Regarding the legitimacy of GMO-Z.com forex brokers, it provides FSA, FSA, SFC, FCA and WikiBit, (also has a graphic survey regarding security).

Is GMO-Z.com safe?

Business

License

Is GMO-Z.com markets regulated?

The regulatory license is the strongest proof.

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

GMOクリック証券株式会社

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都渋谷区道玄坂1-2-3 渋谷フクラスPhone Number of Licensed Institution:

03-6221-0198Licensed Institution Certified Documents:

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

株式会社FXプライム by GMO

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都渋谷区道玄坂1-2-3 渋谷フクラスPhone Number of Licensed Institution:

0354897130Licensed Institution Certified Documents:

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

GMO-Z.com Forex HK Limited

Effective Date:

2012-06-22Email Address of Licensed Institution:

info.trade.hk@z.comSharing Status:

No SharingWebsite of Licensed Institution:

forex.z.comExpiration Time:

--Address of Licensed Institution:

香港九龍海港城港威大廈1座23樓2308-09室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

GMO-Z.com Trade UK Limited

Effective Date:

2014-09-01Email Address of Licensed Institution:

info.globalmarkets@z.comSharing Status:

No SharingWebsite of Licensed Institution:

https://globalmarkets.z.comExpiration Time:

2023-07-19Address of Licensed Institution:

8 Devonshire Square London EC2M 4PL UNITED KINGDOMPhone Number of Licensed Institution:

+442035194751Licensed Institution Certified Documents:

Is Z.com Bullion A Scam?

Introduction

Z.com Bullion is a forex and commodities broker that specializes in online trading of gold and silver. Established in 2006, it has positioned itself as a significant player in the Asian markets, particularly in Hong Kong and Japan. As with any financial service provider, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The forex market is rife with potential pitfalls, including scams and unregulated entities, making it imperative for traders to assess the credibility and safety of their chosen broker. This article will explore whether Z.com Bullion is safe or a scam by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, and overall risk profile.

Regulation and Legitimacy

When evaluating the safety of a broker, regulatory oversight is one of the most critical factors. Z.com Bullion operates under multiple regulatory bodies, which adds a layer of credibility to its operations. The following table summarizes the core regulatory information for Z.com Bullion:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 622897 | UK | Revoked |

| SFC | Aze 792 | Hong Kong | Active |

| FSA | Various | Japan | Active |

Z.com Bullion is regulated by the Financial Conduct Authority (FCA) in the UK, the Securities and Futures Commission (SFC) in Hong Kong, and the Financial Services Agency (FSA) in Japan. However, it's important to note that the FCA license has been revoked, raising concerns about the broker's compliance history. The SFC and FSA regulations are still active, which indicates that Z.com Bullion is subject to oversight in those jurisdictions. The quality of regulation is paramount, as it dictates the level of consumer protection afforded to traders. While the SFC is known for its stringent regulatory framework, the revoked FCA license raises questions about the broker's operational integrity in the UK.

Company Background Investigation

Z.com Bullion is a subsidiary of GMO Financial Holdings, which is part of the larger GMO Internet Group based in Japan. The company has a long-standing history in the financial services sector, having been established in 2006. Over the years, it has expanded its operations to include various global markets, particularly in Asia. The management team at Z.com Bullion is composed of experienced professionals with backgrounds in finance and technology, which enhances the broker's credibility.

However, the transition of ownership to Max Bullions Limited in September 2023 has raised some eyebrows. While the company asserts that this transition will not affect existing clients, the change in ownership structure could lead to uncertainties regarding the company's future direction and operational policies. Transparency is vital in the financial industry, and any lack thereof can be a red flag for potential investors.

Trading Conditions Analysis

Z.com Bullion offers a variety of trading conditions, including competitive spreads and leverage options. The overall fee structure is crucial for traders to understand, as it can significantly impact profitability. Below is a comparison of Z.com Bullion's core trading costs with industry averages:

| Fee Type | Z.com Bullion | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.4 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

Z.com Bullion's spreads are competitive, particularly for gold and silver trading, which is a positive aspect for traders. However, there have been reports of unexpected fees, such as withdrawal charges and inactivity fees, which could catch traders off guard. Understanding the fee structure and any potential hidden costs is essential for assessing whether Z.com Bullion is safe or a scam.

Customer Fund Safety

The safety of customer funds is a paramount concern when selecting a broker. Z.com Bullion claims to maintain client funds in segregated accounts, ensuring that traders' money is kept separate from the company's operational funds. This is a standard practice among regulated brokers and provides an additional layer of security. Additionally, the broker offers a financial services compensation scheme (FSCS) in the UK, which protects eligible claimants up to £50,000 in the event of insolvency.

However, the historical compliance issues, particularly with the FCA, raise questions about the broker's commitment to fund safety. Any past incidents of fund mismanagement can severely undermine trust. Thus, while Z.com Bullion has some safety measures in place, the revoked FCA license and any associated concerns must be carefully considered by potential traders.

Customer Experience and Complaints

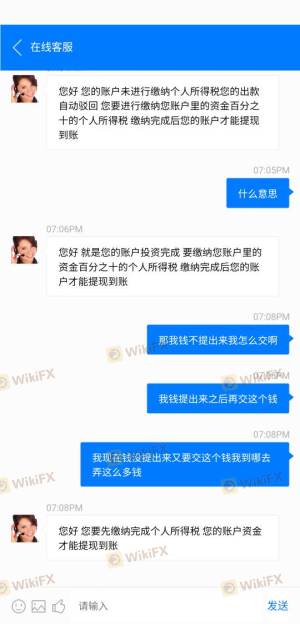

Customer feedback is an invaluable resource for gauging the reliability of a broker. Z.com Bullion has received mixed reviews from users, with some praising its trading conditions and others highlighting significant issues. Common complaints include difficulties in fund withdrawals and inadequate customer service.

The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Quality | Medium | Inconsistent |

| Fee Transparency | High | Unclear explanations |

For instance, several users have reported being unable to withdraw their funds, leading to frustration and distrust. The company's response to these complaints has been described as slow and at times unhelpful, which is concerning for potential traders.

Platform and Trade Execution

The trading platform is another critical aspect of the trading experience. Z.com Bullion primarily uses the widely recognized MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust trading features. However, the platform's performance, stability, and execution quality are equally important.

Traders have reported varying experiences with order execution, including instances of slippage and rejected orders. Such issues can significantly affect trading outcomes and raise concerns about the broker's reliability. It is essential for traders to be aware of any potential signs of platform manipulation, which could indicate deeper issues within the broker's operational practices.

Risk Assessment

Using Z.com Bullion comes with its set of risks. While the broker is regulated in certain jurisdictions, the revoked FCA license and mixed customer feedback present potential red flags. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Revoked FCA license raises concerns |

| Fund Withdrawal Issues | High | Numerous complaints about withdrawal delays |

| Customer Support Quality | Medium | Inconsistent responses to customer issues |

To mitigate these risks, potential traders are advised to conduct thorough research, consider starting with a demo account, and remain vigilant about any unusual activities or fees.

Conclusion and Recommendations

In conclusion, while Z.com Bullion has established itself as a player in the forex and commodities market, several factors warrant caution. The revoked FCA license, mixed customer feedback, and certain operational issues raise questions about its overall safety. Therefore, it is essential for traders to approach Z.com Bullion with a degree of skepticism.

For those considering trading with Z.com Bullion, it is recommended to start with a small investment and utilize the demo account to familiarize oneself with the platform and trading conditions. Additionally, traders may want to explore alternative brokers with a more robust regulatory standing and positive customer feedback, such as those regulated by the FCA or ASIC.

In summary, while Z.com Bullion is not outrightly a scam, potential traders should exercise caution and conduct comprehensive research before proceeding. Understanding the risks and trading conditions will help ensure a safer trading experience.

Is GMO-Z.com a scam, or is it legit?

The latest exposure and evaluation content of GMO-Z.com brokers.

GMO-Z.com Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GMO-Z.com latest industry rating score is 1.64, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.64 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.