AvaTrade 2025 Review: Everything You Need to Know

Executive Summary

AvaTrade is a well-established online broker. This broker has carved out a significant presence in the global trading landscape over many years. This comprehensive ava trade review reveals that the platform serves both novice traders seeking their first market exposure and seasoned professionals requiring sophisticated trading tools. The broker stands out through an extensive regulatory framework spanning multiple jurisdictions and a diverse asset offering. These assets include forex, CFDs, stocks, commodities, and cryptocurrencies.

The platform's multi-regulatory approach provides traders with varying levels of protection depending on their geographical location. Meanwhile, its comprehensive asset selection caters to different trading strategies and risk appetites across the globe. AvaTrade's positioning as a versatile trading platform makes it particularly attractive to individual retail traders and institutional investors. These users value regulatory compliance and asset diversification above all else. The broker's commitment to serving a global clientele is evident in its multilingual support and region-specific regulatory compliance. However, traders should carefully consider which regulatory entity governs their trading relationship based on their location.

Important Disclaimers

AvaTrade operates through multiple legal entities across different jurisdictions. Each entity is subject to distinct regulatory frameworks and client protection schemes that vary significantly. Traders must understand that their specific regulatory protection and available services may vary significantly depending on their country of residence and the applicable AvaTrade entity serving their region. The regulatory landscape includes oversight from authorities such as ASIC in Australia, FSCA in South Africa, and the Financial Services Commission in the British Virgin Islands.

This evaluation is based on publicly available information and user feedback collected from various sources. These sources include regulatory filings and independent review platforms that provide comprehensive broker assessments. Individual trading experiences may differ based on personal trading strategies, market conditions, and specific account configurations. Potential clients should conduct their own due diligence and consider seeking independent financial advice before making trading decisions.

Rating Framework

Broker Overview

AvaTrade has established itself as a prominent player in the online trading industry. The company serves clients across multiple continents through its network of regulated entities that maintain strict compliance standards. The company's business model centers on providing Contract for Difference trading services. This approach enables clients to access various financial markets without direct ownership of underlying assets.

This approach allows traders to benefit from price movements in forex, stocks, commodities, indices, and cryptocurrencies through leveraged positions. The broker's operational structure reflects a commitment to regulatory compliance, with separate legal entities established in key financial jurisdictions worldwide. This ava trade review finds that the company's approach to regulation demonstrates a serious commitment to client protection and operational transparency. AvaTrade's service portfolio extends beyond basic trading execution to include educational resources, market analysis, and automated trading solutions.

The platform's asset coverage spans traditional forex pairs, major stock indices, individual equities from leading exchanges, precious metals, energy commodities, and a growing selection of cryptocurrency CFDs. This diversification strategy enables traders to implement various market strategies and hedge positions across different asset classes effectively. The broker's technology infrastructure supports multiple trading platforms. These platforms cater to different trader preferences and experience levels, from beginner-friendly interfaces to professional-grade analytical tools.

Regulatory Framework

AvaTrade maintains licenses from multiple tier-one regulatory authorities. These include the Australian Securities and Investments Commission, the Financial Sector Conduct Authority in South Africa, the Japanese Financial Services Agency, and the Financial Futures Association of Japan. Additional oversight comes from the Abu Dhabi Global Market Financial Services Regulatory Authority and the Israel Securities Authority.

Available Assets

The platform offers an extensive range of tradeable instruments across major asset classes. Forex trading encompasses major, minor, and exotic currency pairs, while CFD offerings include global stock indices, individual shares from leading exchanges, precious metals like gold and silver, energy commodities including oil and natural gas, and cryptocurrency pairs featuring Bitcoin, Ethereum, and other digital assets.

AvaTrade provides access to multiple trading platforms designed to accommodate different trading styles and experience levels. The platform selection includes proprietary web-based solutions and mobile applications. This ensures traders can access markets from various devices and locations.

Account Features

The broker offers multiple account types with varying minimum deposit requirements and feature sets. Account holders benefit from negative balance protection in regulated jurisdictions. Islamic accounts are available for clients requiring Sharia-compliant trading conditions.

This comprehensive ava trade review indicates that the broker's service structure accommodates both retail and institutional clients. The platform provides dedicated support teams and customized solutions for higher-volume traders.

Account Conditions Analysis

AvaTrade's account structure demonstrates a thoughtful approach to serving diverse trader segments. However, specific details about minimum deposit requirements and account tiers require direct consultation with the broker. The platform's account opening process incorporates standard KYC procedures mandated by regulatory requirements. This ensures compliance with anti-money laundering regulations across all jurisdictions.

The broker's leverage offerings vary by jurisdiction and asset class. These variations reflect regulatory constraints in different markets around the world. European clients operate under ESMA leverage restrictions, while traders in other jurisdictions may access higher leverage ratios subject to local regulatory limits. This regulatory-driven approach to leverage demonstrates AvaTrade's commitment to compliance while providing traders with appropriate risk management tools.

Account funding methods include various payment options. However, specific availability depends on the client's location and applicable regulatory requirements. The broker's approach to client fund segregation follows industry best practices, with client deposits held in separate accounts at tier-one banks. Withdrawal processing times and methods align with industry standards. However, exact timeframes may vary based on the chosen payment method and verification requirements.

Special account features include Islamic accounts for clients requiring swap-free trading conditions. This demonstrates the broker's commitment to serving diverse religious and cultural requirements. The ava trade review process reveals that AvaTrade's account conditions generally meet industry standards while maintaining flexibility to accommodate different trader preferences and regulatory requirements.

AvaTrade's trading infrastructure showcases a comprehensive approach to market access. The platform provides traders with exposure to over 1,000 financial instruments across multiple asset classes. The platform's forex offering encompasses major currency pairs like EUR/USD and GBP/USD, alongside minor pairs and exotic combinations that allow for diverse trading strategies. This extensive currency selection enables traders to capitalize on global economic events and interest rate differentials across different economies.

The CFD selection extends far beyond traditional forex trading. It incorporates global stock indices such as the S&P 500, FTSE 100, and Nikkei 225, allowing traders to gain exposure to broad market movements without purchasing individual stocks. Individual equity CFDs cover shares from major exchanges including NYSE, NASDAQ, LSE, and other prominent markets. This provides access to companies like Apple, Amazon, and Tesla through leveraged positions.

Commodity trading through AvaTrade includes precious metals like gold and silver. These serve as popular hedging instruments during market volatility, as well as energy products including crude oil and natural gas that respond to geopolitical events and supply-demand dynamics. The cryptocurrency CFD offering has expanded to include Bitcoin, Ethereum, Litecoin, and other digital assets. This reflects the growing institutional interest in crypto markets.

The platform's analytical tools and market research resources support informed trading decisions. However, specific details about proprietary research quality and frequency require further investigation. Educational resources appear designed to serve both novice and experienced traders. This contributes to the platform's appeal across different experience levels.

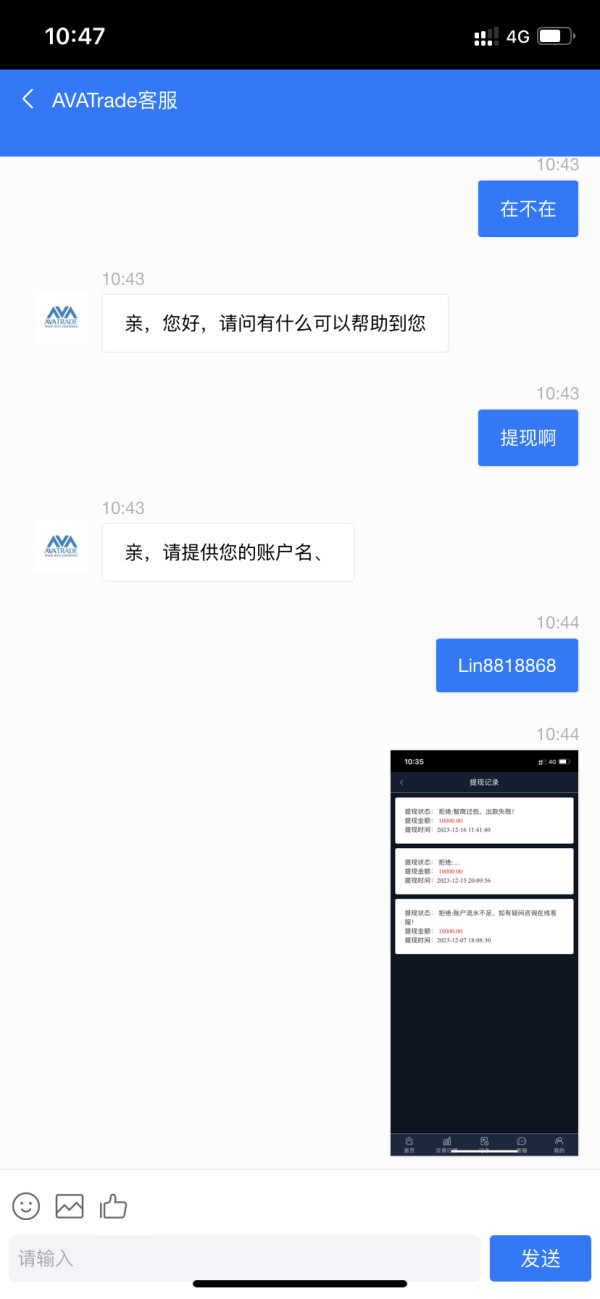

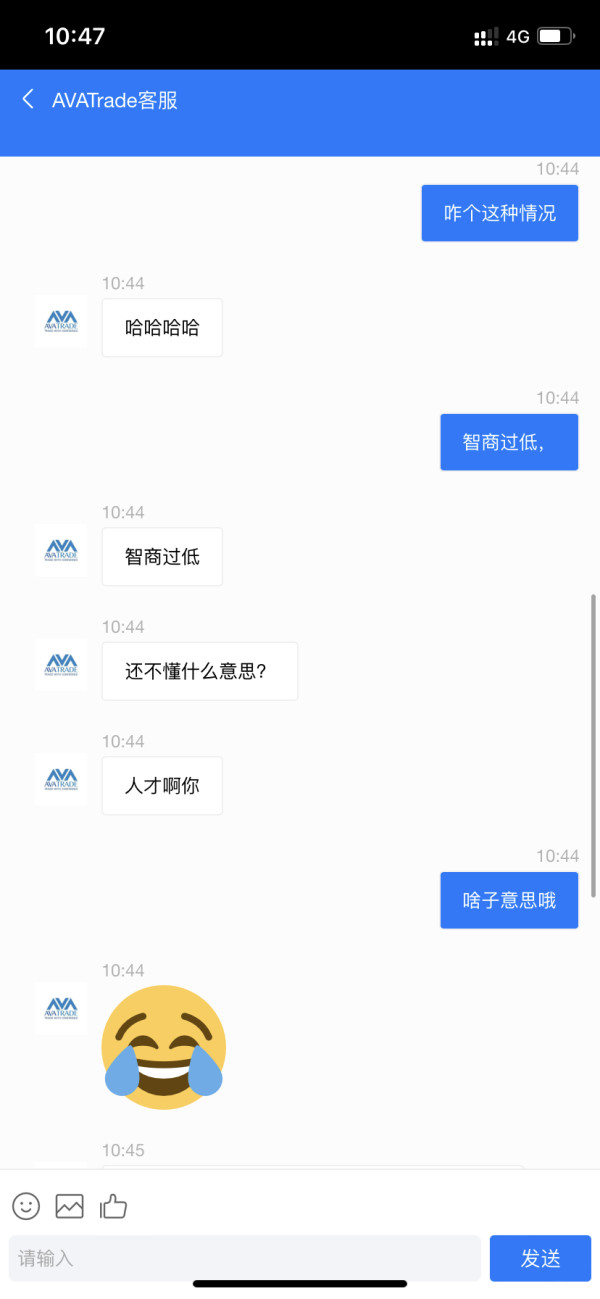

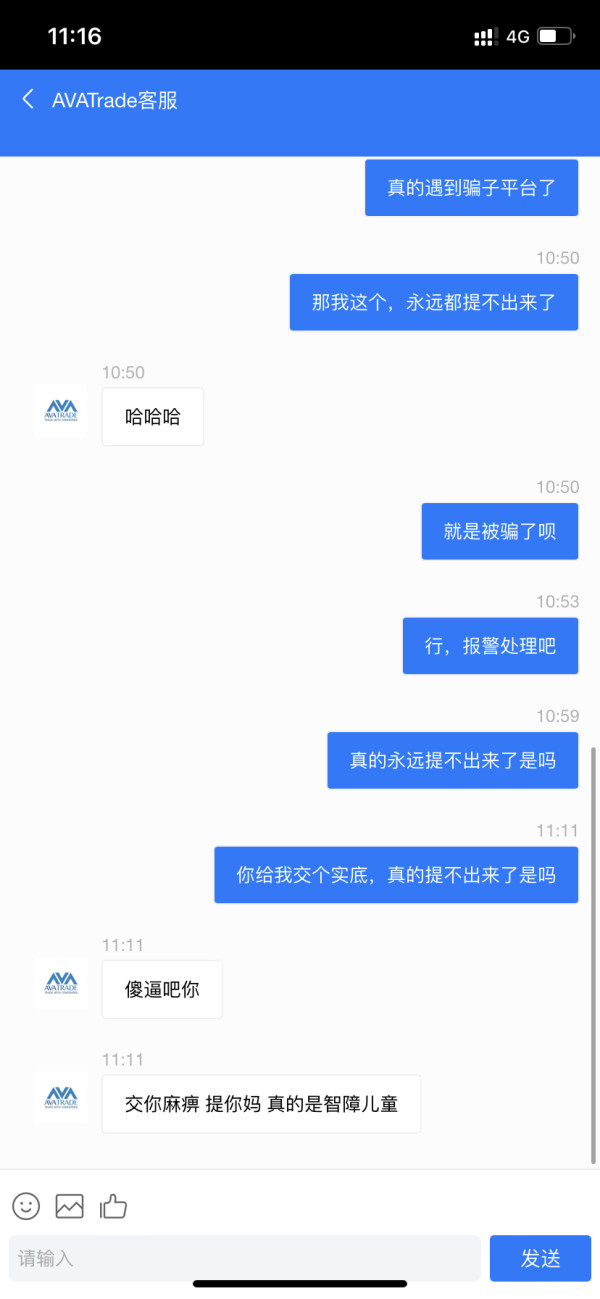

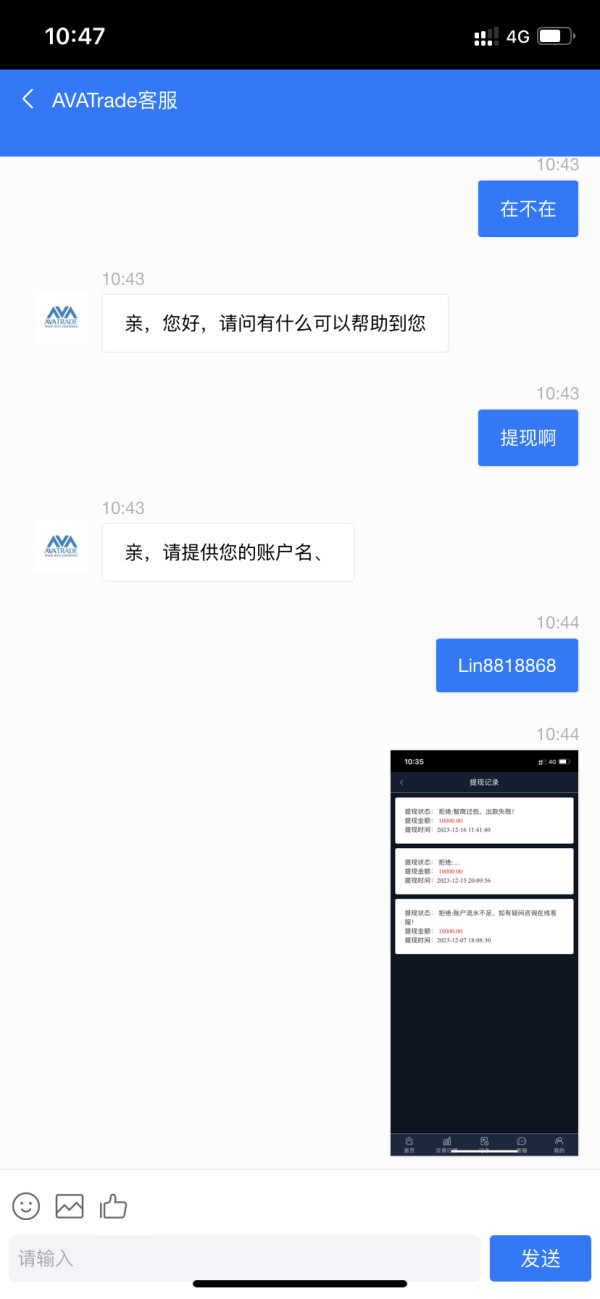

Customer Service and Support Analysis

AvaTrade's customer support infrastructure reflects the broker's global operational scope. The company maintains multilingual support teams serving clients across different time zones. The support structure includes multiple communication channels, though response times and service quality may vary depending on the inquiry complexity and the specific AvaTrade entity handling the client relationship.

The broker's approach to client communication incorporates email support, live chat functionality, and telephone assistance. This provides traders with multiple options for reaching support representatives. However, the availability of specific support channels may differ based on the client's geographical location and the regulatory requirements of their jurisdiction.

Support team expertise appears to cover both technical platform issues and general trading inquiries. However, the depth of market analysis support and educational guidance may vary. The multilingual capabilities of the support team reflect AvaTrade's commitment to serving a diverse international client base. Support is available in major languages including English, Spanish, French, German, and others.

Response time expectations and service level agreements are not explicitly detailed in available materials. This suggests that clients should establish clear expectations about support availability during their account opening process. The ava trade review indicates that while basic support infrastructure appears adequate, traders with complex requirements or urgent issues should verify support availability and expertise before committing to the platform.

Trading Experience Analysis

The trading experience on AvaTrade's platforms encompasses both web-based and mobile applications. These are designed to accommodate different trader preferences and technical requirements. Platform stability and execution quality represent critical factors for trader success, particularly during high-volatility market conditions when rapid order execution becomes essential.

Order execution methodology follows industry-standard practices. However, specific details about execution speeds, slippage rates, and requote frequency require direct testing or consultation with existing clients. The platform's ability to handle simultaneous orders during major market events, such as central bank announcements or economic data releases, significantly impacts the overall trading experience.

Mobile trading capabilities have become increasingly important as traders seek flexibility to monitor and adjust positions while away from desktop computers. AvaTrade's mobile applications provide essential trading functions. However, the comprehensiveness of mobile features compared to web-based platforms may influence trader satisfaction.

The platform's charting capabilities and technical analysis tools support various trading strategies. These range from scalping to long-term position trading. Integration with automated trading systems and expert advisors may appeal to systematic traders, though compatibility and performance require verification based on specific trading algorithms.

Market data quality and real-time pricing accuracy directly affect trading decisions and profitability. This ava trade review suggests that AvaTrade maintains competitive data feeds. However, traders should verify pricing accuracy and market depth information for their preferred instruments before committing significant capital.

Trust Factor Analysis

AvaTrade's regulatory framework represents one of its strongest attributes. The company holds licenses from multiple tier-one financial authorities providing clients with varying levels of protection depending on their jurisdiction. The Australian Securities and Investments Commission oversight offers robust consumer protections for Australian clients, including access to the Financial Ombudsman Service and compensation scheme coverage.

The Financial Sector Conduct Authority regulation in South Africa provides similar protections for African clients. Meanwhile, Japanese oversight through the Financial Services Agency and Financial Futures Association of Japan ensures compliance with stringent Japanese financial regulations. This multi-jurisdictional approach demonstrates AvaTrade's commitment to operating within established regulatory frameworks rather than seeking offshore havens with minimal oversight.

Client fund segregation practices follow regulatory requirements across all jurisdictions. Client deposits are held separately from company operational funds at reputable tier-one banks. This segregation provides protection in the unlikely event of broker insolvency, though specific protection amounts vary by jurisdiction and regulatory scheme.

The broker's operational transparency includes regular regulatory reporting and compliance with disclosure requirements in each jurisdiction. However, detailed financial statements and operational metrics may not be readily available to retail clients. This is typical for privately held brokerage firms.

AvaTrade's industry reputation appears generally positive. The company has no major regulatory sanctions or significant operational disruptions reported in recent years. The company's longevity in the competitive brokerage industry suggests adequate risk management and operational stability. This contributes to overall client trust and confidence.

User Experience Analysis

The overall user experience with AvaTrade reflects the platform's positioning as a broker suitable for both beginning and experienced traders. However, individual satisfaction levels vary based on specific trading requirements and expectations. The platform's interface design emphasizes functionality over aesthetics, prioritizing efficient trade execution and account management over visual appeal.

Account registration and verification processes follow standard industry protocols. These incorporate KYC requirements and document verification procedures mandated by regulatory authorities. The onboarding experience typically involves identity verification, address confirmation, and financial suitability assessments, with processing times varying based on document quality and regulatory requirements.

Navigation and platform usability generally receive positive feedback from users. These users appreciate the straightforward approach to trade execution and account management. However, traders accustomed to highly customizable platforms may find some limitations in interface personalization and advanced analytical tools.

The learning curve for new traders appears manageable. Basic trading functions are accessible without extensive technical knowledge. Educational resources and demo account availability support the transition from simulated to live trading, though the quality and comprehensiveness of educational content may vary.

Common user feedback themes include appreciation for the diverse asset selection and regulatory compliance. Meanwhile, some traders express desires for enhanced analytical tools and more competitive pricing structures. The ava trade review process suggests that AvaTrade successfully serves its target market of retail traders seeking reliable access to global markets. However, specific feature requests and service improvements continue to evolve based on user feedback and market competition.

Conclusion

AvaTrade emerges from this comprehensive evaluation as a well-regulated broker. The platform successfully balances accessibility for novice traders with sufficient sophistication for experienced market participants. The platform's greatest strengths lie in its extensive regulatory framework, diverse asset selection, and commitment to compliance across multiple jurisdictions. These factors combine to create a trading environment that prioritizes client protection and market access over cutting-edge innovation or ultra-competitive pricing.

The broker appears most suitable for retail traders who value regulatory oversight. These traders prefer a straightforward approach to market access without complex fee structures or overwhelming platform features. Institutional clients and high-frequency traders may find more specialized solutions elsewhere, while beginning traders benefit from the platform's educational resources and user-friendly interface design.

Primary advantages include the multi-jurisdictional regulatory protection, comprehensive asset coverage spanning traditional and emerging markets, and stable platform performance during normal market conditions. Areas for potential improvement include enhanced analytical tools, more detailed pricing transparency, and expanded educational content for advanced trading strategies.