Fantex 2025 Review: Everything You Need to Know

Executive Summary

This Fantex review looks at a unique financial services company that has created mixed reactions from users and industry observers. Fantex Holdings, Inc., based in San Francisco, California, runs an innovative investment platform that lets traders invest in securities tied to professional athletes' brand contracts and future earnings. The company launched their first initial public offering in October 2013 with San Francisco 49ers tight end Vernon Davis, and they have continued expanding their athlete portfolio since then.

User feedback shows a concerning picture. Some users have expressed significant trust issues based on available reviews, with certain feedback describing questionable business practices. The platform's unique focus on athlete-linked securities attracts investors interested in sports-related investments, but potential users should approach with considerable caution given the mixed reputation and limited regulatory transparency.

The company's innovative approach to sports investment represents a novel concept in the financial markets. Yet the lack of comprehensive public information about regulatory oversight and operational transparency raises important questions for prospective investors.

Important Notice

Regional Entity Differences: Fantex's regulatory status requires careful evaluation, as comprehensive regulatory information is not clearly detailed in available public materials. Users should conduct thorough due diligence regarding regulatory oversight before engaging with the platform.

Review Methodology: This evaluation is based on publicly available information, user feedback, and company disclosures. Given limited comprehensive data availability, prospective users should seek additional information directly from the company and verify all regulatory credentials independently.

Rating Framework

Broker Overview

Company Background and Establishment

Fantex Holdings, Inc. established itself in the financial services sector with a unique value proposition focused on athlete brand development and investment opportunities. The company launched its first initial public offering in October 2013, featuring securities linked to Vernon Davis's future earnings from the San Francisco 49ers. This groundbreaking approach represented an innovative intersection between sports entertainment and financial markets.

The San Francisco-based company positions itself as both a financial services provider and brand development entity. They create investment vehicles that allow retail and institutional investors to participate in professional athletes' financial success. Since the initial Vernon Davis offering, Fantex has worked to expand its athlete roster and develop additional brand contracts for listing on their proprietary exchange platform.

Business Model and Service Offering

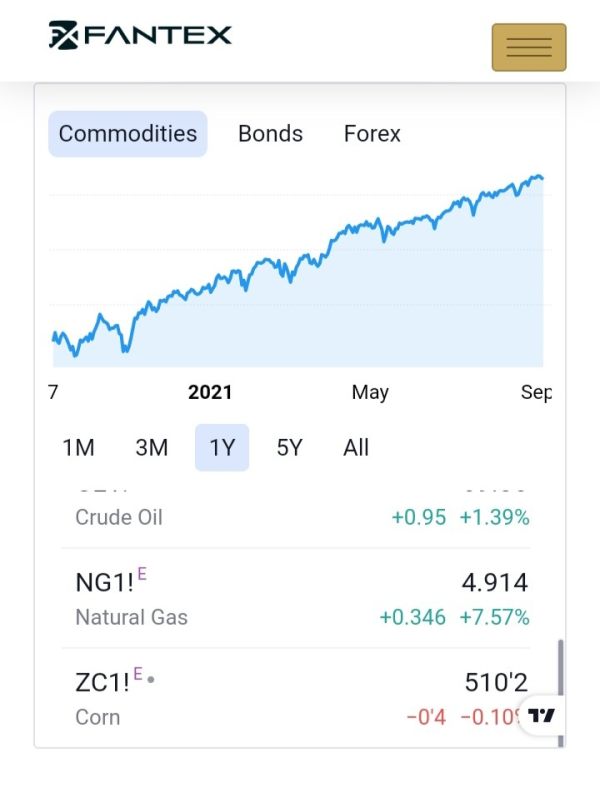

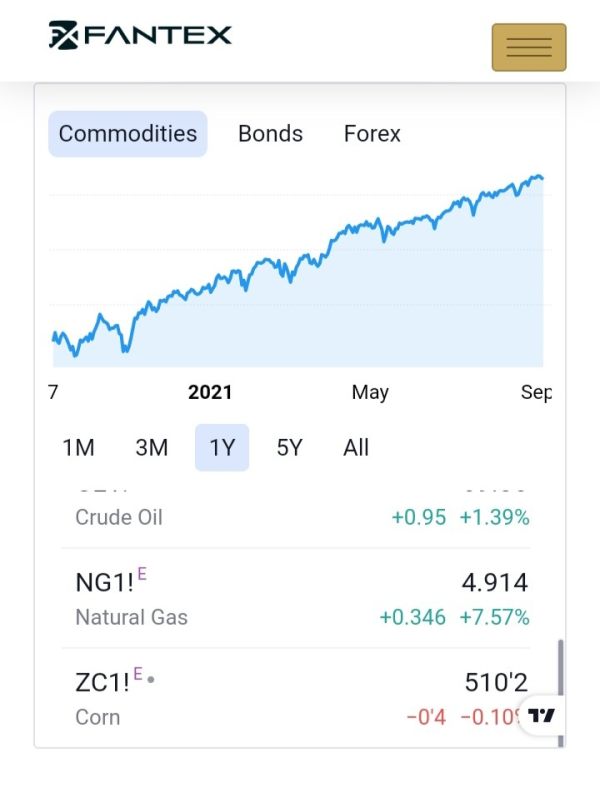

Fantex operates a specialized investment service that enables investors to trade securities directly tied to professional athletes' cash flows and brand contract revenues. This unique business model creates a new asset class that combines elements of traditional equity trading with entertainment industry investments. The platform focuses specifically on creating tradeable securities from athlete brand partnerships and future earning potential.

The company's exchange facilitates trading in these athlete-linked securities. It provides a marketplace where investors can buy and sell positions based on their assessment of individual athletes' market value and earning potential. However, comprehensive details about trading platform specifications, regulatory oversight, and operational procedures remain limited in publicly available documentation.

Regulatory Framework: Available materials do not specify comprehensive regulatory oversight details. This requires prospective users to verify regulatory status independently through direct company contact.

Deposit and Withdrawal Methods: Specific information regarding accepted payment methods and withdrawal procedures is not detailed in accessible public documentation.

Minimum Deposit Requirements: Minimum investment thresholds are not specified in available company materials. This makes direct inquiry necessary for account opening requirements.

Promotional Offers: Current bonus structures and promotional offerings are not outlined in available public information sources.

Tradeable Assets: The platform specializes in securities tied to professional athletes' brand contracts and future earnings. This creates a unique asset class focused on sports entertainment investments. This Fantex review notes that the company has expanded beyond the initial Vernon Davis offering to include additional athlete partnerships.

Cost Structure: Detailed fee schedules are not comprehensively outlined in publicly accessible materials. These include trading commissions, account maintenance charges, and other operational costs.

Leverage Options: Leverage ratios and margin trading capabilities are not specified in available documentation.

Platform Technology: Specific trading platform details and technological infrastructure information are not detailed in accessible sources.

Geographic Restrictions: Regional availability and access limitations are not clearly specified in available materials.

Customer Support Languages: Supported languages for customer service are not detailed in accessible documentation.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Fantex's account conditions presents significant challenges due to limited publicly available information. Standard account types, tier structures, and associated benefits are not comprehensively detailed in accessible materials. This lack of transparency regarding account offerings makes it difficult for prospective users to understand what services and features are available at different investment levels.

Minimum deposit requirements are not specified in available documentation. These requirements are crucial for investment planning. Similarly, account opening procedures, verification requirements, and onboarding processes lack detailed public description. The absence of clear information about Islamic-compliant accounts or other specialized account types further limits understanding of the platform's inclusivity and accessibility.

Without comprehensive account condition details, potential investors cannot adequately assess whether Fantex's offerings align with their investment goals and financial capabilities. This Fantex review emphasizes the importance of obtaining detailed account information directly from the company before making any investment decisions.

The lack of transparent account condition information raises questions about operational transparency. It may contribute to user uncertainty about the platform's legitimacy and professional standards.

Available information does not provide comprehensive details about Fantex's trading tools, analytical resources, or educational materials. Standard trading platforms typically offer charting tools, technical analysis indicators, market research, and educational content. However, specific details about Fantex's tool suite are not detailed in accessible sources.

Research and analysis resources are not described in available materials. These resources are essential for informed investment decisions. The absence of information about market analysis, athlete performance tracking, or industry insights limits understanding of the platform's analytical capabilities.

Educational resources are not detailed in public documentation. These are particularly important given the unique nature of athlete-linked securities. New investors in this novel asset class would benefit from comprehensive educational materials explaining how athlete brand contracts function as investment vehicles.

Automated trading capabilities, API access, and advanced trading features are not specified in available information. The lack of detailed tool descriptions makes it challenging for experienced traders to evaluate whether the platform meets their technical requirements and trading preferences.

Customer Service and Support Analysis

Customer service information is notably absent from available public materials. This creates uncertainty about support quality and availability. Standard support channels such as phone, email, chat, and help desk services are not detailed in accessible documentation.

Response times, service quality metrics, and customer satisfaction data are not provided in available sources. This lack of customer service transparency may contribute to user concerns about the platform's commitment to client support and problem resolution.

Multi-language support capabilities are not specified. This potentially limits accessibility for international users interested in athlete-linked investments. Operating hours, regional support availability, and specialized assistance for complex investment questions remain unclear.

The absence of detailed customer service information in available materials may reflect broader transparency issues. It could contribute to user trust concerns mentioned in feedback reviews.

Trading Experience Analysis

Comprehensive trading experience details are not available in accessible public materials. This makes it difficult to evaluate platform performance, execution quality, and user interface design. Standard trading metrics such as execution speed, order fill rates, and system stability are not documented in available sources.

Platform functionality lacks detailed description in public documentation. This includes order types, trading tools, and market access features. Mobile trading capabilities, which are increasingly important for modern investors, are not specified in available materials.

The unique nature of athlete-linked securities trading may require specialized platform features. However, specific details about how these instruments are traded, priced, and settled are not comprehensively explained in accessible sources. This Fantex review notes that understanding the trading mechanics is crucial for potential investors.

Technical performance data, user interface reviews, and platform reliability information are not detailed in available materials. This makes it challenging to assess the overall trading experience quality.

Trust and Safety Analysis

Trust and safety represent significant concerns based on available user feedback and limited regulatory transparency. Some user reviews indicate serious trust issues, with certain feedback describing the platform in highly negative terms. These reviews include references to questionable business practices.

Regulatory oversight information is not comprehensively detailed in available materials. This raises questions about compliance standards and investor protection measures. The absence of clear regulatory credentials makes it difficult to verify the platform's legitimacy and operational oversight.

Fund security measures, client asset protection, and operational transparency are not detailed in accessible public documentation. These factors are crucial for investor confidence and platform credibility, particularly given the innovative nature of athlete-linked securities.

The combination of negative user feedback and limited regulatory transparency creates significant trust concerns. Potential investors should carefully consider these issues before engaging with the platform.

User Experience Analysis

Comprehensive user experience data is not available in accessible materials. This makes it difficult to assess overall user satisfaction and platform usability. Interface design, navigation ease, and user workflow efficiency are not detailed in available sources.

Registration and account verification processes are not described in public documentation. This creates uncertainty about onboarding complexity and time requirements. Fund management procedures, including deposits, withdrawals, and account maintenance, lack detailed explanation.

User feedback indicates significant concerns about platform trustworthiness. Some reviews express strong negative opinions about the service quality and business practices. The polarized nature of available feedback suggests substantial user experience variations.

Common user complaints appear to center around trust and transparency issues rather than technical platform problems. This indicates that concerns may be more fundamental than operational.

Conclusion

This Fantex review reveals a platform with an innovative concept that faces significant trust and transparency challenges. While the company's unique approach to athlete-linked securities represents an interesting innovation in financial markets, the combination of limited regulatory information and concerning user feedback raises important red flags for potential investors.

The platform may appeal to investors specifically interested in sports-related investments and willing to accept higher risk levels. However, the lack of comprehensive public information about account conditions, trading tools, and regulatory oversight makes it difficult to recommend Fantex to mainstream investors seeking established, transparent trading environments.

Key advantages include the innovative trading concept and unique asset class exposure. However, significant disadvantages include trust concerns, limited transparency, and insufficient regulatory clarity. Prospective users should exercise extreme caution and conduct thorough due diligence before considering any investment through this platform.