Is Ya Hi safe?

Business

License

Is Ya Hi A Scam?

Introduction

Ya Hi is a forex broker that has been operating since 2008, primarily targeting retail traders. Headquartered in St. Vincent and the Grenadines, it offers a range of trading services, including forex, CFDs, and spread betting. As the forex market continues to grow, traders need to exercise caution when selecting a broker. The presence of numerous unregulated or poorly regulated brokers raises concerns about the safety of traders' funds and the integrity of trading practices. This article aims to provide an objective analysis of Ya Hi, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety. Our investigation is based on a review of available online resources, user feedback, and regulatory information to assess whether "Is Ya Hi safe?" is a valid question.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. A regulated broker is subject to supervision by financial authorities, which ensures that it adheres to strict guidelines for the protection of client funds and fair trading practices. Ya Hi claims to be regulated by the Financial Conduct Authority (FCA) in the UK, which is a reputable regulatory body. However, there have been conflicting reports regarding its actual regulatory status, with some sources indicating that it may not be properly licensed.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | N/A | UK | Unverified |

The importance of regulation cannot be overstated. It acts as a safety net for traders, providing recourse in the event of disputes or misconduct. Without proper regulation, traders may find themselves without any legal protections, making it essential to confirm the legitimacy of a broker's claims. In the case of Ya Hi, while it presents itself as regulated, the lack of clear verification raises questions about its compliance history and operational integrity.

Company Background Investigation

Ya Hi was established in 2008, and over the years, it has grown to serve a diverse clientele of over 10,000 traders. The company operates under the ownership of Ya Hi Ltd, a company registered in St. Vincent and the Grenadines. The management team behind Ya Hi includes individuals with experience in financial services, but specific details about their backgrounds remain limited. This lack of transparency regarding the management team may be a red flag for potential traders.

Furthermore, while Ya Hi claims to prioritize transparency and customer service, the absence of detailed information about its operational practices and ownership structure raises concerns. A well-established broker typically provides comprehensive information about its management and operational practices, which is crucial for building trust with potential clients.

Trading Conditions Analysis

When evaluating a broker like Ya Hi, it is essential to analyze its trading conditions, including fees, spreads, and commissions. Ya Hi offers a minimum deposit requirement of $100, which is relatively standard in the industry. However, the overall cost structure can significantly impact a trader's profitability.

| Fee Type | Ya Hi | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | Yes | Varies |

| Overnight Interest Range | Varies | Varies |

Ya Hi charges commissions on certain trading instruments, which can be a disadvantage compared to brokers that offer commission-free trading. Additionally, the spreads offered by Ya Hi may not be competitive, especially when compared to other established brokers. These factors can affect the overall trading experience and profitability for traders.

Customer Fund Security

One of the primary concerns for any trader is the safety of their funds. Ya Hi claims to hold client funds in segregated accounts at tier-1 banks, which is a positive aspect of its operations. This practice is crucial for ensuring that client funds are protected and not used for the broker's operational expenses. Furthermore, the implementation of SSL encryption for personal information adds an extra layer of security.

However, Ya Hi does not offer negative balance protection, which can be a significant risk for traders, especially in volatile market conditions. The absence of this feature means that traders could potentially lose more than their initial investment, leading to financial distress.

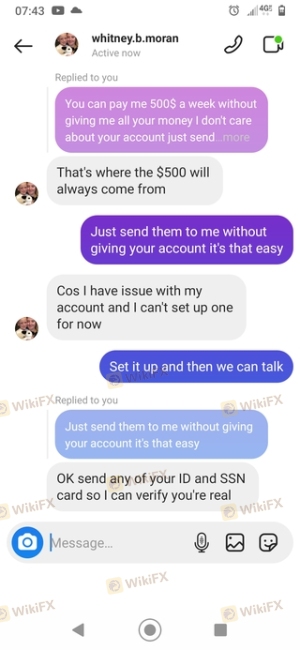

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of Ya Hi reveal a mixed bag of experiences. While some traders report positive interactions and successful withdrawals, others have raised concerns about slow response times and difficulties in withdrawing funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow |

| Customer Support | Medium | Mixed |

One notable case involved a trader who reported delays in accessing their funds after submitting a withdrawal request. While the company eventually processed the request, the time taken raised concerns about its operational efficiency. Such experiences highlight the importance of evaluating a broker's responsiveness and reliability.

Platform and Execution

The trading platform offered by Ya Hi is designed to be user-friendly and accessible across multiple devices. However, the performance of the platform, including order execution quality and slippage, is crucial for traders. Reports indicate that while the platform is generally stable, there have been instances of slippage during high volatility periods.

Traders should be cautious of any signs of platform manipulation, as this can severely impact trading outcomes. Overall, the platform's performance is a critical factor in determining whether "Is Ya Hi safe?" is a valid concern.

Risk Assessment

When trading with Ya Hi, it is essential to consider the associated risks. The lack of regulatory oversight, combined with mixed customer feedback, raises several red flags.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unclear regulatory status |

| Fund Security | Medium | No negative balance protection |

| Customer Service | Medium | Mixed reviews on responsiveness |

To mitigate these risks, traders should conduct thorough research, start with a demo account, and only invest what they can afford to lose.

Conclusion and Recommendations

After a comprehensive analysis of Ya Hi, it is clear that while the broker offers some appealing features, there are significant concerns regarding its regulatory status, customer service, and overall trustworthiness. While it is not outright a scam, potential traders should approach with caution.

For traders seeking reliable alternatives, it may be prudent to consider brokers with established regulatory oversight, competitive trading conditions, and a solid reputation for customer service. Overall, while Ya Hi has the potential to be a viable trading platform, it is essential to weigh the risks and conduct thorough due diligence before committing funds.

In conclusion, Is Ya Hi safe? The answer is not straightforward, and traders should exercise caution and consider their risk tolerance when engaging with this broker.

Is Ya Hi a scam, or is it legit?

The latest exposure and evaluation content of Ya Hi brokers.

Ya Hi Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ya Hi latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.