CIBFX Review 1

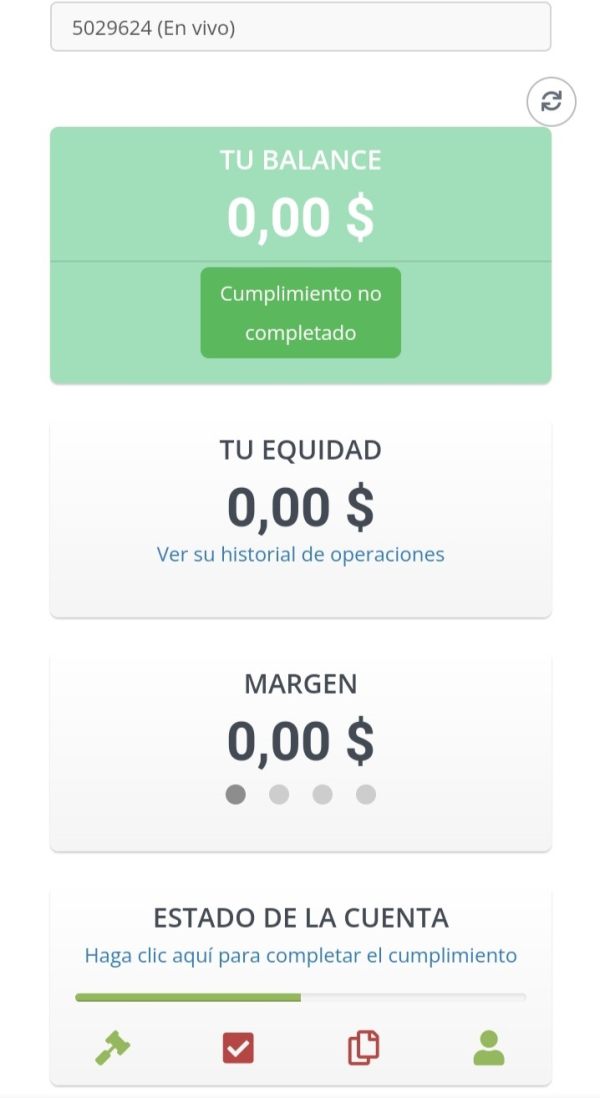

The worst broker that I have ever experienced. They are scammers. they just say this is a lie to cover themselves, if it is true, I know that my $250,153 is not reflected on the board. The truth is disappointment

CIBFX Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

The worst broker that I have ever experienced. They are scammers. they just say this is a lie to cover themselves, if it is true, I know that my $250,153 is not reflected on the board. The truth is disappointment

Capital Investment Brokers presents itself as an online forex and CFD trading platform. The platform has received mixed reactions from traders around the world. This cibfx review provides a complete analysis of what the broker offers in 2025. CIBFX has earned praise for its customer support and professional trading tools, but there are serious concerns about platform safety that traders must consider carefully.

The broker mainly serves forex traders who want reliable support and professional trading environments. It offers access to the popular MetaTrader 4 platform and various CFD instruments, giving traders multiple options for their strategies. However, user feedback shows divided opinions about how reliable the platform really is. Some traders question whether it's truly safe to use. CIBFX targets intermediate traders who value quick customer service and complete trading solutions. The mixed reviews mean that potential clients should research thoroughly before putting money into the platform.

This review uses publicly available information and user feedback from various sources. CIBFX has limited regulatory information available, so traders should know that legal protections may vary greatly across different countries. The evaluation here does not give investment advice. Potential clients should verify all regulatory credentials and terms of service on their own.

Our assessment uses user testimonials, available platform features, and public information. This review has not undergone complete compliance verification or on-site investigation, so readers should treat this analysis as preliminary guidance rather than final recommendations.

| Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific account terms not detailed in available materials |

| Tools and Resources | 7/10 | MT4 platform availability and CFD offerings |

| Customer Service | 9/10 | Consistently positive user feedback on support quality |

| Trading Experience | N/A | Detailed trading performance data not available |

| Trust and Safety | 5/10 | Mixed user reviews regarding platform security |

| User Experience | N/A | Comprehensive user interface feedback not available |

Capital Investment Brokers operates under the CIBFX brand as a specialized online trading platform. The company focuses on forex and CFD markets specifically. It has built its presence in the competitive online trading sector by emphasizing excellent customer support and professional trading solutions. According to available information, CIBFX operates primarily through internet-based trading services that cater to individual retail traders seeking access to global financial markets.

The broker's business model centers on providing access to foreign exchange markets and contracts for difference across various asset classes. CIBFX has developed its services around offering professional-grade trading solutions while maintaining strong customer relationship management. User feedback consistently highlights the platform's commitment to customer service. This suggests that client support represents a core component of the company's operational strategy.

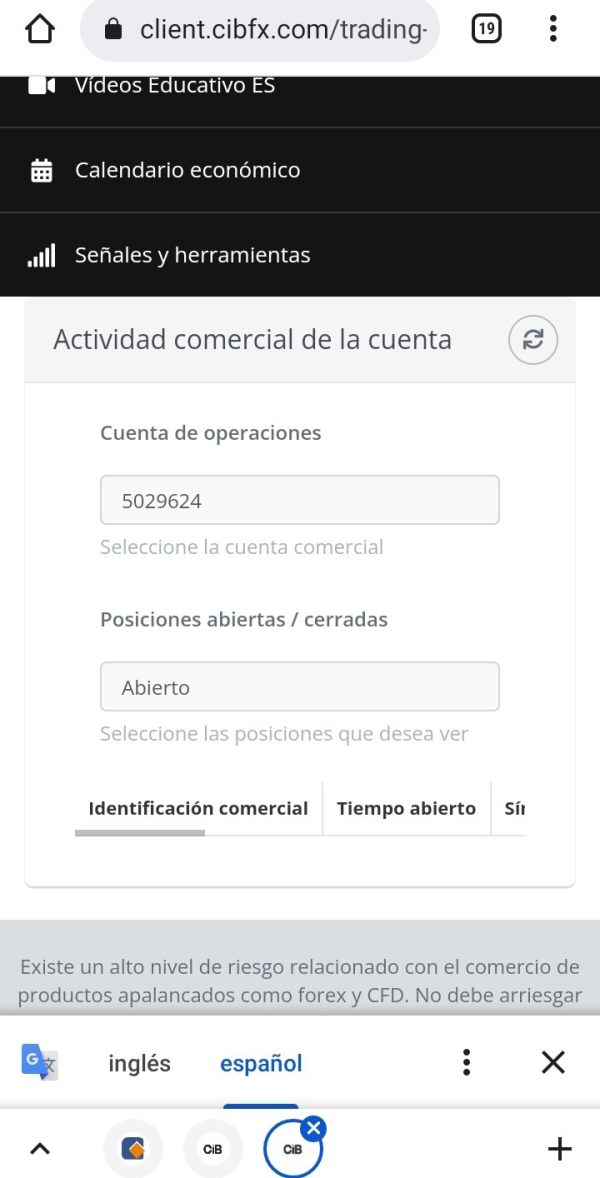

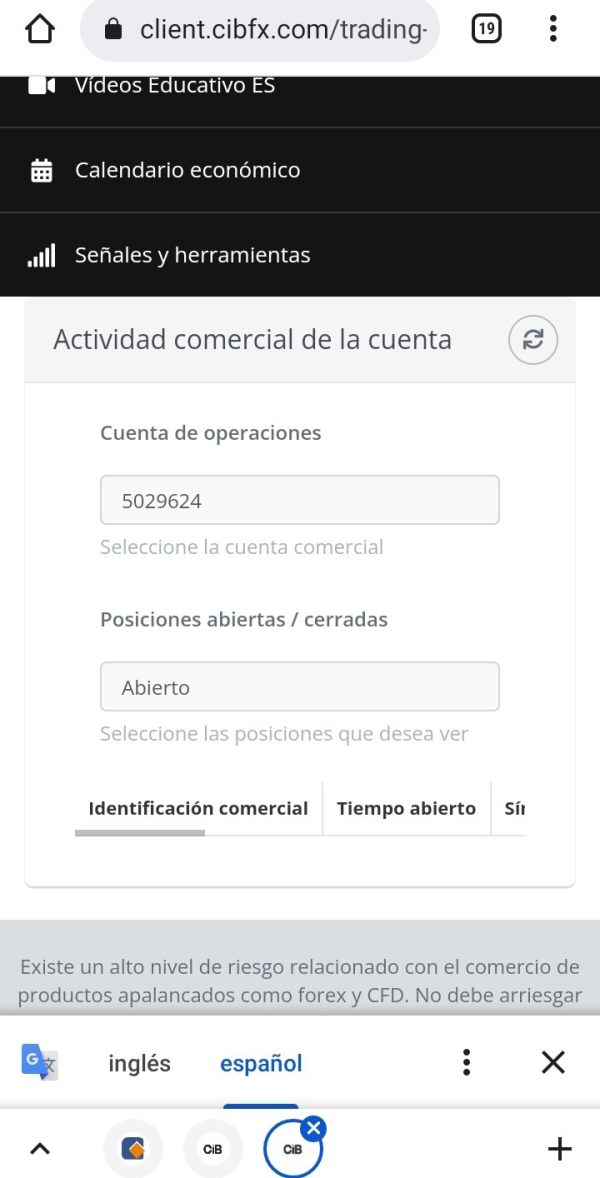

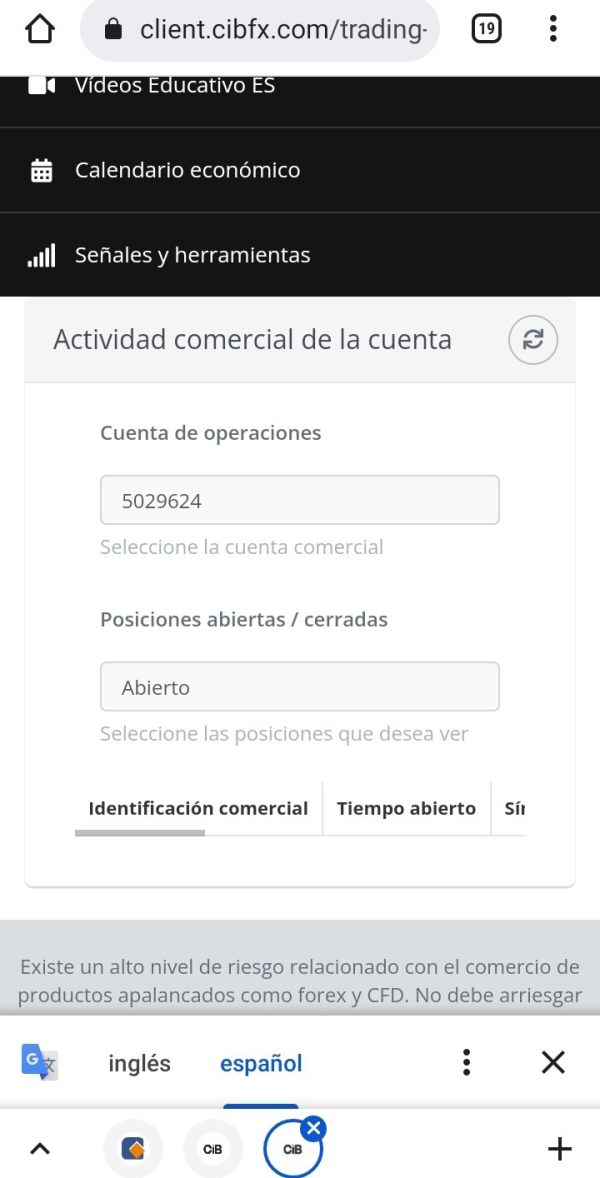

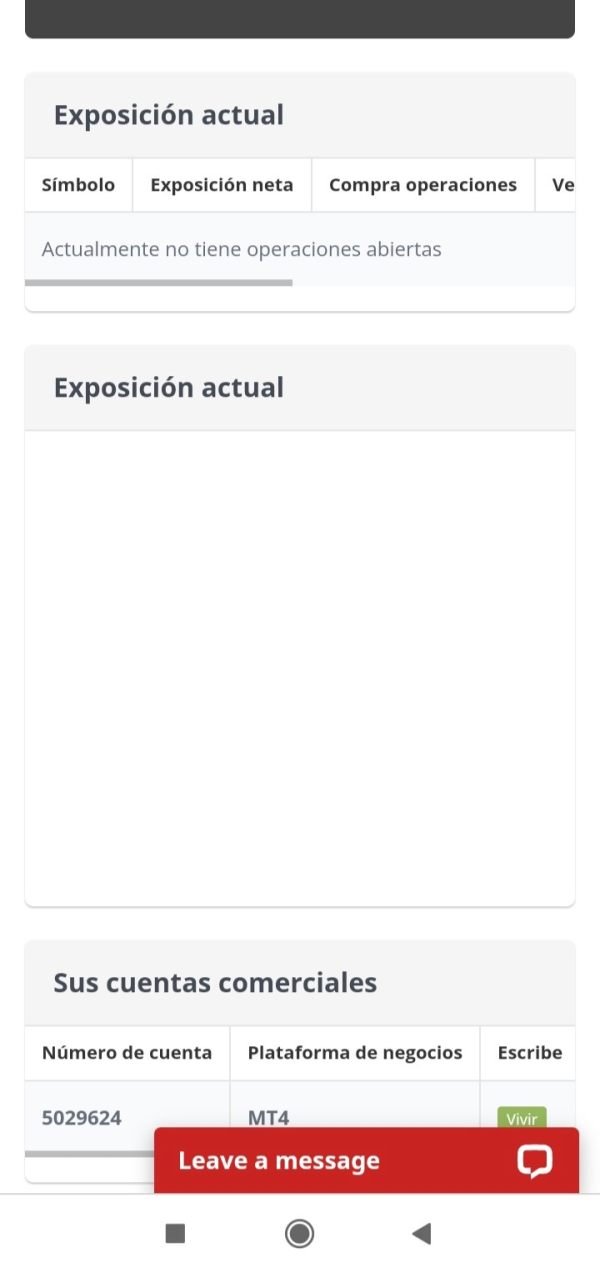

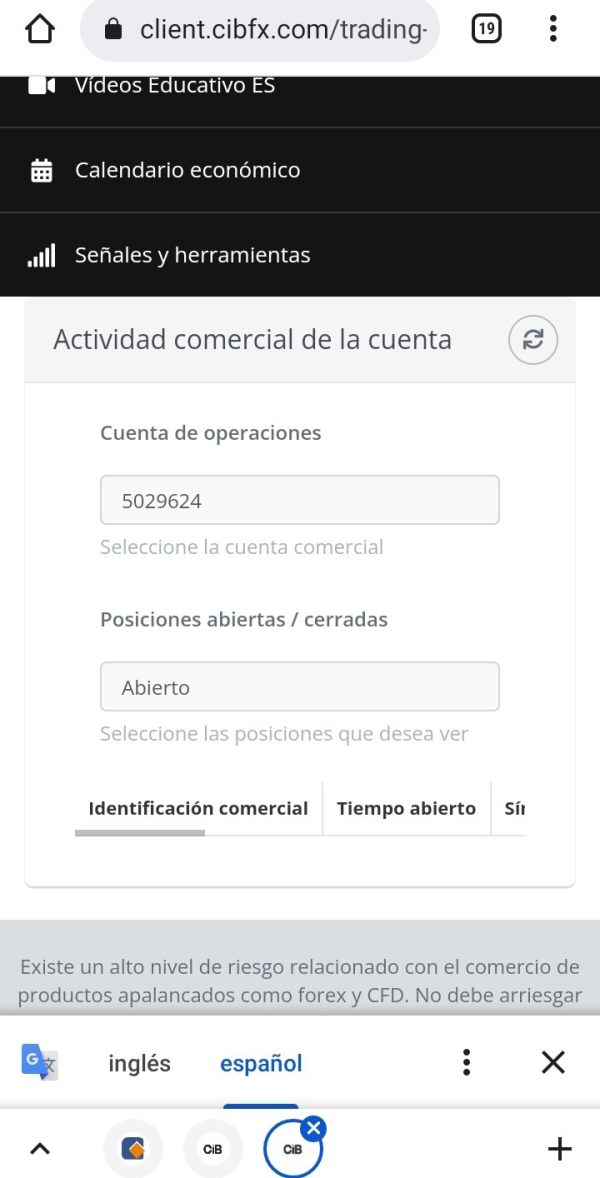

CIBFX primarily operates through the MetaTrader 4 platform, which is one of the industry's most widely recognized trading interfaces. The broker offers access to forex markets and various CFD instruments, though specific details about asset coverage and market depth remain limited in publicly available materials. This cibfx review notes that while the platform provides standard trading capabilities, comprehensive information about regulatory oversight and licensing remains unclear from available sources.

Available materials do not provide specific information about CIBFX's regulatory status or licensing authorities. This absence of clear regulatory information represents a significant consideration for potential traders evaluating the platform's legitimacy and client protection measures.

CIBFX offers access to forex markets and various contracts for difference. The platform appears to focus on major currency pairs and popular CFD instruments, though comprehensive asset listings are not detailed in available sources.

The broker primarily uses the MetaTrader 4 platform. This gives traders access to an industry-standard trading interface that most professionals recognize. MT4 offers comprehensive charting tools, technical analysis capabilities, and automated trading support through Expert Advisors.

Specific information about account types, minimum deposit requirements, and account-specific features is not detailed in available materials. Prospective traders should contact the broker directly for comprehensive account information.

Details about spreads, commissions, and other trading costs are not specified in available sources. This cibfx review cannot provide definitive information about the platform's pricing model without access to detailed fee schedules.

User feedback consistently emphasizes CIBFX's strong customer support capabilities. Multiple sources indicate professional and responsive service delivery that meets trader expectations.

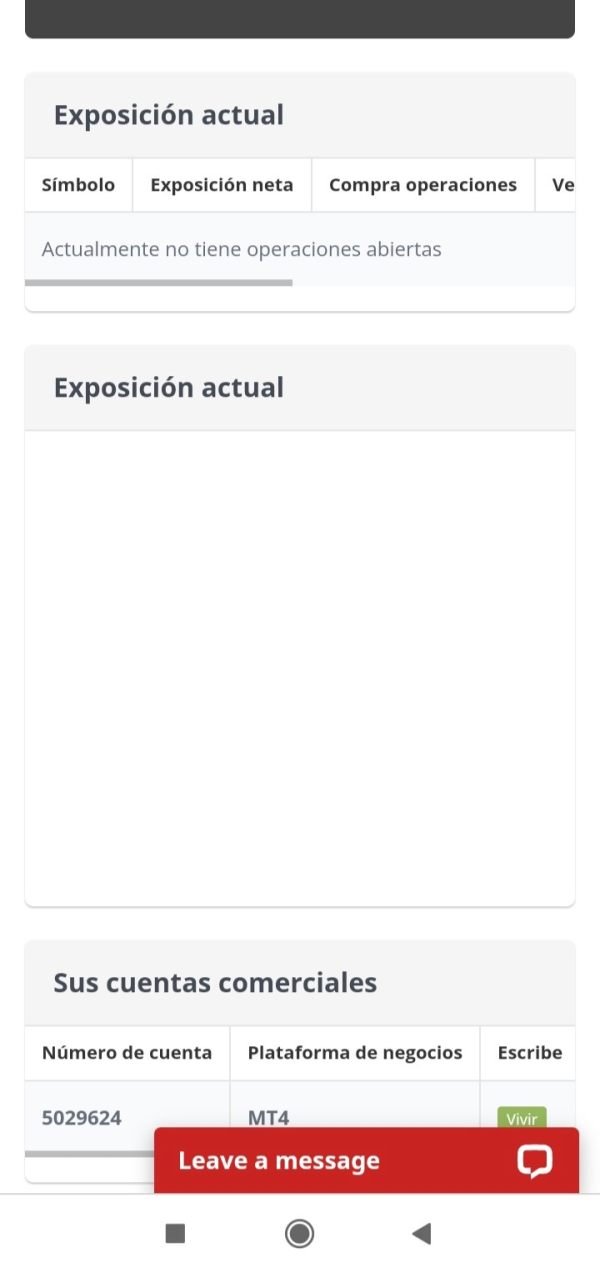

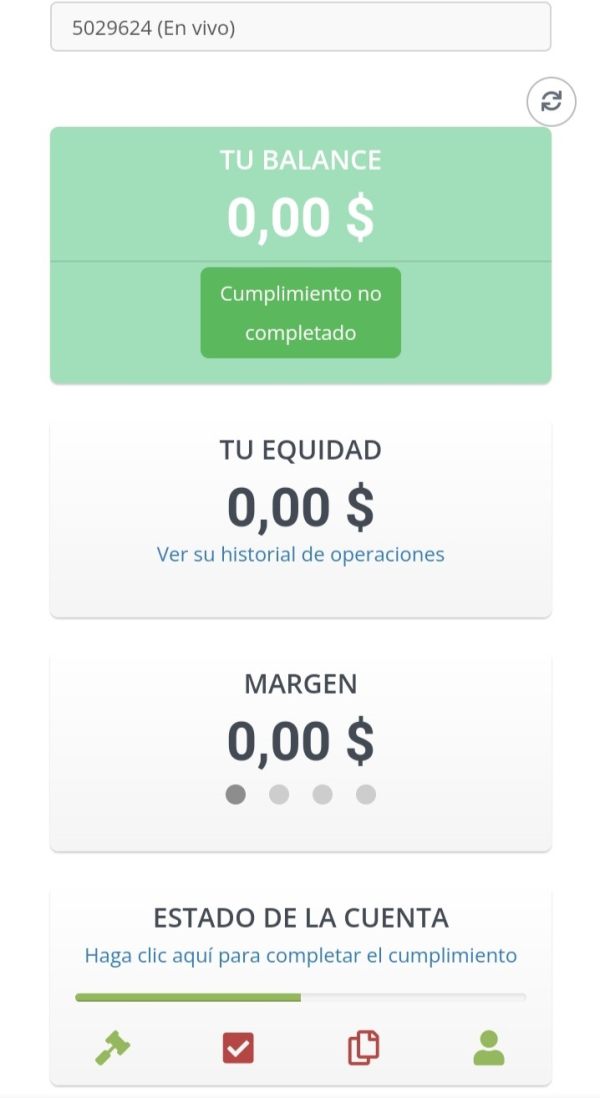

The evaluation of CIBFX's account conditions faces limitations due to insufficient publicly available information. Available materials do not detail the range of account options, minimum deposit requirements, or specialized account features that traders might expect from a comprehensive forex broker. This lack of transparency about account structures represents a significant information gap for potential clients conducting research.

Without specific details about account tiers, leverage options, or minimum balance requirements, this cibfx review cannot provide definitive guidance. Traders cannot determine whether the platform's account conditions align with different trader profiles and capital levels based on available information. The absence of clear information about Islamic accounts, professional trader accounts, or other specialized offerings further limits the assessment. CIBFX's ability to accommodate diverse trading needs and religious considerations remains unclear.

Prospective traders should directly contact CIBFX representatives to obtain comprehensive information about account opening procedures. They should also ask about documentation requirements and ongoing account maintenance conditions directly from the company. The platform's customer service reputation suggests that direct inquiry may yield the detailed account information not readily available through public channels.

CIBFX's trading infrastructure centers around the MetaTrader 4 platform. This provides traders with access to one of the forex industry's most established and feature-rich trading environments that professionals worldwide recognize. MT4 offers comprehensive charting capabilities, technical analysis tools, and support for automated trading strategies through Expert Advisors. The platform's widespread adoption across the industry ensures that traders can leverage familiar interfaces and extensive third-party resources.

The broker's focus on CFD offerings suggests access to diverse markets beyond traditional forex pairs. However, specific details about available instruments and market coverage remain limited in publicly accessible materials. This constraint affects the ability to fully evaluate the breadth and depth of trading opportunities available through the CIBFX platform.

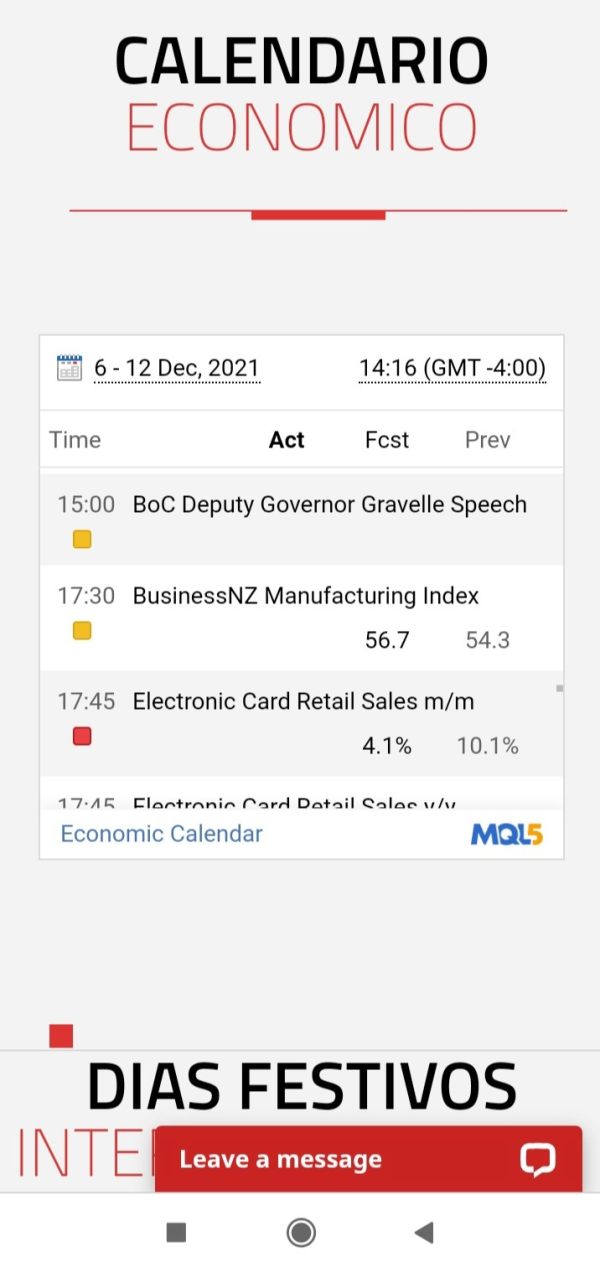

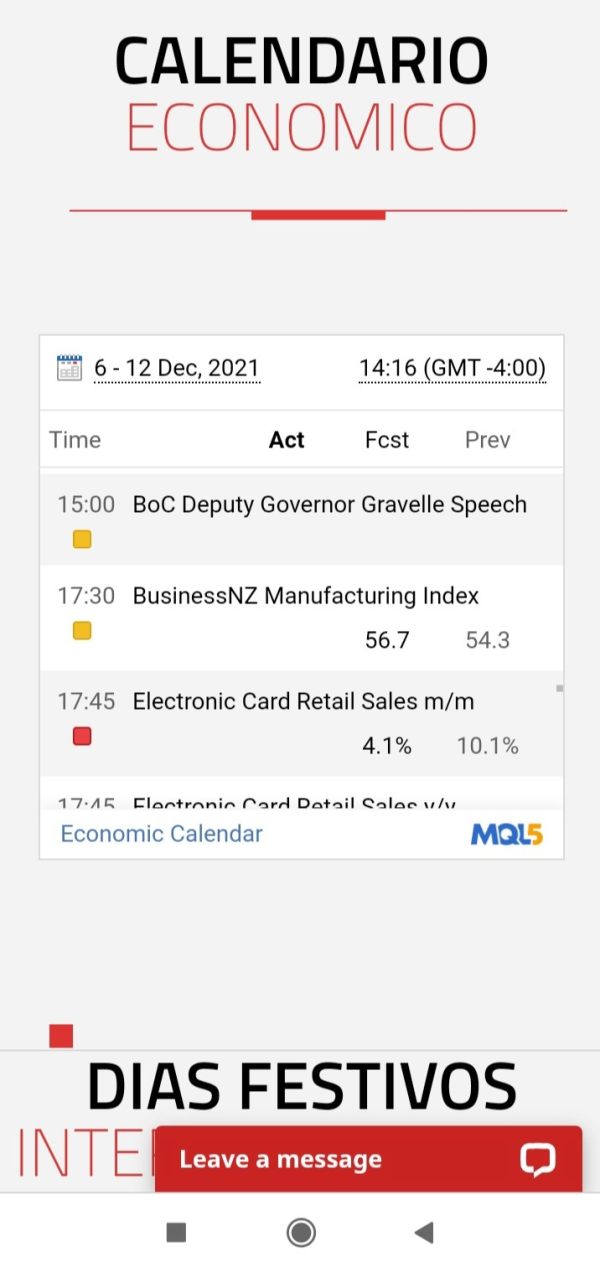

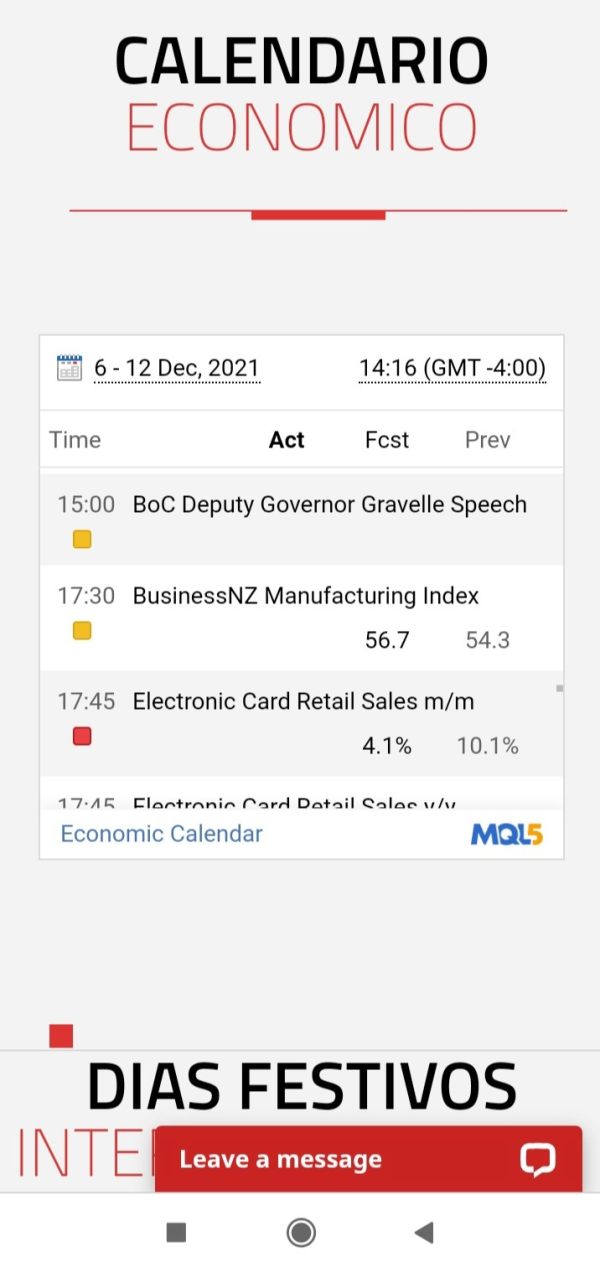

Available information does not detail additional research resources, educational materials, or proprietary trading tools. These features might differentiate CIBFX from competitors in meaningful ways. The absence of information about market analysis, economic calendars, or educational content represents a notable gap. Traders seeking ongoing market insights and skill development opportunities cannot fully understand the platform's comprehensive value proposition.

Customer service represents CIBFX's most consistently praised aspect according to available user feedback. Multiple sources indicate that the broker delivers professional and responsive support services consistently across different user interactions. Users specifically highlight the quality of trading solutions and customer assistance they receive from the support team. This positive reputation suggests that CIBFX has invested significantly in developing strong client relationship management capabilities.

The emphasis on customer support excellence appears to be a core differentiator for CIBFX in the competitive online trading market. User testimonials consistently reference the professional nature of support interactions and the effectiveness of problem resolution processes they experience. This pattern of positive feedback indicates that the platform prioritizes client satisfaction and maintains responsive communication channels. The consistency of these reports suggests genuine commitment to service quality.

However, specific details about support availability hours, communication channels, multilingual capabilities, and response time standards are not detailed in available materials. While user feedback suggests high satisfaction levels, the absence of concrete service level information limits the ability to provide comprehensive guidance. Traders cannot fully understand support accessibility and scope without more detailed information. Potential traders should verify support arrangements that align with their trading schedules and communication preferences.

The evaluation of CIBFX's trading experience faces significant limitations due to insufficient detailed information. Available materials do not provide specific data about platform performance, execution quality, and user interface characteristics that traders need to make informed decisions. Order execution speeds, slippage rates, and platform stability during high-volatility market conditions remain unclear, yet these represent critical factors for assessing trading environment quality.

Without access to detailed performance metrics or comprehensive user feedback about trading execution, this cibfx review cannot definitively assess the platform's capabilities. Traders cannot determine whether the platform meets the technical requirements of active trading or provides competitive execution standards based on available information. The reliance on MetaTrader 4 suggests access to proven trading technology, though platform customization and optimization details remain unclear.

Mobile trading capabilities, platform customization options, and integration with third-party tools represent additional aspects of trading experience. These features lack detailed coverage in available sources and could significantly impact user satisfaction. The absence of specific information about trading environment features limits the ability to guide traders effectively. Potential users cannot understand whether CIBFX's technical infrastructure aligns with their trading strategies and execution requirements.

Trust and safety considerations present the most significant concerns in this CIBFX evaluation. Available user feedback includes specific warnings about the platform's safety credentials that potential traders must take seriously. Some reviewers explicitly state that CIBFX may not represent a secure choice for forex trading. These safety concerns create substantial uncertainty about the platform's reliability and client protection measures.

The absence of clear regulatory information compounds these trust concerns significantly. Traders cannot verify independent oversight or dispute resolution mechanisms through recognized financial authorities, which creates additional risk. Without transparent regulatory credentials, clients face increased uncertainty about fund protection, operational standards, and recourse options. Dispute resolution and platform issues become more complicated without clear regulatory framework.

The contradiction between positive customer service feedback and safety concerns creates a complex risk profile. Potential traders must carefully evaluate this mixed information before making decisions. While users praise support quality, the underlying questions about platform security and regulatory compliance represent fundamental considerations. These issues extend far beyond customer service excellence and affect core platform reliability. Prospective clients should conduct thorough independent verification of the platform's safety credentials and regulatory status before committing funds.

User experience assessment reveals a mixed picture based on available feedback. Positive customer service interactions contrast against broader safety and reliability concerns that affect overall satisfaction. The consistent praise for customer support suggests that CIBFX has developed effective client communication processes and maintains professional service standards. These positive interactions contribute to user satisfaction in specific areas.

However, the broader user experience extends beyond customer service to encompass platform reliability, fund security, and overall trading environment quality. The safety concerns raised by some users indicate that the complete user experience may include significant risk factors. These risks potentially offset positive support interactions and create uncertainty about long-term satisfaction. This creates a complex evaluation scenario where service quality conflicts with fundamental trust considerations.

The target user profile appears to include traders who prioritize responsive customer support and professional service delivery above other considerations. However, the safety concerns suggest that risk-tolerant traders who conduct thorough research may be better suited to evaluate CIBFX's offerings realistically. The platform may appeal to traders seeking personalized support, but the trust issues indicate that conservative traders should exercise particular caution. Their evaluation process should include extensive independent verification of safety measures.

This comprehensive CIBFX review reveals a trading platform with notable strengths in customer service delivery. However, it also shows significant concerns regarding safety and transparency that cannot be ignored. While user feedback consistently praises the broker's professional support services and trading solutions, the warnings about security issues create substantial uncertainty. The absence of clear regulatory information compounds these concerns about the platform's overall reliability and client protection standards.

CIBFX may appeal to traders who prioritize responsive customer support and are willing to accept higher risk levels. These traders might find value in the personalized service the platform appears to offer. However, the safety concerns and regulatory transparency issues suggest that conservative traders should exercise extreme caution. Those prioritizing fund security should be particularly careful when considering this platform. Potential clients should conduct thorough independent verification of all safety credentials and regulatory compliance before making any financial commitments to the CIBFX platform.

FX Broker Capital Trading Markets Review