Ifx Markets 2025 Review: Everything You Need to Know

Ifx Markets has garnered mixed reviews in recent evaluations, with several users expressing concerns about its reliability and customer service. While the broker provides competitive trading conditions and a variety of account types, many clients have reported issues regarding withdrawals and overall satisfaction. Key features include access to popular trading platforms like MT4 and MT5, along with a range of trading assets including forex, commodities, and cryptocurrencies.

Note: The presence of different entities operating under the Ifx Markets name across various regions may impact user experiences and regulatory compliance. This review aims for fairness and accuracy by synthesizing information from multiple sources.

Ratings Overview

We rate brokers based on a comprehensive analysis of user experience, expert opinions, and factual data.

Broker Overview

Founded in 2018, Ifx Markets is headquartered in South Africa and operates under the regulation of the Financial Sector Conduct Authority (FSCA). The broker provides access to the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, facilitating trading across various asset classes. Ifx Markets offers a diverse range of instruments, including forex pairs, commodities, and cryptocurrencies, appealing to both novice and experienced traders.

Regulatory Regions

Ifx Markets is primarily regulated by the FSCA in South Africa, which ensures a level of oversight and compliance. However, it does not have the stringent regulations associated with Tier-1 jurisdictions, which may raise concerns for some traders.

Deposit/Withdrawal Options

Traders can fund their accounts using various currencies, including USD, EUR, GBP, and ZAR. Cryptocurrencies such as Bitcoin and Ethereum are also accepted. The minimum deposit requirement is set at $10 for certain accounts, making it accessible for beginners. Withdrawal options include bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller.

While specific bonus offerings were not detailed in the available sources, Ifx Markets has been known to provide promotional incentives, particularly for new clients. However, the terms and conditions surrounding these bonuses can be restrictive.

Tradable Asset Classes

Ifx Markets offers a wide variety of tradable assets, including:

- Forex: A diverse selection of currency pairs.

- Commodities: Trading options for precious metals and energy products.

- Cryptocurrencies: Limited access to major cryptocurrencies.

Costs (Spreads, Fees, Commissions)

Spreads at Ifx Markets vary depending on the account type, with typical spreads starting from 1.3 pips for standard accounts and lower for premium accounts. Notably, clients have reported that the broker's spreads can be higher than those offered by competitors, which may affect profitability.

Leverage

The broker offers leverage up to 1:1000, which can significantly amplify potential profits but also increases the risk of substantial losses. This high leverage is appealing to some traders, but caution is advised, especially for those new to trading.

Ifx Markets primarily utilizes the MT4 and MT5 platforms, known for their robust features and user-friendly interfaces. These platforms support automated trading, various order types, and advanced charting tools, catering to a wide range of trading strategies.

Restricted Regions

Ifx Markets does not accept clients from certain jurisdictions, including the United States and several European countries. This limitation may impact traders looking for a globally accessible broker.

Available Customer Support Languages

Customer support is primarily available in English, and while the broker offers support through various channels, including email and phone, the absence of live chat options has been noted as a drawback by users.

Repeated Ratings Overview

Detailed Breakdown

Account Conditions

Ifx Markets offers a variety of account types, including cent, standard, premium, VIP, and Islamic accounts. The minimum deposit for these accounts starts at $10, providing an entry point for new traders. However, the lack of diverse educational resources and research tools may hinder the growth of inexperienced traders.

While the broker provides access to popular trading platforms, the educational resources are limited, with few advanced tools or market analyses available. This can be a disadvantage for traders seeking comprehensive support for their trading strategies.

Customer Service and Support

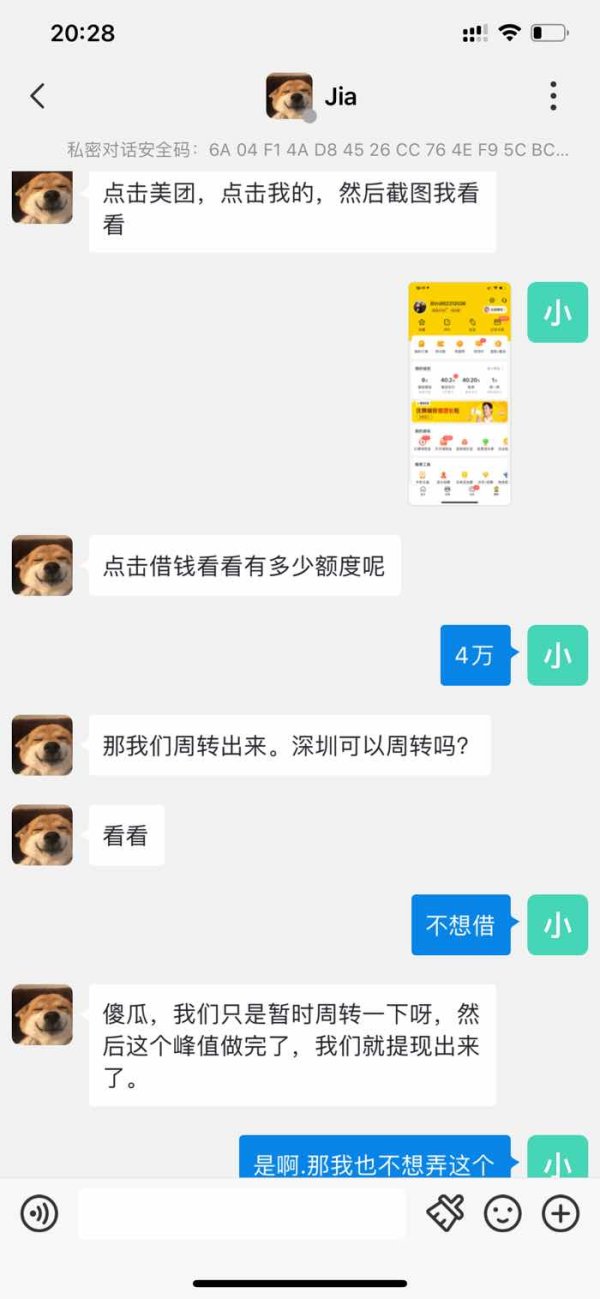

Customer service has received mixed reviews, with some users expressing dissatisfaction with response times and the lack of multilingual support. The absence of a live chat feature further complicates immediate assistance for traders.

Trading Setup (Experience)

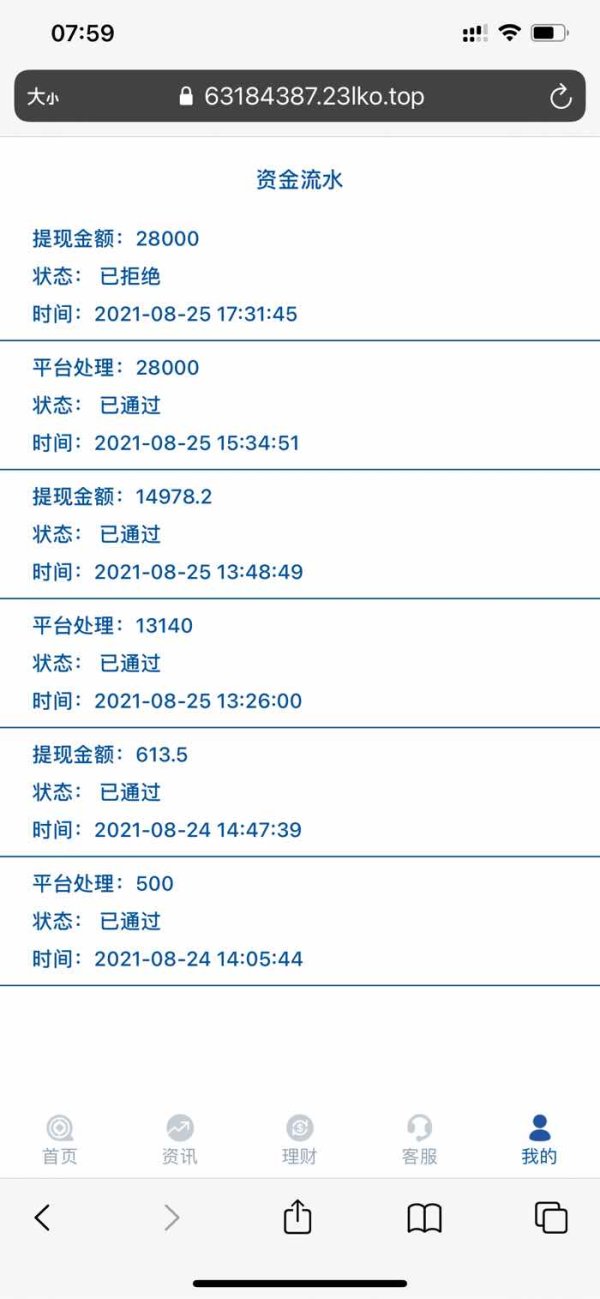

The trading experience on Ifx Markets can be affected by the broker's higher spreads and occasional withdrawal issues reported by users. Traders may find the platform intuitive, but the overall experience can be marred by these concerns.

Trustworthiness

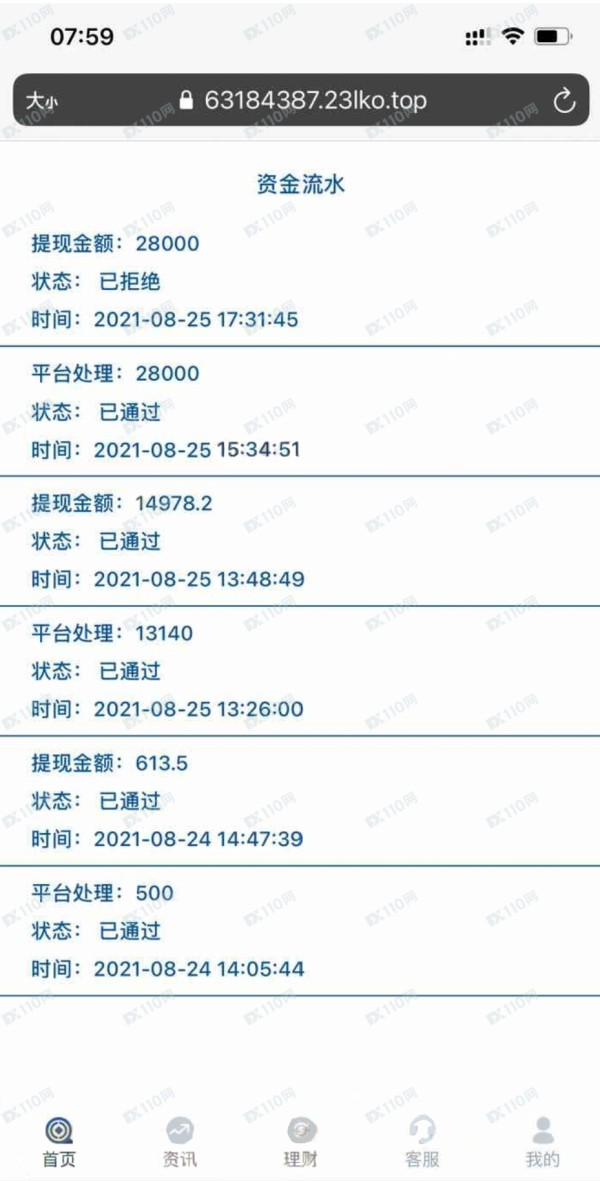

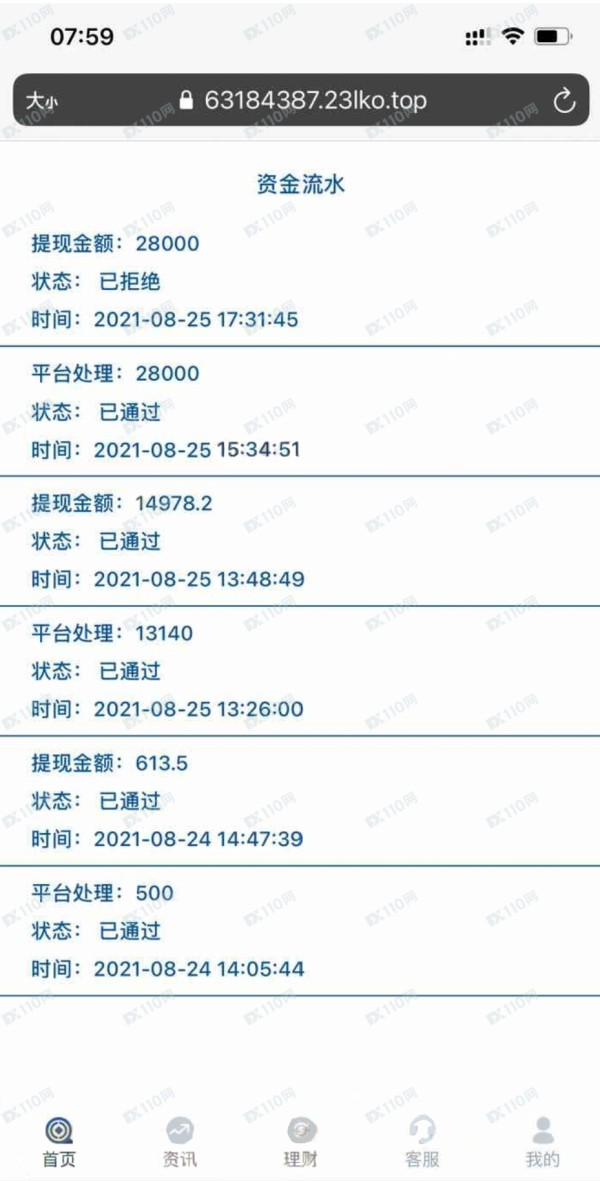

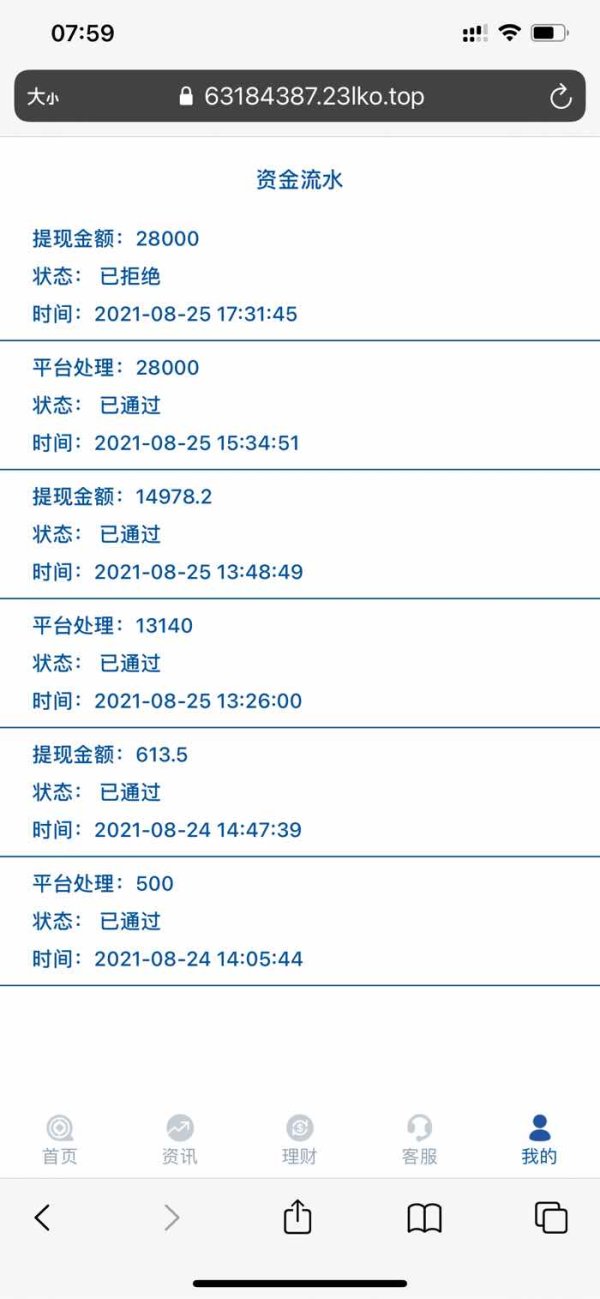

While Ifx Markets is regulated by the FSCA, concerns about negative user experiences and withdrawal issues have been highlighted. This raises questions about the broker's overall reliability and trustworthiness.

User Experience

User feedback indicates a range of experiences, with some traders reporting smooth operations and quick withdrawals, while others have faced challenges with trade execution and customer service. This variability suggests that potential clients should proceed with caution.

In conclusion, Ifx Markets presents a mixed picture for potential traders. While its low minimum deposit and range of trading options are appealing, concerns about customer service and withdrawal issues warrant careful consideration. As always, prospective traders are encouraged to conduct thorough research and consider their individual trading needs before engaging with Ifx Markets.