Is vivkdex safe?

Business

License

Is Vivkdex Safe or a Scam?

Introduction

Vivkdex is an emerging player in the forex market, positioning itself as a platform that caters to both novice and experienced traders. With the rapid growth of online trading, it has become essential for traders to carefully evaluate their chosen brokers to avoid potential pitfalls. The forex market is fraught with risks, including scams and unregulated entities that can jeopardize traders' investments. Thus, assessing the safety and reliability of a broker like Vivkdex is crucial. This article aims to provide a thorough investigation into whether Vivkdex is safe or a scam, utilizing a comprehensive evaluation framework that includes regulatory status, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors to consider when determining its safety. A regulated broker is typically subject to oversight by financial authorities, which can provide a layer of protection for traders. In the case of Vivkdex, it is essential to investigate its regulatory status and whether it adheres to the necessary legal requirements to operate.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

Currently, Vivkdex does not appear to be regulated by any major financial authority. This lack of regulation raises significant concerns about the broker's legitimacy and operational transparency. Regulatory bodies such as the FCA (UK), ASIC (Australia), and SEC (USA) enforce strict compliance standards to protect investors. Without such oversight, traders may face higher risks, including the potential for fraud or mismanagement of funds. Historical compliance issues, if any, are also crucial in evaluating the broker's reputation. Given the absence of regulatory oversight, the question remains: Is Vivkdex safe? The answer leans toward caution.

Company Background Investigation

Understanding the company background of Vivkdex provides valuable insights into its operations, ownership structure, and overall transparency. Vivkdex is relatively new to the forex trading scene, and limited information is available about its history and development. The ownership structure of the company is not clearly disclosed, which can be a red flag for potential investors. A transparent brokerage typically provides detailed information about its founders, management team, and operational history.

The management teams background and expertise play a crucial role in the broker's reliability. If the team comprises experienced professionals with a solid track record in the financial sector, it could enhance the broker's credibility. However, without sufficient information about the management, one must question the level of trustworthiness of Vivkdex.

Moreover, the level of information disclosure is essential for assessing transparency. A broker that fails to provide adequate information about its operations, fees, and policies may not be acting in the best interest of its clients. Therefore, the lack of transparency regarding Vivkdex's ownership and management raises further concerns about its safety. In conclusion, the question of whether Vivkdex is safe remains unanswered, as the broker does not provide substantial information to support its claims.

Trading Conditions Analysis

The trading conditions offered by a broker significantly influence a trader's experience and profitability. Vivkdex's overall fee structure and trading conditions need to be analyzed to determine if they are competitive and fair.

Typically, brokers charge various fees, including spreads, commissions, and overnight interest rates. Understanding these costs is vital for traders to make informed decisions.

| Fee Type | Vivkdex | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies by broker |

| Overnight Interest Rate Range | N/A | Varies by broker |

Unfortunately, specific details regarding Vivkdexs fees are not readily available, which can be concerning. A lack of transparency in fee structures can lead to unexpected costs that may impact trading profitability. Additionally, if the fees are significantly higher than industry averages, it could signal an attempt to capitalize on unsuspecting traders.

Furthermore, any unusual fee policies should be scrutinized. For instance, hidden fees or excessive withdrawal charges can indicate a broker's untrustworthiness. In this case, the absence of clear fee information raises questions about whether Vivkdex is safe for traders, as it may lead to unforeseen financial burdens.

Client Funds Security

The safety of client funds is paramount when evaluating a broker's reliability. Vivkdex must implement robust security measures to protect traders' investments. Key aspects to consider include fund segregation, investor protection schemes, and negative balance protection policies.

Segregated accounts ensure that client funds are kept separate from the broker's operational funds, providing an added layer of security in the event of financial difficulties. Additionally, investor protection schemes can offer compensation in case the broker becomes insolvent.

Moreover, negative balance protection prevents traders from losing more than their initial investment, which is crucial in volatile markets. Without these safeguards, traders risk substantial losses that could exceed their deposits.

Given the lack of regulatory oversight and transparency regarding Vivkdex's security measures, it is essential to question the safety of client funds. If there have been historical issues related to fund security or any disputes, it could further indicate that Vivkdex is not safe for trading.

Customer Experience and Complaints

Customer feedback is invaluable in assessing a broker's reliability. Analyzing user experiences can reveal common complaints and how the broker responds to them.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

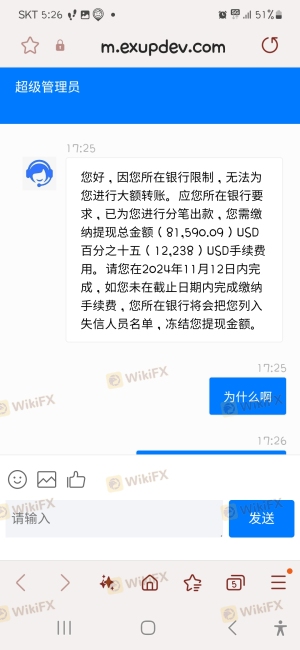

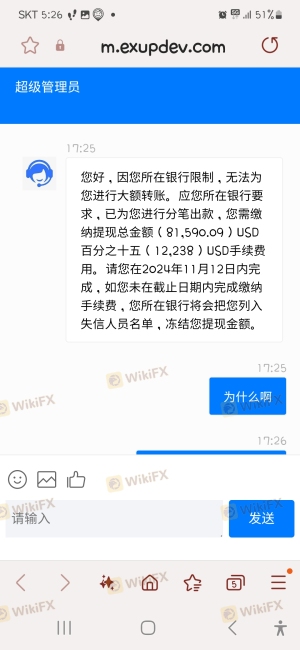

| Withdrawal Issues | High | N/A |

| Poor Customer Support | Medium | N/A |

| Misleading Information | High | N/A |

Common complaints against brokers often include difficulties in withdrawing funds, poor customer support, and misleading information regarding trading conditions. If Vivkdex has received a significant number of complaints in these areas, it could indicate potential issues with its operations.

For instance, if multiple users report challenges in withdrawing funds, it could signal a lack of transparency or financial instability. Additionally, if the company fails to respond effectively to complaints, it may reflect poor customer service practices. Without concrete examples of how Vivkdex addresses customer concerns, it is challenging to ascertain whether Vivkdex is safe for traders.

Platform and Execution

The performance and stability of a trading platform are critical for ensuring a positive trading experience. Traders rely on the platform for executing trades efficiently and effectively. Evaluating Vivkdexs platform involves assessing its user interface, order execution quality, slippage, and any indications of market manipulation.

A reliable platform should provide a seamless user experience, with fast order execution and minimal slippage. High slippage rates can adversely affect trading outcomes, particularly in volatile markets. Additionally, any signs of platform manipulation, such as frequent rejections of orders or unusual price movements, should be carefully examined.

As there is limited information available regarding Vivkdex's platform performance, it is difficult to conclude whether Vivkdex is safe for trading based on execution quality and reliability. Traders should remain cautious and consider alternative platforms with proven track records.

Risk Assessment

Using Vivkdex for trading entails various risks that must be understood and managed. The overall risk profile of a broker can be summarized in a risk assessment table.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Stability Risk | High | Lack of transparency in operations |

| Customer Service Risk | Medium | Mixed reviews on support responsiveness |

The absence of regulation and transparency raises significant concerns about the financial stability of Vivkdex. Traders must be aware of these risks and take necessary precautions to mitigate potential losses. For instance, it is advisable to start with minimal investments and utilize risk management tools such as stop-loss orders.

In conclusion, it is essential to conduct thorough research and consider the risks associated with using Vivkdex. The lack of regulatory oversight and transparency raises serious concerns about whether Vivkdex is safe for trading.

Conclusion and Recommendations

After a comprehensive analysis, it is evident that Vivkdex presents several red flags that warrant caution. The lack of regulatory oversight, transparency regarding company operations, and mixed customer feedback suggest that Vivkdex may not be a safe trading option.

Traders should be particularly wary of the potential risks associated with using an unregulated broker. For those seeking a reliable trading experience, it is advisable to consider well-regulated alternatives that provide greater security and transparency. Brokers regulated by reputable authorities, such as the FCA, ASIC, or SEC, would likely offer a safer trading environment.

In summary, while Vivkdex may attract traders with its offerings, the potential risks and concerns highlighted in this analysis suggest that it is prudent to proceed with caution.

Is vivkdex a scam, or is it legit?

The latest exposure and evaluation content of vivkdex brokers.

vivkdex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

vivkdex latest industry rating score is 1.30, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.30 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.