Is Wealth Sailing safe?

Business

License

Is Wealth Sailing Safe or a Scam?

Introduction

Wealth Sailing is a forex broker that has garnered attention in the trading community, primarily due to its aggressive marketing strategies and promises of high returns. Operating in the competitive landscape of forex trading, it positions itself as a platform for both novice and experienced traders. However, the rise of online trading has also led to an increase in fraudulent schemes, making it imperative for traders to critically evaluate the legitimacy of any broker they consider. A thorough analysis of Wealth Sailing is essential to determine whether it operates as a trustworthy broker or a potential scam. This article employs a mixed-method approach, utilizing data from various online reviews, regulatory information, and user experiences to assess the safety and reliability of Wealth Sailing.

Regulation and Legitimacy

The regulatory status of a forex broker is a crucial factor in evaluating its safety. Wealth Sailing claims to be registered in the United States, but it lacks any valid regulatory licenses, which raises significant red flags. Without proper regulation, traders are exposed to higher risks, including the potential loss of funds without any recourse.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulatory oversight means that Wealth Sailing does not adhere to any established standards for financial conduct, which are designed to protect traders. Regulatory bodies like the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) impose strict guidelines on brokers to ensure transparency, fund security, and fair trading practices. Wealth Sailing's lack of affiliation with these bodies indicates a significant risk for potential investors. Additionally, the broker's history shows no compliance with industry standards, further questioning its legitimacy.

Company Background Investigation

Wealth Sailing's company history is murky at best. While it claims to have been founded in 2016, domain checks reveal that its website was registered only in March 2022. This discrepancy raises questions about the broker's operational history and credibility. The ownership structure remains opaque, as there is no publicly available information regarding its founders or management team.

The lack of transparency is a common trait among fraudulent brokers, and Wealth Sailing appears to fit this profile. A credible broker should provide clear information about its management team, including their qualifications and experience in the financial industry. In the case of Wealth Sailing, potential clients are left in the dark, which is a significant warning sign.

Trading Conditions Analysis

The trading conditions offered by Wealth Sailing are another area of concern. While the broker advertises competitive spreads and leverage, the reality may differ significantly from the claims made on its website. Understanding the fee structure is crucial for traders to assess the overall cost of trading.

| Fee Type | Wealth Sailing | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of detailed information about spreads, commissions, and overnight interest rates suggests that Wealth Sailing may not be operating with the best interests of its clients in mind. Traders should be cautious of brokers that do not provide clear and transparent fee structures, as this can lead to unexpected costs and reduced profitability.

Client Fund Security

The security of client funds is paramount when evaluating a forex broker. Wealth Sailing's lack of regulatory oversight raises serious concerns about its fund security measures. A reputable broker typically employs fund segregation, ensuring that clients' funds are held in separate accounts from the company's operational funds. Furthermore, many regulated brokers offer investor protection schemes to safeguard client deposits.

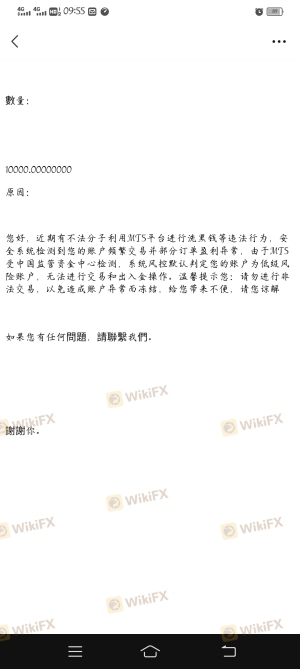

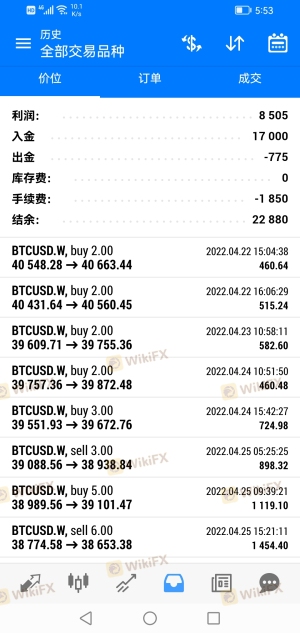

Unfortunately, Wealth Sailing does not provide any information regarding its fund security measures, which leaves clients vulnerable to potential losses. Historical complaints indicate that users have faced difficulties in withdrawing their funds, suggesting that the broker may not prioritize client security.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a broker. Reviews of Wealth Sailing reveal a pattern of negative experiences, particularly regarding withdrawal issues and customer support. Many users report being unable to withdraw their funds, often citing various excuses from the broker as the reason for the delays.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Quality | Medium | Poor |

Several user testimonials describe frustrating interactions with customer support, where representatives were unresponsive or provided vague answers. This lack of effective communication is a significant concern, as it indicates that the broker may not be equipped to handle customer inquiries or resolve issues promptly.

Platform and Trade Execution

The trading platform provided by Wealth Sailing is another critical aspect to consider. While it claims to offer the popular MetaTrader 5 platform, user reviews often highlight technical issues that hinder trading performance. Problems such as order execution delays, slippage, and even instances of order rejections have been reported.

A reliable trading platform is essential for successful trading, and any signs of manipulation or technical failures can severely impact a trader's ability to execute trades effectively.

Risk Assessment

Engaging with Wealth Sailing presents several risks that potential traders should consider. The absence of regulation, combined with negative customer feedback and a lack of transparency, contributes to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | No information on fund safety |

| Customer Support Risk | Medium | Poor response to complaints |

To mitigate these risks, traders are advised to conduct thorough research before committing funds to any broker. Seeking out regulated brokers with a solid reputation can provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Wealth Sailing poses significant risks to potential traders. The lack of regulation, combined with negative user experiences and unclear trading conditions, raises serious concerns about the broker's legitimacy. Therefore, it is prudent for traders to exercise caution when considering Wealth Sailing as a trading option.

For those looking to engage in forex trading, it is advisable to choose well-regulated brokers that prioritize transparency, client security, and customer support. Alternatives include well-established brokers with proven track records and positive user feedback. Always ensure that the broker you choose is licensed and adheres to industry standards to protect your investments.

In summary, is Wealth Sailing safe? The overwhelming evidence points to a high risk of being a scam, and potential traders should be wary of engaging with this broker.

Is Wealth Sailing a scam, or is it legit?

The latest exposure and evaluation content of Wealth Sailing brokers.

Wealth Sailing Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Wealth Sailing latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.