Regarding the legitimacy of China Galaxy forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is China Galaxy safe?

Risk Control

Software Index

Is China Galaxy markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

China Galaxy International Futures (Hong Kong) Co., Limited

Effective Date:

2011-12-14Email Address of Licensed Institution:

enquiry@chinastock.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.chinastock.com.hkExpiration Time:

--Address of Licensed Institution:

香港干諾道中111號永安中心20樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is China Galaxy Safe or Scam?

Introduction

China Galaxy Securities, a prominent player in the financial services market, is recognized for its comprehensive range of offerings, including securities brokerage, investment banking, and asset management. Established in 2007, the company has made significant strides in both domestic and international markets. However, the rise of online trading has made it increasingly crucial for traders to carefully assess the credibility of their brokers. The foreign exchange market, in particular, is rife with potential risks, including scams and unregulated entities. This article aims to provide a thorough evaluation of whether China Galaxy is safe or a potential scam by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory framework is a critical aspect of any brokerage's legitimacy. China Galaxy is regulated by the Securities and Futures Commission (SFC) in Hong Kong, which is known for its stringent oversight and high standards in the financial sector. This regulation is essential as it ensures that the broker adheres to specific operational guidelines, thus providing a layer of protection for investors. Below is a summary of the regulatory information for China Galaxy:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | AYH 772 | Hong Kong | Verified |

The SFC's oversight indicates that China Galaxy is subject to regular audits and must maintain transparency in its operations. However, it is worth noting that some complaints have surfaced regarding the firm's responsiveness and withdrawal processes, which raises questions about its compliance history. While the regulatory framework is solid, traders should remain vigilant and conduct thorough due diligence.

Company Background Investigation

China Galaxy has a rich history, having been founded in 2007 with a focus on providing a wide array of financial services. The company is a state-owned enterprise and operates under the umbrella of Galaxy Financial Holdings. This ownership structure lends it credibility, as state-backed institutions typically have to meet rigorous standards set by the government. The management team comprises seasoned professionals with extensive experience in finance and investment, which is a positive indicator for potential clients.

The company's transparency is relatively high, with readily available information about its services and operational framework. However, some users have reported difficulties in accessing specific details about fees and account types, which could deter potential clients from engaging with the platform. Overall, the company's background suggests a reputable organization, yet the transparency issues highlight a need for improvement.

Trading Conditions Analysis

When evaluating whether China Galaxy is safe, examining its trading conditions is essential. The broker offers competitive spreads and a variety of account types, catering to different types of traders. However, some users have noted that the fee structure can be complex, with hidden costs that may not be immediately apparent. Below is a comparison of key trading costs associated with China Galaxy:

| Fee Type | China Galaxy | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% | 0.3% |

While the spreads are competitive, the variable commission model may lead to higher costs for certain traders. Additionally, the overnight interest rates are slightly above the industry average, which could affect long-term trading strategies. Traders should carefully assess these conditions to ensure they align with their trading strategies and risk tolerance.

Customer Funds Safety

Ensuring the safety of client funds is a paramount concern for any brokerage. China Galaxy implements several measures to protect client funds, including segregated accounts and investor protection schemes. Segregating client funds from the company's operational funds is crucial for safeguarding against potential insolvency. Furthermore, the SFC mandates that all licensed brokers maintain a certain level of capital reserves, providing an additional layer of security for traders.

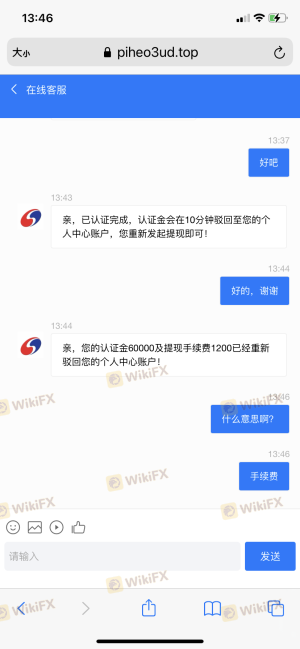

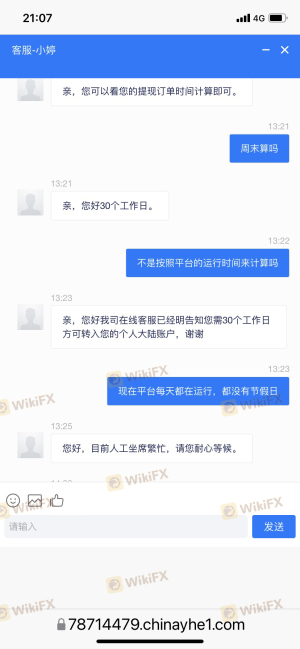

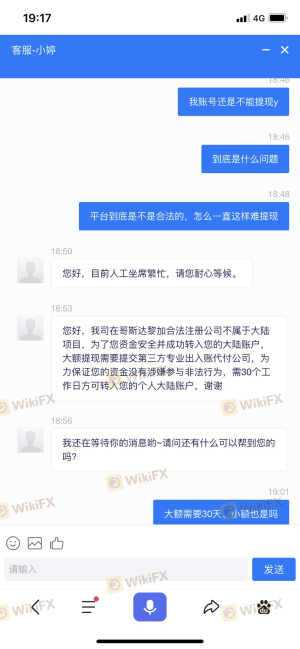

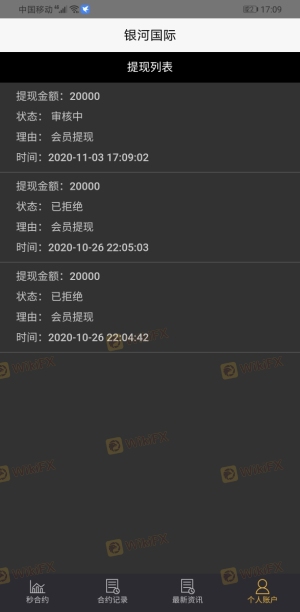

Despite these measures, there have been reports of issues related to fund withdrawals, with some clients claiming that their requests were met with delays and vague explanations. This raises concerns about the effectiveness of the firm's customer service and operational transparency. Overall, while China Galaxy has established protocols for fund safety, the complaints surrounding withdrawals warrant caution.

Customer Experience and Complaints

Analyzing customer feedback is vital in assessing whether China Galaxy is safe or a scam. Many users have praised the broker for its user-friendly trading platform and comprehensive educational resources. However, common complaints include difficulties with fund withdrawals and unresponsive customer service. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Service Quality | Medium | Inconsistent |

| Fee Transparency | Medium | Lacking Details |

A couple of notable cases include traders who reported being unable to withdraw their funds after multiple requests, leading to frustration and distrust. These incidents highlight potential weaknesses in China Galaxy's customer service and operational efficiency. While the broker has positive attributes, these complaints raise red flags that prospective clients should consider.

Platform and Trade Execution

The trading platform offered by China Galaxy is generally regarded as stable and user-friendly, providing a range of tools for both novice and experienced traders. The execution quality is typically satisfactory, with minimal slippage reported. However, there have been isolated incidents where clients experienced order rejections during high volatility periods, raising concerns about platform reliability.

Overall, while the platform performs well under normal conditions, traders should be cautious during major market events. Signs of potential manipulation or execution issues should be monitored, as they could significantly impact trading outcomes.

Risk Assessment

Using China Galaxy entails various risks that traders should be aware of. Below is a summary of the key risk areas associated with this brokerage:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Complaints about withdrawals |

| Customer Service Quality | High | Slow response times |

| Trading Costs | Medium | Variable fees can add up |

To mitigate these risks, traders are advised to maintain a clear understanding of the fee structure, keep track of withdrawal requests, and utilize the demo account to familiarize themselves with the platform before committing significant capital.

Conclusion and Recommendations

In conclusion, while China Galaxy is a regulated entity with a solid reputation in the financial services sector, there are several factors that warrant caution. The complaints regarding withdrawal issues and customer service could indicate underlying operational inefficiencies. Therefore, traders should approach with a degree of skepticism and ensure they are fully informed about the terms and conditions before engaging.

For traders seeking alternatives, consider brokers with a proven track record of excellent customer service and transparent fee structures. Always prioritize due diligence and be aware of the potential risks involved in trading with any brokerage. Ultimately, while China Galaxy may not be a scam, its operational challenges suggest that traders should proceed with caution.

Is China Galaxy a scam, or is it legit?

The latest exposure and evaluation content of China Galaxy brokers.

China Galaxy Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

China Galaxy latest industry rating score is 6.87, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.87 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.