Is K Tinvest safe?

Business

License

Is K Tinvest Safe or a Scam?

Introduction

K Tinvest is a forex broker positioned in the competitive landscape of online trading. Operating primarily in the Asian markets, it claims to offer a range of trading services for currencies, commodities, and indices. However, the influx of unregulated brokers in the forex market has raised significant concerns among traders regarding the safety and legitimacy of their investments. Given the potential risks involved, it is crucial for traders to carefully evaluate any broker before committing their funds. This article conducts a thorough investigation into K Tinvests regulatory standing, company background, trading conditions, customer fund safety, user experiences, and associated risks. Our evaluation is based on a review of multiple sources, including user feedback, regulatory databases, and expert analyses.

Regulation and Legitimacy

The regulatory status of a broker is a key determinant of its legitimacy and reliability. K Tinvest currently operates without any valid regulatory oversight, which raises significant red flags for potential investors. The absence of regulation means that there is no authoritative body to ensure that K Tinvest adheres to industry standards or protects client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulation exposes traders to high risks, including potential fraud and mismanagement of funds. Additionally, K Tinvest has been flagged by various financial watchdogs, indicating a history of suspicious activities. The broker's regulatory index stands at 0.00, suggesting a complete lack of compliance with regulatory standards. This lack of oversight is alarming and warrants caution when considering K Tinvest as a trading partner.

Company Background Investigation

K Tinvest, operating under the name 高 投 國際 ( 香港 ) 有限 公司, is based in Hong Kong. However, there is scant information available regarding its founding, ownership structure, and operational history. This lack of transparency is concerning, as legitimate brokers typically provide comprehensive details about their management teams and business practices.

The management teams background is crucial in assessing a broker's credibility. Unfortunately, K Tinvest does not disclose any information about its executives or their professional experiences. This opacity raises questions about the broker's accountability and operational integrity. Without clear information about the company's leadership, potential investors are left in the dark regarding who is managing their funds and what qualifications they possess.

Moreover, the absence of any verifiable information about the company's history and operational practices contributes to the perception that K Tinvest may not prioritize transparency or client trust. This situation is particularly concerning in an industry where trust and reliability are paramount.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions and fee structures is essential. K Tinvest advertises a variety of trading options, but the specifics of its fee structure are not readily available. This lack of clarity can be a warning sign, as reputable brokers typically provide detailed information about their pricing and trading costs.

| Fee Type | K Tinvest | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies (typically 1-3 pips) |

| Commission Model | N/A | Varies (often $0-$10 per lot) |

| Overnight Interest Range | N/A | Varies (typically 2-5%) |

The absence of clearly defined trading costs can lead to unexpected charges, which is a common tactic used by less reputable brokers. Traders should be cautious of any broker that does not provide transparent information about fees, as this can lead to hidden costs that diminish overall profitability.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. K Tinvest's lack of regulatory oversight raises significant questions about its fund safety measures. Reputable brokers typically implement strict policies regarding fund segregation, ensuring that client funds are kept separate from the company's operational funds. Additionally, they often provide investor protection mechanisms to safeguard client investments in the event of bankruptcy or financial mismanagement.

Unfortunately, K Tinvest has not demonstrated any commitment to these essential safety practices. There are no indications of fund segregation or investor protection policies in place. This lack of measures significantly increases the risk for traders, as they may find themselves vulnerable to losing their investments without any recourse.

Furthermore, there have been no reported instances of fund security breaches or disputes involving K Tinvest, but the absence of such reports does not necessarily imply that the broker is safe. The lack of transparency regarding fund management practices should be a significant concern for potential investors.

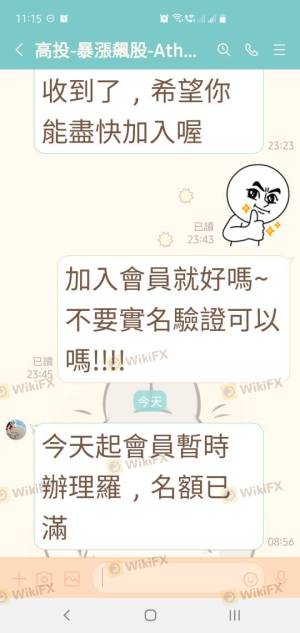

Customer Experience and Complaints

Understanding customer experiences can provide valuable insights into a broker's reliability. K Tinvest has received mixed reviews from users, with several complaints highlighting issues related to withdrawal processes and customer support responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | Medium | Slow Response |

Common complaints include difficulties in withdrawing funds, with users reporting that their requests were either delayed or met with vague explanations. The lack of effective customer support exacerbates these issues, leaving traders feeling frustrated and unsupported.

One notable case involved a trader who attempted to withdraw funds after experiencing significant gains. The broker reportedly delayed the withdrawal process, citing technical issues. This incident raised suspicions about K Tinvest's operational integrity and whether it prioritizes client satisfaction.

Platform and Execution

The trading platform's performance is critical for a successful trading experience. K Tinvest claims to offer a user-friendly platform, but user feedback indicates mixed experiences regarding its stability and execution quality. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

Furthermore, there are concerns about potential platform manipulation, where brokers may interfere with order execution to benefit themselves at the expense of traders. While there is no concrete evidence of such practices at K Tinvest, the lack of regulatory oversight and transparency raises questions about the broker's operational integrity.

Risk Assessment

Using K Tinvest comes with several inherent risks, primarily due to its unregulated status and lack of transparency.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight. |

| Fund Safety Risk | High | Lack of fund segregation and protection policies. |

| Customer Support Risk | Medium | Poor responsiveness and unresolved complaints. |

To mitigate these risks, traders should consider using a regulated broker with a proven track record of compliance and customer satisfaction. Conducting thorough due diligence before investing is essential to protect ones financial interests.

Conclusion and Recommendations

In conclusion, the evidence suggests that K Tinvest exhibits several characteristics indicative of a potential scam. The absence of regulatory oversight, lack of transparency regarding company operations, and poor customer feedback raise significant concerns about the broker's legitimacy.

For traders seeking a reliable trading partner, it is advisable to steer clear of K Tinvest and consider regulated alternatives that prioritize client safety and transparency. Brokers regulated by reputable authorities, such as the FCA or ASIC, offer greater protection and a more trustworthy trading environment.

Ultimately, the question of "Is K Tinvest safe?" leans heavily towards a cautious "No." Traders should prioritize their financial security and seek out brokers that are committed to ethical practices and regulatory compliance.

Is K Tinvest a scam, or is it legit?

The latest exposure and evaluation content of K Tinvest brokers.

K Tinvest Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

K Tinvest latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.