Deleno IFC Review 2025: Everything You Need to Know

Executive Summary

Deleno IFC has become a highly controversial forex broker. This broker has received significant negative attention from multiple regulatory watchdogs and review platforms across the financial industry. This deleno ifc review reveals troubling patterns that potential investors must understand before considering any engagement with this platform.

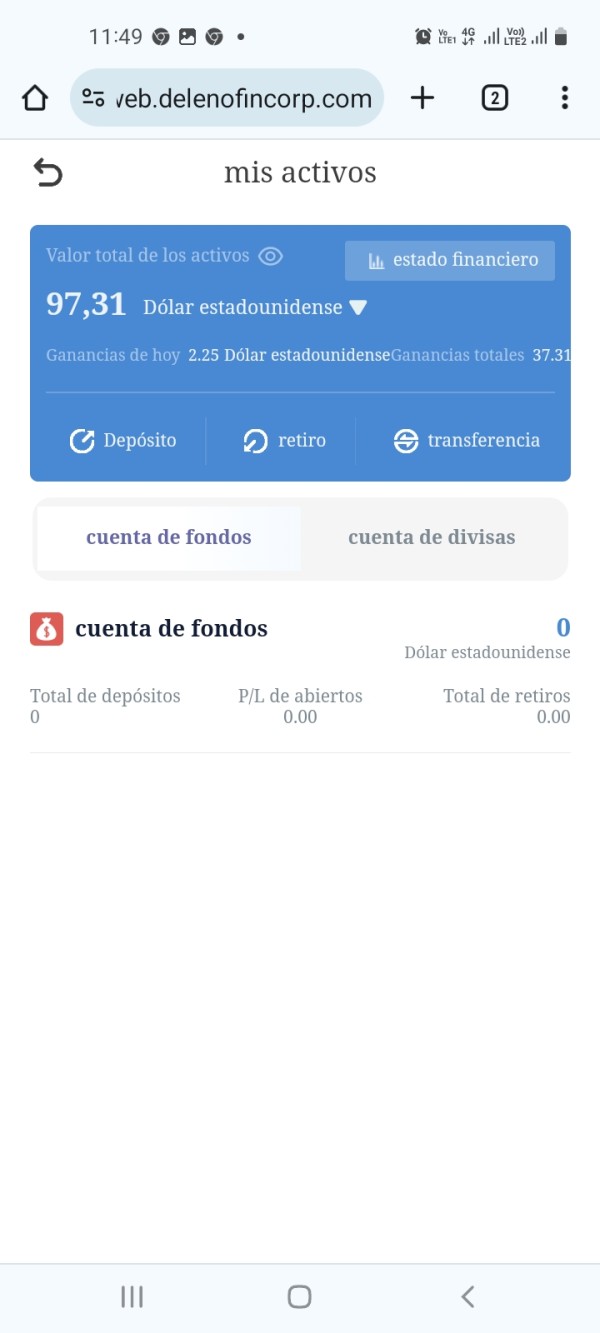

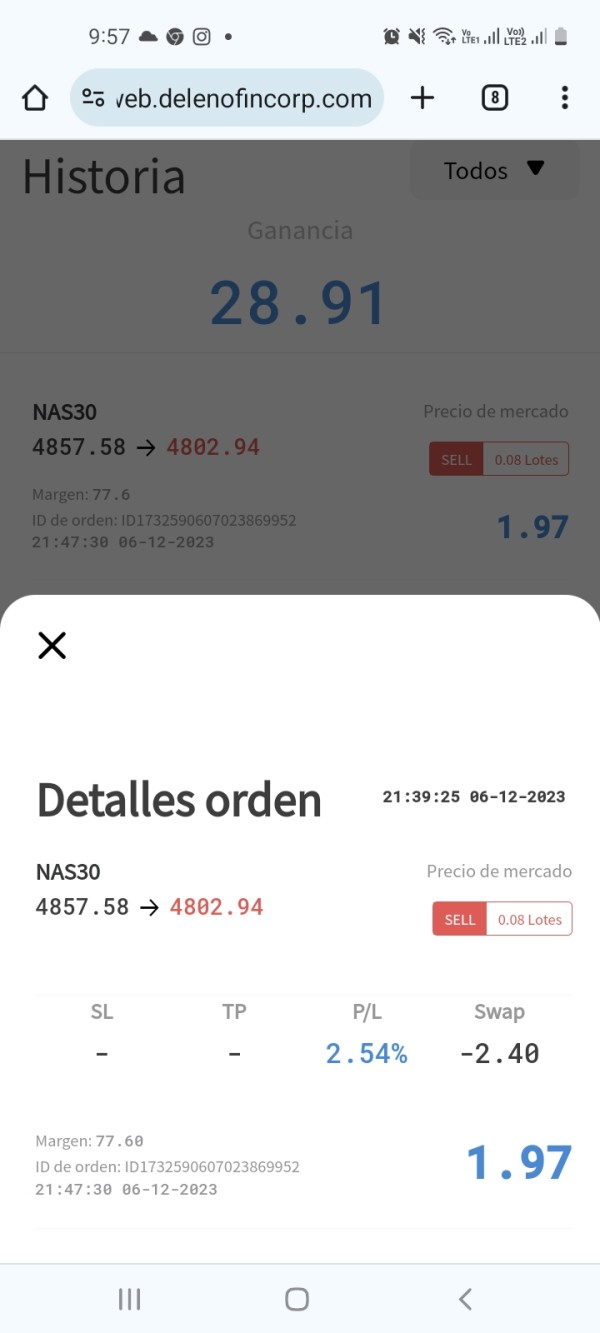

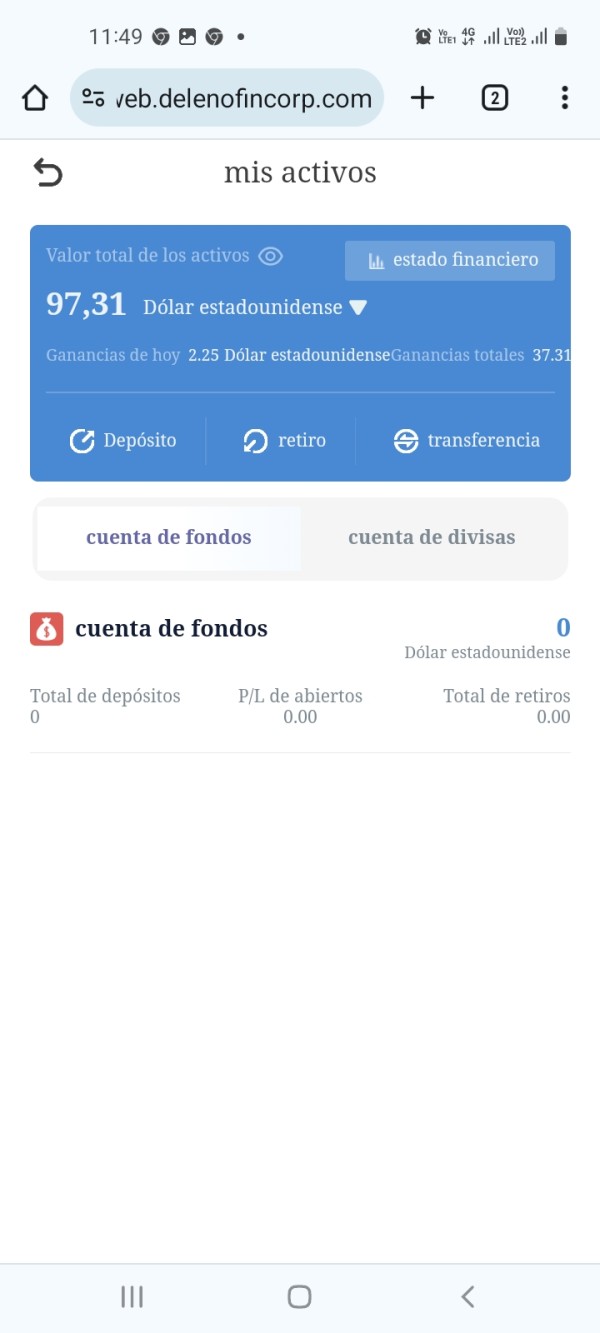

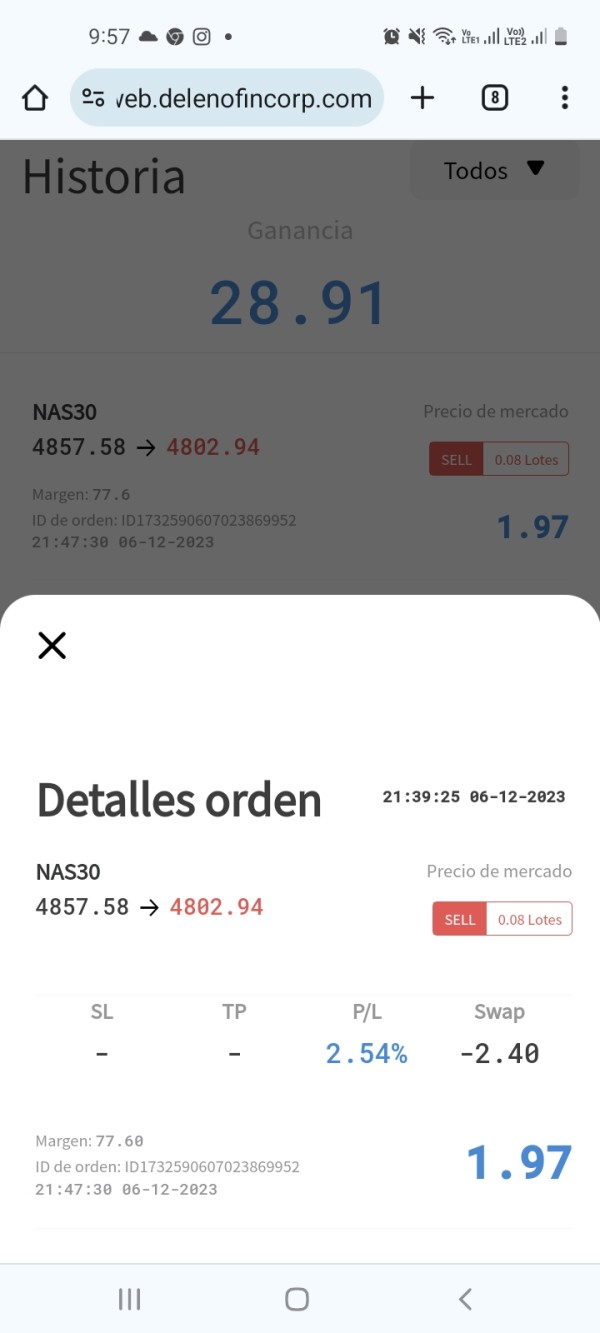

Scam Helpers and Scam Victims Help recognize Deleno IFC as a forex broker with substantial scam risks. The broker receives overwhelmingly negative evaluations across multiple review platforms and consumer protection websites. The broker launched in 2023 and claims to be based in the United States, but numerous sources have flagged it as operating what appears to be a Ponzi scheme targeting unsuspecting retail traders.

The platform primarily targets high-risk investors seeking opportunities in forex and cryptocurrency markets. Multiple warning signals suggest extreme caution is warranted for anyone considering investment with this broker. Enverracapital reports that victims of Deleno IFC's allegedly deceptive practices have been advised to file chargebacks to recover lost funds, indicating serious operational issues.

Key characteristics include a complete lack of regulatory oversight, absence of transparency in operations, and widespread warnings from fraud prevention organizations. Lycan Retrieve and Broker Reviews Hub have both published detailed warnings about the platform's legitimacy. These organizations provide consistent reports of user complaints and potential fraudulent activities across their monitoring systems.

Important Notice

Deleno IFC operates as an unregulated platform. This means investors in different jurisdictions may face varying levels of legal protection or complete lack thereof depending on their location. The regulatory landscape surrounding this broker remains unclear with no verifiable licensing information available from recognized financial authorities.

This review is based on publicly available information and user feedback collected from various sources, including fraud reporting websites and broker review platforms. We have not conducted on-site verification of Deleno IFC's operations or independently verified all claims made in this assessment through direct investigation. Potential investors should conduct their own due diligence and consider consulting with licensed financial advisors before making any investment decisions.

Rating Framework

Broker Overview

Deleno IFC was established in 2023. The company positions itself as a financial brokerage firm with headquarters allegedly located in the United States according to their marketing materials. The company presents itself as a provider of investment products focusing primarily on forex and cryptocurrency markets, targeting retail investors seeking exposure to these volatile asset classes.

Scam Victims Help gathered information showing that the platform launched with ambitious claims about providing comprehensive trading services to international clients. However, the broker's actual operational structure and business model have come under intense scrutiny from fraud prevention organizations and regulatory watchdogs within its first year of operation across multiple jurisdictions.

This deleno ifc review reveals that the platform operates without any verifiable regulatory oversight from recognized financial authorities. The absence of proper licensing from bodies such as the FCA, CySEC, ASIC, or other major regulatory institutions raises significant red flags about the legitimacy of its operations throughout the global financial community. Multiple sources indicate that the platform's business model may involve characteristics commonly associated with fraudulent investment schemes.

The broker's target demographic appears to be retail investors seeking high-return opportunities in forex and cryptocurrency trading. However, the lack of transparency regarding trading conditions, fee structures, and operational procedures has led to widespread warnings from consumer protection agencies and financial fraud prevention organizations worldwide.

Regulatory Jurisdictions: Available information indicates that Deleno IFC operates without oversight from any recognized financial regulatory authority. This creates significant risks for potential investors who would normally rely on regulatory protection in legitimate trading environments.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options has not been disclosed in available materials. This itself represents a concerning lack of transparency that legitimate brokers typically address in their client documentation and marketing materials.

Minimum Deposit Requirements: The platform has not publicly disclosed minimum deposit requirements. This makes it impossible for potential clients to understand entry-level investment thresholds or plan their initial investment strategies accordingly.

Bonus and Promotional Offers: No information about bonus structures or promotional campaigns has been identified in available sources. Such offerings are common tactics used by fraudulent platforms to attract unsuspecting investors with unrealistic promises of enhanced returns.

Tradeable Assets: Available information suggests that Deleno IFC claims to offer access to forex and cryptocurrency markets. However, specific instruments and market coverage details remain undisclosed, preventing potential clients from evaluating the platform's actual trading capabilities.

Cost Structure: Critical information about spreads, commissions, swap rates, and other trading costs has not been made available. This prevents potential clients from conducting proper cost analysis or comparing the platform's fees with legitimate competitors in the forex industry.

Leverage Ratios: Specific leverage offerings have not been disclosed in available materials. This is unusual for legitimate forex brokers who typically highlight their leverage capabilities as key selling points to attract trading clients.

Platform Options: The trading platform infrastructure and software solutions offered by Deleno IFC have not been clearly detailed in available information. Professional brokers typically provide comprehensive information about their trading technology and platform features to help clients make informed decisions.

Geographic Restrictions: Information regarding geographic limitations or restricted jurisdictions has not been specified in available materials. Legitimate brokers typically provide clear guidance about service availability and regulatory restrictions in different countries.

Customer Service Languages: Available customer service languages and support options have not been disclosed in accessible documentation. This deleno ifc review highlights significant information gaps that legitimate brokers typically address transparently in their marketing materials and regulatory disclosures.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The account conditions offered by Deleno IFC represent one of the most concerning aspects of this platform's operations. Available information reveals a complete absence of transparent account type descriptions, minimum deposit requirements, or clear account opening procedures. Legitimate brokers typically provide this information to potential clients as a standard business practice.

Unlike established forex brokers who offer detailed breakdowns of different account tiers, trading conditions, and special features such as Islamic accounts for Muslim traders, Deleno IFC has failed to provide any meaningful information about its account structures. This lack of transparency makes it impossible for potential investors to make informed decisions about account selection. It also prevents them from understanding what services they would receive upon opening an account with the platform.

The absence of clear account opening procedures is particularly troubling for potential investors. Legitimate brokers typically outline their KYC (Know Your Customer) requirements, verification processes, and account activation timelines in detailed documentation available to prospective clients. This deleno ifc review found no evidence of standard account management features that traders expect from professional forex brokers.

User feedback available through fraud reporting websites suggests that individuals who have attempted to engage with Deleno IFC's account opening process have encountered significant issues. However, specific details about these experiences remain limited in available sources, making it difficult to assess the full scope of problems encountered by potential clients.

The trading tools and educational resources offered by Deleno IFC fall significantly short of industry standards. Available information suggests a complete absence of the analytical and educational materials that legitimate forex brokers typically provide to their clients as part of professional service delivery.

Professional forex brokers generally offer comprehensive suites of trading tools including technical analysis indicators, economic calendars, market research reports, and educational resources such as webinars, tutorials, and market analysis. However, available information about Deleno IFC reveals no evidence of such offerings. This represents a significant red flag for potential investors who rely on these tools for successful trading activities.

The absence of educational resources is particularly concerning given that legitimate brokers view client education as both a regulatory requirement and a business necessity. The lack of market analysis tools, research reports, or automated trading support suggests that Deleno IFC may not be operating as a genuine trading platform. Instead, it may be focused on collecting client funds rather than providing legitimate trading services.

Available sources provide no evidence of third-party trading tools integration, such as MetaTrader platforms, which are industry standards for forex trading. This absence of professional trading infrastructure further supports concerns about the platform's legitimacy and operational capabilities in delivering professional trading services.

Customer Service and Support Analysis (Score: 1/10)

Customer service and support capabilities represent critical weaknesses in Deleno IFC's operations. Available information reveals significant gaps in basic customer support infrastructure that legitimate financial service providers typically maintain as part of their professional operations.

Professional forex brokers generally provide multiple customer service channels including live chat, telephone support, email assistance, and comprehensive FAQ sections. They typically offer support in multiple languages and maintain extended service hours to accommodate international clients across different time zones. However, available information about Deleno IFC shows no evidence of such comprehensive support systems.

The absence of clearly defined customer service channels, response time commitments, or service quality standards raises serious concerns about the platform's ability to address client inquiries or resolve issues. This lack of customer support infrastructure is particularly problematic for a financial services provider where timely assistance can be critical for trading activities. Traders often need immediate support during market volatility or technical issues that could impact their trading positions.

Available user feedback suggests that individuals who have attempted to contact Deleno IFC for support have experienced significant difficulties. However, specific details about response times or problem resolution capabilities remain limited in accessible sources, making it difficult to assess the full extent of customer service deficiencies.

Trading Experience Analysis (Score: 1/10)

The trading experience offered by Deleno IFC appears to be severely compromised by fundamental operational deficiencies. These deficiencies prevent the platform from delivering the professional trading environment that forex market participants require for successful trading activities.

Professional forex brokers typically provide stable, high-speed trading platforms with reliable order execution, competitive spreads, and comprehensive trading tools. They invest significantly in technology infrastructure to ensure minimal slippage, fast execution speeds, and platform stability during high-volatility market conditions when trading opportunities are most abundant. However, this deleno ifc review found no evidence that the platform maintains such professional trading infrastructure.

The absence of detailed information about platform stability, execution quality, or trading environment specifications suggests that Deleno IFC may not be operating genuine trading facilities. Legitimate brokers typically highlight their execution statistics, platform uptime records, and technology partnerships as key selling points. They provide this information to demonstrate their commitment to delivering professional trading services to their clients.

Available information provides no evidence of mobile trading applications, which have become essential tools for modern forex traders. The lack of mobile platform options further suggests that Deleno IFC may not be maintaining professional trading infrastructure comparable to legitimate market participants who prioritize accessibility and convenience for their clients.

Trust and Security Analysis (Score: 1/10)

Trust and security concerns represent the most critical weaknesses in Deleno IFC's operations. Multiple sources identify the platform as potentially fraudulent and warn potential investors to avoid engagement entirely with this broker.

Legitimate forex brokers typically maintain regulatory licenses from recognized authorities such as the FCA, CySEC, ASIC, or other major financial regulators. They implement client fund segregation, maintain professional indemnity insurance, and participate in investor compensation schemes to protect their clients' interests. However, available information indicates that Deleno IFC operates without any verifiable regulatory oversight or client protection measures.

Scam Helpers and Scam Victims Help have both published warnings about Deleno IFC. These organizations suggest that the platform may be operating fraudulent schemes targeting retail investors who are seeking legitimate trading opportunities. These warnings from established fraud prevention organizations represent serious red flags that potential investors must consider carefully before making any investment decisions.

The platform's lack of transparency regarding ownership structure, operational procedures, and regulatory compliance creates significant trust deficits. These deficits are incompatible with legitimate financial service provision in today's regulated financial environment. User feedback available through fraud reporting websites consistently reflects negative experiences and warnings about potential fraudulent activities.

User Experience Analysis (Score: 1/10)

User experience with Deleno IFC appears to be overwhelmingly negative. Available feedback suggests that individuals who have engaged with the platform have encountered significant problems and potential fraudulent activities that have resulted in financial losses.

Legitimate forex brokers typically maintain high user satisfaction rates through professional service delivery, transparent operations, and effective problem resolution. They invest in user interface design, streamlined registration processes, and efficient fund management systems to ensure positive client experiences throughout their trading journey. However, available information about Deleno IFC suggests the opposite pattern.

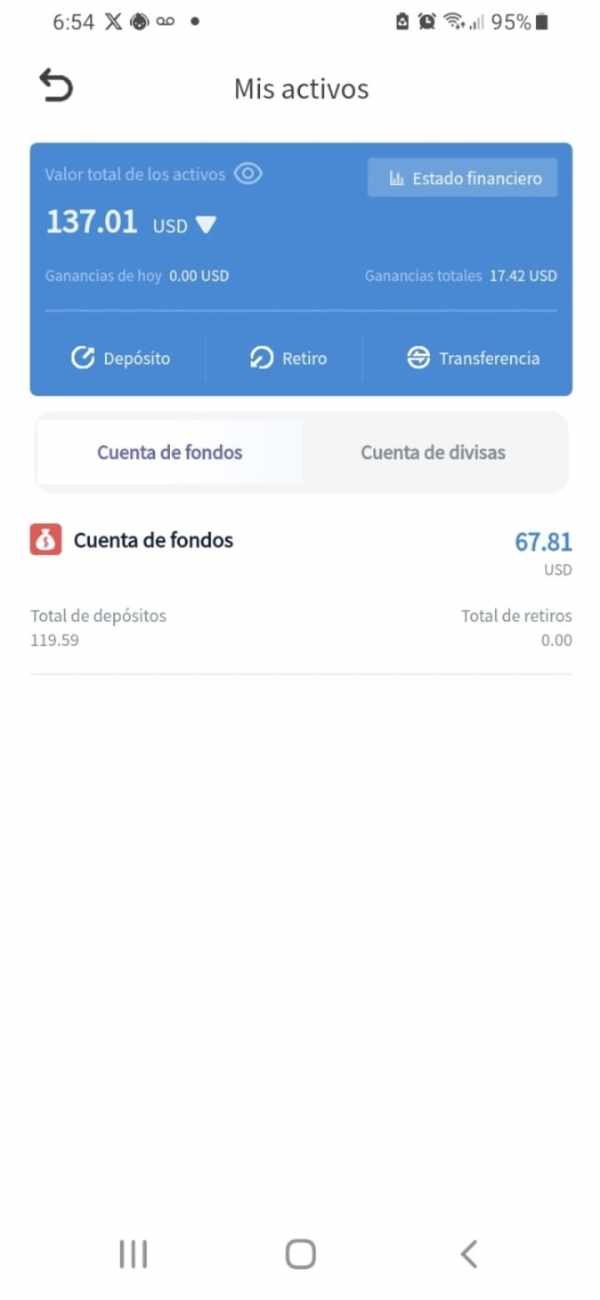

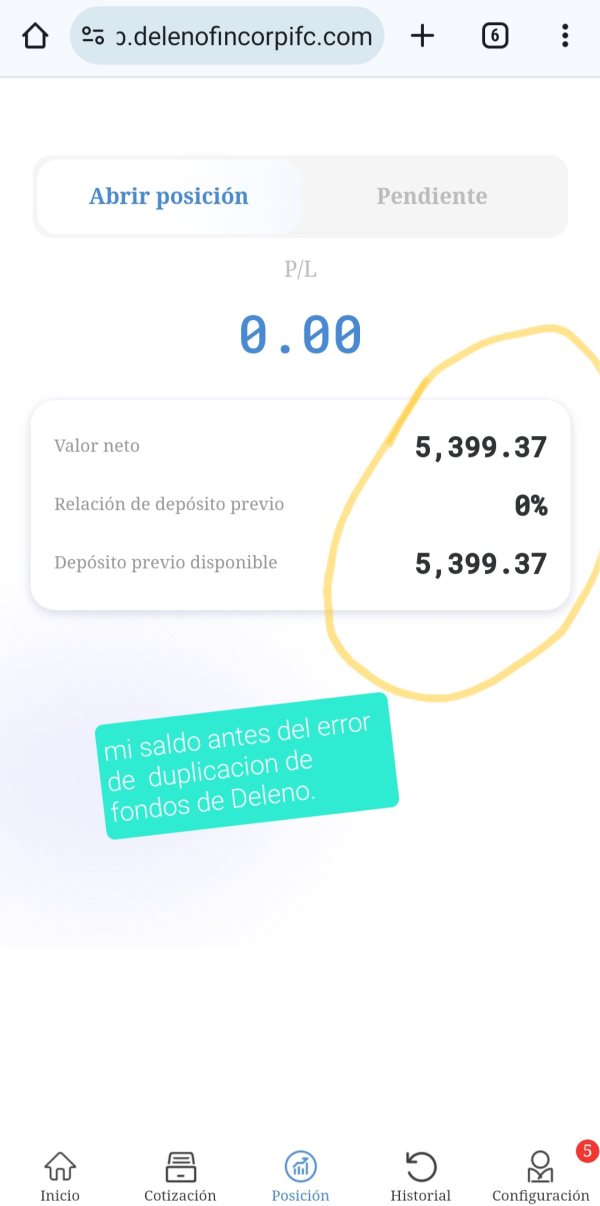

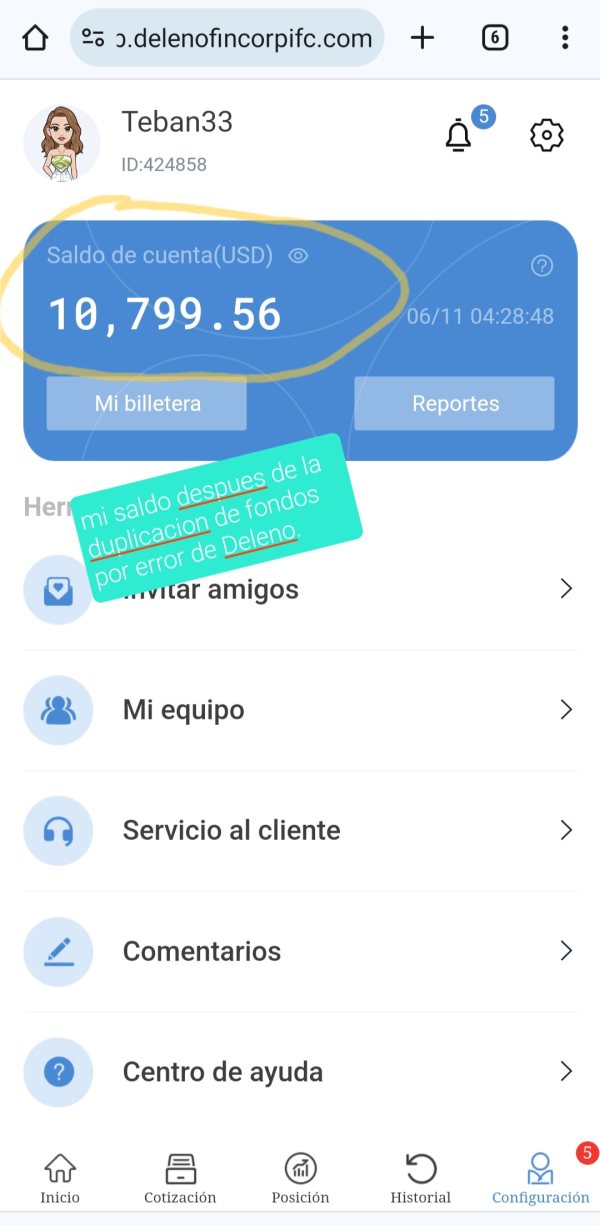

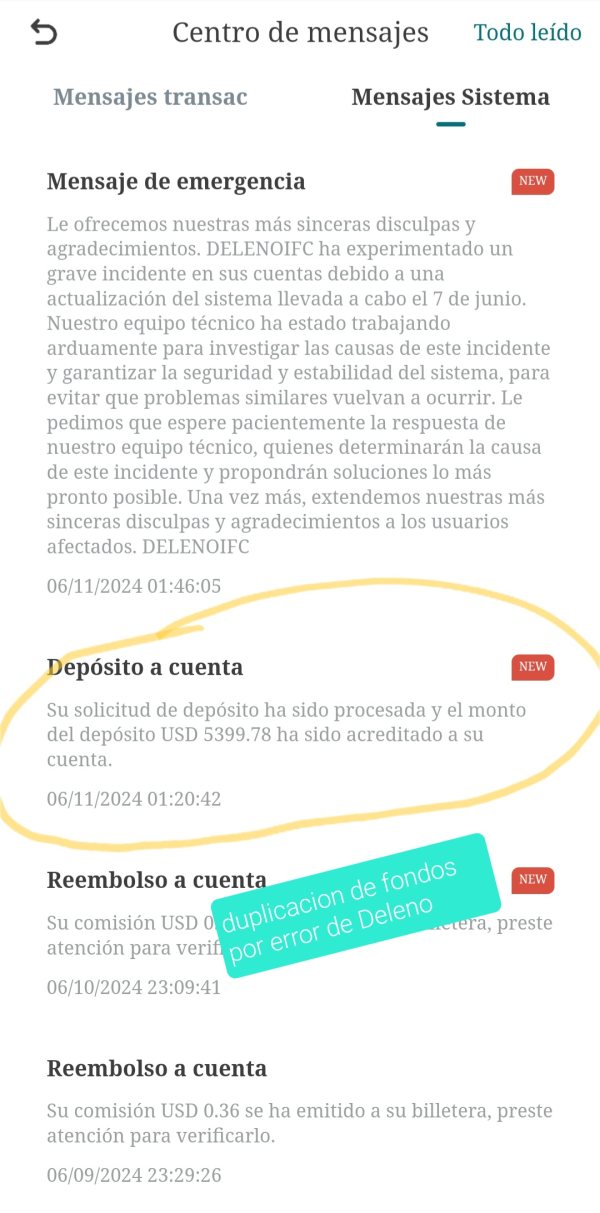

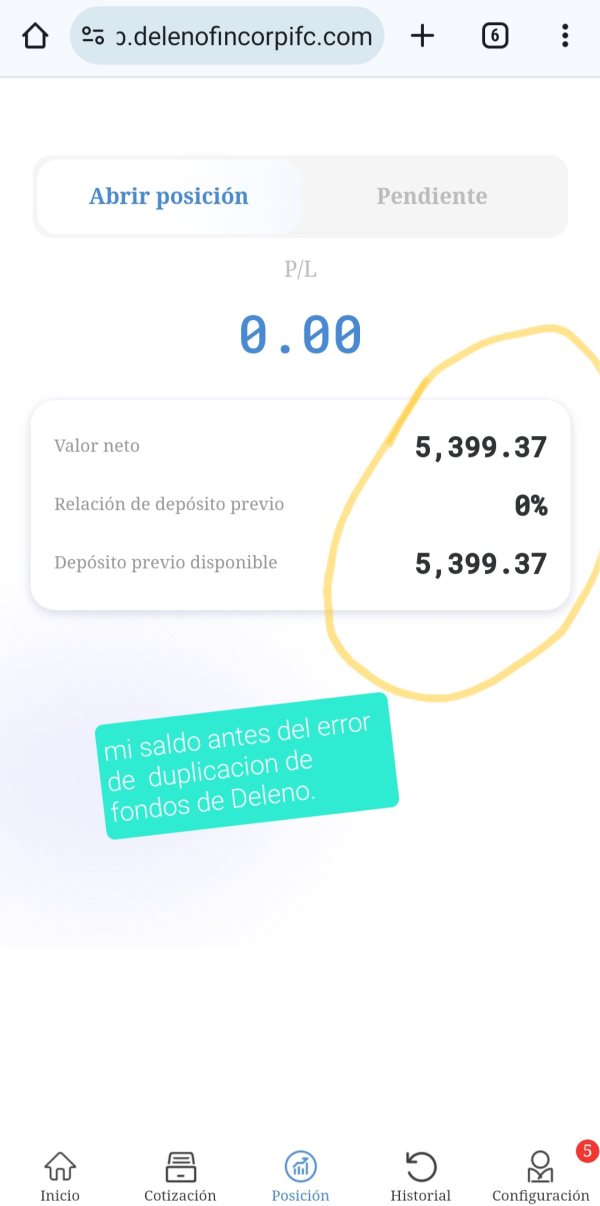

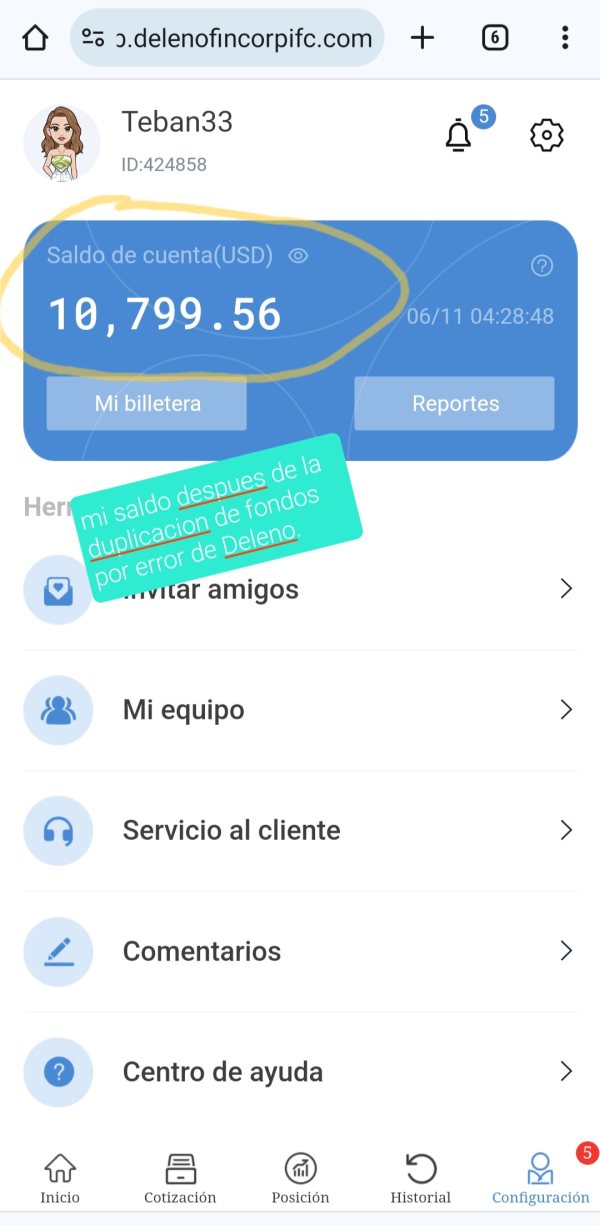

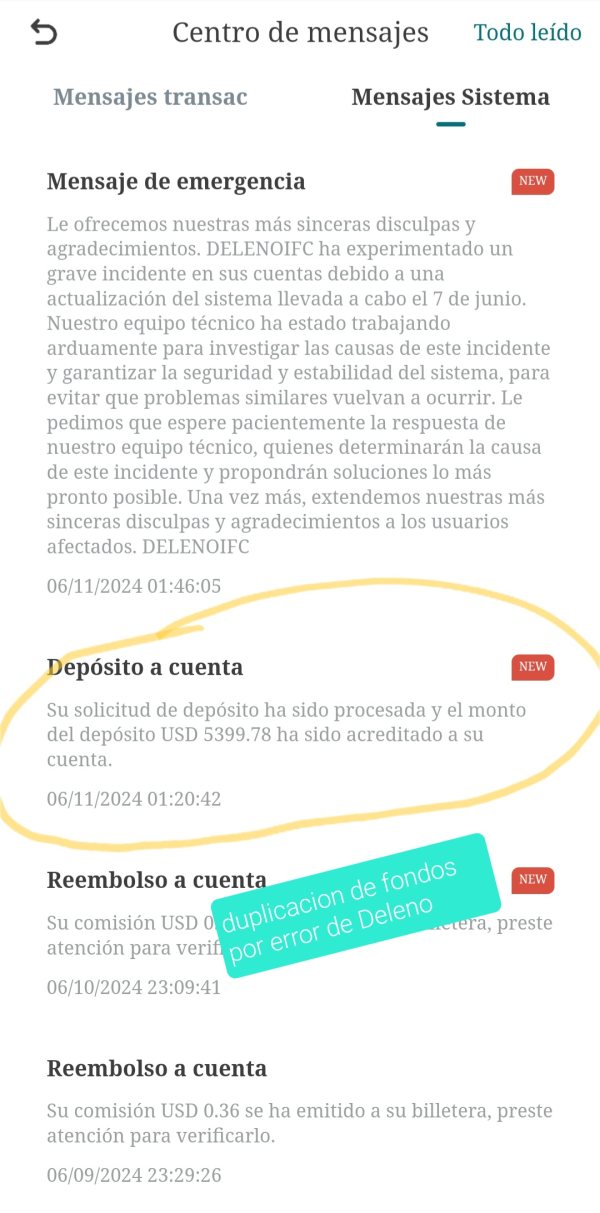

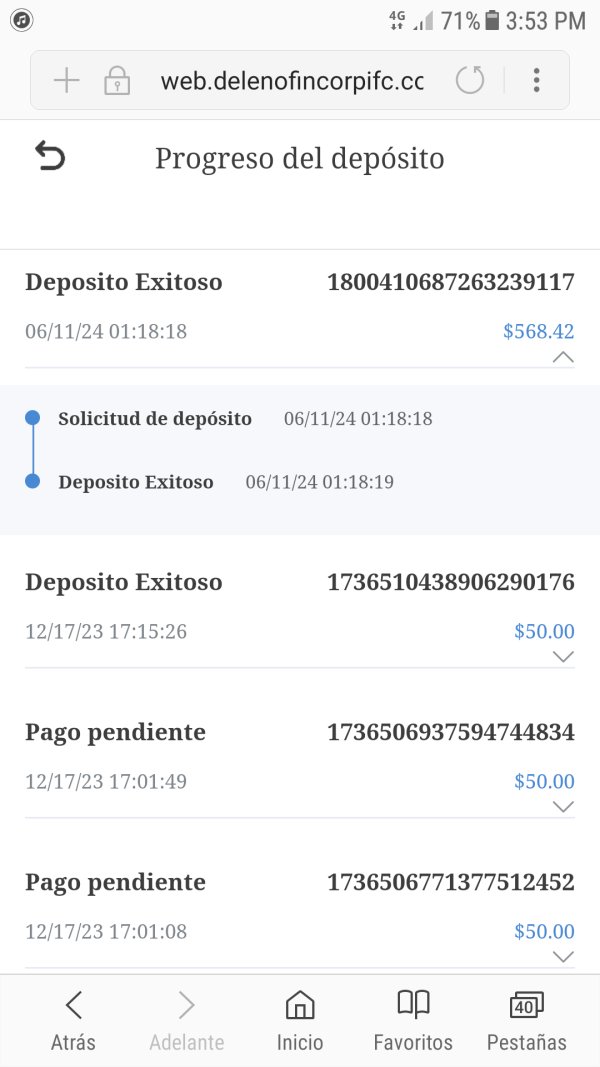

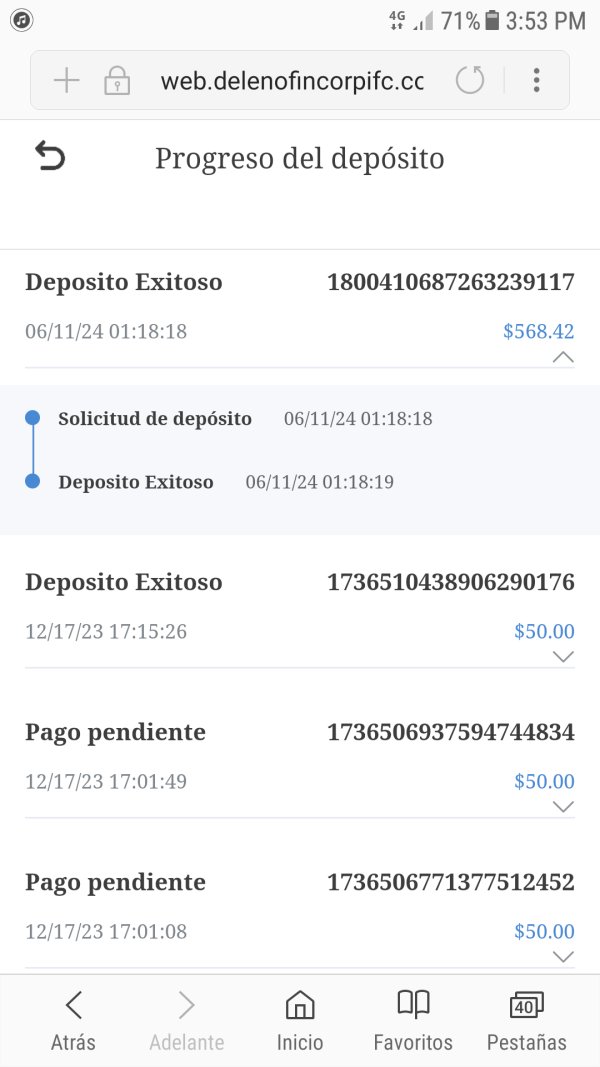

Enverracapital reports that victims of Deleno IFC's allegedly deceptive practices have been advised to pursue chargeback procedures to recover lost funds. This indicates serious operational problems that have resulted in financial losses for users who trusted the platform with their investment capital. This pattern of user complaints and recovery attempts represents a significant warning signal for potential investors.

The absence of positive user testimonials or success stories, combined with consistent warnings from fraud prevention organizations, suggests that Deleno IFC fails to deliver satisfactory experiences for its users. The platform appears to attract primarily high-risk investors who may be particularly vulnerable to fraudulent schemes that promise unrealistic returns on investment.

Conclusion

This comprehensive deleno ifc review reveals that Deleno IFC presents significant risks for potential investors. The platform fails to meet basic standards expected from legitimate forex brokers in today's regulated financial environment. The platform's complete lack of regulatory oversight, absence of transparency in operations, and consistent warnings from fraud prevention organizations create a risk profile that suggests extreme caution is warranted.

We strongly advise against engaging with Deleno IFC for any type of investment or trading activity. The combination of regulatory gaps, operational deficiencies, and negative user experiences suggests that this platform may not be operating as a legitimate financial service provider. Potential investors should consider regulated alternatives that provide appropriate client protections and transparent operations with verifiable track records.

The overwhelming disadvantages include alleged fraudulent activities, complete absence of regulatory protection, lack of transparency in operations, and consistently negative user experiences reported across multiple review platforms. These factors combine to create an investment environment that poses unacceptable risks for retail investors seeking legitimate trading opportunities in the forex and cryptocurrency markets.