Is BelFX safe?

Pros

Cons

Is BelFX Safe or Scam?

Introduction

BelFX is an online forex broker that positions itself within the competitive landscape of the foreign exchange market, offering a variety of trading instruments and account types. However, as with any financial service provider, it is crucial for traders to conduct a thorough evaluation before engaging with such brokers. The potential risks associated with unregulated or poorly regulated brokers can lead to significant financial losses. This article aims to provide an objective assessment of BelFX by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall safety. The investigation is based on a comprehensive review of multiple sources, including user feedback, regulatory information, and expert analyses.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its trustworthiness. BelFX claims to be regulated by the International Financial Services Commission (IFSC) in Belize. However, the IFSC is often criticized for its lenient regulatory framework, which raises concerns about the level of investor protection it provides.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC | 000127/404 | Belize | Verified |

The IFSC does not enforce stringent compliance checks or require regular financial reporting from its licensed brokers. This lack of oversight can expose traders to significant risks, as the regulatory body may not effectively monitor the broker's operations. Furthermore, BelFX does not hold licenses from more reputable regulators, such as the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC), which are known for their strict regulatory standards. Given these factors, potential investors should exercise caution when considering whether BelFX is safe for their trading activities.

Company Background Investigation

BelFX Limited is registered in Belize, a jurisdiction known for its lax regulations concerning forex brokers. The companys history and ownership structure are somewhat opaque, with limited publicly available information about its management team or operational history. This lack of transparency can be a red flag for potential investors.

While the broker claims to have a team of experienced professionals, the absence of verifiable details about their qualifications and backgrounds raises concerns. Transparency in a broker's operations is essential for building trust with clients. Without clear information about the management team and their expertise, it becomes difficult for traders to assess the reliability of BelFX.

Additionally, the company's website does not provide comprehensive information regarding its history or development, which further complicates the evaluation process. In the context of determining whether BelFX is safe, the lack of transparency and verifiable information about the company's operations is a significant concern for potential investors.

Trading Conditions Analysis

BelFX offers a range of trading conditions, including various account types and leverage options. However, the overall fee structure and costs associated with trading on the platform warrant scrutiny. The broker promotes a low minimum deposit requirement, which can be attractive to new traders. Nevertheless, the trading costs, such as spreads and commissions, may not be as competitive as advertised.

| Fee Type | BelFX | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 2.3 pips | 1.0 - 1.5 pips |

| Commission Model | $3.50 per lot | $0 - $2 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by BelFX, particularly for major currency pairs, are significantly higher than the industry average. This can erode potential profits for traders and may indicate that the broker's trading conditions are not as favorable as they might seem. Additionally, the commission structure may impose further costs that traders need to consider.

Overall, while BelFX presents itself as an accessible option for traders, the trading conditions may not align with the expectations of those seeking competitive pricing. As such, potential clients should carefully evaluate whether BelFX is safe in terms of its trading costs before committing their funds.

Customer Funds Security

The safety of customer funds is paramount when assessing a broker's trustworthiness. BelFX claims to implement measures to protect client funds, including segregating client accounts from company funds. This is a standard practice among reputable brokers, as it helps ensure that client funds are not misappropriated for operational expenses.

However, given the broker's regulatory status, the effectiveness of these measures is questionable. The IFSC's oversight is minimal, and there have been reports of brokers in similar jurisdictions engaging in fraudulent activities without facing consequences. Moreover, BelFX does not appear to offer any investor compensation schemes, which are typically present with more reputable brokers to protect clients in the event of insolvency.

Historically, there have been no widely reported issues regarding fund safety specifically related to BelFX. However, the lack of a robust regulatory framework raises concerns about the potential for future problems. Therefore, traders must consider whether BelFX is safe in terms of their funds' security, especially given the broker's operational environment.

Customer Experience and Complaints

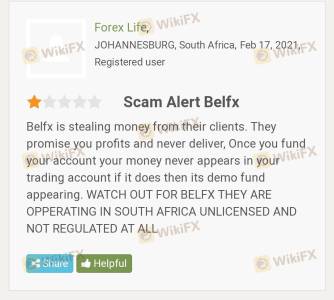

Customer feedback is a crucial aspect of evaluating a broker's reliability. Reviews of BelFX are mixed, with some users reporting positive experiences, while others have raised serious concerns. Common complaints include difficulties with withdrawals, lack of responsive customer support, and issues related to account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Inconsistent |

| Account Management | High | Poor handling |

One notable case involved a trader who reported significant delays in processing withdrawal requests, leading to frustration and financial strain. In contrast, another user praised the broker for providing helpful support and facilitating profitable trades. This stark contrast in experiences highlights the inconsistency in customer service and operational practices at BelFX.

Such discrepancies raise concerns about the overall reliability of the broker, prompting potential clients to question whether BelFX is safe based on the experiences of existing users. The mixed reviews indicate that while some traders may find success, others may encounter significant challenges.

Platform and Trade Execution

BelFX utilizes the widely popular MetaTrader 4 (MT4) platform for trading, which is known for its user-friendly interface and robust features. However, the performance and reliability of the platform are critical factors that can impact a trader's experience. Reports suggest that while the platform generally performs well, there have been instances of slippage and order rejections.

The quality of trade execution is essential for traders, particularly those engaging in high-frequency trading strategies. A high rate of slippage or rejected orders can lead to missed opportunities and financial losses. Users have reported varying experiences with execution quality, with some indicating satisfactory performance while others have faced challenges.

In assessing whether BelFX is safe, the potential for platform manipulation or execution issues is a critical consideration. Traders should remain vigilant and ensure that they fully understand the platform's functionality and any potential risks associated with its use.

Risk Assessment

Engaging with BelFX presents a range of risks that traders should carefully evaluate. The combination of weak regulatory oversight, mixed customer experiences, and questionable trading conditions creates a precarious environment for investors.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Weak oversight from the IFSC |

| Financial Risk | Medium | High spreads and commissions |

| Operational Risk | High | Inconsistent customer service and support |

To mitigate these risks, potential traders should conduct thorough research and consider using a demo account to familiarize themselves with the platform before committing real funds. Additionally, seeking out brokers with stronger regulatory backing and better customer reviews may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that while BelFX may offer some appealing features, the overall assessment raises significant concerns regarding its safety and reliability. The lack of robust regulation, mixed customer feedback, and potential issues with trading conditions indicate that traders should approach this broker with caution.

For those considering trading with BelFX, it is crucial to weigh the risks carefully and consider alternative options. Reputable brokers with strong regulatory oversight and positive customer experiences, such as those regulated by the FCA or ASIC, may provide a more secure trading environment. Ultimately, potential clients must decide if they believe BelFX is safe for their trading activities, but the existing evidence strongly suggests that caution is warranted.

Is BelFX a scam, or is it legit?

The latest exposure and evaluation content of BelFX brokers.

BelFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BelFX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.