Is ZhuoYi Group safe?

Business

License

Is Zhuoyi Group Safe or Scam?

Introduction

Zhuoyi Group is a forex broker that has emerged in the competitive landscape of online trading, primarily targeting retail traders looking for access to the forex market. As with any financial service provider, it is crucial for traders to exercise caution and conduct thorough research before committing their funds. The forex market has seen its share of scams and fraudulent activities, making it imperative for potential clients to assess the legitimacy and safety of brokers. This article investigates whether Zhuoyi Group is a safe option for traders or if it raises red flags that suggest otherwise. Our analysis is based on a comprehensive review of regulatory status, company background, trading conditions, client experiences, and risk assessments.

Regulation and Legitimacy

The regulatory framework governing forex brokers is vital for ensuring the safety and protection of client funds. Zhuoyi Group's regulatory status has raised concerns, as it appears to lack adequate oversight from recognized financial authorities. Below is a summary of the core regulatory information regarding Zhuoyi Group:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation from reputable bodies such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the USA is a significant red flag. Regulatory oversight is essential as it mandates brokers to adhere to strict financial standards, including the segregation of client funds and regular audits. Zhuoyi Group's lack of regulatory affiliation raises concerns about its operational legitimacy and the security of client investments. Furthermore, the presence of suspicious licensing claims, particularly regarding its operations in Canada, adds to the apprehension surrounding its regulatory compliance. As a trader, it is crucial to consider these factors when evaluating if Zhuoyi Group is safe.

Company Background Investigation

Zhuoyi Group has been in operation for several years, but its company history and ownership structure remain somewhat opaque. The broker's website provides limited information about its founding members and management team, which is a common practice among less reputable firms. A transparent company typically shares detailed profiles of its leadership, including their professional backgrounds and experiences in the financial industry.

The management teams experience is crucial in establishing trust with potential clients. Without clear information about the individuals behind Zhuoyi Group, it becomes challenging to assess their credibility and expertise. Transparency in company operations and ownership structure fosters trust and confidence among clients, but Zhuoyi Group appears to fall short in this area.

Additionally, the companys willingness to disclose information about its financial health and operational practices is critical. A lack of transparency could indicate potential issues, making it essential for traders to be cautious. Given the limited information available, it is advisable for potential clients to consider whether Zhuoyi Group is safe for their trading activities.

Trading Conditions Analysis

Understanding the trading conditions offered by Zhuoyi Group is essential for evaluating its overall value proposition. The broker's fee structure and trading conditions can significantly impact a trader's profitability. Zhuoyi Group advertises competitive spreads and commissions, but the specifics of these costs are not always clear. Below is a comparison of core trading costs:

| Fee Type | Zhuoyi Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1.0 - 2.0 pips |

| Commission Model | None | $5 - $10 per lot |

| Overnight Interest Range | Varies | 0.5% - 2.0% |

While the spreads may appear attractive, it is essential to investigate any hidden fees or conditions that could affect overall trading costs. For instance, some brokers impose withdrawal fees or inactivity charges that can eat into profits. Additionally, the absence of a clear commission structure can lead to confusion, especially for traders who rely on transparent pricing models.

Zhuoyi Group's trading conditions should be scrutinized closely. Traders must ensure they fully understand the costs involved and how they compare to industry standards. If the trading conditions are not favorable or lack clarity, this could be a sign that Zhuoyi Group may not be the safest choice for forex trading.

Client Fund Security

The security of client funds is a paramount concern for any forex trader. Zhuoyi Group‘s measures for ensuring the safety of client deposits are critical to assess. A reputable broker typically implements strict security protocols, including the segregation of client funds from operational funds, ensuring that clients’ money is protected even in the event of the brokers insolvency.

However, Zhuoyi Group's lack of regulatory oversight raises questions about its commitment to fund security. There is no clear information available regarding whether client funds are held in segregated accounts or if there are any investor protection schemes in place, such as those provided by the Financial Services Compensation Scheme (FSCS) in the UK.

Moreover, the absence of a clear policy on negative balance protection is concerning. Negative balance protection ensures that clients cannot lose more than their deposited amount, a critical feature in high-volatility markets like forex. Without such protections, traders may face significant financial risks.

Given these factors, it is crucial for potential clients to consider whether Zhuoyi Group is safe regarding the security of their funds. Traders are advised to approach this broker with caution, especially if they do not have robust safety measures in place.

Customer Experience and Complaints

Analyzing customer feedback is essential for assessing the overall experience with Zhuoyi Group. Online reviews and testimonials can provide valuable insights into how the broker operates and how it addresses client concerns. A recurring theme in customer complaints about Zhuoyi Group includes difficulties in withdrawing funds, which is a significant red flag for any broker.

Common complaint types and their severity are summarized below:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Average |

| Misleading Marketing Practices | High | Poor |

The severity of withdrawal issues is particularly alarming. Clients have reported long delays and complications when attempting to access their funds, which can indicate deeper operational issues within the broker. Furthermore, the quality of customer support is crucial; a responsive and helpful support team can significantly enhance the trading experience. However, Zhuoyi Group's customer service has been criticized for being unresponsive and lacking in assistance.

Two typical case studies highlight these concerns. In one instance, a trader reported delays of several weeks in processing a withdrawal request, leading to frustration and financial strain. In another case, a client expressed dissatisfaction with the lack of communication regarding account issues, further emphasizing the need for better customer support.

Given the patterns of complaints and the company's response, potential clients should carefully consider whether Zhuoyi Group is safe for their trading activities.

Platform and Execution

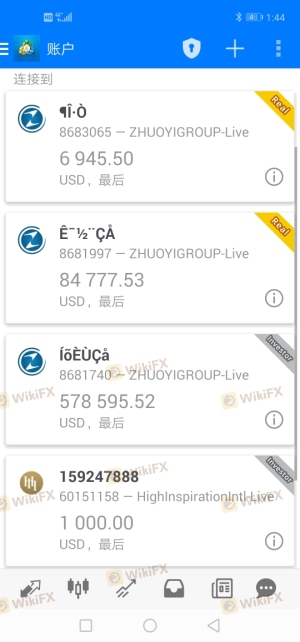

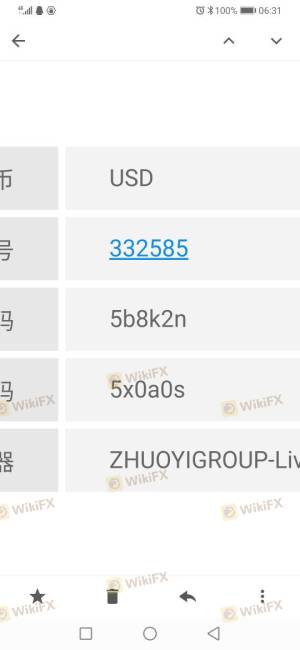

The performance and reliability of the trading platform are crucial for a successful trading experience. Zhuoyi Group uses widely recognized trading platforms, such as MetaTrader 4 and 5, which are known for their user-friendly interfaces and robust features. However, the execution quality, including order slippage and rejection rates, must also be evaluated.

Traders have reported mixed experiences regarding order execution, with some noting instances of slippage during volatile market conditions. High slippage can negatively impact trading outcomes, especially for scalpers and day traders who rely on precise execution. Additionally, any signs of platform manipulation, such as frequent rejections of orders or sudden changes in pricing, should raise concerns about the broker's integrity.

A thorough assessment of the platform's performance is essential for determining whether Zhuoyi Group is safe for trading. Traders are encouraged to test the platform with a demo account before committing real funds, allowing them to gauge execution quality and overall user experience.

Risk Assessment

When considering whether to trade with Zhuoyi Group, it is essential to evaluate the overall risk associated with the broker. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight from reputable authorities |

| Fund Security Risk | High | Unclear policies on fund segregation and protection |

| Customer Support Risk | Medium | Poor response to client complaints |

| Platform Reliability Risk | Medium | Reports of slippage and execution issues |

Based on this assessment, it is evident that trading with Zhuoyi Group carries significant risks. Traders should be aware of these potential pitfalls and consider implementing risk mitigation strategies, such as limiting initial deposits and diversifying trading activities across multiple brokers.

Conclusion and Recommendations

In conclusion, the investigation into Zhuoyi Group raises several concerns about its safety and legitimacy as a forex broker. The lack of regulatory oversight, transparency in company operations, and patterns of customer complaints suggest that traders should approach this broker with caution.

While Zhuoyi Group may offer competitive trading conditions, the potential risks associated with fund security and customer support cannot be overlooked. For traders seeking reliable options, it may be prudent to consider alternative brokers with established regulatory frameworks and positive client feedback.

In summary, it is essential to conduct thorough research and due diligence before trading with Zhuoyi Group. Given the findings, potential clients are advised to proceed with caution and explore other reputable brokers that prioritize regulatory compliance and client security.

Is ZhuoYi Group a scam, or is it legit?

The latest exposure and evaluation content of ZhuoYi Group brokers.

ZhuoYi Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ZhuoYi Group latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.