Regarding the legitimacy of ZHONGYANG HOLDING forex brokers, it provides SFC and WikiBit, .

Is ZHONGYANG HOLDING safe?

Business

License

Is ZHONGYANG HOLDING markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

Clone FirmLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Zhong Yang Securities Limited

Effective Date:

2016-03-04Email Address of Licensed Institution:

cs@zyzq.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.zyzq.com.hkExpiration Time:

--Address of Licensed Institution:

香港干諾道西118號1101室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is ZHONGYANG HOLDING Safe or Scam?

Introduction

ZHONGYANG HOLDING, a brokerage firm based in Hong Kong, has positioned itself within the forex market as a provider of various trading services, including forex, commodities, and futures. As the online trading landscape continues to evolve, it becomes increasingly crucial for traders to carefully evaluate the legitimacy and safety of brokers before engaging with them. The potential for scams in the forex market is significant, making it essential for traders to conduct thorough due diligence. This article aims to provide an objective analysis of ZHONGYANG HOLDING, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety.

To achieve this, we have gathered and analyzed information from multiple reputable sources, including regulatory filings, customer reviews, and industry reports. By employing a structured evaluation framework, we will assess whether ZHONGYANG HOLDING is safe for trading or if there are red flags that potential clients should be aware of.

Regulation and Legitimacy

One of the primary factors in determining the safety of any brokerage is its regulatory status. ZHONGYANG HOLDING claims to be regulated by the Securities and Futures Commission (SFC) of Hong Kong, a reputable regulatory body responsible for overseeing financial services in the region. Regulatory compliance is vital as it ensures that brokers adhere to strict standards of conduct, thereby safeguarding traders' interests.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | BGT 529 | Hong Kong | Verified |

While the SFC's oversight suggests that ZHONGYANG HOLDING is subject to regulatory scrutiny, it is worth noting that there have been multiple complaints against the broker in recent months. Reports indicate that users have raised concerns about withdrawal difficulties and customer service issues, which could indicate potential operational deficiencies. Although ZHONGYANG HOLDING is regulated, the presence of complaints raises questions about the quality of its services and the effectiveness of its regulatory compliance. Thus, while it may not be classified as a scam outright, the reported issues necessitate caution when considering whether ZHONGYANG HOLDING is safe for trading.

Company Background Investigation

Founded in 2016, ZHONGYANG HOLDING has established itself in the competitive landscape of online brokerage services. The company operates through its subsidiaries, which provide a range of financial services, including securities and futures brokerage. The ownership structure of the firm appears to be relatively transparent, with publicly available information detailing its management team and operational strategies.

The management team comprises seasoned professionals with backgrounds in finance and trading, which is a positive indicator of the company's operational competence. However, concerns regarding the transparency of the firm's operations persist. Despite its regulatory status, there are questions about the level of information disclosure to clients, particularly regarding the risks associated with trading on their platform. This lack of transparency could be a red flag for potential investors, further complicating the assessment of whether ZHONGYANG HOLDING is safe.

Trading Conditions Analysis

When evaluating a brokerage, the trading conditions offered play a significant role in determining its attractiveness. ZHONGYANG HOLDING provides a range of trading instruments, including forex pairs, commodities, and futures contracts. However, understanding the cost structure is crucial for traders looking to maximize their returns.

The overall fee structure of ZHONGYANG HOLDING is reported to be competitive, but there are areas of concern that warrant attention. Below is a comparison of key trading costs:

| Fee Type | ZHONGYANG HOLDING | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 - 1.5 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 2% | 1.5% - 2.5% |

While the spreads for major currency pairs are within the industry average, the variable commission model could lead to unexpected costs for traders, particularly those engaging in high-frequency trading. Additionally, the overnight interest rates are slightly higher than average, which may adversely impact long-term positions. Traders should be aware of these potential costs when considering whether ZHONGYANG HOLDING is safe for their trading activities.

Customer Funds Security

The security of customer funds is paramount when assessing the safety of a brokerage. ZHONGYANG HOLDING claims to implement several measures to protect client funds, such as fund segregation and compliance with investor protection regulations. Segregating client funds from the company's operational funds is a standard practice that provides an additional layer of security for traders.

However, the effectiveness of these measures is contingent upon the broker's adherence to regulatory standards. While there have been no significant breaches reported regarding fund security at ZHONGYANG HOLDING, the presence of complaints related to fund withdrawals raises red flags. These issues could indicate potential operational deficiencies that may affect the safety of client funds. Therefore, while ZHONGYANG HOLDING appears to have measures in place to secure customer funds, the reported difficulties in fund withdrawals necessitate caution.

Customer Experience and Complaints

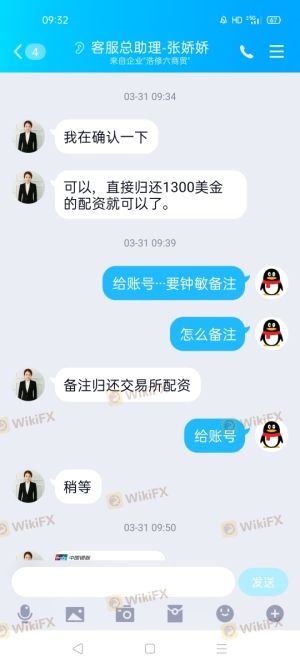

Customer feedback is an invaluable resource for gauging a broker's reliability and service quality. Reviews of ZHONGYANG HOLDING on various platforms indicate a mixed bag of experiences, with several users expressing dissatisfaction with the broker's services. Common complaints include difficulties in withdrawing funds, lack of responsiveness from customer support, and allegations of account manipulation.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Fund Withdrawal Issues | High | Poor |

| Account Manipulation | High | Poor |

| Customer Service Quality | Medium | Fair |

Several users have reported being unable to access their funds after making withdrawal requests, which is a significant concern for any trader. In some cases, clients claimed that their accounts were manipulated, resulting in forced liquidations. These serious allegations point to potential operational deficiencies within the brokerage. A notable case involved a trader who reported losing a substantial amount due to what they described as "manipulative practices" by the broker. Such accounts highlight the necessity for potential clients to approach ZHONGYANG HOLDING with caution.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for providing a seamless trading experience. ZHONGYANG HOLDING offers a proprietary trading platform that is accessible via desktop and mobile devices. User reviews suggest that while the platform is generally stable, there are occasional reports of slippage and order rejections, which can be detrimental to traders, especially during volatile market conditions.

The quality of order execution also plays a vital role in a trader's success. Traders have reported instances of significant slippage during high-impact news events, which can lead to unexpected losses. Moreover, the platform's user interface has been described as less intuitive compared to competitors, which could pose challenges for less experienced traders. In summary, while ZHONGYANG HOLDING's trading platform is functional, the occasional issues with order execution and user experience warrant a closer examination when determining if ZHONGYANG HOLDING is safe.

Risk Assessment

Engaging with any broker carries inherent risks, and ZHONGYANG HOLDING is no exception. The following risk assessment summarizes the key risks associated with trading through this platform:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Complaints about withdrawal issues raise concerns. |

| Fund Security | Medium | Segregation of funds is in place, but past complaints exist. |

| Customer Support | High | Poor response to complaints could affect traders. |

| Trading Conditions | Medium | Variable fees may lead to unexpected costs. |

Traders should be aware of these risks and consider implementing risk mitigation strategies, such as setting stop-loss orders and diversifying their investments. Additionally, it is advisable to start with a demo account or a small investment to gauge the broker's reliability before committing larger sums.

Conclusion and Recommendations

In conclusion, the question of whether ZHONGYANG HOLDING is safe remains complex. While the broker is regulated by the SFC and offers a range of trading products, the numerous complaints regarding fund withdrawals and customer service raise significant concerns. The mixed reviews from users indicate that while some traders may have had positive experiences, the potential for issues exists.

For traders considering this broker, it is crucial to weigh the risks against the potential benefits. Those who prioritize safety and reliability may want to explore alternative options with a better reputation for customer service and fewer reported issues. Some reputable alternatives include brokers like IG, OANDA, and Forex.com, which have established track records in the industry.

Ultimately, due diligence is essential in the forex market, and potential clients should carefully assess all available information before making a decision. While ZHONGYANG HOLDING may not be an outright scam, the reported issues warrant a cautious approach when determining if ZHONGYANG HOLDING is safe for trading.

Is ZHONGYANG HOLDING a scam, or is it legit?

The latest exposure and evaluation content of ZHONGYANG HOLDING brokers.

ZHONGYANG HOLDING Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ZHONGYANG HOLDING latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.