ASA Securities 2025 Review: Everything You Need to Know

Summary

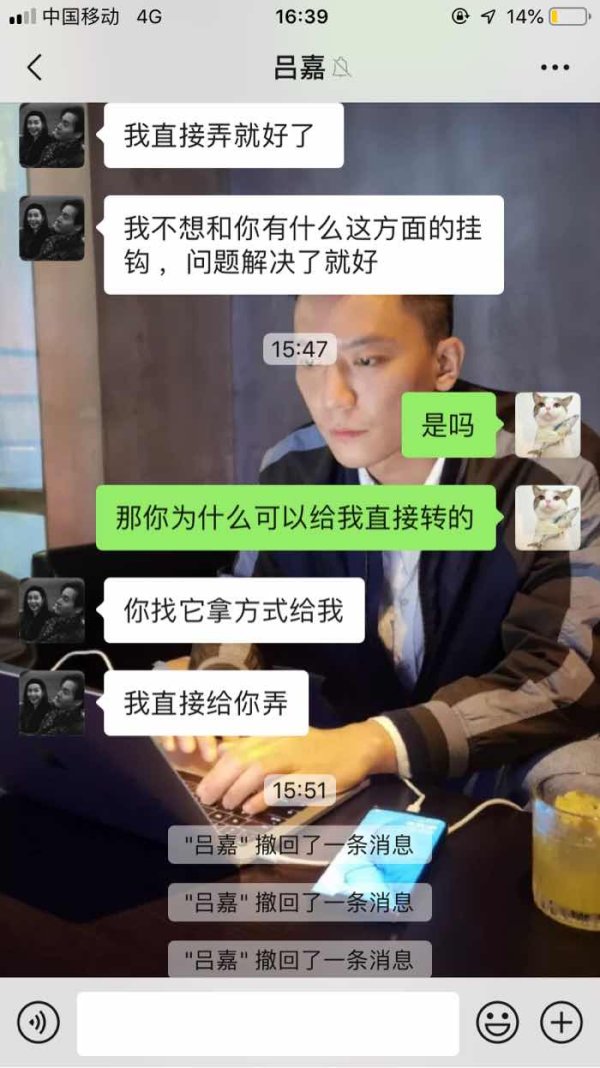

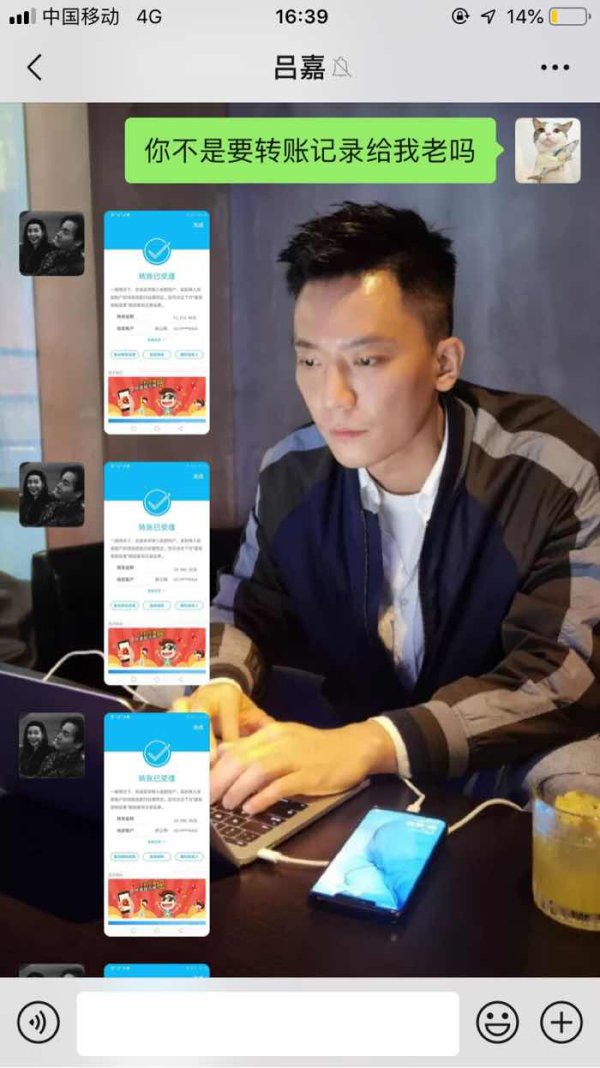

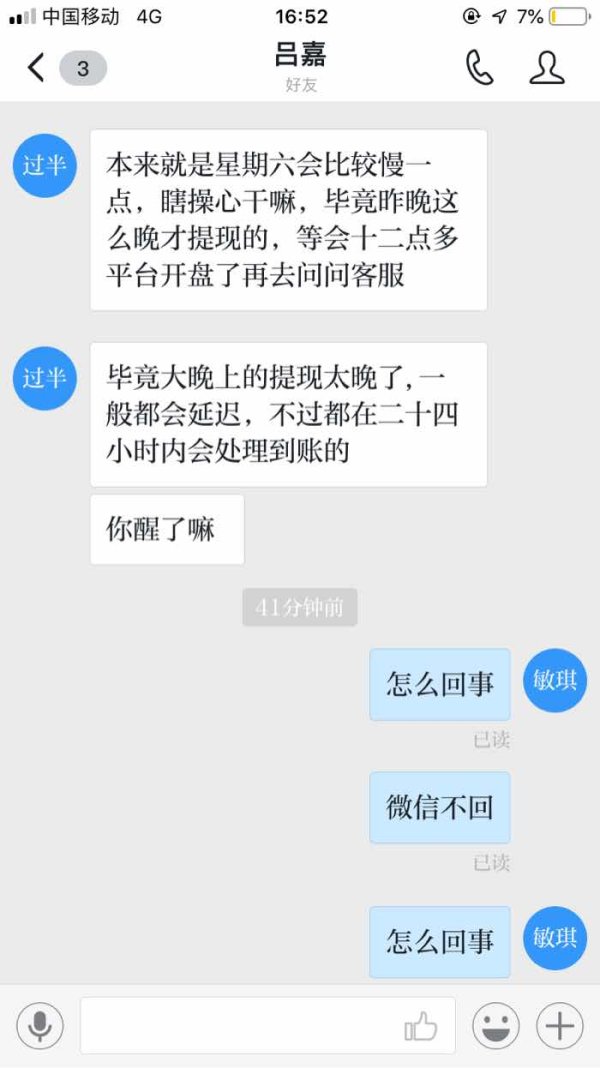

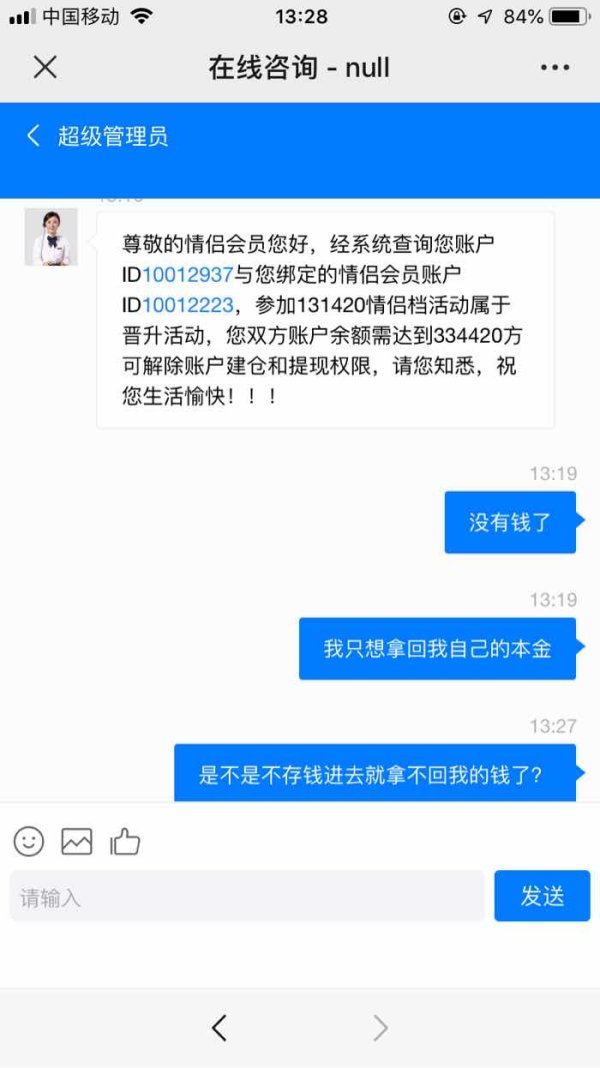

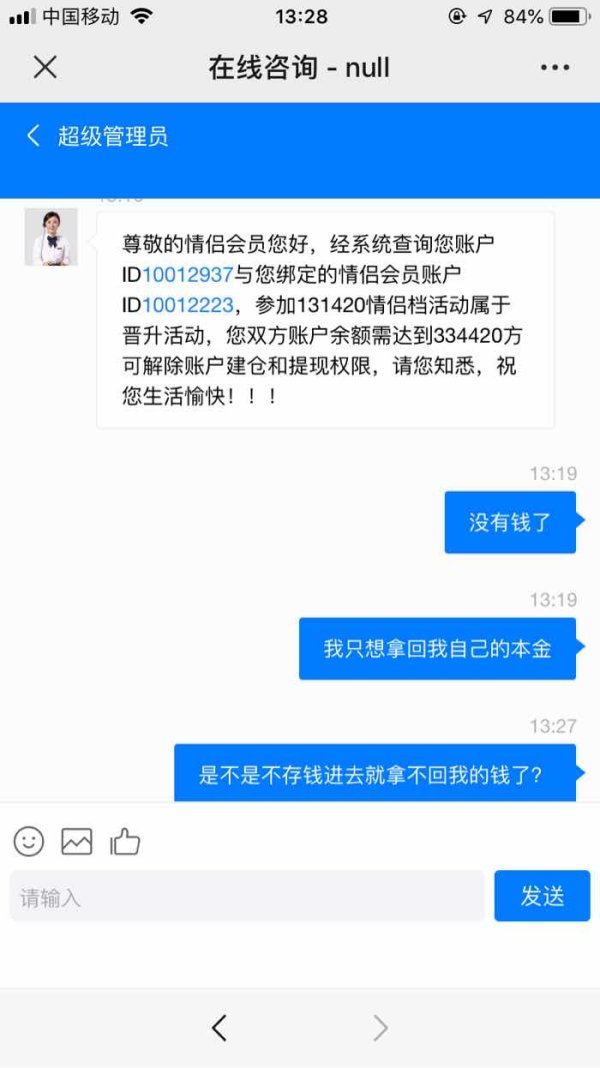

The reviews of ASA Securities present a mixed picture, with several sources expressing significant concerns regarding the broker's regulatory status and user experience. While some highlight the company's long history and variety of trading instruments, many caution potential investors about the risks of trading with an unregulated broker. Notably, user experiences suggest challenges with fund withdrawals and overall trustworthiness, raising red flags for prospective clients.

Note: It is crucial to be aware that there are different entities operating under similar names, which may lead to confusion. This review aims to provide a fair and accurate assessment based on available information.

Rating Box

We rate brokers based on user feedback, regulatory standing, and overall service quality.

Broker Overview

Founded in 1974, ASA Securities is based in Hong Kong and offers a range of trading services, including forex, commodities, and indices. The broker provides access to its proprietary trading platform, which is not based on popular options like MetaTrader 4 or MetaTrader 5. Despite its long history, ASA Securities is often described as unregulated, which raises concerns about the safety of client funds. The company is licensed by the Hong Kong Securities and Futures Commission (SFC) for futures contracts but lacks comprehensive regulation for its broader trading activities.

Detailed Section

Regulatory Regions

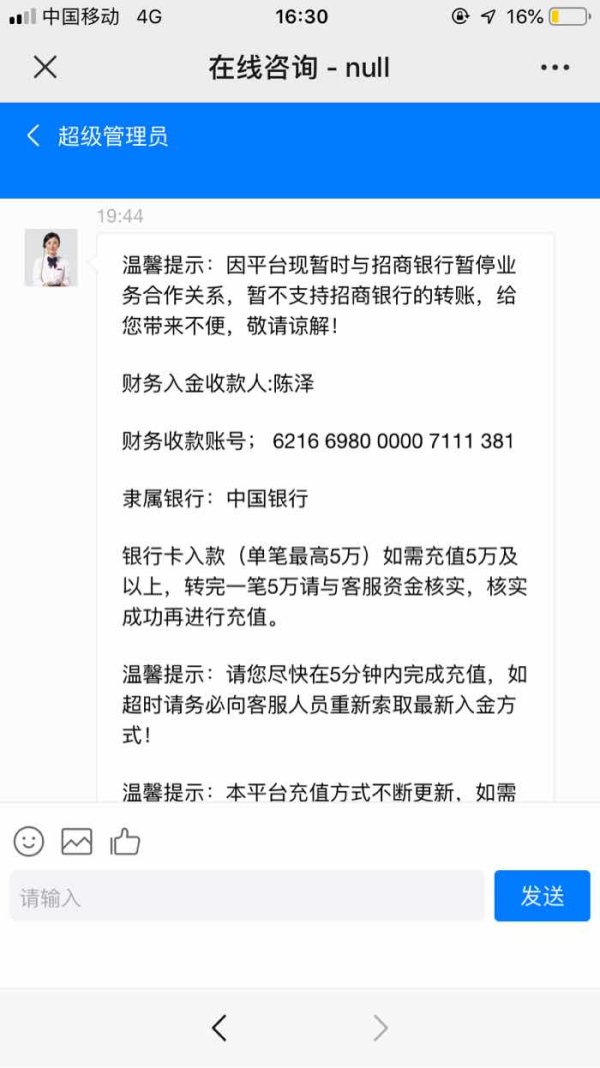

ASA Securities operates primarily in Hong Kong and is licensed by the SFC for futures contracts. However, its lack of broader regulatory oversight has led to skepticism about its trustworthiness. According to various reviews, the absence of strict regulations can expose traders to higher risks, especially concerning fund protection and the broker's operational integrity.

Deposit/Withdrawal Currencies/Cryptocurrencies

The reviews do not provide specific details about the currencies accepted for deposits and withdrawals, nor do they mention the acceptance of cryptocurrencies. This lack of transparency can be a significant drawback for potential clients looking for flexible payment options.

Minimum Deposit

The minimum deposit required to open an account with ASA Securities is not explicitly stated in the sources reviewed. However, the general consensus indicates that the broker may require a higher initial investment compared to other regulated brokers, which typically offer accounts with lower minimum deposits.

There is little to no information regarding bonuses or promotional offers from ASA Securities. This lack of incentives may deter some traders who are accustomed to brokers providing bonuses as part of their account offerings.

Tradable Asset Classes

ASA Securities offers a variety of tradable assets, including forex, commodities, and indices. However, the absence of cryptocurrencies, which have become increasingly popular among traders, may limit its appeal to a broader audience.

Costs (Spreads, Fees, Commissions)

The reviews indicate that ASA Securities has relatively high spreads and may impose fees that are not clearly disclosed. This lack of transparency regarding costs raises concerns about the overall trading conditions offered by the broker.

Leverage

The leverage offered by ASA Securities is not explicitly mentioned in the reviewed sources. However, it is generally understood that higher leverage increases both potential returns and risks, which can be particularly concerning in the context of an unregulated broker.

ASA Securities does not utilize popular trading platforms like MetaTrader 4 or MetaTrader 5, which are favored by many traders for their advanced features and user-friendly interfaces. Instead, it offers a proprietary platform, which may not provide the same level of functionality or trust.

Restricted Regions

The reviews do not specify any particular regions that are restricted from trading with ASA Securities. However, the lack of regulation may deter traders from certain jurisdictions, particularly those with stringent financial regulations.

Available Customer Service Languages

The customer service language options are not explicitly detailed in the reviewed sources. However, given that ASA Securities is based in Hong Kong, it is likely that services are available in Cantonese and English.

Repeated Rating Box

Detailed Breakdown Section

Account Conditions

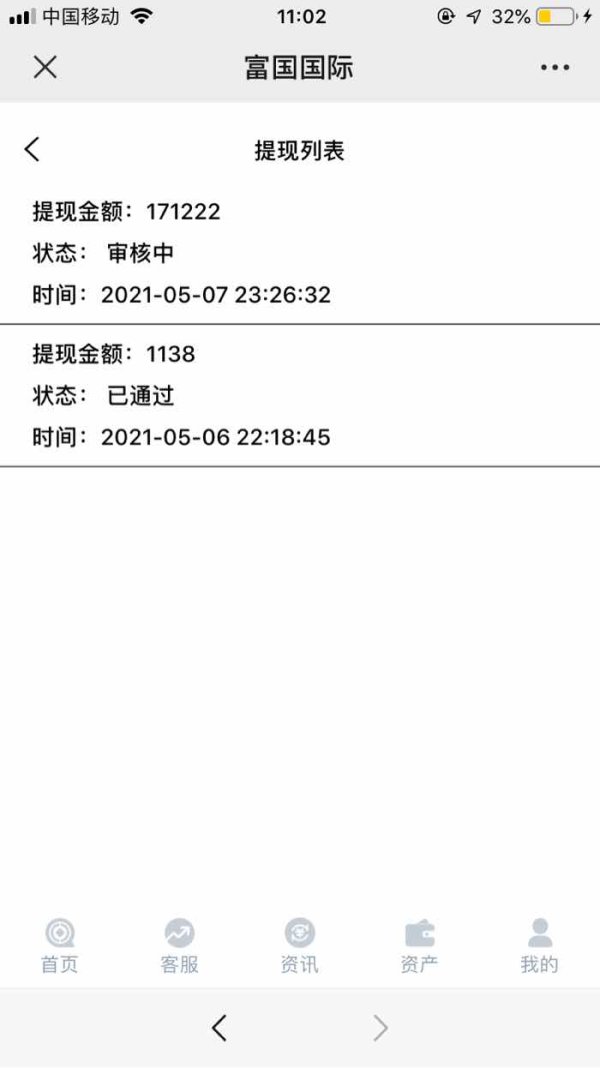

The account conditions at ASA Securities are rated 5 out of 10. While the broker offers a range of trading options, the lack of transparency regarding minimum deposits and withdrawal processes raises concerns among potential users.

With a rating of 6, ASA Securities does provide some trading tools and resources. However, the absence of popular platforms like MT4 or MT5 limits the trading experience for many users.

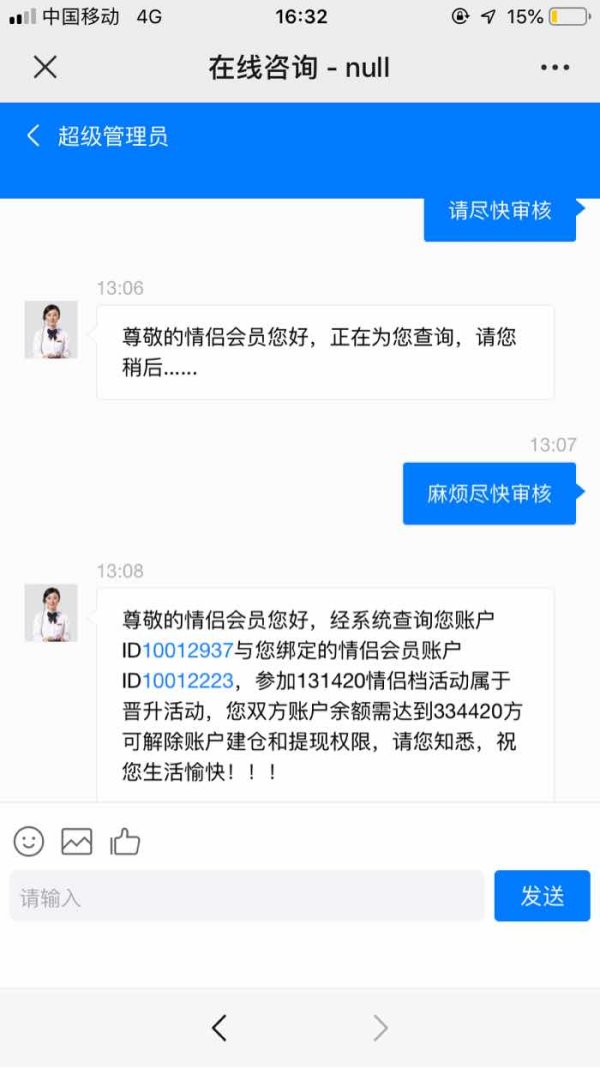

Customer Service and Support

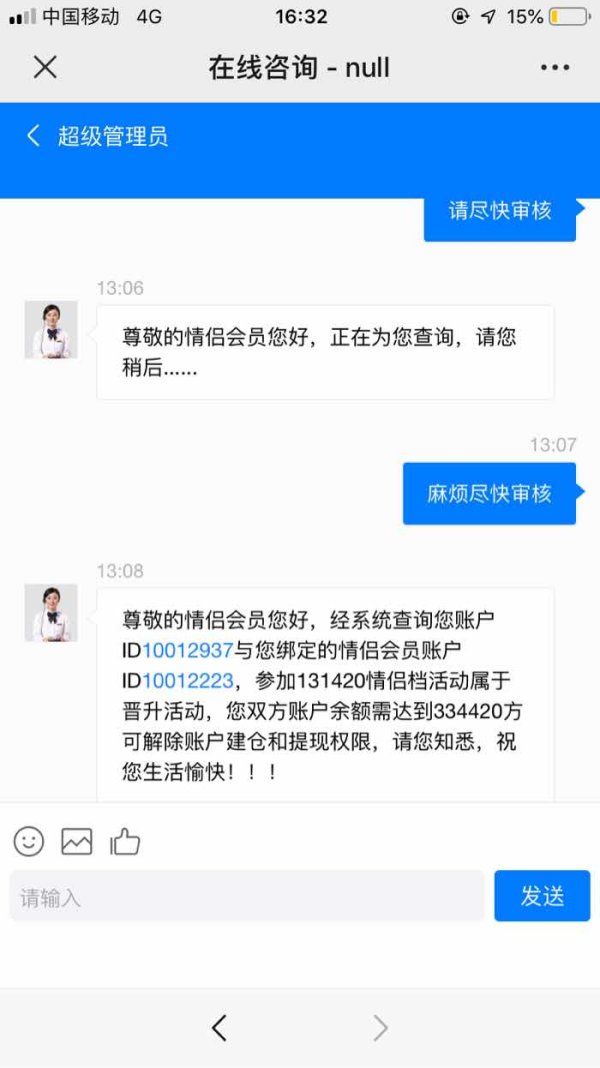

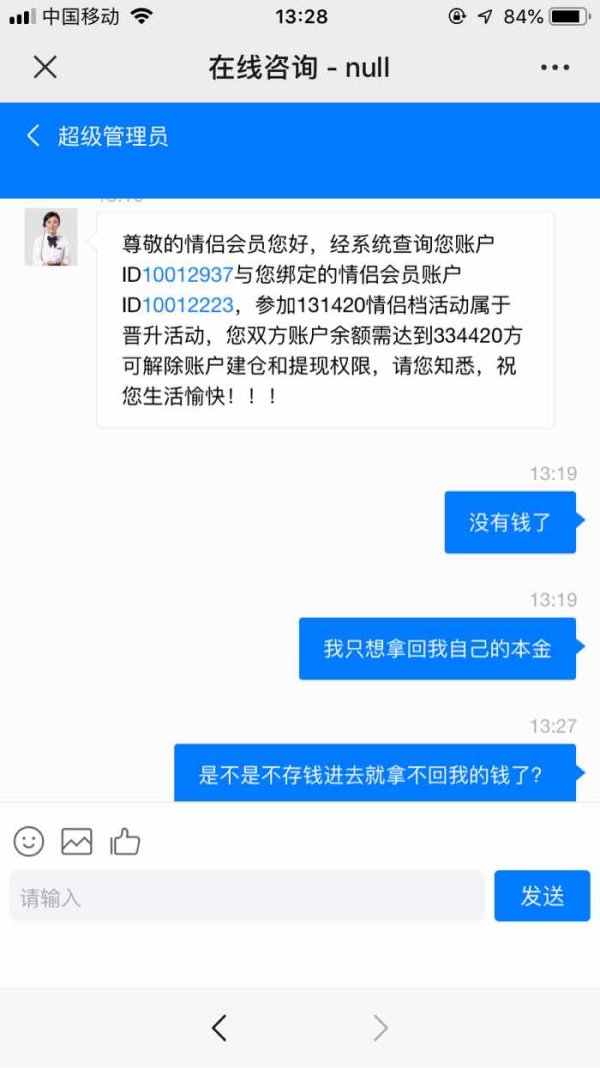

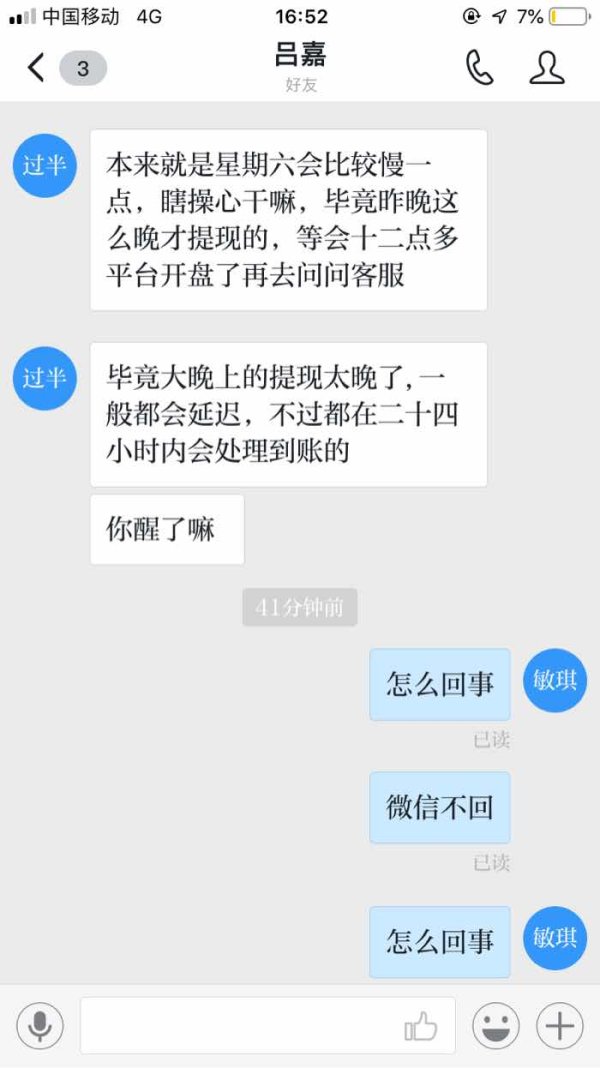

Rated at 4, the customer service experience appears to be subpar, with several users reporting difficulties in communication and support.

Trading Experience

The trading experience at ASA Securities is rated 5, reflecting a basic trading environment that may not meet the expectations of more experienced traders.

Trustworthiness

Trustworthiness is a significant concern with a rating of 3. The lack of comprehensive regulation and user complaints about fund withdrawals contribute to this low score.

User Experience

The user experience is rated at 4, indicating that while some traders may find the platform functional, many others report issues that detract from their overall satisfaction.

In conclusion, ASA Securities presents a complex picture for potential traders. While it has a long history and offers a variety of trading options, the significant concerns regarding its regulatory status and user experiences make it a risky choice. Prospective clients should weigh these factors carefully before deciding to invest with this broker.