EuroTrader 2025 Review: Everything You Need to Know

Executive Summary

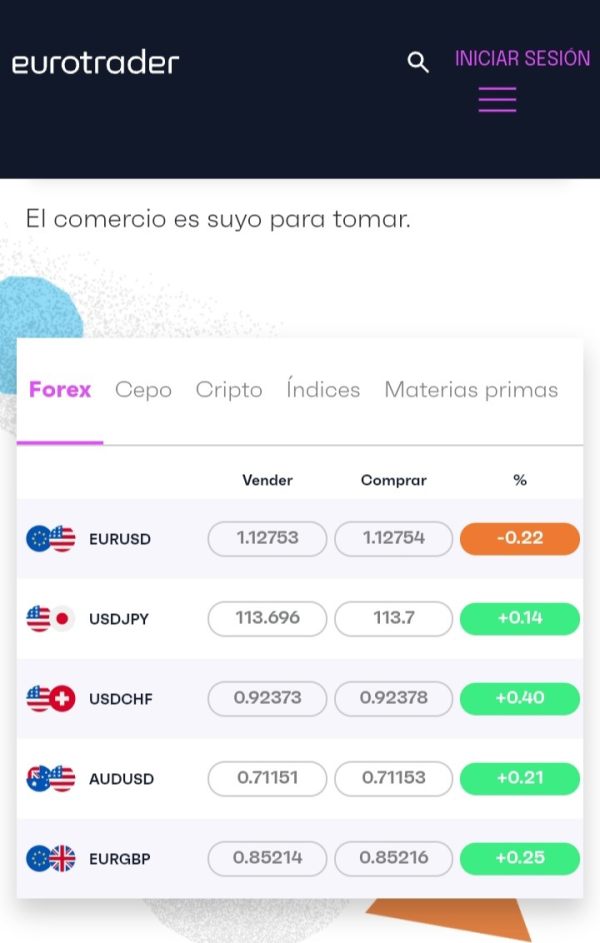

This comprehensive EuroTrader review examines one of the regulated online forex and CFD trading platforms that has been serving traders since 2018. EuroTrader works as a part of Eurotrade Investments RGB Ltd. The company offers many different trading tools including forex, stocks, indices, commodities, and cryptocurrencies through the popular MT4 and MT5 platforms.

Multiple sources show that EuroTrader maintains regulatory oversight from several authorities including CySEC (license no. 279/15), FCA, FSCA, FSC, and FSA. This gives traders multiple layers of protection. The broker targets small to medium-sized traders with a competitive minimum deposit requirement of just $50, making it accessible to newcomers while offering leverage options up to 1:1000 for international clients and 1:30 for EU clients under ESMA regulations.

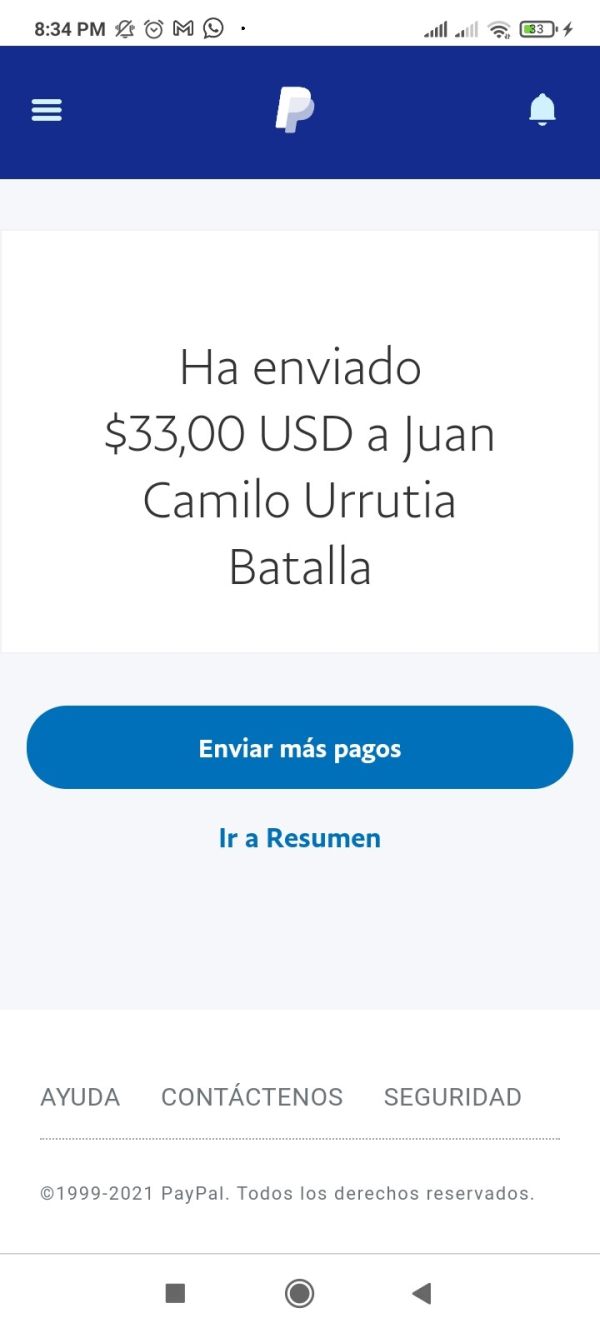

User feedback shows strong satisfaction with the platform's deposit and withdrawal processes. One trader noted: "I have been using the Eurotrader platform for 2 years now, deposits and withdrawals are made without delays, everything is fast and convenient." The broker's trust score stands at about 70/100, reflecting a solid reputation in the industry while maintaining room for improvement in certain areas.

Important Notice

Traders should know that EuroTrader operates through different regulatory entities across various jurisdictions. This may result in varying terms, conditions, and protections depending on your location. EU clients are subject to ESMA regulations including leverage caps and negative balance protection, while international clients may access different trading conditions.

This review is based on comprehensive analysis of user feedback, regulatory information, platform features, and publicly available data. All information presented reflects the most current available sources as of 2025. However, specific terms and conditions may vary based on your jurisdiction and account type.

Rating Framework

Broker Overview

Founded in 2018 and headquartered in Cyprus, EuroTrader has established itself as a multi-regulated forex and CFD broker serving traders across multiple jurisdictions. The company operates under Eurotrade Investments RGB Ltd, which holds regulatory authorization from CySEC under license number 279/15. This regulatory foundation provides the broker with the credibility needed to offer services across European markets while maintaining compliance with strict financial regulations.

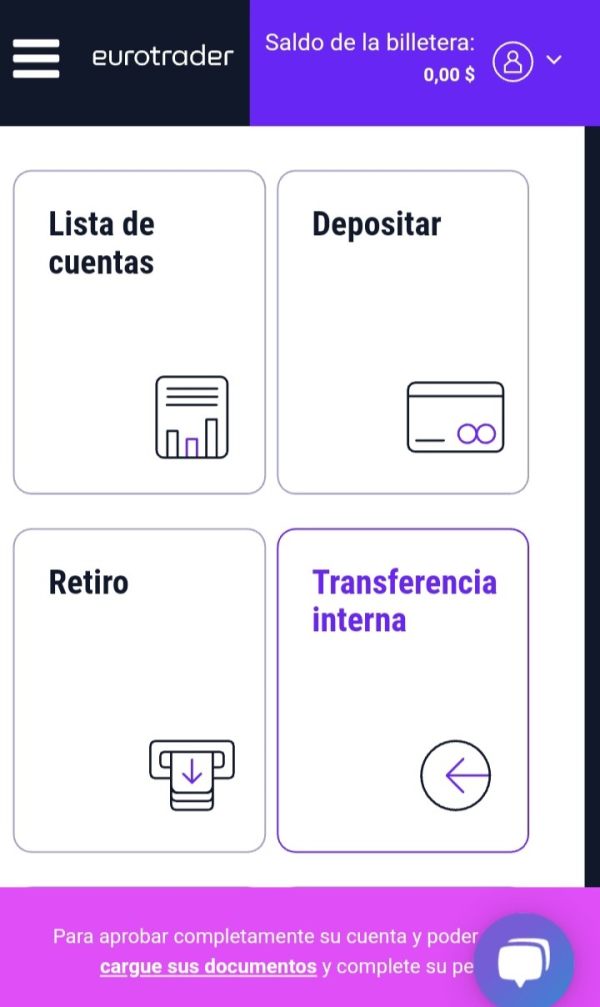

The broker's business model focuses on providing transparent trading conditions across a comprehensive range of financial instruments. EuroTrader emphasizes accessibility for retail traders. It also maintains professional-grade tools and resources typically associated with institutional platforms. According to TradingFinder and other industry sources, the company has built its reputation on reliable execution and customer-focused service delivery.

EuroTrader supports both MT4 and MT5 trading platforms. These platforms offer traders access to advanced charting tools, automated trading capabilities, and a wide array of technical indicators. The broker's asset coverage spans forex pairs, individual stocks, major indices, commodities including precious metals and energy products, and a growing selection of cryptocurrency CFDs. This comprehensive approach positions EuroTrader as a one-stop solution for diversified trading strategies.

The company maintains regulatory oversight from multiple authorities including CySEC (Cyprus), FCA (UK), FSCA (South Africa), FSC, and FSA. This demonstrates its commitment to operating within established regulatory frameworks across different markets. This multi-jurisdictional approach allows EuroTrader to serve a global client base while adapting to local regulatory requirements and providing appropriate investor protections.

Key Features and Specifications

Regulatory Coverage: EuroTrader operates under comprehensive regulatory oversight with CySEC serving as the primary regulator for EU operations. Additional licenses from FCA, FSCA, FSC, and FSA provide coverage for international markets. This multi-regulatory approach ensures compliance with diverse international standards and provides traders with appropriate protections based on their jurisdiction.

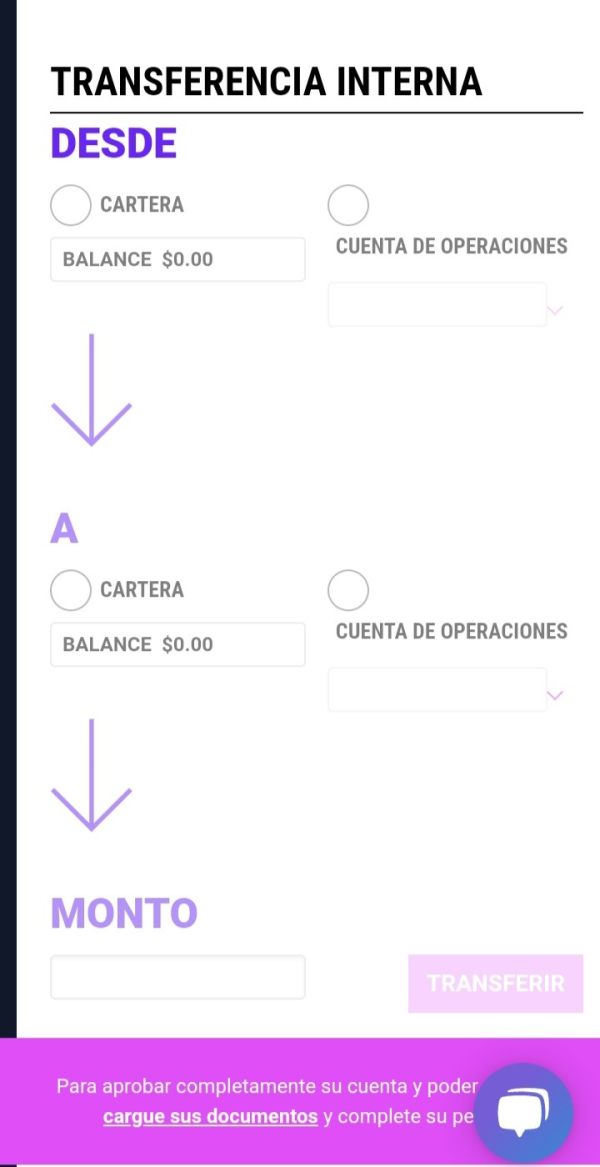

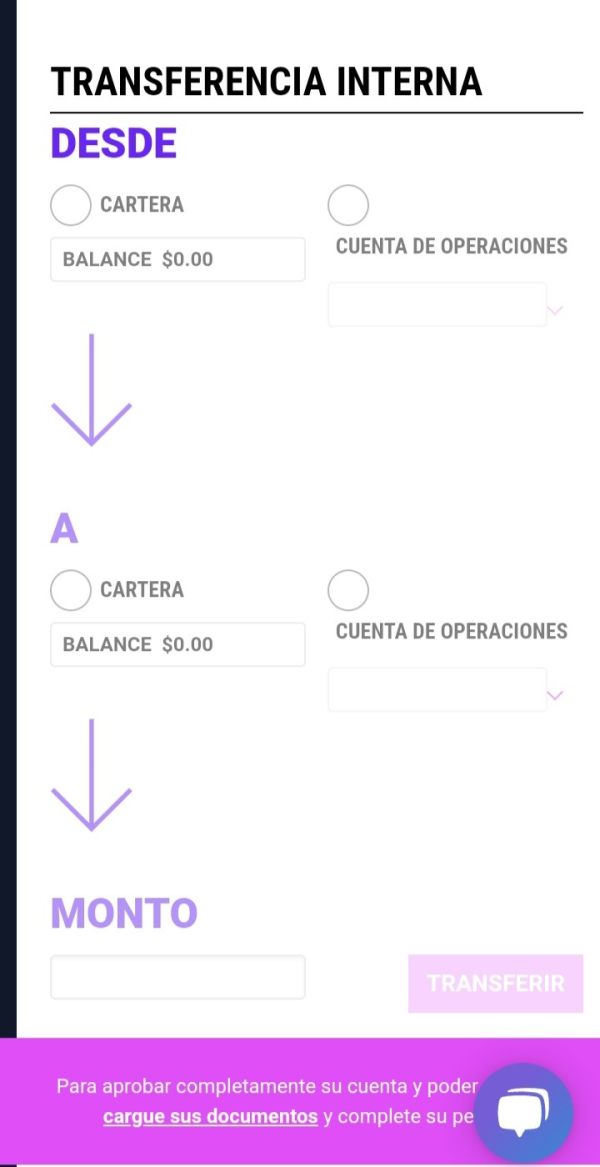

Deposit and Withdrawal Options: The broker offers multiple funding methods with users consistently praising the speed and convenience of transactions. According to user reviews, deposits and withdrawals are processed without delays. This contributes significantly to overall customer satisfaction.

Minimum Deposit Requirements: With a minimum deposit of just $50, EuroTrader positions itself as accessible to new traders and those with limited initial capital. This low barrier to entry aligns with the broker's focus on serving small to medium-sized traders.

Promotional Offers: Available promotional information in current sources does not detail specific bonus structures or ongoing promotional campaigns.

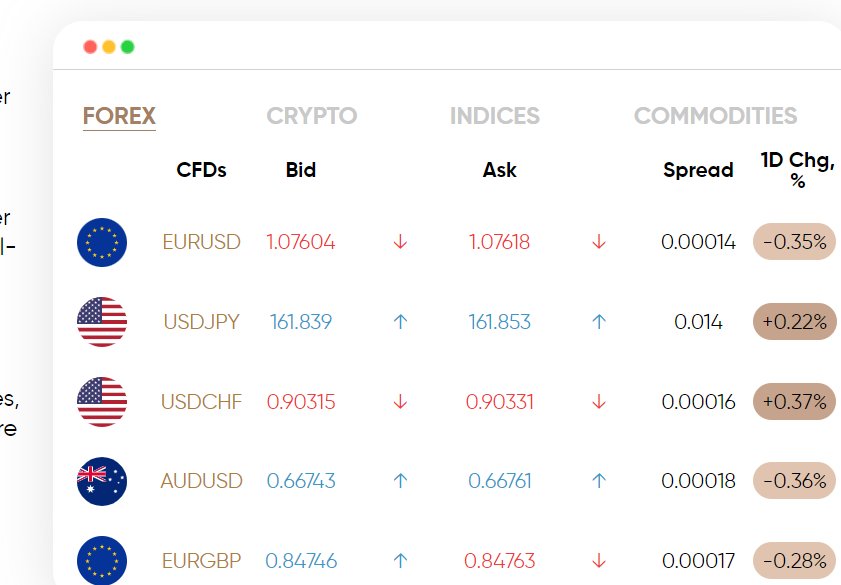

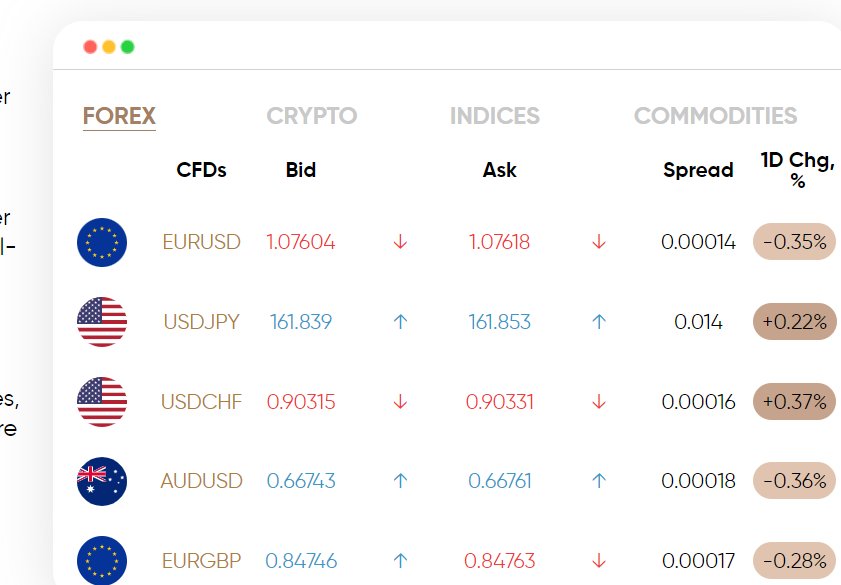

Tradeable Assets: The platform provides access to a comprehensive range of instruments. These include major, minor, and exotic forex pairs, individual stocks from global markets, major indices, commodities covering precious metals and energy products, and cryptocurrency CFDs for digital asset exposure.

Cost Structure: While specific spread and commission details are not extensively detailed in available sources, user feedback suggests competitive pricing structures that support active trading strategies.

Leverage Options: EuroTrader offers flexible leverage up to 1:30 for EU clients (in compliance with ESMA regulations) and up to 1:1000 for international clients. This allows traders to adjust their risk exposure according to their trading strategies and risk tolerance.

Platform Selection: Full support for both MT4 and MT5 platforms ensures traders have access to industry-standard tools, automated trading capabilities, and comprehensive analytical resources.

Geographic Restrictions: Specific regional restrictions are not detailed in available source materials. However, regulatory compliance suggests standard exclusions may apply in certain jurisdictions.

Customer Support Languages: While extensive language support is mentioned across various sources, specific details about supported languages for customer service are not comprehensively detailed in current materials.

Detailed Analysis

Account Conditions Analysis (Score: 7/10)

EuroTrader's account structure demonstrates a clear focus on accessibility and flexibility for traders across different experience levels. The broker's $50 minimum deposit requirement stands out as particularly competitive in the current market. Many regulated brokers require significantly higher initial investments. This low threshold makes EuroTrader review findings particularly relevant for new traders seeking a regulated entry point into forex and CFD trading.

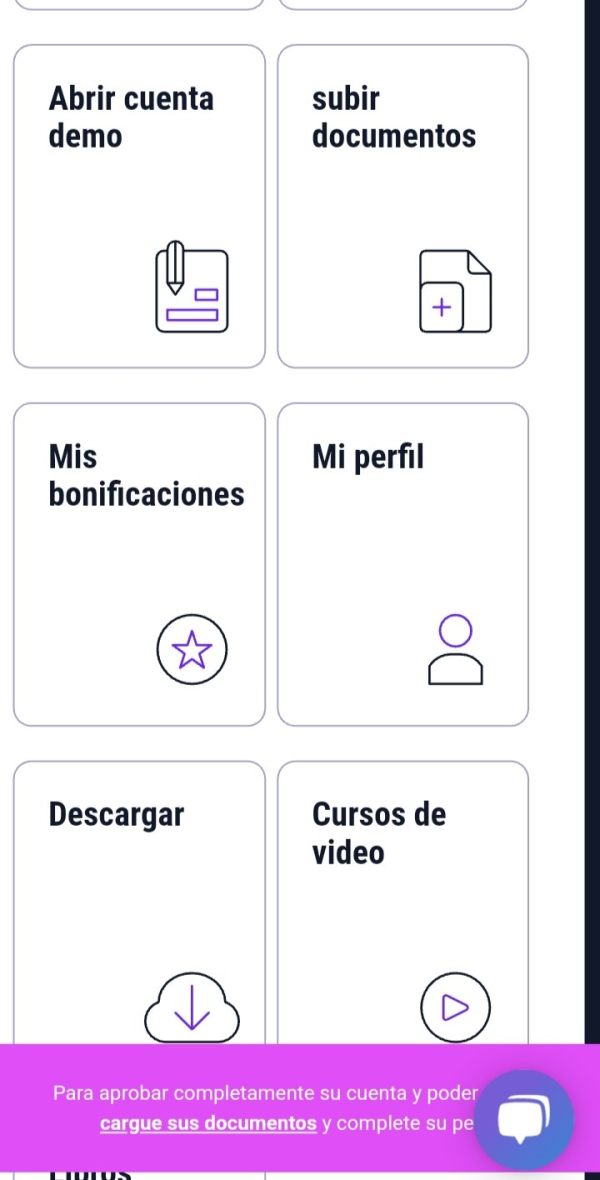

The broker offers multiple account types designed to accommodate varying trading needs and capital levels. However, specific details about premium account features and benefits are not extensively documented in available sources. User feedback suggests that the account opening process is streamlined and efficient, with verification procedures that balance regulatory compliance with user convenience.

According to user testimonials, the account management experience has been consistently positive. Long-term users report stable access to their accounts and reliable platform performance over extended periods. One user specifically noted using the platform for two years without experiencing significant delays or technical issues, suggesting robust account infrastructure.

The combination of low minimum deposits, multiple account options, and positive user experiences regarding account accessibility contributes to the strong 7/10 rating for account conditions. However, the lack of detailed information about premium account features and specific account tiers prevents a higher rating in this category.

EuroTrader's commitment to providing comprehensive trading tools through MT4 and MT5 platforms represents one of its strongest competitive advantages. Both platforms offer full functionality including advanced charting capabilities, automated trading support through Expert Advisors, and extensive technical analysis tools. These tools cater to both novice and experienced traders.

The broker's asset diversity enhances the value of these tools. It allows traders to apply consistent analytical approaches across forex, stocks, indices, commodities, and cryptocurrency markets. This cross-asset accessibility through unified platforms simplifies portfolio management and enables sophisticated trading strategies that span multiple market sectors.

Market analysis and research resources appear to be integrated into the platform experience. However, specific details about proprietary research, market commentary, or educational materials are not extensively documented in available sources. The focus on established platforms like MT4 and MT5 ensures that traders have access to third-party analysis tools and resources that complement the broker's core offerings.

The platform's technical infrastructure supports the demanding requirements of active traders. User feedback indicates reliable performance and minimal technical disruptions. The availability of both MT4 and MT5 allows traders to choose the platform that best matches their trading style and technical requirements, from simple manual trading to complex automated strategies.

Customer Service and Support Analysis (Score: 7/10)

Customer support quality emerges as a notable strength in user feedback. Traders consistently report professional and responsive service experiences. The broker provides multiple contact channels including phone, email, and live chat options, ensuring traders can reach support through their preferred communication method.

Response times appear to be competitive based on user testimonials. The overall customer service experience contributes positively to trader satisfaction. The support team's professionalism and problem-solving capabilities receive particular praise in available user reviews, suggesting well-trained staff capable of addressing both technical and account-related inquiries.

The fast and convenient deposit and withdrawal processing that users frequently mention reflects positively on the support infrastructure. These operations often require coordination between customer service and back-office teams. This operational efficiency suggests robust internal processes that support customer needs effectively.

While specific details about multi-language support capabilities and customer service hours are not extensively documented in current sources, the positive user feedback and professional service delivery contribute to the solid 7/10 rating for customer service and support.

Trading Experience Analysis (Score: 8/10)

The trading experience with EuroTrader receives high marks based on user feedback and platform capabilities. Long-term users report consistent platform stability. One trader specifically noted two years of usage without experiencing delays, indicating robust technical infrastructure and reliable order execution systems.

Platform performance appears to be a particular strength. Users praise the stability of spreads and overall trading conditions. The EuroTrader review data suggests that the broker maintains competitive execution standards that support both manual and automated trading strategies across their range of instruments.

The integration of MT4 and MT5 platforms provides traders with familiar, industry-standard interfaces that support sophisticated trading approaches. These platforms offer comprehensive functionality including advanced order types, one-click trading, and extensive customization options. All of these enhance the overall trading experience.

Order execution quality, while not extensively detailed in available sources regarding specific metrics like slippage or requote rates, appears to meet user expectations based on positive feedback about platform reliability and trading conditions. The absence of significant user complaints about execution issues in available reviews supports the strong rating in this category.

Mobile trading capabilities and cross-device synchronization, while not specifically detailed in current sources, are standard features of MT4 and MT5 implementations. This suggests that traders can expect consistent experiences across different devices and platforms.

Trust and Regulation Analysis (Score: 7/10)

EuroTrader's regulatory foundation provides substantial credibility through its multi-jurisdictional licensing approach. The primary CySEC authorization under license number 279/15 establishes the broker's compliance with European financial regulations. Additional oversight from FCA, FSCA, FSC, and FSA demonstrates commitment to maintaining regulatory standards across different markets.

This comprehensive regulatory coverage addresses one of the primary concerns for traders selecting a broker. It ensures appropriate investor protections and regulatory oversight. The broker's establishment in 2018 provides sufficient operational history to assess stability and regulatory compliance over time.

The trust score of about 70/100 reflects solid industry standing while indicating room for improvement in certain areas. This rating suggests that while the broker maintains good regulatory compliance and user satisfaction, it has not yet achieved the highest levels of industry recognition. It also hasn't reached the market leadership that would warrant premium trust ratings.

Fund security measures and company transparency, while not extensively detailed in available sources, benefit from the regulatory framework that requires segregation of client funds and regular financial reporting. The multi-regulatory structure provides additional layers of protection for traders across different jurisdictions.

The absence of significant negative events or regulatory issues in available sources supports the broker's reputation. It shows they maintain appropriate business standards and regulatory compliance throughout their operational history.

User Experience Analysis (Score: 8/10)

Overall user satisfaction with EuroTrader appears consistently high based on available feedback and testimonials. Users particularly appreciate the speed and convenience of deposit and withdrawal processes. These are fundamental to positive trading experiences and often sources of frustration with other brokers.

The platform interface and navigation receive positive feedback. The familiar MT4 and MT5 environments provide intuitive access to trading functions and account management tools. The registration and verification processes appear streamlined based on user comments, balancing regulatory requirements with user convenience effectively.

Fund management operations represent a particular strength. Multiple users praise the efficiency of transaction processing. This operational excellence contributes significantly to overall user satisfaction and distinguishes EuroTrader from competitors who may struggle with back-office efficiency.

The broker appears to attract and retain traders who value reliability and straightforward service delivery over complex promotional offers or premium features. This user base alignment with the broker's operational strengths creates a positive feedback loop. It supports continued satisfaction and retention.

Common user complaints are not extensively documented in available sources. This suggests either effective issue resolution or genuinely low complaint rates. The positive user testimonials and lack of significant negative feedback support the strong rating for user experience, though the absence of detailed user surveys or comprehensive feedback analysis prevents a perfect score.

Conclusion

This comprehensive EuroTrader review reveals a well-regulated forex and CFD broker that successfully serves small to medium-sized traders through reliable platform performance and efficient operational execution. The broker's multi-regulatory approach, competitive minimum deposit requirements, and strong user satisfaction ratings position it as a solid choice for traders seeking a dependable trading environment.

EuroTrader's primary strengths lie in its operational efficiency, particularly regarding deposit and withdrawal processing, platform stability, and customer service quality. The combination of MT4 and MT5 platform support with diverse asset coverage provides traders with professional-grade tools and market access. These are typically associated with larger brokers.

The broker is particularly well-suited for new and intermediate traders who value regulatory protection, low entry barriers, and reliable service delivery over complex promotional offers or premium account features. The positive long-term user feedback suggests that EuroTrader successfully retains clients through consistent service quality. They don't rely on aggressive marketing tactics.

While areas such as detailed fee structures, comprehensive educational resources, and premium account features could benefit from enhanced transparency and development, the broker's core strengths in regulation, platform reliability, and operational efficiency create a solid foundation for successful trading relationships.