Is Ethusdt safe?

Pros

Cons

Is Ethusdt A Scam?

Introduction

Ethusdt is an online trading platform that positions itself within the forex market, offering a range of trading services to its users. In a landscape crowded with numerous forex brokers, traders must exercise caution and conduct thorough assessments before engaging with any trading platform. The importance of evaluating brokers stems from the potential risks associated with unregulated entities, which can lead to significant financial losses. This article aims to provide a comprehensive analysis of Ethusdt, examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk assessment. Our evaluation is based on a review of various online resources, user feedback, and expert opinions to determine whether Ethusdt is safe or a potential scam.

Regulation and Legitimacy

When assessing the safety of a trading platform like Ethusdt, understanding its regulatory status is crucial. Regulation serves as a safeguard for traders, ensuring that brokers adhere to industry standards and operate transparently. Ethusdt, however, operates without any regulatory oversight, which raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulation means that Ethusdt is not subject to the scrutiny and compliance requirements imposed by recognized financial authorities. This lack of oversight can expose traders to various risks, including the possibility of fraud and the mishandling of funds. Furthermore, unregulated brokers are often associated with high-risk trading environments, where unethical practices may thrive. Historical compliance issues with similar brokers emphasize the need for traders to be vigilant. The regulatory quality and oversight play a vital role in protecting traders' interests, and the lack of it in the case of Ethusdt is a significant red flag.

Company Background Investigation

Ethusdt is operated by Ethusdt International Limited, a company that claims to be based in China. However, the lack of transparency regarding its ownership structure and the absence of a physical address further complicate the assessment of its credibility. Established in 2020, Ethusdt has not provided substantial information about its history or development trajectory, which is essential for evaluating its reliability.

The management team's background is also unclear, as there is little to no publicly available information about their experience or qualifications in the financial industry. This opacity raises concerns about the company's transparency and its commitment to ethical business practices. A trustworthy broker should provide clear information about its management team and their professional backgrounds, which Ethusdt fails to do. Without this information, potential clients are left in the dark regarding who is managing their investments, which is a crucial aspect of trust in financial services.

Trading Conditions Analysis

Ethusdt claims to offer competitive trading conditions, but a closer examination reveals several alarming aspects. The overall fee structure is not clearly defined, which can lead to unexpected costs for traders. Additionally, the lack of transparency regarding fees is a common tactic used by potentially fraudulent brokers.

| Fee Type | Ethusdt | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear data on spreads, commissions, and overnight interest rates suggests that Ethusdt may not operate under standard industry practices. Traders should be cautious of brokers that do not disclose their fee structures, as this can indicate hidden fees or unfavorable trading conditions. A transparent broker typically provides detailed information on all trading costs, allowing traders to make informed decisions.

Customer Fund Safety

The safety of customer funds is paramount when selecting a trading platform. Ethusdt's lack of regulatory oversight raises serious concerns about its fund security measures. There is no indication that customer funds are kept in segregated accounts, which is a crucial practice for protecting traders' capital.

Additionally, the absence of investor protection schemes further exacerbates the risks associated with trading on this platform. In the event of financial difficulties or insolvency, traders may find it challenging to recover their funds. Historical disputes involving unregulated brokers often highlight the vulnerabilities faced by traders, making it essential to choose a platform that prioritizes fund safety.

Customer Experience and Complaints

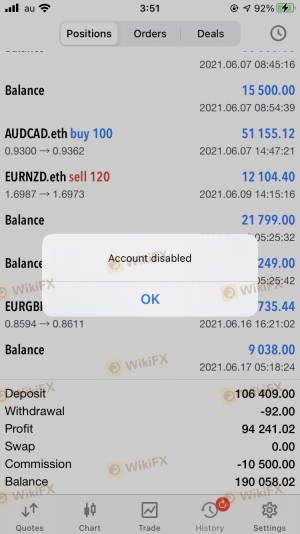

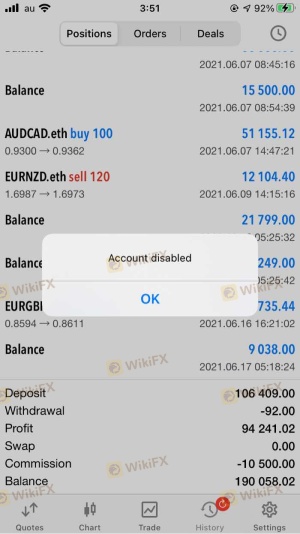

User feedback is a critical component of evaluating a trading platform's reliability. Numerous complaints have been reported against Ethusdt, indicating a pattern of negative experiences among traders. Common issues include difficulties in withdrawing funds, poor customer service, and a lack of responsiveness from the support team.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| Customer Service | Medium | Poor |

One notable case involved a user who reported being unable to withdraw their funds despite multiple requests. This situation reflects a broader trend of customer dissatisfaction that raises alarms about the platform's operational integrity. Such complaints should not be taken lightly, as they can signify deeper issues within the broker's practices.

Platform and Trade Execution

The trading platform's performance is another critical factor in assessing Ethusdt's reliability. Users have reported mixed experiences regarding platform stability and execution quality. Issues such as slippage and order rejections have been highlighted, which can significantly impact trading outcomes.

A reliable broker should provide a seamless trading experience, characterized by fast execution times and minimal slippage. However, the reports of poor execution quality on Ethusdt's platform raise concerns about the broker's ability to facilitate effective trading. Traders should be wary of platforms that exhibit signs of manipulation or operational deficiencies, as these can lead to financial losses.

Risk Assessment

Engaging with Ethusdt entails a range of risks that potential traders should carefully consider. The lack of regulation, unclear trading conditions, and negative user feedback collectively contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Safety Risk | High | No segregation of funds. |

| Operational Risk | Medium | Reports of execution issues. |

To mitigate these risks, traders are advised to conduct thorough research before committing funds. Engaging with regulated brokers and seeking platforms with a proven track record can significantly reduce exposure to potential scams.

Conclusion and Recommendations

In conclusion, the evidence suggests that Ethusdt exhibits several characteristics commonly associated with scam brokers. The lack of regulation, coupled with numerous complaints and operational deficiencies, raises significant concerns about its legitimacy. Potential traders should exercise extreme caution when considering this platform, as the risks may outweigh any potential benefits.

For those seeking reliable trading options, it is advisable to explore regulated brokers with transparent practices and positive user reviews. Platforms that prioritize fund safety and have a solid reputation in the industry are recommended for traders looking to safeguard their investments. Ultimately, the decision to engage with Ethusdt should be made with careful consideration of the associated risks and available alternatives.

Is Ethusdt a scam, or is it legit?

The latest exposure and evaluation content of Ethusdt brokers.

Ethusdt Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ethusdt latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.