agl 2025 Review: Everything You Need to Know

Abstract

The agl review shows a neutral picture of AGL. The company has an overall user rating of 3.1, which reflects mixed customer experiences across different service areas. Customers like how easy the service is to use and how quickly customer service responds, which has made some areas of the customer experience positive. However, people criticize the pricing structure, and many complaints about frequent unwanted calls have hurt how users feel about the company. AGL received high praise in the 2023 Customer Satisfaction Awards, which shows the company does some things well. It also offers a unique no-lock monthly billing option that makes it different from competitors. The broker mainly targets residents and businesses that need electricity and gas services. It focuses strongly on the Australian market, where it has built its main customer base. While some parts like client support and simple operations get praise, concerns remain about cost competitiveness and aggressive telemarketing practices. This review uses user feedback, market data, and industry analysis to make sure readers get complete insights into AGL's performance, strengths, and areas that need improvement.

Important Considerations

AGL's pricing and service structures may vary a lot across different Australian states. This makes it essential for users to check the specific fees and conditions that apply to their region before making decisions. This evaluation comes from a complete analysis based on user feedback, market insights, and industry experts. The method behind this review relies on looking at client reviews, publicly available data, and recognized industry awards, which provides a balanced view of the company's performance. Specific regulatory details and oversight information were not provided in the available resources. Therefore, readers should consult additional sources for detailed regulatory confirmations to get the full picture.

Rating Framework

Broker Overview

AGL stands as one of Australia's leading retail providers of electricity and gas. The company has a long history in the energy sector, which gives it experience and market knowledge. As one of the three major electricity and gas retailers in the country, AGL has built a reputation on wide service coverage and a commitment to customer satisfaction. The company's business model focuses firmly on serving both residential and commercial users. It concentrates on providing essential energy services with options designed to meet diverse consumer needs, from basic plans to more specialized offerings. Despite ongoing issues raised by some clients about aggressive telemarketing, the overall customer service remains a highlight. Many clients appreciate its ease of use, especially when it comes to billing and account management tasks.

The information on the actual trading platform or detailed asset classes is not provided in the available sources. However, the agl review emphasizes that AGL offers a no-lock monthly billing option, which is a key feature that works well with price-sensitive users who want flexibility without being tied into long-term contracts. Regulatory oversight details and the nature of the electronic trading environment are missing from the current data. This leaves some questions about operational specifics unanswered, which creates uncertainty for potential customers. This gap in information further shows the need for potential customers to do additional research before fully committing to AGL's services.

The available data does not clearly mention the regulatory regions that AGL operates within. This creates an information gap for international comparisons and regulatory understanding. About deposit methods, specific options for both deposits and withdrawals have not been detailed. Similarly, information on any promotional bonuses or special offers is not provided in the current documentation. It is clearly stated, however, that the minimum deposit required is 500. This figure is one that some users found to be on the higher side compared to competitors.

The cost structure of AGL has not been fully detailed in the available data. This includes aspects such as spreads, commissions, and any hidden fees that customers might encounter. Despite this lack of detail, customer feedback points to a view of relatively high pricing compared to other providers. Some users do note that the quality of service may justify the higher rates they pay. The leverage offered by AGL is stated to be 30, which is a key figure for potential clients who are assessing risk levels and investment strategies. Information on platform selection options, regional service limitations, and the languages available for customer support remains unspecified in current materials. Overall, while key parameters like the minimum deposit and leverage are provided, there remains a significant lack of detailed information about transactional methods and asset offerings. This gap highlights the need for further inquiry for users seeking complete operational insights. As noted in this agl review, prospective customers should consider these gaps when weighing their decision to use AGL.

Detailed Rating Analysis

2.6.1 Account Conditions Analysis

The account conditions offered by AGL have been looked at closely within this review. AGL requires a minimum deposit of 500, which is a benchmark that many users have found relatively high compared to competitors in the energy supply market. The lack of detailed information about various account types, account opening procedures, and any specialized versions makes the account setup process more complicated than it needs to be. This information gap makes it hard for potential customers to fully evaluate whether AGL's account structures suit their specific financial and operational needs. Compared to other energy service providers, the higher minimum deposit requirement has drawn criticism. This indicates that while the account conditions are straightforward, there is little room for flexibility in meeting different customer needs. Additionally, potential users may face challenges in checking if any unique features or account-specific benefits exist due to the limited information provided. The overall feeling in this agl review is that customers want improvements in this area. Particularly, they want the entry barrier for new users reduced, which could contribute significantly to a better customer onboarding experience.

When looking at AGL's available tools and resources, there is a clear lack of detailed information. This makes it challenging to assess the full extent of their utility and value to customers. The agl review indicates that the provider does not offer significant insights into the variety and quality of trading tools typically seen in competitive sectors. There are no clear descriptions of research and analysis tools, educational resources, or automated trading options. These features are critical for customers who rely heavily on them to make informed decisions about their energy needs. The limited data provided reveals that users have not experienced significant benefits from an abundance of trading tools. Such resources either lack depth or are entirely missing from the service portfolio, which limits customer options. As a result, while basic functionality may be present, the lack of advanced tools signals an area where AGL could enhance its offering to remain competitive. This scarcity leaves potential clients at a disadvantage. This is particularly true for those accustomed to a rich ecosystem of informational and educational support that robust trading platforms typically offer. Overall, the agl review serves as an indicator that more complete resource offerings would be a valuable addition in future updates.

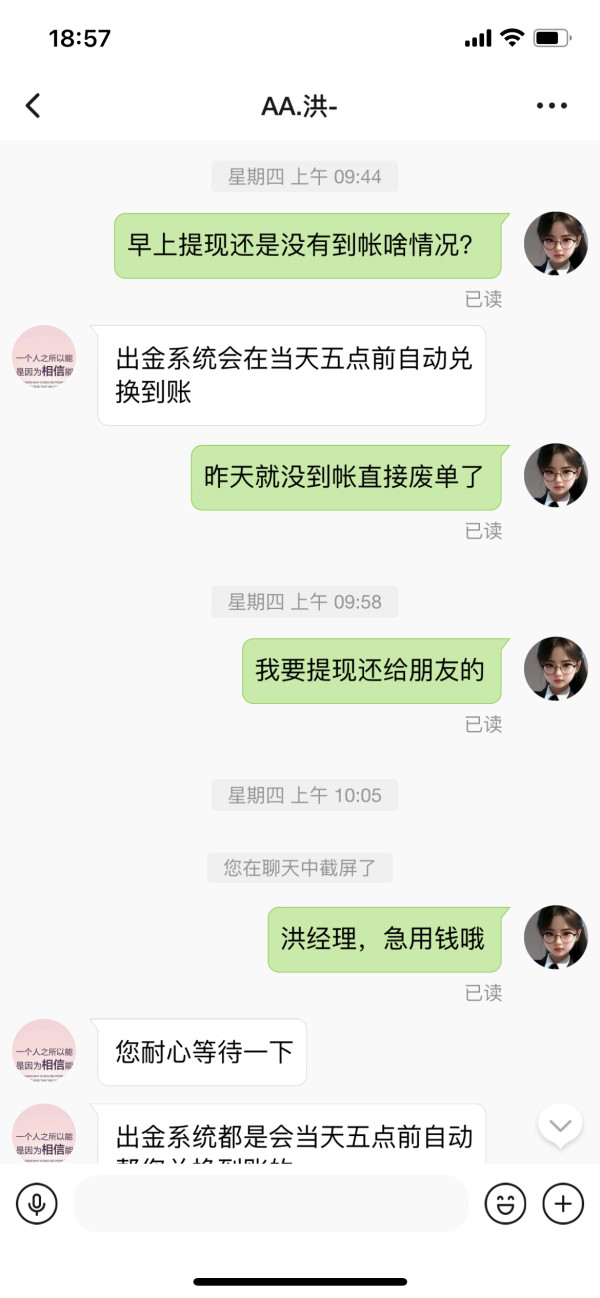

2.6.3 Customer Service and Support Analysis

In customer service and support, AGL has received mixed reviews from users. On one hand, the ease of accessing support and the generally positive user interactions have contributed positively to the overall experience. This is evident from various positive customer remarks and feedback collected over time. On the other hand, an overwhelming number of complaints relate to frequent unwanted calls, which have negatively affected the customer experience. While the service quality itself is considered satisfactory by most users, the persistent telemarketing issues suggest that communication practices need to be looked at again. The available data does not specify the range of customer support channels, hours of operation, or multilingual support options. This leaves some potential users uncertain about whether the support structure fully serves all types of customers with different needs. These gaps, combined with the negative experiences related to unwanted calls, indicate that while the in-house customer service is responsive when engaged, its overall execution is hurt by external marketing tactics. In this agl review, customers are advised to weigh the convenience of prompt support against the downsides of aggressive outreach practices. Making communication policies more transparent could help AGL achieve a more balanced and customer-friendly service reputation.

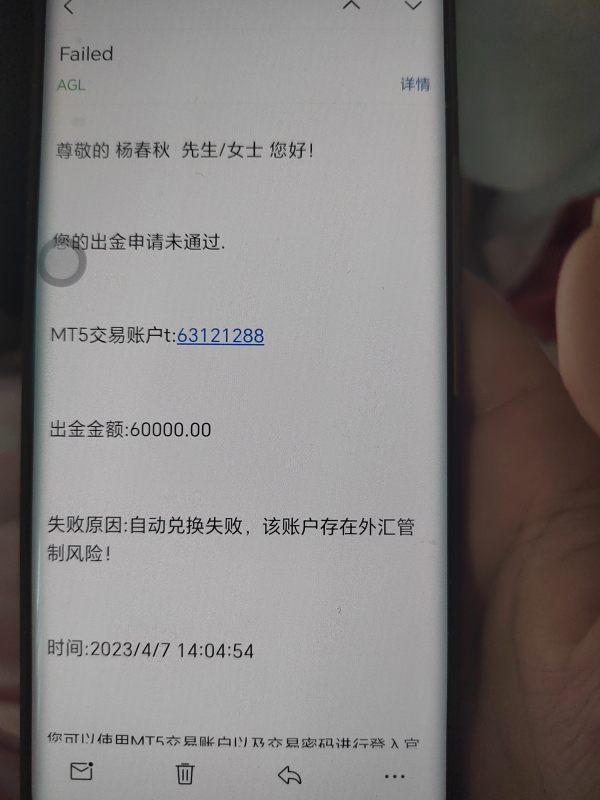

2.6.4 Trading Experience Analysis

The trading experience provided by AGL remains unclear due to insufficient available data on platform stability, order execution quality, and the overall digital infrastructure. Users have not reported extensive feedback on the specifics of the trading platform. This results in an unclear picture of the user interface, functionality, and mobile experience for customers. As a result, AGL's trading environment is rated modestly, with a score that reflects the current uncertainty about its capabilities. Despite the fact that no clear issues regarding technical performance have been highlighted, the absence of detailed information prevents a fully favorable assessment. The agl review notes that there appears to be a gap in the communication of operational strengths. This could otherwise help in building user confidence in the system's reliability and performance. Without clearer descriptions of platform features and performance benchmarks, users are left relying on stories from other customers to form their impressions. As a result, while AGL's trading experience may hold potential for improvement, better transparency regarding technical tools and performance metrics is essential to build user trust and satisfaction.

2.6.5 Trust Analysis

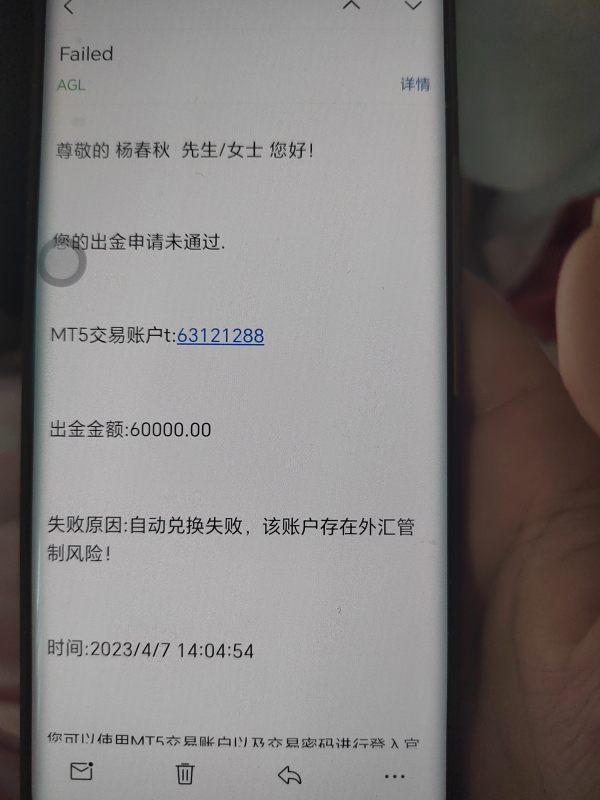

Trust in a financial service is built on regulatory compliance, fund safety measures, and overall corporate transparency. In the case of AGL, the evaluation is limited by the absence of clear regulatory details and complete information about risk management practices. Although AGL has earned recognition through the 2023 Customer Satisfaction Award, which positively influences its perceived reputation, significant elements such as clear oversight mechanisms and detailed funding security protocols remain unspecified. This lack of transparency reduces the overall trust rating, resulting in a neutral score that reflects uncertainty. Different sources present varying perspectives on AGL's commitment to transparency, and without concrete data on regulatory adherence, users might remain cautious about fully trusting the service. The agl review emphasizes that while the company is generally reputable within its targeted market, prospective customers may need to conduct further investigations to verify claims about its trustworthiness and operational stability. Better disclosure of regulatory confirmations and safety measures would be vital in strengthening customer confidence and building long-term trust.

2.6.6 User Experience Analysis

The overall user experience with AGL is characterized by a mixture of satisfaction and frustration. With an average customer rating of 3.1, users express neutral feelings that are overshadowed by recurring issues such as persistent unwanted calls. Although many customers praise the intuitive, user-friendly aspects of account management and billing, particularly the no-lock monthly billing option, the repeated interruptions via aggressive telemarketing create notable dissatisfaction among users. Additionally, details about the interface design, registration processes, and fund management operations are sparse. This leaves important aspects of the end-user journey unaddressed and creates uncertainty for potential customers. While some users benefit from the straightforward and accessible service, others have raised concerns that undermine the overall experience and satisfaction levels. The agl review suggests that while AGL does offer certain practical advantages in its service model, improvement areas clearly exist. This is especially true in stopping intrusive practices and providing more complete digital support for customers. Tailoring solutions to such concerns could significantly improve the platform's user satisfaction levels.

Conclusion

AGL demonstrates solid performance in delivering essential electricity and gas services in Australia. The company particularly benefits residential and commercial users through features like a flexible no-lock monthly billing option and commendable customer service that responds quickly to user needs. However, the company faces notable challenges in pricing, account conditions, and aggressive telemarketing practices. These issues have led to a middling overall rating of 3.1, which reflects mixed customer experiences. While industry recognition, such as the 2023 Customer Satisfaction Award, shows some of its strengths, the lack of detailed information on regulatory compliance and trading tools remains a concern for potential customers. This agl review advises potential customers to carefully consider these factors and conduct further research before committing to AGL's services.