G-LINK Review 1

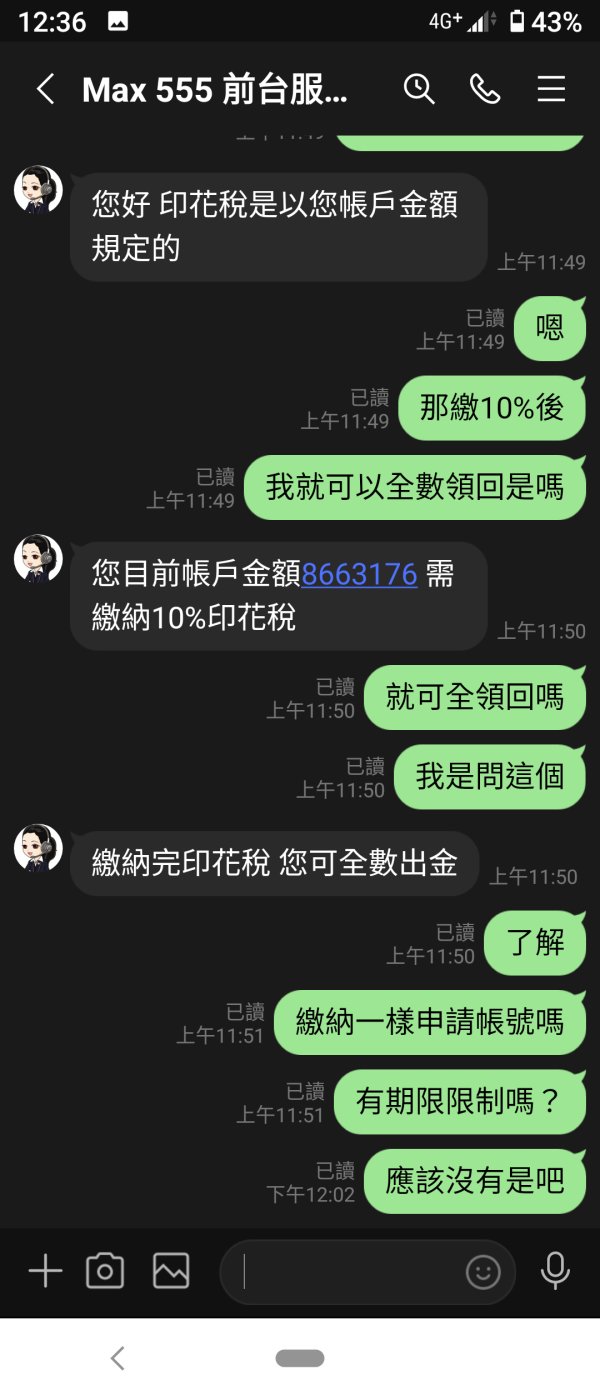

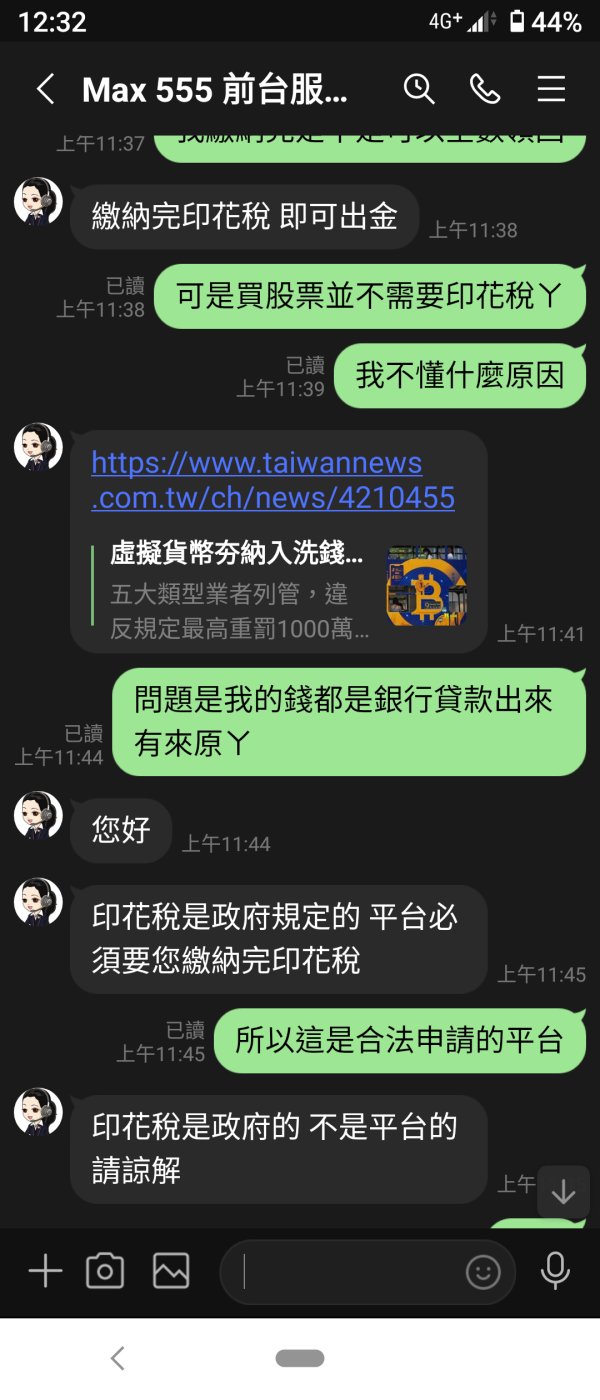

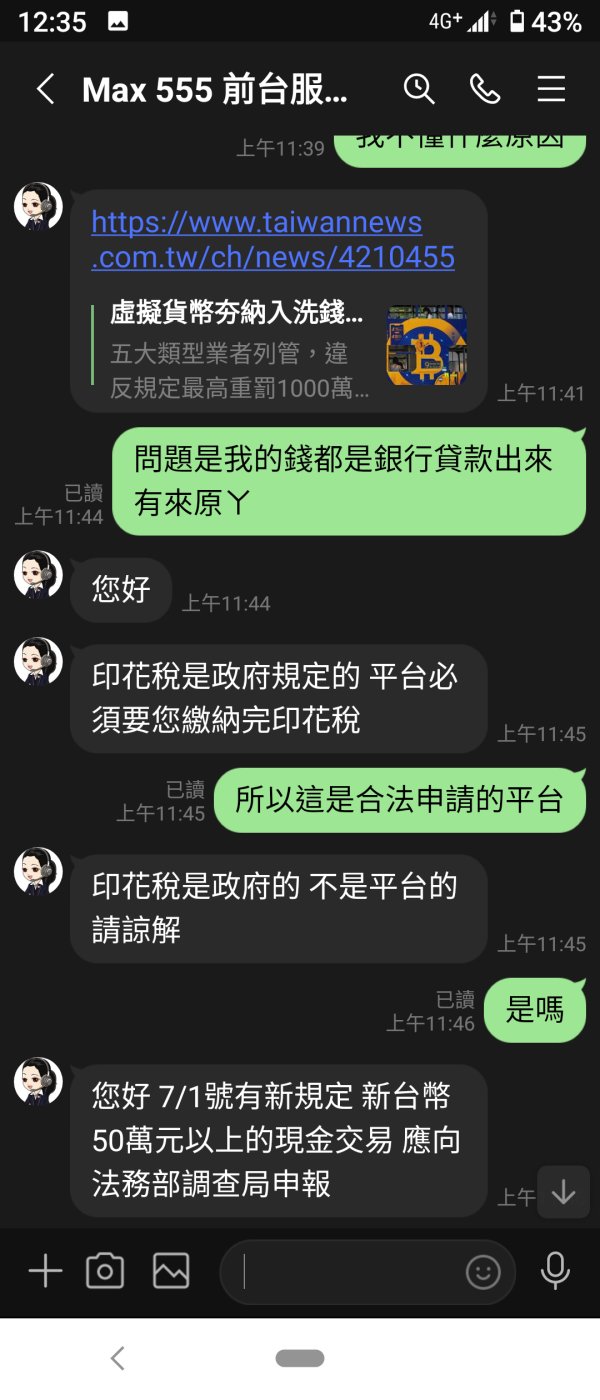

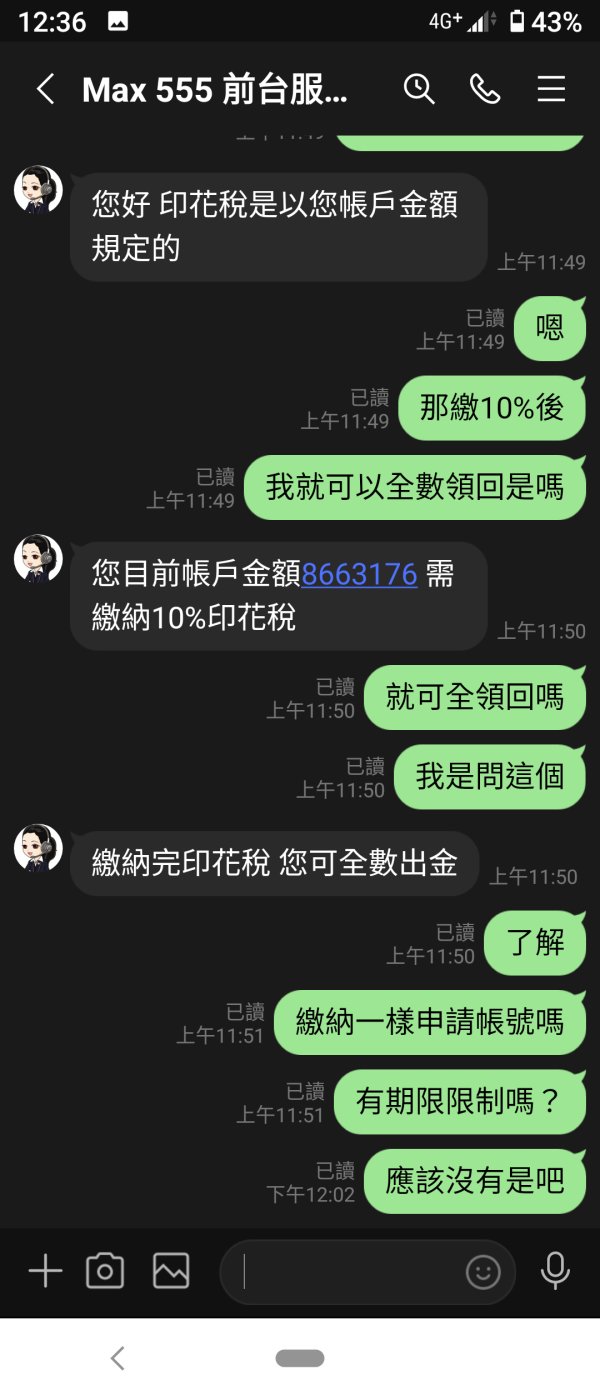

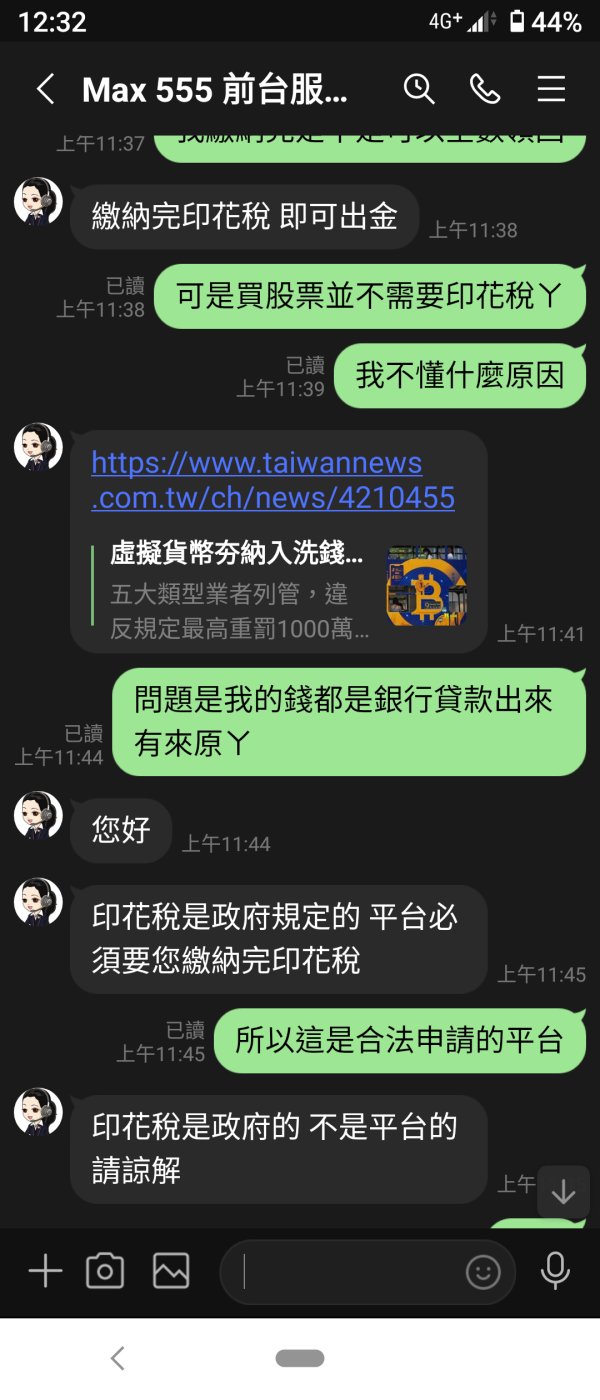

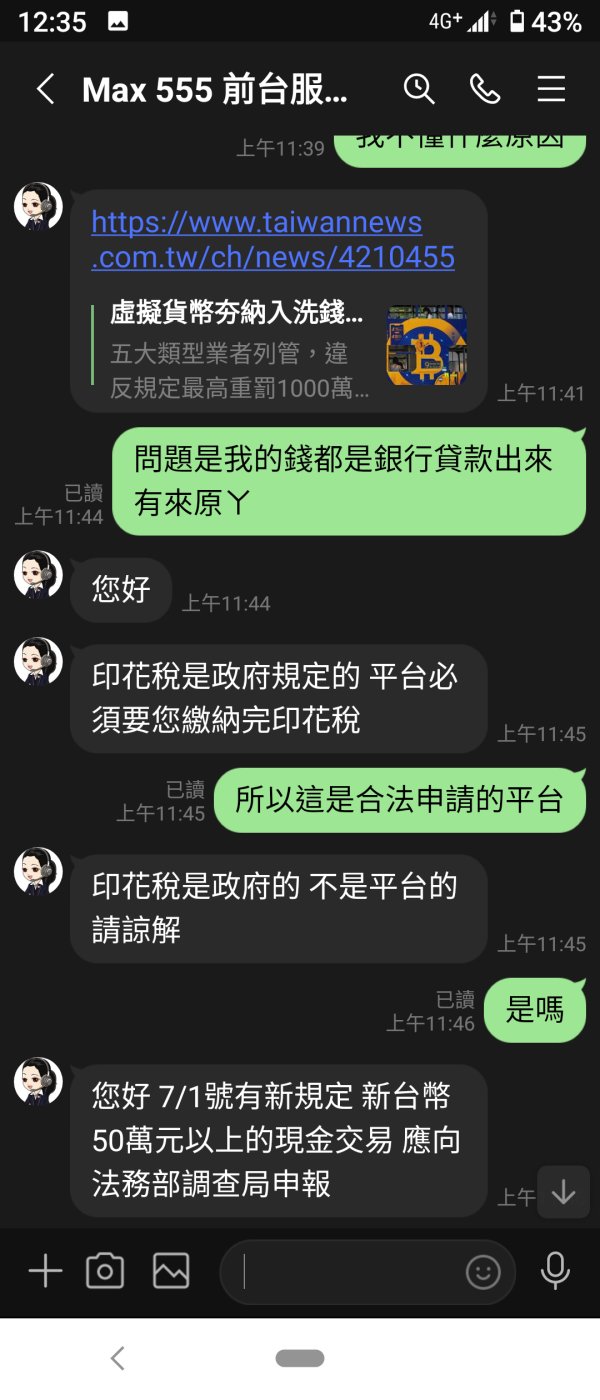

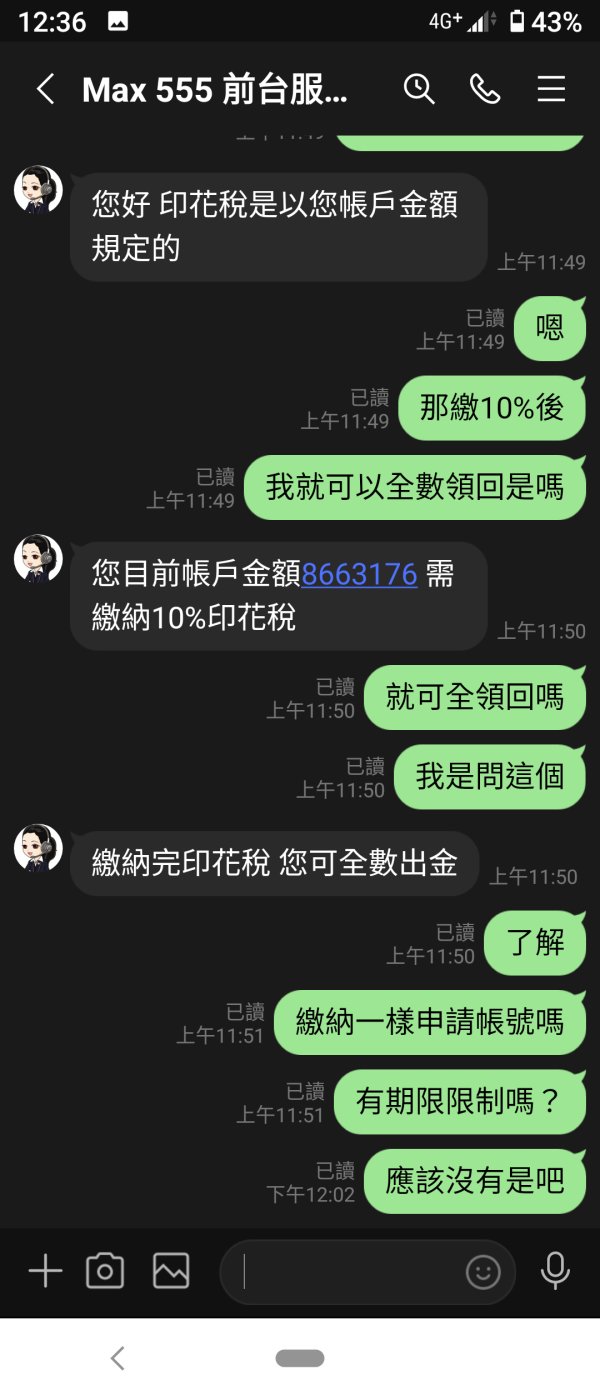

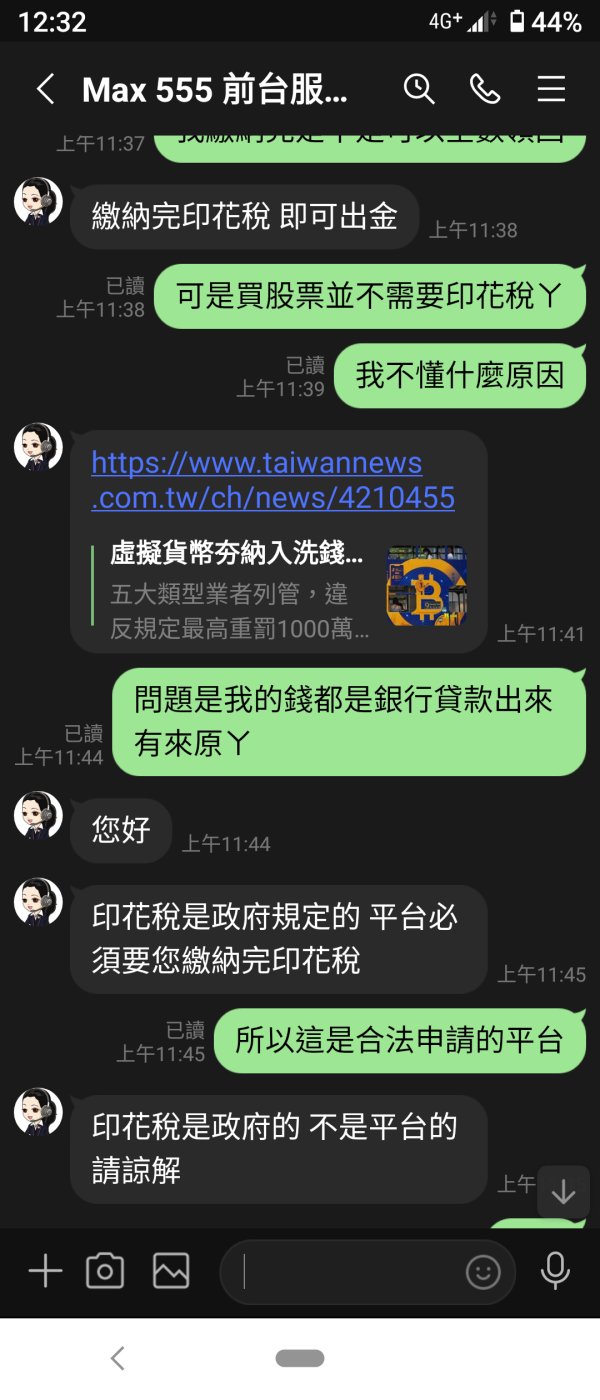

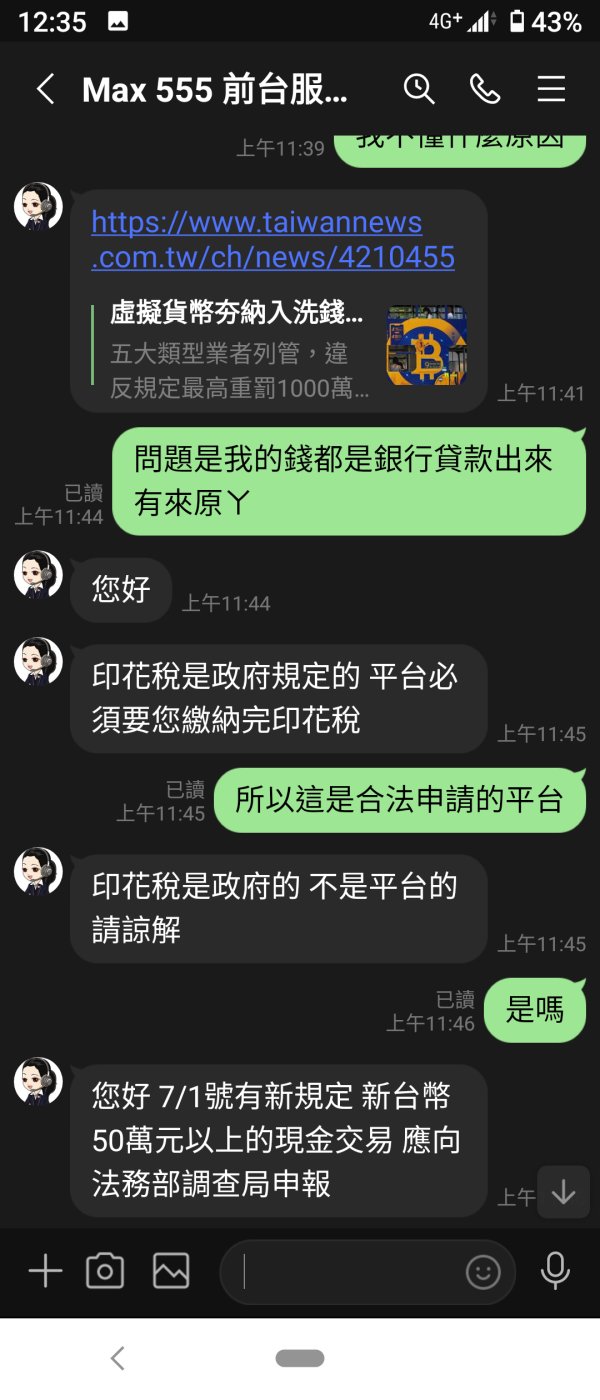

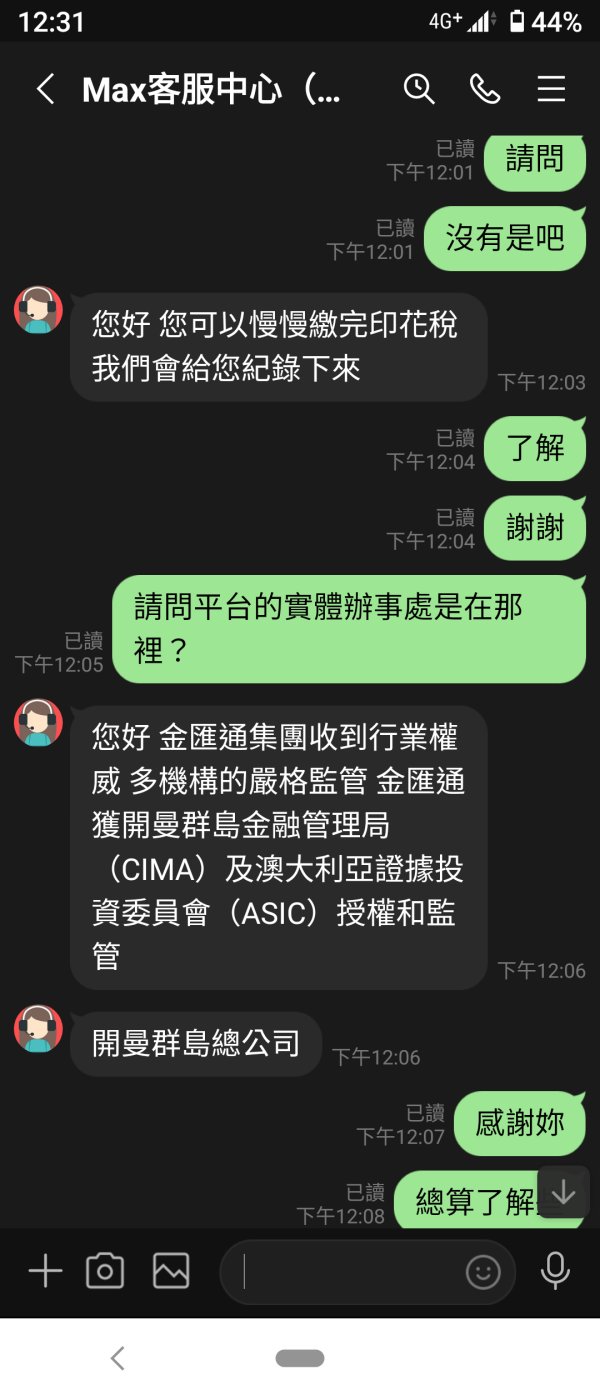

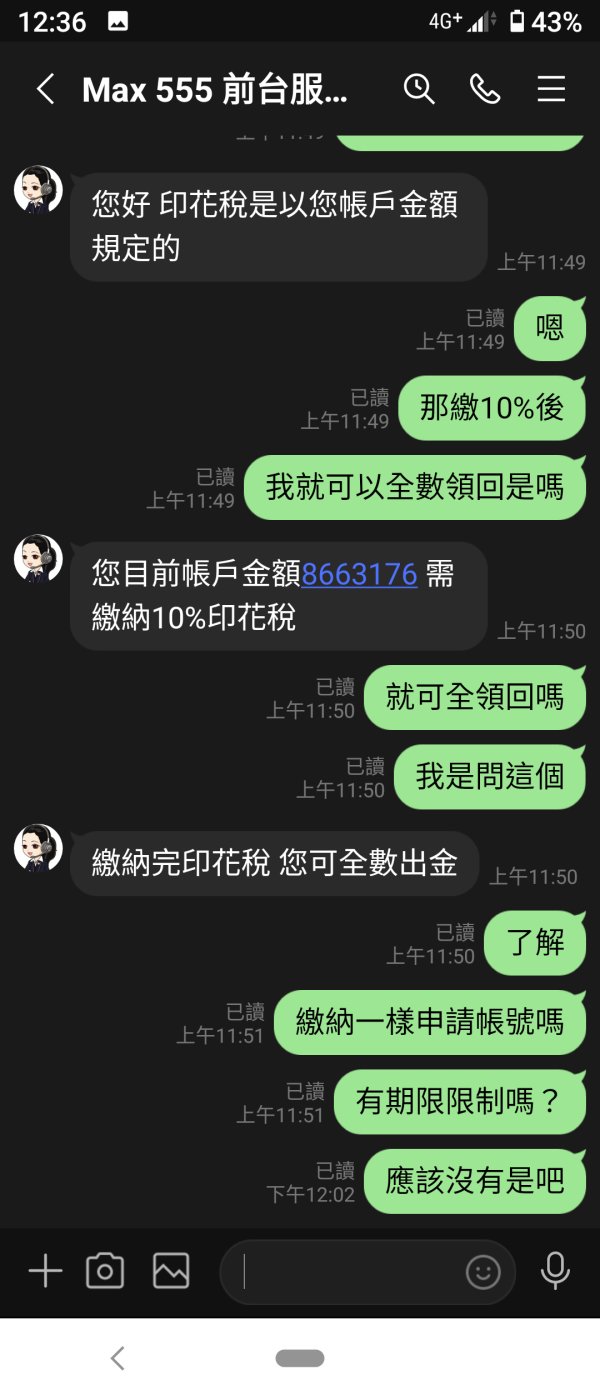

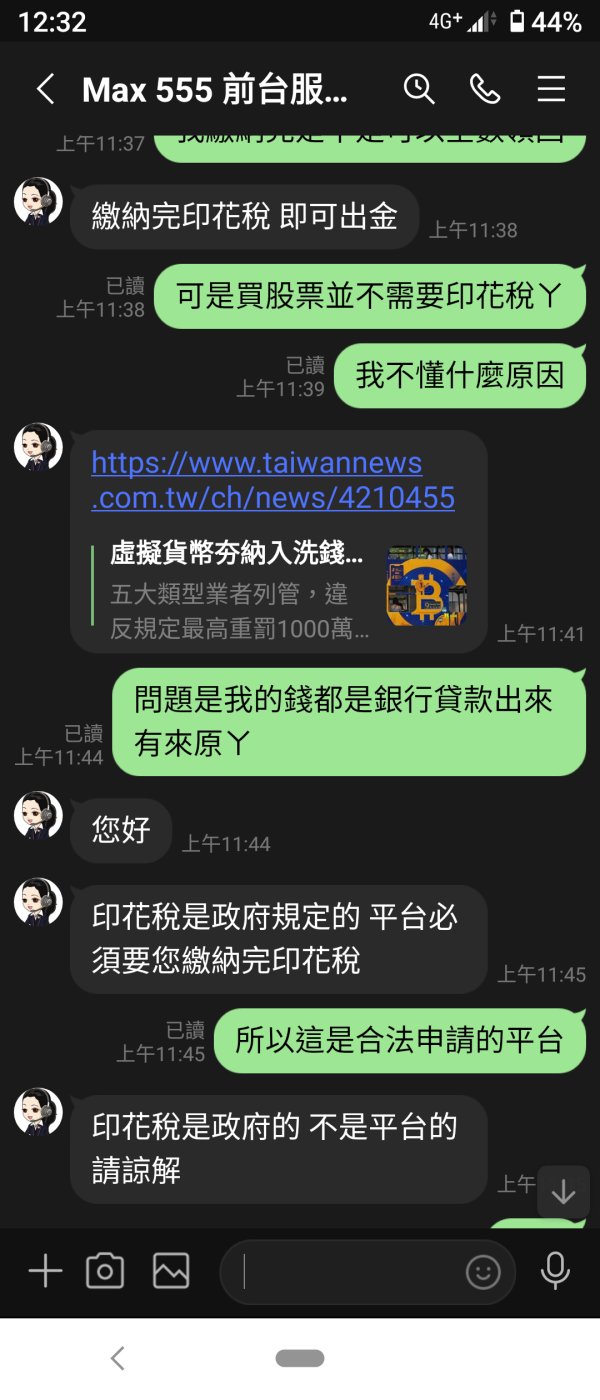

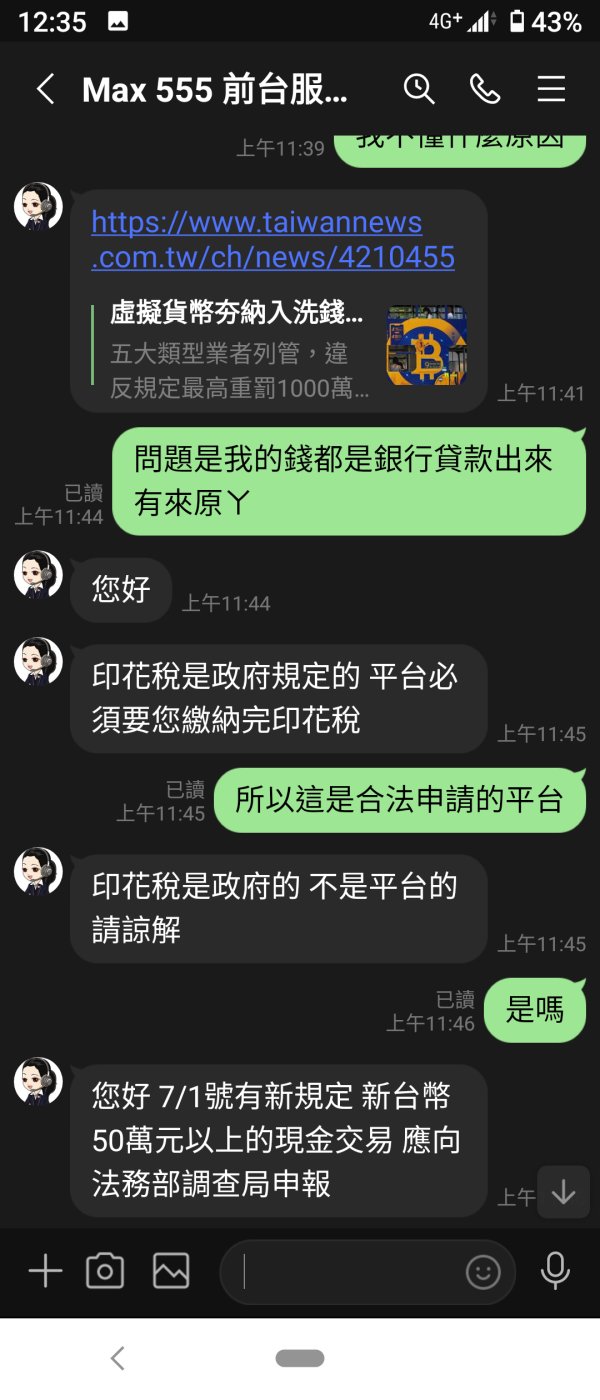

I deposited 1.33 million. The balance totalled 8.40 million including profits. It asked me to pay another deposit of 440,000. After I deposited, it still urged me to pay 840,000 in stamp duty. Finally my account was blocked.

G-LINK Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I deposited 1.33 million. The balance totalled 8.40 million including profits. It asked me to pay another deposit of 440,000. After I deposited, it still urged me to pay 840,000 in stamp duty. Finally my account was blocked.

G Link, a Cambodia-based forex broker established in 2018, presents itself as an appealing option for beginners and intermediate traders seeking low-cost trading opportunities. However, the broker suffers from a low regulatory score and a swelling number of user complaints surrounding withdrawal difficulties, significantly undermining its trustworthiness. Potential investors must weigh the benefits of competitive trading costs against the substantial risks associated with dealing with a broker that lacks comprehensive regulatory oversight and has received numerous negative reviews. This review examines G Links services and warns potential customers about critical risks involved, encouraging traders to proceed with caution.

| Dimension | Rating (Out of 5) | Justification |

|---|---|---|

| Trustworthiness | 2.0 | Lack of rigorous regulatory oversight; numerous negative user testimonials signal potential unreliability. |

| Trading Costs | 3.0 | Offers low-cost trading options but conceals high withdrawal fees that could offset initial savings. |

| Platforms & Tools | 2.0 | Limited choice of trading platforms (MT4) and tools, showing little advancement in technology or user experience. |

| User Experience | 2.0 | User-friendly interface but marred by complaints about withdrawal processes and support response times. |

| Customer Support | 2.0 | Support delayed, with long wait times reported and mixed reviews on effectiveness. |

| Account Conditions | 2.0 | Minimum deposit requirement of $1,000 may be a barrier for beginner traders; however, leverage up to 1:100 provides options for varying risk appetites. |

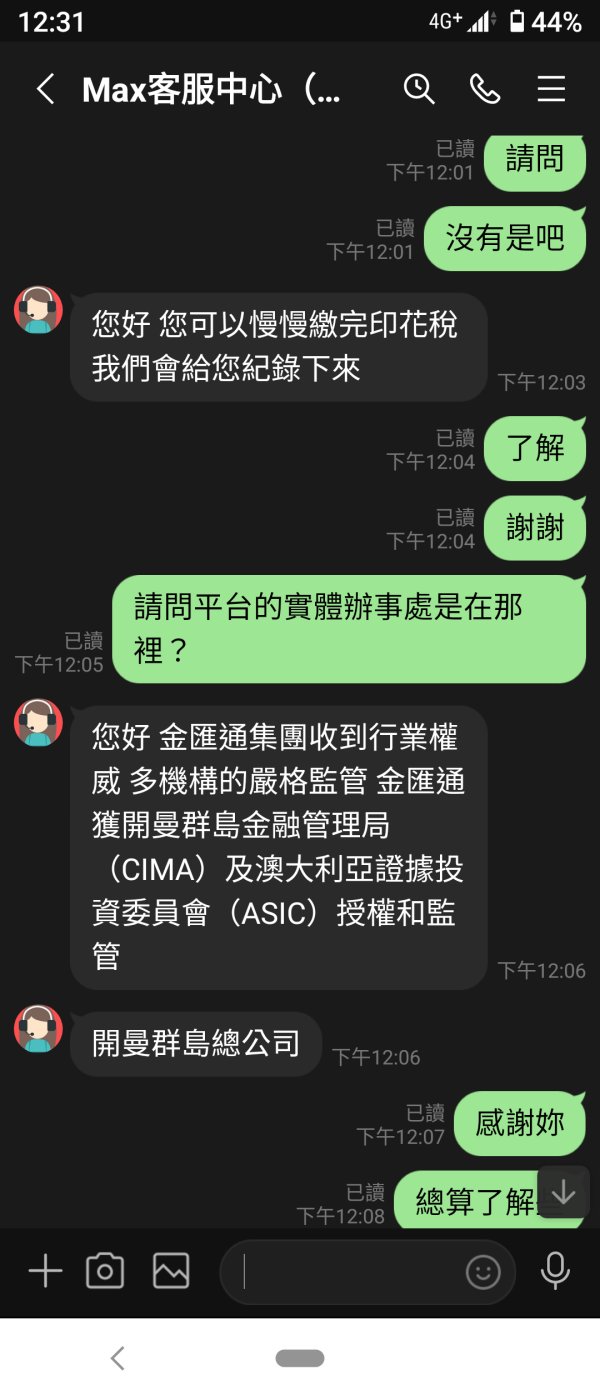

G Link, formally known as Golden FX Link Capital Co., Ltd., is based in Phnom Penh, Cambodia. Founded in 2018, it specialized in foreign currency trading and derivatives. Although it provides services under the oversight of the Securities and Exchange Regulator of Cambodia (SECC), it is crucial to note that SECC does not regulate forex trading in Cambodia. This raises immediate concerns regarding its reliability for investors seeking secure and regulated trading environments. The minimal operational history combined with a low regulatory score paints a worrying picture for potential clients.

G Link's primary business model focuses on the electronic and physical trading of precious metals and foreign currencies. The broker claims to offer a diverse array of trading instruments, primarily through the MetaTrader 4 (MT4) platform, enabling traders access to forex, precious metals, and derivatives. Despite the allure of low trading costs, the lack of regulatory validation raises questions about the safety and reliability of the trading environment they provide.

| Key Details | Information |

|---|---|

| Regulation | Registered with SECC (not regulating forex) |

| Minimum Deposit | $1,000 |

| Maximum Leverage | 1:100 |

| Major Fees | Non-transparent withdrawal fees |

| Trading Instruments | Forex, precious metals |

| Trading Platform | MT4 |

Trustworthiness is paramount when selecting a forex broker, and unfortunately, G Link presents several red flags.

The regulatory status of G Link raises questions. While it is officially registered with SECC, the sheer fact that the Cambodian regulatory authority does not govern forex trading, combined with user complaints, creates significant doubt about the broker's reliability. Verifying the broker's regulatory status through independent financial directories can help potential users gauge trust.

To ensure their safety, users should verify G Links regulatory claims yourself:

User feedback provides insight into the operational integrity of a broker. Several complaints highlight a trend toward funds being mishandled, with one user stating, “After I made a deposit, they requested additional fees before allowing any withdrawal.” Therefore, to summarize the industry reputation of G Link, user testimonials suggest a concerning trend for potential investors.

"G Link utilizes aggressive marketing tactics and engages in questionable withdrawal activities, leading many users to caution against trusting them."

While G Link is known for its low commissions, the double-edged sword of non-trading fees speaks louder.

Traders appreciate G Links low-cost commission structure, which may seem attractive at first glance. For customers looking to minimize upfront trading costs, this could serve as an enticing feature. However, hidden fees are the traps.

As one user lamented, “With withdrawal fees ranging up to $440, what initially seemed low-cost turned out to be a costly mistake.” Moreover, reports indicate other charges may pop up during the withdrawal process.

In summary, while G Link advertises low commissions:

When it comes to trading platforms, G Link primarily offers access to MetaTrader 4, but features and tools are limited.

MT4 is renowned for its robust functionality and reliability, but the lack of diversity in platforms available is a notable disadvantage. Features such as comprehensive educational resources and trading analytics aren't adequately provided by G Link.

Feedback indicates usability is a concern. One user stated, “While MT4 is functional, G Link's limited tools made trading feel basic and less enriching.”

Overall, G Links platform usability offers basic trading necessities but lacks the depth and resources that could enhance trader performance.

User experience is a critical aspect of any trading platform, and G Link has room for improvement.

The platform interface received mixed reviews. While many users find it intuitive, the experience is marred by reports of difficulties during withdrawal processes. One trader reported, “The platform is user-friendly; however, my funds were stuck for over a month during the withdrawal process.”

Ultimately, the balance between user interface satisfaction and withdrawal troubles presents issues in user retention and overall satisfaction.

Customer support remains a vital consideration for traders facing difficulties.

While G Link offers various methods of communication for support, including phone and email, reports indicate that response times can be excessively long. One user highlighted, “Though they have support channels, the waiting period to resolve issues is exasperating.”

Overall, while support is available, slow response times could deter traders when urgent assistance is needed.

The account conditions at G Link provide both opportunities and challenges.

Users must deposit a minimum of $1,000 to start trading, which may deter beginners. However, the leverage offered up to 1:100 allows for various trading strategies, especially for those familiar with higher-risk trading environments.

In summary, while the minimum deposit may be seen as a drawback, the leverage is attractive for those willing to embrace the risk, making G Link a mixed bag for account conditions.

G Link presents a high-risk trading environment cloaked in seemingly attractive low-cost opportunities. The lack of regulatory oversight, combined with multiple user complaints surrounding withdrawal processes, poses significant concerns for potential users, especially those prioritizing security and transparency. While the broker may attract beginner to intermediate traders, whom the low costs could appeal to, experienced traders and those with substantial capital should proceed with caution. Understanding the risks associated with G Link, along with performing due diligence and self-verification, is essential for anyone considering this broker.

FX Broker Capital Trading Markets Review