Is Trustplus247 safe?

Business

License

Is Trustplus247 A Scam?

Introduction

Trustplus247 is an online forex broker that has gained attention in the trading community for its wide range of trading instruments and account types. Operating in a highly competitive financial market, Trustplus247 positions itself as a platform for both novice and experienced traders. However, the legitimacy of this broker has been a topic of concern among potential clients, prompting the need for a thorough examination of its credibility. This article aims to provide a comprehensive analysis of Trustplus247, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The evaluation will be based on data gathered from reputable financial review sites, user testimonials, and market analysis.

Regulation and Legitimacy

When it comes to forex trading, regulatory oversight is crucial for ensuring the safety and security of traders' funds. Trustplus247 currently operates without any valid regulatory license, which raises significant red flags regarding its legitimacy. The absence of regulation means that there is no oversight from a recognized financial authority, increasing the risk of potential scams or fraudulent activities.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulatory oversight can lead to various issues, including untrustworthy practices and a lack of accountability. Traders are advised to exercise extreme caution when considering engagement with Trustplus247, as trading with unregulated brokers can result in substantial financial losses. Historical compliance issues, if any, are hard to track due to the broker's unregulated status, which makes it difficult to ascertain its operational integrity.

Company Background Investigation

Trustplus247 is reportedly registered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory framework. This offshore registration allows brokers to operate with minimal oversight, which often attracts dubious entities. The company's history and ownership structure remain largely opaque, with limited information available about its founding and operational history.

The management team behind Trustplus247 has not been disclosed, which raises questions about their qualifications and experience in the financial services industry. A transparent broker typically provides information about its executive team, including their backgrounds and expertise. The lack of such details can be indicative of a company that does not prioritize transparency or accountability.

Trading Conditions Analysis

Trustplus247 offers a variety of trading accounts with different features, aiming to cater to a broad audience. However, the overall fee structure and trading conditions warrant careful scrutiny. The broker provides various trading instruments, including forex pairs, metals, energies, indices, and cryptocurrencies, but the specifics of its fee structure can be concerning.

| Fee Type | Trustplus247 | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.4 pips (floating) | 1.0 pips |

| Commission Model | Not disclosed | Varies by broker |

| Overnight Interest Range | Not specified | 0.5% to 3% |

The spreads offered by Trustplus247 appear competitive, but the lack of transparency regarding commissions and overnight interest rates raises concerns. Traders should be wary of hidden fees that could significantly impact their trading profitability. It is essential for potential clients to inquire directly with the broker for detailed information on any additional costs.

Customer Funds Safety

The safety of customer funds is paramount in the forex trading world. Trustplus247's lack of regulatory oversight raises significant concerns about its fund security measures. The broker's policies on fund segregation, investor protection, and negative balance protection remain unclear.

Traders should seek brokers that offer robust security measures, such as segregated accounts held with reputable banks and insurance against potential losses. The absence of these protective measures can expose traders to risks, especially in the event of financial difficulties faced by the broker.

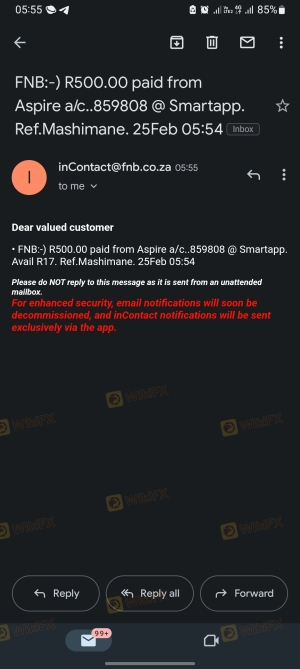

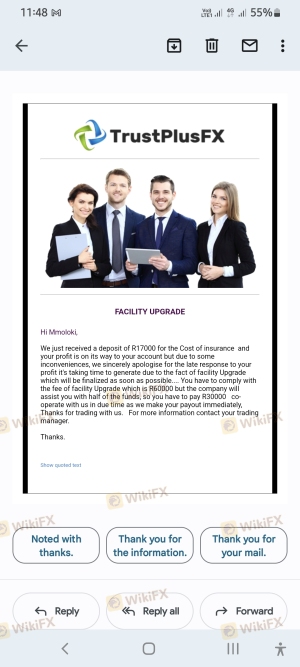

Customer Experience and Complaints

User feedback is a vital component in assessing a broker's reliability. Trustplus247 has received mixed reviews from customers, with several complaints highlighting issues related to withdrawal requests and customer support. Common patterns in complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or unresponsive |

| Customer Support Quality | Medium | Limited availability |

Many users have reported difficulties in withdrawing their funds, claiming that the broker either delayed their requests or outright denied them. Such complaints are alarming and suggest that Trustplus247 may not be a trustworthy platform for trading. A few typical cases reveal that clients have experienced prolonged waiting periods for withdrawals, leading to frustration and financial loss.

Platform and Trade Execution

The trading platform provided by Trustplus247 is reportedly proprietary, lacking industry-standard trading platforms like MetaTrader 4 or MetaTrader 5. This can be a significant drawback for traders who prefer the advanced features and user-friendly interfaces of these widely recognized platforms.

Issues related to order execution quality, including slippage and order rejections, have been reported by users. Such problems can severely affect trading outcomes, particularly in a fast-paced market environment. The absence of transparency regarding execution quality raises concerns about potential platform manipulation.

Risk Assessment

Using Trustplus247 presents several risks that potential traders should consider. The overall risk profile of this broker can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Safety Risk | High | Lack of transparency in fund protection |

| Withdrawal Risk | High | Numerous complaints regarding withdrawals |

| Platform Reliability Risk | Medium | Proprietary platform with reported issues |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative brokers with established regulatory oversight and a solid reputation in the industry.

Conclusion and Recommendations

In summary, Trustplus247 raises multiple red flags that suggest it may not be a safe choice for traders. The absence of regulation, coupled with numerous complaints regarding fund withdrawals and customer support, indicates a potential risk of scam.

For traders seeking reliable trading experiences, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of transparency and customer satisfaction. Brokers such as FXCM, Roboforex, and Tickmill are examples of platforms that offer greater security and regulatory protections.

Ultimately, traders should prioritize safety and transparency in their trading endeavors, ensuring that they engage with brokers that uphold industry standards and provide robust support for their clients.

Is Trustplus247 a scam, or is it legit?

The latest exposure and evaluation content of Trustplus247 brokers.

Trustplus247 Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Trustplus247 latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.