Fx Global 2025 Review: Everything You Need to Know

Summary

Fx Global presents itself as a global online forex broker offering multiple asset classes to traders worldwide. This Fx Global review examines a broker that provides access to foreign exchange, precious metals, energy, indices, bonds, cryptocurrencies, and stocks through their platform. While the platform offers diversified trading opportunities, user feedback indicates concerns about relatively high spreads that may impact trading profitability for many traders. The broker appears to target traders seeking variety in their investment portfolios, though potential users should carefully consider the cost implications before making any commitments. Based on available information, Fx Global operates in a competitive market where transparency and regulatory clarity remain important factors for trader confidence and long-term success. The platform's multi-asset approach may appeal to those looking to diversify beyond traditional forex pairs, but the reported spread issues suggest traders should compare costs carefully before committing funds to their accounts.

Important Notice

Due to limited regulatory information available in public sources, users should exercise caution and verify compliance requirements in their respective jurisdictions before engaging with Fx Global. Trading conditions and legal frameworks may vary significantly across different regions, and potential clients are advised to conduct thorough due diligence before proceeding with account registration. This review is based on available market data and user feedback from various sources, though comprehensive regulatory verification was not possible from the materials examined during our research process. Traders should independently confirm all account terms, conditions, and regulatory status before making any financial commitments to this platform.

Rating Overview

Broker Overview

Fx Global operates as an online forex broker in the competitive global trading market. The company positions itself as a multi-asset broker, extending beyond traditional forex trading to encompass a broader range of financial instruments that modern traders demand. This approach reflects the evolving demands of modern traders who seek diversified investment opportunities within a single platform environment that can meet their various trading needs.

The broker's business model centers on providing access to various asset classes. These include foreign exchange pairs, precious metals such as gold and silver, energy commodities, major market indices, government and corporate bonds, popular cryptocurrencies, and individual stocks from global markets. This Fx Global review notes that while the diversification strategy may attract traders seeking variety, the execution quality and cost structure remain critical factors in determining overall value proposition for potential clients who want to maximize their trading success.

Regulatory Status: Specific regulatory information was not clearly detailed in available documentation. This raises questions about oversight and compliance frameworks that govern the broker's operations in different jurisdictions.

Deposit and Withdrawal Methods: Available sources did not provide comprehensive details about supported payment methods. Processing times and associated fees for funding and withdrawal operations were also not clearly specified in the documentation we reviewed.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types were not clearly specified in the materials reviewed. This lack of information may make it difficult for potential traders to plan their initial investment amounts.

Promotions and Bonuses: Information regarding welcome bonuses, loyalty programs, or promotional offers was not detailed in available sources. Many traders look for these incentives when choosing a new broker, so this represents a significant information gap.

Tradeable Assets: Fx Global offers access to foreign exchange pairs, precious metals, energy commodities, stock indices, bonds, cryptocurrencies, and individual equity shares. This provides a comprehensive range of investment opportunities for traders seeking diversification across multiple asset classes.

Cost Structure: User feedback indicates that spreads may be higher than some competitors in the market. Specific commission structures and fee schedules were not detailed in available documentation, making cost comparison difficult for potential clients.

Leverage Options: Maximum leverage ratios and margin requirements were not clearly specified in the sources examined for this Fx Global review. These details are crucial for traders who want to understand their potential exposure and risk management capabilities.

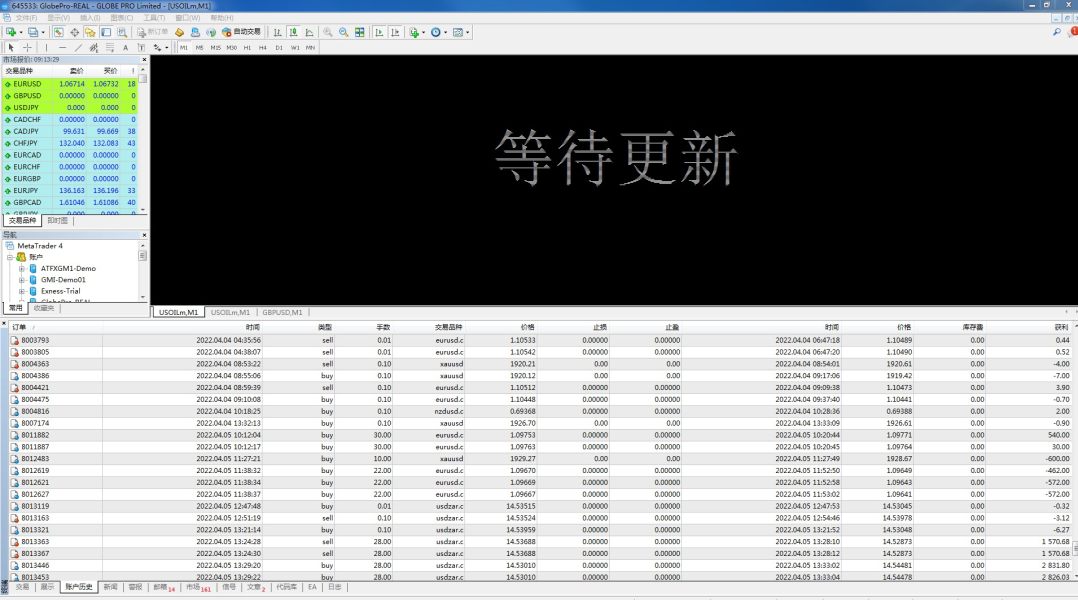

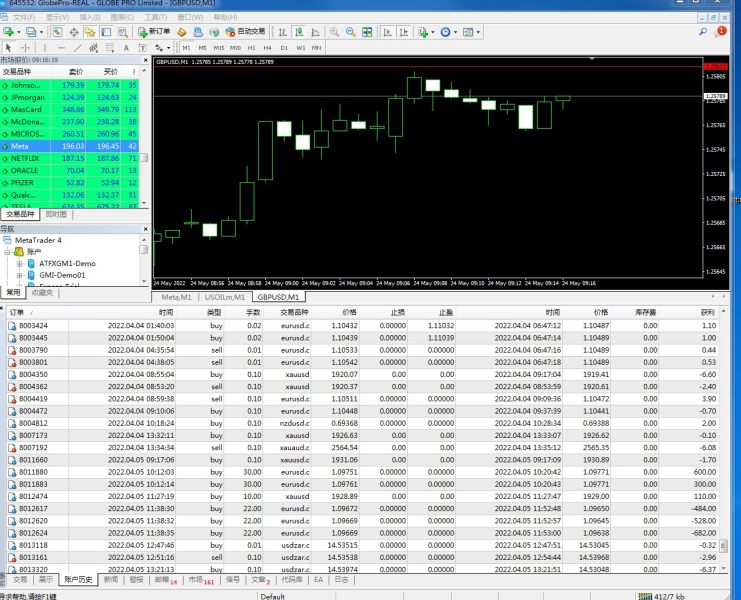

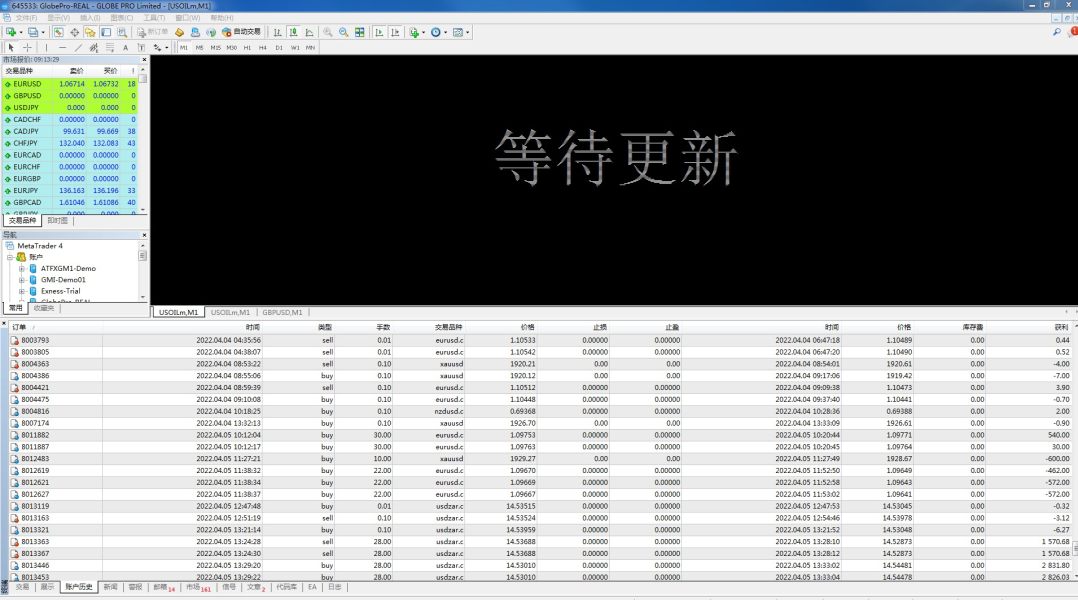

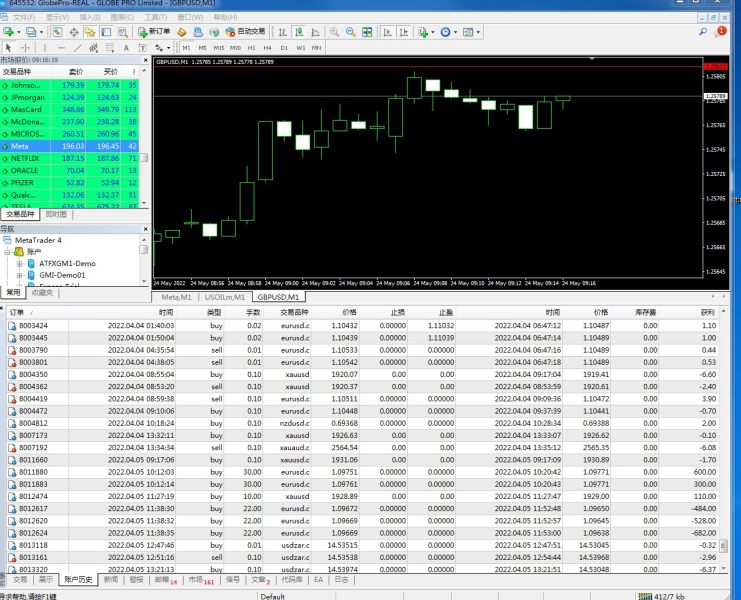

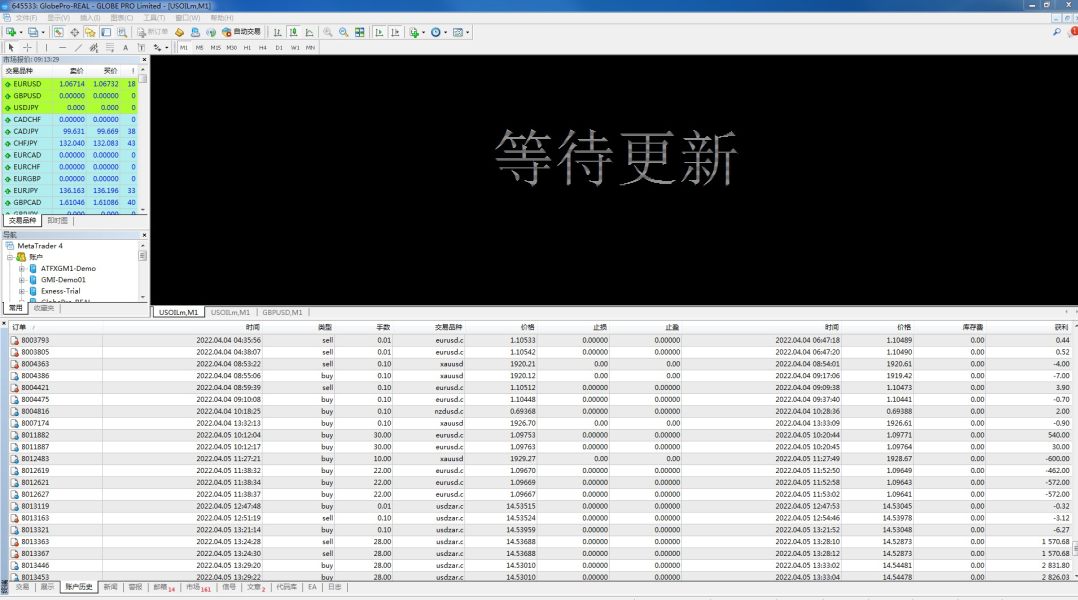

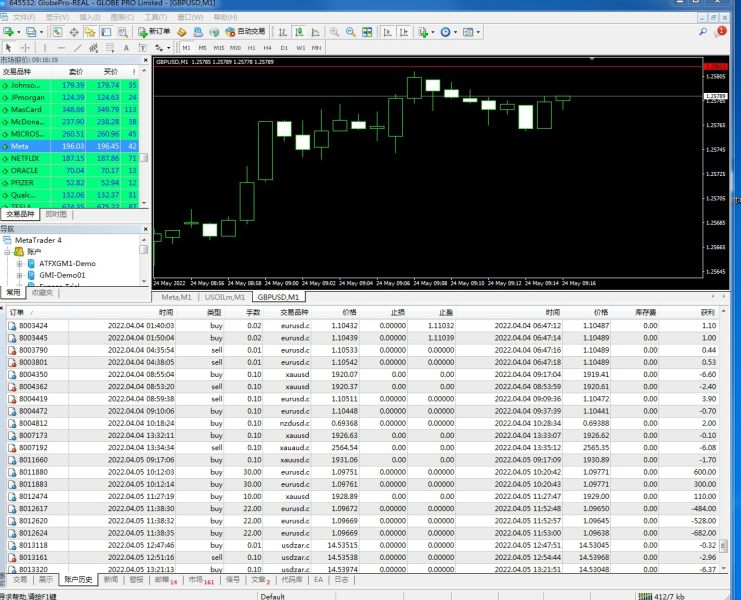

Platform Options: Specific trading platform details were not comprehensively covered in available materials. Software compatibility and mobile applications information was also limited in the sources we examined.

Geographic Restrictions: Regional availability and restrictions were not clearly outlined in the documentation reviewed. This information is important for international traders who need to verify their eligibility before opening accounts.

Customer Support Languages: Multi-language support capabilities were not detailed in available sources. International brokers typically provide support in multiple languages to serve their global client base effectively.

Account Conditions Analysis

The account structure and conditions offered by Fx Global remain somewhat unclear based on available documentation. Without specific details about account types, minimum deposit requirements, or tiered service levels, potential traders face uncertainty when evaluating whether the broker meets their financial capacity and trading objectives effectively. This lack of transparency in account specifications may concern traders who prefer clear, upfront information about costs and requirements before making any commitments.

User feedback suggests that spread costs may be higher than industry averages. This directly impacts account profitability regardless of account size, making it a significant consideration for all types of traders. The absence of detailed commission structures makes it difficult for traders to calculate total trading costs accurately before they begin trading.

Additionally, without information about special account features such as Islamic accounts for Sharia-compliant trading, the broker may not serve diverse client needs effectively. The account opening process details were not comprehensively available, leaving questions about verification requirements, documentation needs, and approval timeframes that potential clients need to understand. This Fx Global review notes that successful brokers typically provide clear, streamlined onboarding processes that help traders understand exactly what to expect when establishing their trading accounts with the platform.

The trading tools and resources available through Fx Global were not extensively detailed in available documentation. This creates gaps in understanding the platform's analytical capabilities that modern traders typically expect from their brokers. Modern traders typically expect comprehensive charting tools, technical indicators, economic calendars, and market analysis resources to support their trading decisions effectively throughout their trading activities.

Research and analysis resources were not clearly described in the materials examined. These typically include market commentary, fundamental analysis, and trading signals that help traders make informed decisions about their positions. Educational resources such as webinars, tutorials, and trading guides that help both novice and experienced traders improve their skills appear to be undocumented or limited based on available information we could gather.

Automated trading support was not specified in the sources reviewed. This includes expert advisor compatibility and algorithmic trading features that have become increasingly important for modern trading operations. These tools have become increasingly important for traders seeking to implement systematic trading strategies or manage positions outside regular trading hours when they cannot monitor markets actively. The absence of clear information about these capabilities may limit the platform's appeal to technically oriented traders who rely on automated systems.

Customer Service and Support Analysis

Customer service capabilities and support infrastructure details were not comprehensively available in the documentation reviewed. Modern trading platforms typically provide multiple communication channels including live chat, telephone support, email assistance, and comprehensive help documentation to address trader inquiries promptly and effectively. Response times and service quality metrics were not detailed in available sources, making it difficult to assess whether Fx Global meets industry standards for customer support responsiveness during critical trading situations.

Traders often require quick resolution of technical issues, account questions, and trading-related problems. This is particularly important during volatile market conditions when time-sensitive decisions can significantly impact trading outcomes. Multi-language support capabilities, which are essential for serving international client bases, were not clearly specified in the available documentation we examined.

Additionally, customer service availability hours were not documented in the materials examined. Weekend and holiday coverage information was also not available, though these factors can significantly impact user satisfaction and trading experience quality. Traders who operate across different time zones need to understand when support will be available to assist them with urgent issues.

Trading Experience Analysis

The overall trading experience with Fx Global shows mixed indicators based on available feedback. User evaluations highlight concerns about spread competitiveness, with reports suggesting that trading costs may be higher than some market alternatives that offer similar services. This factor directly impacts trading profitability, particularly for active traders who execute multiple positions daily and need to manage their cost structure carefully.

Platform stability and execution speed details were not comprehensively documented in available sources. These factors remain crucial for successful trading operations, especially during high-volatility market conditions when quick execution can make the difference between profit and loss. Order execution quality requires further verification through direct user experience or independent testing to provide accurate assessments.

The trading environment appears to offer access to diverse asset classes. This may benefit traders seeking portfolio diversification across multiple markets and instruments within a single platform. However, the Fx Global review indicates that cost considerations may outweigh diversification benefits for cost-sensitive traders who prioritize low trading expenses. Mobile trading capabilities and cross-device synchronization features were not detailed in available sources, though these have become essential features for modern traders.

Trust and Safety Analysis

Trust and safety considerations present significant concerns based on available documentation. The absence of clear regulatory information raises questions about oversight mechanisms and client protection measures that typically provide trader confidence in broker operations and long-term stability. Fund safety measures were not detailed in available sources, including segregated account practices and insurance coverage that protect client investments.

These protections are fundamental to broker trustworthiness and help ensure client funds remain secure even if the broker encounters financial difficulties. Company transparency regarding ownership, financial backing, and operational history appears limited based on available materials that we could access during our research. Industry reputation and third-party ratings were not comprehensively documented, making it difficult to assess the broker's standing within the professional trading community and among regulatory bodies.

The lack of clear information about dispute resolution procedures and regulatory recourse options may concern potential clients. Traders need to understand what protections and remedies are available if issues arise with their accounts or trading activities.

User Experience Analysis

User experience feedback presents a mixed picture of Fx Global's service delivery. Available evaluations suggest that while the broker offers access to multiple asset classes, cost-related concerns may impact overall satisfaction levels among traders who prioritize competitive pricing. The diversity of trading instruments may appeal to traders seeking variety, but execution costs remain a significant consideration that affects the overall value proposition.

Interface design and platform usability details were not comprehensively available in our research. These factors significantly influence daily trading operations and can impact trader success and satisfaction with the platform. Registration and account verification processes were not clearly documented, potentially creating uncertainty for prospective clients about onboarding requirements and timeframes.

Common user concerns appear to center on spread competitiveness according to available feedback. This suggests that cost optimization remains an area requiring attention from the broker to improve client satisfaction. The target user profile seems to include traders interested in multi-asset exposure, though cost-conscious traders may find better alternatives in the competitive broker marketplace that offers similar services at lower costs.

Conclusion

Fx Global operates as a multi-asset broker offering access to diverse trading instruments. These include forex, commodities, indices, bonds, cryptocurrencies, and stocks across global markets. However, this review reveals significant information gaps regarding regulatory oversight, specific account conditions, and platform capabilities that may concern potential traders who need complete information before making decisions. User feedback indicates that spread costs may be higher than competitive alternatives, which could impact trading profitability for many types of traders. While the broker may suit traders seeking asset diversification, the combination of limited transparency and cost concerns suggests careful consideration before account opening with this platform. Prospective clients should verify regulatory status, compare trading costs, and ensure the platform meets their specific requirements before committing funds to any trading account.