Is Trust Markets safe?

Pros

Cons

Is Trust Markets Safe or Scam?

Introduction

Trust Markets is an online forex and CFD broker that has garnered attention in the trading community for its aggressive marketing and purportedly attractive trading conditions. Established in 2023 and claiming to operate from St. Lucia, Trust Markets positions itself as a gateway for traders seeking to engage in various financial markets, including forex, commodities, and cryptocurrencies. However, the increasing number of concerns regarding its regulatory status and customer experiences raises significant questions about its legitimacy.

In the highly volatile and often unregulated world of forex trading, it is crucial for traders to thoroughly assess the reliability and safety of their chosen brokers. Given the potential for scams and fraud, understanding the regulatory landscape, company background, trading conditions, and customer feedback is essential for making informed trading decisions. This article employs a comprehensive investigative approach, utilizing data from various reputable sources to evaluate whether Trust Markets is safe or a scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. A legitimate broker should be regulated by a recognized financial authority that enforces strict compliance standards to protect investors. Unfortunately, Trust Markets does not hold any valid regulatory licenses from reputable authorities.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation is a significant red flag. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC), ensure that brokers adhere to stringent operational standards, which include maintaining client fund segregation and providing transparency in pricing. Trust Markets claims to be registered in the UK; however, no records confirm its legitimacy within the FCA or any other recognized regulatory framework. This lack of oversight not only jeopardizes the safety of client funds but also raises concerns about the broker's operational integrity.

Regulatory compliance is not just a formality; it is a protective measure for traders. Without it, clients have little recourse in the event of disputes or alleged wrongdoing by the broker. Historical compliance issues and the absence of a regulatory framework suggest that Trust Markets may not be a safe option for traders.

Company Background Investigation

Trust Markets is operated by TM Ltd., a company incorporated in St. Lucia. Despite its recent establishment, very little information is available regarding its ownership structure, management team, or operational history. This lack of transparency can be concerning for potential investors, as it raises questions about the broker's accountability and long-term viability.

The management team behind Trust Markets remains largely anonymous, with no verifiable professional backgrounds or relevant industry experience disclosed. A credible broker typically provides detailed information about its leadership, including qualifications and prior experience in the financial sector. In the case of Trust Markets, this information is conspicuously absent, further exacerbating concerns about its legitimacy.

Moreover, the companys operations in an offshore jurisdiction like St. Lucia, known for its lax regulatory environment, suggest a strategic choice to minimize oversight and accountability. Offshore brokers often exploit such environments to operate with fewer restrictions, which can lead to unethical practices. Therefore, the combination of an unregulated status, lack of transparency, and questionable management raises significant doubts about whether Trust Markets is a safe trading platform.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and spreads, is vital. Trust Markets advertises competitive trading conditions, including high leverage ratios and low spreads. However, the actual trading costs may differ significantly from what is presented in promotional materials.

| Fee Type | Trust Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0-2.0 pips |

| Commission Model | $7 per lot | $5-10 per lot |

| Overnight Interest Range | Varies | Varies |

While the advertised spread of 0.0 pips is enticing, such low figures often come with hidden costs or conditions that are not immediately apparent to traders. Additionally, the commission structure may also include unexpected fees, particularly for withdrawals or account maintenance, which are not clearly outlined in the broker's terms.

Unusual fee policies, such as high withdrawal fees or conditions for accessing bonus funds, can create barriers for traders trying to access their capital. Moreover, the high leverage offered—up to 1:1000—can be very risky for traders, especially inexperienced ones, as it magnifies both potential gains and losses. Therefore, while Trust Markets may present itself as a cost-effective trading option, the reality may involve hidden charges that could impact the overall trading experience and profitability, raising questions about whether Trust Markets is truly safe.

Client Funds Safety

The safety of client funds is paramount when choosing a forex broker. Trust Markets claims to implement measures to protect client funds, such as segregating client accounts from operational funds. However, without regulatory oversight, there is no guarantee that these claims are upheld.

The absence of investor protection mechanisms, such as compensation funds provided by regulatory bodies, further jeopardizes the safety of client deposits. In cases where brokers engage in fraudulent activities or become insolvent, unregulated brokers like Trust Markets leave their clients with limited options for recovering lost funds.

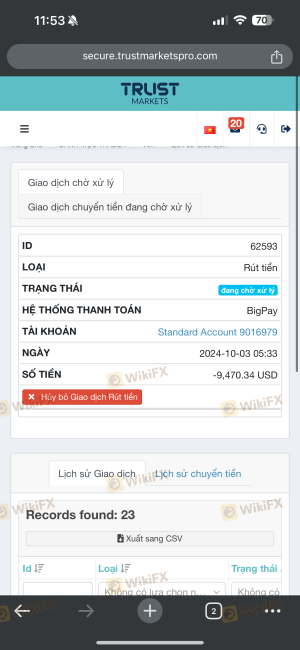

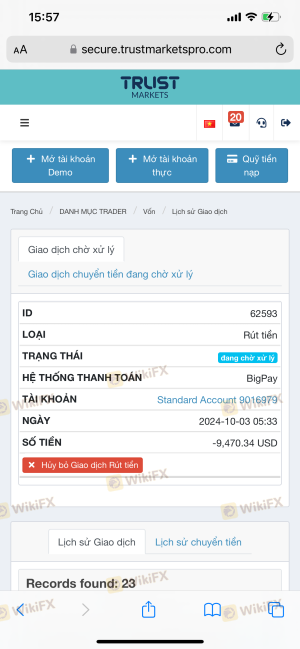

Historically, unregulated brokers have faced numerous allegations related to mishandling client funds, including difficulties in processing withdrawals and outright fraud. Trust Markets has already attracted negative attention due to reports of clients experiencing significant challenges in withdrawing their funds. Such issues are often indicative of deeper systemic problems within the brokerage, further questioning whether Trust Markets is safe for traders.

Customer Experience and Complaints

Customer feedback is a crucial aspect of evaluating a broker's reliability. Trust Markets has received numerous complaints from users, primarily concerning withdrawal issues and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

| Hidden Fees | High | Poor |

Many users report being unable to withdraw their funds after making deposits, a common complaint associated with potentially fraudulent brokers. In several cases, clients have claimed that their requests for withdrawals were met with unreasonable delays or outright denials, often accompanied by requests to make additional deposits or trades to "verify" their accounts.

For instance, one user reported attempting to withdraw $3,000 from their account, only to face repeated obstacles and a lack of communication from customer service. Such experiences highlight a troubling pattern that raises significant concerns about the operational integrity of Trust Markets.

Platform and Trade Execution

The trading platform offered by Trust Markets is another critical factor in assessing its reliability. The broker utilizes the MetaTrader 5 (MT5) platform, which is widely regarded for its advanced features and user-friendly interface. However, the effectiveness of a trading platform is not solely determined by its technology but also by the execution quality and reliability.

Traders have reported issues with order execution, including slippage and high rejection rates for trades. These problems can significantly impact trading performance, especially for those employing high-frequency trading strategies. Moreover, any signs of platform manipulation, such as sudden spikes in spreads or unexplainable trading conditions, should raise alarms for potential users.

Risk Assessment

Evaluating the risks associated with using Trust Markets is essential for informed decision-making.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Safety Risk | High | Lack of investor protection mechanisms. |

| Withdrawal Risk | High | Numerous complaints regarding withdrawal issues. |

| Trading Condition Risk | Medium | Potential hidden fees and high leverage. |

The overall risk profile of Trust Markets suggests a high level of concern for potential traders. The lack of regulation combined with numerous customer complaints and withdrawal challenges indicates a precarious trading environment. Traders should exercise extreme caution and consider these risks before engaging with Trust Markets.

Conclusion and Recommendations

In conclusion, the evidence suggests that Trust Markets exhibits several characteristics commonly associated with untrustworthy brokers. The absence of regulatory oversight, coupled with a lack of transparency regarding company operations and management, raises significant red flags. Furthermore, numerous customer complaints regarding withdrawal issues and unresponsive support further question the broker's legitimacy.

Traders seeking to engage with Trust Markets should proceed with extreme caution and consider the significant risks involved. It is advisable to explore alternative, well-regulated brokers that offer robust investor protections and transparent trading conditions. Some reputable alternatives include brokers regulated by top-tier authorities such as the FCA, ASIC, or CySEC.

In summary, the question of "Is Trust Markets safe?" leans heavily towards "not safe," and traders should be wary of engaging with this broker.

Is Trust Markets a scam, or is it legit?

The latest exposure and evaluation content of Trust Markets brokers.

Trust Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Trust Markets latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.