Regarding the legitimacy of UGM Securities forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is UGM Securities safe?

Business

License

Is UGM Securities markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Elidi Securities Ltd

Effective Date: Change Record

2017-12-28Email Address of Licensed Institution:

info@elidi.cySharing Status:

No SharingWebsite of Licensed Institution:

www.elidi.cyExpiration Time:

--Address of Licensed Institution:

62 Agiou Athanasiou Avenue, Office/Flat 303, Agios Athanasios, 4102, Limassol, CyprusPhone Number of Licensed Institution:

+357 22 257 670Licensed Institution Certified Documents:

Is UGM Securities Safe or a Scam?

Introduction

UGM Securities is a forex broker based in Cyprus, established in 2016. It positions itself as a provider of trading services in the foreign exchange market, offering various financial instruments to traders worldwide. However, the rapidly expanding forex market attracts both legitimate brokers and those with questionable practices. Therefore, it is crucial for traders to assess the trustworthiness of a broker before committing their funds. This article aims to evaluate whether UGM Securities is a safe trading option or a potential scam. The investigation is based on a comprehensive review of regulatory status, company background, trading conditions, customer feedback, and overall risks associated with the broker.

Regulatory and Legality

The regulation of forex brokers is of paramount importance, as it provides a framework for investor protection and ensures that brokers adhere to specific operational standards. UGM Securities claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC). This regulatory body is known for its stringent requirements and oversight, which can offer some level of confidence to investors. However, the effectiveness of regulation can vary, and it is essential to examine the broker's compliance history and any associated risks.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 360073 | Cyprus | Active |

Despite being regulated, there are reports of significant issues surrounding UGM Securities. Numerous complaints from clients highlight difficulties in withdrawing funds and alleged deceptive practices, raising questions about the broker's legitimacy. The lack of a robust regulatory framework can expose clients to risks, especially when the broker operates in a jurisdiction with lax oversight. Therefore, while UGM Securities claims to be regulated, potential investors should approach with caution, considering the mixed reviews regarding its operational integrity.

Company Background Investigation

UGM Securities Ltd. was founded in 2016 and is headquartered in Nicosia, Cyprus. The company claims to provide a range of financial services, primarily focusing on forex and contract for difference (CFD) trading. The ownership structure of the company, while not entirely transparent, includes several directors who have been associated with the firm since its inception. This continuity may suggest a level of stability; however, the overall transparency regarding company operations and ownership remains limited.

The management team at UGM Securities consists of professionals with varying degrees of experience in the financial sector. However, the lack of detailed information about their qualifications and previous roles raises concerns about the company's operational transparency. Furthermore, the information disclosed on their website is minimal, which can be a red flag for potential investors. A broker's transparency is crucial for establishing trust, and UGM Securities appears to fall short in this aspect.

Trading Conditions Analysis

When evaluating whether UGM Securities is safe, understanding its trading conditions is essential. The broker offers a relatively standard fee structure, but there are reports of unusual charges that may not be immediately apparent to traders. For instance, some clients have reported unexpected fees during the withdrawal process, which can be a significant deterrent for potential investors.

| Fee Type | UGM Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Structure | Variable | Typically fixed |

| Overnight Interest Range | 0.5% | 0.3% |

The spreads offered by UGM Securities are slightly higher than the industry average, which can impact profitability, especially for high-frequency traders. Additionally, the variability in commission structures may lead to unexpected costs, making it essential for traders to read the fine print before opening an account. Overall, the trading conditions at UGM Securities may not be competitive, and the presence of hidden fees can further complicate the trading experience.

Customer Funds Safety

The safety of client funds is a critical aspect when evaluating any broker. UGM Securities claims to implement various measures to secure client funds, including segregating client accounts from operational funds. However, the effectiveness of these measures is often questioned in light of numerous complaints regarding fund withdrawals and alleged fraudulent practices.

Historically, there have been reports of clients experiencing difficulties accessing their funds, which raises significant concerns about the broker's commitment to safeguarding client assets. Furthermore, the absence of negative balance protection can leave traders vulnerable to losses exceeding their initial deposits. Without robust investor protection mechanisms, clients may find themselves at risk, especially during volatile market conditions.

Customer Experience and Complaints

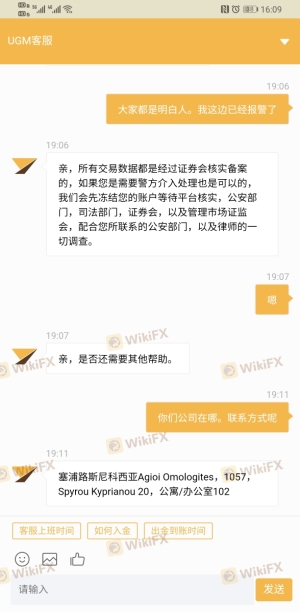

Customer feedback is a vital component in assessing whether UGM Securities is safe. A review of user experiences reveals a pattern of complaints, particularly regarding withdrawal issues and customer service. Many clients have reported being unable to withdraw their funds, often citing vague explanations and unresponsive support teams.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inconsistent |

Typical cases involve clients who successfully deposited funds but faced significant hurdles when attempting to withdraw. For instance, one user reported being asked to pay additional fees to process their withdrawal, while another claimed that their account was frozen without explanation. These experiences suggest a troubling trend that potential investors should consider seriously.

Platform and Execution

Evaluating the trading platform offered by UGM Securities is essential for understanding the overall trading experience. The platform is reported to have stability issues, with users experiencing frequent glitches and execution delays. These problems can lead to slippage and missed trading opportunities, which can be detrimental, especially for day traders.

Moreover, there have been allegations of potential manipulation within the platform, raising concerns about the integrity of trade executions. A reliable broker should provide a seamless trading experience, and any signs of platform issues can significantly impact a trader's success.

Risk Assessment

After reviewing the various aspects of UGM Securities, it is crucial to assess the overall risk associated with trading through this broker. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Issues with withdrawal and compliance history. |

| Fund Security | High | Reports of fund access issues and lack of investor protection. |

| Customer Support | High | Poor response rates and unresolved complaints. |

Given the identified risks, potential traders should consider these factors carefully. It is advisable to implement risk mitigation strategies, such as starting with a small investment and closely monitoring account activities.

Conclusion and Recommendations

In conclusion, the evidence suggests that UGM Securities raises several red flags that may indicate it is not a safe trading option. The numerous complaints regarding withdrawal issues, lack of transparency, and potential manipulation within the trading platform warrant serious consideration. While the broker claims to be regulated, the effectiveness of this regulation is questionable, given the mixed reviews and reported experiences of clients.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that offer robust regulatory oversight, transparent trading conditions, and a proven track record of customer satisfaction. Brokers regulated by reputable authorities such as the FCA or ASIC may provide safer trading environments. Ultimately, potential investors should exercise caution and conduct thorough research before engaging with UGM Securities, as the risks involved may outweigh the potential benefits.

Is UGM Securities a scam, or is it legit?

The latest exposure and evaluation content of UGM Securities brokers.

UGM Securities Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UGM Securities latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.