Kristen 2025 Review: Everything You Need to Know

Summary

This comprehensive kristen review examines a real estate brokerage service rather than a traditional forex broker. Designated Broker Solutions was founded in 2018 by Kristen Zimmerman and represents a specialized compliance-focused real estate service provider. Unlike conventional forex brokers, this entity operates within the real estate sector. It offers licensing and compliance solutions for property management companies and real estate professionals across multiple states.

The company emerged from practical necessity when Zimmerman faced licensing challenges while expanding her former company's property management portfolio. After pursuing licensure in every state, she established Designated Broker Solutions. The service provides clients with comprehensive real estate compliance pathways. The service primarily targets real estate professionals, property managers, and firms requiring multi-state licensing solutions.

Based on available information, this entity receives a neutral assessment due to limited data regarding traditional brokerage services. These services include trading platforms, regulatory oversight for financial services, or client trading experiences. The focus remains distinctly on real estate compliance rather than financial market access. This makes direct comparison with forex brokers challenging.

Important Notice

This review assessment differs significantly from traditional forex broker evaluations. The entity focuses on real estate services rather than financial market trading. The evaluation methodology relies primarily on available company background information and professional profiles. Comprehensive trading-related data remains unavailable in current sources.

Readers should note that this assessment cannot provide typical forex broker metrics. These include spread comparisons, platform stability reports, or trading execution quality due to the fundamental difference in business models. The review focuses on available professional credentials and company establishment details. It does not focus on trading service quality.

Rating Framework

Broker Overview

Company Background and Establishment

Designated Broker Solutions entered the real estate compliance market in 2018. It was founded by Kristen Zimmerman following her direct experience with licensing complexities in property management expansion. The company's origin story reflects practical industry challenges. Zimmerman encountered significant obstacles when attempting to obtain firm licenses for her former company's rapidly expanding property management portfolio across multiple jurisdictions.

After departing from her previous position, Zimmerman pursued comprehensive licensure across all states. She recognized a market gap for streamlined compliance solutions. This experience directly informed the company's service model, which focuses on providing clients with clear pathways to achieve true real estate compliance across diverse regulatory environments.

Business Model and Service Focus

The organization operates as a specialized compliance facilitator rather than a traditional brokerage service. According to available information from Designated Broker Solutions' official communications, the company concentrates on licensing solutions and regulatory compliance for real estate professionals and property management firms. This kristen review finds that the business model diverges significantly from conventional forex or financial services brokerage. Instead, it serves the real estate industry's regulatory needs.

The service portfolio appears designed for established real estate professionals requiring multi-state licensing capabilities. This particularly applies to those involved in property management operations across various jurisdictions. This specialized focus distinguishes the entity from traditional trading platforms or financial service brokers commonly reviewed in forex market analyses.

Regulatory Framework: Current sources do not specify financial services regulatory oversight. The entity operates within real estate compliance rather than financial market regulation.

Deposit and Withdrawal Methods: Information regarding financial transaction methods for trading purposes is not available in accessible sources. This is consistent with the real estate service focus.

Minimum Deposit Requirements: Specific deposit requirements for trading accounts are not detailed in available materials. This reflects the non-trading nature of services.

Promotional Offers: Current sources do not indicate trading-related bonuses or promotional offers. This aligns with the real estate compliance service model.

Tradeable Assets: Traditional trading assets such as forex pairs, commodities, or indices are not mentioned in available company information.

Cost Structure: Detailed fee structures for trading services are not specified in current sources. Real estate licensing services likely involve different pricing models.

Leverage Options: Leverage ratios and margin requirements are not addressed in available materials.

Platform Selection: Trading platform options are not detailed in accessible sources.

Geographic Restrictions: Multi-state licensing suggests broad geographic coverage within the United States. However, specific trading service availability is not documented.

Customer Support Languages: Specific language support for trading services is not detailed in current sources. This kristen review notes English language capability based on available materials.

Detailed Rating Analysis

Account Conditions Analysis

The traditional account conditions assessment proves challenging for this entity due to its real estate service focus rather than trading account provision. Available sources do not detail account types, minimum balance requirements, or account opening procedures typical of forex brokers. Instead, the service model appears centered on licensing facilitation and compliance consulting for real estate professionals.

Without specific information regarding trading account structures, deposit requirements, or account tier benefits, a comprehensive evaluation of account conditions remains impossible. The business model suggests client relationships based on compliance service needs rather than trading account management. This fundamental difference in service provision means traditional account condition metrics do not apply to this kristen review assessment.

Professional credentials indicate Kristen Skebe's role as Managing Broker at Engel & Völkers Atlanta. This suggests industry expertise, though this relates to real estate brokerage rather than financial trading services. The multi-million-dollar production record and team leadership experience demonstrate professional competence within the real estate sector. However, these credentials do not translate directly to forex trading service quality.

Assessment of trading tools and resources encounters significant limitations due to the entity's real estate compliance focus. Traditional forex broker tools such as charting software, technical analysis platforms, economic calendars, or automated trading systems are not mentioned in available sources. The service model appears oriented toward compliance documentation and licensing facilitation rather than market analysis or trading execution tools.

Educational resources specific to forex trading or market analysis are not detailed in current materials. Instead, the company's expertise appears concentrated in real estate regulatory navigation and compliance procedures across multiple state jurisdictions. This specialization, while valuable for real estate professionals, does not provide the analytical tools or market research resources typically expected from forex brokers.

Research capabilities seem focused on regulatory requirements and licensing procedures rather than market analysis or trading signal generation. The absence of traditional trading tools reflects the fundamental difference between real estate compliance services and financial market brokerage operations. This makes direct comparison with forex broker tool offerings inappropriate for this evaluation.

Customer Service and Support Analysis

Customer service evaluation encounters substantial limitations due to insufficient information regarding support channels, response times, or service quality metrics. Available sources indicate contact information including telephone numbers, suggesting basic communication channels exist. However, specific service quality data remains unavailable for comprehensive assessment.

The professional background of key personnel, particularly Kristen Skebe's role as Managing Broker at Engel & Völkers Atlanta, suggests industry experience that could translate to competent client service within the real estate sector. Her track record of exceeding client expectations and delivering superior service levels indicates potential for quality customer support. However, this relates to real estate transactions rather than trading support.

Multi-language support capabilities are not detailed in current sources. English language service can be inferred from available materials. Response time metrics, support availability hours, and problem resolution procedures are not documented in accessible information. This prevents thorough customer service quality assessment for this review.

Trading Experience Analysis

Trading experience evaluation proves impossible due to the entity's focus on real estate compliance rather than financial market trading services. Traditional metrics such as platform stability, execution speed, order processing quality, or trading environment conditions are not applicable to the current service model. The absence of trading platform information reflects the fundamental difference between real estate licensing services and forex brokerage operations.

Mobile trading capabilities, platform functionality, and trading tool integration cannot be assessed as these services appear outside the company's current scope. User interface design, order execution quality, and platform reliability metrics require trading platform operation. This is not evident in available company information.

The kristen review finds that trading experience assessment requires redirection toward real estate service quality. However, specific client feedback regarding compliance service efficiency, licensing process navigation, or regulatory guidance quality is not detailed in current sources. This limitation prevents comprehensive trading experience evaluation using traditional forex broker criteria.

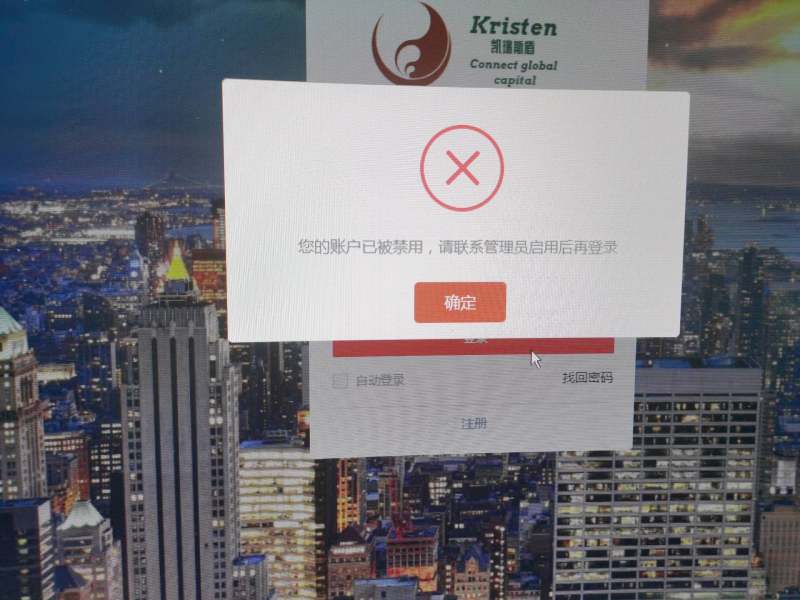

Trust and Reliability Analysis

Trust assessment encounters challenges due to limited information regarding regulatory oversight, financial security measures, or industry reputation within the forex trading sector. The company's establishment in 2018 provides a relatively recent operational history. However, specific performance records or client satisfaction data are not detailed in available sources.

Professional credentials suggest industry competence, particularly Kristen Skebe's Managing Broker position and multi-million-dollar production record within real estate. These qualifications indicate professional capability and industry recognition. However, this is within real estate rather than financial trading services. The absence of financial services regulatory information prevents traditional trust metric evaluation.

Company transparency appears limited based on available information. Basic contact details and founding history are provided, but comprehensive service documentation, fee structures, or client testimonials are not readily accessible. This information limitation affects trust assessment capability, though no negative incidents or regulatory issues are mentioned in current sources. The neutral stance reflects information insufficiency rather than identified trust concerns.

User Experience Analysis

User experience evaluation faces significant constraints due to limited client feedback and service interaction documentation. Available sources do not provide user testimonials, satisfaction surveys, or experience reports that would enable comprehensive user experience assessment. The absence of detailed service interaction information prevents evaluation of registration processes, service delivery efficiency, or overall client satisfaction.

Interface design and usability cannot be assessed without access to service platforms or client interaction systems. The real estate compliance focus suggests different user experience priorities compared to forex trading platforms. It emphasizes regulatory navigation and documentation processes rather than trading interface design or market access efficiency.

Client demographic information is not detailed in current sources. However, the service model suggests targeting real estate professionals and property management companies rather than individual forex traders. This fundamental difference in user base affects experience evaluation criteria. It requires focus on compliance service satisfaction rather than trading platform usability. The lack of specific user feedback prevents detailed experience quality assessment for this review.

Conclusion

This kristen review reveals a significant divergence from traditional forex broker services. Designated Broker Solutions operates primarily within real estate compliance rather than financial market trading. The neutral assessment reflects substantial information limitations regarding conventional brokerage metrics such as regulatory oversight, trading conditions, platform capabilities, and client experiences.

The entity appears most suitable for real estate professionals requiring multi-state licensing solutions and compliance guidance rather than individual or institutional forex traders seeking market access. The specialized focus on real estate regulatory navigation represents a distinct service category that does not align with typical forex broker evaluation criteria. This makes direct comparison with trading service providers inappropriate and potentially misleading for prospective forex trading clients.