Trustplus247 2025 Review: Everything You Need to Know

Executive Summary

This detailed trustplus247 review shows major concerns about this forex broker. Traders should think carefully before investing their money with this company. Trustplus247 started in 2021 and has its main office in China. The company works without proper rules and oversight, which is a big warning sign for people who might want to trade with them.

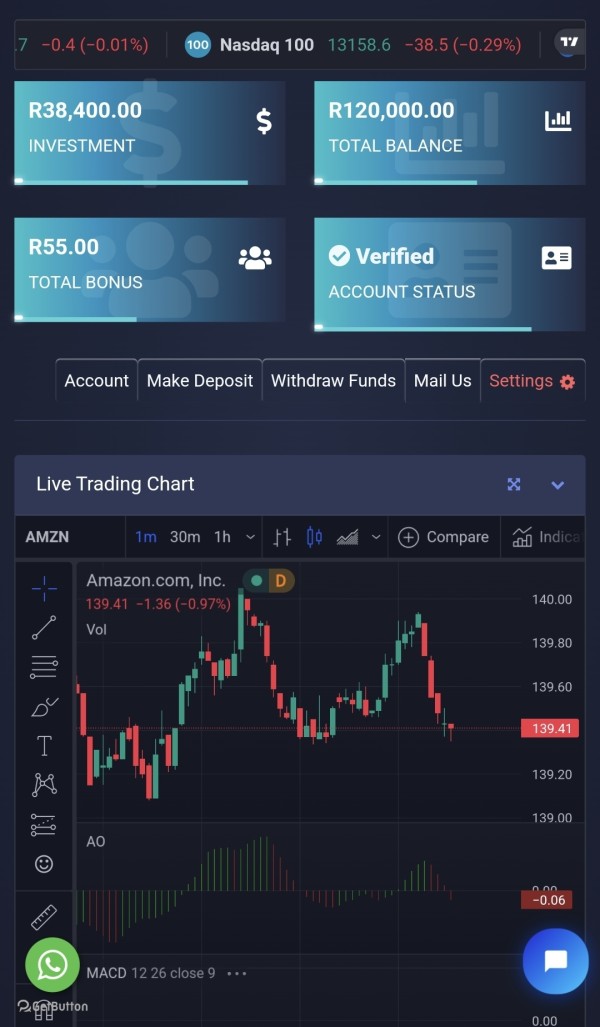

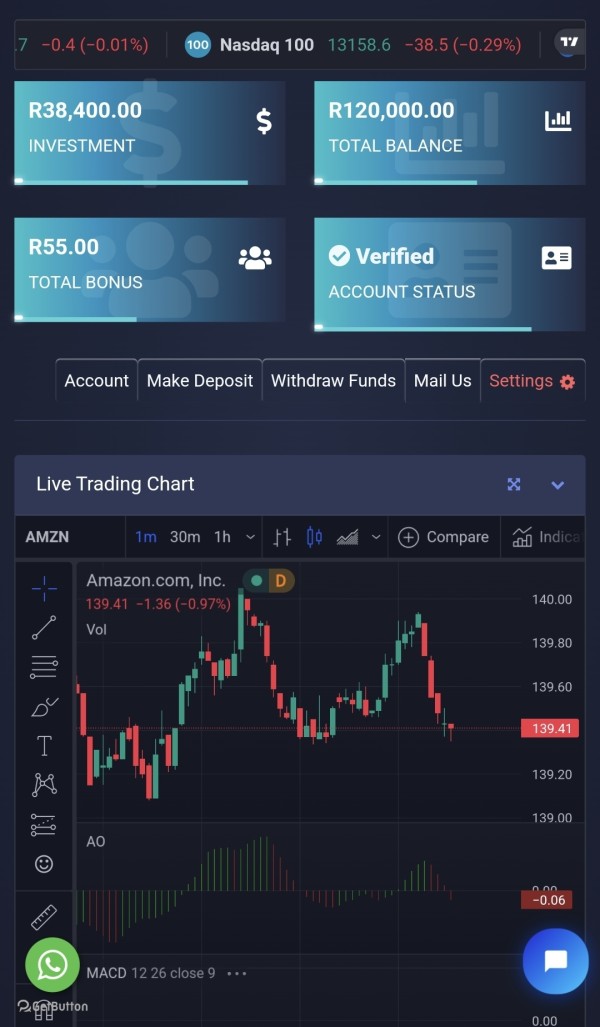

The platform lets you trade forex, metals, energy, indices, and cryptocurrencies. You can get leverage up to 1:200 for currency pairs, which means you can control more money than you actually have.

But user reviews tell a scary story. The company only gets 2.6 out of 10 stars from users, and WikiFX gives it a score of 1, which means extremely high risk. Many people complain about problems getting their money back and terrible customer service that doesn't help when you need it.

Some traders might like the high leverage because it lets them make bigger trades. However, the huge risks from having no regulation and bad user experiences make this broker wrong for most regular investors who want to protect their money.

The worst part is how many users say the company acts like a scam. People report being asked to pay extra money just to get their own funds back, which is a classic sign of fraud. These problems make Trustplus247 a very dangerous choice that even experienced traders should avoid completely.

Important Notice

Regional Entity Differences: Trustplus247 works as an unregulated company without watching from major financial authorities. Traders should be extremely careful when thinking about this broker because no regulation means you have very little help if something goes wrong or if they try to cheat you.

The broker's operations might be different in various countries, but the lack of proper licensing stays the same everywhere. This means you're taking the same big risks no matter where you live.

Review Methodology: This review uses user feedback from many review websites, outside rating services like WikiFX, and public information about the broker's services and business practices. Since the company doesn't share much information about itself, most of this analysis comes from other sources and what users have experienced when trading with them.

We looked at complaints, ratings, and reports from multiple places to get a complete picture. The lack of transparency from Trustplus247 itself is another warning sign that potential clients should notice.

Overall Rating Framework

Broker Overview

Trustplus247 started in the forex market in 2021. The company says it's a trading platform that gives access to many different financial instruments, but important details about who runs it and how it's organized are missing from public records.

The company is based in China and tries to get customers from around the world through its online trading services. However, you can't find basic information about the company's structure and leadership, which is very unusual for a legitimate business.

The broker's business plan seems to focus on giving high-leverage trading chances across different types of investments. These include foreign exchange, precious metals, energy commodities, stock indices, and cryptocurrencies, but the lack of clear corporate information and rule-following raises serious questions about whether the company is real and will stay in business.

Trustplus247 says it offers multiple account types including PRO, ECN, and MICRO accounts. But specific details about minimum deposits, account features, and trading conditions are not clear, which makes it hard to know what you're getting into.

The platform's trading setup and technology partnerships are not well explained. This is strange because real forex brokers usually talk a lot about their technology and partnerships with established platform providers to show they're professional.

The broker's presence in the market has mainly involved aggressive marketing and promises of high returns. These are common warning signs in the forex industry that suggest the company might not be legitimate.

This trustplus247 review wants to give you clear information about these worrying patterns. We hope this helps traders make smart decisions about whether to risk their money with this company.

Regulatory Status: Trustplus247 works without permission from recognized financial regulatory bodies like the FCA, ASIC, CySEC, or other major authorities. This unregulated status makes trading much more risky because you have no protection if something goes wrong.

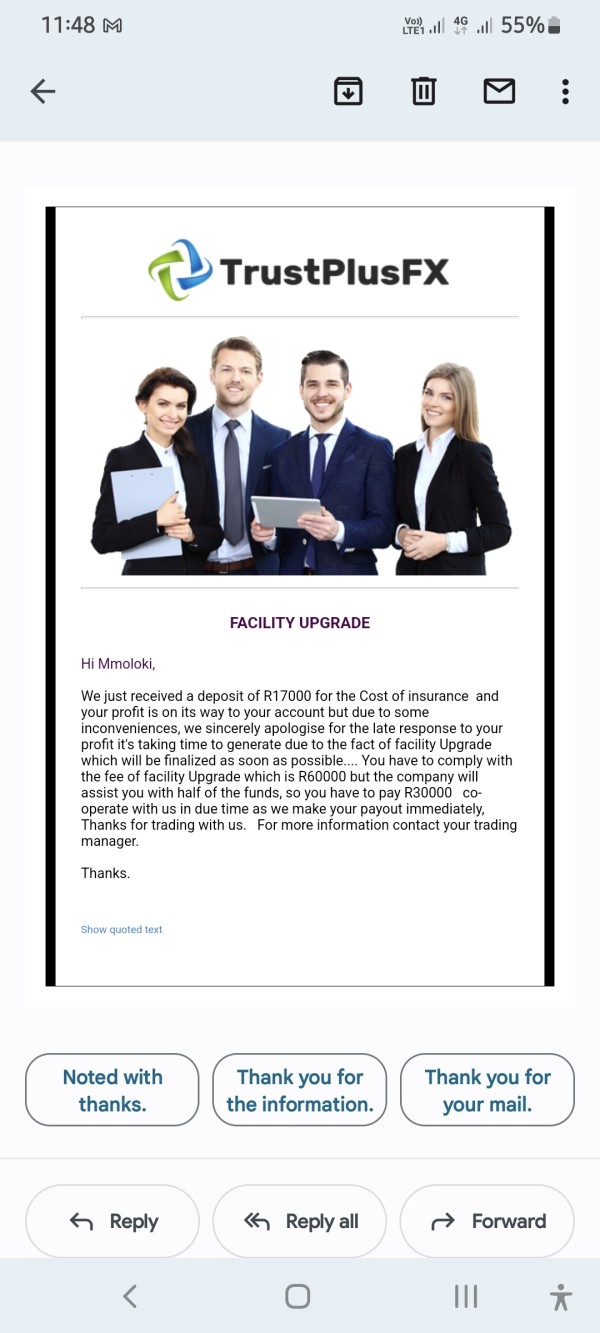

Deposit and Withdrawal Methods: The broker hasn't clearly explained what payment methods they accept, how long it takes to process payments, or what fees they charge. This lack of transparency is concerning for people who want to know exactly how their money will be handled.

Minimum Deposit Requirements: The broker hasn't told the public how much money you need to start trading with different account types. This makes it impossible for traders to plan how much they need to invest initially.

Bonuses and Promotions: No clear information about special offers, welcome bonuses, or trading rewards has been shared in public materials. Most legitimate brokers advertise their promotions clearly to attract new customers.

Available Trading Assets: The platform says you can trade in five main areas: foreign exchange pairs, precious metals like gold and silver, energy commodities like oil and gas, major stock indices, and various cryptocurrencies including Bitcoin and Ethereum. However, the exact list of available instruments isn't detailed.

Cost Structure: Important information about spreads, commissions, overnight fees, and other trading costs hasn't been shared openly. This makes it impossible to compare costs with other brokers, which is something smart traders always do.

Leverage Ratios: The broker offers different leverage depending on what you trade: up to 1:200 for currency pairs, 1:100 for metals and energy, 1:50 for stock indices, and 1:2 for cryptocurrency trading. While these ratios might seem attractive, remember that higher leverage means higher risk of losing money.

Trading Platforms: Information about what trading platforms you can use, whether they're made by the company or well-known third-party solutions like MetaTrader 4/5, hasn't been clearly explained. This is important because the platform you use affects your entire trading experience.

Geographic Restrictions: The broker hasn't clearly said which countries it serves or if there are any places where people can't use their services. This lack of clarity could cause problems for international clients.

Customer Support Languages: The company hasn't specified what languages their support team can help you in. This could be a problem if you need help and don't speak English well.

This trustplus247 review must point out that not being transparent about these basic things is itself a major warning sign. Legitimate brokers always provide clear information about these important details.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

Trustplus247's account setup includes PRO, ECN, and MICRO account types. This suggests they're trying to serve different kinds of traders, but the lack of detailed information about each account type makes them practically useless for making informed decisions.

The company doesn't clearly state minimum deposit requirements, so traders can't understand how much money they need to commit for each account level. This basic information should always be available and easy to find on a broker's website.

Details about how to open an account are not available to the public. This raises concerns about how they verify who you are and whether they follow anti-money laundering rules that legitimate financial companies must follow.

User feedback about account conditions has been mostly negative. People complain about unexpected fees, unclear terms and conditions, and trouble accessing account features they thought were included with their chosen account type.

The lack of Islamic account options or other specialized accounts further limits who might want to use this broker. Many legitimate brokers offer accounts that follow Islamic finance principles or cater to specific trading styles.

When you compare Trustplus247's account conditions to regulated brokers in the industry, they appear deliberately unclear and potentially misleading. This trustplus247 review finds that the account structure lacks the transparency and clarity that professional traders need to make good decisions.

The trading tools and resources that Trustplus247 offers appear to be very limited based on what information is available. Unlike established brokers who usually provide complete sets of analysis tools, charting software, economic calendars, and market research, Trustplus247's offerings are poorly documented and seem minimal.

Educational resources are crucial for trader development and success, but they appear to be either missing or not promoted well. Professional brokers usually offer webinars, tutorials, market analysis, and educational content to help their clients learn and succeed.

The absence of such resources suggests either they don't care about client success or they don't have enough infrastructure to support good trader education. Either way, this is bad news for people who want to learn and improve their trading skills.

Research and analysis capabilities seem to be another weak area. There's no evidence of market analysis done by the company, partnerships with research providers, or advanced analytical tools that serious traders need.

Support for automated trading, including Expert Advisor compatibility or algorithmic trading features, hasn't been mentioned in available materials. Many modern traders rely on automated systems, so this is a significant limitation.

User feedback consistently points to inadequate tools and resources. Traders express frustration about the limited functionality available on the platform, which makes it hard to analyze markets and make informed trading decisions.

The lack of professional-grade tools significantly hurts serious trading activities. This suggests the platform may be more focused on getting new clients than providing genuine trading value to existing ones.

Customer Service and Support Analysis (2/10)

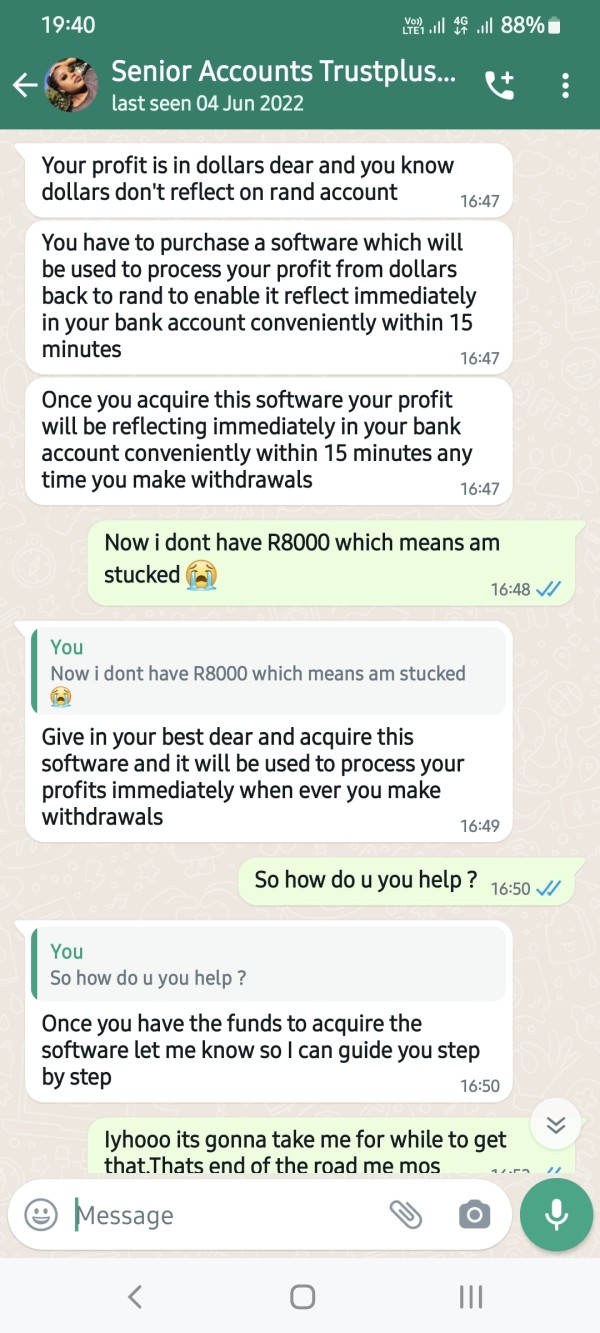

Customer service is one of the most concerning aspects of Trustplus247's operations. Many user complaints highlight significant problems with support quality and how quickly they respond to issues.

Available feedback suggests that customer service options are limited and often don't respond when clients have problems. This is especially true when people try to withdraw their money, which is when you most need reliable support.

Response times appear to be consistently poor. Users report waiting days or weeks for help with account issues, technical problems, or withdrawal concerns, which is far below what you should expect from any financial service provider.

The quality of service when support finally responds has been heavily criticized by users. Many complaints show that representatives either can't or won't solve legitimate client problems, particularly those related to getting funds back.

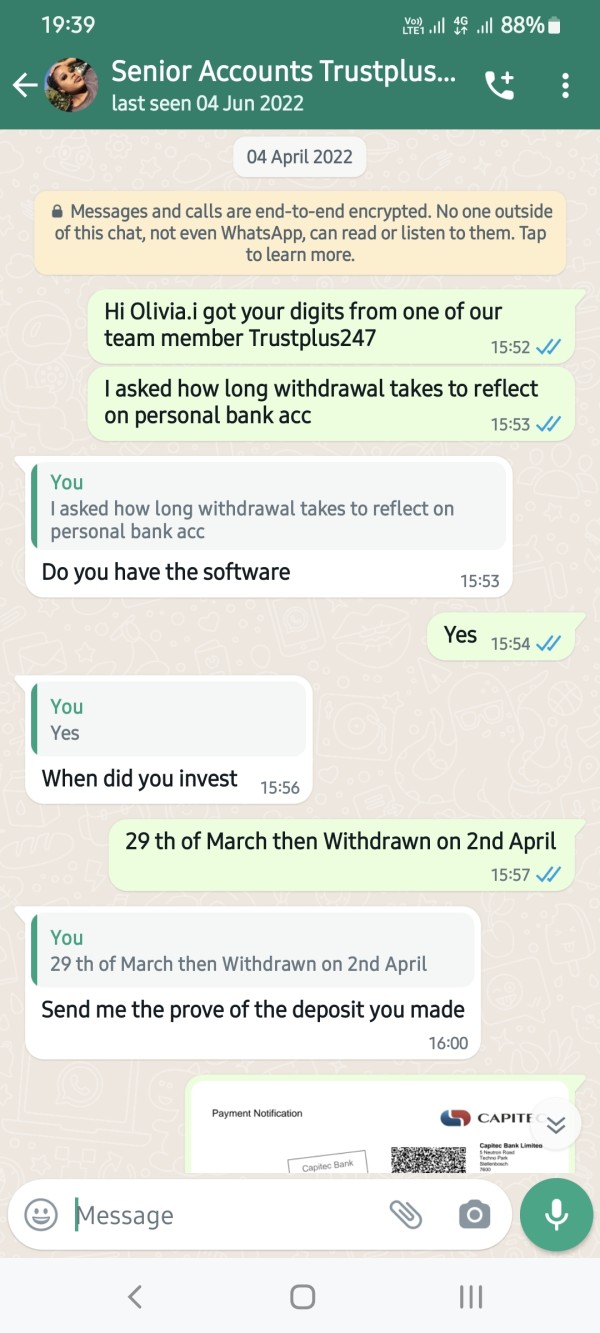

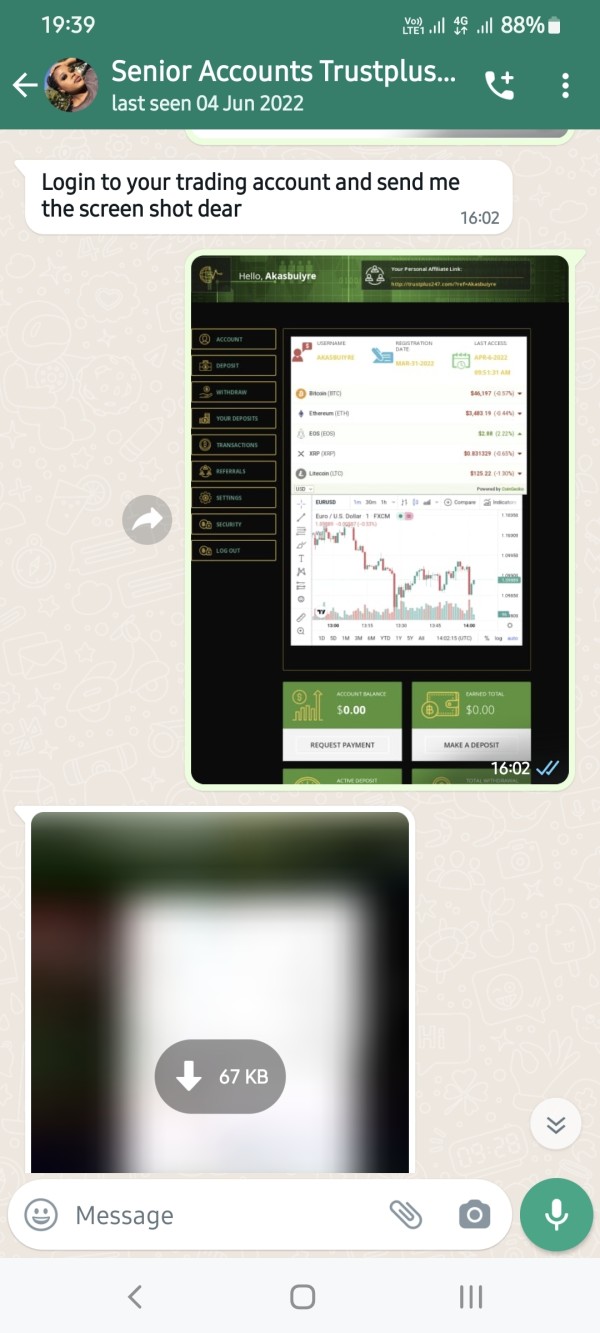

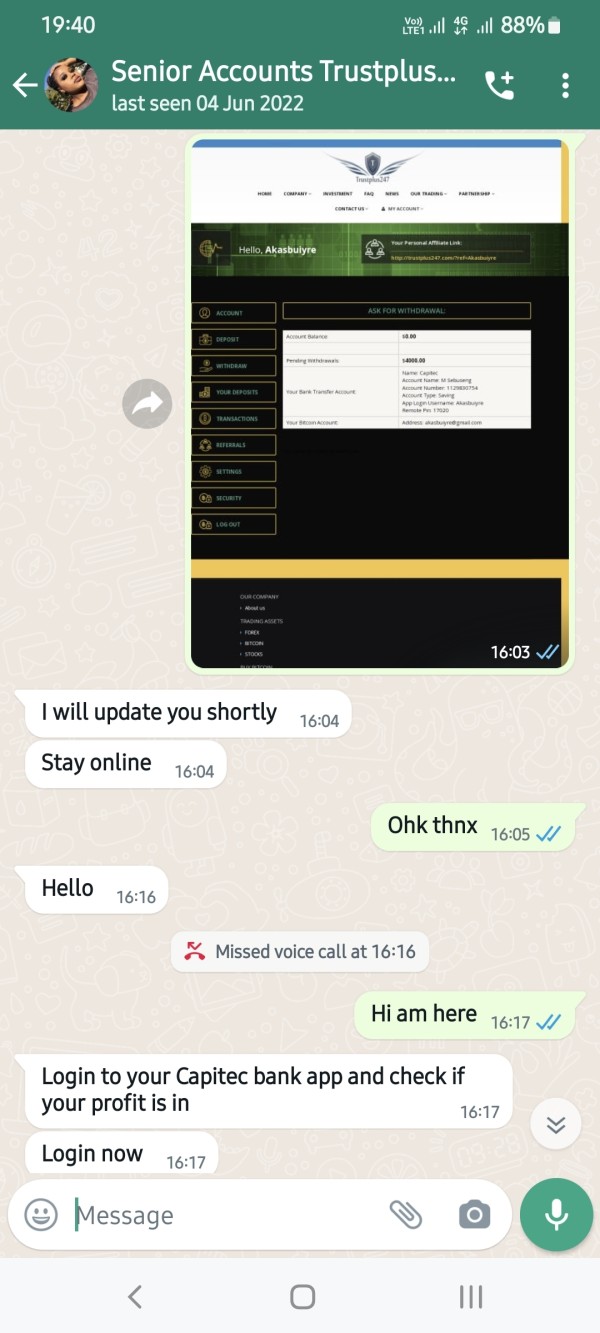

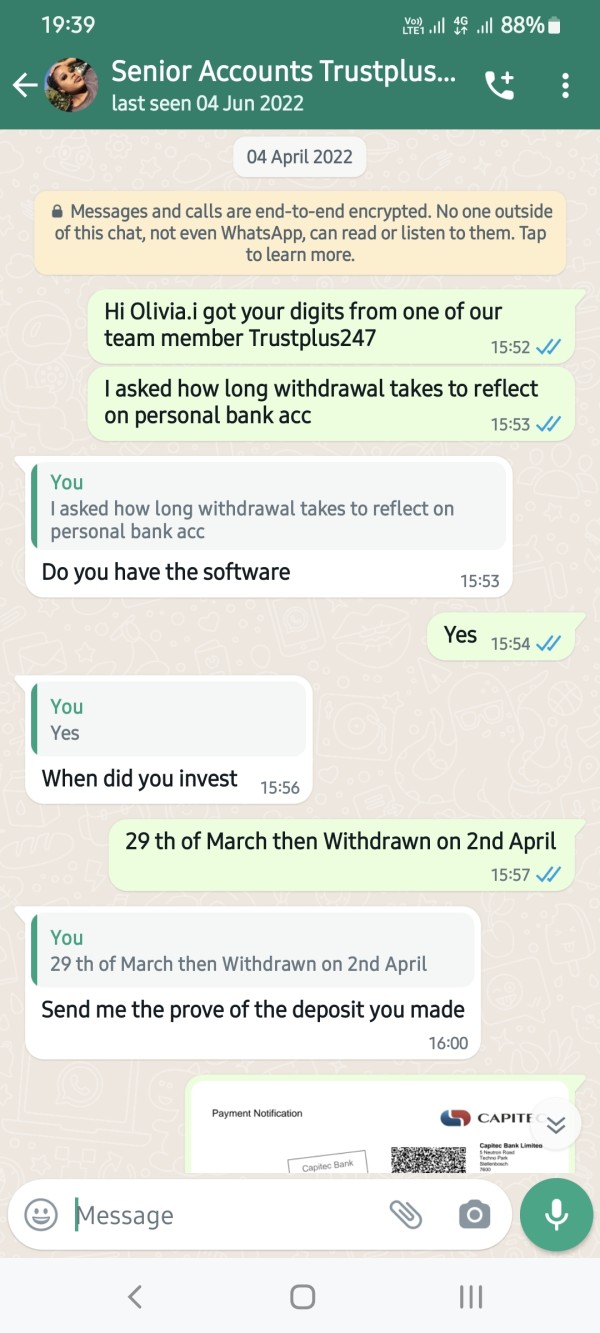

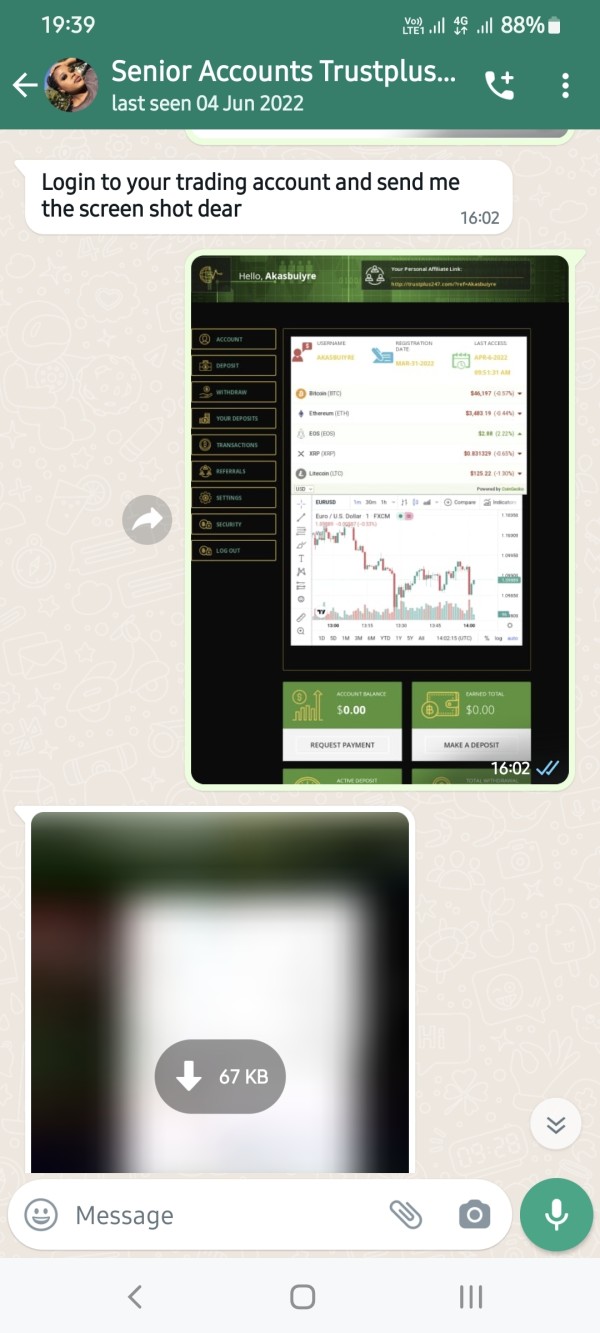

Some users report being given conflicting information or being asked to make additional payments to solve their problems. This type of response is completely unacceptable and suggests the company may be trying to scam its clients rather than help them.

Information about what languages support is available in and what hours they work hasn't been clearly shared. This further complicates getting help for international clients who may be in different time zones.

The pattern of poor customer service matches with other warning signs identified in this review. It suggests systematic problems with how the broker prioritizes and handles client relationships.

Trading Experience Analysis (4/10)

The trading experience with Trustplus247 appears to be significantly hurt by various operational and technical issues. While the broker offers attractive leverage ratios that might appeal to experienced traders wanting higher market exposure, user feedback suggests the actual trading environment doesn't meet professional standards.

How stable the platform is and the quality of trade execution have been questioned by users. However, specific technical performance data isn't easily available, which makes it hard to judge how well the system actually works.

The lack of information about trading platform options is concerning. Whether they use their own system or established third-party solutions like MetaTrader makes a big difference in your trading experience, and this information should be clearly available.

Order execution quality appears to be problematic based on user complaints. Some traders report difficulties not just with withdrawals but also with executing trades during volatile market conditions when quick, accurate execution is most important.

The absence of detailed information about execution policies, slippage management, and order types further hurts confidence in the trading environment. Professional traders need to understand exactly how their orders will be handled.

Mobile trading capabilities and the ability to sync across different devices haven't been adequately documented. This is concerning because mobile access is very important in modern forex trading, and many traders need to monitor and manage positions on the go.

The overall trading environment seems to focus more on getting new clients than providing a professional, reliable trading experience. This trustplus247 review finds that while high leverage ratios might initially attract traders, the underlying trading infrastructure appears insufficient to support professional trading activities safely and effectively.

Trust and Safety Analysis (1/10)

Trust and safety represent the most critical weaknesses in Trustplus247's operations. Multiple factors contribute to an extremely poor rating in this essential area that should be every trader's top concern.

The broker's unregulated status immediately puts it in the highest risk category. Clients have no regulatory protection or way to get help through established financial authorities if something goes wrong.

The absence of proper licensing from recognized regulatory bodies means that client funds lack the protections typically required by law in regulated areas. This includes keeping client money separate from company money, compensation schemes if the broker fails, and regular auditing requirements that help ensure broker integrity.

Company transparency is severely lacking. Very little information is available about corporate structure, management team, financial backing, or business operations, which is completely unacceptable for a financial services company.

Legitimate brokers typically provide comprehensive corporate information, regulatory filings, and transparent communication about their business model and risk management practices. The lack of this basic information is a huge red flag.

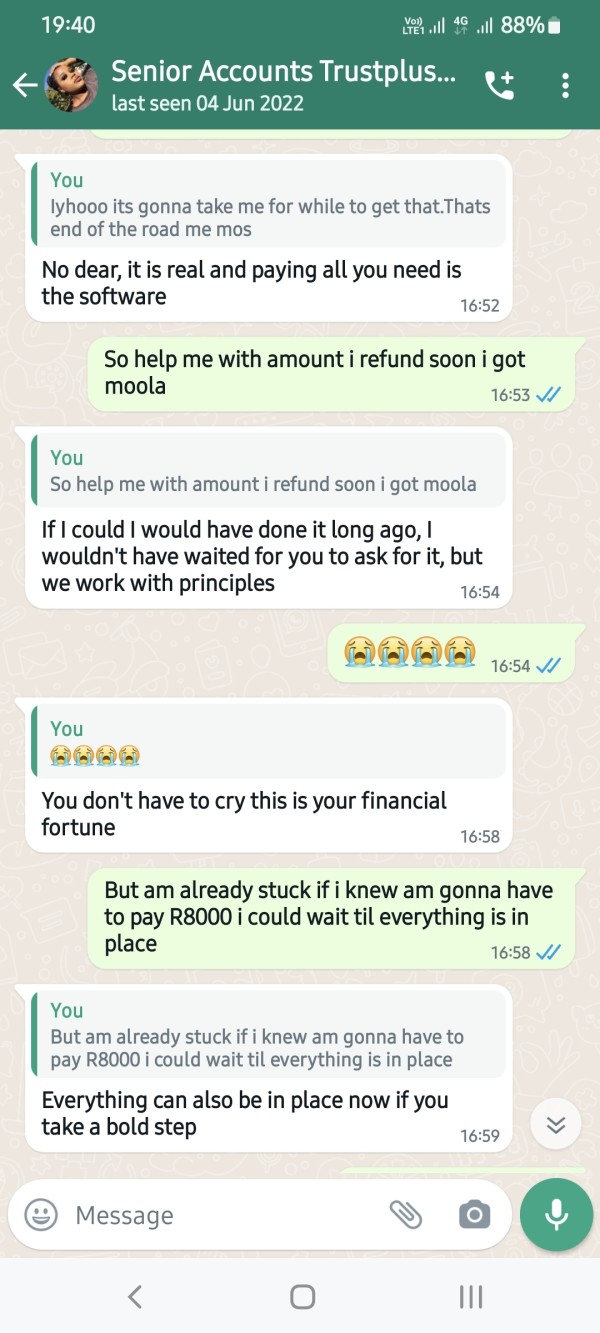

Industry reputation has been significantly damaged by user complaints alleging fraudulent activities. These are particularly focused around withdrawal processes where clients report being asked for additional payments to access their own funds, which is a classic scam tactic.

WikiFX's rating of 1 out of 10 reflects the consensus among industry monitors that this broker represents extremely high risk to potential clients. This rating should be taken very seriously by anyone considering trading with this company.

The way negative events and user complaints are handled appears to follow patterns commonly associated with fraudulent operations. Legitimate concerns are ignored or met with demands for additional payments rather than proper resolution, which is completely unacceptable.

User Experience Analysis (3/10)

Overall user satisfaction with Trustplus247 is extremely poor. The 2.6 out of 10 user rating and consistently negative feedback across multiple review platforms show fundamental problems with the broker's service delivery and how they treat clients.

While specific information about interface design and how easy the platform is to use is limited, user complaints suggest that the overall experience is frustrating and unprofessional. This affects everything from the first time you try to use the platform to managing your trades and money.

The registration and verification processes haven't been clearly documented. This may contribute to user confusion and dissatisfaction from the very beginning of the client relationship, which sets a bad tone for everything that follows.

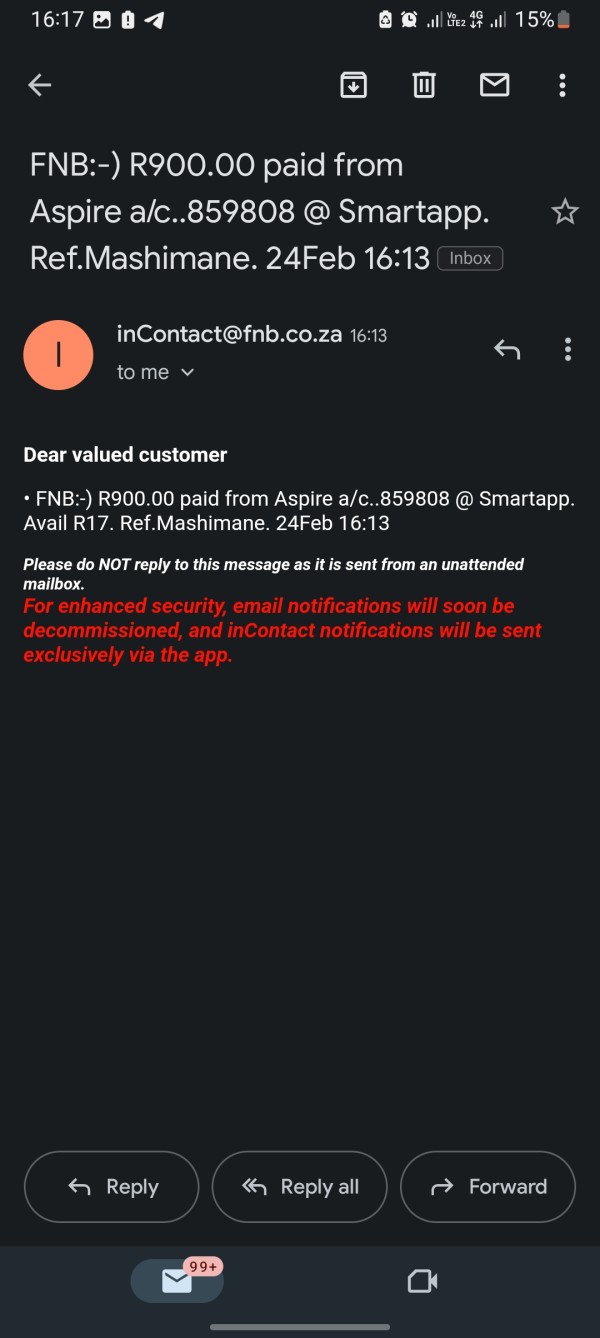

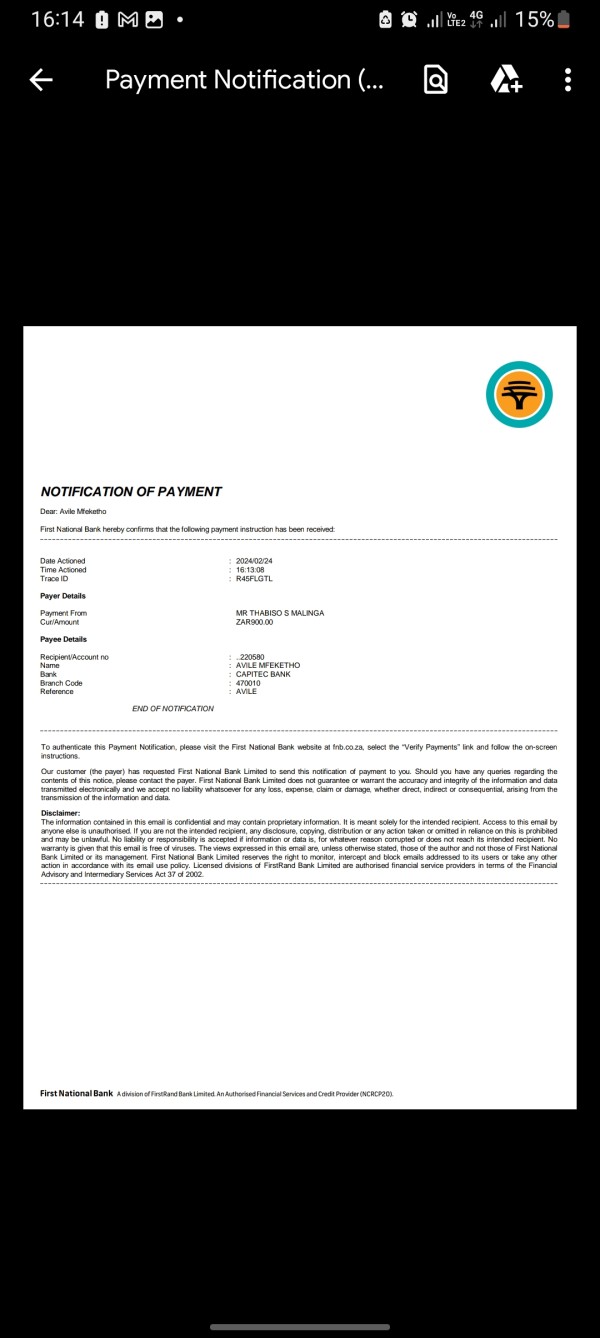

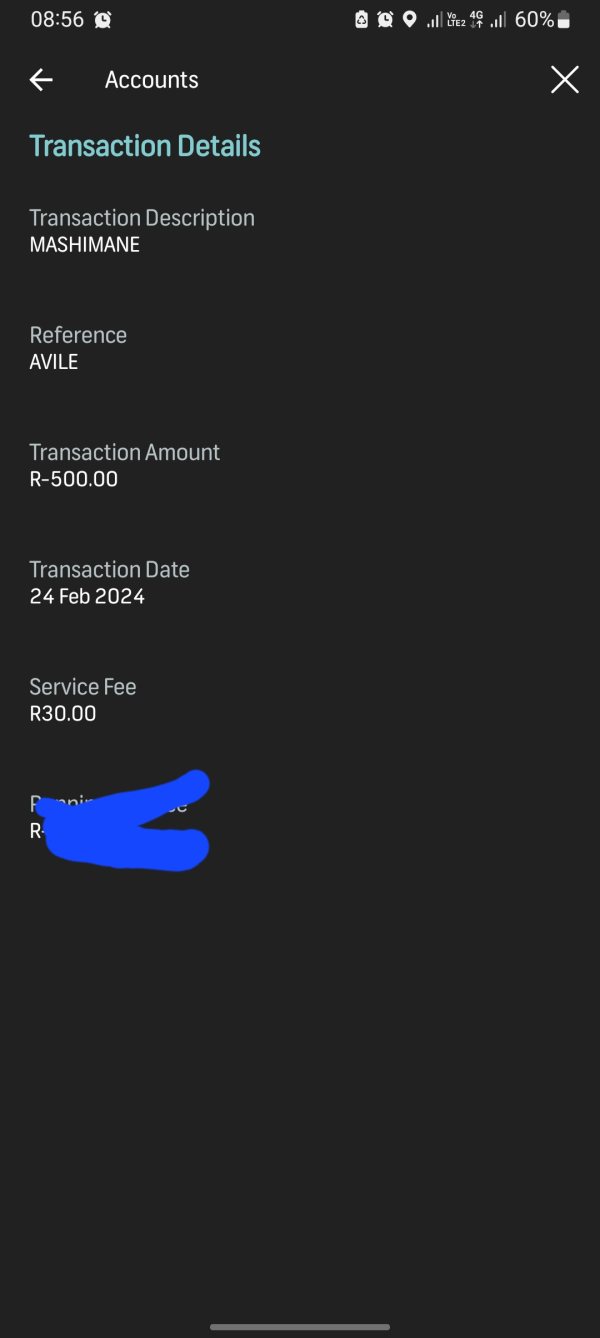

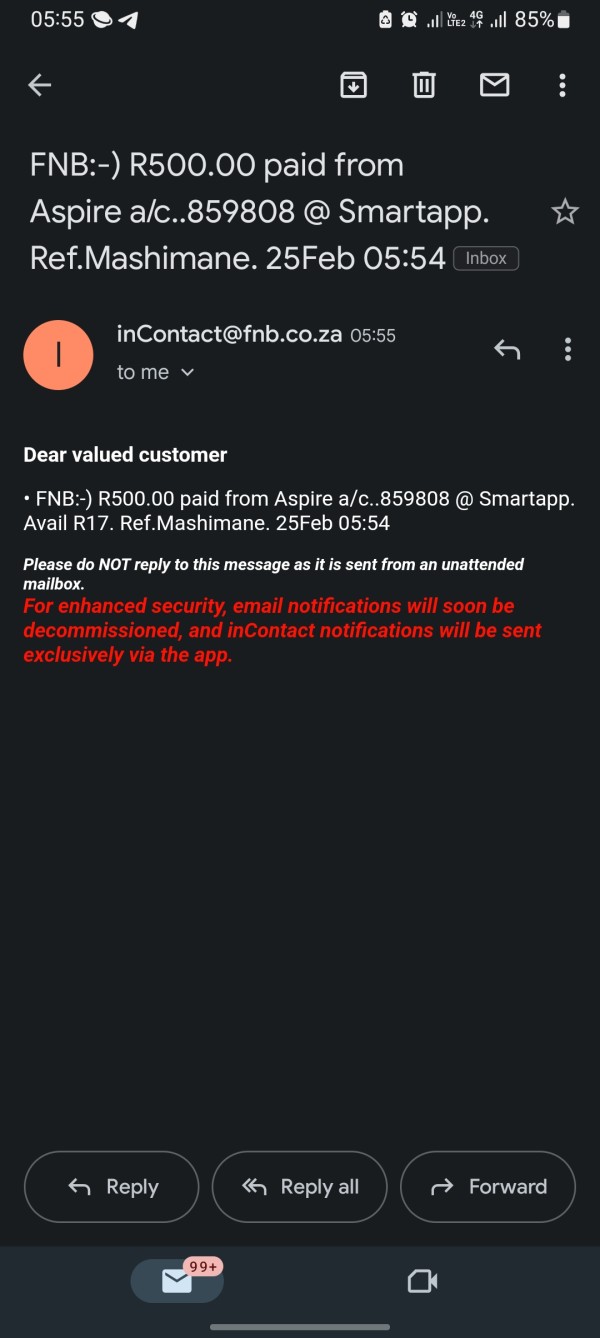

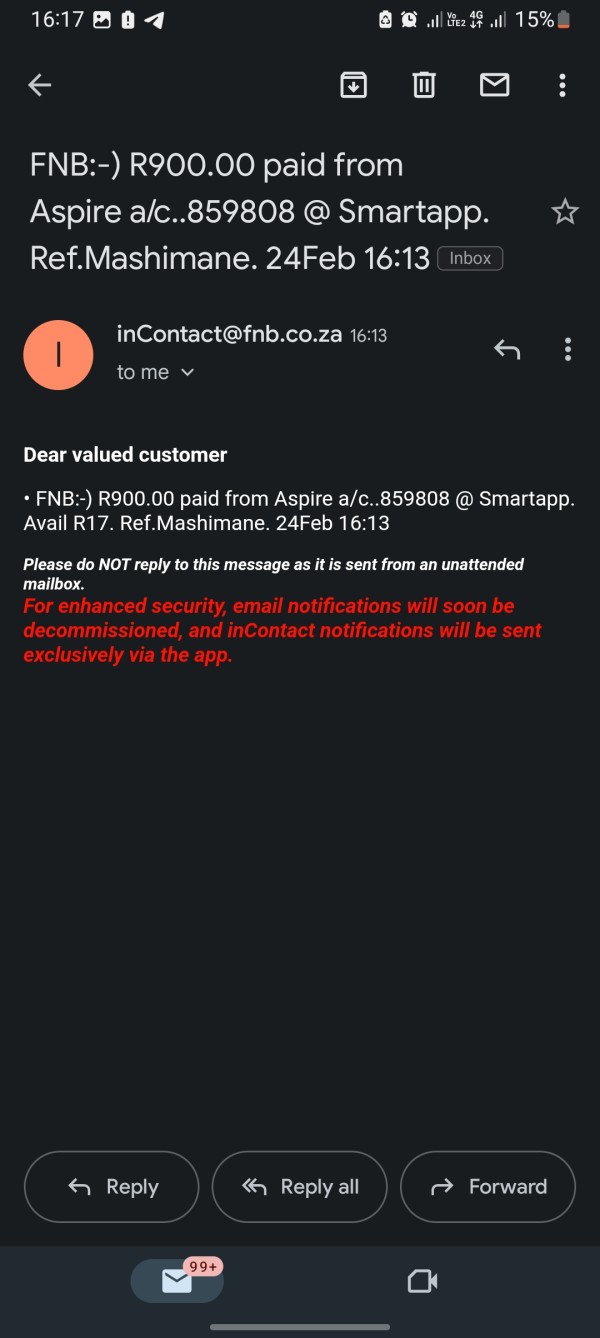

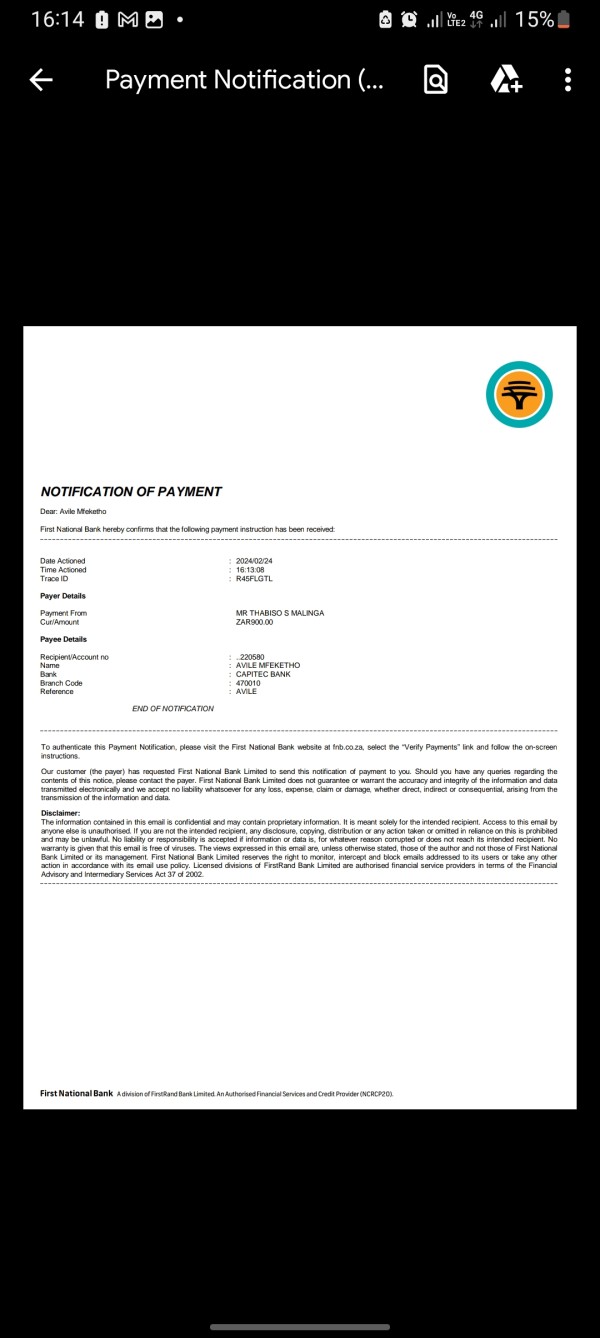

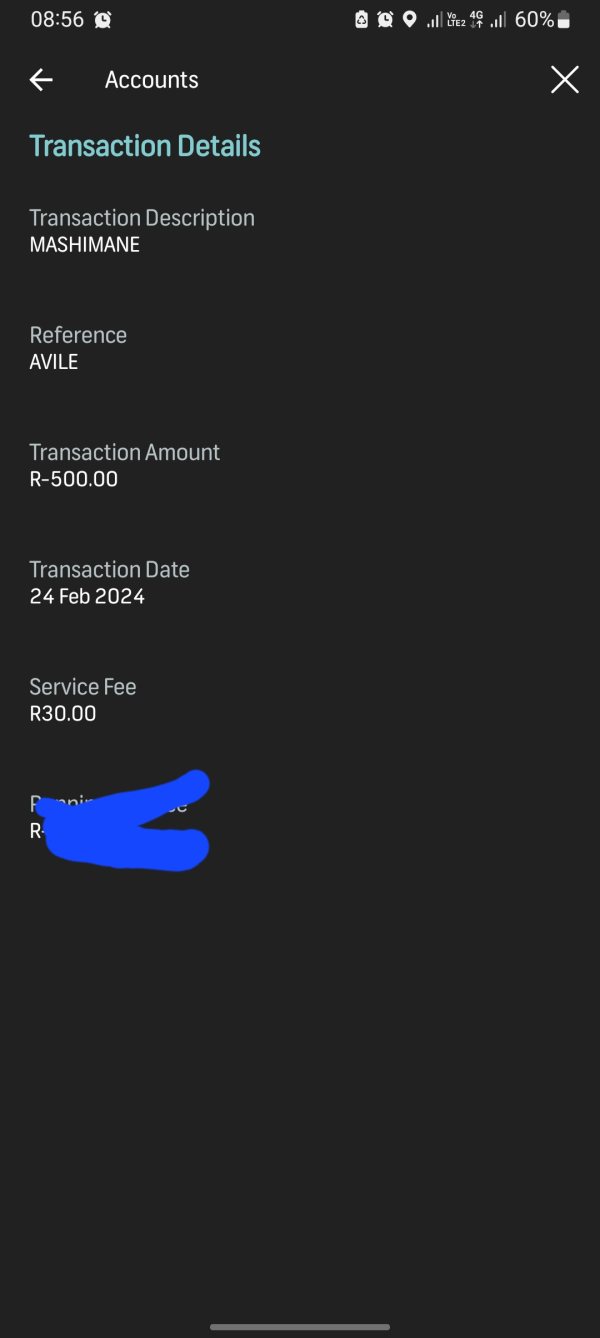

The fund management experience appears to be particularly problematic. Numerous users report significant difficulties when attempting to withdraw their funds, which is one of the most important aspects of any trading relationship.

These withdrawal complaints often describe scenarios where additional payments are requested before withdrawals can be processed. This is a common characteristic of fraudulent operations and should be considered a major warning sign by potential clients.

Common user complaints center around withdrawal difficulties, poor customer service, lack of transparency, and what many describe as deceptive business practices. The pattern of complaints suggests systematic issues rather than isolated incidents, which indicates fundamental problems with the broker's business model.

The user demographic appears to include traders attracted by high leverage offers. However, they subsequently discover the significant risks and operational problems that weren't clearly explained upfront.

This suggests that the broker's marketing may be misleading potential clients about the actual nature of the service provided. When marketing promises don't match reality, it creates disappointed and frustrated customers.

Conclusion

This comprehensive trustplus247 review reveals a broker that poses significant risks to potential clients and fails to meet basic industry standards for safety, transparency, and service quality. The combination of unregulated status, poor user ratings, and numerous complaints alleging fraudulent activities creates a clear pattern that experienced traders should recognize and avoid.

While Trustplus247 may initially attract traders with offers of high leverage ratios, the fundamental weaknesses in regulatory compliance, customer service, and operational transparency make it unsuitable for any serious trading activities. The broker appears to target traders seeking high-risk, high-reward opportunities, but the actual risk profile extends far beyond normal market risks to include potential loss of capital through operational issues and possible fraud.

The main advantages, if they can be called that, include high leverage ratios and multiple asset classes for trading. However, these are vastly outweighed by critical disadvantages including lack of regulatory protection, poor customer service, withdrawal difficulties, limited transparency, and allegations of fraudulent practices.

These characteristics make this operation extremely high-risk for any potential clients. The evidence suggests that traders should look elsewhere for their forex trading needs and choose regulated brokers with good reputations and transparent business practices.

Final recommendation: Avoid Trustplus247 completely and choose a properly regulated broker instead.