Equityworld Futures 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Equityworld Futures, an Indonesian brokerage established in 2005, presents a mixed bag of opportunities and pitfalls for traders. With a low minimum deposit requirement of $250 and a variety of trading products, it caters primarily to new traders looking to enter the fast-paced futures market, especially within Indonesia. However, this accessibility is marred by serious concerns regarding withdrawal issues and customer service quality, prompting potential clients to exercise extreme caution. While some users report positive experiences with the platform, the prevailing concern among many is about accessing their funds when needed. It is crucial for prospective investors to weigh these trade-offs carefully.

⚠️ Important Risk Advisory & Verification Steps

Data Integrity Warning:

Before engaging with Equityworld Futures, consider the following:

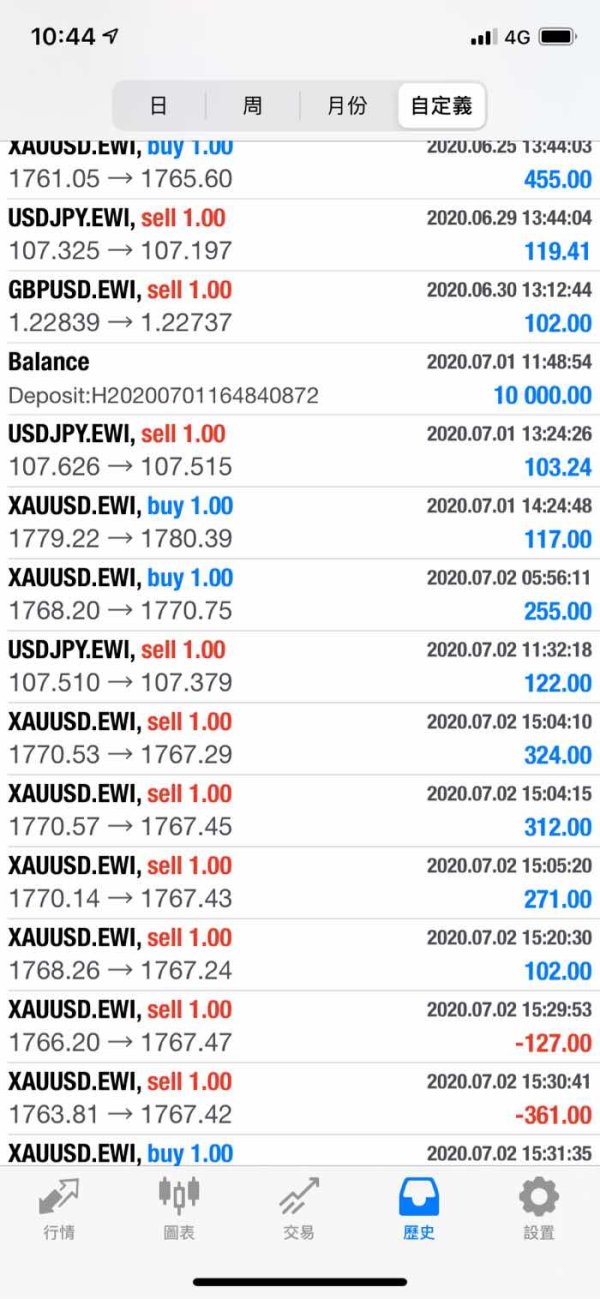

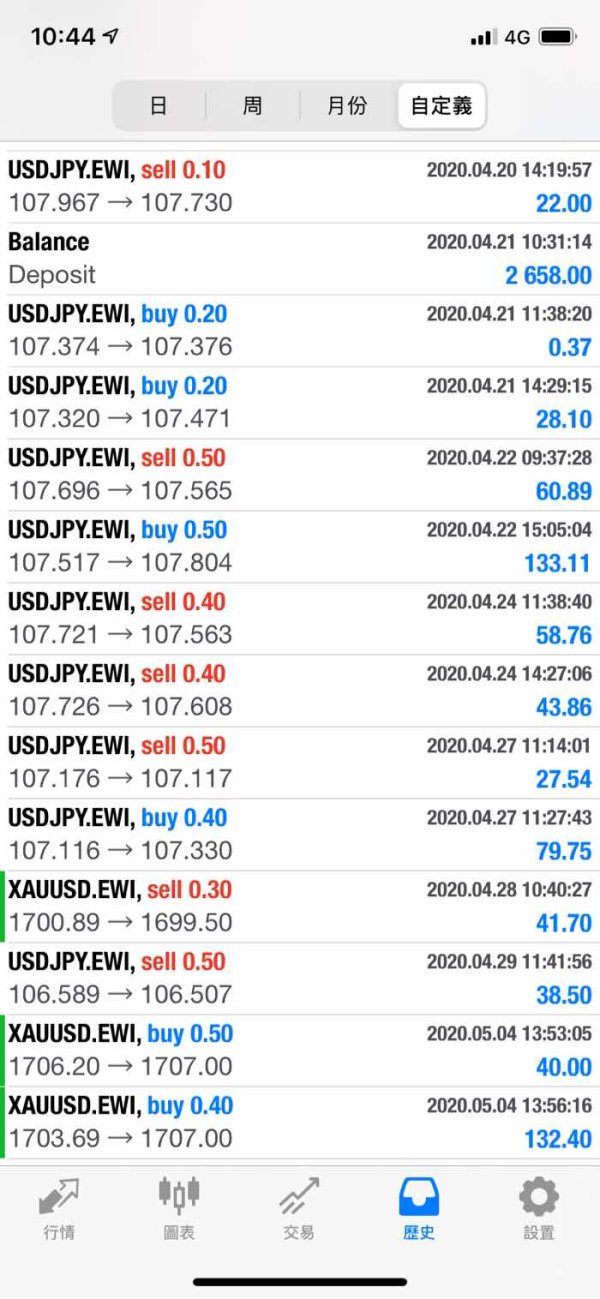

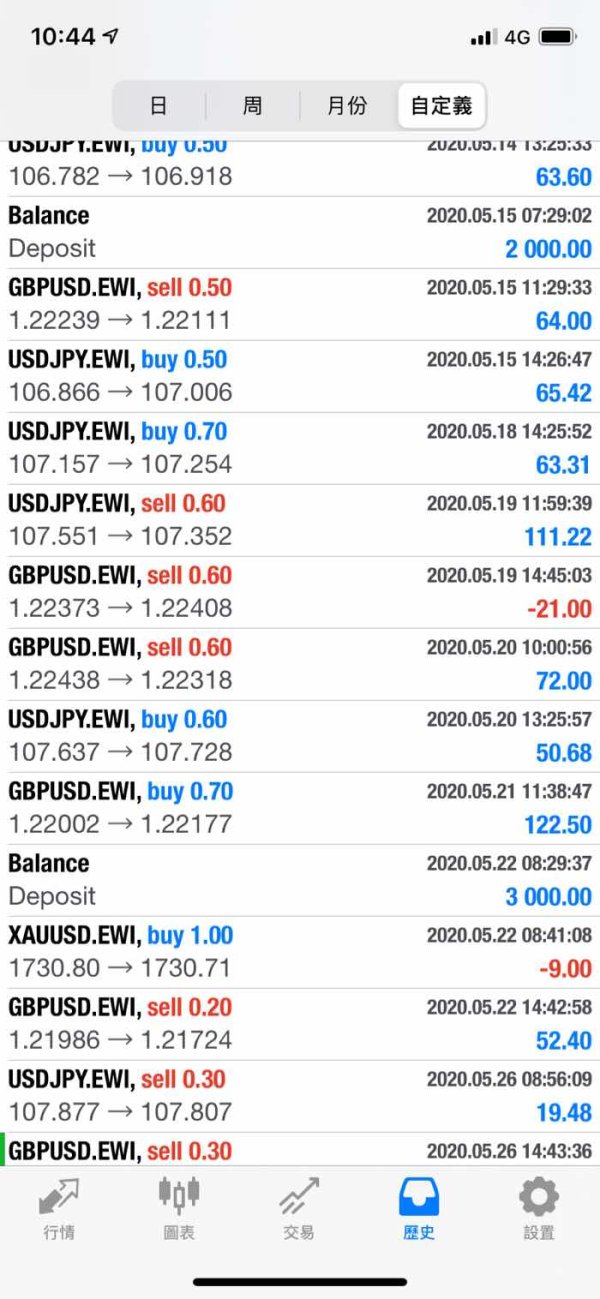

- Withdrawal Issues: Numerous complaints have emerged regarding clients' inability to access their funds.

- Regulatory Oversight: As an Indonesian broker regulated by Bappebti, the oversight may not be as stringent as that of brokers in developed markets.

- Mixed Reputation: User feedback is varied, with serious allegations concerning customer service responsiveness.

Self-Verification Steps:

- Check Regulations: Verify with Bappebti if the broker is legitimate and compliant.

- Review Feedback: Look for user reviews on independent sites regarding withdrawal experiences.

- Engage Customer Support: Test their response times and efficacy by asking questions ahead of any funding.

Rating Framework

Broker Overview

Company Background and Positioning

Equityworld Futures emerged in the Indonesian market in 2005 and is regulated by the Indonesian Commodity Futures Trading Regulatory Agency (Bappebti). Its foundational goal was to provide access to futures trading for individual investors, primarily focusing on the Indonesian market. Over the years, it has developed its offering to include a broad spectrum of asset classes, including forex and commodities. However, the regulatory environment in Indonesia is often perceived as less stringent compared to more developed markets, resulting in potential risks that must be considered by investors.

Core Business Overview

Equityworld Futures operates primarily in the futures and options trading space, with platforms designed to cater to beginner traders through accessible designs. Their offerings include a proprietary web trader and a mobile platform, though traders looking for more advanced tools like MT4 or MT5 will find them absent. The broker claims regulation under Bappebti, holding the license number 850/Bappebti/si/12/2005, which underscores its commitment to adhere to local guidelines. Nonetheless, traders should remain vigilant given the mixed reviews regarding trustworthiness and service quality.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

-

Regulatory Information Conflicts: While Equityworld Futures is claimed to be regulated by Bappebti, there are underlying concerns about the effectiveness of this regulation. The complaints regarding withdrawal issues suggest a gap in oversight and consumer protection. Many traders have reported serious difficulties in accessing their funds, raising alarms about the credibility of the broker.

User Self-Verification Guide:

- Visit the Bappebti website and look for the list of regulated brokers.

- Check the license number: 850/Bappebti/si/12/2005.

- Research user reviews on independent platforms like WikiFX and PediaFX to gauge real experiences.

- Contact Bappebti directly to inquire about any complaints against Equityworld Futures.

- Industry Reputation and Summary: Users have expressed concerns about fund safety when citing experiences of delayed or unfulfilled withdrawals.

“I wanted to make a withdrawal, while Equityworld Futures placed orders for me randomly... currently, the service is also out of contact. How could I take back my fund?” Such experiences underline the importance of independent verification and due diligence.

Trading Costs Analysis

-

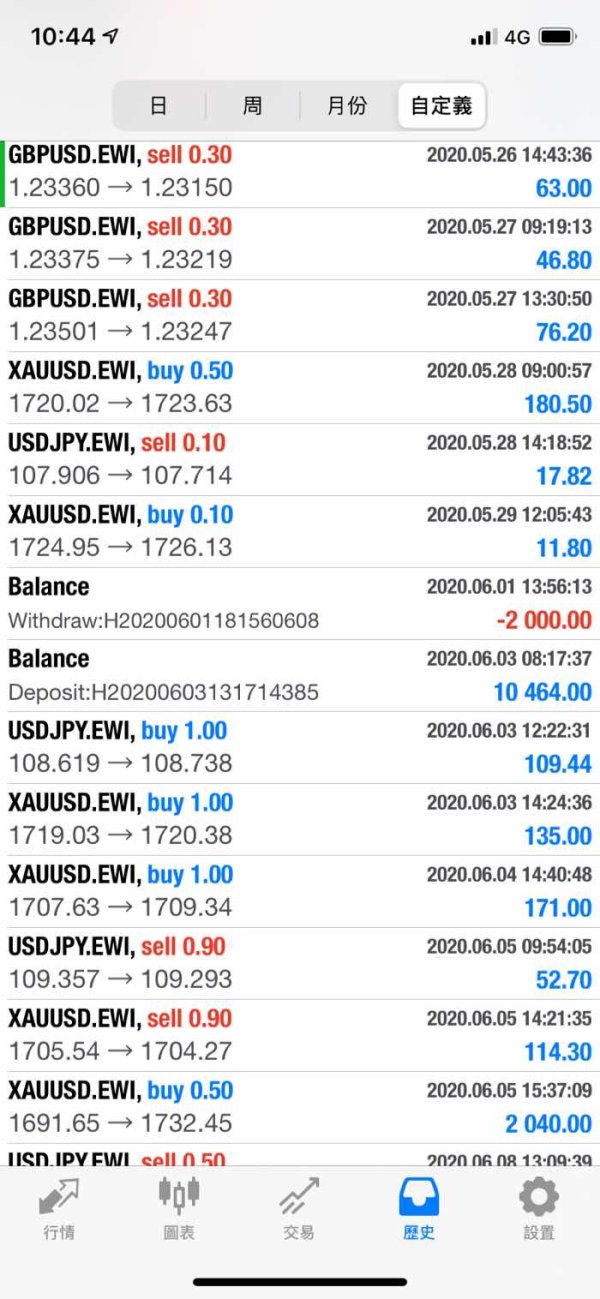

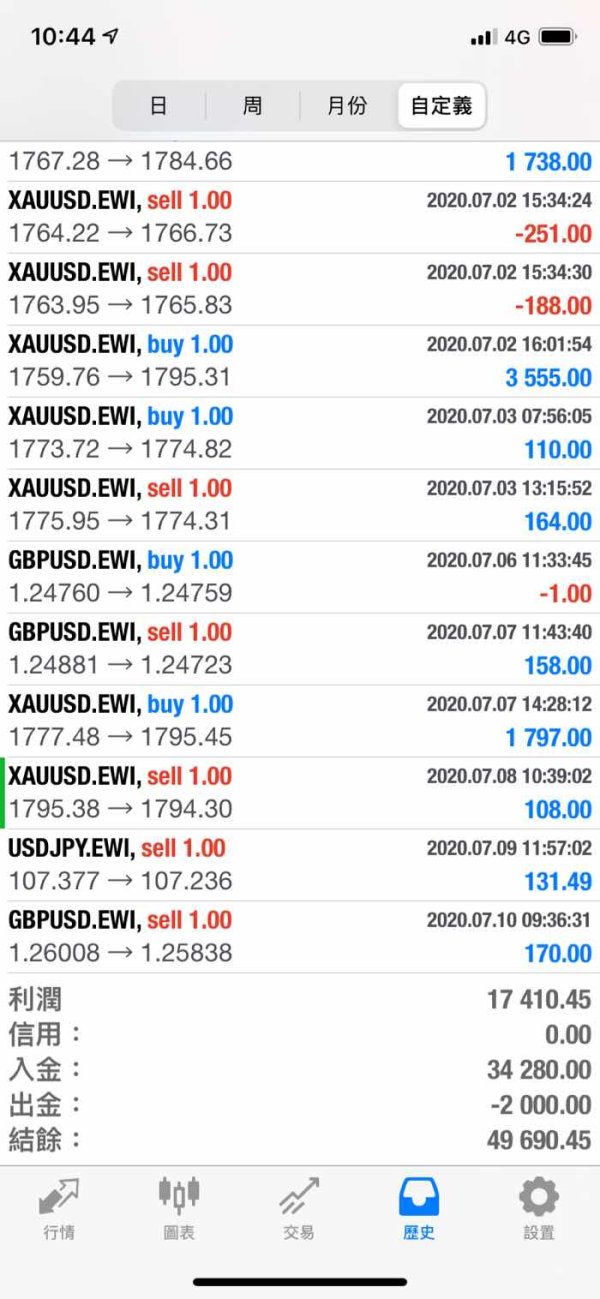

Advantages in Commissions: The cost structure of Equityworld Futures is relatively advantageous, featuring low commissions starting at $15 per lot. This pricing model may appeal to new traders who are looking to manage startup costs effectively.

The "Traps" of Non-Trading Fees: Although the commission may look favorable, significant withdrawal fees have been reported, leading to overall high costs for active traders. Users have complained that

"I required a withdrawal while the service placed orders for me randomly," adding frustration to the cost-benefit analysis. The total costs can quickly escalate.

- Cost Structure Summary: The balance between low trading fees and potential punitive withdrawal costs means traders need to thoroughly assess their trading frequency and style before committing.

-

Platform Diversity: Equityworld Futures provides access to a proprietary web trader and mobile app, which are designed to be user-friendly, particularly for novice traders. However, the absence of robust platforms like MT4 or MT5 appears to limit advanced trading opportunities.

Quality of Tools and Resources: The platform offers basic charting tools and interfaces, but lacks extensive educational content or analytical tools that many experienced traders seek in a broker.

Platform Experience Summary: User feedback indicates a range of experiences, with some praising its accessibility while others highlight the lack of essential features.

“The fantastic trading system is user-friendly, with great customer support,” contrasts with users who have noted slow responses.

User Experience Analysis

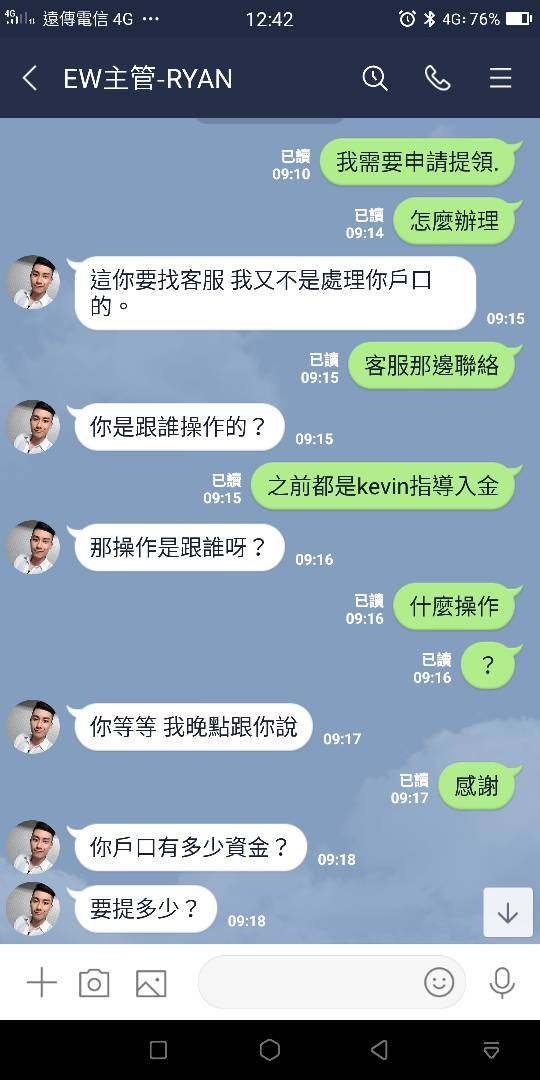

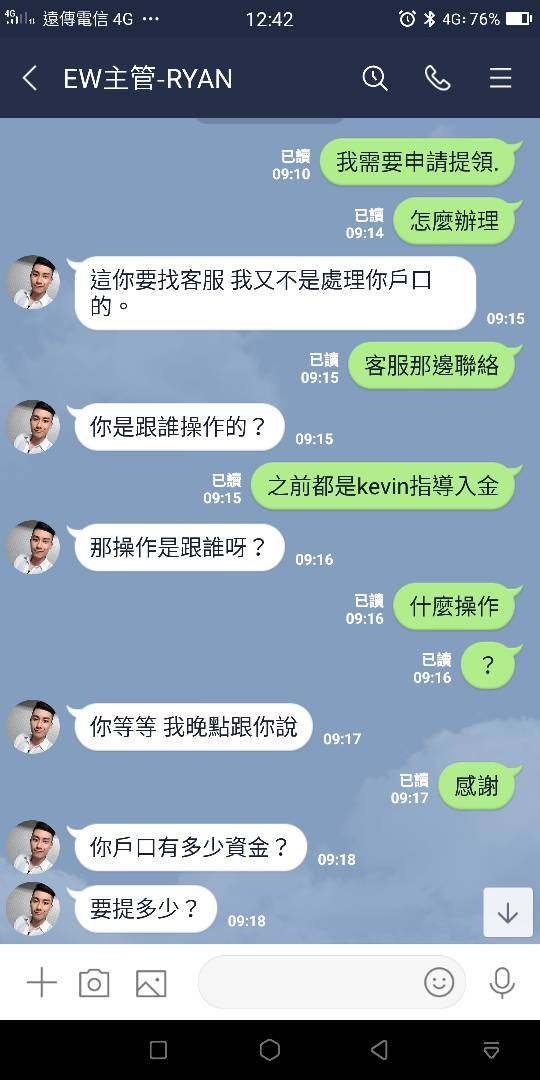

- General User Sentiment: Reviews reflect a split in user experiences. Some traders commend the trading system, while numerous reports of withdrawal difficulties illustrate significant pitfalls. Users specifically mention frustrations with

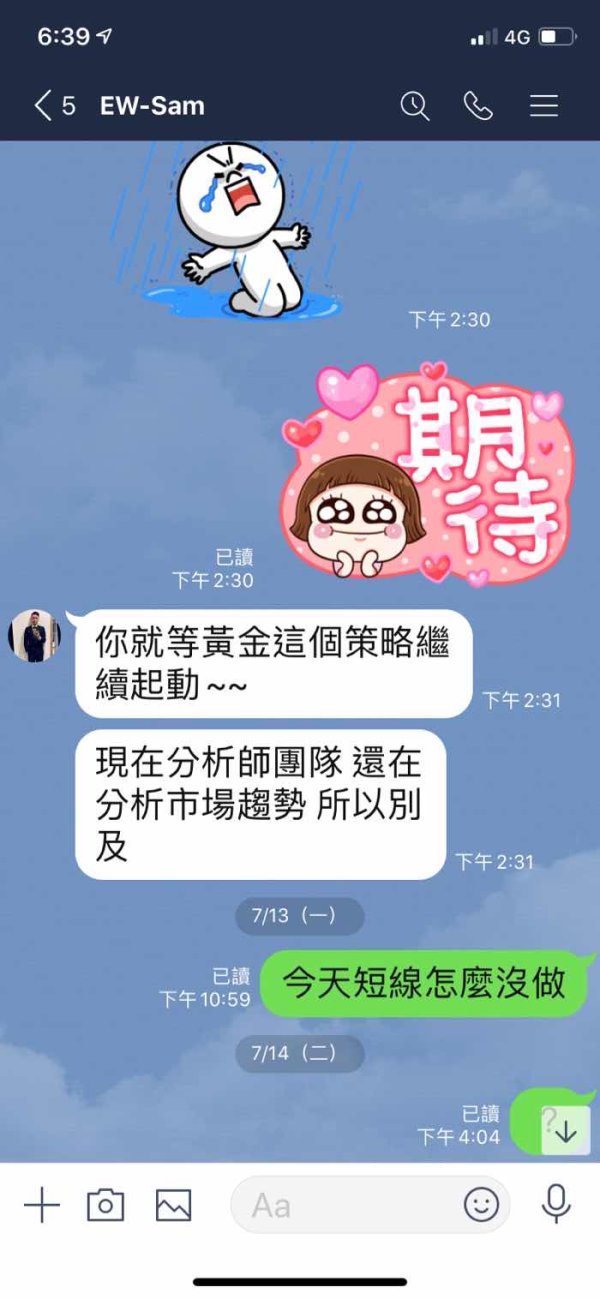

“...no service replied to me,” emphasizing the unresolved nature of many inquiries.

Customer Support Analysis

-

Quality of Support Received: Customer service at Equityworld Futures has received mixed feedback. While the support is available in several languages, including English, many users have reported slow response times.

Customer Support Summary: The ability to contact support via multiple channels like phone, email, and online complaints is beneficial, but the effectiveness of these channels has been called into question by numerous complaints regarding unreturned inquiries, which leads to stress for clients requiring assistance.

Account Conditions Analysis

-

Account Types and Accessibility: Equityworld Futures allows for a variety of account types with a relatively low minimum deposit, enticing to new traders. However, the structure of fees and regulations can be disconcerting for more seasoned investors.

Account Conditions Summary: While the low deposit requirements support accessibility, the high trading fees involved could deter frequent or high-volume traders.

Conclusion

Equityworld Futures offers a potential entry point for new traders looking to explore the futures market, particularly within Indonesia. Nonetheless, significant concerns regarding customer service, fund withdrawal issues, and regulatory effectiveness demand that prospective investors conduct thorough due diligence. The trade-offs between accessibility and trustworthiness should be carefully balanced before proceeding with investments. As always, potential clients should weigh evidence from user experiences and confirm regulatory compliance before making any commitments.