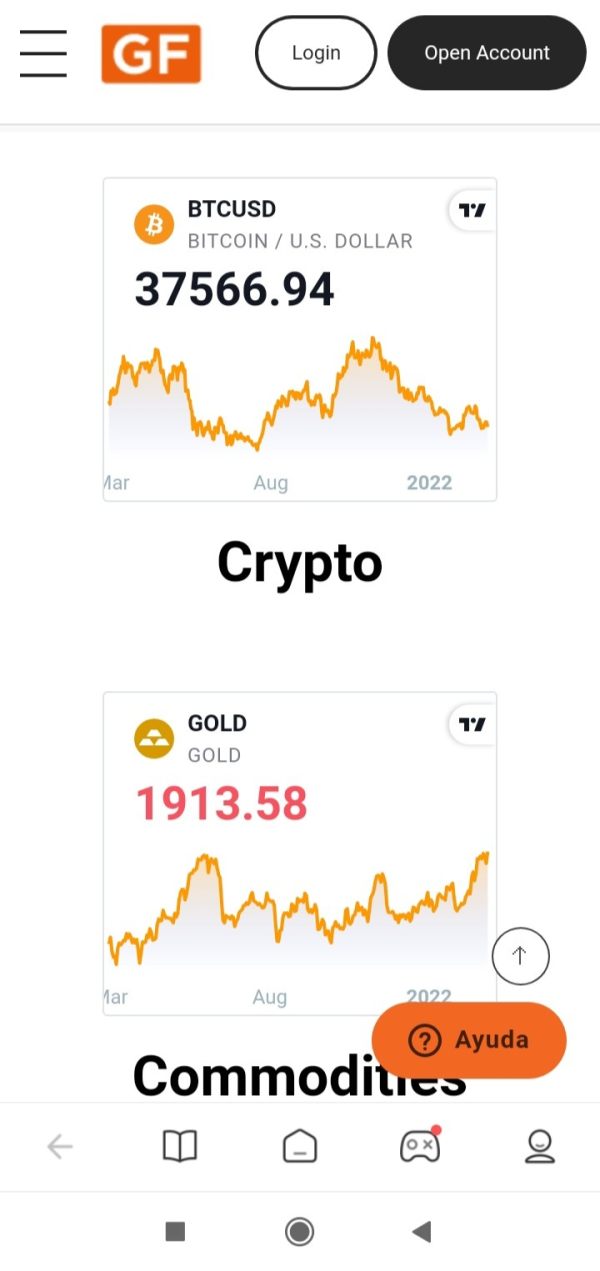

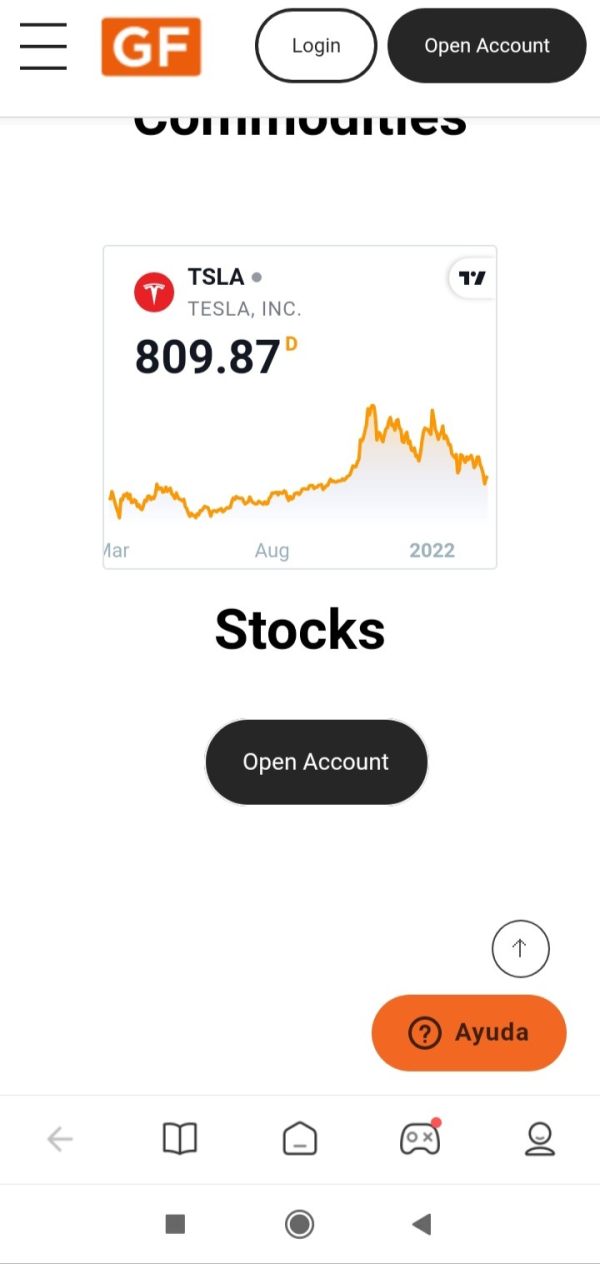

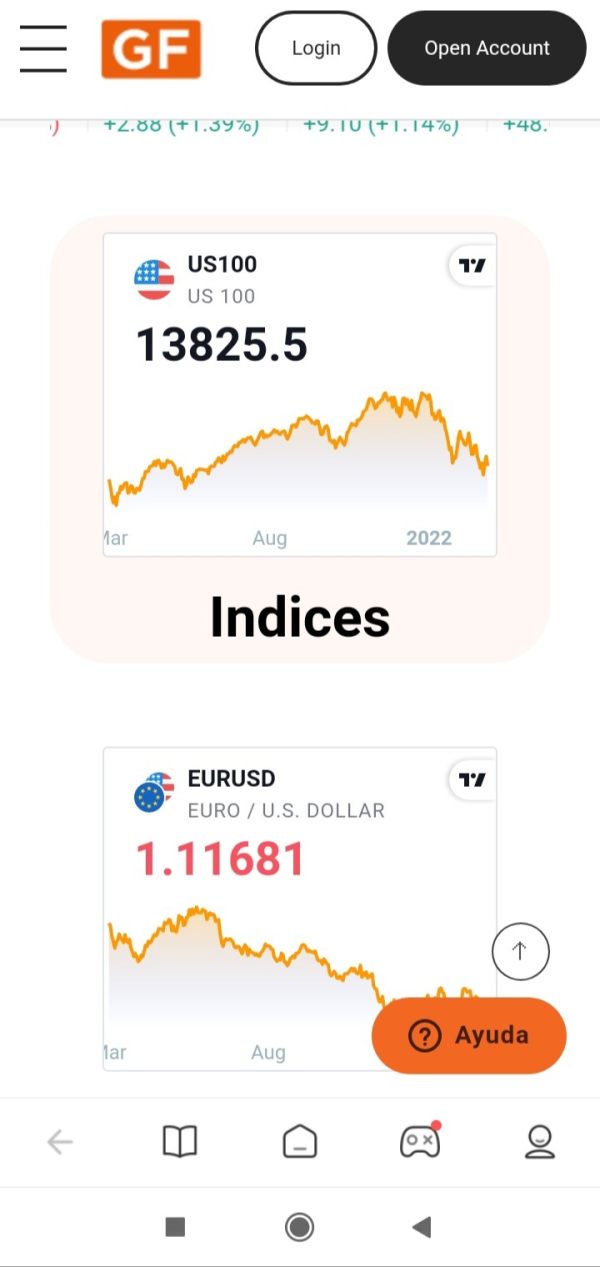

The broker offers many trading tools including forex, stocks, commodities, indices, and cryptocurrencies. You need at least $250 to start trading, and the maximum leverage is 1:200. The platform wants to help retail investors who want to start trading without much money.

But the lack of regulatory oversight creates serious worries about client fund safety and how transparent their operations are. GF Markets gives you access to the MT5 trading platform. They offer different account types like Standard, Gold, Platinum, and VIP accounts for different kinds of traders.

The broker offers many trading tools and educational resources, but its unregistered status hurts its reputation. Negative user feedback about possible fraud makes things worse in the competitive forex market. Traders thinking about this broker should be very careful because of regulatory concerns and trust issues found in online reviews.

Important Notice

GF Markets operates in different areas with different regulatory rules. The broker's unregistered status might put clients at serious legal and financial risk since there's no regulatory protection for client funds or trading disputes.

Traders should know that unregistered brokers work outside the watch of financial authorities. This can put client safety at risk. This review uses publicly available information and user feedback from various sources.

Some information might be incomplete or could change because the broker doesn't share much official information. Potential clients should do careful research before working with any unregistered financial service provider.

Overall Rating Framework

Broker Overview

GF Markets started in the forex market in 2019 as an online trading platform. It's registered in Saint Vincent and the Grenadines, with some sources saying it operates from Saint Lucia. The broker says it provides different financial trading services and gives access to multiple asset types including foreign exchange, stock markets, commodities, and new cryptocurrency markets.

Even though it started recently, the company has tried to get market share by offering good entry-level requirements and complete trading tools. The broker works mainly through the MetaTrader 5 platform. This gives traders access to advanced charting tools, automated trading abilities, and real-time market analysis.

GF Markets' business plan focuses on offering zero-commission trading across different tools, though detailed spread information stays limited in available documents. The platform helps both new and experienced traders through its layered account structure and educational resource offerings. However, this gf markets review must stress the big regulatory concerns around the broker's operations.

The lack of proper licensing from recognized financial authorities raises big questions about client fund security and operational legitimacy. This makes it a high-risk choice for potential traders.

Regulatory Status: GF Markets operates as an unregistered entity from Saint Vincent and the Grenadines. It lacks oversight from any recognized financial regulatory authority, which poses big risks for client fund protection and dispute resolution.

Minimum Deposit Requirements: The broker requires a minimum deposit of $250. This positions itself as accessible to retail traders with limited starting capital, and this relatively low barrier aligns with the broker's target group of new investors.

Available Trading Assets: GF Markets provides access to multiple asset classes. These include major and minor forex pairs, stock indices, individual stocks, precious metals and energy commodities, and various cryptocurrencies. The variety of tools aims to fit different trading strategies and risk preferences.

Cost Structure: The broker advertises zero-commission trading across its tool offerings. However, specific information about spreads, overnight financing costs, and other potential fees remains unclear in available documents, which might affect trading cost transparency.

Leverage Ratios: Maximum leverage is set at 1:200. This falls within moderate risk parameters compared to some high-leverage offerings in the market, and this leverage level provides reasonable trading flexibility while keeping some risk management limits.

Platform Options: GF Markets mainly uses the MetaTrader 5 platform. This offers traders access to advanced technical analysis tools, automated trading systems, and complete market data feeds.

Geographic Restrictions: Specific information about geographic trading restrictions and compliance requirements for different areas is not detailed in available documents.

Customer Support Languages: Available customer service language options and communication channels are not specified in the information gathered for this gf markets review.

Account Conditions Analysis

GF Markets offers a layered account structure designed to fit traders with different experience levels and capital requirements. The account types include Standard, Gold, Platinum, and VIP levels. Each presumably offers different features and benefits, though specific details for each tier remain limited in available documents.

The minimum deposit requirement of $250 for account opening represents a moderate entry barrier. This makes the platform accessible to retail investors without requiring big initial capital commitment. The account opening process and verification requirements are not clearly detailed in available information, which raises concerns about the broker's transparency regarding client onboarding procedures.

Standard industry practices typically require identity verification, proof of address, and financial suitability assessments. But GF Markets' specific requirements remain unclear. User feedback about account conditions reveals mixed experiences, with some traders expressing concerns about the legitimacy of account operations and fund security.

The absence of regulatory oversight means that traditional client protection measures might not be in place. These include segregated client accounts and compensation schemes. The broker's account management features and additional services for higher-tier accounts are not fully documented, which limits potential clients' ability to make informed decisions about account selection.

This gf markets review notes that the lack of detailed account information transparency is concerning for a financial service provider.

GF Markets provides access to a range of trading tools across multiple asset classes. It offers forex pairs, stock indices, individual stocks, commodities, and cryptocurrency markets. The variety of available tools allows traders to use different portfolio strategies and risk management approaches.

However, specific details about the number of tools in each category and their trading conditions remain limited in available documents. The broker offers educational resources aimed at developing trader skills and market knowledge. Though the specific content, quality, and depth of these materials are not detailed in available information.

Educational support is crucial for retail traders, especially those new to financial markets. But the effectiveness of GF Markets' offerings cannot be properly assessed based on current information. Trading tools and analytical resources appear to be mainly delivered through the MT5 platform, which provides complete charting abilities, technical indicators, and automated trading support.

The platform's built-in features offer professional-grade analysis tools. Though any additional proprietary tools or research services from GF Markets are not clearly documented. The lack of detailed information about research services, market analysis, and trading signals represents a big gap in understanding the broker's value proposition.

Professional traders often rely on quality research and analysis to inform their trading decisions, making this information crucial for platform evaluation.

Customer Service and Support Analysis

Customer service quality and availability represent critical factors in broker evaluation. This is especially true for retail traders who may need help with platform navigation, account issues, or trading questions. Unfortunately, specific information about GF Markets' customer support channels, availability hours, and service quality is limited in available documents.

This makes it difficult to assess this crucial aspect of the broker's operations. User feedback reveals concerning trust issues about customer service interactions and overall platform legitimacy. Some reviews suggest potential fraudulent activity, which greatly impacts confidence in the broker's customer support abilities and willingness to help clients with legitimate concerns or disputes.

The absence of detailed information about support channels raises questions about the broker's commitment to client service. These channels include live chat, telephone support, email response times, and multilingual abilities. Professional forex brokers typically provide complete support options with clearly defined response time commitments and escalation procedures.

Without proper regulatory oversight, clients have limited options for dispute resolution if customer service issues arise. This lack of external protection mechanisms makes the quality and reliability of direct customer support even more critical. Yet the available information provides insufficient insight into these crucial service aspects.

Trading Experience Analysis

The trading experience offered by GF Markets centers around the MetaTrader 5 platform. This provides a strong foundation for forex and multi-asset trading. MT5 offers advanced charting abilities, complete technical analysis tools, automated trading support through Expert Advisors, and real-time market data feeds.

The platform's professional-grade features can handle both manual and algorithmic trading strategies. However, specific user feedback about platform stability, execution speed, and order processing quality is limited in available documents. These technical performance factors are crucial for active traders who require reliable order execution and minimal slippage during market volatility.

The absence of detailed performance data makes it difficult to assess the actual trading environment quality. Information about spreads, liquidity provision, and execution models is not fully available. This limits traders' ability to evaluate the true cost and quality of trade execution.

Professional traders require transparency about market making versus agency execution, average spread ranges, and slippage statistics to make informed broker selections. Mobile trading abilities and cross-device synchronization features are not detailed in available information. Though MT5 typically provides mobile applications for iOS and Android devices.

The quality and functionality of mobile trading access represent increasingly important factors for modern traders who require flexibility in market access. This gf markets review notes that the lack of detailed trading environment information and limited user experience feedback make it challenging to provide a complete assessment of the actual trading experience quality.

Trust and Safety Analysis

Trust and safety represent the most significant concerns regarding GF Markets. This is mainly due to the broker's unregistered status and lack of regulatory oversight. Operating without proper licensing from recognized financial authorities means that client funds lack the protection typically provided by regulatory frameworks.

This includes segregated account requirements, compensation schemes, and operational oversight. The absence of regulatory supervision eliminates external monitoring of the broker's financial health, business practices, and client fund handling procedures. This regulatory gap creates big risks for traders, as there are no established mechanisms for dispute resolution or fund recovery in case of operational issues or business failure.

User reviews and online discussions reveal serious concerns about the broker's legitimacy. Some sources suggest potential fraudulent activity. These allegations, combined with the unregistered status, create a high-risk environment for potential clients considering the platform for trading activities.

The lack of transparent information about fund segregation, insurance coverage, and operational transparency further adds to trust issues. Professional brokers typically provide clear documentation about client fund protection measures, operational licenses, and regulatory compliance. None of these are properly addressed in available GF Markets information.

Financial transparency about company ownership, operational history, and regulatory compliance status remains limited. This makes it difficult for potential clients to conduct proper due diligence before engaging with the platform.

User Experience Analysis

User experience evaluation for GF Markets is complicated by limited complete feedback and concerning reports about platform legitimacy. The broker targets retail investors seeking low-barrier entry to financial markets. It offers a $250 minimum deposit that fits traders with modest initial capital.

However, the overall user satisfaction and platform usability remain difficult to assess due to limited verified user testimonials. The account registration and verification processes are not clearly documented. This may create uncertainty for potential clients about onboarding requirements and timeframes.

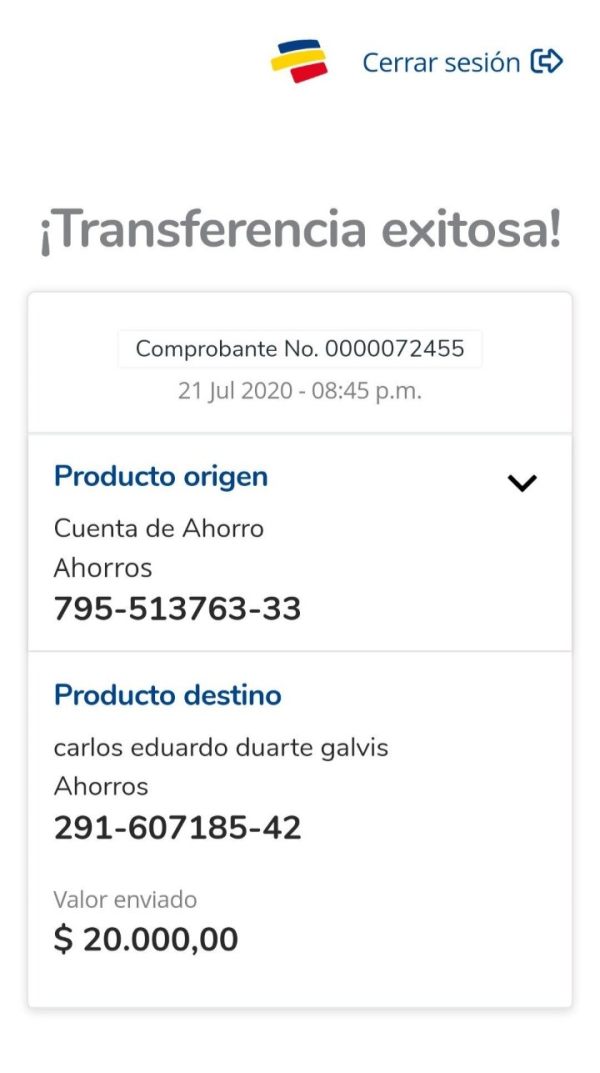

Professional brokers typically provide clear guidance about account opening procedures, required documentation, and verification timelines. But this information is not readily available for GF Markets. Deposit and withdrawal procedures, processing times, and available payment methods are not fully detailed in available documents.

These operational aspects greatly impact user experience, especially regarding fund accessibility and transaction convenience. The absence of clear information about funding processes raises additional concerns about platform transparency. Common user complaints appear to focus on trust and legitimacy concerns rather than specific platform functionality issues.

The negative feedback about potential fraudulent activity greatly impacts the overall user experience assessment. This suggests that traders should exercise extreme caution when considering this broker. The lack of positive user testimonials and detailed experience reports makes it challenging to identify any particular strengths in the platform's user experience design or customer satisfaction levels.

Conclusion

This complete gf markets review reveals big concerns about the broker's legitimacy and regulatory compliance. These issues overshadow any potential advantages in trading conditions or platform offerings. While GF Markets offers competitive minimum deposit requirements and access to diverse trading tools through the MT5 platform, the fundamental issues of unregistered status and user trust concerns make it a high-risk choice for traders.

The broker may appeal to new traders seeking low-barrier market entry. But the absence of regulatory protection and concerning user feedback about potential fraudulent activity create big risks that outweigh any potential benefits. Professional traders and serious investors should prioritize regulated brokers that offer transparent operations and proper client fund protection.

The main advantages include diverse asset class availability and relatively low minimum deposit requirements. The critical disadvantages include lack of regulatory oversight, trust issues, and limited operational transparency. Given these significant concerns, traders are strongly advised to consider well-regulated alternatives that provide proper client protection and transparent business operations.