BICE 2025 Review: Everything You Need to Know

Executive Summary

This bice review looks at a broker that raises serious concerns for traders. BICE Brokers comes from Argentina and operates without proper regulation, which creates immediate red flags for trader safety and fund security. The company does have some business operations, including restaurant ventures in Florida that have received positive customer feedback with 4-star ratings on platforms like TripAdvisor, but the brokerage side lacks the essential regulatory framework that professional traders need.

The broker's background shows connections to commercial brokerage services. Patrick Bice is identified as a certified commercial intermediary, but the absence of financial services regulation creates big risks for retail forex traders. Our analysis reveals that BICE Brokers targets users seeking diversified trading platforms, but the lack of regulatory protection makes this offering unsuitable for serious traders who prioritize capital safety and regulatory compliance.

This broker fails to meet industry standards for regulated financial services. Some positive user experiences exist in other business areas, but that doesn't change the regulatory concerns.

Important Notice

Regional Entity Differences: BICE operates across multiple business sectors, including restaurant services and commercial brokerage. The BICE Brokers entity discussed in this review lacks appropriate financial services regulation, which significantly impacts user trust and safety, and this absence of regulatory oversight distinguishes it from legitimate, regulated forex brokers operating in major financial jurisdictions.

Review Methodology: This evaluation is based on available public information, user reviews from various platforms, and industry standards for broker assessment. Due to limited transparency from the broker regarding its operations, some aspects of this review rely on publicly available data and user feedback rather than comprehensive broker-provided documentation.

Rating Framework

Broker Overview

BICE Brokers presents a complex picture in the financial services landscape. The company has its origins in Argentina, with headquarters located in Buenos Aires, and the organization operates across multiple business sectors, which includes both commercial brokerage services and hospitality ventures. Patrick Bice is identified as a certified commercial intermediary and appears to be associated with the company's commercial brokerage operations, though specific details about the forex trading division remain limited.

The broker's business model focuses on commercial transactions and appears to have expanded into various service areas. The lack of clear information about its forex trading operations raises questions about the company's primary focus and expertise in retail trading services, and the company's multi-sector approach, while potentially offering diversification, also creates uncertainty about its commitment to forex trading excellence.

Specific information about BICE Brokers' forex and CFD offerings remains unclear from available sources. The absence of detailed platform specifications, available trading instruments, and regulatory framework information represents a significant gap that potential traders should consider carefully, and this bice review emphasizes that major regulatory authorities do not appear to oversee the broker's operations, which is a critical factor for trader safety and fund security.

Regulatory Jurisdiction: Available information does not specify any recognized financial regulatory authority overseeing BICE Brokers' operations, which represents a major concern for potential traders.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in available source materials. This leaves traders without clarity on funding procedures.

Minimum Deposit Requirements: The broker's minimum deposit requirements are not specified in accessible documentation. This makes it difficult for potential clients to plan their trading capital allocation.

Bonuses and Promotions: No specific information about bonus structures or promotional offerings appears in the available source materials. This suggests limited marketing focus on retail traders.

Tradeable Assets: Available sources do not provide comprehensive details about the range of forex pairs, CFDs, or other financial instruments offered by the broker.

Cost Structure: Spread information, commission rates, overnight fees, and other trading costs are not detailed in available documentation. This makes cost comparison impossible, and this bice review notes that transparent pricing is essential for informed trading decisions.

Leverage Ratios: Maximum leverage ratios and risk management parameters are not specified in accessible information.

Platform Options: Trading platform choices and technical specifications are not detailed in available source materials.

Geographic Restrictions: Regional trading limitations are not clearly outlined in accessible documentation.

Customer Support Languages: Available customer service languages are not specified in source materials.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of BICE Brokers' account conditions faces significant limitations due to the lack of comprehensive information available in source materials. Standard account features such as account types, minimum balance requirements, and special account offerings cannot be adequately assessed without proper documentation from the broker, and this absence of transparent account information represents a concerning pattern for potential traders who require clear terms and conditions.

Professional traders typically expect detailed information about account tiers, Islamic account availability, and specific account features before committing funds. The lack of readily available account condition details suggests either limited focus on retail trading services or insufficient transparency in business operations, and without proper account documentation, traders cannot make informed decisions about whether the broker's offerings align with their trading strategies and capital requirements.

This bice review emphasizes that legitimate brokers typically provide comprehensive account information as part of their client onboarding process. The absence of such details raises questions about the broker's commitment to transparent client relationships and professional service standards.

Assessment of BICE Brokers' trading tools and educational resources cannot be completed based on available source materials. Professional trading platforms typically offer technical analysis tools, economic calendars, market research, and educational content to support trader development, and the lack of detailed information about these essential trading resources represents a significant gap in the broker's public presentation.

Modern traders expect access to advanced charting tools, automated trading capabilities, and comprehensive market analysis. Without clear documentation of available tools and resources, potential clients cannot evaluate whether the broker provides the technical infrastructure necessary for effective trading, and educational resources, including webinars, tutorials, and market analysis, are standard offerings from reputable brokers.

The absence of detailed tool and resource information may indicate limited investment in trader support infrastructure or insufficient focus on retail trading services. Professional traders require robust technical tools and ongoing educational support to maintain competitive advantage in forex markets.

Customer Service and Support Analysis

Customer service evaluation for BICE Brokers cannot be thoroughly assessed due to limited information about support channels, response times, and service quality metrics. Available source materials do not provide specific details about customer service availability, multilingual support options, or problem resolution procedures, and this information gap prevents comprehensive evaluation of the broker's commitment to client support.

Professional forex brokers typically offer multiple communication channels including live chat, telephone support, email assistance, and comprehensive FAQ sections. Response time commitments, escalation procedures, and specialized support for different account types are standard features of quality customer service programs, and without access to these details, potential clients cannot assess whether the broker provides adequate support infrastructure.

The lack of transparent customer service information may indicate limited focus on retail client support or insufficient investment in customer care infrastructure. Traders require reliable, responsive support to address technical issues, account questions, and trading concerns promptly.

Trading Experience Analysis

Evaluation of the trading experience with BICE Brokers faces significant limitations due to the absence of detailed platform information, execution quality data, and user experience feedback in available source materials. Professional trading requires stable platforms, fast execution speeds, minimal slippage, and reliable order processing, and without specific information about these critical factors, traders cannot assess the broker's technical capabilities.

Modern trading platforms should offer advanced order types, real-time pricing, mobile trading capabilities, and seamless user interfaces. Platform stability during high-volatility periods, server uptime statistics, and execution speed metrics are essential considerations for serious traders, and the lack of detailed platform specifications prevents thorough evaluation of the trading environment quality.

This bice review notes that legitimate brokers typically provide comprehensive platform demonstrations, technical specifications, and performance metrics to help traders evaluate their services. The absence of such information raises concerns about platform quality and technical infrastructure investment.

Trust and Safety Analysis

The trust and safety evaluation of BICE Brokers reveals significant concerns that potential traders must carefully consider. The most critical issue is the apparent lack of proper regulatory oversight from recognized financial authorities, and legitimate forex brokers typically operate under strict regulatory frameworks provided by authorities such as the FCA, ASIC, CySEC, or other established financial regulators. The absence of such regulatory protection creates substantial risks for trader funds and legal recourse options.

Regulatory oversight provides essential protections including segregated client funds, compensation schemes, regular audits, and standardized business practices. Without these protections, traders face increased risks of fund misappropriation, operational failures, and limited legal recourse in case of disputes, and professional traders prioritize regulatory compliance as a fundamental requirement for broker selection.

Additional trust factors such as company transparency, financial audits, and industry reputation cannot be adequately assessed due to limited public information. The combination of regulatory gaps and information limitations creates a trust profile that falls significantly below industry standards for professional forex brokers.

User Experience Analysis

User experience evaluation for BICE Brokers presents mixed signals based on available information. While some business operations associated with the BICE brand have received positive user feedback, including 4-star ratings for restaurant services, specific user experience data for forex trading services is not available in source materials, and this disconnect between business sectors makes it difficult to assess the broker's commitment to user satisfaction in trading services.

Professional trading requires intuitive platform design, streamlined account opening procedures, efficient verification processes, and smooth fund management operations. Without specific user feedback about these critical areas, potential traders cannot evaluate whether the broker provides satisfactory user experience standards, and the absence of detailed user testimonials or experience reports for trading services represents a significant information gap.

The positive ratings in other business areas suggest potential for quality service delivery, but the lack of specific trading-related user feedback prevents comprehensive evaluation of the broker's performance in forex services. Traders typically rely on peer experiences and detailed reviews to assess broker quality before committing funds.

Conclusion

This comprehensive evaluation of BICE Brokers reveals significant concerns that outweigh potential benefits for serious forex traders. The most critical issue is the apparent lack of proper regulatory oversight, which creates unacceptable risks for trader fund safety and legal protection, and while the company appears to operate successfully in other business sectors, including restaurant services that have received positive customer feedback, the brokerage operations fail to meet industry standards for regulated financial services.

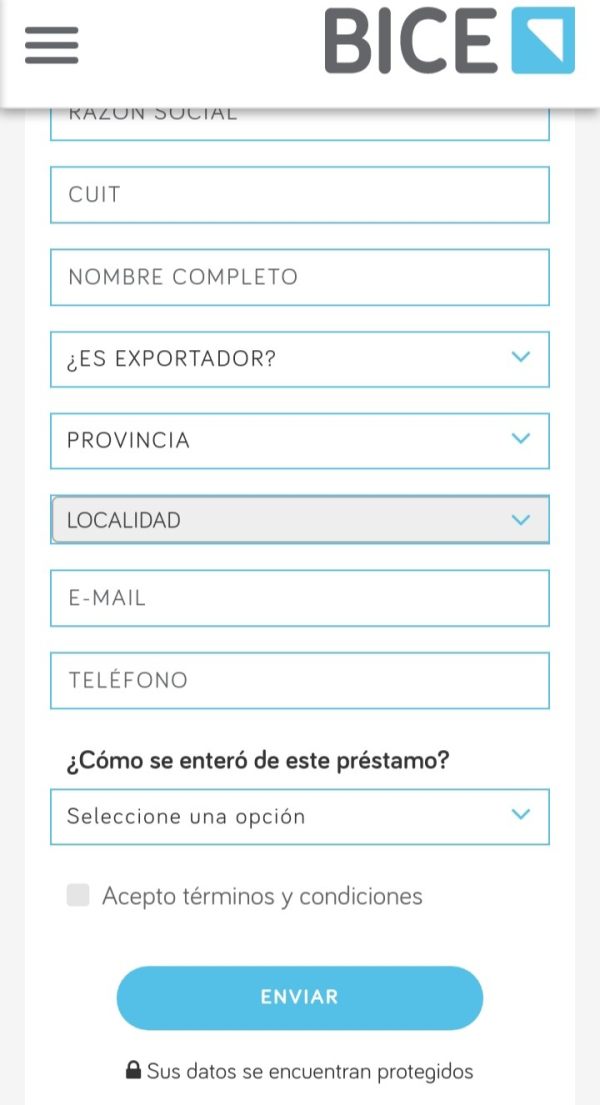

The absence of transparent information about trading conditions, platform specifications, and regulatory compliance makes it impossible to recommend BICE Brokers for professional trading activities. Traders seeking reliable, regulated brokers should prioritize companies with established regulatory oversight, transparent operations, and comprehensive client protections, and the limited available information and regulatory gaps identified in this bice review suggest that potential clients should exercise extreme caution and consider alternative brokers with proper regulatory credentials and transparent business practices.