FX-Trading 2025 Review: Everything You Need to Know

FX-Trading has garnered mixed reviews in 2025, with some traders praising its competitive pricing and extensive asset offerings, while others express concerns regarding withdrawal issues and regulatory oversight. This comprehensive review aims to provide insights into the broker's strengths and weaknesses, enabling potential clients to make informed decisions.

Note: It is essential to consider that FX-Trading operates under different entities across regions, which may impact the trading experience and regulatory protections available to clients.

Ratings Overview

We evaluate brokers based on user feedback, expert opinions, and factual data from various sources.

Broker Overview

Founded in 2014, FX-Trading is an online brokerage based in Sydney, Australia, regulated by the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). The broker provides access to the popular trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), catering to a wide range of trading styles. FX-Trading offers a diverse selection of tradable assets, including over 70 currency pairs, commodities, indices, and cryptocurrencies.

Detailed Breakdown

Regulatory Regions

FX-Trading operates under ASIC in Australia and VFSC in Vanuatu. While ASIC is a reputable regulator, the VFSC's oversight is considered weaker, which may raise concerns for some traders regarding the protection of their funds.

Deposit/Withdrawal Currencies

FX-Trading supports various base currencies, including AUD, USD, EUR, GBP, SGD, NZD, CAD, and HKD. Traders can fund their accounts using multiple payment methods, such as credit cards, PayPal, Neteller, and bank transfers. However, the minimum deposit requirement is set at $200, which some users find relatively high compared to other brokers.

FX-Trading offers several promotional programs, including a welcome bonus that provides up to 25% rebate on losses from initial deposits. However, these promotions are subject to specific conditions, which may deter some traders.

Tradable Asset Classes

FX-Trading provides access to a wide array of assets, including forex, cryptocurrencies, commodities, indices, and shares. The broker supports over 10,000 stock CFDs, making it a versatile choice for traders looking to diversify their portfolios.

Costs (Spreads, Fees, Commissions)

The broker offers competitive spreads, starting from 0.0 pips on its pro accounts. However, there are commission fees of $2 per lot on these accounts. The standard account features zero commissions but higher spreads. Traders should also be aware of potential overnight swap fees, which can vary based on the asset class.

Leverage

FX-Trading provides leverage of up to 1:500, which can amplify both potential gains and losses. While high leverage can be attractive to experienced traders, it also increases the risk of significant losses, particularly for newcomers.

FX-Trading primarily supports MT4 and MT5, which are well-known for their robust features and user-friendly interfaces. Additionally, the broker offers proprietary tools for enhanced market analysis.

Restricted Regions

FX-Trading does not accept clients from certain jurisdictions, including the United States, which may limit its accessibility for some traders.

Available Customer Service Languages

Customer support at FX-Trading is available in multiple languages, including English and Chinese. However, some users have reported slow response times and challenges in resolving issues, which could affect the overall trading experience.

Repeated Ratings Overview

Detailed Explanations

Account Conditions

FX-Trading offers two main account types: a standard account with zero commissions and a pro account with raw spreads. The minimum deposit requirement of $200 may be a barrier for some traders, especially beginners. However, the flexibility in account types allows for various trading strategies.

The broker provides access to educational materials, market analysis, and trading tools, which can enhance the trading experience. However, the availability of resources may not be as extensive as those offered by some competitors.

Customer Service and Support

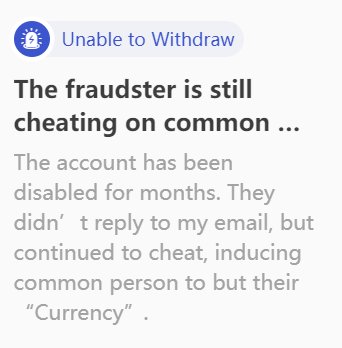

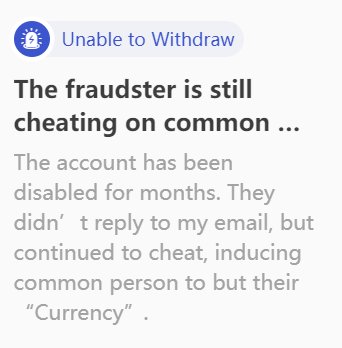

Customer support has received mixed reviews. While the broker offers multiple channels for assistance, including live chat and email, some users have expressed dissatisfaction with response times and the effectiveness of support.

Trading Experience

The overall trading experience at FX-Trading is generally positive, with competitive spreads and a user-friendly platform. However, some traders have reported issues with withdrawals and account management.

Trustworthiness

While FX-Trading is regulated by ASIC, the weaker oversight from VFSC raises concerns about the safety of funds. Additionally, user reviews indicate mixed experiences, with some traders reporting challenges in withdrawing funds.

User Experience

The user experience is generally satisfactory, with a well-designed trading platform. However, the lack of a proprietary mobile app and limited customer support may detract from the overall experience.

In conclusion, the FX-Trading review for 2025 indicates that while the broker has several attractive features, potential clients should weigh the risks associated with its regulatory status and user feedback. As always, conducting thorough research and considering personal trading needs is crucial before opening an account.