Forex Limited 2025 Review: Everything You Need to Know

Executive Summary

This forex limited review looks at the broker's performance. We check user feedback, trading conditions, and industry standards to make our evaluation. Forex Limited is a regulated forex broker that works with new and intermediate traders.

The platform has several good features that make it attractive. Regulatory oversight gives users confidence in their trading. The minimum deposit is only $100, which helps new traders get started easily. Competitive leverage goes up to 1:200, and this appeals to experienced traders who want more market exposure.

Forex Limited gets a neutral rating based on available feedback and trading conditions. The broker does well with user satisfaction and accessibility. This is especially true for people entering the forex market with limited money. However, some areas need improvement, including transparency about regulatory information and detailed platform specifications.

The reasonable entry requirements and user satisfaction with platform stability make Forex Limited worth considering. Traders who want a straightforward trading environment might like this broker. However, potential users should do thorough research since limited regulatory details are publicly available.

Important Disclaimer

Regional Entity Differences: Forex Limited may operate under different rules in various countries. Different nations have varying regulatory requirements, investor protection measures, and compensation schemes. The services, trading conditions, and legal protections available may differ significantly depending on your location and the specific entity serving your region.

Review Methodology: This evaluation uses comprehensive analysis of user feedback, available market data, and industry benchmarks. However, specific regulatory information including detailed licensing numbers and supervisory authorities was not clearly specified in available materials. Potential traders should verify regulatory status and get complete terms and conditions directly from the broker before opening accounts.

Rating Framework

Broker Overview

Forex Limited works as a forex trading broker. The company provides currency trading services and related financial tools to retail traders. While the exact establishment date was not specified in available materials, the company says it is a regulated entity serving traders across multiple experience levels.

The broker's business model focuses on providing forex trading access through external platforms. They also offer analytical support and customer service infrastructure. The company makes trading accessible for new traders through its low minimum deposit requirement while offering leverage ratios that attract more experienced market participants.

User feedback suggests that Forex Limited focuses on platform stability and execution quality. However, specific details about the underlying trading technology and platform partnerships were not detailed in available sources. This forex limited review finds that while the broker presents competitive basic conditions, potential traders may need to request additional information directly from the company to fully understand the complete service offering and regulatory framework under which they would be trading.

Regulatory Framework: Available information shows that Forex Limited operates under regulatory oversight. However, specific regulatory authorities, license numbers, and jurisdictional details were not provided in source materials. Traders should verify regulatory status directly with the broker.

Deposit and Withdrawal Methods: Specific funding methods were not detailed in available materials. The minimum deposit requirement is set at $100, making the platform accessible for new traders with limited capital.

Minimum Deposit Requirements: The $100 minimum deposit is competitive compared to many industry players. This is particularly beneficial for novice traders testing their strategies with limited risk exposure.

Promotional Offerings: Information about bonus programs, promotional campaigns, or new trader incentives was not specified in available source materials.

Tradeable Assets: The broker focuses on forex trading. However, specific details about available currency pairs, exotic pairs, or additional asset classes were not provided in source materials.

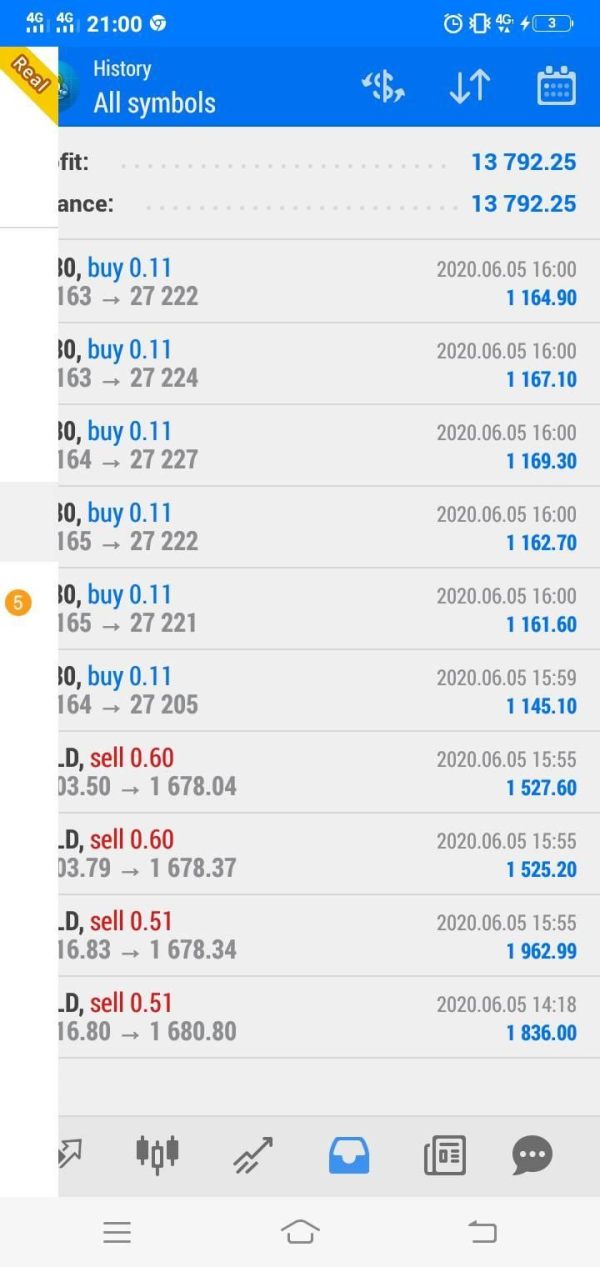

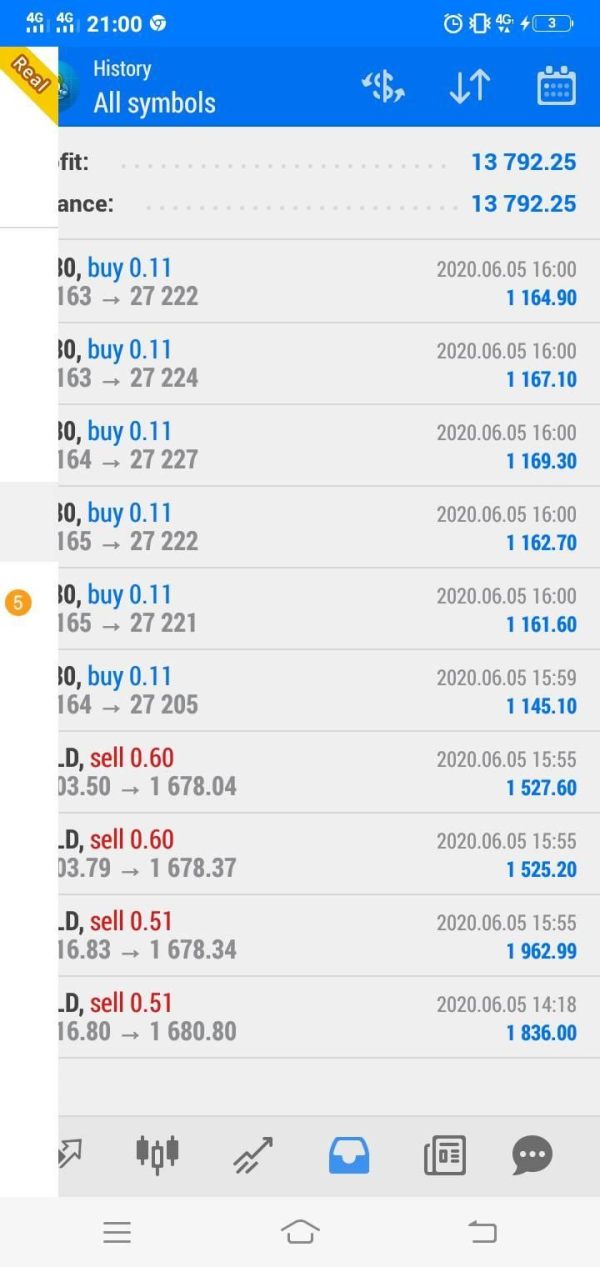

Cost Structure: Spreads begin from 1.57 pips according to available information. Commission structures, overnight financing rates, and additional fees were not detailed, requiring direct inquiry with the broker for complete cost transparency.

Leverage Ratios: Maximum leverage reaches 1:200. This provides significant market exposure potential while remaining within reasonable risk management parameters for experienced traders.

Platform Selection: Specific trading platform details were not specified in available materials. This includes whether the broker uses MetaTrader, proprietary platforms, or other solutions.

Geographic Restrictions: Information about restricted countries or regional limitations was not provided in source materials.

Customer Support Languages: Available support languages were not specified. However, the broker maintains dedicated support teams for account and technical assistance.

Account Conditions Analysis

Forex Limited's account structure focuses on accessibility and competitive trading conditions. The $100 minimum deposit requirement positions the broker well for new traders. These traders want to enter the forex market without substantial initial capital commitment.

This low barrier to entry aligns with the broker's targeting of novice and intermediate traders. However, specific account types and their respective features were not detailed in available materials. The leverage offering up to 1:200 provides traders with significant market exposure potential while remaining within reasonable risk parameters.

This leverage ratio appeals to intermediate traders seeking enhanced position sizing capabilities. It avoids the extreme risk associated with higher leverage products. However, potential traders should note that specific account opening procedures, verification requirements, and any special account features such as Islamic accounts were not specified in source materials.

User feedback in this forex limited review suggests general satisfaction with the trading conditions offered. However, traders seeking specific account features or premium services may need to inquire directly with the broker. The combination of low minimum deposits and competitive leverage suggests that Forex Limited aims to balance accessibility with trading flexibility.

The absence of detailed account tier information limits complete evaluation of the account condition landscape.

Forex Limited provides trading tools and analytical resources to support client trading decisions. However, specific platform details were not comprehensively outlined in available materials. The broker offers daily and weekly analysis reports that provide market insights and trading perspectives.

These reports can be valuable for traders seeking external market analysis to supplement their own research efforts. The availability of trading tools through external platforms suggests that Forex Limited may operate as an introducing broker or utilize third-party technology solutions. While this approach can provide access to established trading infrastructure, the specific platforms, charting capabilities, technical indicators, and analytical tools available were not detailed in source materials reviewed for this evaluation.

User feedback indicates satisfaction with the tools provided. This suggests that the analytical resources and trading infrastructure meet basic trader requirements. However, traders seeking advanced features such as algorithmic trading support, custom indicator capabilities, or sophisticated backtesting tools may need to verify availability directly with the broker.

Educational resources, webinars, or trading tutorials were not mentioned in available materials. This represents a potential area for service enhancement.

Customer Service and Support Analysis

Forex Limited maintains a dedicated support team specifically focused on account setup assistance and technical issue resolution. User feedback suggests general satisfaction with the support quality provided. This indicates that the broker prioritizes responsive customer service as part of its value proposition.

The availability of specialized support for both account-related and technical matters suggests a structured approach to customer service. However, specific details about support channels, response times, and availability hours were not provided in source materials. The absence of information about multilingual support capabilities may be a consideration for international traders, particularly those preferring support in languages other than English.

User testimonials indicate positive experiences with the support team's ability to resolve issues and provide assistance when needed. However, this evaluation could not verify specific response time metrics, escalation procedures, or the breadth of issues that the support team can effectively address. Traders requiring specialized support for complex trading strategies or technical platform issues should verify the support team's capabilities directly with the broker before committing to the platform.

Trading Experience Analysis

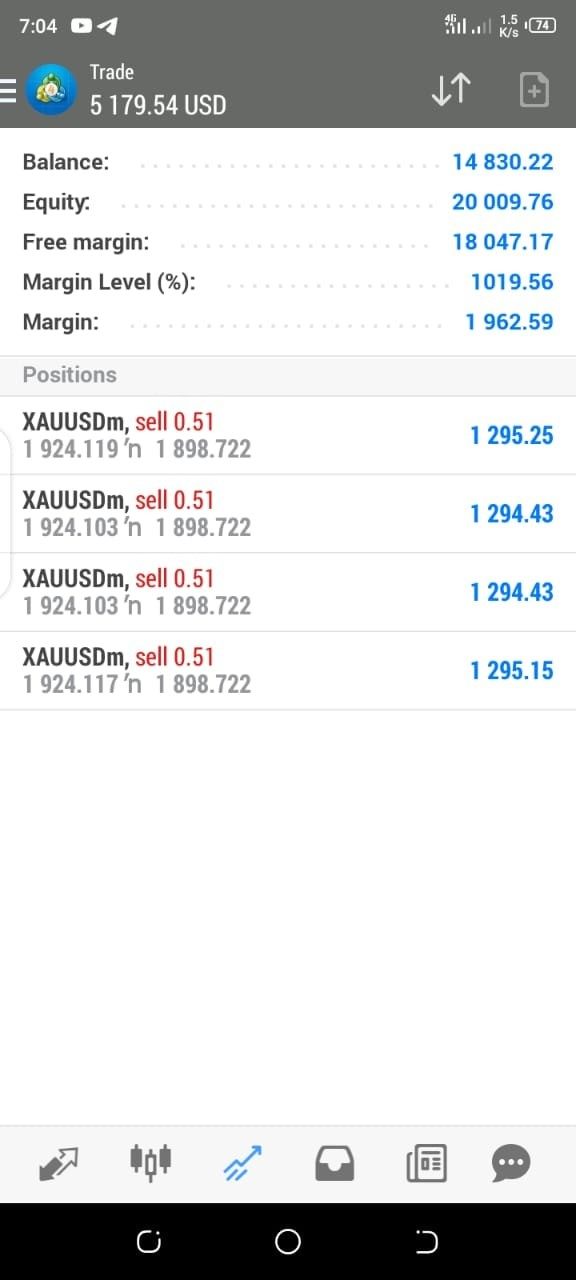

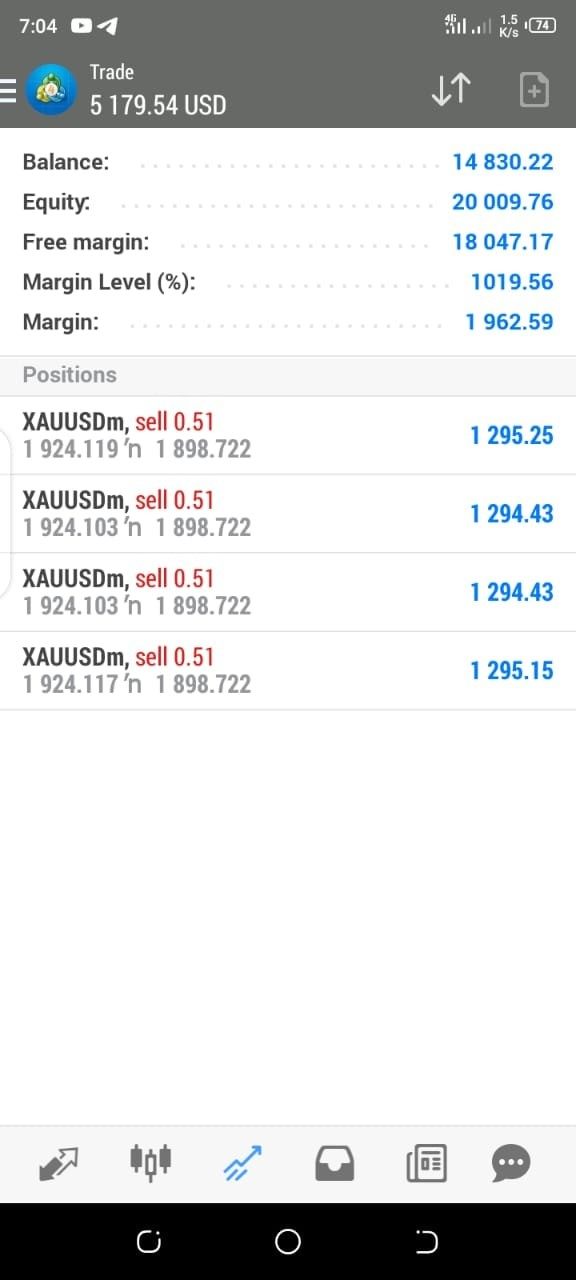

User feedback consistently indicates positive experiences with platform stability and execution speed. These are fundamental requirements for effective forex trading. The reported fast execution times suggest that Forex Limited's technology infrastructure can handle order processing efficiently.

This is crucial for traders seeking to capitalize on market movements without significant slippage concerns. Platform stability feedback indicates that users experience consistent access to trading functionality without frequent disconnections or technical disruptions. This reliability is particularly important for active traders who need dependable platform performance during volatile market conditions.

However, specific technical performance metrics, server location details, or uptime statistics were not available for verification in this forex limited review. The trading environment appears to maintain stable spreads according to user reports. However, detailed spread analysis across different market conditions and trading sessions was not available in source materials.

Mobile trading capabilities, advanced order types, and platform customization options were not specifically addressed. This potentially limits evaluation for traders requiring sophisticated trading tools. Overall user satisfaction with the trading experience suggests that Forex Limited meets basic performance expectations.

Traders with advanced technical requirements should verify specific capabilities directly with the broker.

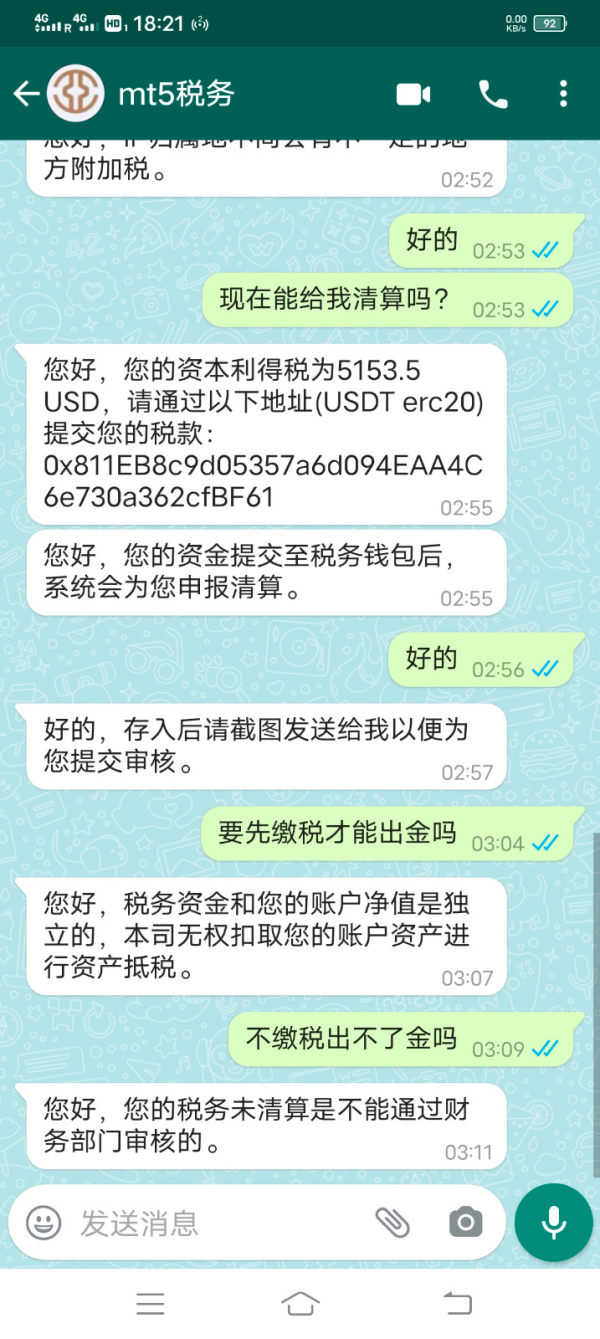

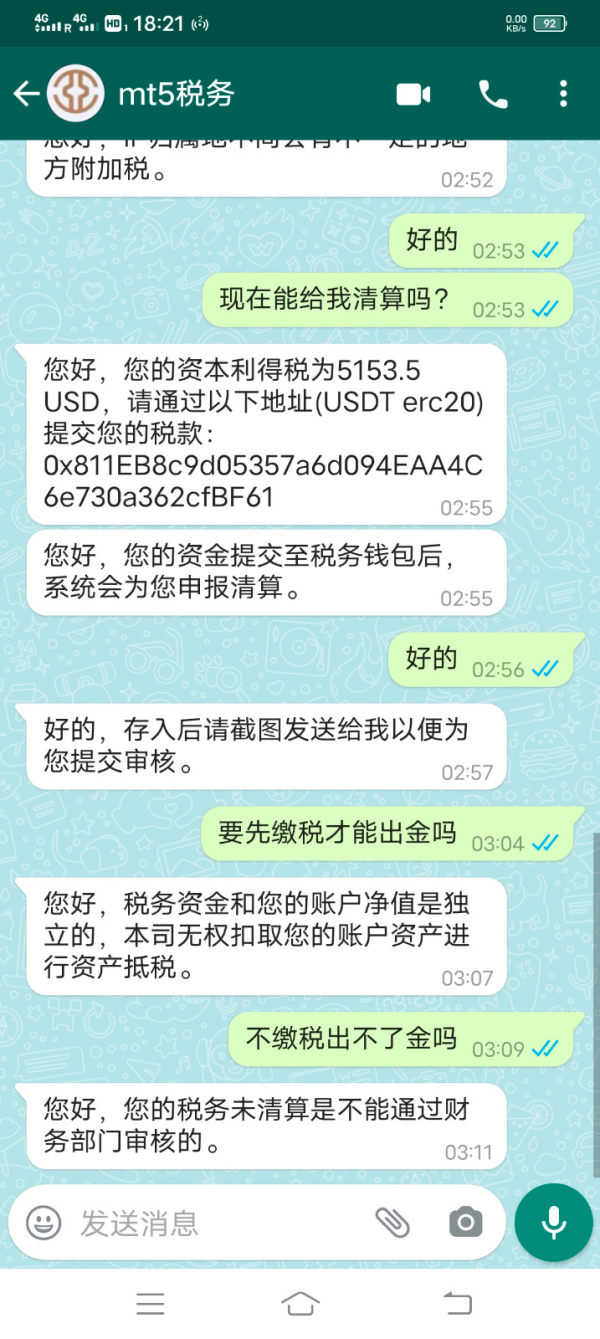

Trust and Reliability Analysis

The regulatory status of Forex Limited presents both strengths and areas requiring clarification. While the broker claims regulatory oversight, specific regulatory authorities, license numbers, and jurisdictional details were not provided in available materials. This lack of detailed regulatory transparency represents a significant consideration for traders prioritizing regulatory clarity and investor protection verification.

The absence of specific regulatory information makes it challenging to verify the exact investor protections, compensation schemes, or regulatory oversight mechanisms that would apply to client accounts. Different regulatory jurisdictions offer varying levels of investor protection. Traders should obtain complete regulatory details directly from the broker before opening accounts.

User feedback suggests general confidence in the broker's operations. However, the lack of detailed regulatory transparency may concern traders who prioritize comprehensive due diligence. Third-party ratings, industry awards, or independent verification of regulatory status were not available in source materials.

The broker's handling of any past regulatory issues, compliance matters, or negative events was not documented in available information. This limits complete trust assessment.

User Experience Analysis

Overall user satisfaction with Forex Limited appears positive based on available feedback. Traders express general contentment with the platform's performance and service delivery. The broker's targeting of novice and intermediate traders appears well-aligned with user experiences.

This suggests that the platform meets the needs of its intended audience effectively. User feedback indicates satisfaction with the overall trading environment. However, specific details about interface design, platform navigation, registration procedures, and account verification processes were not detailed in available materials.

The positive user sentiment suggests that Forex Limited successfully delivers on basic trading requirements and customer expectations. The absence of detailed user complaints or specific areas of dissatisfaction in available materials may indicate either generally positive user experiences or limited availability of comprehensive user feedback data. Traders considering the platform should note that while available feedback is positive, the limited scope of detailed user experience information may warrant direct communication with existing users or trial account testing to fully evaluate platform suitability for individual trading needs.

Conclusion

Forex Limited presents itself as a regulated forex broker offering reasonable trading conditions. These conditions appear well-suited for novice and intermediate traders. The combination of a low $100 minimum deposit, leverage up to 1:200, and positive user satisfaction feedback creates a foundation for consideration by traders seeking accessible forex trading opportunities.

However, this forex limited review identifies significant areas requiring clarification, particularly regarding specific regulatory details and comprehensive platform information. While user feedback suggests general satisfaction with platform performance and customer service, the limited availability of detailed regulatory and technical specifications may concern traders prioritizing complete transparency. Potential users should conduct thorough due diligence and obtain complete regulatory and service information directly from the broker before making trading decisions.