FOYA 2025 Review: Everything You Need to Know

Summary

FOYA is a new brokerage firm in the forex market. We don't have much information about this broker from available sources. This foya review gives traders an honest look at what we know about FOYA's services and what they offer. FOYA seems to be a multi-asset broker, but we can't find clear details about trading conditions, rules, or platform features in public materials.

We don't know when FOYA started or what rules they follow. This is important for traders who want to pick the right broker. We also don't have details about minimum deposits, spreads, leverage, or trading platforms, so traders should be very careful when thinking about FOYA. This review looks at all the information we can find while pointing out the big gaps in what we know about FOYA's work and services.

Important Notice

This review uses limited public information about FOYA. We don't have enough data about the broker's rules, trading conditions, and how they work, so potential clients should research carefully before making investment choices. The information in this review might not show the complete picture of FOYA's services, and traders should check all details directly with the broker before opening trading accounts.

Our review method uses available online sources and industry standards. But since we lack detailed information about FOYA's operations, some parts of this review will show information gaps instead of giving complete analysis.

Rating Framework

Broker Overview

FOYA works as a brokerage firm, but we can't find specific details about when it started, how it's organized, or its history in public sources. The limited information suggests that FOYA might be a multi-asset broker, but without full documentation of its services, trading tools, or business model, it's hard to give a clear assessment of the company's place in the market.

We don't know about the broker's background, including who founded it, its financial backing, and how the business developed. This lack of openness about basic company information raises questions about how mature the broker's operations are and its presence in the market. Usually, established brokers keep detailed public information about their company history, leadership team, and business achievements.

FOYA doesn't provide clear information about its regulatory status, trading platforms, or asset offerings, so potential clients face big uncertainty when comparing this broker to established market competitors. The absence of detailed service descriptions, fee structures, or client reviews makes it even harder for traders to find reliable brokerage partnerships.

Regulatory Status: Available sources don't give clear information about FOYA's regulatory oversight or licensing status. This is a big concern for potential traders, as following regulations is basic to broker credibility and client protection.

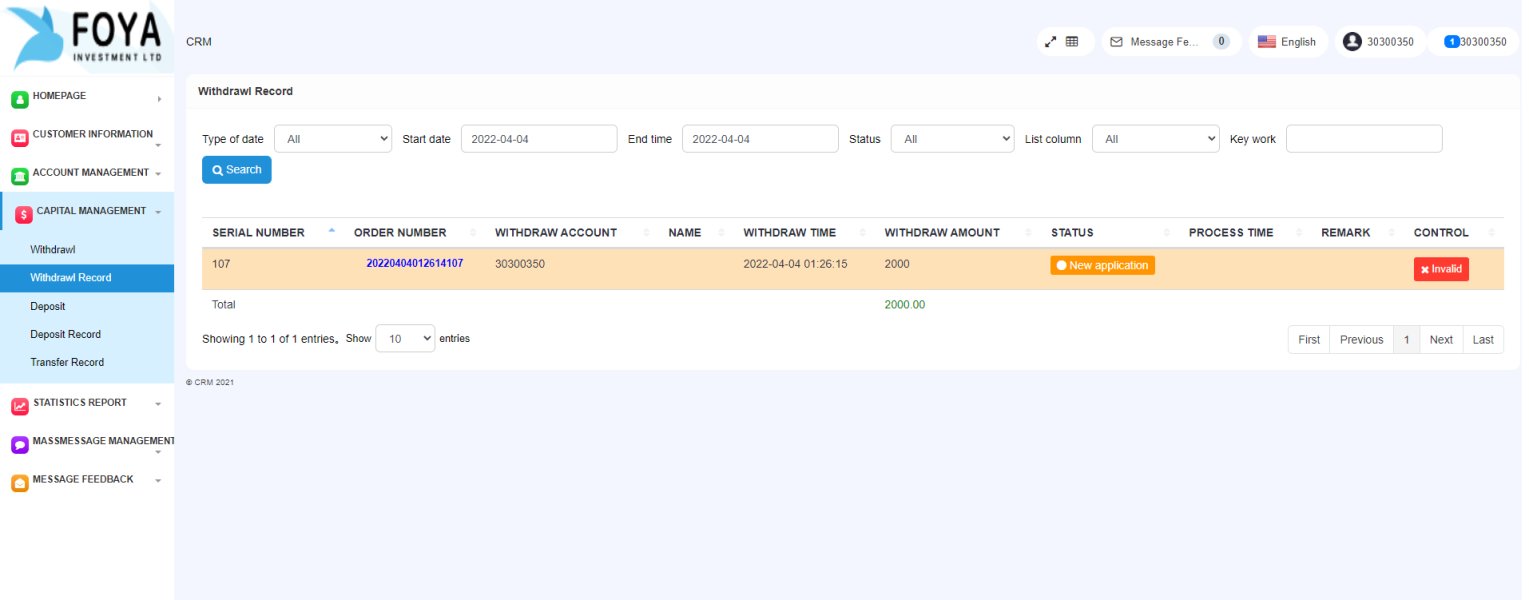

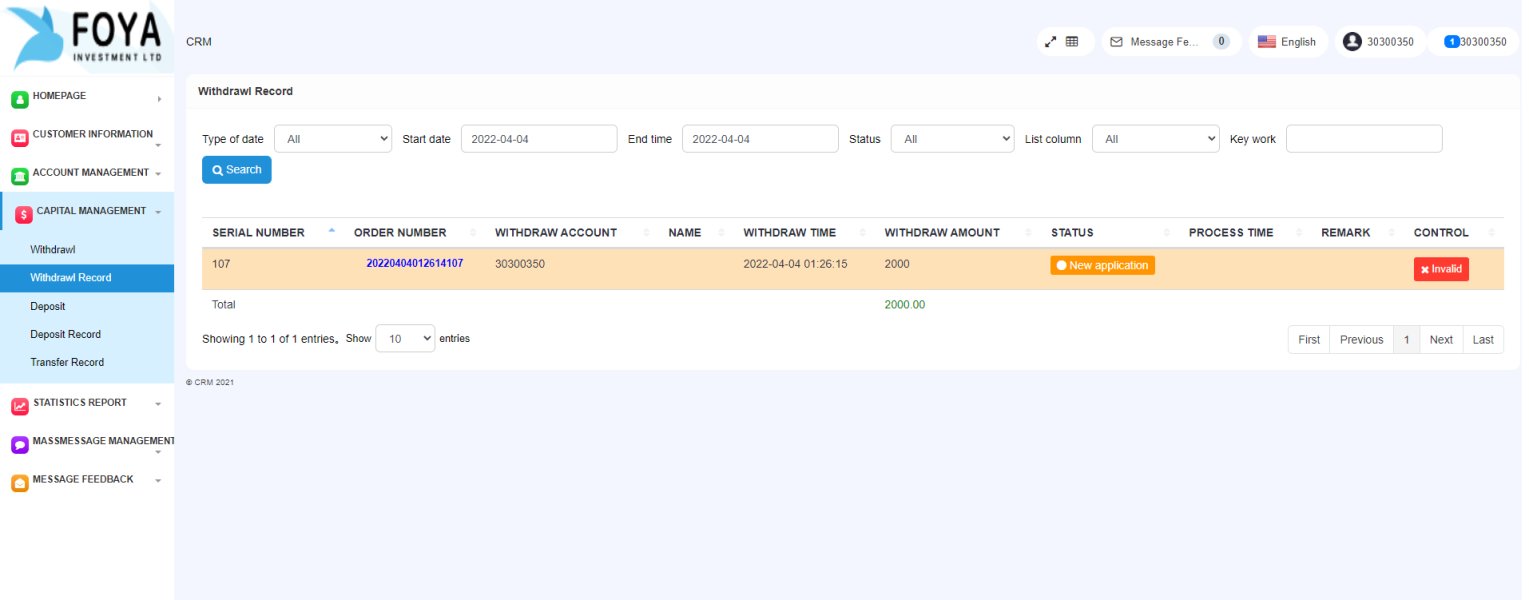

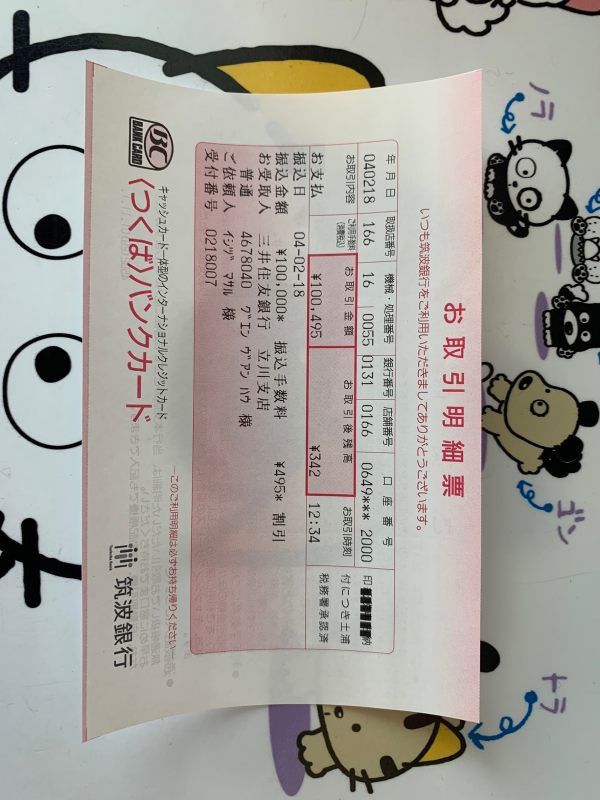

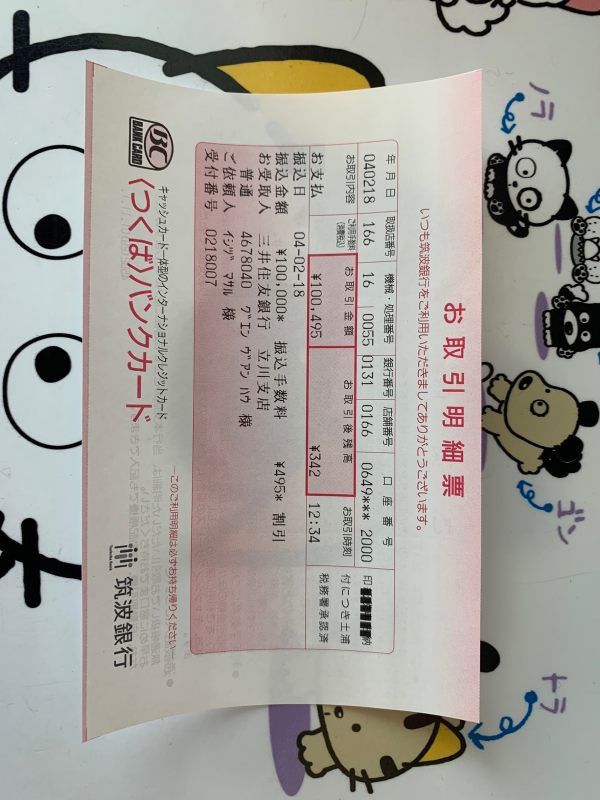

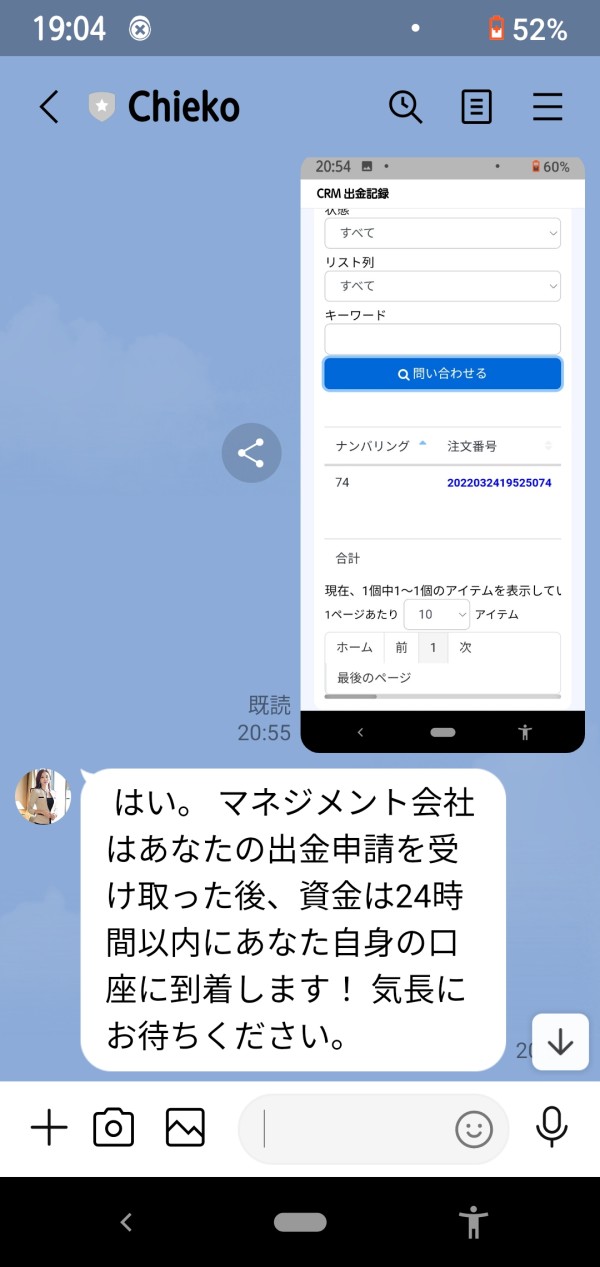

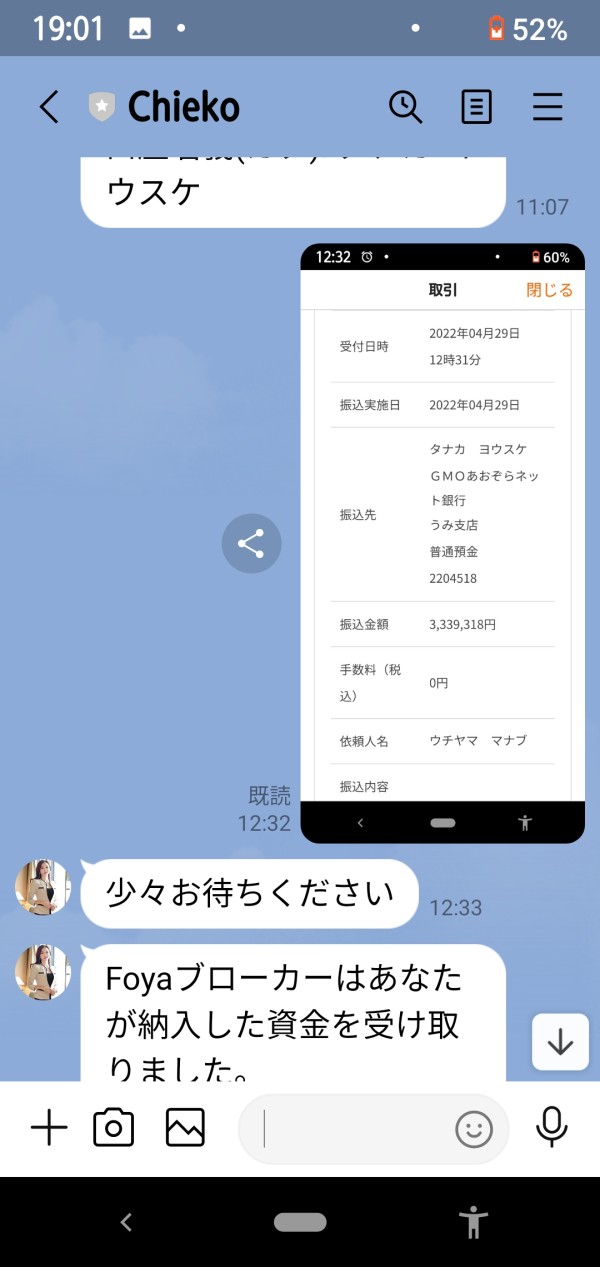

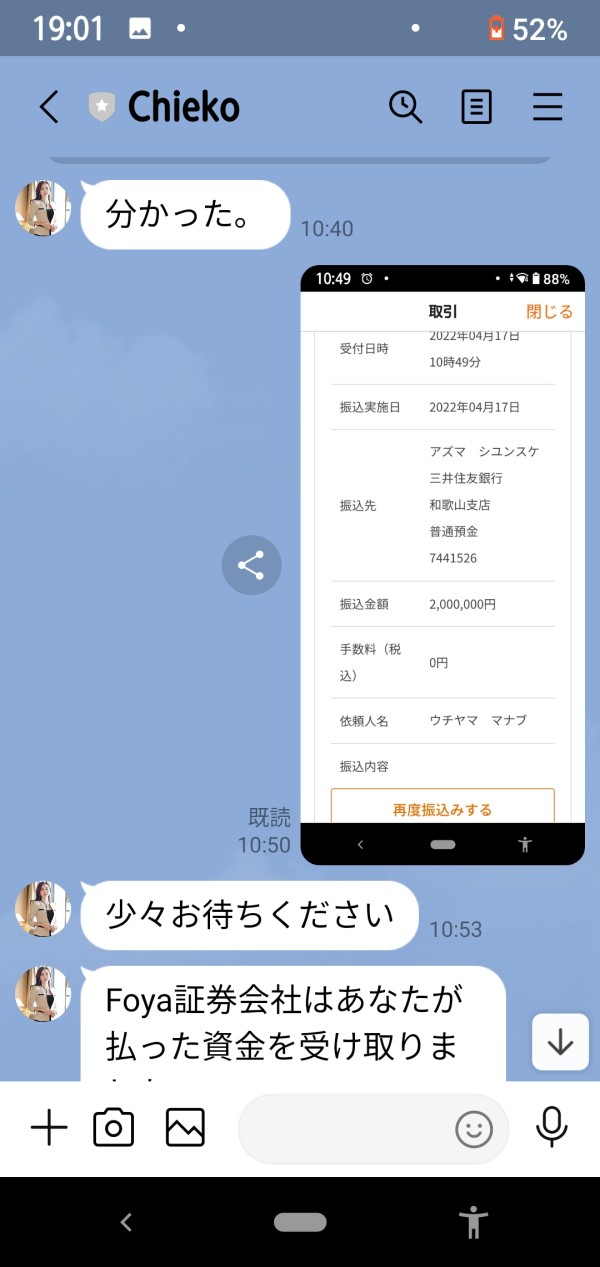

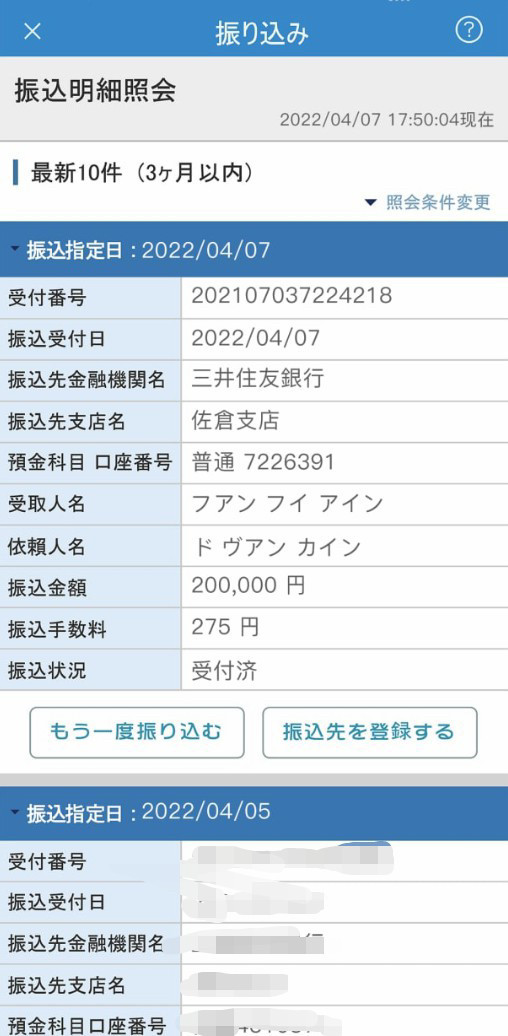

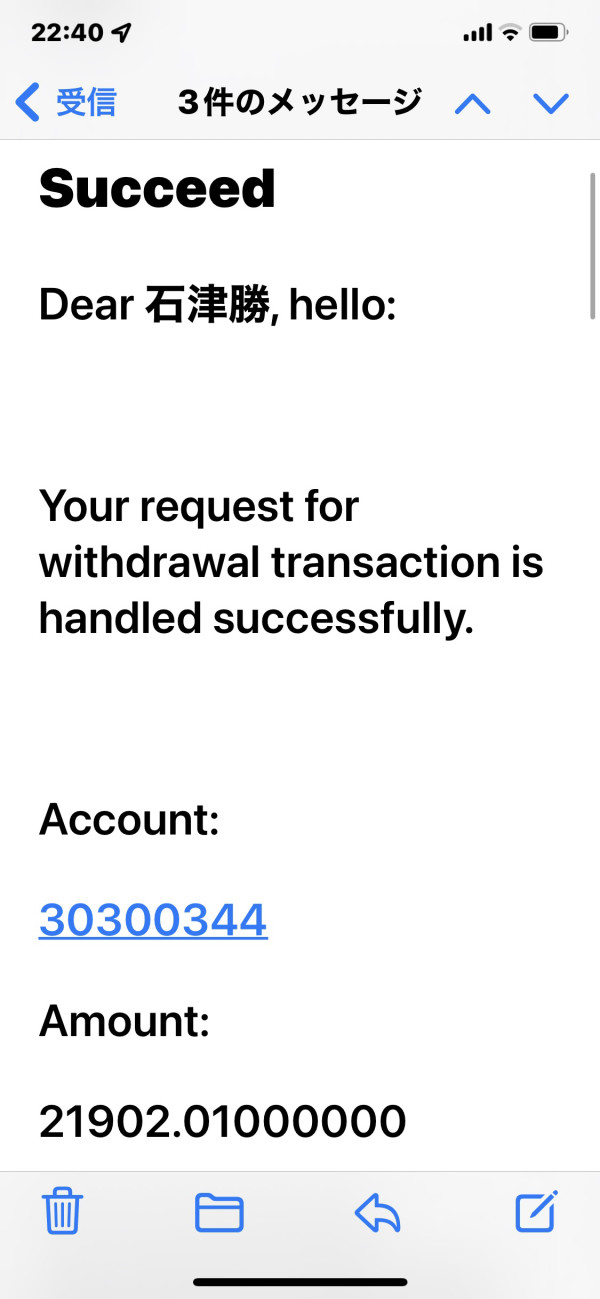

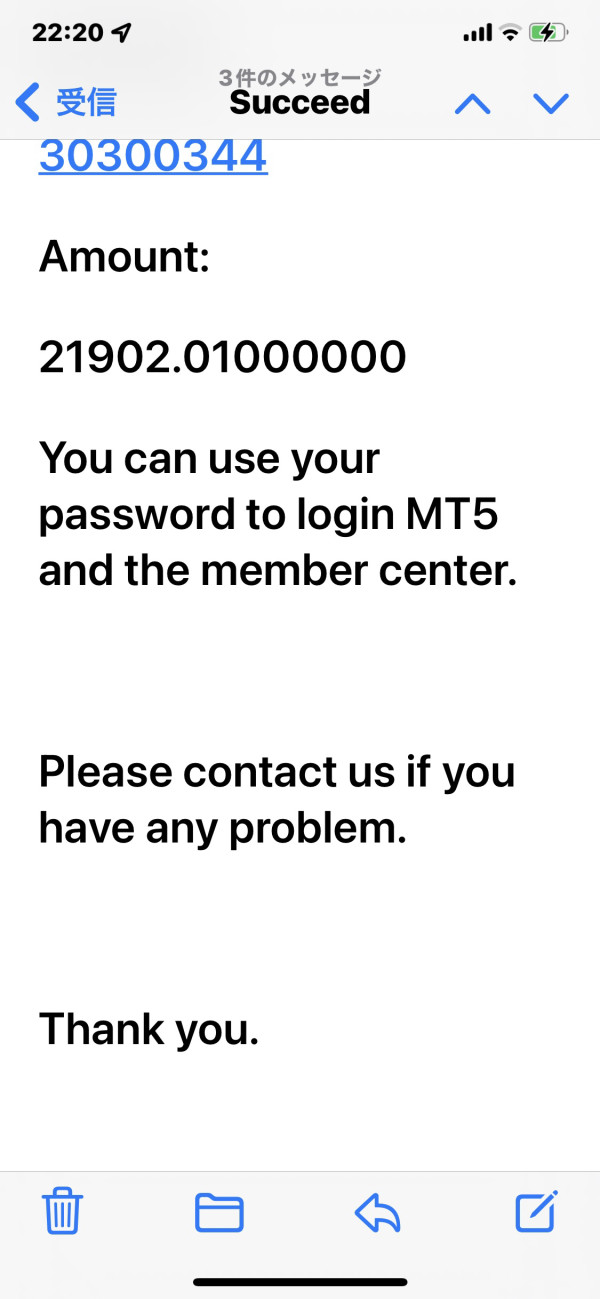

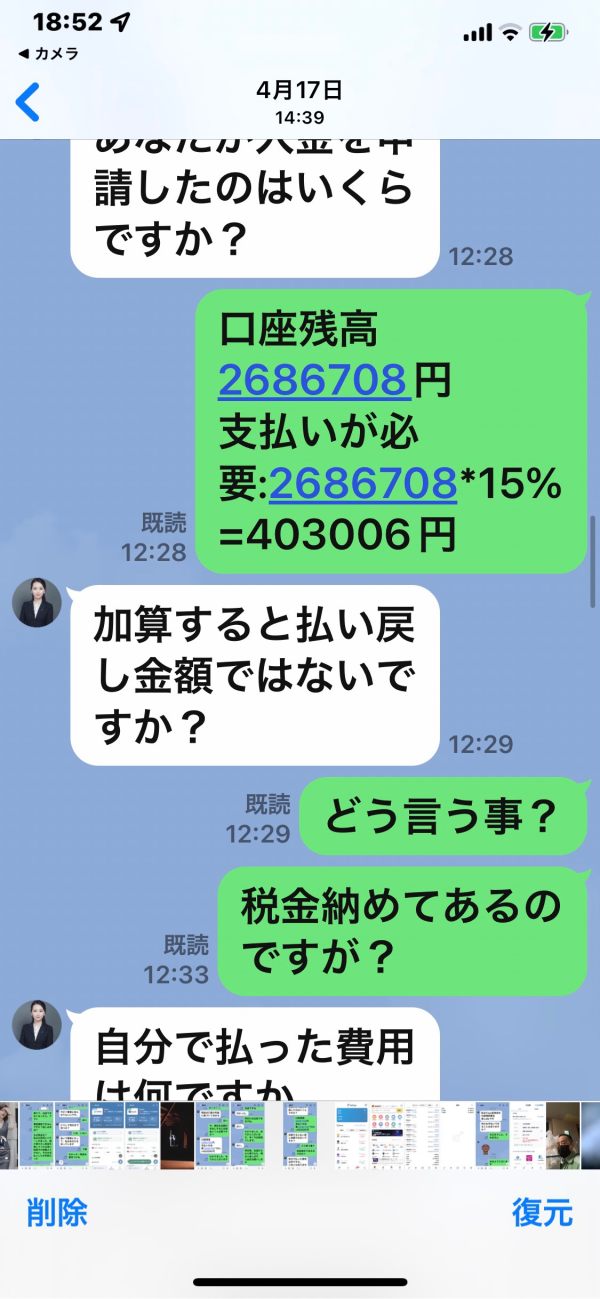

Deposit and Withdrawal Methods: We don't have specific information about funding options, processing times, and fees in available materials. Standard industry practices usually include bank transfers, credit cards, and electronic payment systems.

Minimum Deposit Requirements: The minimum deposit amount needed to open a trading account with FOYA isn't specified in available documentation, making it hard for potential clients to plan their investment approach.

Promotional Offers: We don't see details about welcome bonuses, trading incentives, or promotional campaigns in available sources. Many brokers use such programs to attract new clients and improve trading conditions.

Trading Assets: While FOYA may offer multiple asset classes, we don't have specific information about available forex pairs, commodities, indices, or other instruments in accessible materials.

Cost Structure: We lack detailed information about spreads, commissions, overnight fees, and other trading costs in current sources. Understanding fee structures is important for traders to evaluate total trading costs.

Leverage Options: Available leverage ratios and margin requirements aren't specified in the materials we reviewed, though this foya review notes that leverage policies vary a lot based on regulatory jurisdiction.

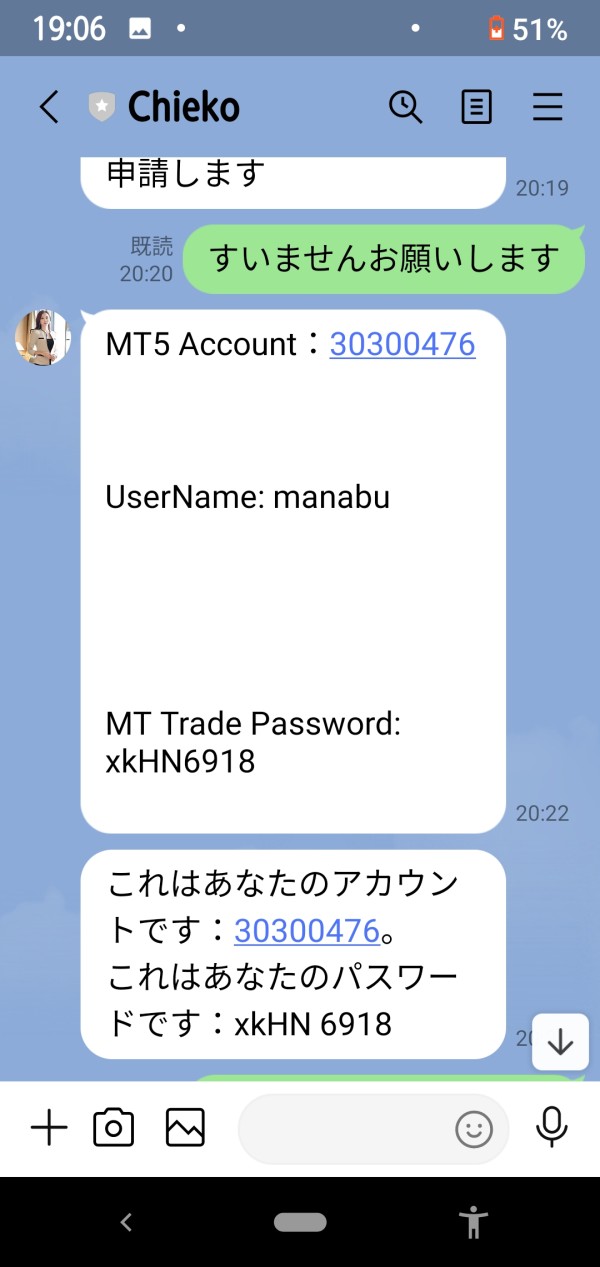

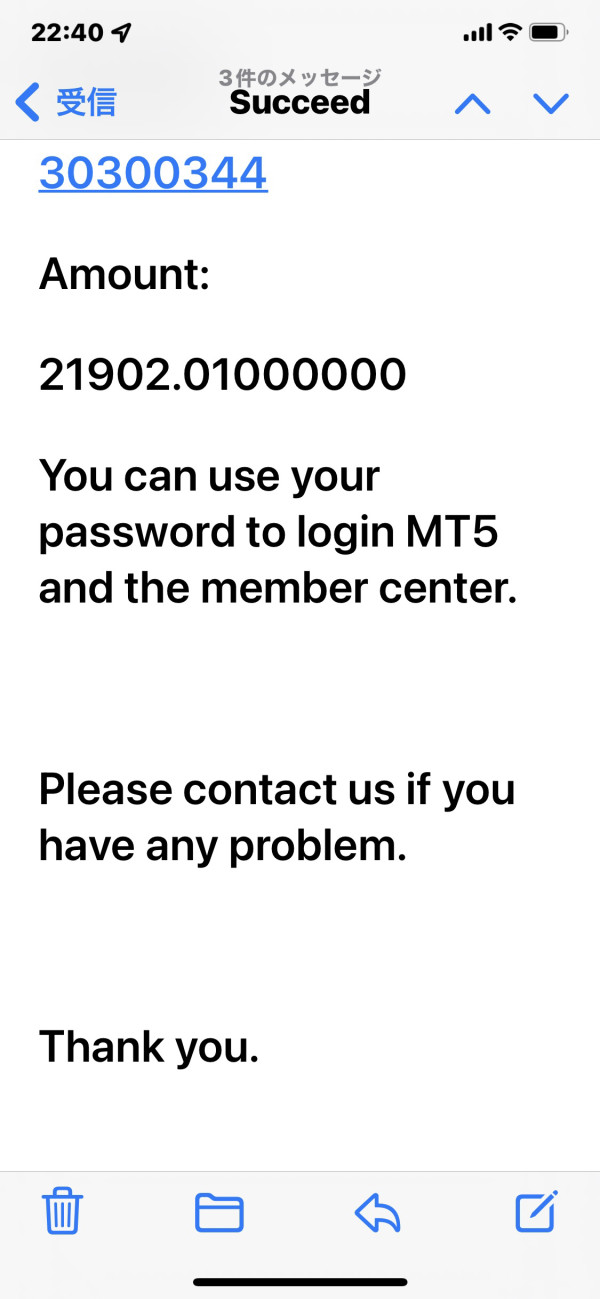

Trading Platforms: We don't have information about supported trading platforms, whether they're proprietary or third-party solutions like MetaTrader, in available sources.

Geographic Restrictions: We don't see details about service availability in different countries or regions in current documentation.

Customer Support Languages: Information about multilingual support options isn't available in the materials we reviewed.

Detailed Rating Analysis

Account Conditions Analysis

Evaluating FOYA's account conditions is hard because we don't have detailed information about account types, minimum deposit requirements, and specific trading terms. Standard industry practice involves offering multiple account levels with different features, but FOYA's account structure isn't documented in available sources.

We don't have information about demo account availability, Islamic account options, or professional trader classifications, so potential clients can't properly assess whether FOYA's account offerings match their trading needs and regulatory requirements. The absence of clear account opening procedures and verification requirements makes the evaluation process even harder.

Most established brokers give transparent information about account features, including leverage options, minimum trade sizes, and account maintenance requirements. The lack of such details in FOYA's case suggests either limited market presence or poor public communication about their services.

The scoring shows the big information gaps that prevent a complete assessment of account conditions. This foya review emphasizes that traders usually need detailed account information to make smart decisions about broker selection.

Assessment of FOYA's trading tools and resources faces big limitations due to insufficient publicly available information. Modern forex brokers usually provide complete trading platforms, analytical tools, market research, and educational resources to support trader success.

We don't have specific details about charting capabilities, technical indicators, automated trading support, or market analysis tools, so it's impossible to evaluate FOYA's technology offerings against industry standards. Educational resources, including webinars, tutorials, and market commentary, are standard broker offerings that aren't documented for FOYA.

Research and analysis capabilities, such as economic calendars, market news feeds, and expert commentary, are essential broker features that lack documentation in available sources. The absence of information about mobile trading applications or platform compatibility further limits our assessment of FOYA's technology infrastructure.

Trading tools quality and availability significantly impact trader experience and success potential. The limited information available prevents a meaningful evaluation of whether FOYA provides adequate technology support for different trading styles and experience levels.

Customer Service and Support Analysis

Evaluation of FOYA's customer service capabilities faces big constraints due to the absence of detailed information about support channels, availability, and service quality. Industry-standard customer service usually includes multiple contact methods, extended operating hours, and multilingual support capabilities.

We don't have information about live chat availability, email response times, phone support options, or help desk functionality, so potential clients can't assess FOYA's commitment to customer service excellence. The lack of documented support procedures or service level agreements raises questions about problem resolution capabilities.

Customer service quality often sets brokers apart in competitive markets, with traders expecting prompt, knowledgeable, and helpful support interactions. The absence of user testimonials or service quality metrics prevents evaluation of FOYA's performance in this critical area.

Professional customer support includes account management services, technical assistance, and trading guidance. Without documented information about these services, traders can't determine whether FOYA provides adequate support for their operational needs and trading objectives.

Trading Experience Analysis

Assessment of FOYA's trading experience relies heavily on platform performance, execution quality, and overall trading environment factors that aren't documented in available sources. Trading experience includes platform stability, order execution speed, price accuracy, and system reliability during various market conditions.

We don't have specific information about execution models, whether market maker or ECN, so traders can't evaluate potential conflicts of interest or execution quality expectations. Platform functionality, including order types, risk management tools, and trading automation capabilities, isn't specified in current documentation.

Mobile trading capabilities and cross-platform synchronization are increasingly important for modern traders, but FOYA's mobile offerings lack detailed documentation. The absence of platform performance metrics, uptime statistics, or execution quality reports prevents objective assessment of trading environment quality.

This foya review notes that trading experience significantly impacts trader satisfaction and success potential. The limited available information prevents complete evaluation of whether FOYA provides a competitive trading environment compared to established market participants.

Trust and Regulation Analysis

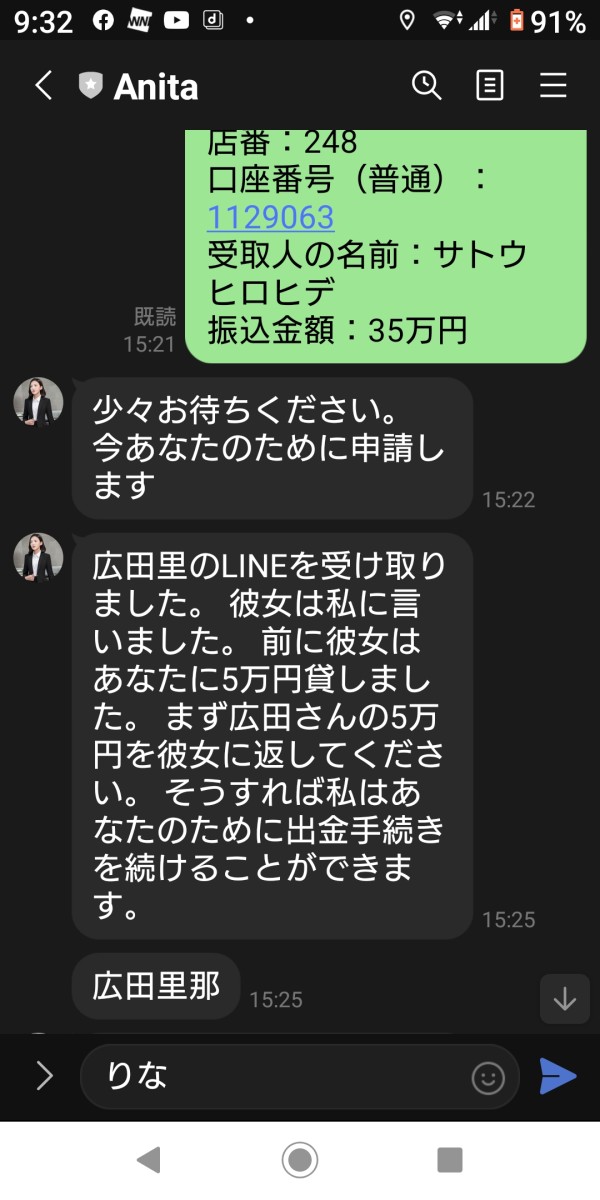

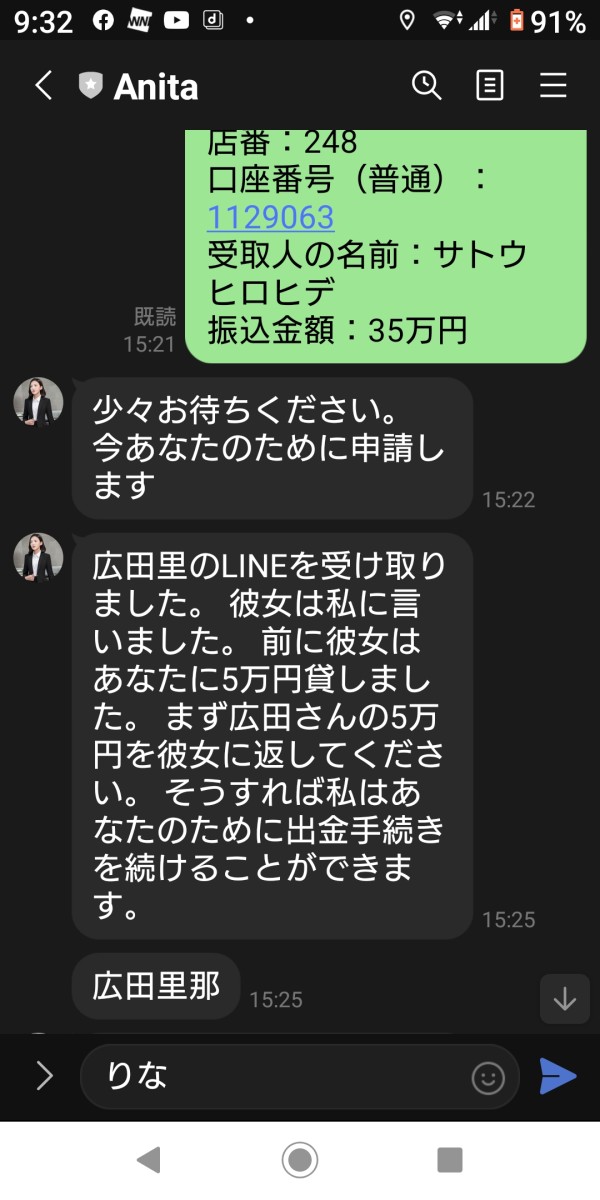

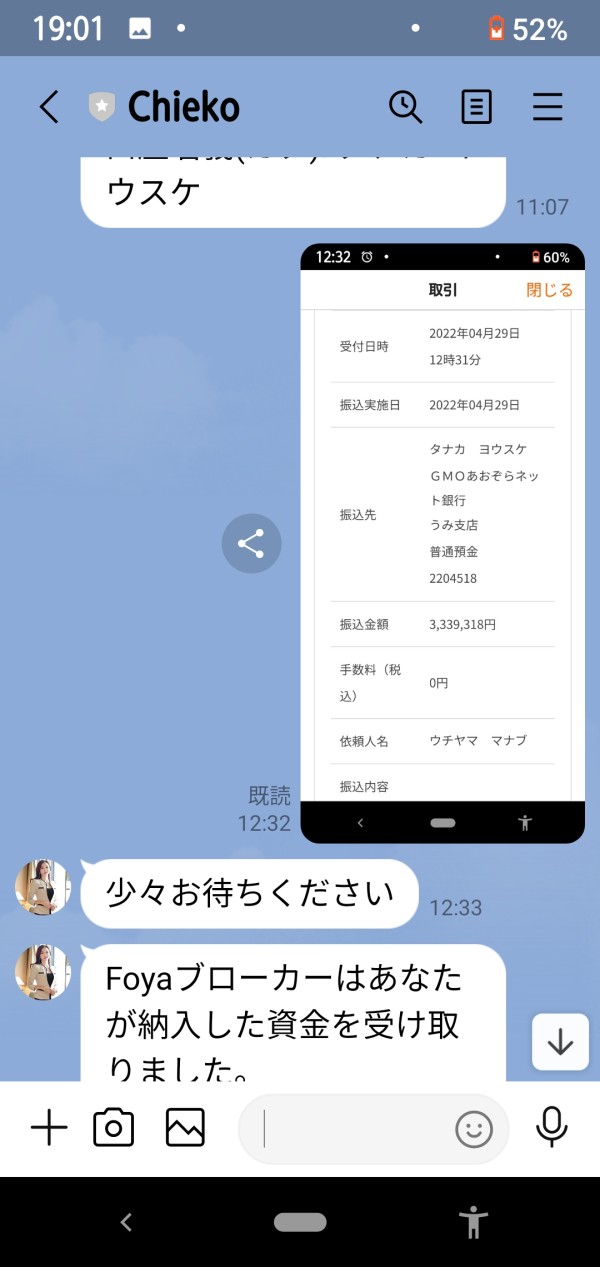

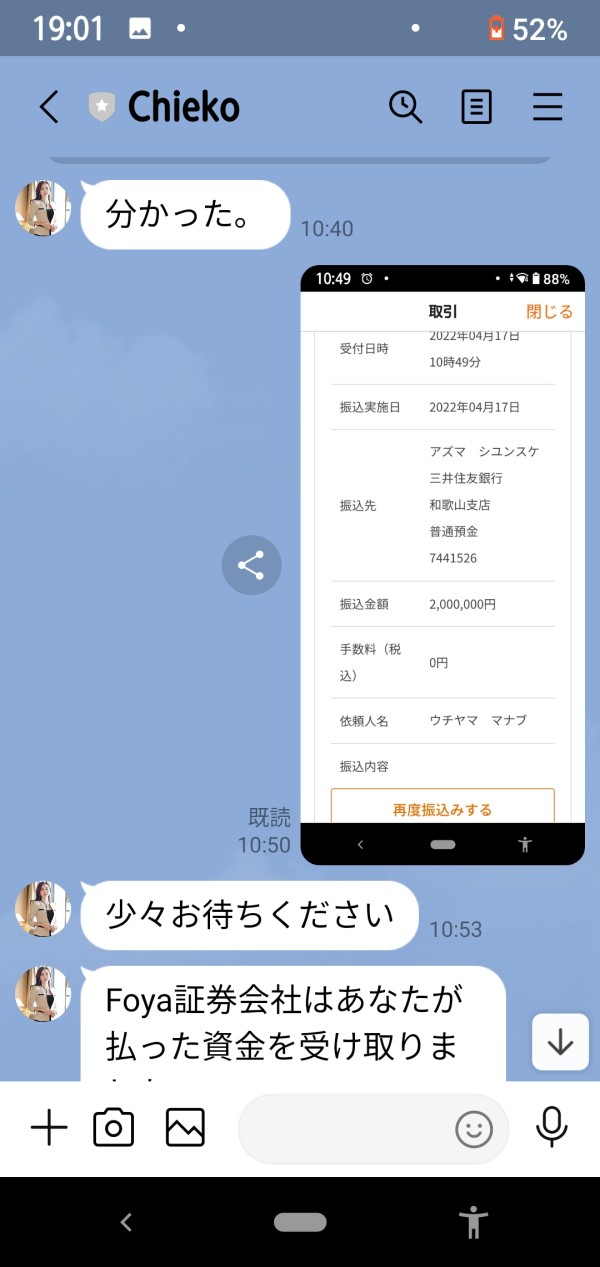

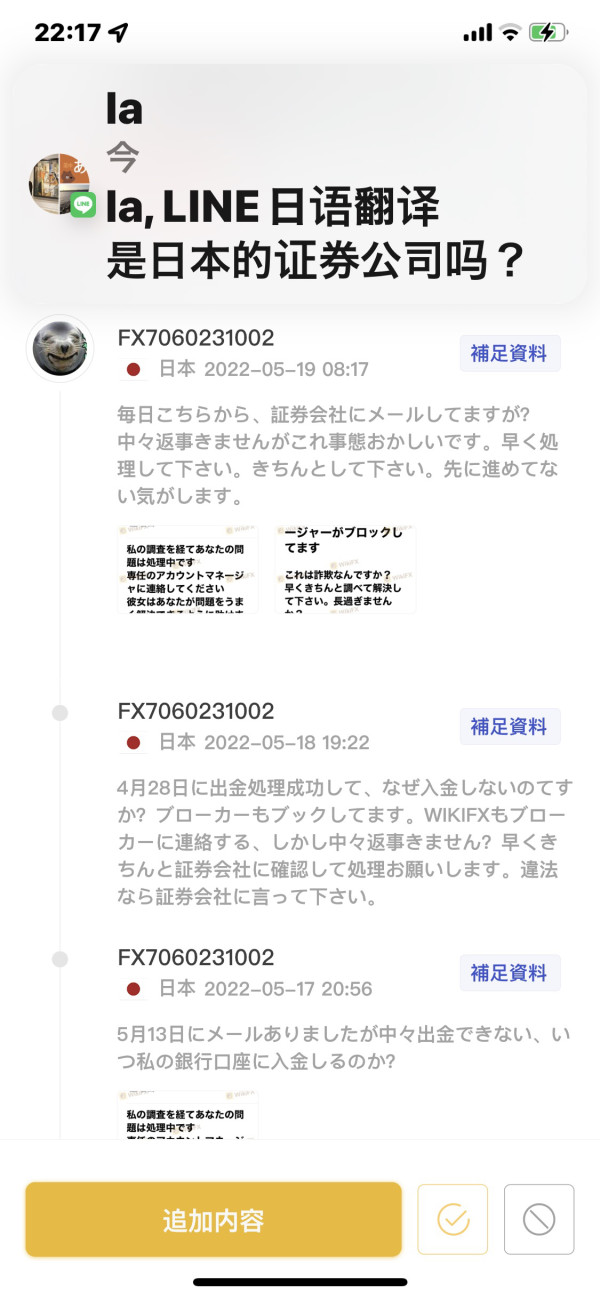

Trust and regulatory compliance represent perhaps the most concerning aspects of this FOYA evaluation due to the complete absence of clear regulatory information in available sources. Regulatory oversight provides essential client protections, including segregated fund requirements, dispute resolution mechanisms, and operational transparency standards.

We don't have documented regulatory licenses from recognized authorities such as FCA, CySEC, ASIC, or other major regulators, so traders face big uncertainty about client protection measures and legal recourse options. The absence of regulatory information raises serious questions about operational legitimacy and client fund security.

Industry best practices require brokers to maintain transparent regulatory disclosures, including license numbers, regulatory warnings, and compliance documentation. FOYA's lack of such information represents a big red flag for potential clients considering account opening.

Trust factors also include company transparency, financial stability, and industry reputation, all of which aren't documented in available sources. The absence of third-party audits, financial reporting, or industry recognition further undermines confidence in FOYA's operational credibility.

User Experience Analysis

User experience evaluation for FOYA faces big limitations due to the absence of client testimonials, user reviews, or detailed platform descriptions in available sources. User experience includes platform usability, account opening procedures, funding processes, and overall satisfaction with broker services.

We don't have documented user feedback about platform navigation, feature accessibility, or service quality, so potential clients can't gauge whether FOYA provides satisfactory user experiences compared to established competitors. The absence of user ratings or review platform presence suggests limited market adoption or customer engagement.

Registration and verification procedures usually impact initial user impressions, but FOYA's onboarding process lacks detailed documentation. Similarly, funding and withdrawal experiences, which significantly influence user satisfaction, aren't described in available materials.

Interface design, platform customization options, and overall system usability contribute to positive user experiences. The lack of detailed platform information prevents assessment of whether FOYA provides intuitive and efficient trading interfaces for different user types and experience levels.

Conclusion

This complete foya review reveals big information gaps that prevent a thorough evaluation of the broker's services and capabilities. While FOYA may operate as a legitimate brokerage firm, the absence of detailed information about regulatory status, trading conditions, platform offerings, and user experiences raises big concerns for potential clients.

The consistently low ratings across all evaluation criteria reflect the basic challenge of assessing a broker without adequate publicly available information. Traders seeking reliable brokerage partnerships usually require transparent information about regulatory compliance, trading costs, platform capabilities, and customer service quality.

Based on the limited information available, traders should exercise extreme caution when considering FOYA and should prioritize brokers with complete regulatory oversight, transparent operating conditions, and established market reputations. The forex market offers numerous well-regulated alternatives with documented track records and complete service offerings.