BelFX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive belfx review examines a controversial forex broker that has raised significant concerns within the trading community. BelFX presents itself as an international forex and CFD broker, claiming to be managed by financial industry professionals. However, our analysis reveals substantial regulatory concerns that potential traders must carefully consider.

The broker offers some attractive features, including zero-point spreads and leverage up to 1:500. These features may appeal to high-risk investors seeking aggressive trading conditions. BelFX provides access to multiple asset classes through the MetaTrader 4 platform, including forex pairs, CFDs, stocks, bonds, stock indices, and select cryptocurrencies like Ethereum and Bitcoin.

Despite these offerings, BelFX operates as an offshore broker registered in Belize. This registration raises serious questions about regulatory oversight and trader protection. According to multiple sources, including reports from August 2023, the broker's legitimacy remains highly questionable. User feedback consistently highlights concerns about customer service quality, platform stability, and most critically, the broker's regulatory status.

This review is particularly relevant for traders considering high-leverage opportunities. However, it emphasizes the importance of regulatory compliance and trader safety. Based on available evidence, BelFX appears most suitable for experienced, high-risk investors who fully understand the implications of trading with an offshore, potentially unregulated entity.

Important Notice

Regional Entity Differences: BelFX operates as an offshore broker registered in Belize. As noted in various industry reports, the effectiveness of Belize-based regulation for international forex brokers remains questionable. Traders should be aware that offshore registration may not provide the same level of protection as established regulatory jurisdictions.

Review Methodology: This assessment is based on comprehensive analysis of user feedback, available regulatory information, and market analysis from multiple sources. Information was gathered from industry publications, user reviews, and regulatory databases to provide an objective evaluation of BelFX's services and credibility.

Rating Framework

Broker Overview

BelFX positions itself as an international forex and CFD broker. The company claims management by experienced financial industry professionals. The broker offers trading services across multiple asset classes, presenting itself as a comprehensive solution for retail and institutional traders. According to available information, BelFX focuses on providing competitive trading conditions through technological solutions and market access.

The broker's business model centers on providing access to global financial markets through the MetaTrader 4 platform. BelFX claims to offer institutional-grade trading infrastructure while maintaining accessibility for retail traders. However, specific information about the company's founding date and detailed corporate background remains limited in available documentation.

BelFX operates primarily through the MetaTrader 4 trading platform. The platform provides access to forex pairs, commodity CFDs, stocks, bonds, stock indices, and select cryptocurrencies including Ethereum and Bitcoin. The broker claims registration in Belize, though as noted in multiple industry analyses, the regulatory effectiveness of this jurisdiction for international forex operations remains questionable. This belfx review emphasizes the importance of understanding these regulatory limitations before considering the broker's services.

Regulatory Jurisdiction: BelFX claims registration in Belize, operating as an offshore broker. Industry experts consistently question the regulatory effectiveness of Belize-based forex brokers. This jurisdiction is commonly associated with minimal oversight and limited trader protection mechanisms.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods was not detailed in available documentation. This represents a significant transparency concern for potential traders.

Minimum Deposit Requirements: The minimum deposit requirement is set at $200. This positions BelFX in the mid-range category compared to other forex brokers in the market.

Bonus and Promotional Offers: Available documentation does not provide specific information about bonus structures or promotional campaigns offered by BelFX.

Tradeable Assets: BelFX offers access to forex pairs, CFDs on commodities, stocks, bonds, stock indices, and select cryptocurrencies including Ethereum and Bitcoin. The broker claims to provide comprehensive market access across these asset classes.

Cost Structure: The broker advertises zero-point spreads with no commission structure. They claim no hidden fees. However, trading costs may vary due to market volatility, and the sustainability of zero-spread offerings raises questions about the broker's revenue model and potential conflicts of interest.

Leverage Ratios: BelFX offers leverage up to 1:500. This appeals to traders seeking high-leverage opportunities but also significantly increases risk exposure.

Platform Options: Trading is conducted exclusively through the MetaTrader 4 platform. This provides standard forex trading functionality and automated trading capabilities.

Geographic Restrictions: Specific information about geographic restrictions was not detailed in available documentation.

Customer Service Languages: Available documentation does not specify the languages supported by BelFX's customer service team.

This belfx review highlights significant information gaps that potential traders should consider when evaluating the broker's transparency and operational standards.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

BelFX's account conditions present a mixed picture for potential traders. The $200 minimum deposit requirement places the broker in a moderate range, making it accessible to many retail traders while not being the lowest in the industry. However, the lack of detailed information about different account types raises transparency concerns.

The broker's commission-free structure with zero-point spreads appears attractive on the surface. Experienced traders should question how the broker generates revenue without these traditional income streams. This pricing model may indicate potential conflicts of interest or hidden costs that aren't immediately apparent.

User feedback suggests that while the minimum deposit is relatively reasonable, the overall account conditions may not be suitable for all investor types. This is particularly true given the regulatory concerns. The absence of detailed information about account features, Islamic accounts, or tiered account structures limits traders' ability to make informed decisions.

The account opening process details are not clearly outlined in available documentation. This represents another transparency issue. Professional traders typically expect clear, detailed information about account terms, conditions, and features before committing funds. This belfx review emphasizes that potential traders should thoroughly understand all account conditions before proceeding.

BelFX provides access to the MetaTrader 4 platform. This platform is widely recognized as a professional-grade trading platform with comprehensive functionality. The platform offers standard charting tools, technical indicators, and automated trading capabilities that meet most traders' basic requirements.

The broker claims to offer multiple asset classes including forex pairs, CFDs, stocks, bonds, stock indices, and select cryptocurrencies. This diversity provides traders with portfolio diversification opportunities across different market sectors.

However, available documentation does not detail specific research and analysis resources, market commentary, or educational materials. The absence of educational resources is particularly concerning for novice traders who rely on broker-provided education to develop their trading skills.

User feedback indicates satisfaction with the MT4 platform's basic functionality. However, users express disappointment regarding the lack of educational support and advanced analytical tools. Industry standards typically include market analysis, economic calendars, and educational content as essential broker services.

The platform supports automated trading through Expert Advisors. This appeals to algorithmic traders. However, the absence of proprietary tools or advanced features limits the broker's competitiveness compared to more established firms.

Customer Service and Support Analysis (4/10)

Customer service represents one of BelFX's most significant weaknesses according to user feedback. Multiple reviews indicate dissatisfaction with response times and service quality, suggesting systemic issues with the broker's support infrastructure.

Available documentation does not specify customer service channels, operating hours, or multilingual support capabilities. This lack of transparency about support services raises concerns about the broker's commitment to customer care.

User reports consistently mention slow response times and inadequate problem resolution capabilities. Professional traders expect prompt, knowledgeable support, particularly when dealing with time-sensitive trading issues or account problems.

The absence of detailed contact information, support ticket systems, or live chat availability in public documentation suggests limited customer service infrastructure. Industry best practices include multiple communication channels and clearly defined response time commitments.

Several user reviews specifically cite customer service quality as a primary concern. Complaints include issues with staff professionalism and technical competence. This pattern of negative feedback indicates systemic customer service challenges that potential traders should carefully consider.

Trading Experience Analysis (5/10)

The trading experience with BelFX receives mixed reviews from users. Several concerning patterns emerge from available feedback. While the MetaTrader 4 platform provides familiar functionality for experienced traders, execution quality appears inconsistent based on user reports.

Platform stability issues have been reported by multiple users. These include occasional delays and connectivity problems that can significantly impact trading performance. Professional trading requires reliable platform performance, particularly during high-volatility market conditions.

User feedback indicates concerns about slippage and requote issues. These problems can substantially impact trading profitability. These execution quality problems are particularly problematic for scalpers and high-frequency traders who depend on precise order execution.

The broker's zero-spread offering, while attractive, may come with execution compromises that effectively increase trading costs through poor fills or delays. Experienced traders understand that sustainable zero-spread models often involve trade-offs in execution quality.

Mobile trading capabilities through MT4 mobile are standard. However, specific information about mobile platform optimization and performance is not detailed in available documentation. This belfx review notes that modern traders expect seamless mobile trading experiences across all devices.

Trust and Reliability Analysis (3/10)

Trust and reliability represent BelFX's most significant challenges. Multiple sources question the broker's legitimacy and regulatory status. The broker's registration in Belize, while technically legal, provides minimal regulatory oversight and limited trader protection.

Available documentation lacks transparency about fund security measures, segregated account policies, or insurance coverage. Established brokers typically provide detailed information about client fund protection and regulatory compliance measures.

The company's corporate transparency is limited. There is insufficient information about founding dates, management team, or corporate structure. Professional traders expect comprehensive corporate disclosure from their chosen brokers.

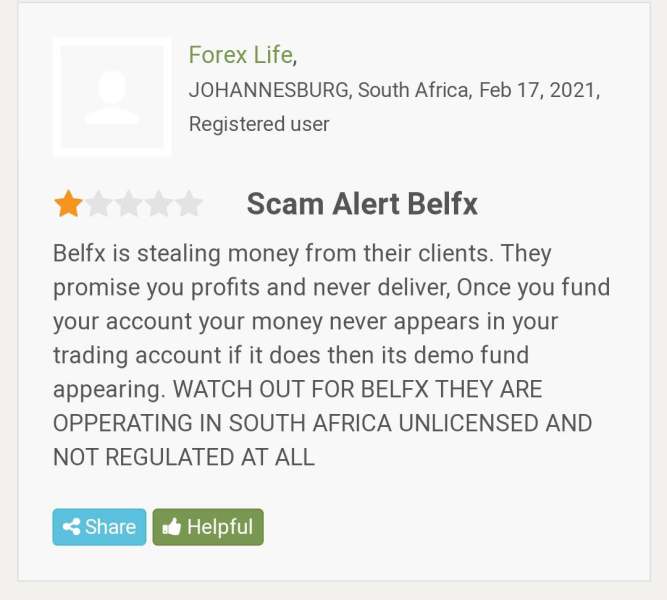

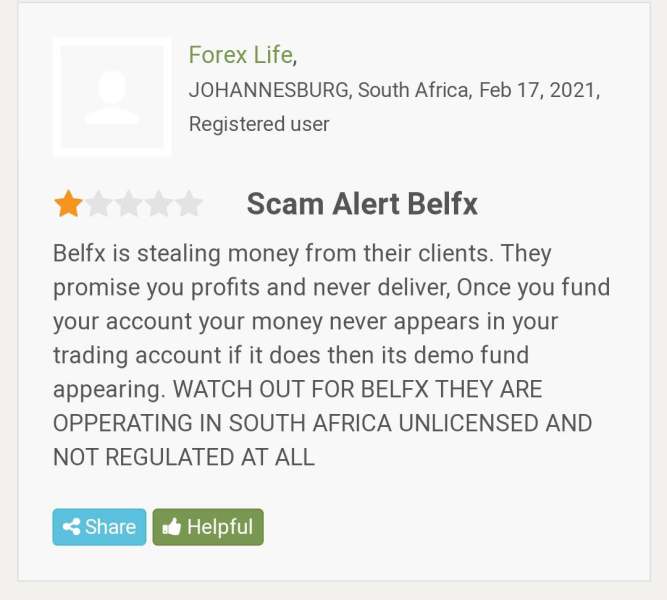

Multiple industry reports and user reviews express concerns about potential scam risks associated with BelFX. The August 2023 report specifically warns against the broker, citing regulatory and operational concerns.

Third-party industry analysis consistently questions BelFX's regulatory effectiveness and operational legitimacy. The pattern of negative assessments from multiple independent sources suggests systemic trust issues that potential traders should seriously consider.

User Experience Analysis (5/10)

Overall user satisfaction with BelFX appears limited based on available feedback. Negative reviews significantly outweigh positive assessments. Users consistently express concerns about the broker's trustworthiness and operational reliability.

The MetaTrader 4 interface receives some positive recognition for its familiar layout and functionality. This helps experienced forex traders adapt quickly to the platform. However, this standard platform advantage is offset by concerns about the broker's overall operations.

Registration and account verification processes are not clearly documented. This creates uncertainty for potential users about onboarding requirements and timelines. Professional brokers typically provide clear, step-by-step guidance for new account establishment.

User complaints frequently center on customer service quality and platform stability issues. This indicates systemic operational challenges. The pattern of negative feedback suggests that user satisfaction is consistently below industry standards.

The broker appears most suitable for high-risk investors specifically seeking high-leverage trading opportunities. These investors must be willing to accept significant regulatory and operational risks. However, this belfx review emphasizes that most traders would benefit from choosing more established, properly regulated alternatives.

Conclusion

This comprehensive belfx review reveals a broker with questionable regulatory status and concerning operational practices. These issues make it unsuitable for most traders. While BelFX offers some attractive features like zero-point spreads and high leverage up to 1:500, these benefits are overshadowed by significant regulatory concerns and poor user feedback.

The broker may appeal to experienced, high-risk investors specifically seeking high-leverage trading opportunities. These investors must be willing to accept substantial regulatory and operational risks. However, the lack of effective regulatory oversight, poor customer service quality, and concerning user feedback patterns make BelFX inappropriate for most traders, particularly beginners.

Key advantages include the commission-free structure and high leverage availability. Major disadvantages encompass regulatory uncertainty, poor customer service, platform stability issues, and limited transparency. Based on available evidence and industry analysis, traders are advised to consider more established, properly regulated alternatives that provide better protection and service quality.