arc market 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

In the realm of online trading, arc market presents itself as a structured yet simplified platform designed primarily for forex traders. It caters to experienced traders with its user-friendly interface and functionality, facilitating access to 39 currency pairs, gold, and silver. However, the trading conditions may raise concerns; notably, the broker's minimum deposit requirement of $5,000 for standard accounts and high average spreads around 3-4 pips make it less appealing for less capitalized traders. Investors are faced with a precarious trade-off between the platform's usability and its prohibitive costs, suggesting that while it's well-suited for seasoned forex traders, it may not fit the needs of novice traders or those with limited investment capacity.

⚠️ Important Risk Advisory & Verification Steps

Risk Statement: High spreads and minimum deposits pose significant risks for traders.

Potential Harms: Losses may exceed expectations due to high costs, particularly for individuals unable to withstand significant financial risks.

Self-Verification Steps:

- Conduct a comprehensive search in reputable regulatory databases such as the Financial Conduct Authority (FCA) or the Swiss Financial Market Supervisory Authority (FINMA) to check for the brokers regulatory compliance.

- Cross-reference user reviews and ratings from multiple platforms to gauge the overall sentiment toward arc market.

- Validate the claims made by the broker about its services, checking for any discrepancies in terms of account offerings or associated costs.

Broker Overview

Company Background and Positioning

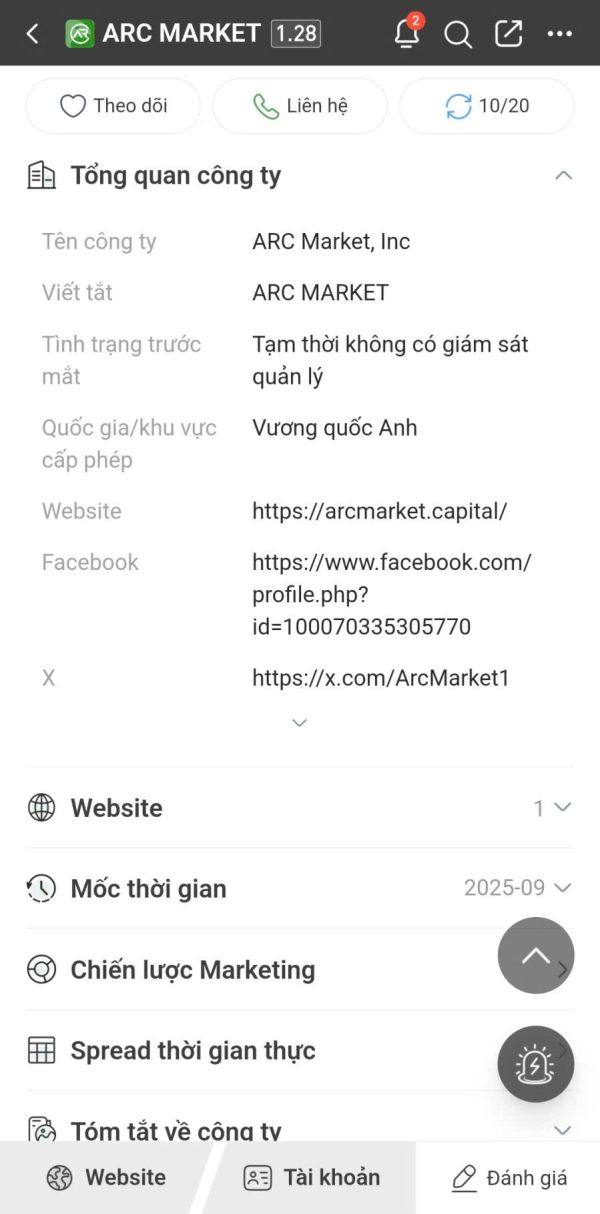

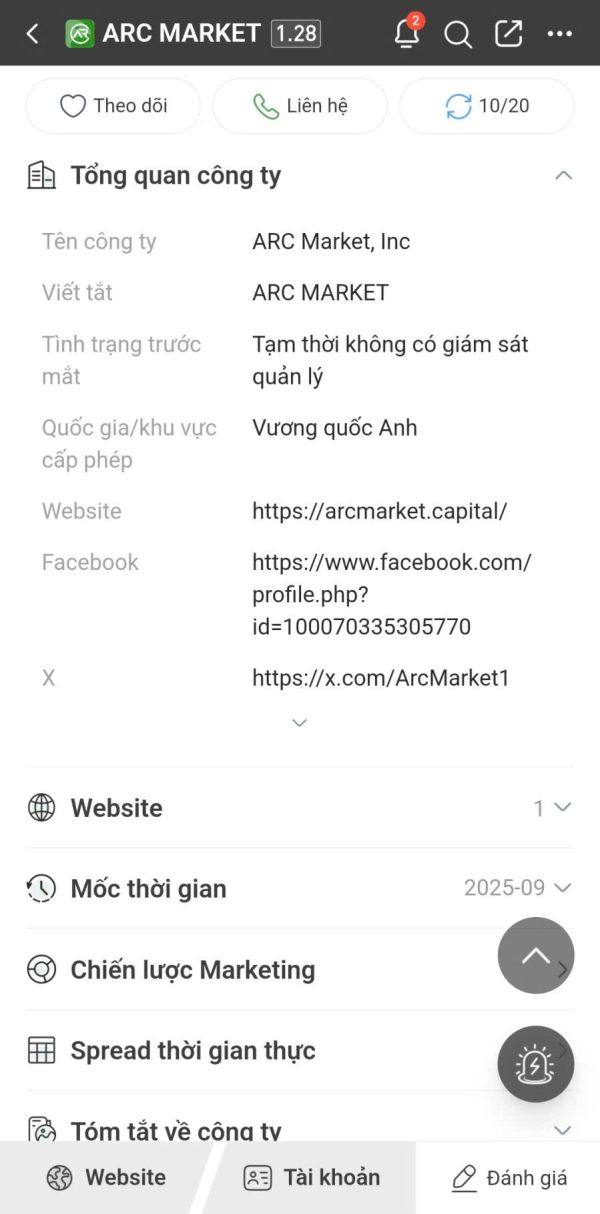

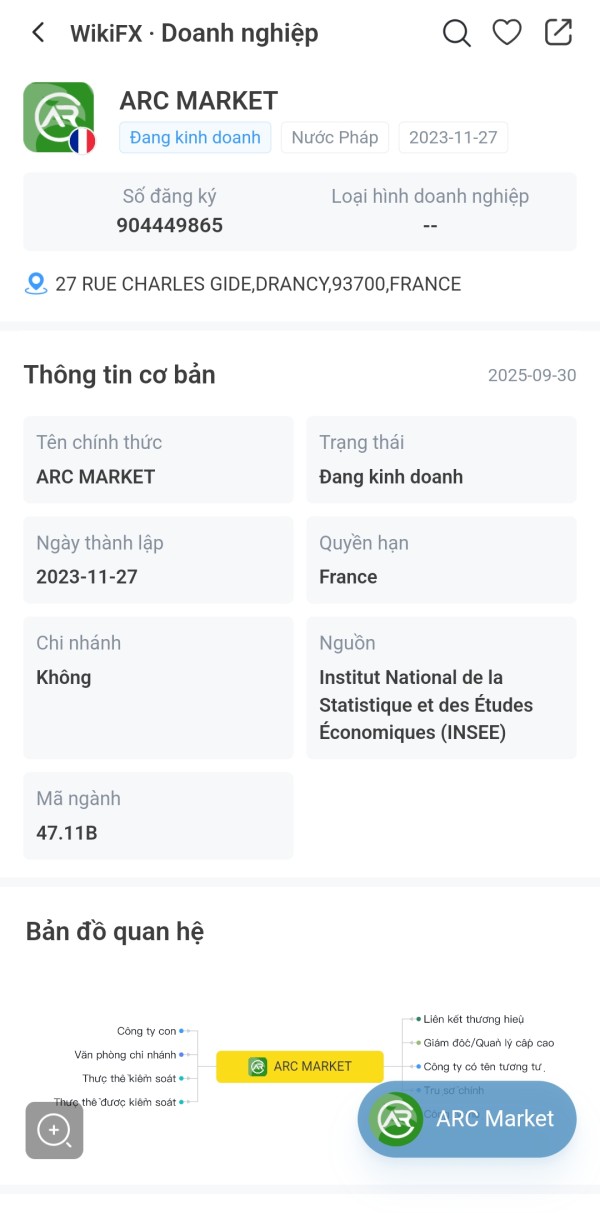

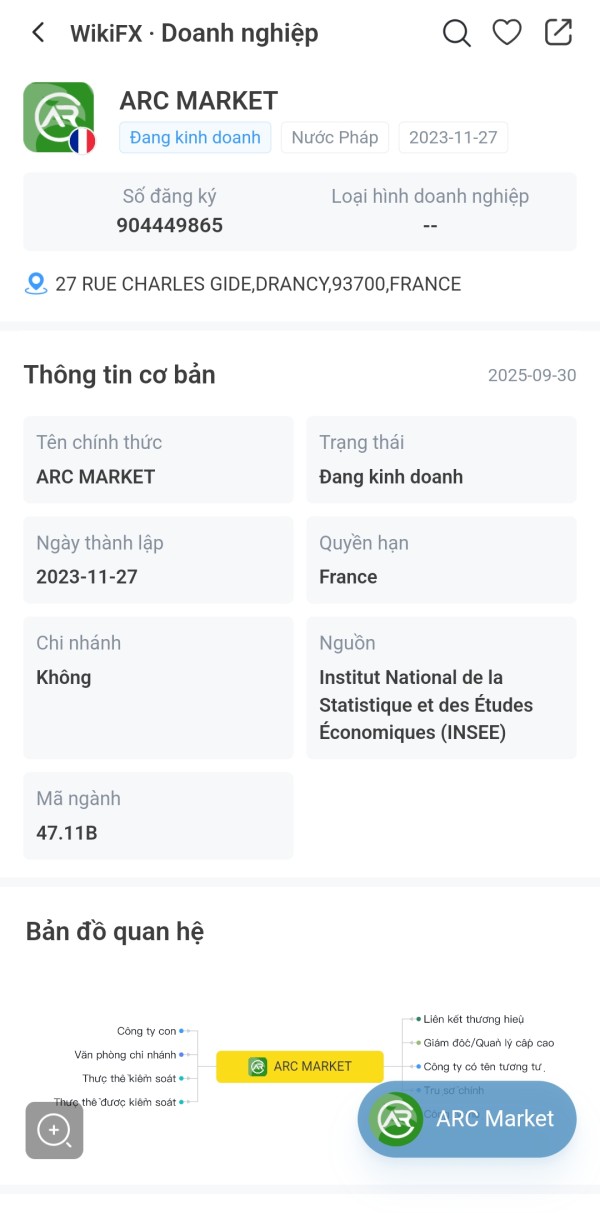

Established in 2002, arc market operates out of Geneva, Switzerland, capitalizing on the nation's robust financial reputation. The broker aims to provide a simplified and effective forex trading experience, but its marketing and position as a market leader come with caveats. While it successfully attracts seasoned traders, the glaring lack of regulatory oversight and the higher-than-average costs associated with trading might compromise its credibility in a competitive marketplace increasingly leaning towards transparency and safety.

Core Business Overview

The core business of arc market lies in forex trading, alongside the availability of trading services for gold and silver. The platform claims to offer competitive trading features, yet user reviews indicate that issues surrounding transparency and user dissatisfaction linger, particularly regarding service quality during high-volume trading. Further, the process of account registration is complex, entailing rigorous personal details submission, which could be off-putting for potential clients looking for straightforward access.

In-Depth Analysis of Each Dimension

Trustworthiness Analysis

Teaching users to manage uncertainty.

The absence of regulatory oversight surrounding arc market surfaces significant concerns regarding its trustworthiness. Reviews indicate that the broker lacks clarity in its operational legitimacy. For prospective traders, it's essential to scrutinize any documentation related to company registration and regulatory compliance, particularly due to the companys claims of FCA regulation, which cannot be independently verified.

Analysis of Regulatory Information Conflicts: The claim of being regulated by the FCA raises flags since no related entries appear in their database, making it crucial for users to engage in extensive research to protect their investments.

User Self-Verification Guide:

Search for the broker on official regulatory websites to verify its status.

Check the company's history and feedback from multiple platforms.

Look for third-party assessments that can provide additional context about the platform's legitimacy.

Industry Reputation and Summary: A combination of low trust scores and a pattern of similar complaints regarding customer service and unexpected costs clouds the reputation of arc market, fostering an environment of skepticism among potential clients.

Trading Costs Analysis

The double-edged sword effect.

While arc market does present seemingly competitive commission structures, the overall cost of trading—including fees associated with withdrawals—renders it a "double-edged sword."

Advantages in Commissions: Users appreciate some competitive commissions; however, they are overshadowed by heightened costs in other areas.

The "Traps" of Non-Trading Fees:

- Customers have noted withdrawal fees ($30) as excessively steep, particularly in a market where such fees can vary dramatically. As one user states, “paying $30 just to get my funds back feels like a trap.”

- Cost Structure Summary: For traders accustomed to brokers with lower withdrawal fees and minimum deposit thresholds, the financial implications of engaging with arc market could be costly.

Professional depth vs. beginner-friendliness.

Arc market provides a range of platforms suitable for a variety of trading preferences, yet the depth of available tools leaves much to be desired for those seeking advanced features.

Platform Diversity: Offering multiple platforms—including the “Advanced Trader” and “Advanced Web Trader”—caters to users seeking accessibility. The seamless integration across platforms is a plus for user experience.

Quality of Tools and Resources: Tools for technical analysis are generally good, albeit basic, which may ultimately frustrate users looking for in-depth trading tools and educational resources.

Platform Experience Summary: Feedback indicates a favorable experience for beginner traders, although seasoned professionals may find the limited tool offering lacking.

User Experience Analysis

Balancing service and satisfaction.

Overall user experience reveals a dichotomy between initial satisfaction and deeper issues that surface as engagement grows.

Initial Impressions: New users typically enjoy a smooth onboarding experience, thanks to user-centric design.

Sustained Engagement Concerns: As traders increase their activities, many report consistent dissatisfaction, particularly when engaging in larger trade sizes where spreads fluctuate significantly, enhancing the risk of losses.

Ultimate Experience Reflection: A critical need for improvement in user service and support becomes apparent as trading scales, leading to frustration amongst the community of users.

Customer Support Analysis

Need for enhanced support mechanisms.

Users frequently echo sentiments of frustration when it comes to customer support, with many expressing difficulties in prompt resolution of issues.

Quality of Customer Service: Despite claims of 24-hour support, reports of delayed responses roam the community, indicating a potential gap in effective service.

Response Time and Efficiency: Users describe their attempts to reach customer support as “slow” and “inefficient,” undermining confidence in the platform's ability to assist adequately.

Overall Summary of Support Services: It is crucial for any trading platform to ensure timely and effective communication with its users, particularly as issues become more complex during larger trading activities.

Account Conditions Analysis

Understanding conditions impacting trader entry.

High minimum deposit requirements have served as a significant barrier to entry for many potential clients eyeing arc market as a trading option.

Accessibility Evaluation: The $5,000 threshold for standard accounts presents a steep entry point, serving as a deterrent for budding investors.

Comparative Analysis with Industry Norms: This requirement falls noticeably above industry standards, further alienating new and smaller traders.

Deterred User Base: As the broker aims for a particular clientele, it inherently excludes those unwilling or unable to meet these high financial barriers.

Conclusion

While arc market delineates a clear path for seasoned traders seeking a user-friendly environment to engage in forex and related assets, it presents significant barriers that may limit market participation. Users must surf through a landscape of high costs, unregulated status, and unconvincing customer service experiences to assess the viability of the platform. Ultimately, potential clients are advised to exercise caution and due diligence, keeping in mind both the enticing ease of use and the risk-laden environment that surrounds arc market.