Trust Markets Review 12

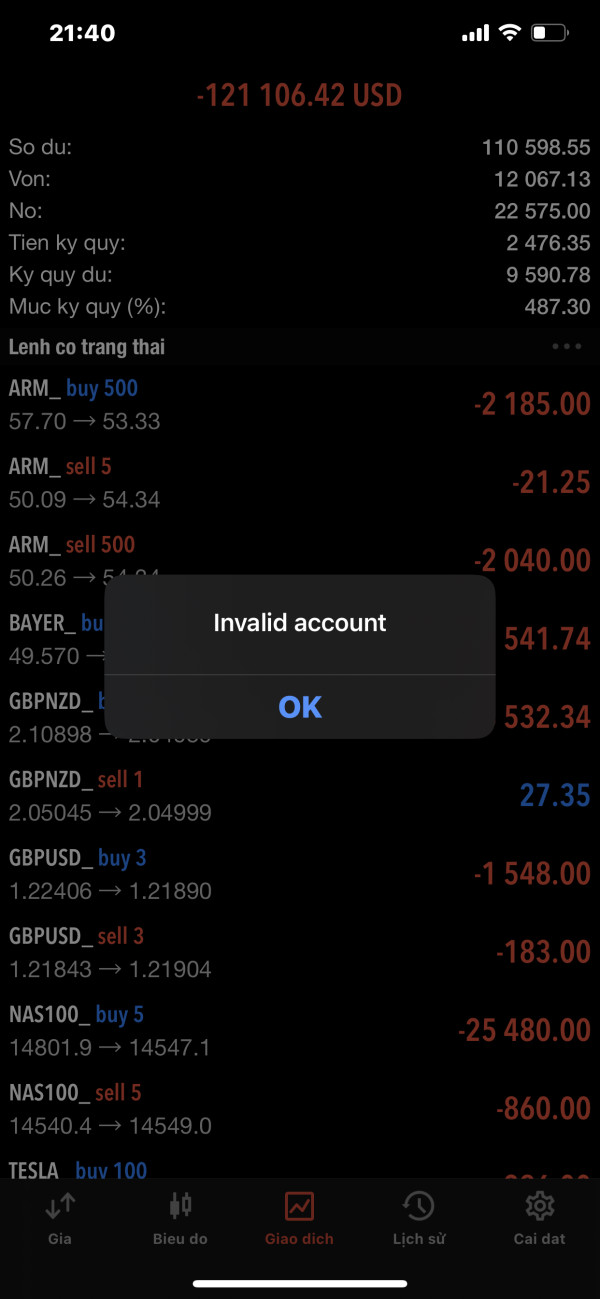

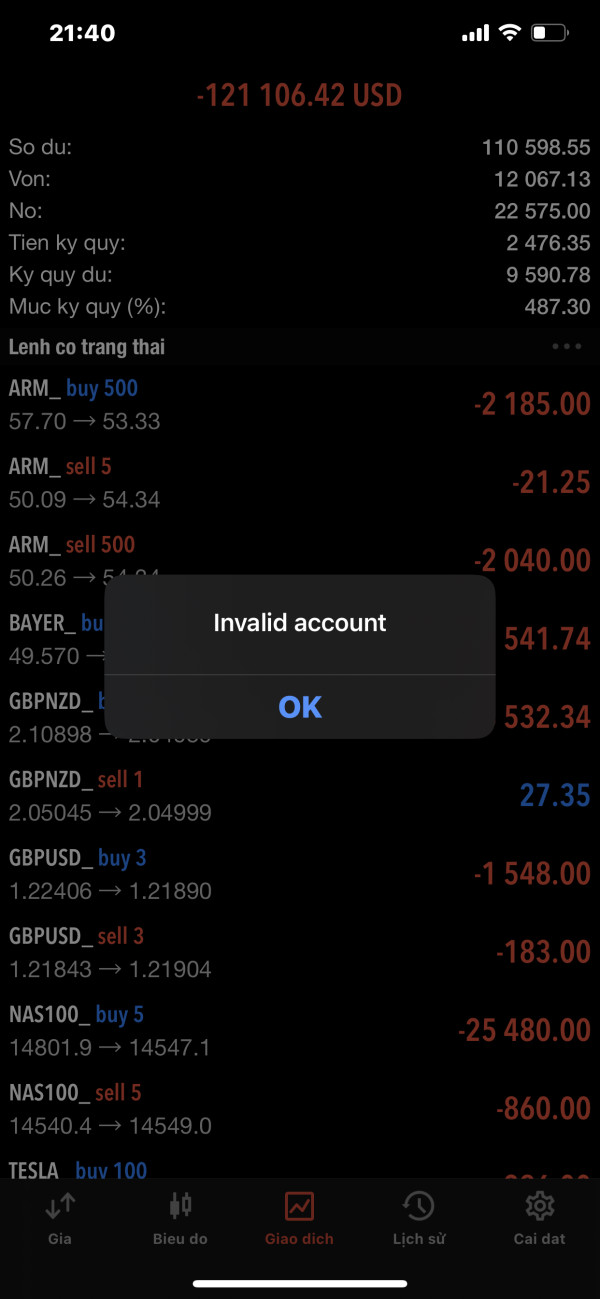

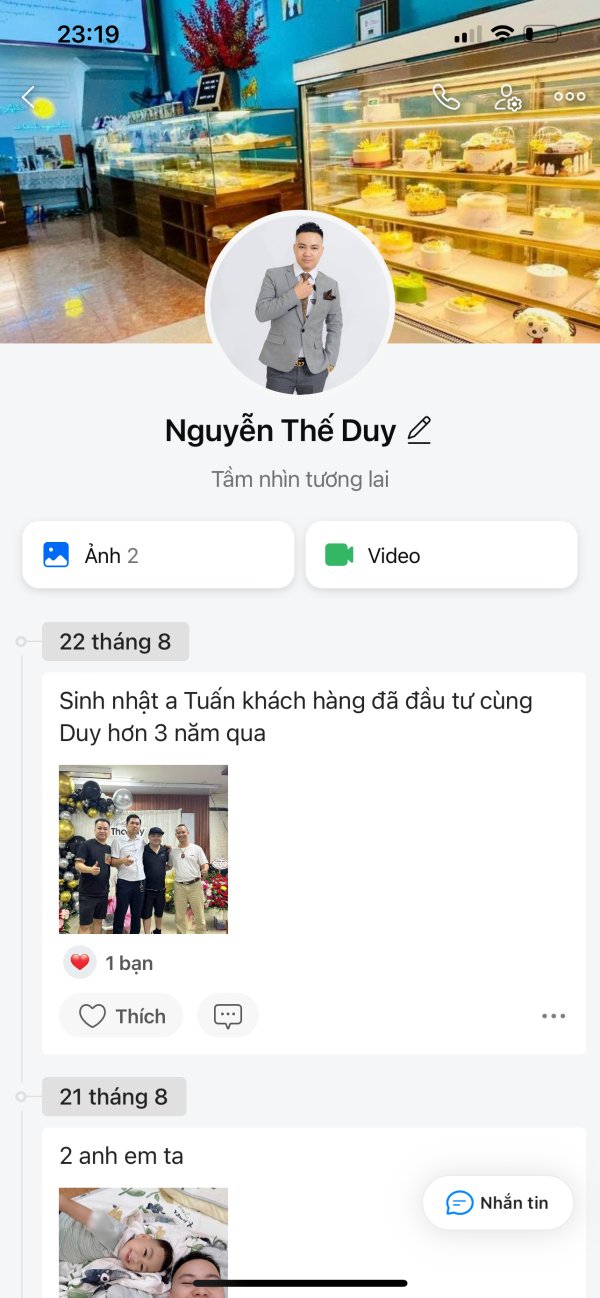

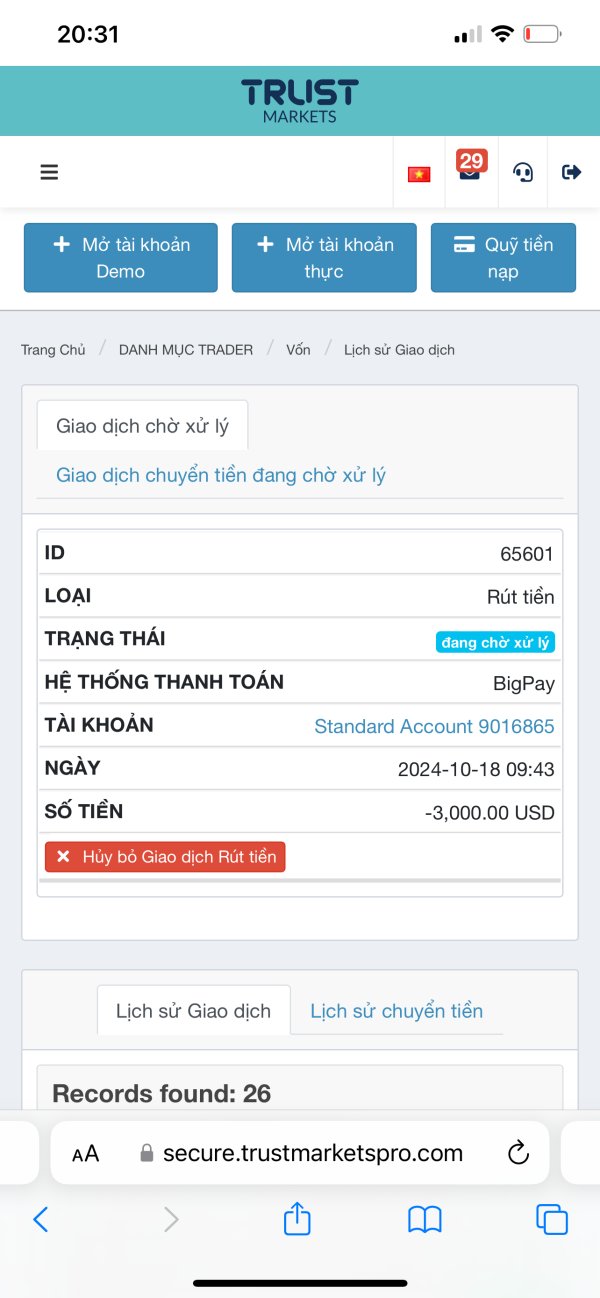

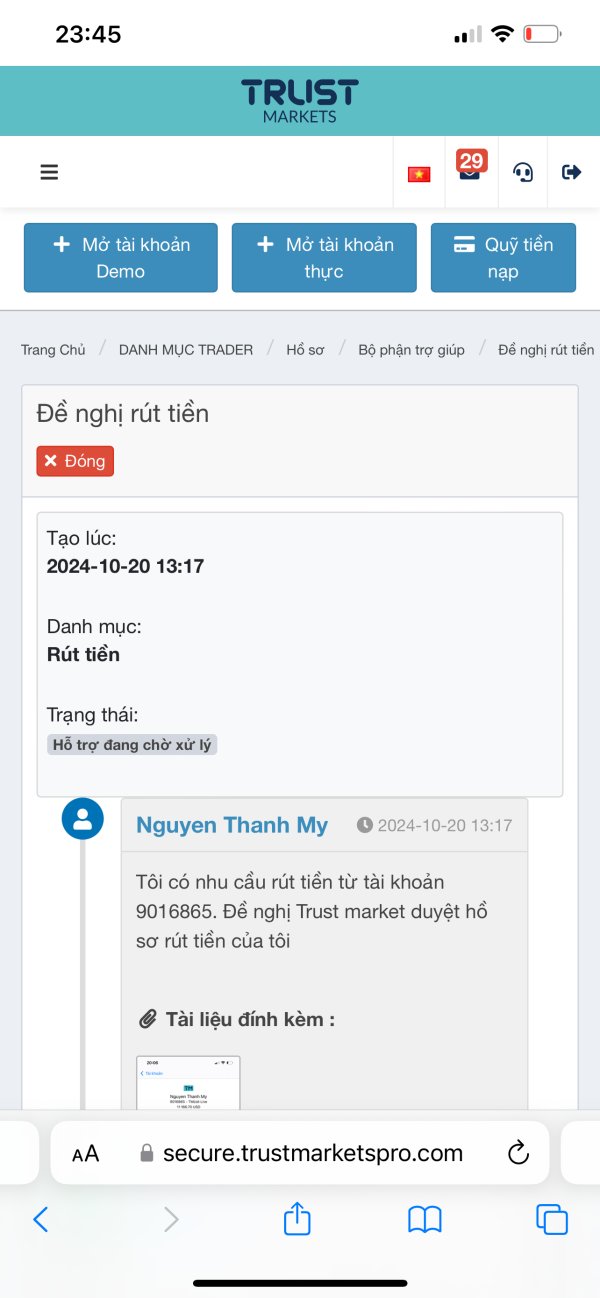

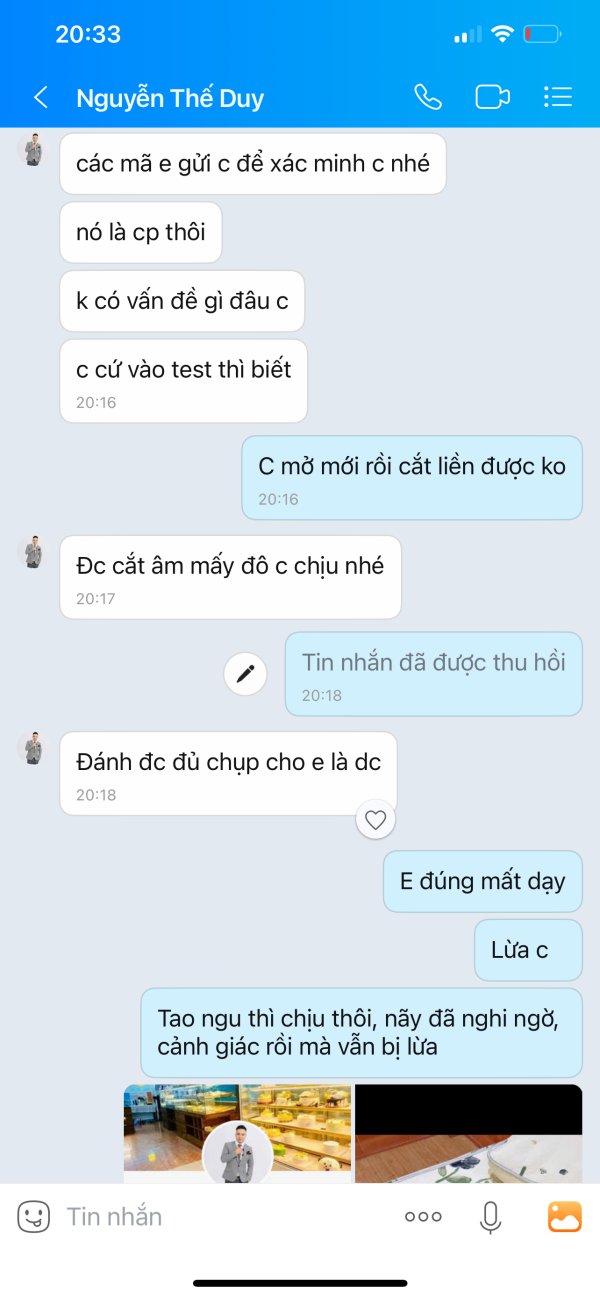

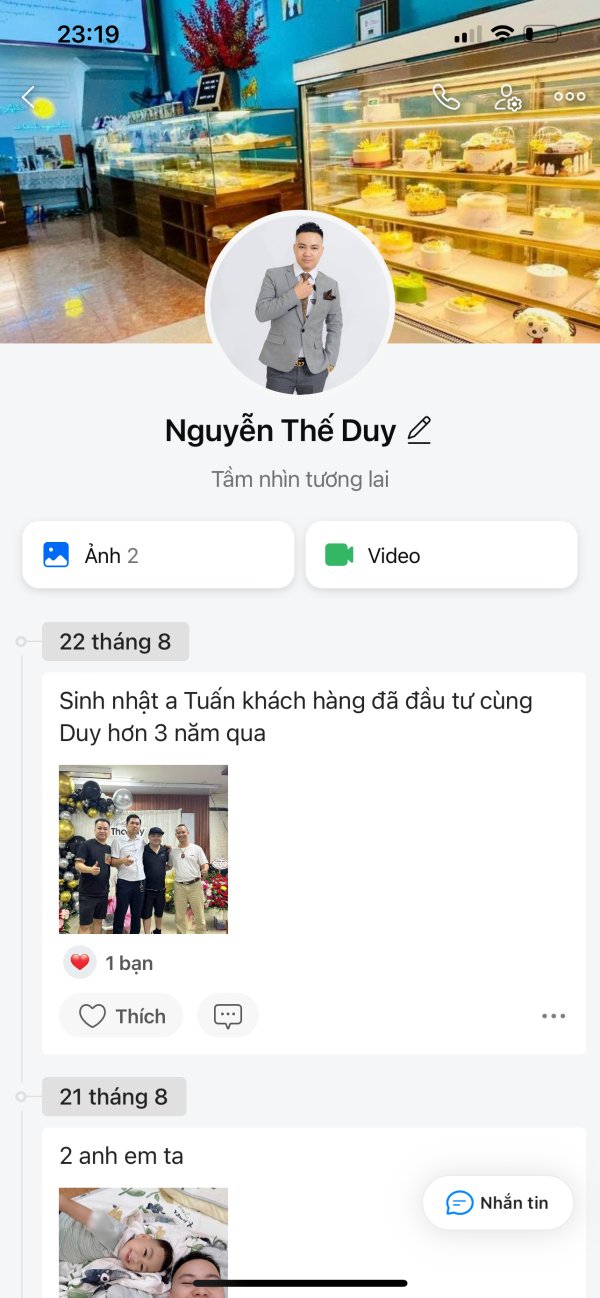

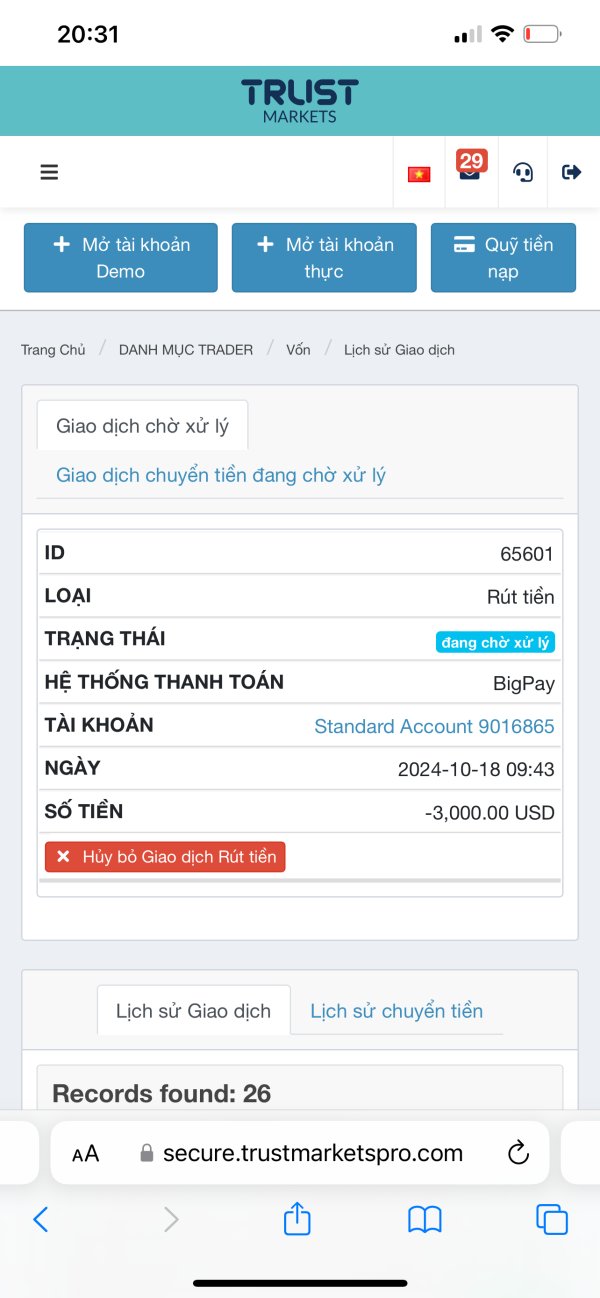

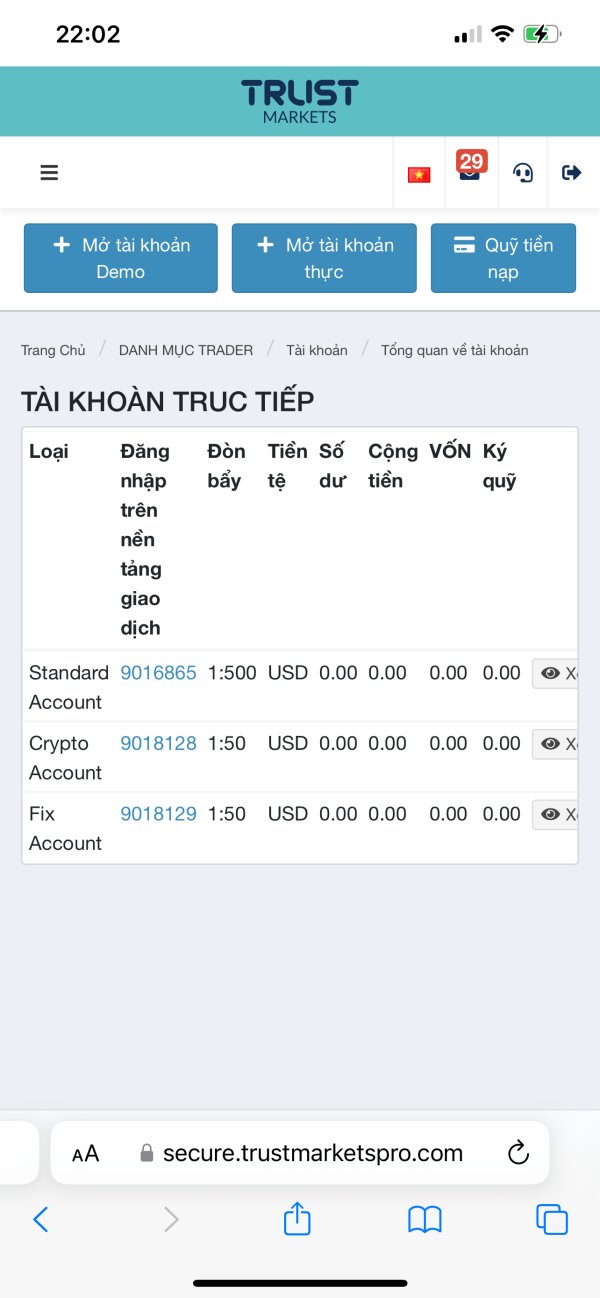

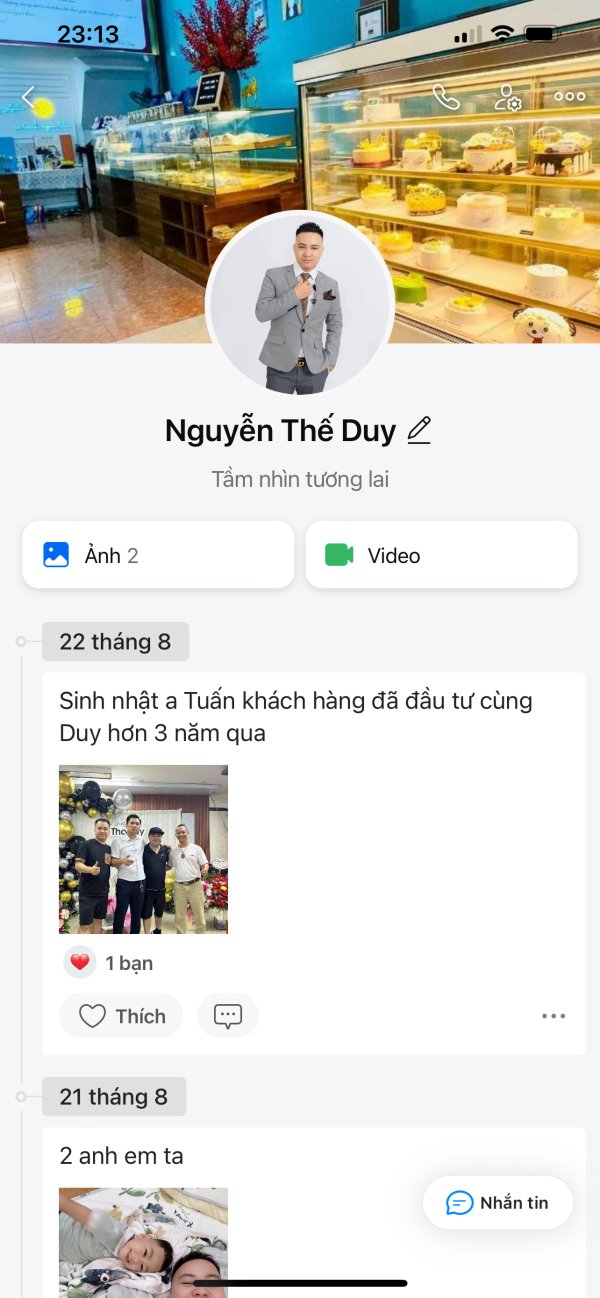

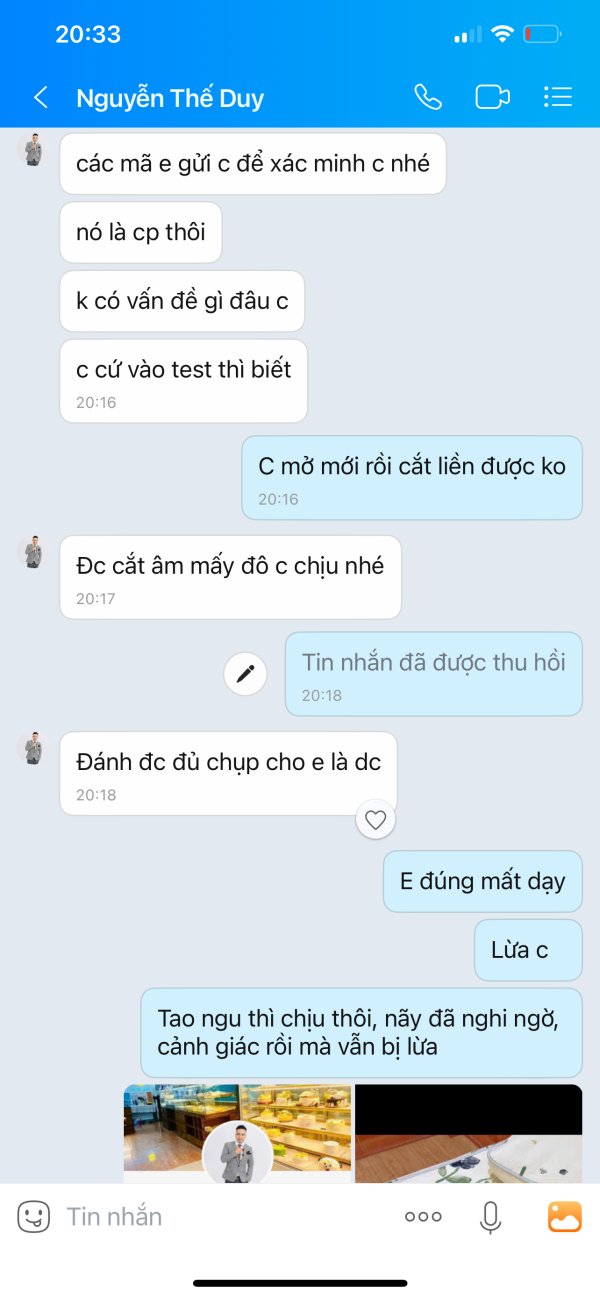

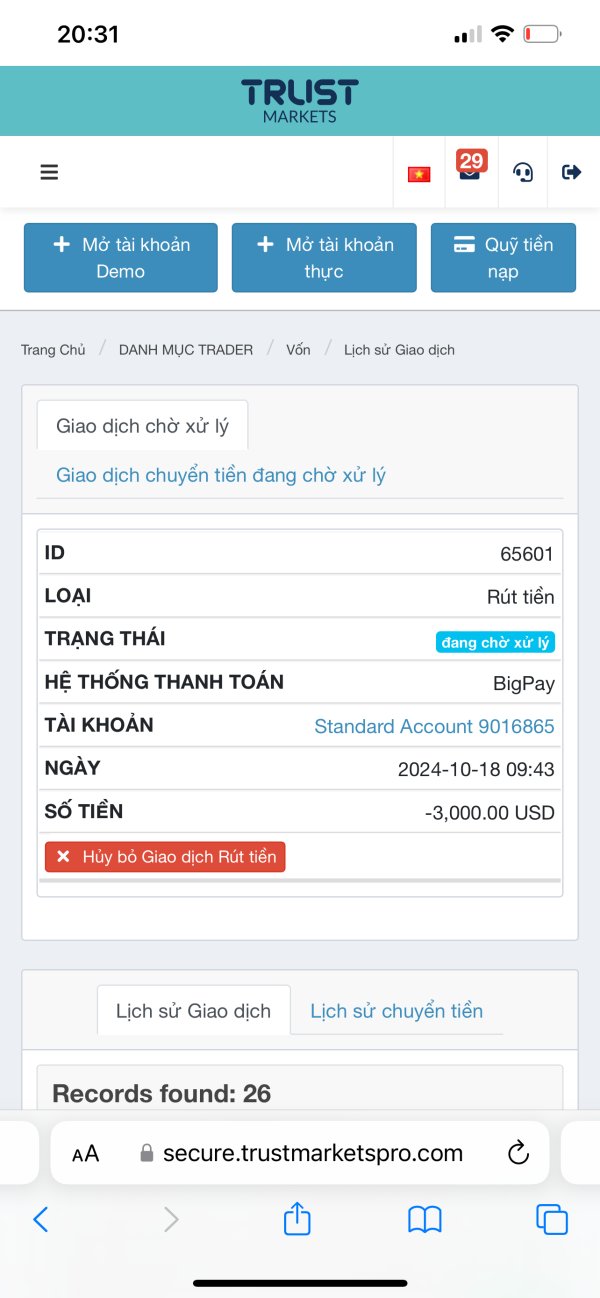

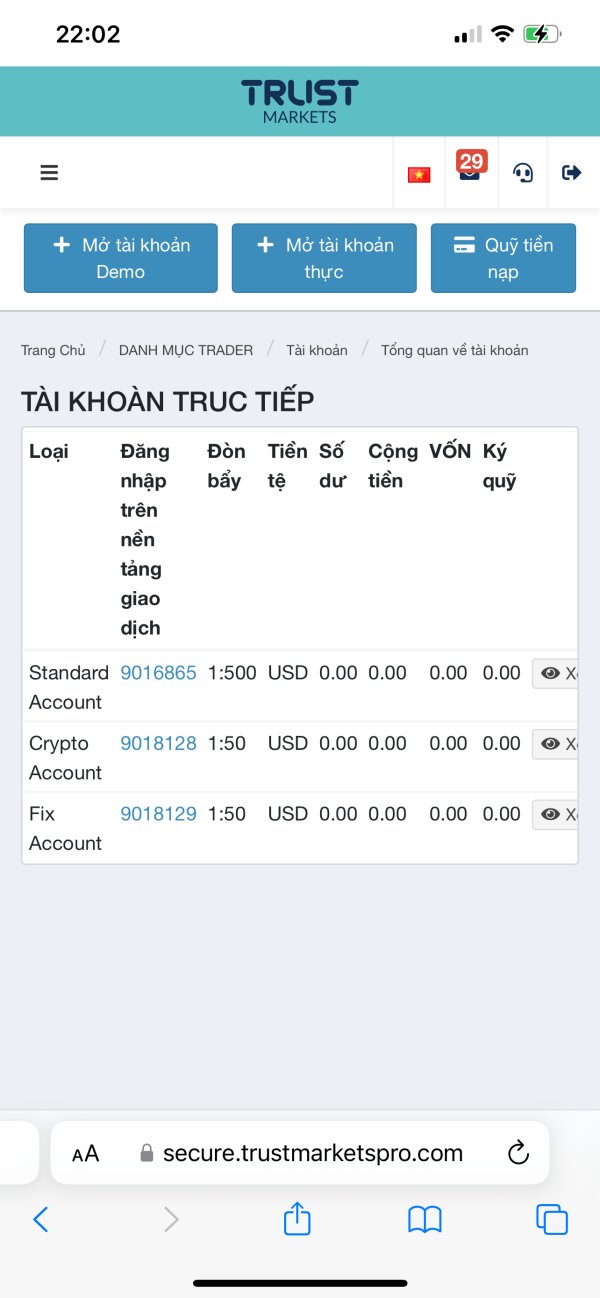

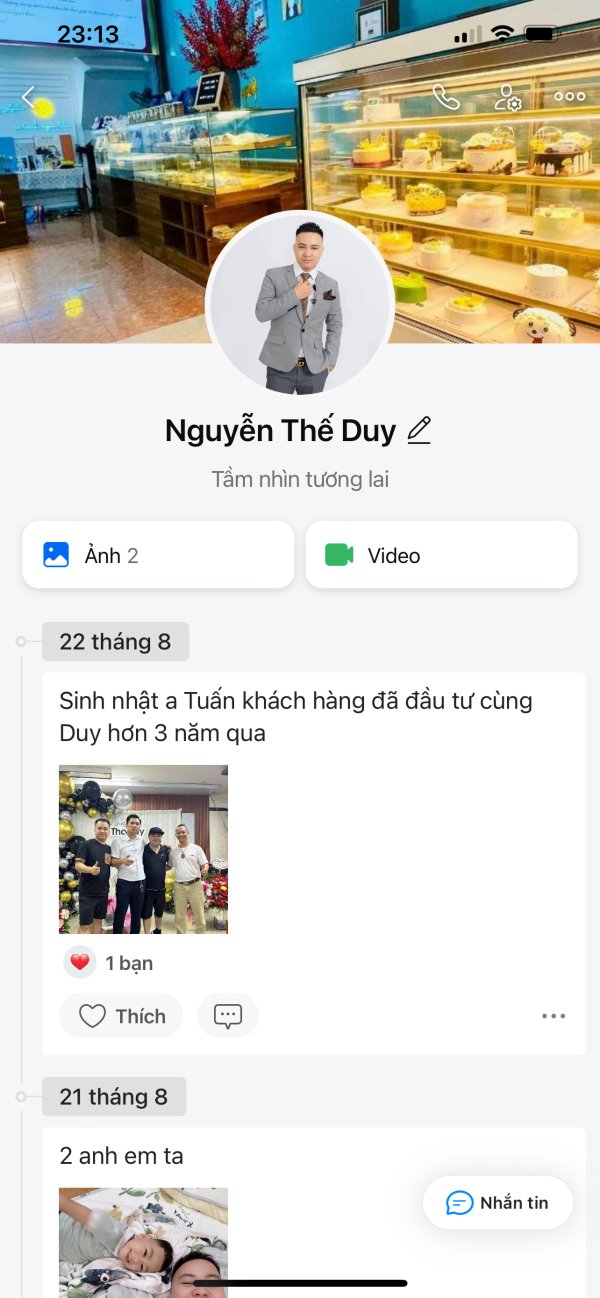

My account has over $11,000, I tried to withdraw $3,000 but failed. I contacted the advisors Tuấn Anh and Giang Phạm but couldn't reach them, so I messaged the support department on the website. Then, employee Nguyễn Thế Duy called me and asked me to buy 4 new stocks so that I could withdraw money. At first, I didn't agree because I was afraid my account wouldn't have enough funds. It said that buying a small quantity wouldn't have any impact. Due to the desire to recover the money, I tried with the first stock and found that it didn't affect my account. After that, I continued to buy the recommended stocks one by one, and my account lost everything. Trust Market deliberately deceived me by increasing my margin too high, leaving my account with nothing to avoid paying me.

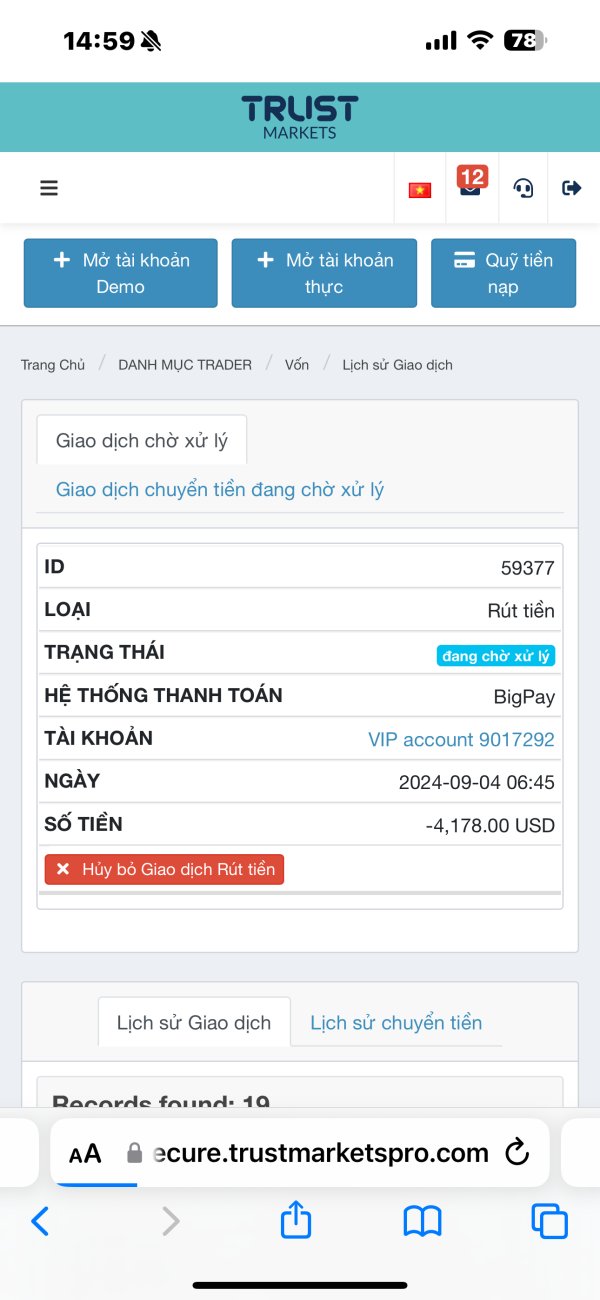

My account has over $11,000. I placed a withdrawal order for $3,000 but it was not processed. I tried contacting the advisor but couldn't reach them, so I sent a message to the support department on the website. After that, a staff member named Nguyễn Thế Duy called me and said they would help me with the withdrawal. They asked me to buy new stocks to verify my account and allow the withdrawal. At first, I was skeptical, but because I couldn't withdraw for over a month, I still followed their instructions. As soon as I opened the order to buy some stocks, they said my account was empty.

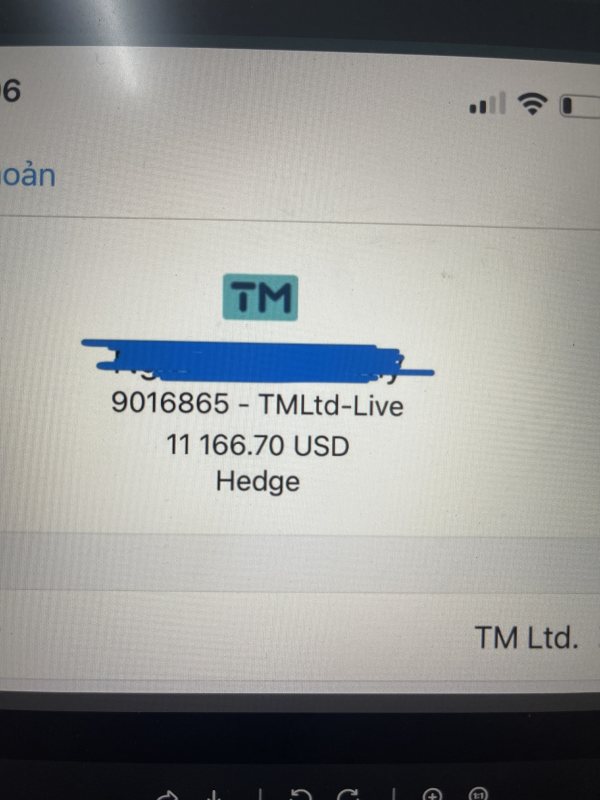

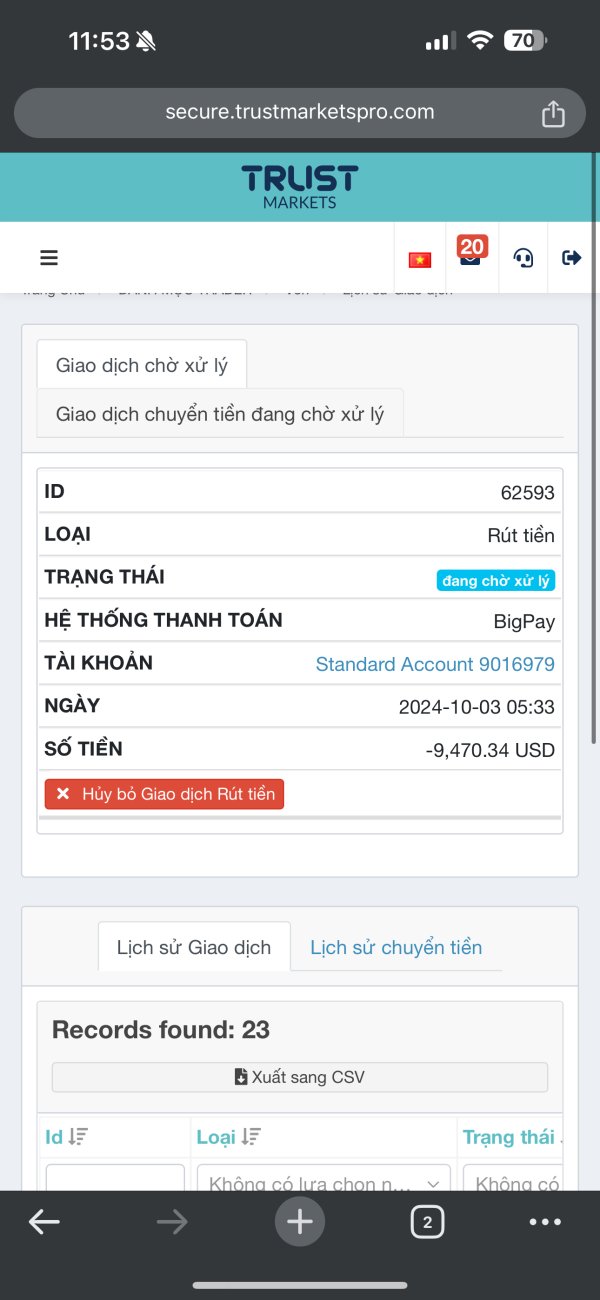

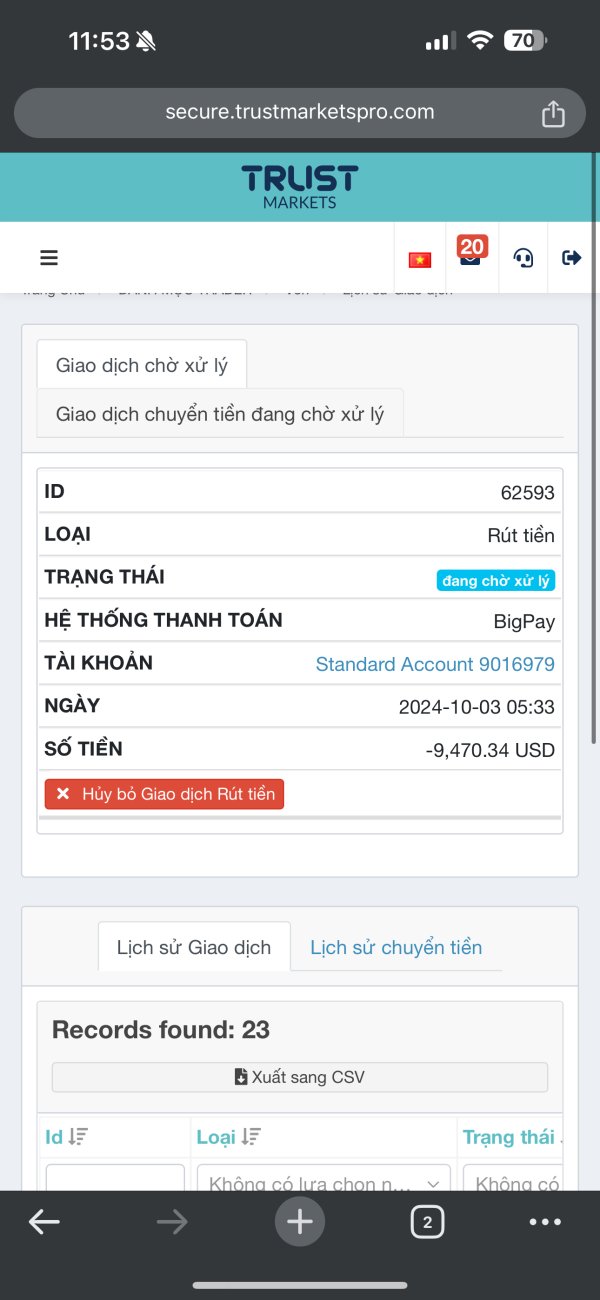

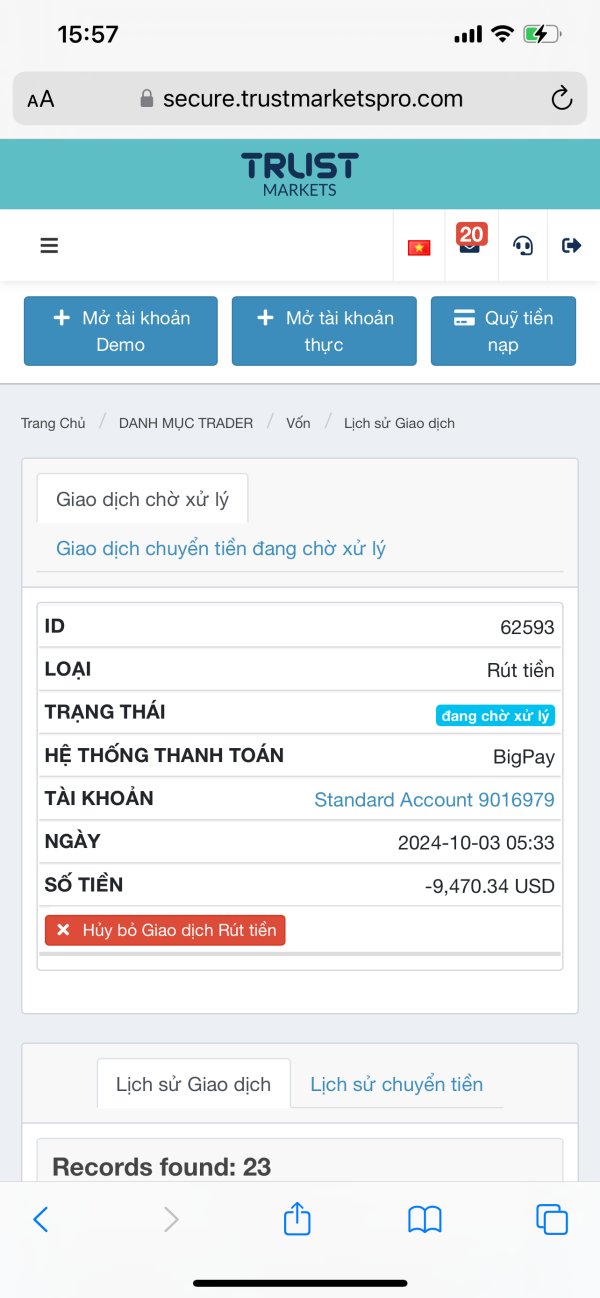

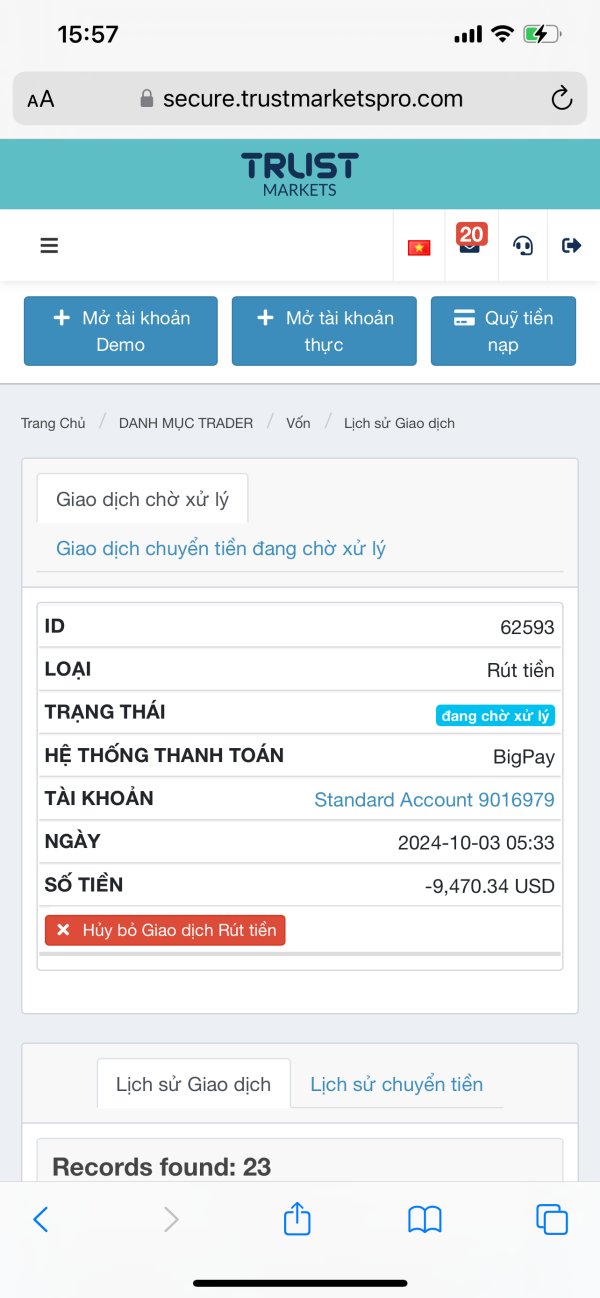

I have made deposits and traded normally, but since I withdrew all the money last time, they have not resolved and supported my withdrawal. The $9,470 I withdrew from 3-10-2024 until now, which is 10 days, I have not received any support. I kindly request Wiki to review and support me in recovering my money that the exchange has taken.

I am Nguyễn Thị Liễu using id 9016979 at TrustMarkets exchange. Currently, I have deposited $10,000 into the exchange and there is still $9,470.34 in my trading account. I no longer want to trade and have requested a withdrawal since 03/10/2024. However, until today, 08/10/2024, the exchange has not approved it.

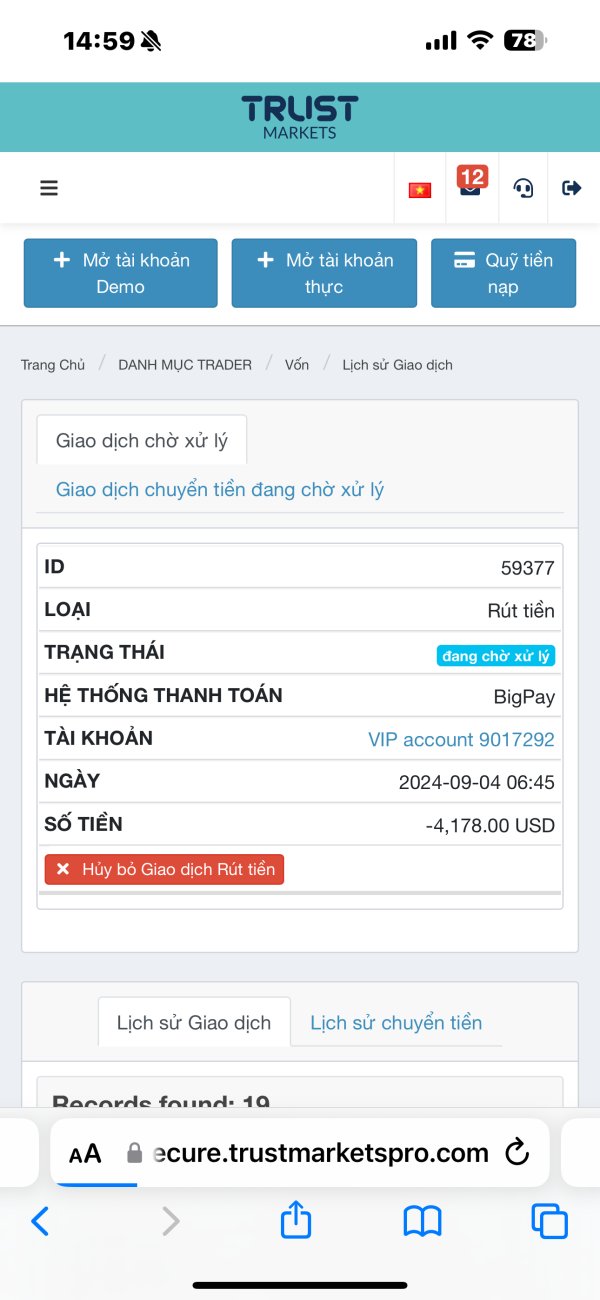

Unable to withdraw money despite having a positive balance

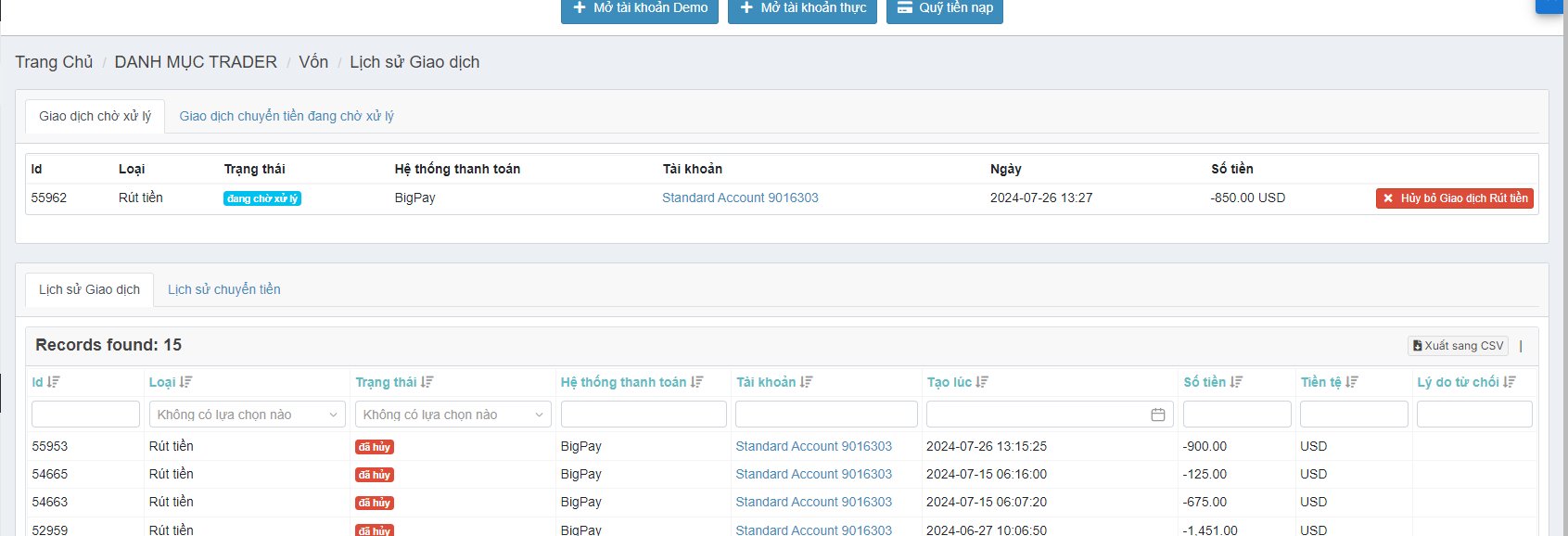

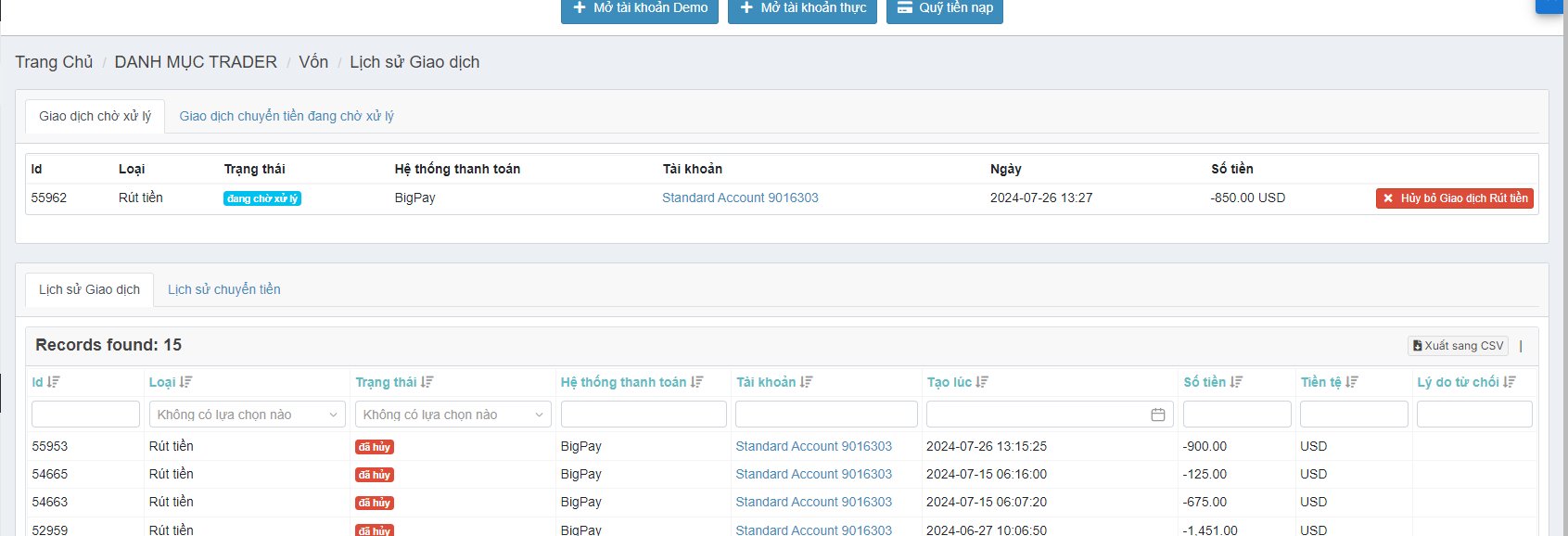

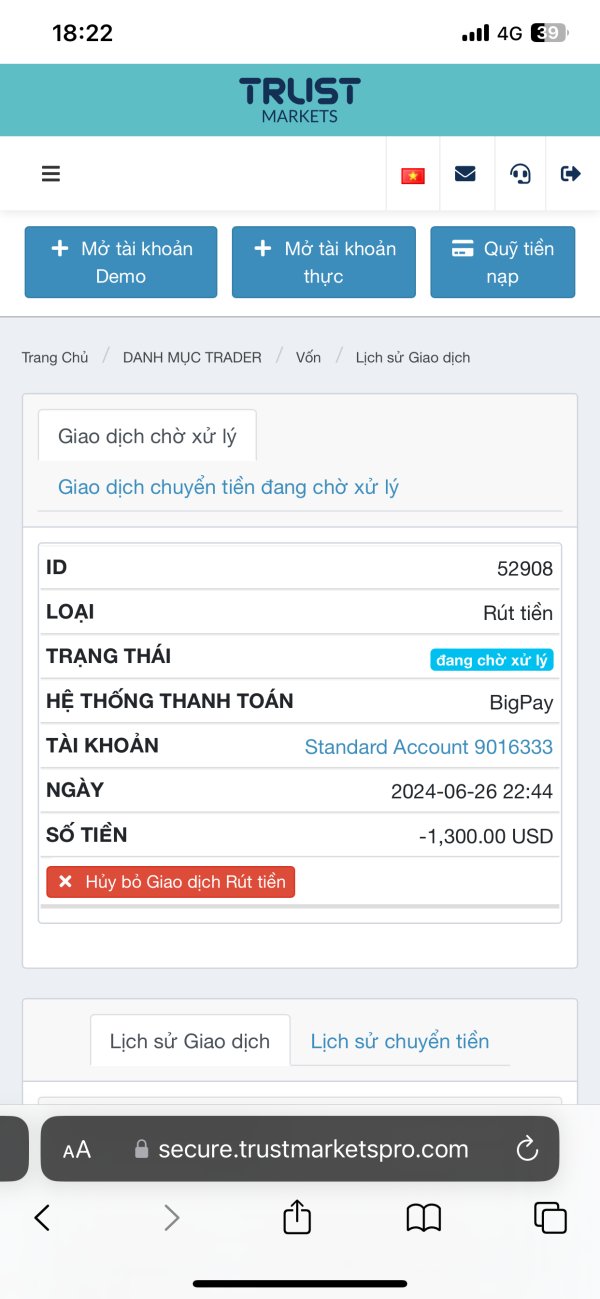

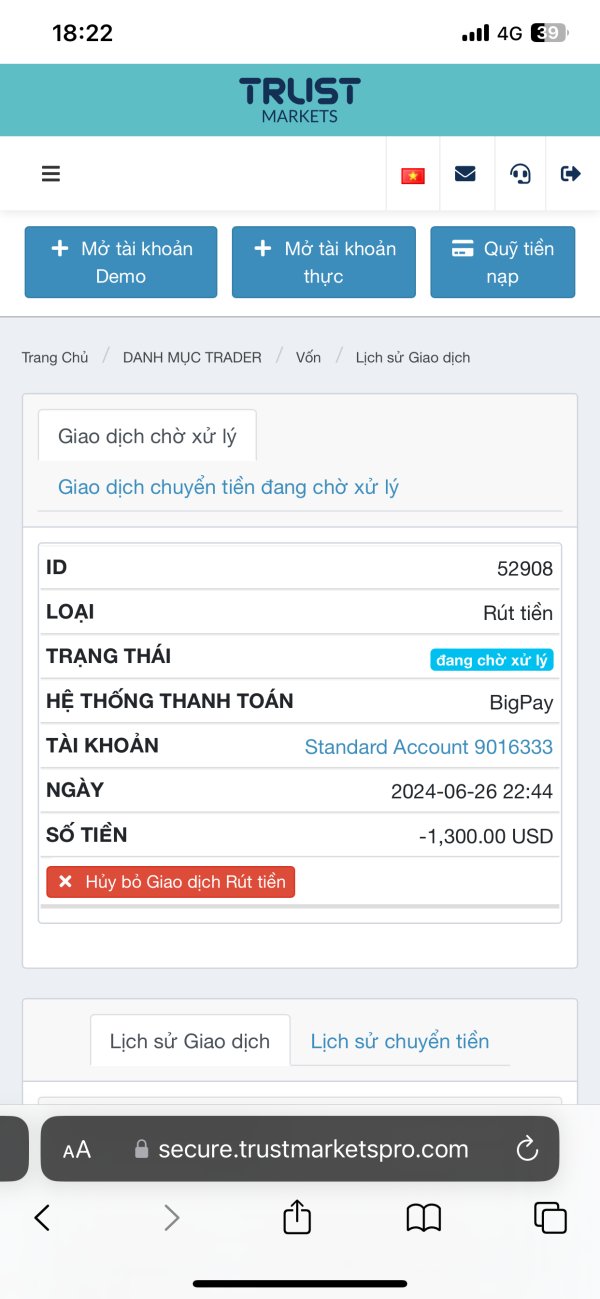

I joined the exchange on 18/6 with a capital of 1k. When I joined, there was a promise of automatic deposit and withdrawal with a dedicated expert support team. However, after I started real trading, the dedicated expert support team was often unreachable. Either the signals were more losing than winning, so I lost trust in the support. I decided to withdraw my capital, but even after placing multiple withdrawal orders, I haven't been able to withdraw for a week. When I reported this to customer service, someone said they would transfer to the relevant department, the technical department, or the expert team, and after a while, someone called back and said they would support me on the condition of buying 2 lots of sugar. But I was hesitant and didn't proceed; luckily, at that time, I couldn't make the transaction. Otherwise, I would have lost even more capital. And now my account is still suspended, and I can't withdraw. Is there anyone who can help me? My MT5 ID is 9016303.

This exchange cannot withdraw money, please consider it

Fraudulent platform appropriating assets