West Capital 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive West Capital review reveals a lending company that stands out in the mortgage industry through its commitment to personalized service and competitive loan products. West Capital Lending, Inc. operates under NMLS #1566096. The company provides diverse lending solutions across 44 states, making it accessible to a broad range of borrowers seeking homeownership opportunities.

The company's most compelling feature is its minimum down payment requirement of just 3%. This amount is significantly lower than many traditional lenders and makes homeownership more accessible to first-time buyers and those with limited savings. Additionally, West Capital offers mortgage rates below the industry average. These rates provide substantial cost savings over the life of a loan. The company serves primarily individuals and families seeking diverse loan options with personalized guidance throughout the lending process.

According to available customer feedback, West Capital maintains a user rating of 4 out of 5. This rating reflects generally positive experiences among borrowers. The company's approach emphasizes one-on-one guidance and tailored solutions, distinguishing it from larger, more impersonal lending institutions. This personalized service model has resonated well with customers who appreciate dedicated support during what can be a complex financial process.

Important Disclaimers

Regional Service Variations: West Capital operates across 44 states. Prospective borrowers should be aware that loan policies, rates, and available products may vary significantly between different states due to local regulations and market conditions. Specific terms and conditions may differ based on your location. Not all loan products may be available in every state where the company operates.

Review Methodology: This evaluation is based on publicly available information provided by the company, customer reviews from various platforms, and industry data. The assessment reflects information available at the time of writing. It may not capture all recent changes to products, services, or policies.

Rating Framework

Company Overview

West Capital Lending, Inc. has established itself as a notable player in the residential mortgage lending sector. The company focuses on providing personalized lending solutions to homebuyers across the United States. While specific founding details are not detailed in available materials, the company has built its reputation on offering competitive loan products with flexible terms that cater to diverse borrower needs.

The company's business model centers on providing comprehensive mortgage services including conventional loans, FHA loans, VA loans, HELOC products, home equity loans, and interest-only mortgage options. This diverse product portfolio allows West Capital to serve various customer segments. The company serves everyone from first-time homebuyers to experienced real estate investors seeking specialized financing solutions.

Operating under NMLS #1566096, West Capital maintains regulatory compliance across its 44-state service area. The company's approach emphasizes relationship-based lending, where borrowers receive dedicated support throughout the application and approval process. This personalized service model differentiates West Capital from larger institutional lenders that may rely more heavily on automated processing systems. The company's commitment to maintaining mortgage rates below industry averages while offering flexible down payment options has contributed to its positive market reception.

Regulatory Coverage: West Capital operates under NMLS #1566096 supervision and provides lending services across 44 states. The company maintains compliance with federal lending regulations and state-specific requirements where it operates.

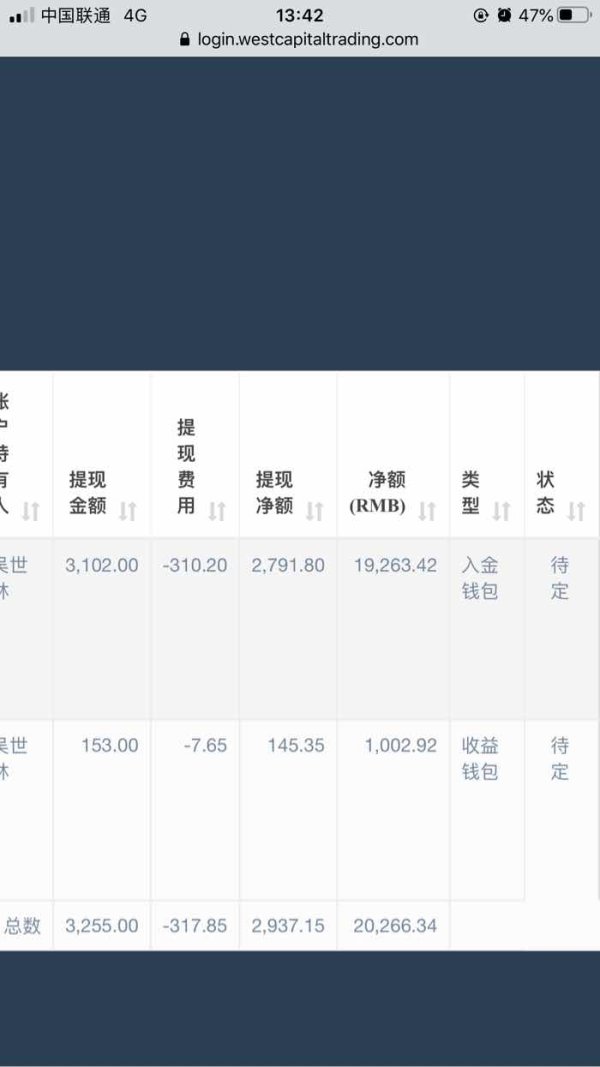

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal procedures for loan processing is not detailed in available materials. However, standard industry practices typically apply.

Minimum Down Payment: West Capital offers a minimum down payment requirement of 3%. This requirement makes homeownership more accessible compared to traditional 20% down payment requirements.

Promotional Offers: Current bonus promotions and special offers are not specified in available materials. The company's competitive rate structure serves as an ongoing benefit to borrowers.

Available Assets: The company focuses on residential real estate financing rather than tradeable financial assets. Loan products cover primary residences, investment properties, and refinancing options.

Cost Structure: West Capital maintains mortgage rates below industry average. However, specific spread and commission details are not publicly detailed. The competitive rate structure represents a key value proposition for borrowers.

Leverage Options: Traditional mortgage leverage ratios apply based on down payment amounts and loan-to-value requirements. Specific leverage details are not outlined in available materials.

Platform Options: Specific details about digital platforms and application systems are not detailed in available materials.

Geographic Restrictions: Services are limited to 44 states. Certain states are not covered by the company's current licensing.

Customer Service Languages: Supported languages for customer service are not specified in available materials.

Account Conditions Analysis

West Capital's account conditions present significant advantages for borrowers, particularly those seeking accessible homeownership opportunities. The company's 3% minimum down payment requirement represents one of its strongest competitive advantages. This low requirement enables borrowers to secure financing with substantially lower upfront costs compared to traditional lending requirements.

This low down payment threshold makes West Capital particularly attractive to first-time homebuyers, young professionals, and families who may have steady income but limited savings for large down payments. According to user feedback, this accessibility has been a key factor in positive customer experiences. It allows individuals to achieve homeownership sooner than might otherwise be possible.

The variety of loan products available through West Capital provides flexibility for different borrower situations. From government-backed FHA and VA loans to conventional mortgages and specialized products like HELOCs, the company can accommodate diverse financial circumstances and homeownership goals. This West Capital review finds that the breadth of available products enhances the company's appeal to a wide customer base.

However, specific details about account opening procedures and timeline are not extensively detailed in available materials. Prospective borrowers should inquire directly about application processes and approval timeframes to set appropriate expectations for their lending experience.

West Capital's tools and resources center primarily around its diverse loan product offerings rather than traditional trading or investment tools. The company provides multiple loan types including conventional, FHA, VA, HELOC, home equity, and interest-only options. These options give borrowers flexibility in choosing financing structures that match their specific needs and circumstances.

The emphasis on personalized service suggests that West Capital's primary "tool" is its human expertise and guidance. User feedback consistently highlights the value of one-on-one guidance provided by company representatives. This feedback indicates that personalized consultation serves as a key resource for borrowers navigating the mortgage process.

While specific details about digital tools, calculators, or educational resources are not extensively outlined in available materials, the company's focus on personalized service suggests that borrowers receive tailored guidance and information relevant to their specific situations. This approach may be particularly valuable for first-time homebuyers who benefit from expert guidance through complex lending processes.

The lack of detailed information about automated tools or self-service resources may indicate an opportunity for enhancement. Modern borrowers often appreciate access to digital calculators, rate comparison tools, and educational materials that complement personalized service.

Customer Service and Support Analysis

Customer service represents one of West Capital's strongest performance areas, earning a 9/10 rating based on consistently positive user feedback. The company's commitment to personalized service and one-on-one guidance has resonated strongly with borrowers. These borrowers appreciate dedicated support throughout their lending experience.

User reviews consistently emphasize the quality of personal attention received from West Capital representatives. Borrowers report feeling supported and informed throughout the application and approval process. Staff members take time to explain complex lending terms and guide customers through decision-making processes.

The company's approach to customer service appears to prioritize relationship-building over transaction processing, which has contributed to positive customer experiences and the overall 4-star user rating. This personalized approach is particularly valuable in mortgage lending, where borrowers often need guidance on significant financial decisions.

While specific details about customer service channels, response times, and availability hours are not detailed in available materials, the positive user feedback suggests that the company maintains effective communication with borrowers. The emphasis on one-on-one guidance indicates that customers receive direct access to knowledgeable representatives rather than being routed through multiple service tiers.

Transaction Experience Analysis

The transaction experience with West Capital receives generally positive feedback from users. However, specific technical details about platform performance and processing speeds are not extensively documented in available materials. Customer reviews indicate overall satisfaction with the lending process, suggesting that the company maintains effective systems for loan processing and approval.

Users appreciate the streamlined approach to mortgage applications and the guidance provided throughout the transaction process. The combination of competitive rates and personalized service appears to create a positive overall experience for borrowers. This positive experience contributes to the company's 4-star rating.

However, detailed information about processing times, digital platform functionality, and mobile accessibility is not specified in available materials. Modern borrowers increasingly expect efficient digital experiences alongside personal service. This West Capital review notes that more detailed information about technological capabilities would enhance transparency.

The company's focus on below-market interest rates contributes positively to the transaction experience by providing tangible financial benefits to borrowers. This cost advantage, combined with flexible down payment requirements, creates attractive transaction terms that enhance overall customer satisfaction.

Trust Factor Analysis

West Capital's trust factor is anchored by its NMLS #1566096 registration. This registration provides regulatory oversight and consumer protection through the Nationwide Multistate Licensing System. The registration ensures compliance with federal and state lending regulations and provides borrowers with recourse through established regulatory channels.

The company's operation across 44 states demonstrates substantial regulatory compliance capabilities and suggests established systems for meeting diverse state-level requirements. This geographic breadth indicates operational maturity and regulatory sophistication that supports borrower confidence.

While specific details about financial strength, insurance coverage, and additional security measures are not detailed in available materials, the NMLS registration provides a foundation of regulatory oversight. The positive user feedback and 4-star rating also suggest that borrowers generally trust the company's handling of their lending needs.

The emphasis on personalized service and relationship-based lending may actually enhance trust factors by providing borrowers with direct access to knowledgeable representatives who can address concerns and provide transparency throughout the lending process. This personal approach can build confidence compared to more automated lending systems.

User Experience Analysis

West Capital achieves strong user experience metrics with a 4-star customer rating. This rating reflects generally high satisfaction levels among borrowers. The company's user base appears to consist primarily of individuals and families seeking personalized lending solutions with competitive terms and flexible requirements.

The emphasis on one-on-one guidance has particularly resonated with users who appreciate personal attention during what can be a complex and stressful process. Customer feedback consistently highlights the value of having dedicated representatives who provide clear explanations and support throughout the lending process.

The 3% minimum down payment requirement has been particularly well-received by users, as it makes homeownership more accessible and reduces the financial barriers to securing mortgage financing. This accessibility has contributed to positive user experiences and expanded homeownership opportunities for borrowers with limited savings.

While specific details about digital interfaces and self-service capabilities are not extensively documented, the strong customer rating suggests that West Capital's current service model effectively meets user needs. The focus on personalized service may actually enhance user experience for borrowers who prefer human interaction over purely digital processes.

Conclusion

This comprehensive West Capital review reveals a lending company that has successfully differentiated itself through personalized service and competitive loan terms. With mortgage rates below industry average and minimum down payments of just 3%, West Capital provides accessible homeownership opportunities while maintaining strong customer satisfaction levels.

The company is particularly well-suited for first-time homebuyers, individuals with limited savings for down payments, and borrowers who value personalized guidance throughout the lending process. The 4-star user rating and positive feedback regarding one-on-one service support the company's relationship-focused approach to mortgage lending.

Key advantages include competitive rates, flexible down payment options, and strong customer service. Areas for potential improvement include enhanced transparency regarding specific processes and expanded digital service capabilities. Overall, West Capital represents a solid choice for borrowers seeking personalized mortgage lending solutions with competitive terms.