Is West Capital safe?

Pros

Cons

Is West Capital Safe or Scam?

Introduction

West Capital is an online forex broker that emerged in the trading scene in 2018, positioning itself as a platform for retail traders looking to engage in currency trading. In a rapidly evolving market like forex, where numerous brokers are vying for traders attention, it is crucial for investors to carefully evaluate the legitimacy and reliability of their chosen trading platform. With the increasing prevalence of scams and fraudulent schemes in the financial sector, understanding the nuances of broker operations has never been more essential. This article aims to provide a comprehensive analysis of West Capital, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. Our investigation is based on various online reviews and regulatory disclosures, allowing us to present an objective evaluation of whether West Capital is safe or if it presents potential risks for traders.

Regulation and Legitimacy

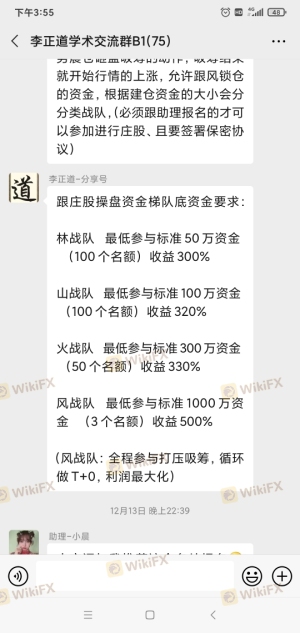

The regulatory framework within which a forex broker operates is a key determinant of its credibility. Regulation serves as a protective measure for traders, ensuring that brokers adhere to established standards of conduct and financial integrity. In the case of West Capital, the broker claims to be regulated by the National Futures Association (NFA), yet it has been flagged as a suspicious clone of authorized firms. This raises significant concerns regarding its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0526628 | United States | Unverified |

It is imperative to highlight that West Capital has not been found in the NFA's official database, which casts doubt on its claims of regulatory compliance. The absence of a credible regulatory body overseeing its operations is a red flag for potential investors. Moreover, brokers that lack robust regulatory oversight often engage in practices that can jeopardize traders' funds. Historical compliance issues, such as unfulfilled withdrawal requests and allegations of fraudulent activities, further complicate the assessment of West Capital's safety. Consequently, traders must approach this broker with caution and conduct thorough due diligence.

Company Background Investigation

Understanding the history and ownership structure of a broker is vital for assessing its reliability. West Capital was established in 2018 and operates out of Ukraine. However, there is limited information available regarding its ownership and management team. The lack of transparency regarding the company's background raises questions about its operational integrity.

A broker's management team plays a crucial role in its success and adherence to ethical practices. Unfortunately, West Capital has not provided detailed insights into the qualifications or professional experience of its leadership. This lack of information can lead to distrust among potential clients, as it is difficult to ascertain the broker's commitment to ethical trading practices without a clear understanding of who is at the helm. Furthermore, the absence of a comprehensive disclosure policy regarding its operations and financial standing further exacerbates concerns about West Capital's transparency.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is essential. West Capital offers a variety of trading instruments and claims to provide competitive spreads and trading fees. However, a closer inspection reveals some inconsistencies in its fee structure that could raise concerns among traders.

| Fee Type | West Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | 2-5% | 1-3% |

While the spreads appear to be slightly higher than the industry average, the lack of clarity regarding commission structures can be alarming. Additionally, the overnight interest rates offered by West Capital seem disproportionately high, which could lead to unexpected costs for traders. Such fees can significantly impact a trader's profitability, especially for those engaging in long-term positions. Thus, it is essential for traders to carefully consider these factors when deciding whether West Capital is safe for their trading activities.

Customer Funds Security

The safety of customer funds is paramount in the forex trading landscape. West Capital has made claims regarding the security of client funds, including segregation of accounts and investor protection measures. However, the actual implementation of these measures remains unclear.

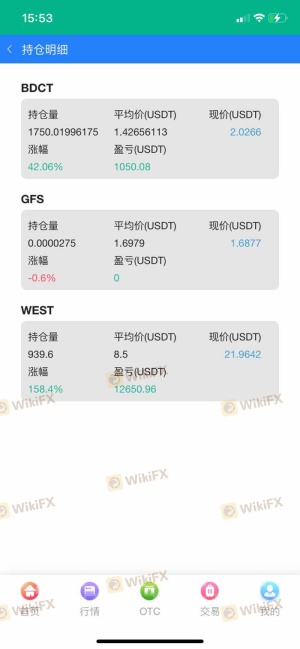

A broker that genuinely prioritizes client safety typically provides detailed information about its fund protection policies. Unfortunately, West Capital has not disclosed sufficient information regarding its practices for fund segregation or negative balance protection. This lack of transparency can be disconcerting for potential investors, as it raises questions about the broker's commitment to safeguarding client assets. Moreover, historical complaints from users regarding withdrawal difficulties and alleged fraud further amplify concerns about the security of funds held with West Capital.

Customer Experience and Complaints

Customer feedback is a critical component in assessing a broker's credibility. Reviews and testimonials from current and former clients can provide valuable insights into the broker's operational practices and customer service quality. In the case of West Capital, a significant number of negative reviews have surfaced, highlighting common complaints related to withdrawal issues and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Average |

| Misleading Promotions | High | Poor |

For instance, multiple users have reported being unable to withdraw their funds, with some alleging that their accounts were suspended without explanation. This pattern of complaints paints a troubling picture of West Capital's customer service and operational reliability. Furthermore, the company's slow response to customer inquiries exacerbates the dissatisfaction among clients, leading many to question whether West Capital is safe for trading.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a successful trading experience. West Capital claims to offer a robust trading platform with stable execution. However, user reviews indicate mixed experiences regarding order execution quality.

Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes. Moreover, any signs of platform manipulation, such as the inability to execute trades during volatile market conditions, could further erode trust in West Capital. A broker that prioritizes transparency and reliability in its trading platform is essential for fostering a positive trading environment.

Risk Assessment

Engaging with any broker carries inherent risks, and West Capital is no exception. After analyzing various factors, it is evident that potential traders should exercise caution when considering this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of credible regulation |

| Fund Security Risk | High | Unclear fund protection measures |

| Customer Service Risk | Medium | High volume of complaints |

Given the high-risk level associated with regulatory compliance and fund security, traders must be vigilant. It is advisable to seek alternative brokers with established reputations and regulatory oversight to mitigate potential risks.

Conclusion and Recommendations

In summary, the evidence suggests that West Capital is not a safe broker for forex trading. The lack of credible regulation, combined with a troubling history of customer complaints and insufficient transparency, raises significant concerns about the broker's reliability. Traders are advised to approach West Capital with caution and consider alternative options that offer more robust regulatory frameworks and positive customer experiences. For those seeking safer trading environments, reputable brokers regulated by top-tier authorities such as the FCA or ASIC should be prioritized. Ultimately, ensuring the safety of investments should be the foremost consideration for any trader.

Is West Capital a scam, or is it legit?

The latest exposure and evaluation content of West Capital brokers.

West Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

West Capital latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.