Is FOYA safe?

Pros

Cons

Is Foya Safe or a Scam?

Introduction

Foya Limited has emerged as a player in the forex trading market, positioning itself as a brokerage that offers various trading instruments, including forex, stocks, cryptocurrencies, and CFDs. However, as the forex market continues to grow, so does the number of dubious brokers, making it essential for traders to conduct thorough evaluations before committing their funds. The risks associated with trading can be exacerbated by choosing an unreliable broker, which is why assessing the legitimacy of Foya is critical. This article aims to provide an objective analysis of Foya's credibility, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risks. Our investigation draws from multiple sources, including user reviews, regulatory databases, and industry reports, to present a comprehensive overview of whether Foya is safe for traders.

Regulation and Legitimacy

The regulatory framework under which a brokerage operates is a crucial indicator of its legitimacy and reliability. Foya Limited claims to be regulated by the National Futures Association (NFA); however, upon verification, it appears that this claim does not align with the records available on the NFA's official website. The absence of valid regulatory oversight raises significant concerns regarding the broker's credibility and operational integrity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | Not applicable | United States | Not verified |

This lack of regulation is particularly alarming, as unregulated brokers can engage in practices that are detrimental to traders, such as misappropriating funds or providing misleading information about trading conditions. The regulatory quality is paramount in safeguarding traders' interests, and Foya's dubious claims about its regulatory status suggest a potential risk for those considering trading with them. Given the absence of credible oversight, it is advisable for traders to approach Foya with caution.

Company Background Investigation

Foya Limited was incorporated in the United Kingdom and has been operating for approximately 1-2 years. However, details about its ownership structure and management team remain vague, raising questions about transparency. The broker's website lacks comprehensive information about its founders or the qualifications of its management team, which is a red flag in the financial services industry.

Transparency in ownership and management is vital for establishing trust. A reliable broker typically provides detailed information about its team and their professional backgrounds. In contrast, Foyas failure to disclose such information could indicate a lack of accountability, which is essential for any financial institution.

Furthermore, the absence of a clear operational history or track record of compliance with regulatory standards further diminishes the broker's credibility. Traders should be wary of engaging with a broker that does not provide sufficient information about its operations and leadership.

Trading Conditions Analysis

Foya Limited presents an array of trading conditions, including a minimum deposit requirement of $250 and leverage ratios of up to 1:500. While these features may appear attractive to potential traders, it is crucial to delve deeper into the cost structure associated with trading on this platform.

| Fee Type | Foya Limited | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 0.0 pips | Varies (typically 1-2 pips) |

| Commission Model | Not specified | Typically ranges from $5 to $10 per lot |

| Overnight Interest Range | Not specified | Varies (typically 0.5% to 2%) |

The competitive spreads advertised by Foya may seem appealing; however, the lack of clarity regarding commissions and overnight fees raises concerns. Traders often face hidden costs that can significantly impact their profitability. Moreover, the absence of a demo account for practice trading further complicates the evaluation of Foya's trading conditions, as potential users cannot assess the platform's functionality or execution quality before committing real funds.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Foya Limiteds practices regarding fund security remain unclear. There is no available information on whether customer funds are kept in segregated accounts, which is a standard practice among reputable brokers to protect client assets from operational risks.

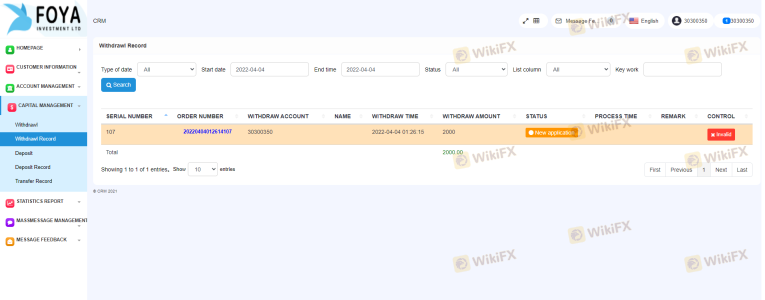

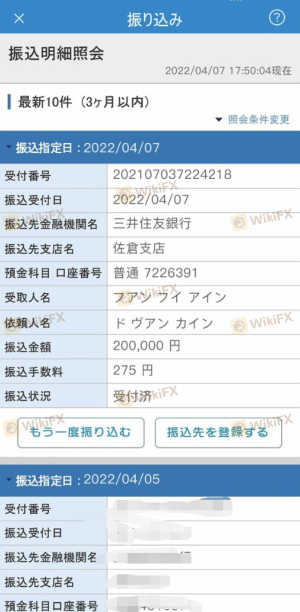

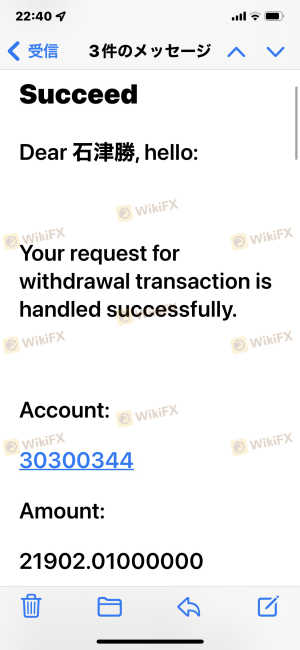

Additionally, the absence of investor protection measures, such as negative balance protection, further exacerbates the risk associated with trading on Foya. Historical issues related to fund withdrawals have been reported by users, indicating potential problems with accessing their own money. Such experiences are alarming and suggest that traders may face significant challenges in retrieving their funds, especially in adverse market conditions.

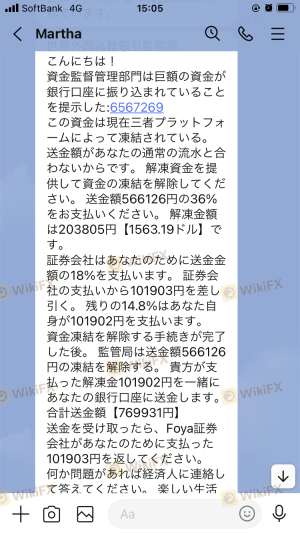

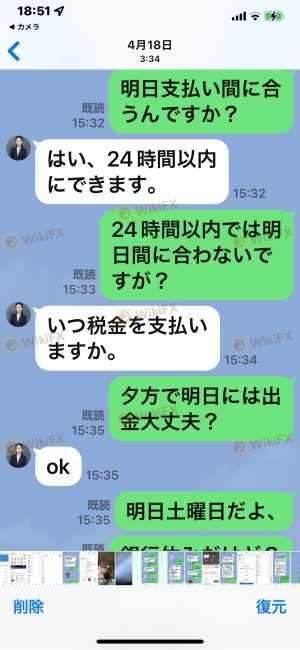

Customer Experience and Complaints

Customer feedback is an essential component in assessing the reliability of a broker. Reviews of Foya Limited reveal a concerning pattern of complaints, particularly regarding withdrawal issues. Many users have reported difficulties in accessing their funds, with some stating that withdrawal requests remain unprocessed for extended periods.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Lack of Transparency | Medium | Limited clarification provided |

| Poor Customer Support | High | Primarily email-based, slow response |

Typical cases include users who reported being unable to withdraw substantial amounts, leading to frustration and loss of trust in the broker. Such experiences highlight the potential risks associated with trading on the Foya platform. The lack of timely and effective customer support exacerbates these issues, leaving traders feeling vulnerable and unsupported.

Platform and Execution

The trading platform offered by Foya Limited has not been explicitly disclosed, creating uncertainty about the tools and features available to traders. A reliable platform should provide robust functionality, including advanced charting tools, order types, and automated trading capabilities.

Concerns about order execution quality, including slippage and rejection rates, are also prevalent. Traders need assurance that their orders will be executed promptly and accurately, particularly in volatile market conditions. The absence of detailed information regarding the trading platform raises suspicions about its reliability and user-friendliness, which are critical for a successful trading experience.

Risk Assessment

Engaging with Foya Limited entails various risks that potential traders should consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns about legitimacy. |

| Withdrawal Risk | High | Reports of unresolved withdrawal requests. |

| Transparency Risk | Medium | Lack of information about management and operations. |

| Platform Reliability | High | Unclear platform features and execution quality. |

To mitigate these risks, traders are advised to conduct thorough due diligence, seek out well-regulated brokers, and consider starting with smaller investments to gauge the broker's reliability before committing larger amounts of capital.

Conclusion and Recommendation

In conclusion, Foya Limited presents a mixed picture for traders. While it offers attractive trading conditions, significant concerns regarding its regulatory status, customer fund safety, and overall transparency raise red flags. The absence of credible regulatory oversight and the reported difficulties with withdrawals suggest that Foya is not safe for traders.

Given the potential risks associated with trading on the Foya platform, it is advisable for traders to exercise caution. For those seeking reliable alternatives, consider brokers that are well-regulated, transparent about their operations, and have a proven track record of customer service. Some reputable options include brokers regulated by the FCA or ASIC, which offer robust investor protection and a more secure trading environment.

Is FOYA a scam, or is it legit?

The latest exposure and evaluation content of FOYA brokers.

FOYA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FOYA latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.